In the face of a global pandemic and a financial meltdown, Founders are confronted with a new reality. The world has rapidly shifted under all our feet. Seemingly overnight, the economic dialogue has changed from measured confidence to murky chaos. If you are running a startup today, this will likely be one of the most challenging climates you’ll ever face.

I have been there — twice — and have a sense for what Founders are feeling right now. At lastminute.com, a European online travel site, we were in the eye of the storm during the September 11th crisis. And at Trulia in 2008, we faced not only a recession but a catastrophic meltdown in our core market, residential real estate.

In most ways, crises are horrible. But know this — crises always end. They are a cyclical part of our market economy and there are black swans that inevitably occur. The only way to build an iconic company is to do things differently. And in a crisis, survival requires being and thinking differently.

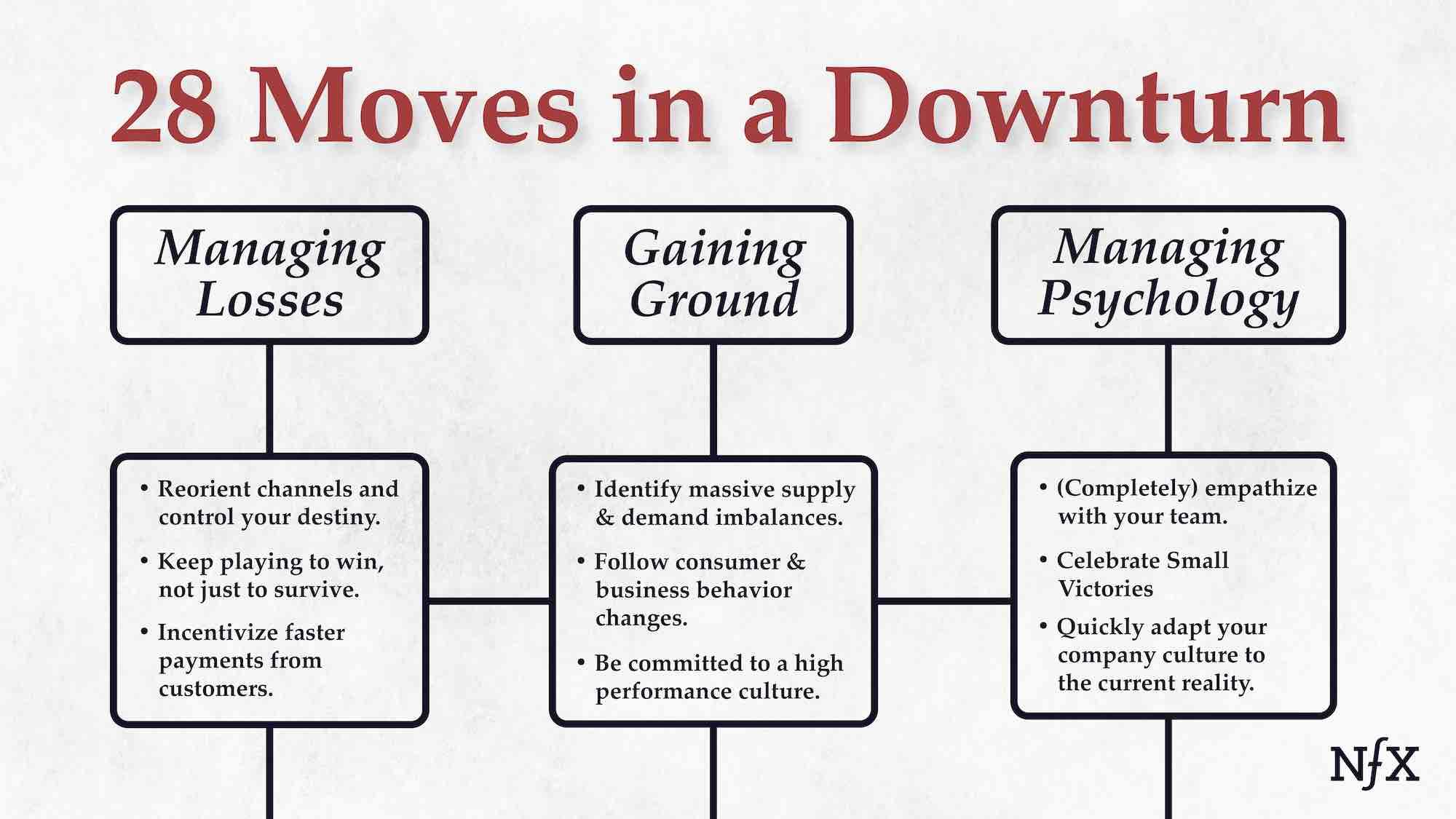

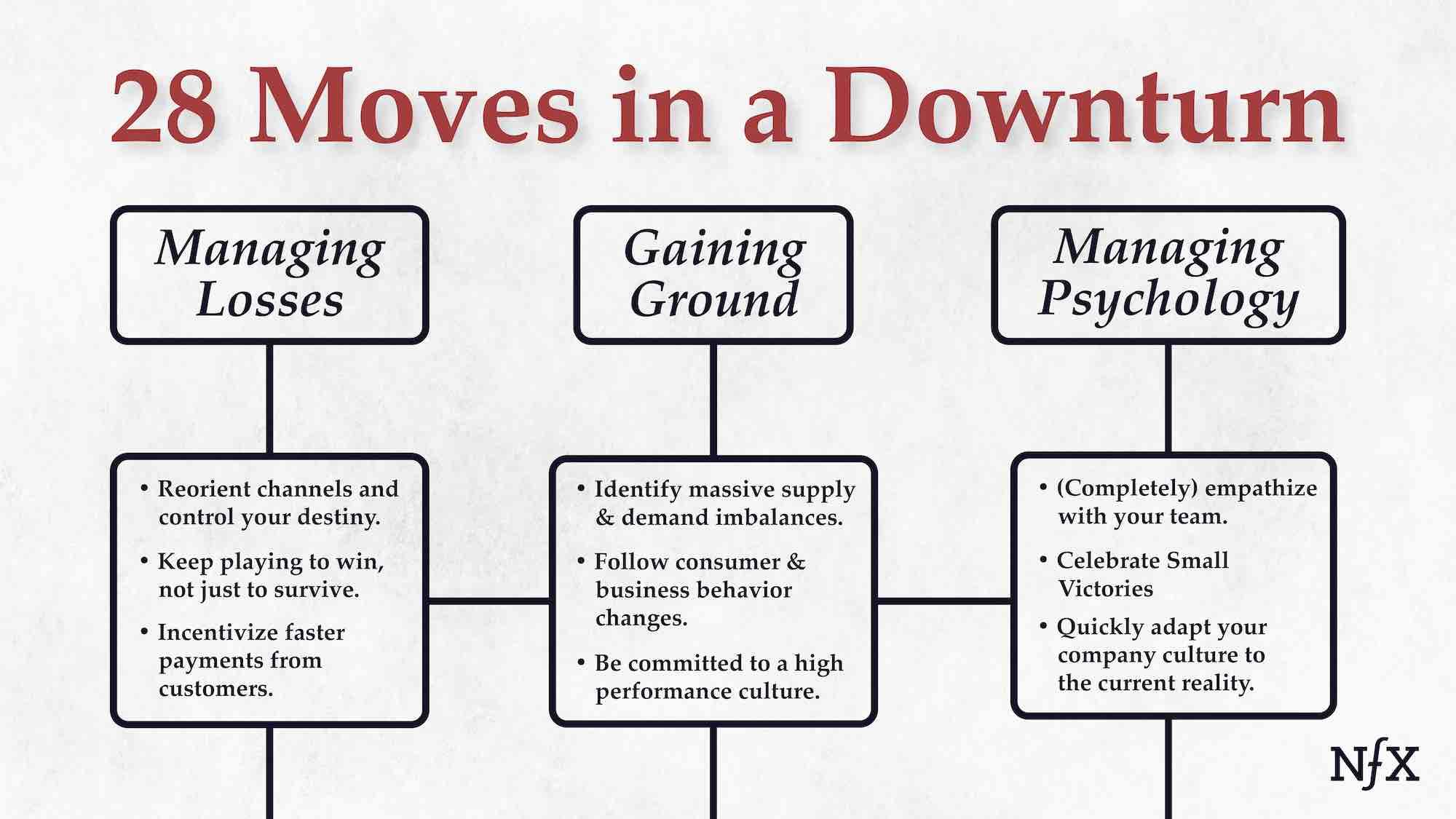

I’ve found there are three distinct but equally critical elements of how you manage a crisis:

1. The first is managing losses. This will be the most difficult and painful thing you do as a CEO because it involves people, but it’s often not so much about the what as it is the how. Your empathy and speed are key here.

2. The second is gaining ground. These are the ways you will reorient your focus, your tactics, and your team so you come out ahead after a crisis.

3. The third is managing psychology. It is crucial you keep yourself, your team, and those around you healthy, sane and productive.

Both lastminute.com & Trulia emerged stronger post-crisis because of the swift actions we took in these 3 areas. I’ve been advising my portfolio companies on the tactics we used to navigate through those very tough days, weeks, and months — and I felt it would be beneficial for the entire Founder community to make these publicly available.

We will continuously update this list with additional suggestions and resources.

Managing Losses

This is by far the hardest and least fun part of being a CEO or on a founding team. Above all, remember that there is a human being behind every decision you make to cut, outsource, repurpose or restructure.

1. Accept the new reality and (likely) change plan to prioritize cash.

Assume things are going to be worse than you think. The market has dramatically shifted. Your previous financial plan is likely irrelevant. So it’s necessary to change your plan to reflect the new reality. For some companies, your product-market fit just evaporated. Prepare and plan for a worst-case scenario and be delighted when you exceed it. Above all, your primary objective is to not run out of cash. There are two ways to do that. Either you can become profitable or you can survive long enough and grow efficiently enough to be able to raise a new round of financing. We have seen many times that the leaders in markets are often just the ones that were the last company standing coming out of a recession when everyone else threw in the towel or went bankrupt as they were unable to raise additional capital. They had the grit and resilience to battle through and build an enduring company. This was my experience at lastminute.com, where the very fact that we survived and were the last European online travel agency standing at the end of a crisis gave us tremendous market power during the recovery.

2. If you have to make layoffs, make them deep and early.

The best way to do layoffs is in one deep cut early in the crisis. Nothing is more demoralizing than multiple rounds of layoffs and retaining cash is key to prolonging survival. Always remember that a layoff upends someone’s life at the worst possible time. Be as human, kind, and generous as possible. We did this at Trulia by organizing a job fair, renting out a conference room at a nearby hotel, and inviting every company we knew that was hiring to come. This is even more important as layoffs are now sadly likely to be done remotely. After the layoff, be sure to tell the remaining employees how painful it is to lay people off but that you believe this will be the only round of cuts — now the company is in a more stable and solid position to survive. The peace of mind you are giving them is crucial.

3. During layoffs, focus more on the “stay team”, but care deeply for the “leave team”.

At Trulia at one point, we needed to layoff one-third of the company. It was incredibly hard. I found that as a CEO, you are pulled to spend more time with those leaving. But remember — your most important job as the leader is to motivate and communicate with the stay team. They are depending on you for guidance and support. Helping them do their jobs really well is precisely what will save their jobs and the company.

4. Keep playing to win, not just to survive.

If you have been already running lean and have a strong cash balance, don’t make significant cuts. If you do have to make significant cuts, ensure the stay team is actually capable of turning things around. Generally, this means you should not decimate the product and engineering teams. Those teams have the most leverage to help you survive. Repurpose employees you don’t want to fire because chances are you will need them again soon. For example, if you have an A+ office manager but no longer have an office (or are working from home as we are in the current Coronavirus pandemic), have him or her move over into sales support or take over some operations tasks.

5. Implement a hiring freeze, but be ready to make opportunistic moves.

Sometimes getting tremendous talent can help you survive a downturn. In addition, great talent will be cheaper and more available in a downturn. Be fair in your hiring; ideally, offer to move their compensation higher when the downturn ends. Or offer them strong total compensation by increasing stock. But be ready to grab the best talent if you have the flexibility. It will put the company in a better position both during and after the downturn. Note — if you did layoffs, then hiring of any sort is not recommended for a while. It sends the wrong message to the team.

6. Assume you will not be able to raise money soon.

You are better off avoiding pitching VCs for the near term because you won’t get their attention. Most VCs I know are making much much fewer investments as they focus on their portfolio and wait for things to stabilize. That is why we continuously advise Founders to raise money when you can — once you’ve been through a downturn you realize more than ever the advantage capital offers in coming out stronger.

7. Reward outstanding performance with stock.

You still want to reward a few of your highest performers. Give them stock. Tell them you can’t pay them more due to the cash situation but you want them to understand how much you value what they are doing. Personally thank them for their commitment and contribution and make it clear that if they stay with you and the company, they will have a bright future. Even a small amount as a gesture at this time can go a long way to help reduce the feeling of loss.

8. Adjust compensation where possible to reduce cash burn and share risk.

Be creative in how you pay employees. For example, you can increase commissions as part of take-home compensation for sales teams. For marketing and engineering teams, you might be able to attach bonuses or pay to overall team goals with more upside if they hit stretch numbers. Be cognizant that this can introduce uncertainty into their lives and acknowledge this fact — that you see they are stepping up and sharing the risk. If all goes well, then everyone actually will do better and earn more money — and the company thrives.

9. Right-size and recast marketing plans.

This is traditionally one of the easiest places to trim back to retain cash. Longer-term projects and initiatives can be back-burnered. Reassess all your marketing channels and their cost-effectiveness — focus on channels that deliver rapid payback on spend and don’t assume that historical churn and spend rates will survive — dive deeply into the data and recast your strategy. It’s quite possible new opportunities have opened up as companies are more interested in incremental revenue. PR should be deprioritized unless it’s highly relevant to the market sentiment. During times of crisis, people don’t focus on business news as much. Large external agency contracts should be put on hold or severely reduced. This is not the time to revamp your website. For the agencies, this can hurt. Please try to give them as much notice as you can or be creative in your ongoing relationship.

10. Refocus marketing on the highest ROI activities.

Task your internal team with identifying the lowest-cost / highest-ROI marketing opportunities and scaling those to the max. Obviously, put events on hold. If you do have event budgets, this is one area where you can potentially fund new initiatives by redirecting it to other areas.

11. Renegotiate contracts and leases.

It never hurts to ask for reductions or better payment terms. Keep in mind, however, that these companies also have to stay alive. They are probably having to lay off employees as well. We’re all in this together. Be fair and compassionate, but there is no shame in asking.

12. Reorient channels and control your destiny.

Focus on channels you can control. If you are selling through third parties, you may no longer be able to count on them to keep selling your product. They most likely will be distracted by other things. This will make it even more important to manage what you can control. If successful, this has the additional benefit of driving higher margins and is a great forcing function to reorient sales channels and sales motion towards direct sales.

13. Incentivize faster payments from your customers.

Offer discounts on invoices to get cash in quickly. Cash in hand is worth taking a temporary hit to your gross margins. This is particularly true when cash is in short supply.

14. Assess all software and infrastructure costs.

Chances are, you have some things you can cut there. Extra spend on AWS? Stranded licenses for Salesforce? Contractors using Google accounts on the corporate domain? You can decide what’s really necessary and what’s a luxury. Now is the time to tighten your belt. Start by cutting things no one uses then move on to cuts that are “nice-to-haves” but not critical — like extra licenses of design software you may share with external designers or extra GitHub seats.

Gaining Ground

A downturn is the best time to position your company for growth. Your large competitors will likely be knocked sideways and unable to react. Many of your smaller competitors will be short on cash, hibernating and unable to match your moves. While you are managing losses, you must be simultaneously making moves to gain ground.

15. Identify massive supply/demand imbalances.

Downturns tend to generate big gaps between supply and demand. You need to either source new supply to meet the needs of the current demand or change your positioning so it’s attractive to where the new demand is (or find new kinds of demand).

Addressing supply-side imbalances: If you’re going to see significant reduction in volume in a market downturn, don’t try to push against the tide. It’s meaningless. Instead, go upstream to how you can lock in supply. Be a great partner to them and to be well-positioned when things recover. If you are providing a valuable service in a downturn, then when things recover you will be highly sought after.

At Trulia, we did this by getting integrations with brokers and technology partners so all the real estate listing inventory came onto Trulia at a time when these partners needed low-cost distribution the most. We also used this time to integrate our supply and partner ecosystem for the long haul. This is not just a business development conversation; you need to enlist your engineering team to do the plumbing on your side. Most likely, the counterparties will do the plumbing on their side to integrate their platform with your platform because they need the bump in usage and customers.

At lastminute.com, we used the downturn to secure more inventory at rock-bottom rates. We figured people would start traveling again in the not so distant future. We also secured inventory for entire Eurostar trains and sold tickets on them dirt cheap — matching the new demand. These stunts helped catalyse long-term supply and demand relationships that were important when the market recovered.

Addressing demand-side imbalances: How can you provide services to companies such that they can quickly reduce costs or increase revenue? Conversations that were historically challenging can become surprisingly easy if you’re able to directly impact the P&L. You can use these engagements to push through broader systemic changes to relationships and systems that might have been met with internal resistance previously. At Trulia, we negotiated deals with newspapers and other online portals to take over their real estate classified sections, add our branding and integrate with our system. As most companies in a downturn refocus on their core, how can you help them to turn cost centers into profit centers?

16. Follow the behavior changes as consumers/businesses become more cost-conscious.

Your customers’ behavior will change. Their thresholds for purchases will move. This often creates advantages if you follow them and pivot smartly. At Trulia, we integrated foreclosure listings into the core search experience during the housing downturn. It became a very popular product and was one of our biggest growth segments during the downturn. Watch closely for changes in customer behavior. Ask yourself and your team: ‘What can we create that will fulfill their current needs or address their anxieties?’

17. Speed is your asset. Move fast and try new things.

Anyone can be a chess grandmaster if they can move two times before their opponent moves. During a downturn, you have an opportunity to make three moves ahead of them. Incumbents will be doubly slow during a crisis. So lock in inventory, secure partnerships, and do other things that take incumbents much longer.

18. 10x your product.

Now is the time to make sure you are building a painkiller rather than a vitamin. The only way to break through in this new reality is to have a dramatically better product or service. Talk to all of your best customers. Dive deeply into the user analytics data. Find out how users are engaging with your product today — what features they love, where they seem to get stuck. Compare current user behaviors with previous ones. Identify new behaviors that you can better support and amplify to make their experience better. Be creative, ask how you can solve problems in novel ways. Asking these questions will not only improve your product; it may also save your company because you will see signs of trouble and identify reasons for them to leave. If you 10x your product during a crisis and get your users excited, imagine what will happen after the crisis abates?

19. Turn fixed costs into variable costs.

This can give you more flexibility as you grow. Maybe you had a content marketer that you had to lay off? Are there 3rd party services that can provide a similar level of service, but on a performance basis? You can dial that variable output up when you start growing again and even add more contractors or service providers. This may seem to contradict my advice to ditch agencies — but it actually doesn’t. Independent contractors are a bargain compared to most agencies — and can be a bargain compared to FTEs for some roles. Converting fixed to variable costs when the costs are people does create internal change management issues you should address; explain to your employees why you are making the shift and whether it is permanent.

20. Replace people-driven processes with technology wherever possible.

This is a good use of engineering time during a downturn that could yield big cost savings and improve efficiency. It’s also an essential muscle to grow. All great startups have done a masterful job of doing more with less. Are there opportunities to automate basic customer service responses, streamline sales functions, or reduce operational costs? The most obvious way to do this is by leveraging technology more effectively. Again, you should explain what’s going on to your team and why you are doing it. In most cases, top performers who are technology-disrupted can either shift to another role in your company or can be highly successful elsewhere with a company that still has more people-centric processes for their role in place.

21. Make your sales more efficient.

If you can figure out ways to increase the chance of any sales prospect turning into a customer, you are creating amazing future margin leverage even as you are reducing burn rate (you don’t need to acquire as many customers). At Trulia, with a small team, we were converting roughly 2% of real estate agents we contacted. We looked deep in the data and built out a great data science discipline to identify how to better prospect and identify potential customers. As a result, we increased conversions to 20% by the end of the recession. The math on that is astounding.

22. Be committed to building a high-performance culture.

In a downturn, everyone must perform. This becomes non-negotiable. Hitting 95% of your goal is missing your goal. If you don’t have a strong performance culture — clear, measurable targets for everyone — then create one.

1. Explain what you are doing and why you are doing it.

2. Give everyone clear numerical goals.

3. Be visible with metrics company-wide.

4. Be fair — reforecast and revise targets to be realistic.

Managing Psychology

Crises are psychologically taxing for everyone. Your team needs you to go above and beyond. You need to think about caring for their minds as much as anything else; clear minds will get you through this. Above all, be as humane and empathetic as possible.

23. (Completely) empathize with your employees.

People tend to adopt more of a “What will happen to me?” mindset in times of fear and uncertainty. Even if you are stressed about managing the entire company, acknowledging their concerns is critical in helping them be productive. Be as transparent as possible and explain in detail how the company will be able to get through this crisis and what can everyone do to contribute to the new plan.

24. Encourage company bonding.

Get to know each other even better. Have everyone share something about their day that made them happy or sad at team meetings. Be sure to call out birthdays, anniversaries, and highlight funny or touching shared memories. Instill a warm feeling as much as you can. While there are so many big things going on, it’s even more important to take time out to focus on the little things that make people people. Teams that are emotionally engaged are also higher performing. This type of connection makes work more meaningful — both during and after a crisis.

25. Practice spontaneous, random acts.

Call people. Sing a song for them. Send them a funny GIF. Send them a virtual cookie. Use your imagination in crazy ways. All of this shows you care about them. Keep it within bounds — no one wants to feel like they have to be on 24/7. But show your employees you care with your acts, not just your emails.

26. Quickly adapt your company culture to the current reality.

In the current environment, everyone is working from home. So move all team meetings online but also take extra steps like creating online office hours for executives or designated periods when everyone is on video together, just working and interacting. Team happy hours, or “Quarantinis” as we at NFX call them, bring lightness to heavy times. Everyone can give the company a virtual house tour to show where they live and what it’s like. The next crisis may be different and may require different cultural shifts but react quickly to help everyone stay engaged and feel safe. In general, many of these shifts may stick after the crisis, so make sure they are all practices you would adopt for the long-haul.

27. Focus. Have candid, honest conversations with yourself and your team.

Focusing in on vanity metrics, pet projects that should die, and other activities that might be left alone in a normal situation now exert critical drag you must avoid. Ask yourself the hard questions and ask your team members the same. Above all, this is a time of focus. This is really about managing psychology and helping people focus on what’s most important in a time when you have the least room for error.

28. Celebrate small victories.

With all the uncertainty and stress, take time out to celebrate the team’s small wins on a weekly basis. Build a long term vision, but focus on a near term plan and things you can achieve quickly. The compounding impact of many seemingly little wins can be astounding. Small wins have an outsized impact in tough times and give you a sense of progress and success when things around you are grim.

Mind Over Matter

Downturns are hard and negativity and fear will be everywhere. But having been through two cataclysmic market crashes where both companies emerged ahead of my competitors, I can promise you this is an exercise of mind over matter. Once you realize there is a binary choice at play — either the downturn will end or it will continue forever — then it’s easy to see through the fog of emotion.

Yes, this is a crisis. But it is also your opportunity to breakout, if you choose that mindset.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.