Every technology has a limited open window when it’s a good idea to start a new company. You need to know where you are in your technology window.

They don’t teach this at HBS, GSB, or any accelerator, and I’m not sure why. It’s the unspoken mechanism that determines the chances for your startup to succeed.

Most, if not all, great companies are founded inside these technology windows of opportunity – moments when technologies shift. You have to know what these windows look like and if you’re in one to have a sense of how much opportunity is really in front of you.

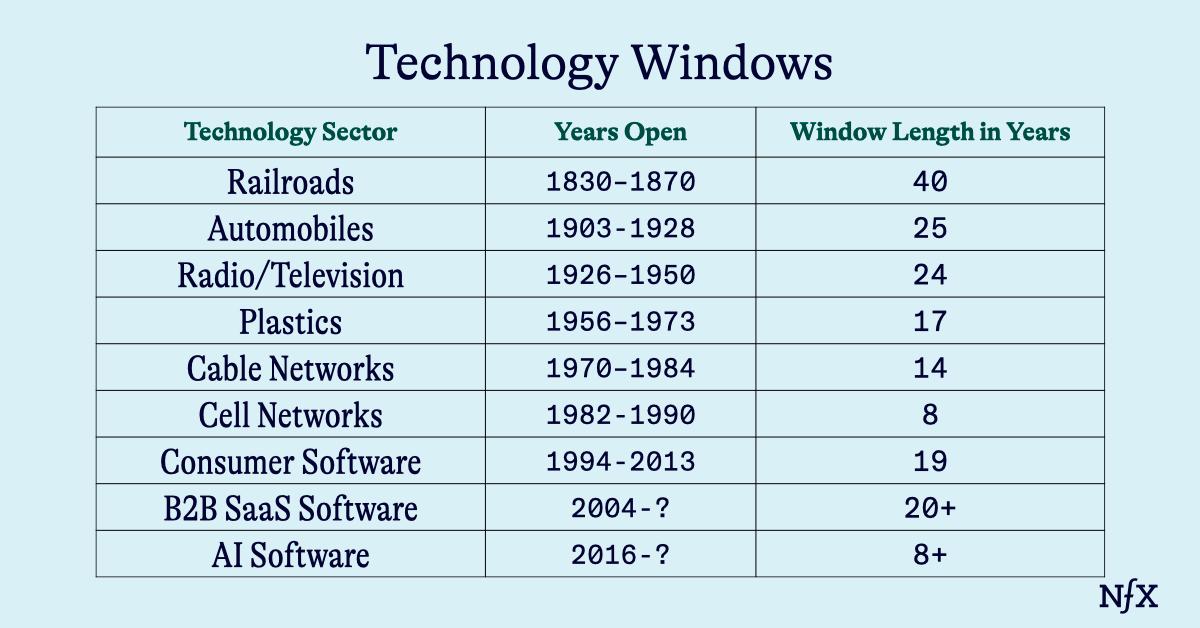

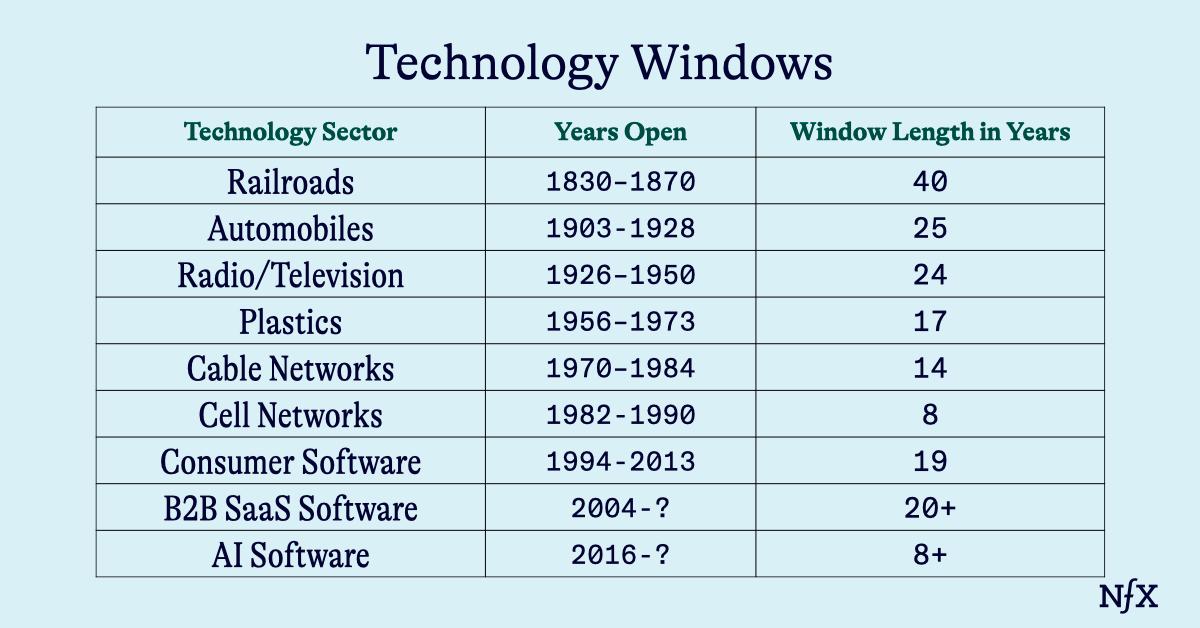

For instance, railroad technology. In the US, it was a good idea to start a railroad between about 1830 and 1870. If you tried to start a railroad after that, no bueno. And lots of people tried after 1870. They were looking backwards saying “I want to be like those railroad barons, who have lots of money, fancy houses, and a lot of respect and status.” But the window for that technology had closed. The only people who did well after 1870 were the M&A people, private equity players, financiers and lawyers of existing railroads. Not the creatives and entrepreneurs.

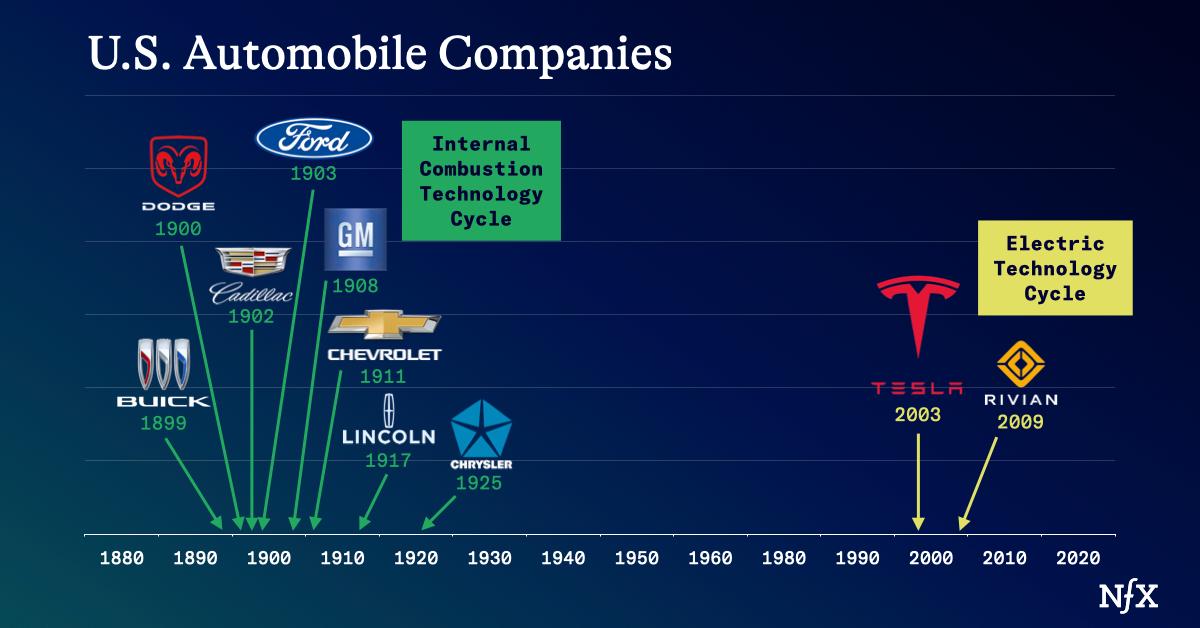

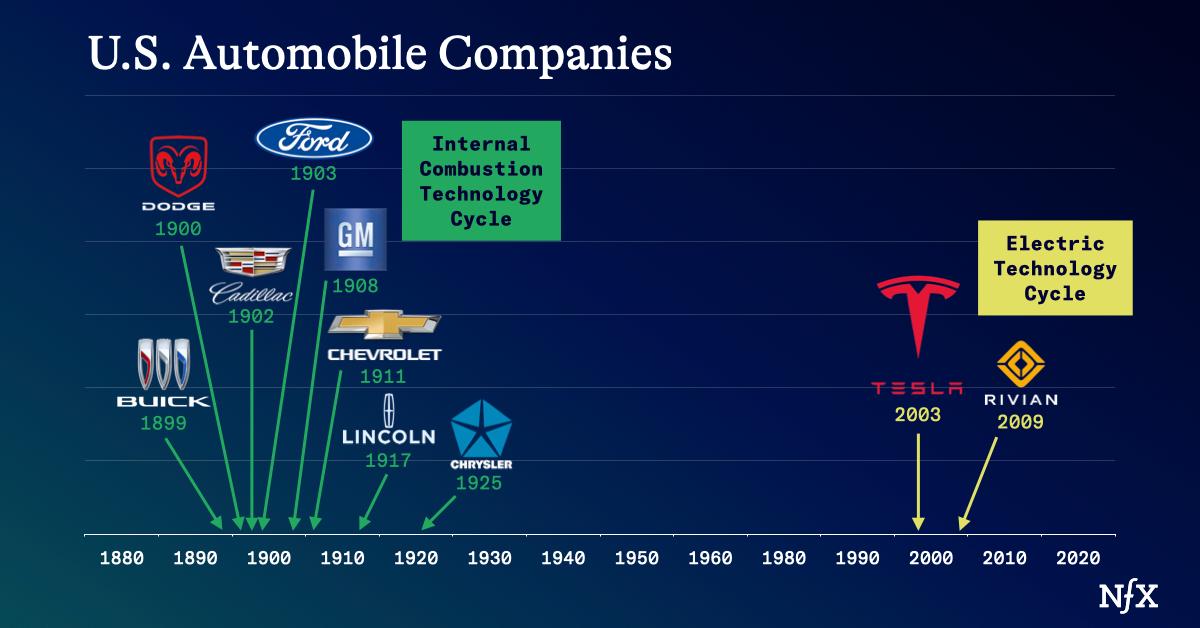

Another example: US Automobile startups. The internal combustion engine technology window was open between 1899 (Buick) and 1925 (Chrysler). After 1925, no interesting US car company was built (Jeep in 1941 was a branding innovation and a function of a world war). Watch the movie Tucker if you want to see what it’s like to try and start a car company after the technology window is closed. After 78 years, a new technology window opened in 2003 with battery and electric motor tech that birthed Tesla.

The same is true for every technology you can think of. And your startup is riding the pattern.

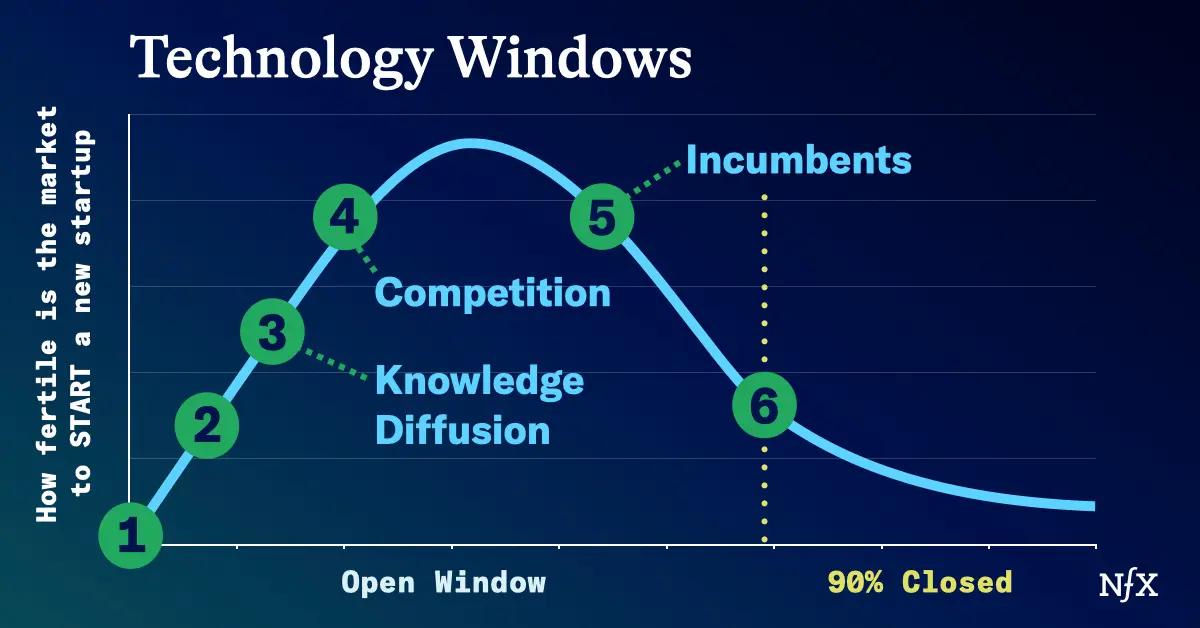

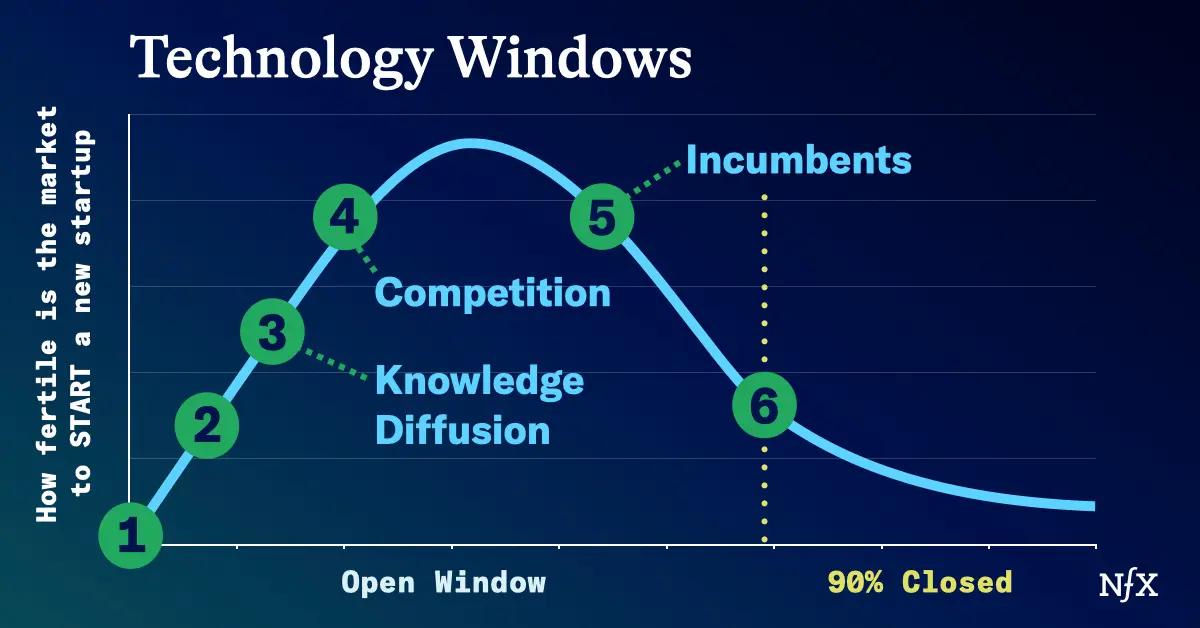

The Shape of a Technology Window

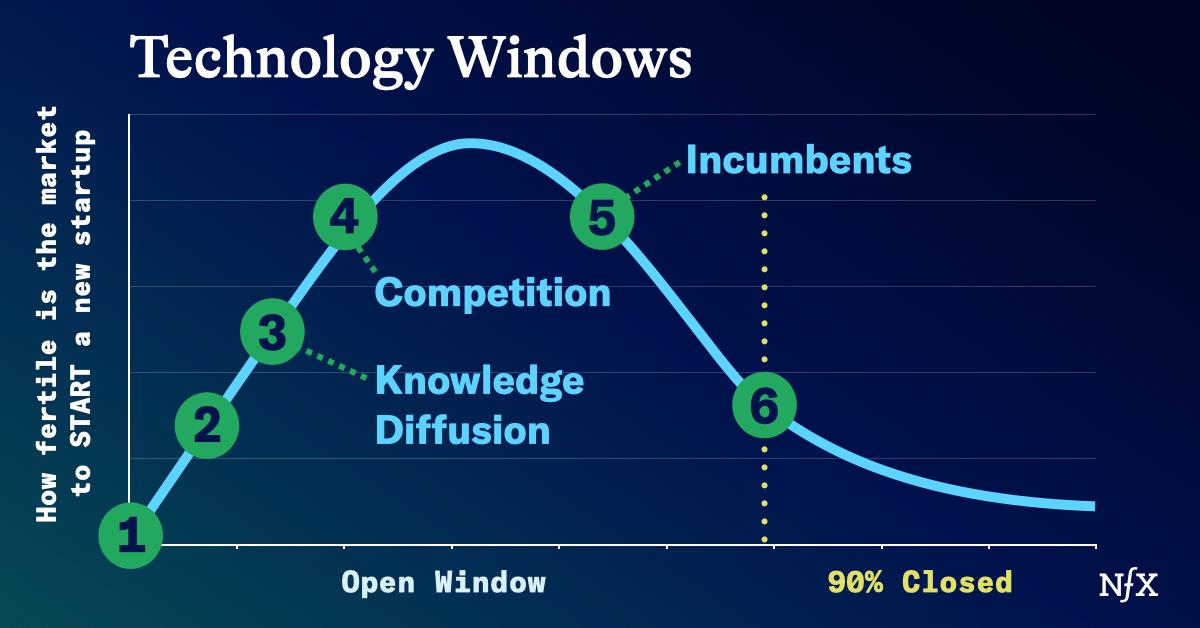

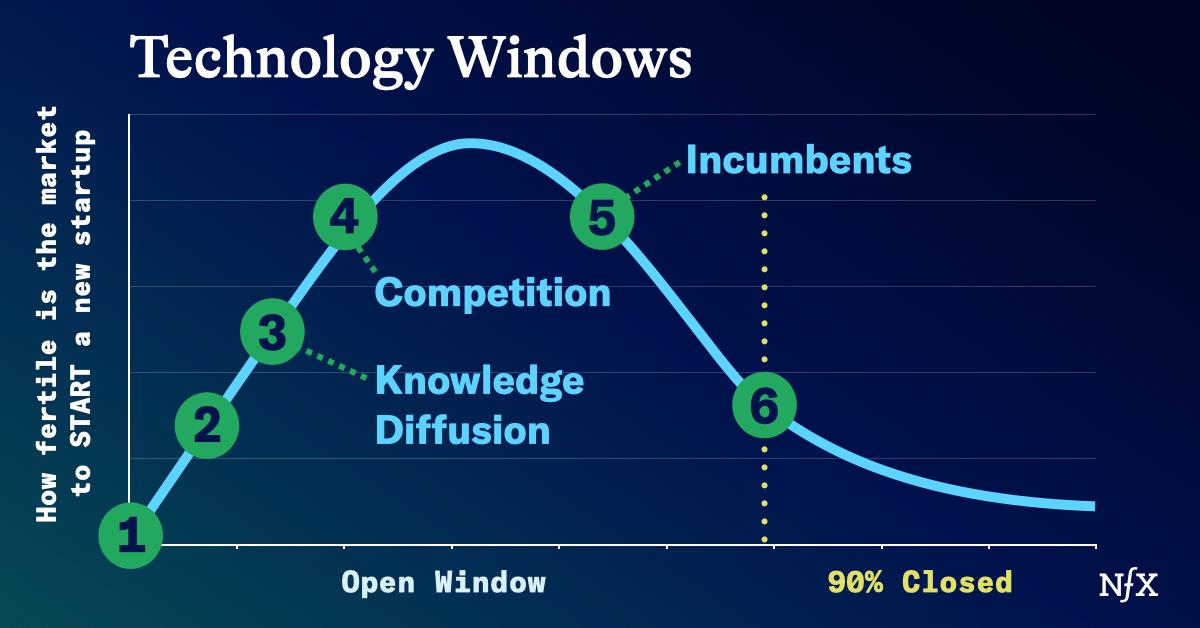

- A technology is invented. Hobbyists play with it out of innate interest and creativity.

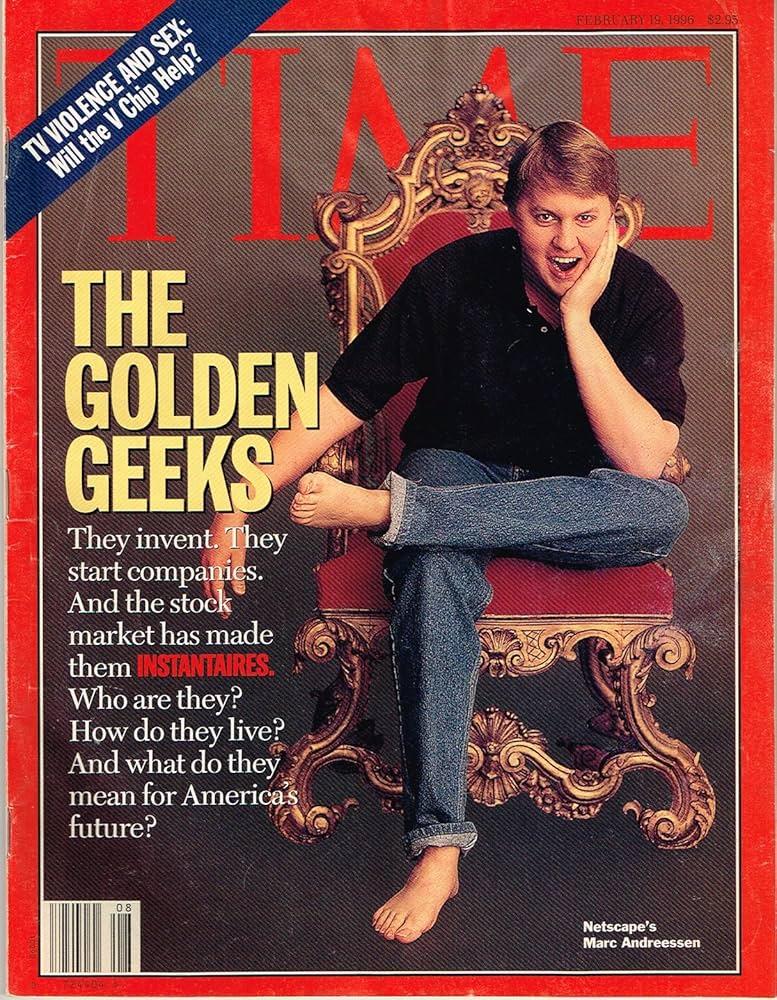

- Status moment. One of those hobbyists achieves status and wealth using the new technology. That alerts the mainstream that they should pay attention. For the internet technology window, that was this magazine cover in 1996.

- Knowledge diffusion. Alerted to the opportunity for status and wealth, many people start investigating the technology and exploring what it can do.

- Competition floods in.

- Incumbents emerge, because they have better management, or they grab the key defensibilities like network effects.

- Technology window closes 90%. Incumbents close off opportunities for new startups by locking up distribution, achieving scale economics, building network effects, growing their brands, encouraging government regulation, etc. Margins decrease, CAC increases, operating costs increase, thresholds to entry increase. In many cases, some teams are simply more talented than others.

This is the general shape of these technology window curves. Exogenous factors can put dents or delays in the curve shape, such as big business cycles or safety concerns about the technology. But this general shape holds.

The details of the closing of the window look different for every technology and geography, but the closing happens every time and predictably.

The window is not completely closed to new entrants, of course, but it’s 90% harder to get something big started, and the outcomes will typically be far smaller.

Great Technology Change Gives Great Opportunity; Little Change, Little Opportunity

When there are big, fast technology changes happening, bigger inflections in your fortunes are possible.

“I wished for a war, … I knew it was the only way to rise up.”

– Line from the Hamilton musical

And the opposite is true. In times when little is changing, everyone knows the game, and progress is incremental, there is little opportunity to build an important company. For example:

Other Fields Where Technology Windows Rule

Note that this technology window pattern is true in other fields, not just technology startups.

Here is our discussion of the same technology pattern affecting artists, creatives, musicians, etc. We don’t usually think about how the technology of a time affects the fortunes of artists. But we should. It’s central to the causality of success or failure.

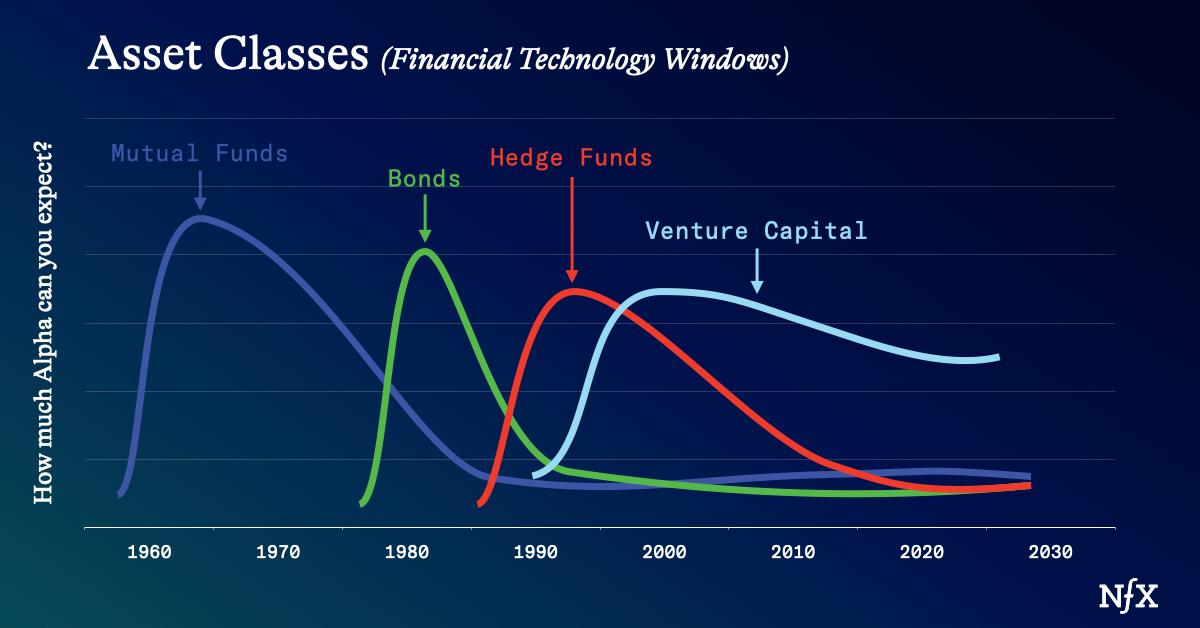

The technology window pattern also affects what we think of as “asset classes.” Assets classes are not immutable. Technology will shift and suddenly bring these asset classes into being, and then the “alpha” of these asset classes follows the same trajectory.

A new asset class is very profitable when it’s first getting going, but then competition comes in. Inefficiency is eliminated, incumbents are established, and the window closes 90%. You can still make money in an asset class, but it won’t be nearly as good as it was in the early days. Until a new technology comes along, and permits you to find new inefficiencies to exploit.

I could have added a “crypto” asset class to this chart (2008 start), but I didn’t want to distract from the main point of this essay.

I could have added a “crypto” asset class to this chart (2008 start), but I didn’t want to distract from the main point of this essay.

As you can see, venture capital has maintained its alpha a bit better. Two major reasons:

- The asset is still really inefficient because the data hasn’t been digitized yet.

- It’s a small asset class compared to the rest.

So What Technology Window Are You Playing in?

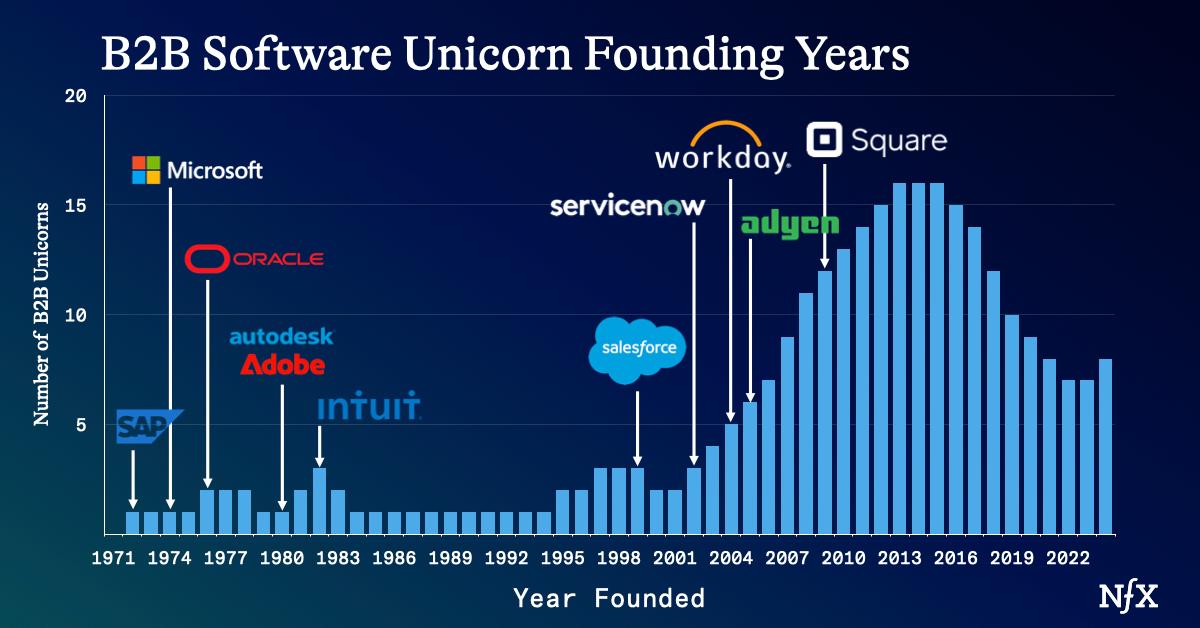

As an example, the B2B software technology window looks like this:

These unicorn numbers are approximate and illustrative.

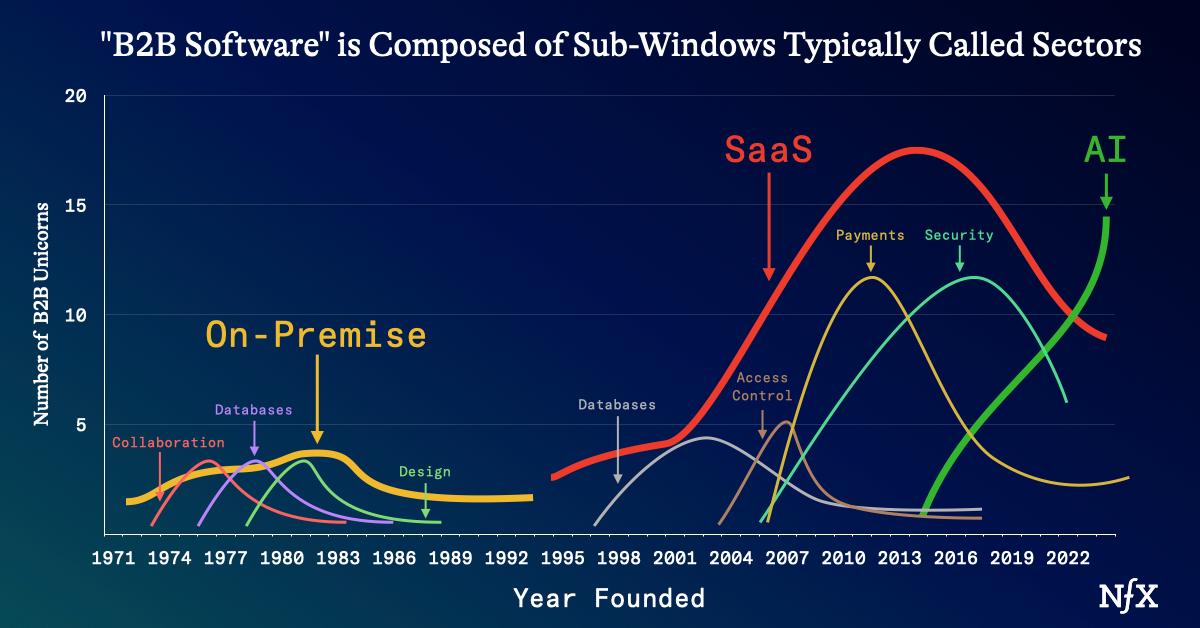

Look below. We have seen three underlying tech windows for B2B software: on premise, SaaS and AI. We are eight years into the third tech window, AI. There is still an open window to create big companies using AI as a wedge.

Recognize that each technology window is made up of sub-windows.

Again, this graphic is intended to be demonstrative of the concept, not an accurate map.

Notice that it’s important where you are in your window and sub-window – and even your sub-sub-window. Be honest with yourself.

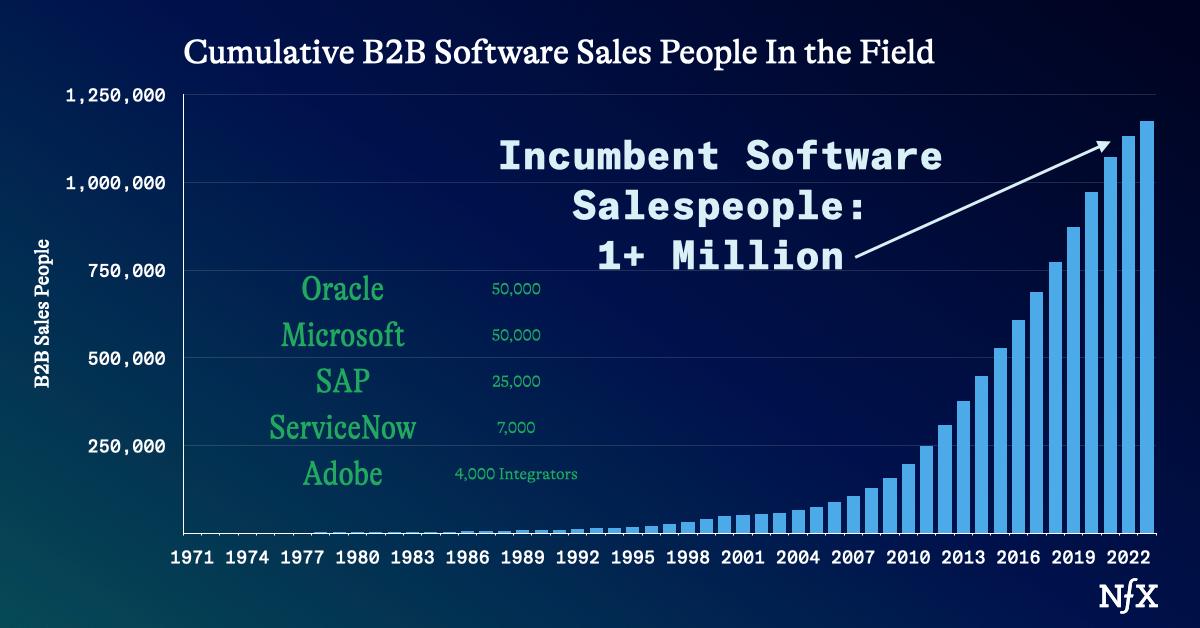

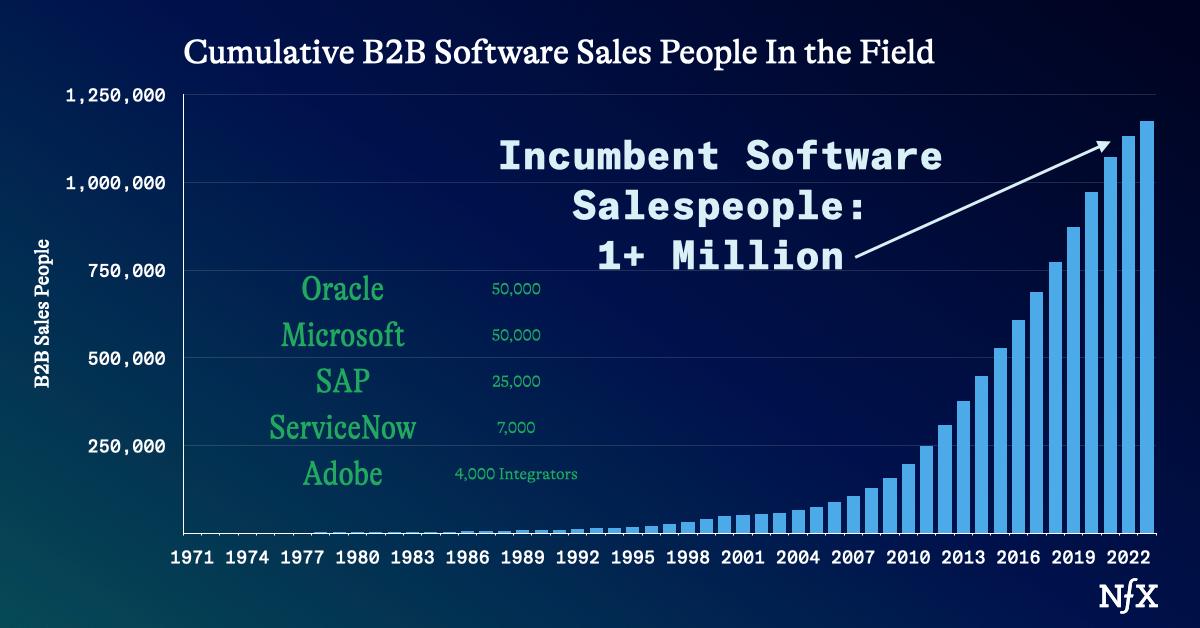

Here is some data which shows you ONE mechanism by which the B2B SaaS window is changing.

There are now between 1.1 million to 1.8 million B2B SaaS sales people in the world. These sales people need to hit their quotas. They have relationships with the customers your startup wants to sell to, and their software is already installed. Their engineering teams can add AI capabilities to their products. They don’t want to lose their jobs. Twenty years ago, the few B2B SaaS sales people were fighting customer ignorance about the benefits of SaaS software. Now you and your small team of sales people are up against these very sales people. They don’t want to lose portions of the budgets of their customers to you, even if your product is new.

Ride a Tech Window, or Sub-Window

Now that you can see technology windows, you should realize that one of your best bets is to hop on one or more of these windows in your career.

I was just out of college when the browser came out in 1994. I’ve been riding the software window ever since. I know some who made their careers riding sub-windows like the “data-com hot-box” tech window of 1991-2000, the “social networking” window of 2002- 2011, or the crypto/blockchain tech window of 2010 to who-knows-when.

Currently, nearly everyone is trying to ride the “AI” tech window that started in 2016. What about sub-windows like AI driven robotics? AI consumer products? AI SMB software? AI fintech? AI data aggregators?

Grabbing a good tech window is the main goal if you want to build something big.

The ideal time to enter is different in every window, and it’s hard to time anyway. If there is a sweet spot, it seems to be a point 3 or 4 in the curve, during knowledge diffusion and competition entering. The earlier players have taken the arrows in their back, have made mistakes and successes you can learn from, and the capital to accelerate rapidly will be more available.

What Part of a Tech Window Suits You Best?

The personalities favored during one part of the window may not be favored in another. Where do you fit in?

In the open window phase at the beginning, the winners tend to be creative and flexible dreamers, visionaries, tinkerers and hobbyists. They are fast and often loose. They adapt and adjust to the tech and the competition as it rolls out, finding the holes and early trends.

In the closed phase, also called the incumbent phase, the winners tend to be lawyers, spreadsheet analysts, cost cutters, and more ruthless, sharp-elbowed folks. If you have a more hard-nosed, logical business personality, you should consider finding a technology window that recently closed and jump in to cut costs, buy your weaker competitors, rationalize the workforce, optimize each process, and optimize the balance sheet.

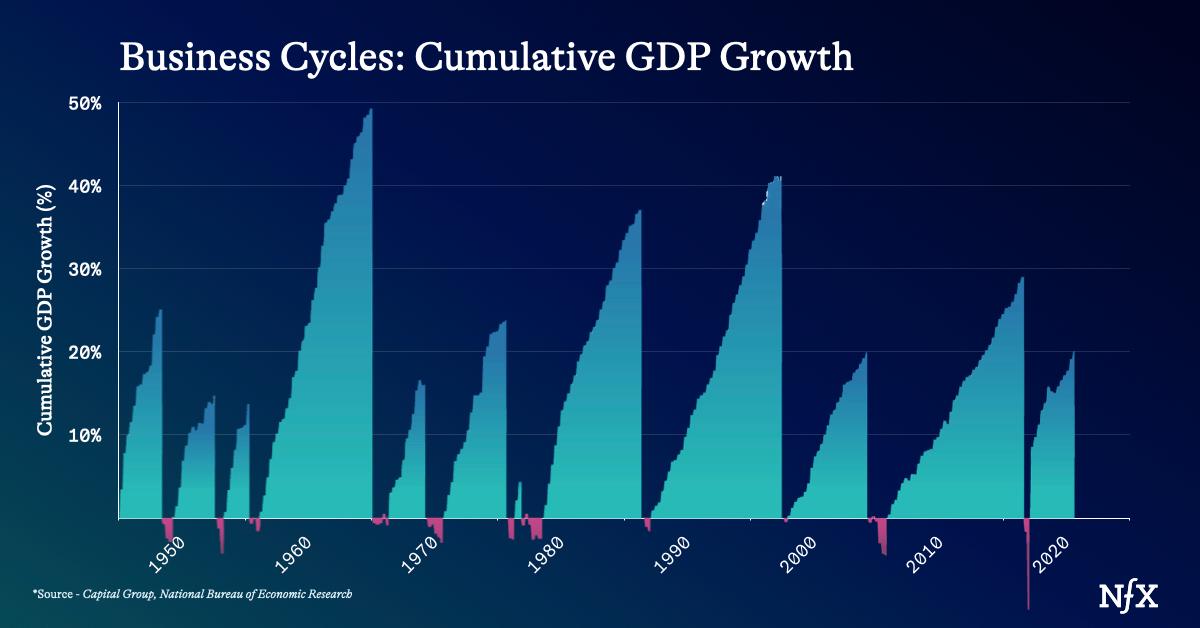

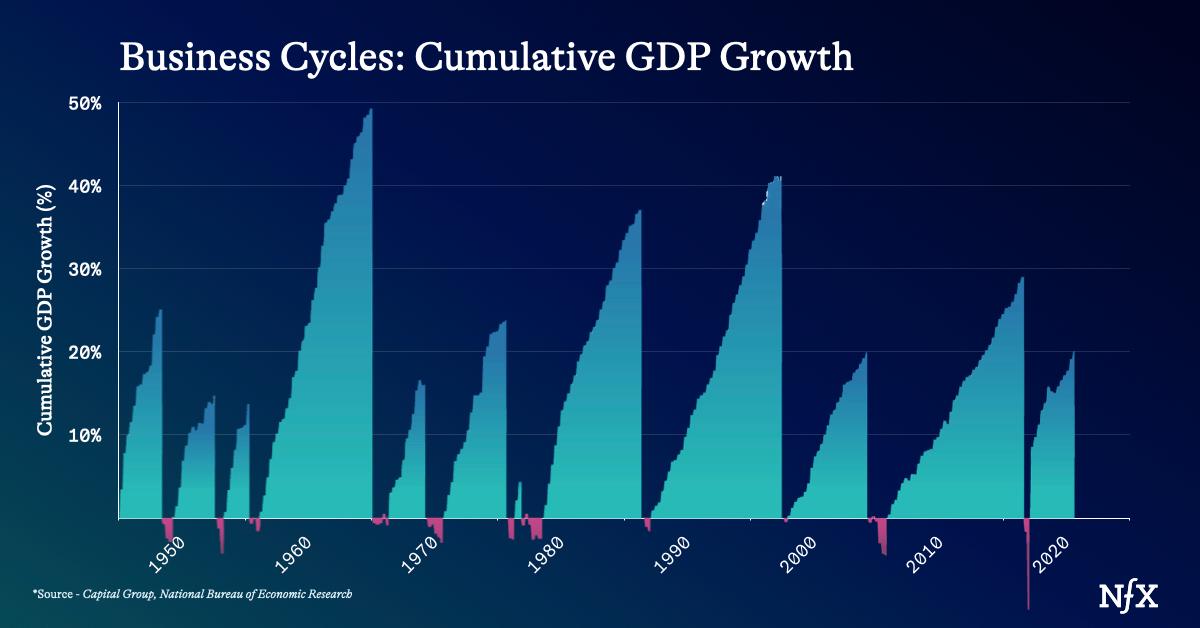

We Are NOT Talking About Business Cycles

Business cycles are mostly psychological, not technological. Business cycles have to do with exuberance and fear, interest rates, employment levels, inflation, and all the macroeconomic indicators typical prognosticators talk about daily when they talk about “the markets.”

From my perspective, business cycles are a distraction. That’s not where the real action is – not for world class founders. For the founders we want to invest in, the real action is in the technology windows.

World class founders ignore the economic environment. (One exception: raise capital when it’s easy and then preserve their resources for tougher times.)

Building Companies Based on Non-Tech Trends Isn’t Recommended

Sure, you CAN start a company with old technologies based on slower moving non-tech trends.

Starbucks, for instance, was based on packaging, brand and marketing innovations, not based on a technology innovation. It used coffee technologies which were old when it was founded in 1971, and it was more or less a copy of Peet’s which was founded in 1966. Lululemon, founded in 1998, also falls in this category, using proven clothing materials and manufacturing technologies.

Today in places like LA and NYC, we see 1000s of founders working to find brand, packaging and marketing innovations for their energy bar, clothing line, kitchen utensil or supplement concepts. They are all using proven technologies for proven market demands.

But the very biggest companies will be built on new technologies.

Why? Discontinuous technologies create explosive gaps in value creation for customers. There’s so much potential energy available in such a short amount of time that the probability of bringing a huge company into existence is significantly higher.

A lot of founders come to us with company ideas where they see opportunity in demographic trends, or changing preferences for Gen Z or Gen Alpha. But we don’t invest in those. Those are slow moving trends, giving incumbents and other founders time to see the shift and jump in, leaving less potential energy for your company to capture. It’s very hard to build breakout companies on these types of insights.

Insight into a new technology is what matters.

Where You Should Spend Your Time

Because it’s typically only new technology windows that produce big companies, VC firms, including NFX, choose to invest in technology companies. Further, they want to invest early in the technology window of a given technology. It’s where the best returns to capital and labor are.

It’s where we suggest you play, given it’s the best returns to your time. And, of course, it moves humanity forward faster.

So what technology windows are just opening?

Obviously AI is still fresh. As we’ve written, there are ways to use AI to beat software incumbents. But competition might be tougher for the AI technology window than any that has come before.

All eyes are on AI. AI is the #1 focus for the majority of top founders. It’s the #1 priority of the vast majority of VCs. AI is the #1 priority for every software incumbent your startup has to get around. And as NFX Venture Partner Stan Chudnovsky pointed out, this might be the first time in history where the #1 priority of the six most valuable companies in the world is the same thing – AI.

So you’re going to have to move fast, you’ll need to think differently, you’ll need to be very thoughtful and aggressive at finding a wedge into a 30+ year old software technology window, and you’re probably going to need to bring something deeper to your AI-powered startup.

It’s phase 4 of the AI technology window, and it’s on steroids this time. Time’s a wastin’. We know what happens in the next phase. Incumbents are established and they close the window.

Because the AI technology window is still very much open, we’re seeing great opportunities in AI-powered everything: consumer, vertical SaaS, SMB SaaS, games, fintech, techbio, robotics, defense, and marketplaces. We see great opportunities in crypto, which always benefits from network effects.

Please come talk to us if you’re a world class founder riding a new technology window, sub-window, or sub-sub-window.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.