Seemingly overnight, everything changed. It was 2008 and I was running Trulia. We not only faced a recession but a catastrophic meltdown in our core market.

It wasn’t my first crisis. I’d been in the eye of the storm once before when lastminute.com, a European online travel site where I was one of the founding team, was massively impacted by the 9/11 crisis and 2001 recession.

So when the Covid-19 pandemic landed hard in March 2020, I decided to write about what I’d learned managing the previous crises. I listed out several tactical decisions we’d made at Trulia and lastminute.com that worked.

Decisions that not only gave us a fighting chance, but the chance to pull ahead of our competition. These learnings helped many of our NFX Guild companies gain ground, at speed, while others stalled out during the pandemic.

Today, it seems we’re on the cusp of another economic downturn. Only this downturn is different. It’s bigger. And it’s likely to last much longer.

We’re facing a confluent swirl of the following: inflation rates hitting a near 40-year high; rising interest rates, oil and gas prices skyrocketing; a pullback in public equities and the crypto markets; a snapback of tech growth as the pandemic recedes; increasing layoffs; and socioeconomic and political turmoil due to the current war in Ukraine. It’s not pretty out there.

Your journey in this new bear market is only now getting started. Startup CEOs, Founders and teams: if you’re working at a startup today, this will likely be among the most challenging climates you’ll face.

That’s why I want to take an updated look now at what lies ahead for startups, and share an actionable list for how to find the opportunity in the storm. I’ve built this list pulling from my experience both as a former Founder and now as a VC.

***

Know this — crises always end. We have seen repeatedly how economic shocks drive efficiency and accelerate automation, which in turn drives tech adoption. They are a cyclical part of our market economy and there are black swans that inevitably occur. Many of the most successful technology companies (Airbnb, Uber, WhatsApp, etc) have started during periods of market uncertainty. You’ve probably heard this many times, and I know it’s small consolation for what is going to be really tough times for many.

But the point is this: The only way to build an iconic company is to do things differently. And in a crisis, survival requires being and thinking differently. There is an abundance of opportunity in this moment, if you can see what others do not, act quickly, and keep your head up.

My 3-Part Framework For Managing A Crisis

I’ve found there are three distinct but equally critical elements of how you manage a crisis, and I’ve organized this post around each of them.

- The first is managing losses. This will be the most difficult and painful thing you do as a CEO or leader because it involves people, but it’s often not so much about the what as it is the how. Your empathy and speed are key here.

- The second is gaining ground. These are the ways you will reorient your focus, your tactics, and your team so you come out ahead after a crisis.

- The third is managing psychology. It is crucial you keep yourself, your team, and those around you healthy, sane and productive. Taking action always brings good energy. Now is a time for you to lead with confidence in your team and in your mission.

I’m proud to say that lastminute.com (2001 crisis), Trulia (2008 recession), and our NFX companies (during the Covid-19 pandemic) all emerged stronger because of the swift actions taken in these 3 areas.

I’ve been advising my portfolio companies yet again on these tactics. When so much feels uncontrollable right now – these are the things you can control. If you execute right you could carve out a market that you dominate in for years to come.

Managing Losses

This is by far the hardest and least fun part of being a CEO or on a founding team during a downturn. Above all, remember that there is a human being behind every decision you make to cut, outsource, repurpose or restructure.

1. Change plans to prioritize cash

Think like an investor gauging downside risk in any particular investment. Assume things are going to be worse than you think. The market has shifted. Above all, your primary objective is to not run out of cash. There are two ways to do that.

- Either you can become profitable. (We’ll discuss more below).

- Or you can survive long enough and grow efficiently enough to be able to raise a new round of financing.

We have seen many times that the leaders in markets are often just the last ones standing coming out of a recession, when everyone else threw in the towel or went bankrupt as they were unable to raise additional capital. They had the grit and resilience to battle through and build an enduring company.

This was my experience at lastminute.com, where the very fact that we survived and were the last European online travel agency standing at the end of a crisis gave us tremendous market power during the recovery.

2. Assume you will not be able to raise money soon

Most VCs I know are making fewer investments as they focus on their portfolio right now and wait for things to stabilize. That is why we have always advised Founders to raise money when you can when the checkbooks are open. Because once you’ve been through a downturn, you realize more than ever the advantage capital offers in coming out stronger.

As public company valuations and multiples have come down dramatically in the first half of 2022, investors have become cautious and will be much more selective in making new investments. That is particularly true for later-stage companies. Growth-stage capital flooded the market in recent years, but it has been hit hard as prices decline. These investors have now pulled out.

Early-stage firms such as NFX – exclusively focused on Seed and Pre-Seed rounds – are actively investing. But overall the bar for all investments for all managers has gone up, and the valuations have, or are about to, go down.

New investment rounds that are getting done in this market will have fully climbed the ladder of proof and outperform other startups in ALL major metrics and milestones including: growth, efficiency, team, unit economics, market opportunity, defensibility, etc.

It is certainly still possible to raise money, but many investors at the beginning of a downturn are going to wait for the market to stabilize and also to understand what impact this will have on consumer and business spending and how your startup’s prospects will be impacted (positively or negatively) by the macro changes.

As they say, no one wants to catch a falling knife.

3. Protect your runway for at least 24 months

We’d generally recommend companies at this time try to have runway for at least 18-24 months, and avoid trying to fundraise until 2024. Remember you want to start fundraising when you have at least 9 months of cash to be able to close when you have at least 6 months of cash in the bank.

For Pre-Seed and Seed stage companies that have some initial investment, often the single most important factor to help you find product market fit is time. It just takes time to collect the necessary customer feedback, iterate on your product and experiment, in and hone your marketing and sales tactics. In this context, now could be a great time for a small, focused, already-funded team to make progress on its goals from Seed to Series A.

For later-stage companies, investors today are more focused on underlying profitability and efficiency than they are on growth. Given potential future fundraising risk, companies with significant negative gross margins and high opex are hard to get funded.

In the near term, if you don’t have really efficient customer acquisition, then you likely want to be focused on improving the efficiency of your growth and trading off the rate of growth. Give yourself the time to innovate to drive efficiency here ahead of scaling. It will likely be impossible to raise until you can show high growth AND underlying profitability.

There are typically 4 ways to calculate your cash runway, based on your forecasted expenses:

- Assume zero revenue (this was the case for some companies in Covid)

- Assume current revenue and cash collection from the last month

- Assume revenue and cash collection based on your revised plan

- Assume a modestly downgraded/conservative revenue target, anticipating some headwinds.

In general I prefer #4, although it depends on how conservative and predictable your revenue is.

4. Accept that valuations will be substantially lower

In 2021, venture funding hit $643 billion globally, shattering year-over-year records. New unicorns were minted every week and valuations were high across the board. You probably have startup friends who founded or work for startups that raised massive rounds in the last 12 months, or you’ve seen a competitor that has done that. Well done to them.

But that’s in the past.

While you might think your company is better than those others, and should deserve at least the same valuation, you’re in a whole new ballgame now. Now is the time to face reality and the fact that valuations have come way down. Not only is fundraising going to be harder, but the valuation is going to be substantially lower.

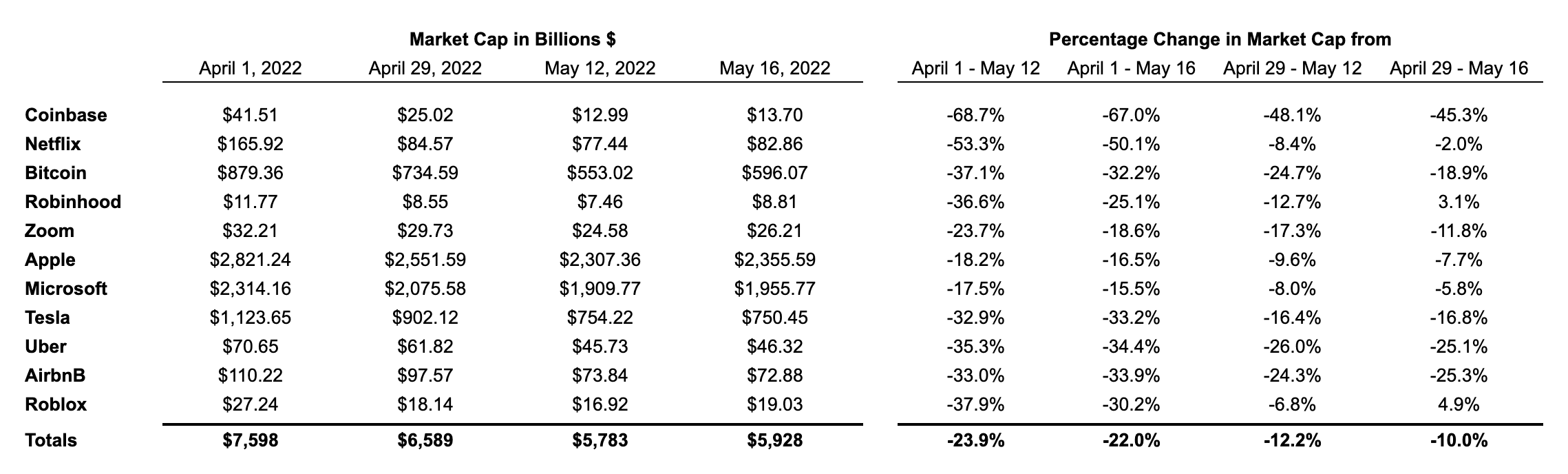

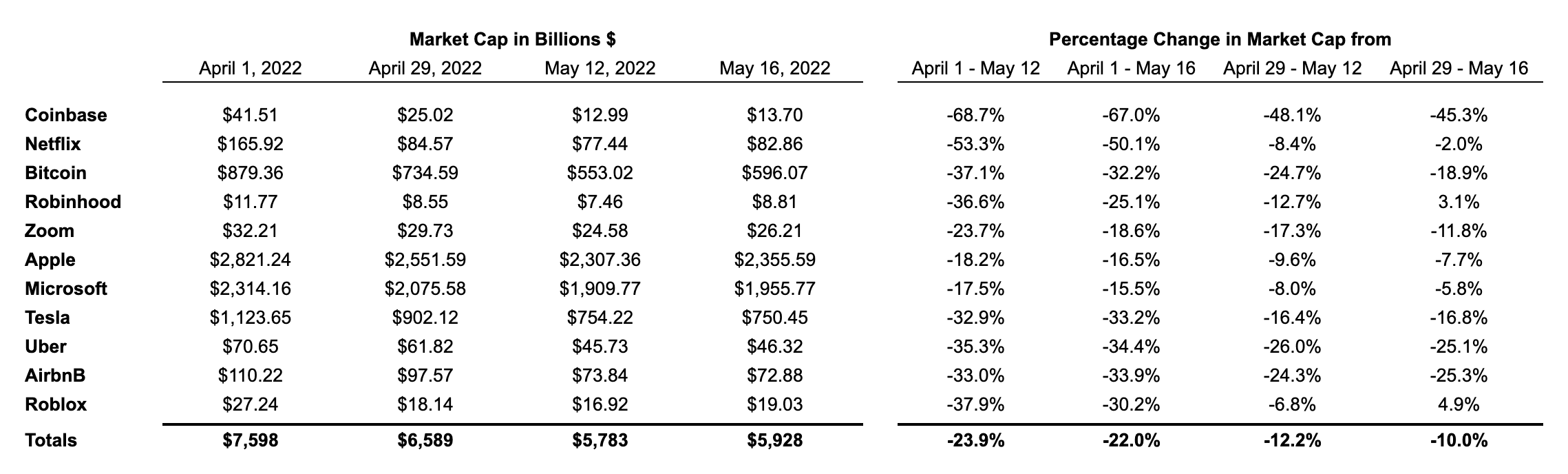

Sourced from Factset & Coinmarketcap, courtesy of NFX Research Team

In fact, public company multiples in certain sectors have come down as much as 80%. Given that public markets represent exit valuations, it is possible that your valuation is now ⅕th of what it was when you last raised. To avoid navigating a very challenging downround, you need to give yourself enough time to grow back into that valuation.

That said, great companies and promising teams can still raise in this market, reach out to investors who are familiar with your business, but perhaps could not get into the prior round or have built a relationship in the meantime. Consider opening up your previous round or asking investors to participate at a similar valuation to your prior round via a SAFE note.

5. Evaluate, quickly, if you need to downsize your team. Here’s how

Layoffs are hard, really hard. No one likes to do them. But if you are cash-constrained, it might be necessary.

To evaluate if you should, the first step is to build multiple potential financial scenarios to evaluate which option is best for you and then discuss these options with your cofounders, founder friends, closest investors and advisors. If you have a board, then you need to have this discussion with them first.

You need to compare how key financial and operational metrics change under these different scenarios.

Key metrics for the next couple of years should include:

- Revenue

- Cash burn

- Headcount

- Cash balance including the date you run out of cash

The scenarios you should consider are:

- Base plan (your existing plan)

- Revised plan (anticipating a recession or underperformance)

- Revised plan with hiring freeze + reduced opex

- Revised plan with hiring freeze + reduced opex + small layoff

- Revised plan with hiring freeze + reduced opex + large layoff

There could be any number of other scenarios that you consider. It’s critical to be honest with yourself to consider all options. Likely, you will know what the realistic options are for the company to put you in a strong position and then present a subset of 3-5 to your closest advisors and investors to hone in on what is the best (or least bad) decision for the company.

6. If you have to make layoffs, make them deep and early

If you have to do layoffs, the best way to handle it is with one deep cut as fast as possible. Nothing is more demoralizing than multiple rounds of layoffs. And retaining cash is key to prolonging survival.

Always remember that a layoff upends someone’s life at the worst possible time. Be as human, kind, and generous as possible. We did this at Trulia by organizing a job fair, renting out a conference room at a nearby hotel, and inviting every company we knew that was hiring to come. This is even more important as layoffs are now sadly likely to be done remotely.

Speed is important, but don’t cut corners in the process. Plan it effectively and consult with your advisors, investors, lawyers and others who have had to go through similar experiences.

After the layoff, be sure to tell the remaining employees how painful it is to lay people off but that you believe this will be the only round of cuts — now the company is in a more stable and solid position to survive. The peace of mind you are giving them is crucial.

7. During layoffs, focus on the “stay team” – but care deeply for the “leave team”

At Trulia at one point, we needed to lay off one-third of the company. It was incredibly hard. I found that as a CEO, you are pulled to spend more time with those leaving. But remember — your most important job as the leader is to motivate and communicate with the stay team. They are depending on you for guidance and support. Helping them do their jobs really well is precisely what will save their jobs and the company.

8. Ensure your stay team is capable of turning things around

If you have been already running lean and have a strong cash balance, then trim any unnecessary positions where you can, but don’t make significant cuts. You need to ensure the stay team is actually capable of turning things around. Generally, this means you should not decimate the product and engineering teams. Those teams have the most leverage to help you survive. Keep playing to win, not just to survive.

Repurpose employees you don’t want to fire because chances are you will need them again soon. For example, if you have an A+ product manager but no longer have the need for them due to your budget cuts, have them move over into a revenue operations position to automate tasks across the organization.

9. Reward outstanding performance with stock

You still want to reward a few of your highest performers. Give them stock. Tell them you can’t pay them more due to the cash situation but you want them to understand how much you value what they are doing. Personally thank them for their commitment and contribution and make it clear that if they stay with you and the company, they will have a bright future. Even a small amount as a gesture at this time can go a long way to help reduce the feeling of loss.

10. Creatively adjust compensation, where possible, to reduce cash burn and share risk

Be creative in how you pay employees. For example, you can increase commissions as part of take-home compensation for sales teams. For marketing and engineering teams, you might be able to attach bonuses or pay to overall team goals with more upside if they hit stretch numbers. Be cognizant that this can introduce uncertainty into their lives and acknowledge this fact — that you see they are stepping up and sharing the risk. If all goes well, then everyone actually will do better and earn more money — and the company thrives.

11. Refocus marketing on the highest ROI activities

This is traditionally one of the easiest places to trim back to retain cash. Reassess all your marketing channels and their cost-effectiveness. Task your internal team with identifying the lowest-cost / highest-ROI marketing opportunities and scaling those to the max.

Focus on channels that deliver rapid payback on spend and don’t assume that historical churn and spend rates will survive. Dive deep into the data and recast your strategy.

Longer-term projects and initiatives can be put on the back-burner. It’s quite possible new opportunities have opened up as companies are more interested in incremental revenue.

12. Reconsider PR Budgets

PR should be reconsidered unless it’s highly relevant to the market sentiment. Right now people are just watching the NASDAQ and BTC going up and down, reading news about the war in Ukraine, and worrying. It takes Elon attempting to buy Twitter to break through. Can you compete with that?

Not as many people are focusing right now on specific business news or new company launches or announcements.

Large external PR agency contracts should be put on hold or severely reduced. For the agencies, this can hurt. Please try to give them as much notice as you can or be creative in your ongoing relationship.

13. Assess all software and infrastructure costs

Chances are, you have some things you can cut there, too. Extra spend on AWS? Stranded licenses for Salesforce? Contractors using Google accounts on the corporate domain? You can decide what’s really necessary and what’s a luxury. Now is the time to tighten your belt. Start by cutting things no one uses then move on to cuts that are “nice-to-haves” but not critical — like extra licenses of design software you may share with external designers or extra GitHub seats.

14. Eliminate other critical drag

Vanity metrics, pet projects, and other activities that might be allowed in a normal situation now exert critical drag you must avoid. Ask yourself the hard questions and ask your team members the same. Above all, this is a time of focus. This is really about helping people focus on what’s most important in a time when you have the least room for error.

15. Fire certain customers

There’s often a bias for quantity of revenue over quality of revenue. We disagree. Not all revenue is created equal – you want profitable revenue. Now is the time to tighten your funnel and focus on your top customer segments. You want to understand everything possible about them. You want to retain them above any others and find more of them. They are the ones who bring in profitable revenue and have demonstrated stickiness with your product or service. For customers that are not critical strategic partners and who are loss making, determine if there are internal changes you can make to turn these relationships profitable. If not, approach them to renegotiate, and be ok to lose them.

16. Reorient channels and control your destiny

Focus on channels you can control. If you are selling through third parties, you may no longer be able to count on them to keep selling your product. They most likely will be distracted by other things. This will make it even more important to manage what you can control. If successful, this has the additional benefit of driving higher margins and is a great forcing function to reorient sales channels and sales motion towards direct sales.

17. Incentivize faster payments from your customers

Offer discounts on invoices to get cash in quickly. Cash in hand is worth taking a temporary hit to your gross margins. This is particularly true when cash is in short supply.

18. Renegotiate contracts and leases

It never hurts to ask for reductions or better payment terms. Keep in mind, however, that these companies also have to stay alive. They are probably having to lay off employees as well. We’re all in this together. Be fair and compassionate, but there is no shame in asking.

19. Build a pipeline for M&A

You thought you were going to be the next Airbnb, but maybe that’s not possible. Especially if you are short on cash, even after managing losses, and if you’re not able to raise capital, or think it is going to get substantially harder.

Now could be a great time to be open to M&A opportunities. It can often be worth selectively having conversations while you are also talking to potential investors. Good outcomes come from good options.

But be aware that some corporate development teams at larger companies can be a huge distraction and a waste of time. If you feel this might be the best path, start today to build relationships with companies you’d like to be acquired by. Building a BD or commercial relationship at a senior level is often a great starting point.

M&A is a slow process with many steps. If this is of interest to you, start now.

Gaining Ground

Contrary to what many would expect, a downturn is the best time to position your company for growth and long-term success. Your larger competitors will likely be knocked sideways and unable to react. Many of your smaller competitors will be short on cash, hibernating, or unable to match your moves. While you are managing losses, you must also be making moves to gain ground.

20. Identify massive supply/demand imbalances

Downturns tend to generate big gaps between supply and demand. You need to either source new supply to meet the needs of the current demand, or change your positioning so it’s attractive to where the new demand is (or find new kinds of demand).

Addressing supply-side imbalances: If you’re going to see significant reduction in volume in a market downturn, don’t try to push against the tide. It’s meaningless. Instead, go upstream to how you can lock in supply. Be a great partner to them and be well-positioned when things recover. If you are providing a valuable service in a downturn, then when things recover you will be highly sought after.

At Trulia, we did this by getting integrations with brokers and technology partners so all the real estate listing inventory came onto Trulia at a time when these partners needed low-cost distribution the most. We also used this time to integrate our supply and partner ecosystem for the long haul. This is not just a business development conversation; you need to enlist your engineering team to do the plumbing on your side. Most likely, the counterparties will do the plumbing on their side to integrate their platform with your platform because they need the bump in usage and customers.

At lastminute.com, we used the downturn to secure more inventory at rock-bottom rates. We figured people would start traveling again in the not-so-distant future. We also secured inventory for entire Eurostar trains and sold tickets on them dirt cheap — matching the new demand. These stunts helped catalyze long-term supply and demand relationships that were important when the market recovered.

Addressing demand-side imbalances: How can you provide services to companies such that they can quickly reduce costs or increase revenue? Conversations that were historically challenging can become surprisingly easy if you’re able to directly impact the P&L. You can use these engagements to push through broader systemic changes to relationships and systems that might have been met with internal resistance previously. At Trulia, we negotiated deals with newspapers and other online portals to take over their real estate classified sections, add our branding, and integrate with our system. As most companies in a downturn refocus on their core, how can you help them to turn cost centers into profit centers?

If demand side conversion is weak as customers try to grapple with the market or just don’t have the budget yet, then identify ways to continue to build a positive value-added relationship with potential customers at a low cost over time. This way you don’t have to re-acquire them later on when spend comes back.

Both lastminute.com and Trulia did this via email. Lastminute.com with fun and inspirational content, and Trulia with aspirational houses and lots of data and insights.

21. Anticipate that your customers’ behavior will change. A lot.

Your customers’ behavior will change. Their thresholds for purchases will move. This often creates advantages if you follow them and pivot smartly.

At Trulia, we integrated foreclosure listings into the core search experience during the housing downturn. It became a very popular product and was one of our biggest growth segments during the downturn. Watch closely for changes in customer behavior. Ask yourself and your team: ‘What can we create that will fulfill their current needs or address their anxieties?’

22. Incentivize customers to pay up front

For new customers, try to get them to pay for your product or service up front. Test out annual subscriptions versus monthly subscriptions and see how you can make that more attractive for your users. Not only does this change your cash flows, but it can also be a strong indication that you have product-market fit. A customer’s ability to pay you today for a product that you’d deliver in the future is a sign the service is compelling and important to them.

23. Get smart on pricing

During the pandemic, I had the chance to sit down with Madhavan Ramanujam – the legendary Jedi Master of pricing among tech unicorns – including Trulia. We talked about how to think about pricing during extreme swings. Either your demand spikes like crazy because a recession triggers more need for your product, or demand is falling and often pretty fast. I’m re-posting some of that conversation here because it is so valuable.

If you’re in a situation where a down market is favorable to your company, here are some tips on what to do when customer demand is spiking:

- For companies that are seeing a demand spike, it could be tempting to think about a price change in terms of an increased price because you’re seeing more demand. Classic economics would tell you to increase your price because you are also seeing increased demand. But the obvious backlash is that you could come across as gouging your customers and that is absolutely something you should not do.

- Instead, a better strategy would be to focus on gaining as much market share as you can, but at the same time, creating more premium lines of services. If you’re onboarding many more customers, chances are you can also sell more premium stuff to those existing customers. Focus on more of a “land and expand” strategy. This will grow your all-important net revenue retention rate.

What to do when you are losing demand:

- The far more dominant pattern is companies losing some sort of demand, 10% to 20% or even more. And hence, on average, they are 10% to 20% or a bit more down on revenue.

- For these companies, it could be super tempting to lower the price. You’re seeing demand fall down. Should they lower the price to gain back the demand?

- Lowering the price would be absolutely the wrong thing to do in most situations.

- If you lower the price, it does not necessarily mean that you will get the demand back. What you might want to do is think about options that you have at your disposal that could probably achieve the same purpose, but without dropping your price.

- If you drop your price, you’re training your customers to expect your service for less when things pick up again.

- One tactic is to think of 3 non-pricing concessions before you even think about dropping prices.

- For example, can you give more product away and preserve the price? Let’s say you have a good, better, and best product lineup and you’re seeing a drop in demand. Can you give a better product and preserve your price so that customers won’t leave? Can you be more flexible with payment terms? Can you work on a risk or reward basis? Can you bundle products and create a white-glove service?

- There are various things you can do to see if you can achieve, or perhaps even create a lower entry offering. De-feature the products and create a low-entry offer that people can actually buy during these times so they still are in the system, but at a reduced value.

- Essentially, keep the price and value alignment intact even during these tough times.

24. 10x your product

Now is the time to make sure you are building a painkiller rather than a vitamin. The only way to break through in a downturn is to have a dramatically better product or service.

Talk to all of your best customers. Dive deeply into the user analytics data. Find out how users are engaging with your product today — what features they love, where they seem to get stuck. Compare current user behaviors with previous ones. Identify new behaviors that you can better support and amplify to make their experience better. Be creative, ask how you can solve problems in novel ways.

Asking these questions will not only improve your product; it may also save your company because you will see signs of trouble and identify reasons for them to leave. If you 10x your product during a crisis and get your users excited, imagine what will happen after the crisis abates?

25. Consider the acquihire or small tuck-in acquisition

If you’re not strapped for cash, now could be a good time to consider small companies you can acquihire to bolster your talent. For a larger, cash-rich company, the prospect of immediately hiring a pre-existing high-quality team that has worked closely with each other in a similar area can be really compelling. It can accelerate the roadmap and bring on more entrepreneurial talent.

Financially, for the right company, it can be a great deal for all sides. I’ve seen how many of the largest companies like Google, Facebook, Airbnb, and others did this when they were much smaller companies in 2008-2009 and everyone succeeded beyond their wildest expectations.

26. Make your sales more efficient

If you can figure out ways to increase the chance of any sales prospect turning into a customer, you are creating amazing future margin leverage even as you are reducing burn rate (you don’t need to acquire as many customers). At Trulia, with a small team, we were converting roughly 2% of real estate agents we contacted. We looked deep in the data and built out a great data science discipline to identify how to better prospect and identify potential customers. As a result, we increased conversions to 20% by the end of the recession. The math on that is astounding.

Another metric that VCs especially look at is the burn multiple, which measures how much money a startup burns in order to achieve an additional dollar of ARR.

Burn Multiple = Net Burn / Net New ARR

It’s a more complete metric than CAC to LTV, because it accounts for the spend across the entire business. For example, you’d have a 2x burn multiple if you’re burning $10M per quarter to add $5M in ARR. Low burn multiples are good.

You should target 1 to 1.5x burn multiples if you’re a Seed or Series A stage company that’s post-product-market fit. For later-stage companies, you should have a clear path to below 1x.

27. Turn fixed costs into variable costs

This can give you more flexibility as you grow. One fixed cost you can transform into variable cost is in how you staff various projects and roles. Are there 3rd party services that can provide a similar level of service as someone you might otherwise have hired as a FTE, but on a performance basis? You can dial that variable output up when you start growing again, and even add more contractors or service providers.

This may seem to contradict my advice to ditch agencies — but it actually doesn’t. Independent contractors are a bargain compared to most agencies — and can be a bargain compared to FTEs for some roles. If you figure this out during the downturn, you can gain ground with this lighter weight cost structure as you grow

28. Replace people-driven processes with technology where it makes sense to

This is a good use of engineering time during a downturn that could yield big cost savings and improve efficiency. It’s also an essential muscle to grow. All great startups have done a masterful job of doing more with less. Are there opportunities to automate basic customer service responses, streamline sales functions, or reduce operational costs? The most obvious way to do this is by leveraging technology more effectively. Again, you should explain what’s going on to your team and why you are doing it. In most cases, top performers who are technology-disrupted can either shift to another role in your company or can be highly successful elsewhere with a company that still has more people-centric processes for their role in place.

The flip side of this is: think strategically about where you spend your human resources. For instance, Founders should be spending time with the top accounts and most important partners to ensure that they continue to be your partners in the future. Confirm to them your commitment, and see if there are ways to expand on these relationships. Are there other high-touch experiences you can provide customers to wow them? Can you go above and beyond to properly onboard them and help to increase engagement or retention and word of mouth?

Also, if you need to test new products or evolve existing ones, how much can you manually do to test out the market demand ahead of investing in scarce engineering resources.

29. Opportunistically Hire & Unlock Talent

Sometimes getting tremendous talent can help you survive a downturn. If you have cash and have not recently done a large layoff, this is potentially a great time to hire some amazing people. Talent can be cheaper and more available in a downturn. Layoffs at larger startups and tech companies will enable early stage companies to hire top talent.

World-class talent will put the company in a better position both during and after the downturn.

You probably know some great people out there who would be great additions to the team. Or you know companies, even competitors, that might have talent that you’d love to bring on board. Now is your time to do your research. Find out who these people are and contact them. Invite them for coffee, try to persuade them to join.

And be fair in your hiring. You might not have the salary they’d typically command, but you can offer to move their compensation higher when the downturn ends. Or offer them strong total compensation by increasing stock. Or find other benefits that they value.

30. Identify alternative funding vehicles to fuel your growth, including debt

Raising capital during a downturn is difficult to near impossible, but if you’ve been able to crack the code on a new opportunity and have the ability to demonstrate consistent cash flows with strong margins, debt financing becomes a viable option that investors may jump on. It can be a good way to help companies extend their runway as long as there is a path at the end that looks interesting.

If your financials are strong enough to get an investor to open up your deck, then you have a few options in front of you. Revenue-based financing, factoring of contracts, venture debt, and convertible notes are some of the debt-based vehicles you can explore.

At Trulia coming out of the recession, we were very close to cash flow positive and it was more attractive to raise debt to give us a bit more flexibility, and it was cheaper than raising capital.

If your company is not in a good place, debt is almost certainly too risky. But if your financials are strong and clearly improving, and if it helps you gain more ground on your competitors and outlast them, then debt may be worth exploring.

31. Be committed to building a high-performance culture

In a downturn, everyone must perform. This becomes non-negotiable. Hitting 95% of your goal is missing your goal. If you don’t have a strong performance culture — clear, measurable targets for everyone — then create one. Here’s how:

- Explain what you are doing and why you are doing it.

- Give everyone clear numerical goals specific to their function.

- Show how their goals impact the other functions.

- Be visible with metrics company-wide.

- Be fair — reforecast and revise targets to be realistic.

This will be an enormously strong habit to help you pull away from the competition.

32. Move fast and try new things

Anyone can be a chess grandmaster if they can move two times before their opponent moves. During a downturn, you have an opportunity to make three moves ahead of them. Incumbents will be doubly slow during a crisis. So lock in inventory, secure partnerships, and do other things that take incumbents much longer.

Speed is always an asset, but never more so than during a downturn.

Managing Psychology

Stressful market conditions can be taxing for everyone. Your team needs you to go above and beyond. You need to think about caring for their minds as much as anything else; clear minds will get you through this.

33. Quickly adapt your company culture to the current reality

During Covid, there were unprecedented stressors on us all. We’ve all been through a lot over the last 2 years, and now there’s war in Ukraine alongside this pending economic downturn. The key to great leadership is to react quickly to help everyone stay engaged and feel safe. Mental health, happiness and connectivity is your #1 goal for your company culture. In general, many of these shifts may stick after a crisis, so make sure they are all practices you would adopt for the long-haul.

34. Empathize with your employees

People tend to adopt more of a “what will happen to me?” mindset in times of fear and economic uncertainty. Even if you are stressed about managing the entire company, acknowledging their concerns is critical in helping them be productive. Be as transparent as possible and explain in detail how the company will be able to get through this particular crisis and what everyone can do to contribute to the new plan.

35. Build camaraderie

Get to know each other even better. It may seem counterintuitive when you feel like you’re running around with your hair on fire, but while there are so many big things going on, it’s even more important to take time out to focus on the little things that make people people.

Ask people about themselves in meetings. Celebrate birthdays and work anniversaries. Go the extra step to find out when their wedding anniversaries are, or their kids birthdays, and celebrate those. Start a book club for each team. Assuming Covid has subsided in your region, let your employees bring their kids to the office for a day. Or their dogs. Or their parents. One of our companies, Papaya Global, did just that. “We did this campaign, bring your parents to work day. Our employees brought their parents to show them where they work, to show them the environment, to show them their friends. There is something about the fact that your parents don’t understand what you are doing or they don’t know how your office looks, who are your colleagues that really gets them excited. It was such a memorable experience for everyone.”

Teams that are emotionally engaged are also higher performing. This type of connection makes work more meaningful — both during and after a crisis.

36. Practice spontaneous, random acts

Write a handwritten note to someone on your team. Answer an email with an iPhone video instead. Send them a funny GIF. Send them a coffee. Use your imagination in crazy ways. All of this shows you care about them. Keep it within bounds — no one wants to feel like they have to be on 24/7. But show your employees you care with your acts, not just your emails.

37. Make space for creative collisions

Remote and distributed teams became standard during Covid. This came with several benefits – it enables efficient work and the ability to tap into a larger talent pool, especially when you have clear product-market fit and clarity about your organizational structure and path forward and.

However, remote teams are likely not optimal for the creative process that is needed to initially find – or rediscover as a result of a crisis – your product-market fit. When there is significant uncertainty about the economy and direction of the company, getting people together is the right move.

If you are struggling as a remote-first company in a downturn, try getting everyone together for a few days. Rent an airbnb, rent an office. If your team is small, invite them to your house. You might be surprised by the productivity, but even more so by the much-needed creative problem solving that comes out of being in person with your team for 8 hours.

38. Celebrate small victories

With all the uncertainty and stress, take time out to celebrate the team’s small wins on a weekly basis. Build a long term vision, but focus on a near term plan and things you can achieve quickly.

The compounding impact of many seemingly little wins can be astounding. Small wins have an outsized impact in tough times and give you a sense of progress and success when things around you are grim.

39. Get inside a VC’s mind

At NFX, we continue to believe that the Pre-Seed and Seed stages are the most attractive and protected places to invest.

But first let’s take a look at how a downturn impacts VCs.

First, LPs lose money in the public market. This means they will have less capital allocated for private. Which means less money flowing to VCs to invest in your company. Some VCs will have a tough time raising new funds from LPs. (And many smaller, boutique funds may even disappear.)

When there is less money flowing to VCs, investors push even more to invest only in the best opportunities derisked by startups that have impressively climbed the Ladder of Proof.

Finally, public markets represent private exit valuations. That means when the public markets take a beating, after a while, private valuations start to fall. We’re seeing early signs of this happening. But know that there’s a market force at work behind your potential lower valuation, not that VCs don’t value your startup.

There’s good news too. Seed firms like NFX are safe harbor. And early-stage companies are more sheltered from the pullback described above – since they are more resource efficient, easier to adapt, faster to pivot, and have a longer runway to the public markets.

We remain excited about investing at the earliest stage in new companies and Founders who are pushing innovation forward – and we expect to see the next generation of founders starting transformational companies, today.

Seeing What Others Do Not In A Downturn

Downturns are hard. Even if you don’t go looking for it, negativity and panic will find you.

I’ve now been through two cataclysmic market crashes where both companies emerged ahead of our competitors, plus one pandemic in which many of my portfolio companies were able to grow beyond expectation.

I can promise you this is an exercise of mind over matter. Take a breath and realize that this is cyclical, that many of us have been here before, and we are here to help. That’s why I updated this playbook for managing your startup through a crisis.

This now is my fourth go at surviving, and thriving, in a downturn. My partners at NFX have similar experiences with the ups and downs of market cycles, with hard-won expertise as both Founders as well as VCs. Together, we and the entire NFX team work with our Guild Founders as well as the greater startup community from a mindset of playing to not lose – to playing to win.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.