I always cringe when people say they “believe in science.”

Science has nothing to do with believing. It’s a process of creating a hypothesis, testing it, and adjusting or discarding that hypothesis. I like to think about it this way: It’s the best method humans have invented to not lie to ourselves and get closer to the truth.

Scientific thinking is a cognitive superpower – not just in the lab – but in your startup, and almost every other aspect of your life.

I’m a scientist, but I’m also a founder, an investor, a CEO, and more. The below mental models, rooted in my scientific training and (admittedly) my personal quirks, have helped me gain perspective and make important decisions in my life.

I hope thinking like a scientist helps in your life, and startup too.

You Understand Exponential Growth

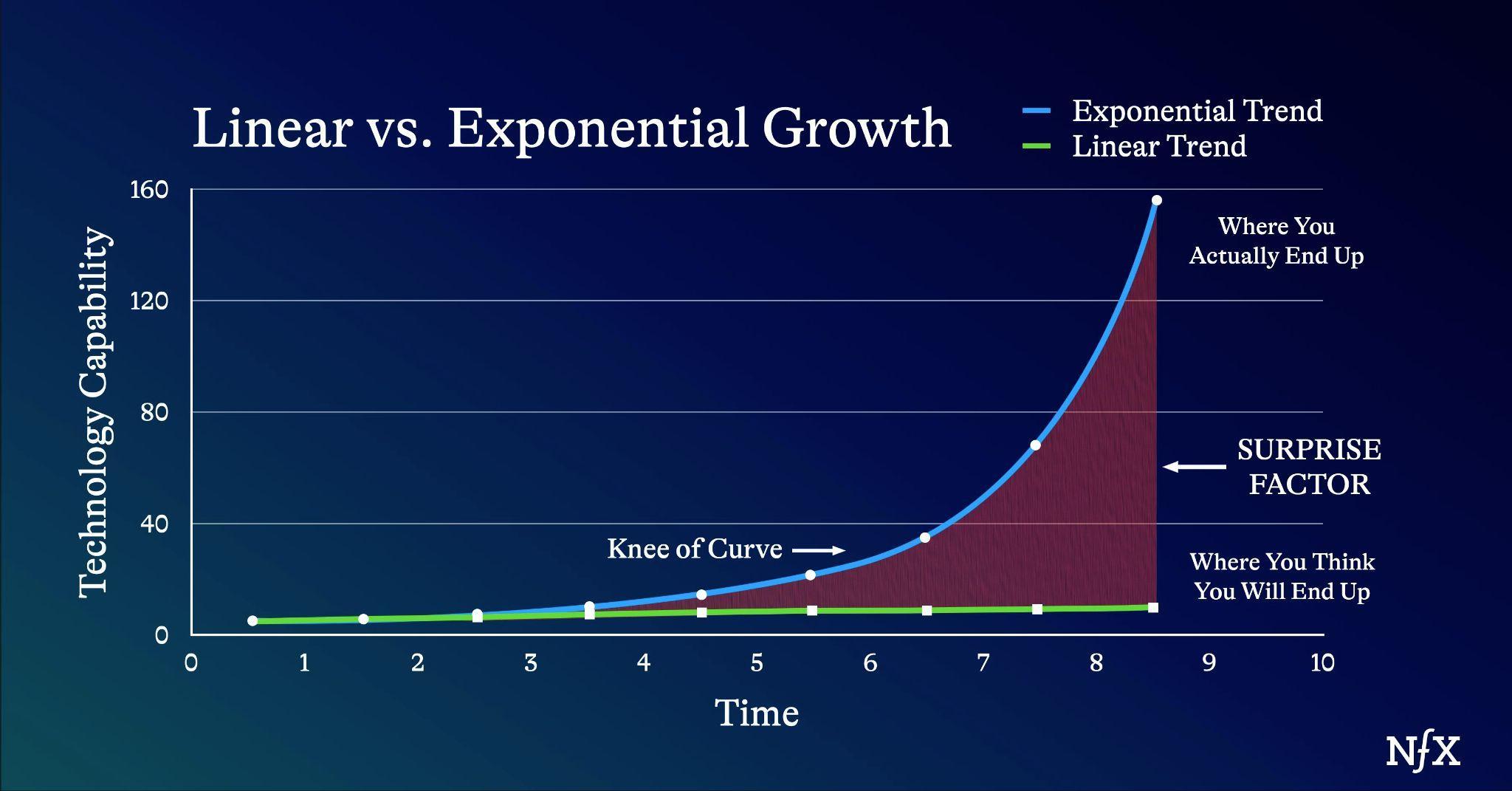

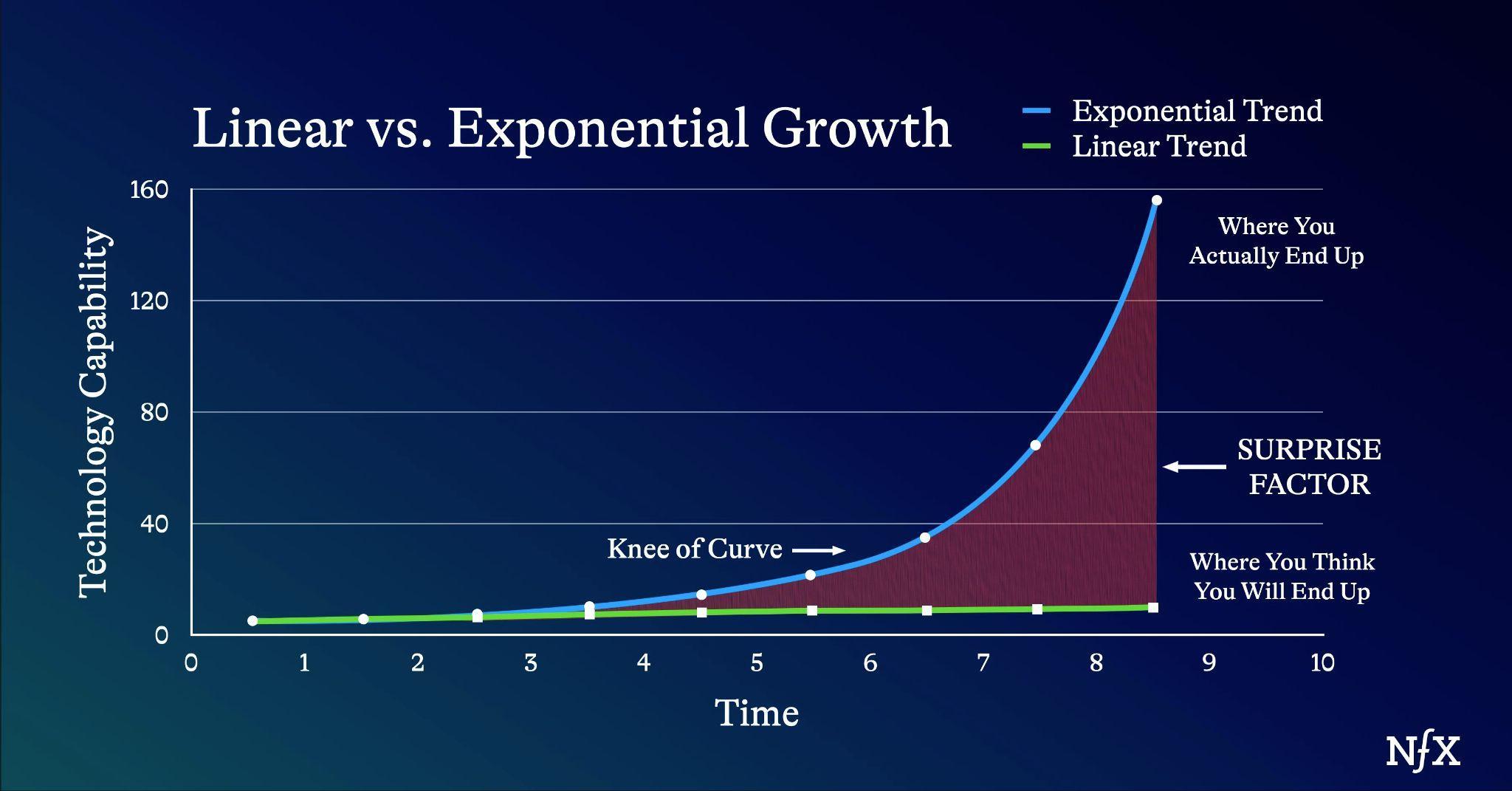

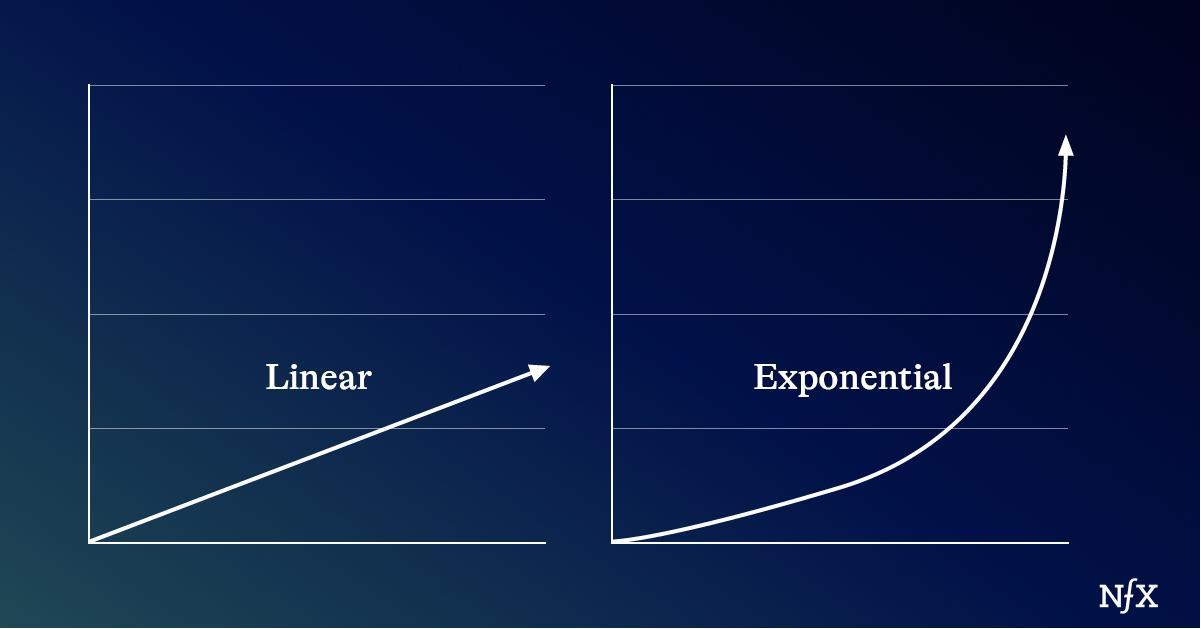

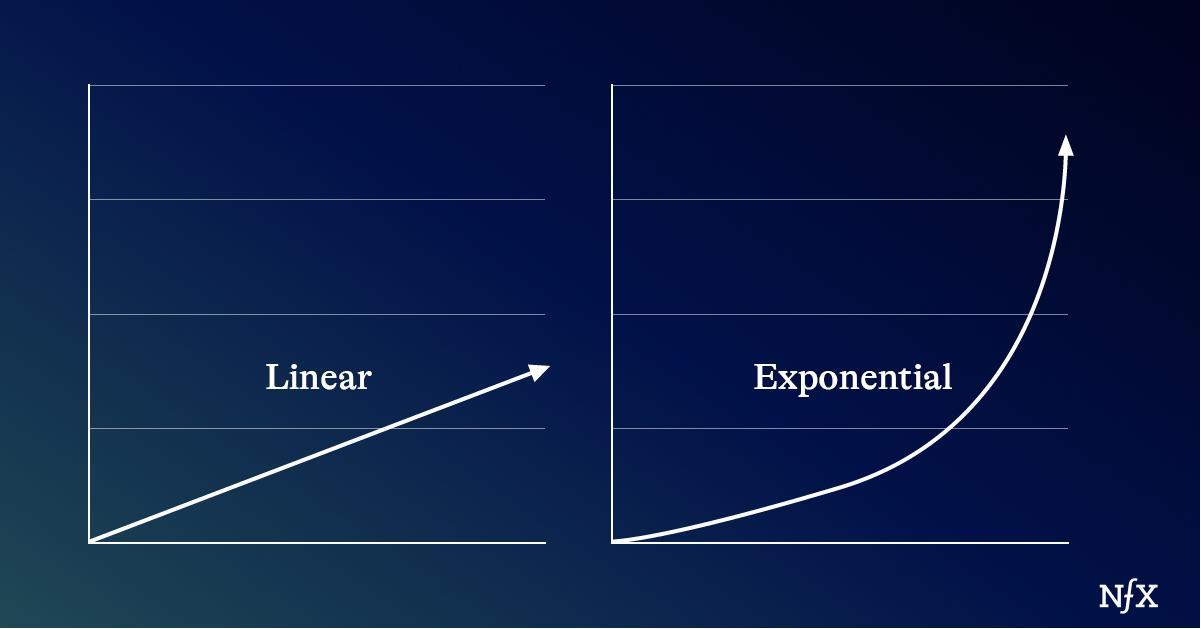

Linear growth happens at a constant rate. And that’s how most people expect life, and building a company to go. You get a little better each year. They’re totally shocked when lots of change happens at once, because according to your linear mental model, that’s out of the ordinary.

Exponential growth occurs when change happens at an accelerating rate, rather than a constant one. The more growth you have, the more change you get. It compounds.

Meaningful change happens exponentially. It seems like magic to most people. But scientists are especially good at recognizing this pattern.

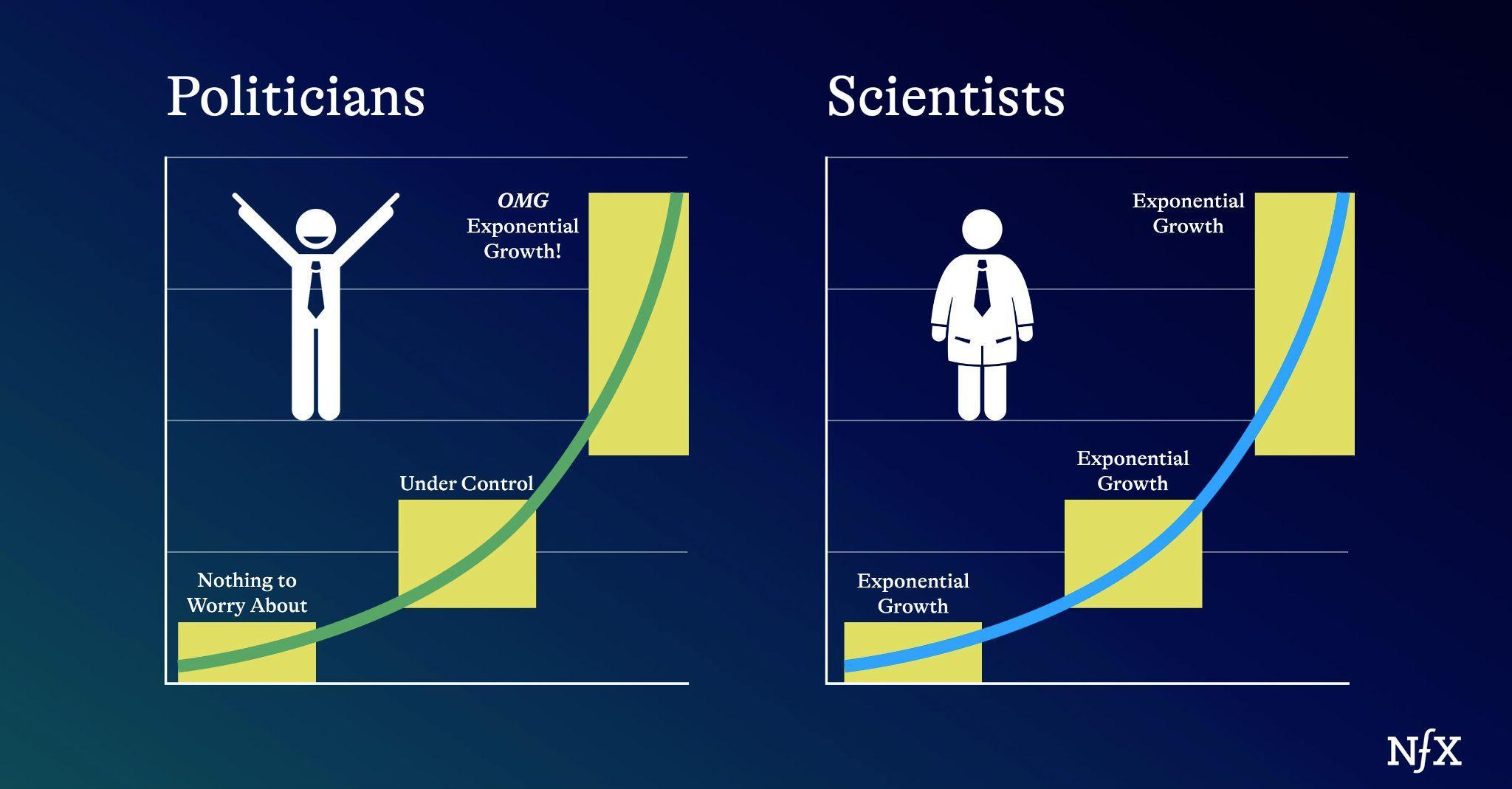

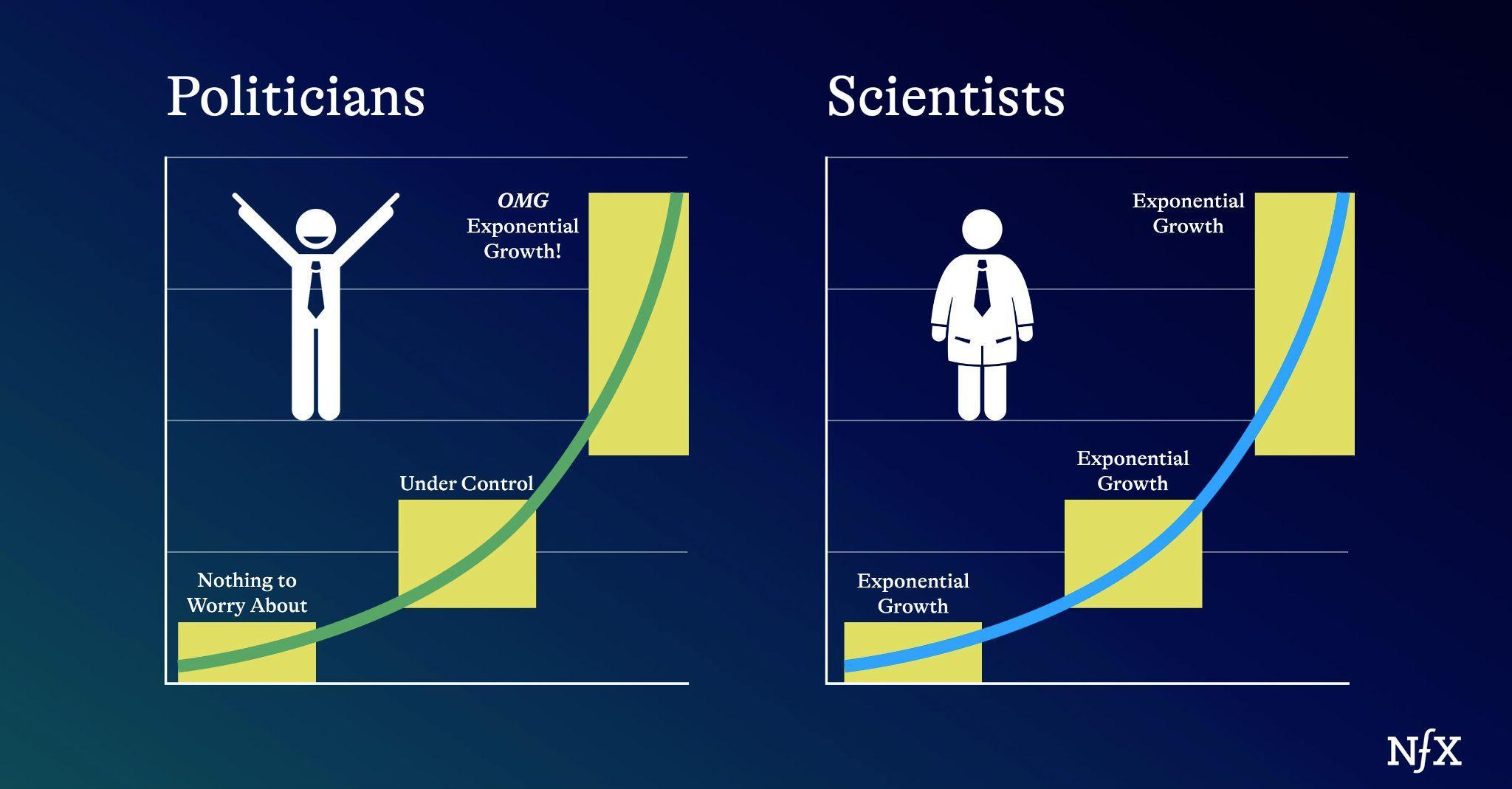

Think about the rise of COVID. At first, we only had a few cases here and there. Politicians and regular people weren’t worried (at first). Scientists understood what was happening right away, and sounded the alarm. Because when you’re dealing with exponential growth, things get freaky really fast (in good, and bad ways).

Familiarity with this type of growth is where scientists have an advantage: we know to expect and recognize exponential patterns because they’re rampant in nature. They recognize them before most people do, in the early stages.

This makes scientists great founders, because these patterns are everywhere in the story of technology too.

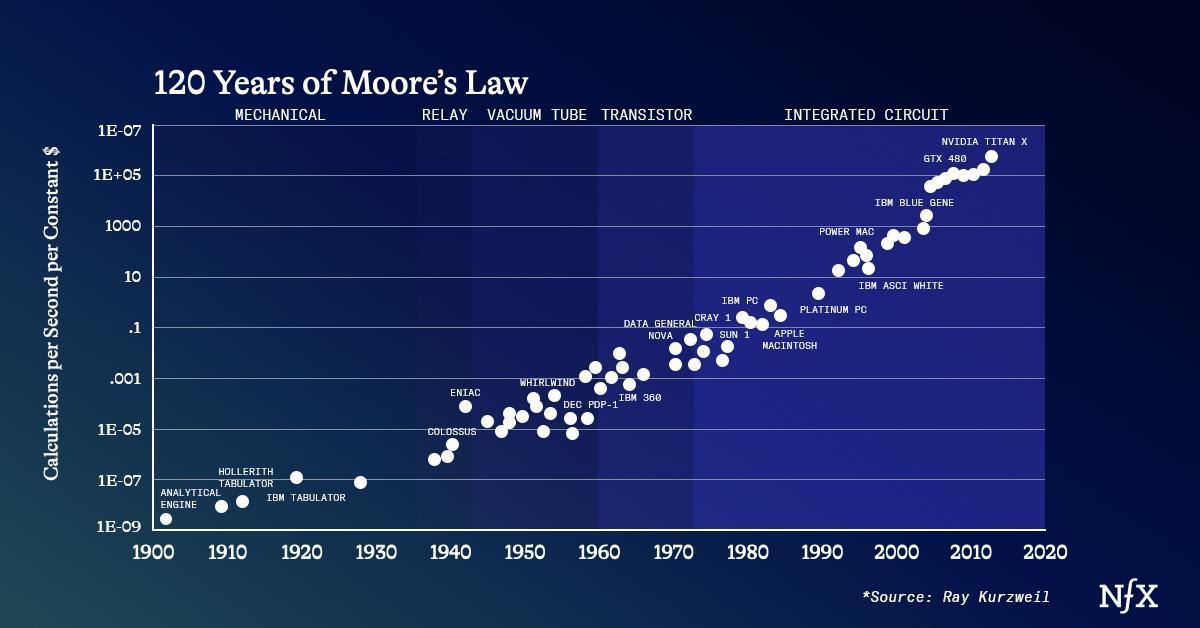

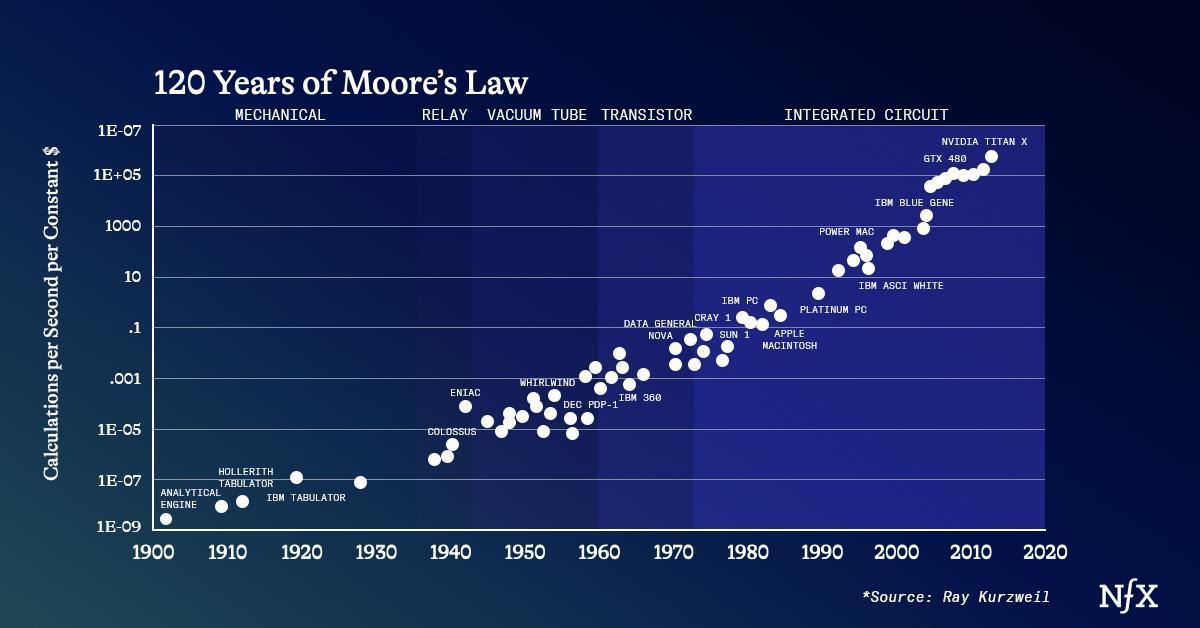

For example, Moore’s Law. The number of transistors on a computer chip doubles every two years. That’s exponential growth (most image renderings you see of Moore’s law are using a logarithmic value for one axis, which is one way to portray exponential growth as linear growth).

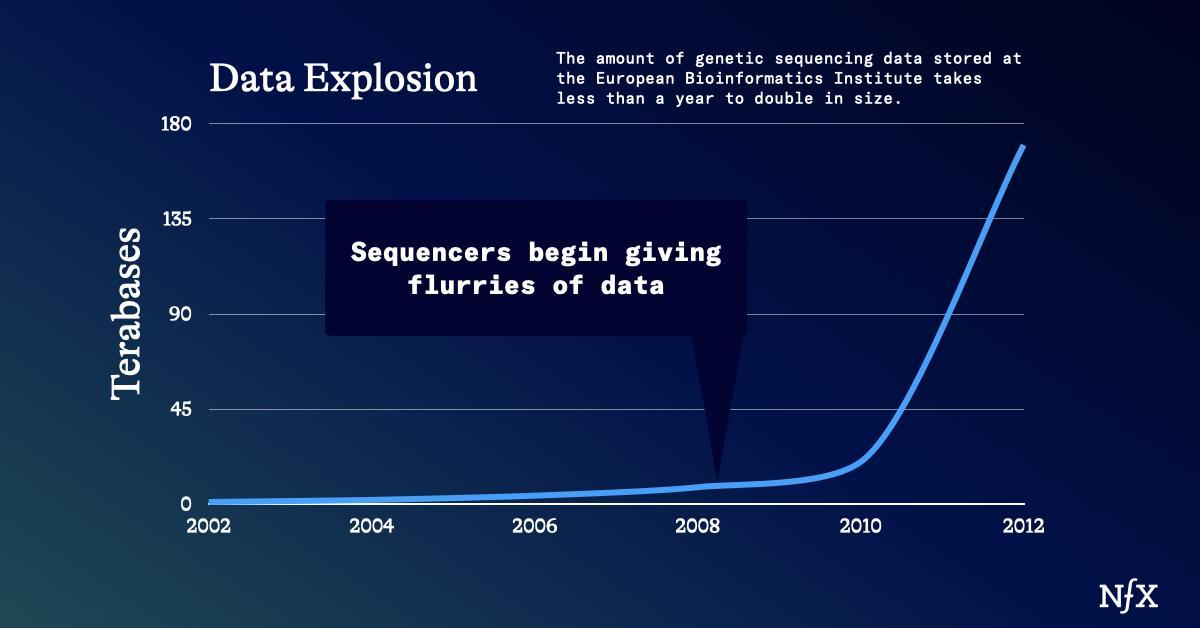

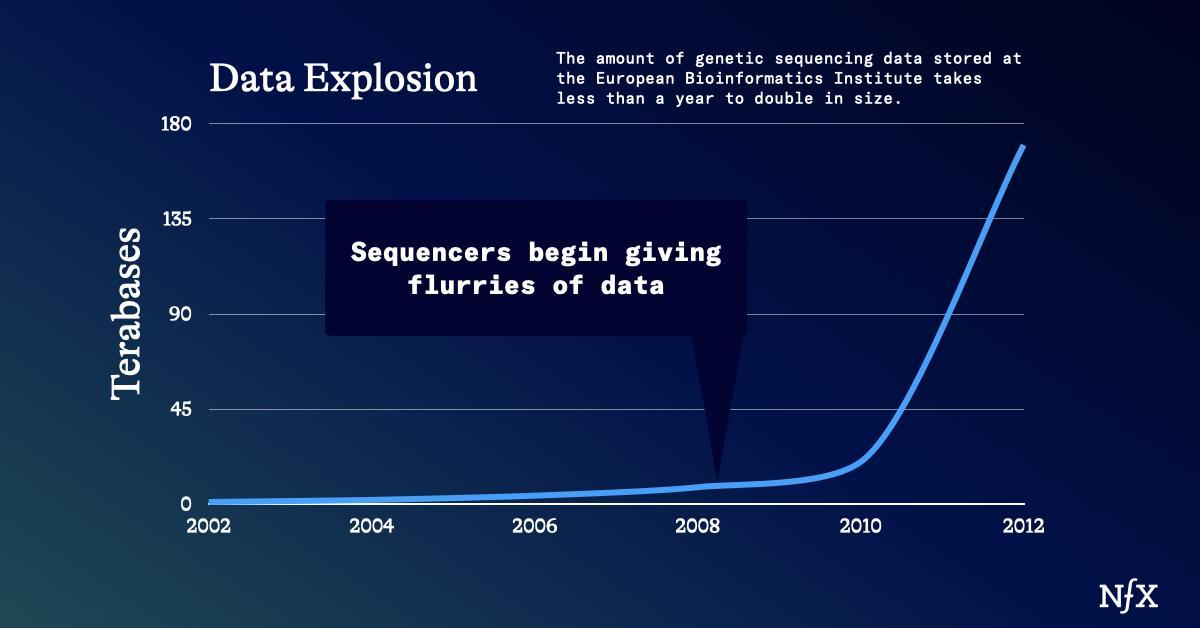

Another example, this time from techbio. The amount of biological data we produce:

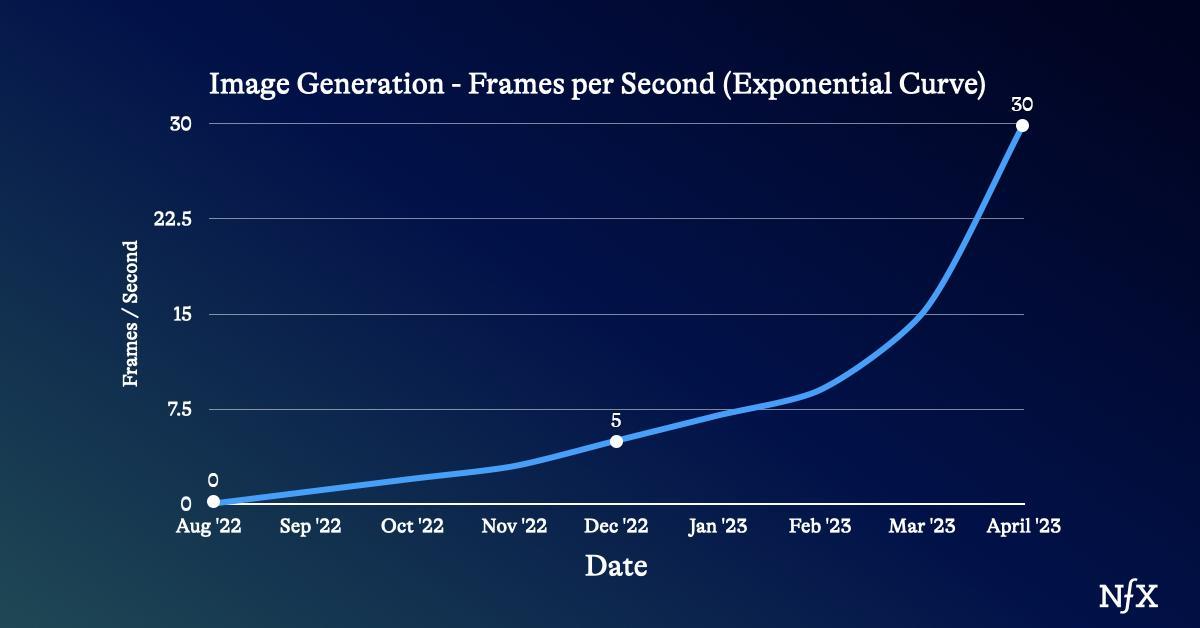

Any time you suspect exponential growth, alarm bells should go off in your brain. Even though something looks stupid, or like a game, any time you see a curve like that, you know something interesting is happening. Remember the first AI videos, or the first DALL-E videos. They looked like this:

But beneath that was fast exponential growth in AI image processing technology:

If you recognize the exponential curve, you know something big is happening. The earlier you can spot it the better.

You may find that investors are all saying no to your pitch deck. But if you start to get a few people to say yes, at an increasing rate…good things are coming. Suddenly they’re all saying yes.

You may find that a few customers want your product. But if that rate is accelerating over time, all of the sudden, you will have more interest than you can handle.

It’s a bit of a cliché, but many people tell founders to show potential investors a curve that goes “up and to the right.” We see lots of curves like the first, but what we actually mean is, show us curves that go up and then almost straight up. More look like the second curve:

We know it takes time to get there. From an investor perspective, we care about terminal values. I don’t necessarily care where you are right now. But I need to see signs that you are on this pathway, long term.

If we, as investors, see that your company is growing exponentially, we know you’re going to infect the world if the trend continues.

You Understand How to Manage (and Manipulate) Energy

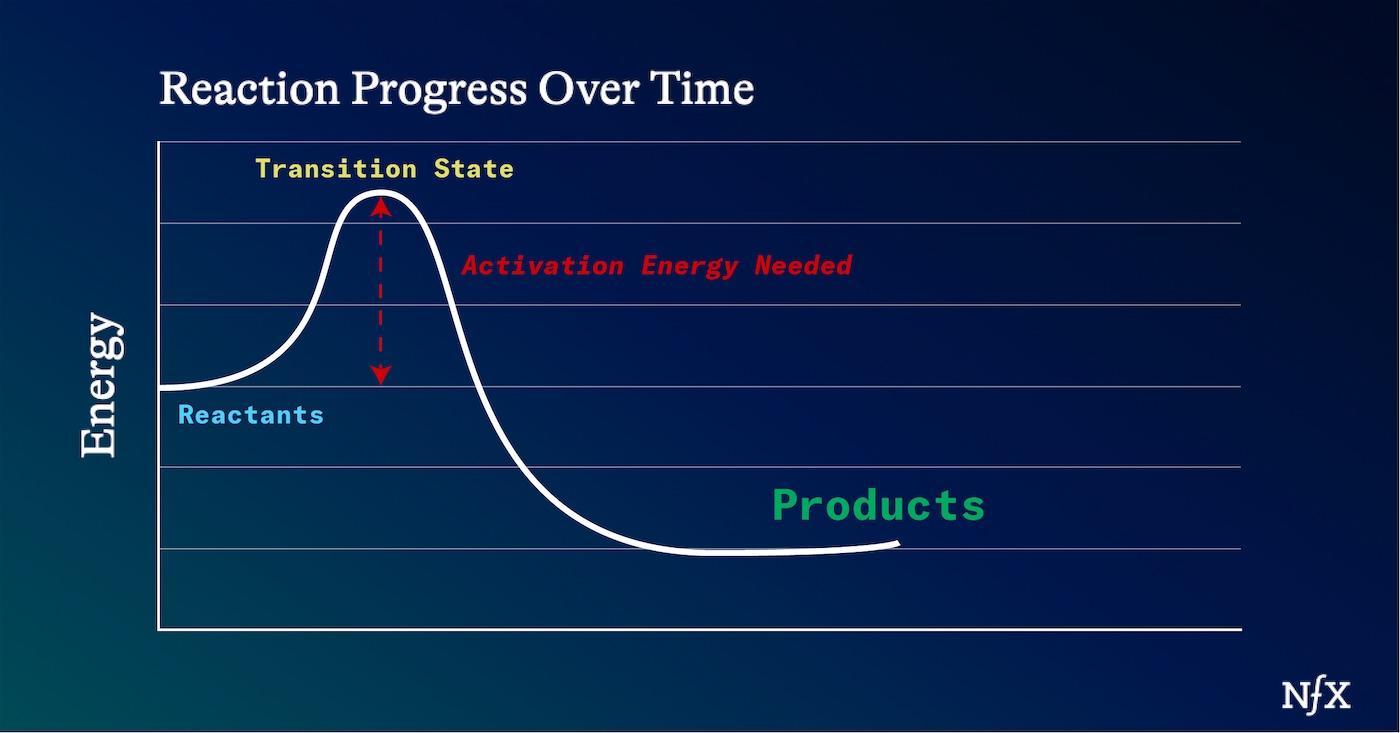

I spend a lot of time thinking about activation energy: the amount of extra energy you need to apply to get something to happen.

If you want something to happen you need to get over the “energy hump.” You must apply just enough energy that the reaction starts to happen, then it flows easily.

If you want something to happen, you have to lower the activation energy needed to get moving. And if you don’t want something to happen, you make the activation energy higher.

There’s a reason it’s so easy to subscribe to all those monthly subscriptions like Netflix, Disney+, Spotify (big buttons), and so hard to cancel (tiny little hidden links). There’s a reason it takes just seconds to open a new credit card, and hours to cancel one.

You can tweak the circumstances so that even a small amount of energy gets something to happen.

Most people find that there’s one big energy hump in the way of everything they want. I call this “imagination barrier.”

If you can’t imagine what the world would be like with your company in it, you’ll never get off the starting line. That’s the imagination barrier. Most people have a hard time imagining the world as it can be.

This is one of the superpowers of great founders: because they can imagine the world as it can be, their activation energy to start a company is lower.

So the best way to manipulate energy, and get what you want, is to remove that imagination barrier.

When we try to recruit somebody, we bring them to the office, and without their knowledge, simulate their day for them. We show them “their desk, their coffee machine, where the snacks are.” We are secretly lowering the imagination barrier for them.

We use this for onboarding customers too. The best marketing lowers the imagination barrier. It’s not about being 20% cheaper or 20% faster….it’s about how your life will be WAY better. About how everyone will like you if you buy these jeans or this watch.

If you want to get money, reduce the imagination barrier for us to invest in you. When you pitch investors you want them to imagine a world as you see it. You’re showing them your vision.

Centivax, our company developing universal vaccines, has a vision of a “world without viruses…”

SpaceX’s vision is colonies of life on other planets.

Tesla’s vision is a world run on sustainable energy.

These are big visions, but if you can show people that vision, they’ll invest in you.

Some exceptionally talented founders surpass this barrier instantly. They have a vision, and all that is left is taking the steps to get there. Those steps are easy to manage if you know exactly where you are going.

You Know Which Rules Are Breakable

I like to think of rules in two categories. There are man-made rules, and there are physics rules.

Man-made rules are the things we should be breaking all the time. Breaking these societal conventions is how we make new, amazing things. People don’t want to admit that they want to live to 500 or more now, but there will be a day when that’s normal.

People run into problems when they believe they can break the physical rules of nature. You can’t create matter from nothing. Or suspend gravity indefinitely, or wind back time (as far as we know).

That’s why, whenever we review a company, we first ask ourselves: is this even physically possible?

Whenever you are building something there will be conventional rules that can be tweaked. But there are physical constraints that exist in every system that can’t be broken. If you do break them, odds are you’re being dishonest or on the road to disaster.

The best founders I work with know the difference between rules you should break, and rules you can’t.

How to Use Your Powers: Be in the Right Place at the Right Time

Admittedly, this one isn’t that scientific. But, it’s still an image I use to make sure I’m using my time and energy effectively. This is how you can use those superpowers to achieve your company (and life) goals.

Have you ever been to a concert where beach balls are getting thrown around a crowd? Some hit you straight on the head. Some pass right by, others hit you with a glancing blow.

Playing the startup game is like being at a concert with beach balls flying around in the crowd. Each section of the crowd is like a different field. The people up in the front in the mosh pit are the Techbio people. The enterprise SaaS people are off to the left. The generative AI people are on the right. Some aren’t playing the game, they’re just standing on the side of the concert – not dancing.

But some people, like Founders, are in the middle of the crowd. But that’s not enough.

I like to picture money like a giant beach ball, floating around that concert crowd. You want to be where those beach balls are falling.

Every time there’s a new technology or a new type of business created, a new ball gets thrown in. You want to be in the right place so the biggest ones hit you.

When chips came along, money began to fall on anyone trying to build a cheaper computer. When social networks were created, huge balls of money were falling on anyone trying to build a social network, like meteors from the sky. When Generative AI came along, it happened again.

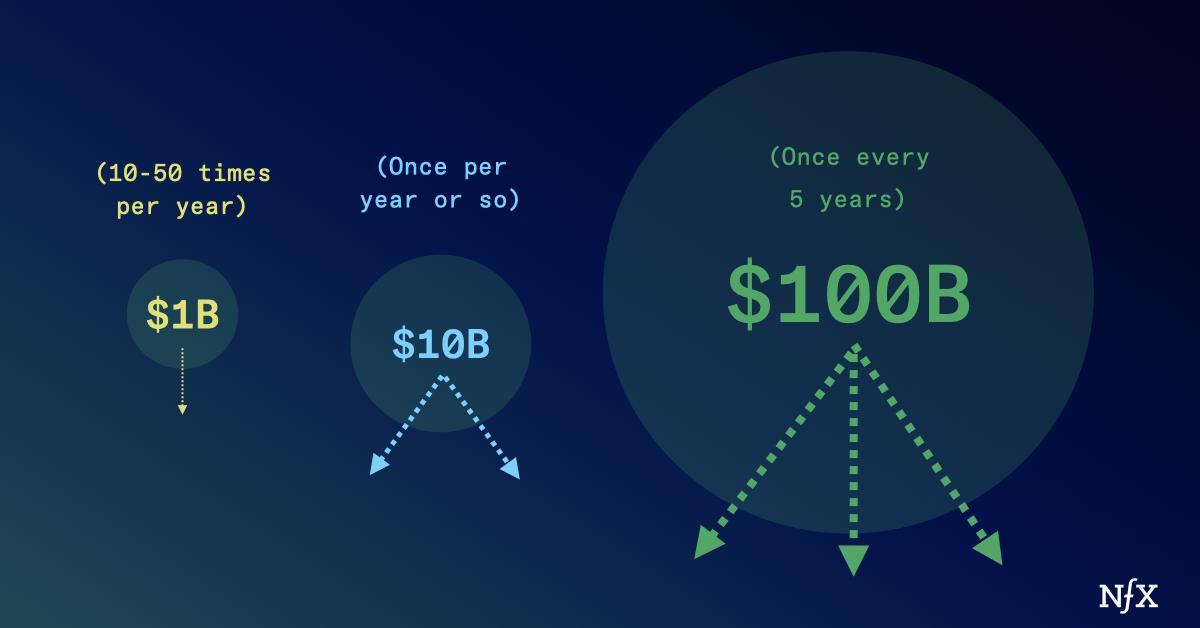

You have to figure out how to position yourself beneath these beach balls. The positioning depends on the size of the ball.

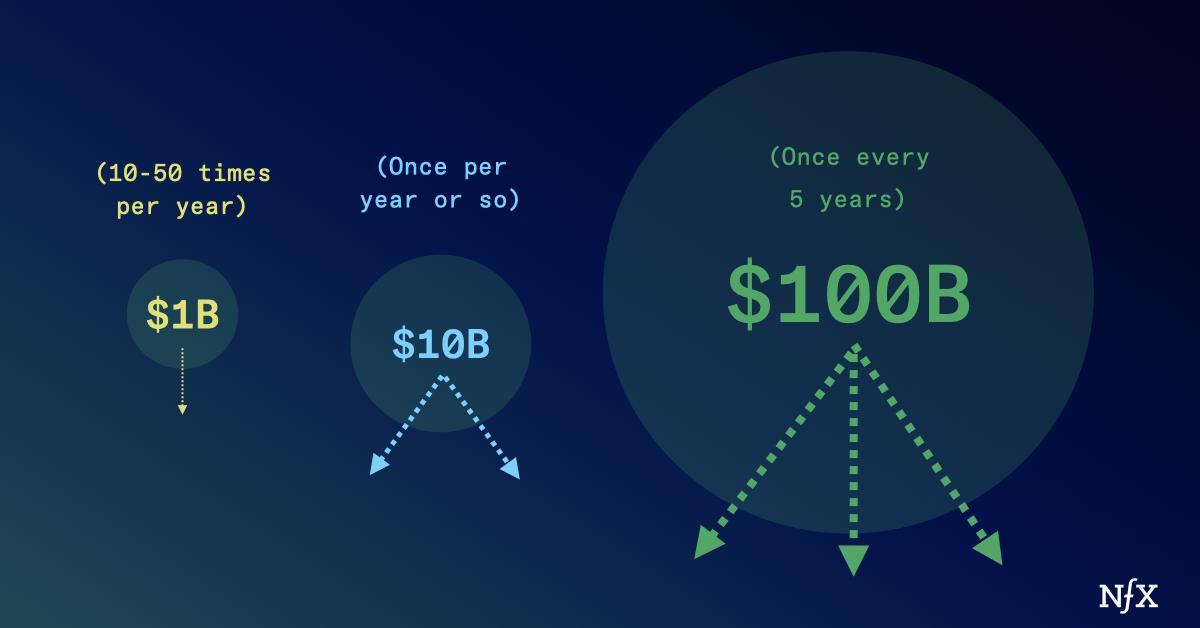

You need to be directly underneath a $1B ball to see any effect. Those balls fall 10-50 times per year, and someone builds a big company. Maybe they become a millionaire.

You can be close to a medium sized ball of about $10 billion. Maybe you’re a founder or early employee of one of these companies. You might become a billionaire.

The bigger the ball, the further from the center you can be, and still get a big outcome. Even a glancing blow from a $100 billion ball will make you rich. For example, can be employee #100 at Google, and still probably make more money than a founder of a company in a smaller space.

These giant balls fall about once every five years. If you see a ball like that, run like hell to get underneath it. Even a glancing blow could change your life.

Here, in Silicon Valley, people are especially attuned to looking for these beach balls They usually put it this way: a ticket on a rocket ship will still get you to space. No matter what class you’re in, you’re still fucking blasting off.

If you can train yourself to see them too, you’re unlikely to make a bad choice.

We’re In the Crowd With You

We investors are in the crowd with you.

We’re dropping beach balls, and looking for areas of the crowd that are especially ready to make the best use of them.

And whenever I see a scientist-Founder out there in the crowd, I know they have these secret superpowers.

With great power comes great responsibility. Use it well.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.

Try ChatNFX