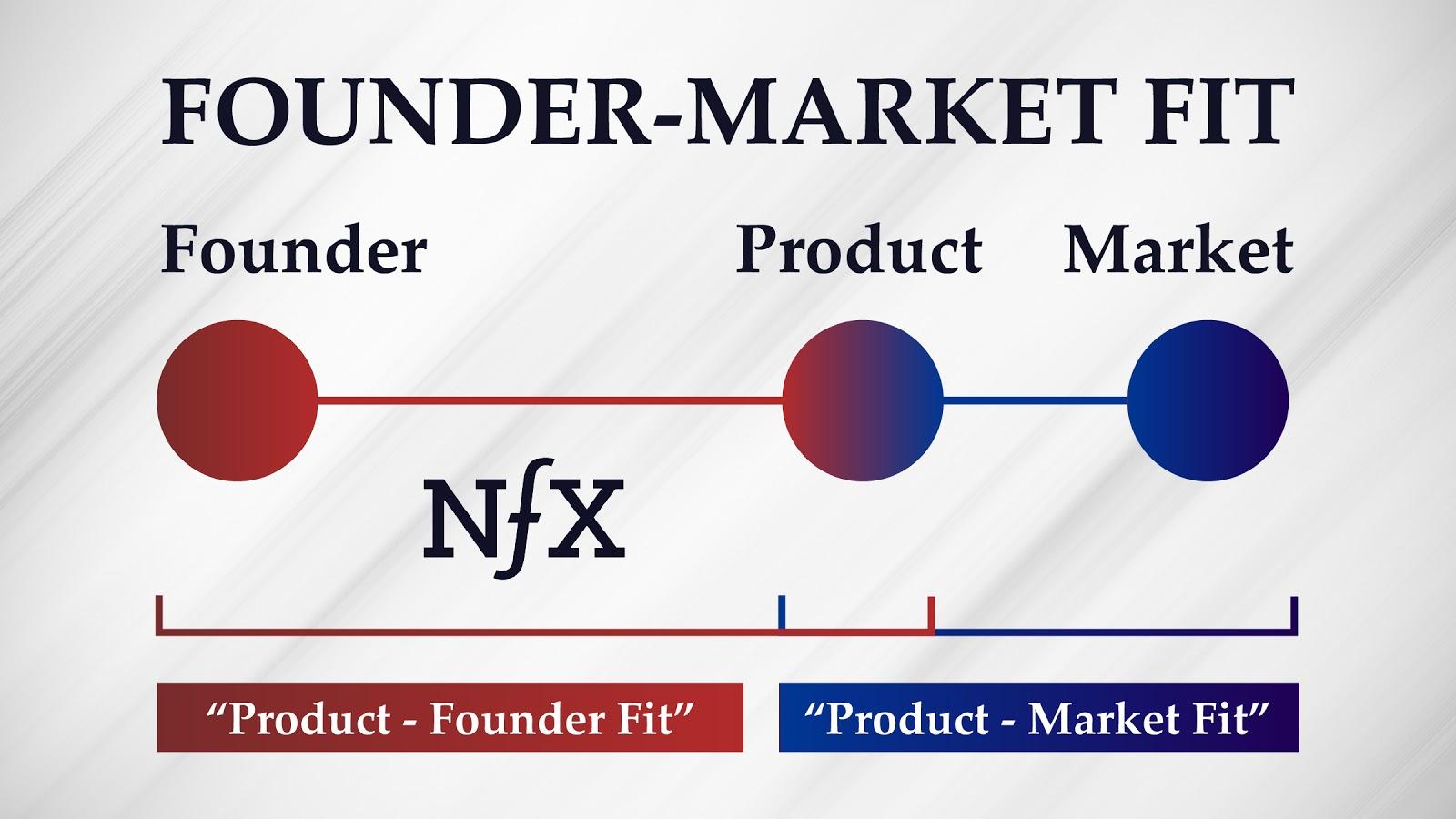

Most of the discussions around “Founder-Market Fit” tend to focus on the more tangible concept of industry expertise. In my years as a Founder and investor, I’ve found that there’s a lot more to it. We see four dimensions that contribute to Founder-Market Fit:

- Obsession

- Founder Story

- Personality

- Experience

Let’s break it down.

1. Obsession

I often tell Founders “don’t start a company unless you can’t not do it… unless you can’t sleep at night and your brain is exploding with the idea.” Founder-Market Fit means you would choose to work on the idea in your free time. It means you can work effortlessly on your product and customer issues. It’s the kind of thing where you don’t notice the time passing. There’s nothing you’d rather be doing. It’s something you need to see out there in the world, and you’re going to will it into existence.

World-class, iconic companies are almost always founded by Founders with that level of obsession because it equips them to endure for the long haul that it takes to build a company without burning out or losing faith.

If you have this kind of obsession, you become a Founder not because you want to move to Silicon Valley and be an entrepreneur and live the lifestyle but because you are compelled by something deep inside. Something creative that resonates in an inexplicable way with the market.

One sign of this healthy obsession is knowledge.

I’m often surprised and disappointed by otherwise competent Founders who haven’t taken the time to go deep in their market and know everything about former attempts to build similar businesses, their current competitors, and future potential competitors.

Studying a market from a distance is not to be underestimated. Founders should talk to 10-30 practitioners and experts who have done something related to what they are targeting. Founders should create an extensive competitive map, researching and studying everything online about competing companies including failed companies in your market. This helps build a deeper idea maze quickly and more fully.

A lack of such attention to detail typically conveys to me that a Founder doesn’t love their market enough to have real Founder-Market Fit. Founders should be obsessed and go deep enough to clear this bar.

Willful naïveté gives you courage, which is good, but shouldn’t ever be an excuse for superficiality.

If you’re building a company in a market which doesn’t exist yet, it might be harder to study up on others, but not impossible. Every significant company had direct antecedents.

Further, in these cases of brand new markets, Founder-Market Fit may reveal itself in the rich process of mapping out the decision trees and probabilities that Founders anticipate the market might manifest. Mapping this “idea maze” and being able to discuss it succinctly indicates a Founder is sufficiently aligned with their market.

Lack of obsession for — and knowledge of — the market is almost always a bad sign.

2. Founder Story

Customers care a lot more about who the company Founder is than most Founders realize. The Founder has to fit with the market, i.e. the customer, and vice versa. Customers have to identify with the Founder’s story and believe that there’s a compelling “why” inside the Founder — that there’s a human behind the company.

For evidence of how influential founders’ stories can be, note Steve Jobs. Apple customers famously identified with Steve Jobs, his garage story, and his reason for “why.” It defined how the customers related to Apple products on an emotional level. Apple users identified with his story as a creative genius and ascribed similar aspirations to themselves.

Facebook’s acceptability on all college campuses was influenced by Mark Zuckerberg’s origin story as a Harvard student. Like Facebook’s early users, Zuck was simply a college student who wanted to use technology to help improve the thing that matters most to college students — their social lives.

LinkedIn carried more credibility because Reid Hoffman was part of the PayPal mafia as well as high-status Silicon Valley insider.

Imagine a company founded by someone in a suit who’s story was nothing more than “I saw a market opportunity.” The story wouldn’t likely be compelling to users, and the company would be less likely overall to gain traction as a result. A compelling narrative signals to both customers and investors that the Founder has a mission and is in it for the long haul and for the right reasons. This is so true that even though Pierre Omidyar founded eBay because it was a good idea, he and his PR team made up a story about his fiancé collecting Pez dispensers as a way of humanizing the Founder story and the “why” of the company.

3. Personality

Markets tend to attract people with similar personalities. Are you the kind of personality that can fit in and make connections with your peers in your market? If so, it’s a positive indicator. The personality profiles — dress, norms, behaviors, passions, interests, recreational preferences, common lingo — tend to coalesce within clusters of professionals.

Having peers that you can connect with, that can bring positive energy, practical advice, and constructive feedback, is essential. Creative genius does not last long in isolation. Most innovation happens as a result of people forming networks with a high density of ambitious, competent people in a similar field or market. This particular kind of network effect is the main reason why Silicon Valley stubbornly remains the dominant force in tech startups to this day, and why Los Angeles does the same with entertainment.

Another example of how personality can fit with the market or product is Mark Zuckerberg. Time Magazine suggested that Mark was the perfect person to build Facebook because his personality lead him to be desperate to automate human interaction. He was obsessed with it and had unique intuition into the problem due to his personal daily experience. Hard to say, but perhaps that rings true with those who know him best.

4. Experience

As mentioned earlier, experience is often overrated when it comes to Founder-Market Fit. If you look closely you’ll understand a lot of nuance is required to properly evaluate how experience influences Founder-Market Fit.

First, too much experience is not always a good thing. Certainly, we do look for Founders who have enough industry experience that they understand the market. But not so much experience that they don’t have any disruption left in them. At some point, if you stay in a sector too long, you get the curse of too much knowledge, and you stop being able to see fresh or new ways of doing things. The angle for innovation becomes harder.

Ignorance is an opportunity for one out of fifty. Knowledge is an opportunity for one out of five. Too much knowledge is a blocker to innovation.

Second, the type of business you’re building matters. There’s a difference between the optimal amount of experience in B2B vs. B2C vs. bio/health.

We know from our own experience that the typical way to invest in B2B/enterprise is to find people who did it before and are doing it again in the same space. Experience is more important in the B2B space, where the complexity of the industry raises the threshold of how much domain knowledge a Founder needs before they’re going to get it right. The more regulated and enterprise-facing the space is, the more you need a ton of experience and credibility to have a shot.

It’s skewed even further in healthcare and biotech, where closer to 80% of founding CEOs have directly relevant experience.

Experience seems to matter the least in consumer.

This disruption/experience curve isn’t definitive, it’s just a guide towards how to think about it. As with any general framework, there are exceptions.

Third, a further insight that few talk about is the difference required by the CEO and a VP of Sales / CMO / CTO or whoever is second in command. We’ve noticed that the number two ranked person at a startup tends to be technical, but industry experience is less important for them as it is for the Founder/CEO.

As a Founder, if you don’t fit neatly into any of these frameworks, it doesn’t mean you don’t have Founder-Market Fit. It’s just one out of multiple indicators. There is usually a correlation, but not always.

The benefits of Founder-Market Fit

Having Founder-Market Fit improves your chances of building a transformative company:

- You have a higher chance of getting a critical insight

- It keeps you 100% focused on the problem with an obsessive, almost maniacal commitment because it resonates so deeply.

- You’ll resonate with other people in the sector you’re in, and the more people you have on your side, both in the company and in related companies, the greater your chance of success

- You will actually be able to pull off nuances in the product experience and product language that make your product best-in-class.

What investors look for

As a seed-stage investor, we look at many things when evaluating whether to invest in a company. See the Ladder of Proof for an overview or NFX Managing Partner Gigi Levy-Weiss on How VCs See Your KPIs for a breakdown of how we look at traction metrics. But the quality of the founding team is paramount.

With Founders, we look for speed, grit, intelligence, and yes, Founder-Market Fit as we’ve broadly defined.

Ask yourself if you have Founder-Market Fit. It allows you to see yourself from an outside point of view and form a realistic estimate about how you will do in terms of having a real disruptive insight, executing on that insight, and raising capital.

If you have it, you’ll know it… and we will too.