The Big 5 — Apple, Google, Microsoft, Facebook and Amazon — are hitting all-time high valuations. Airbnb is worth more than Hilton in the private market. Uber is worth more than GM. Spotify and Dropbox IPOed in 2018, with Slack and Didi Chuxing on an IPO track.

It’s fitting they should all be mentioned in the same breath, because other than Amazon, their business DNA is amazingly similar.

They are all network effect businesses. And it turns out that most of the outsized returns of companies since 1994 have used network effects.

If you know the playbook, you shouldn’t be shocked at these companies’ rapid growth. But it’s surprising how few people know the network effects playbook. Many still confuse it with viral effects. Many know it’s important, but don’t know what it means.

My partners and I have spent our careers founding or running digital companies with network effects. Initially, it was somewhat accidental, and now it’s all we do.

The Study

We wanted to put an actual number on the amount of value network effects have created in the digital world.

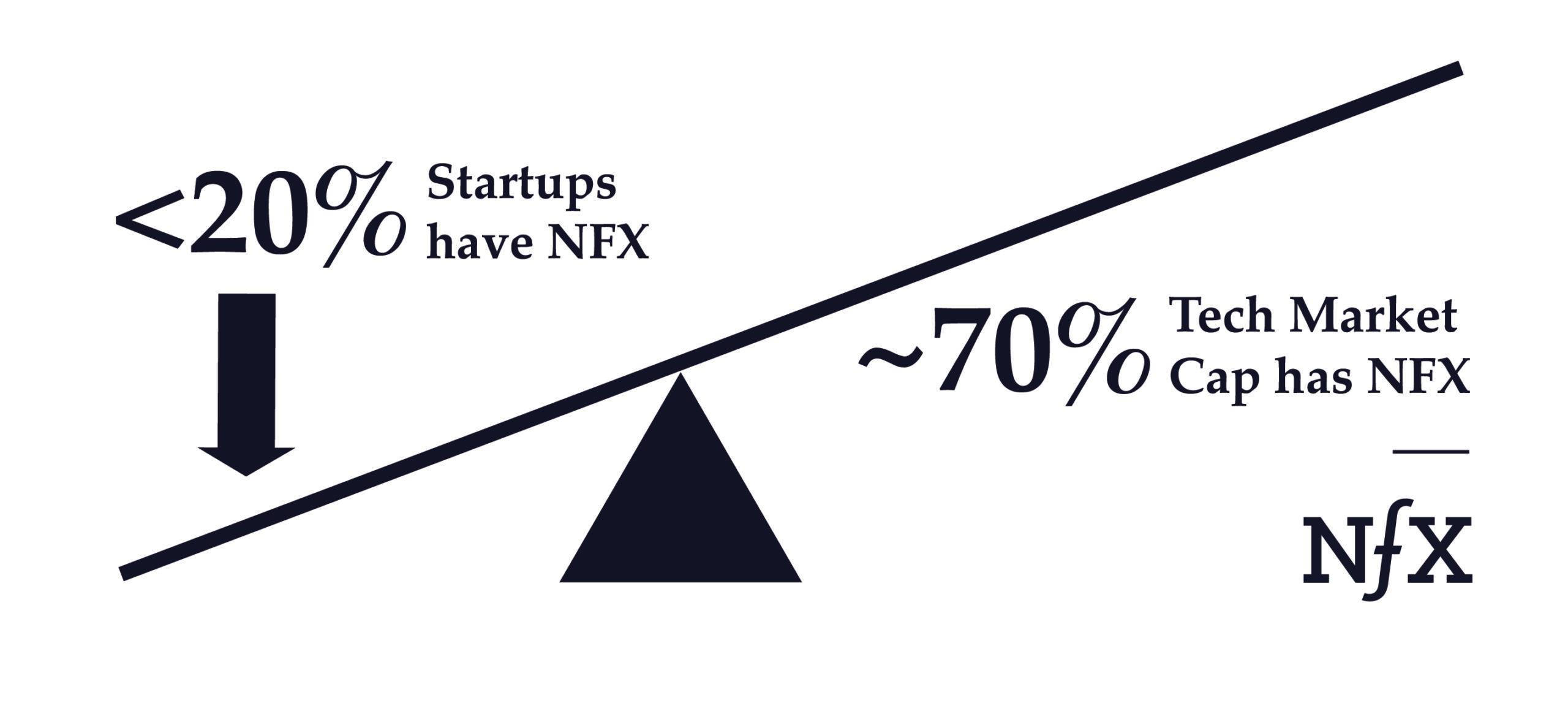

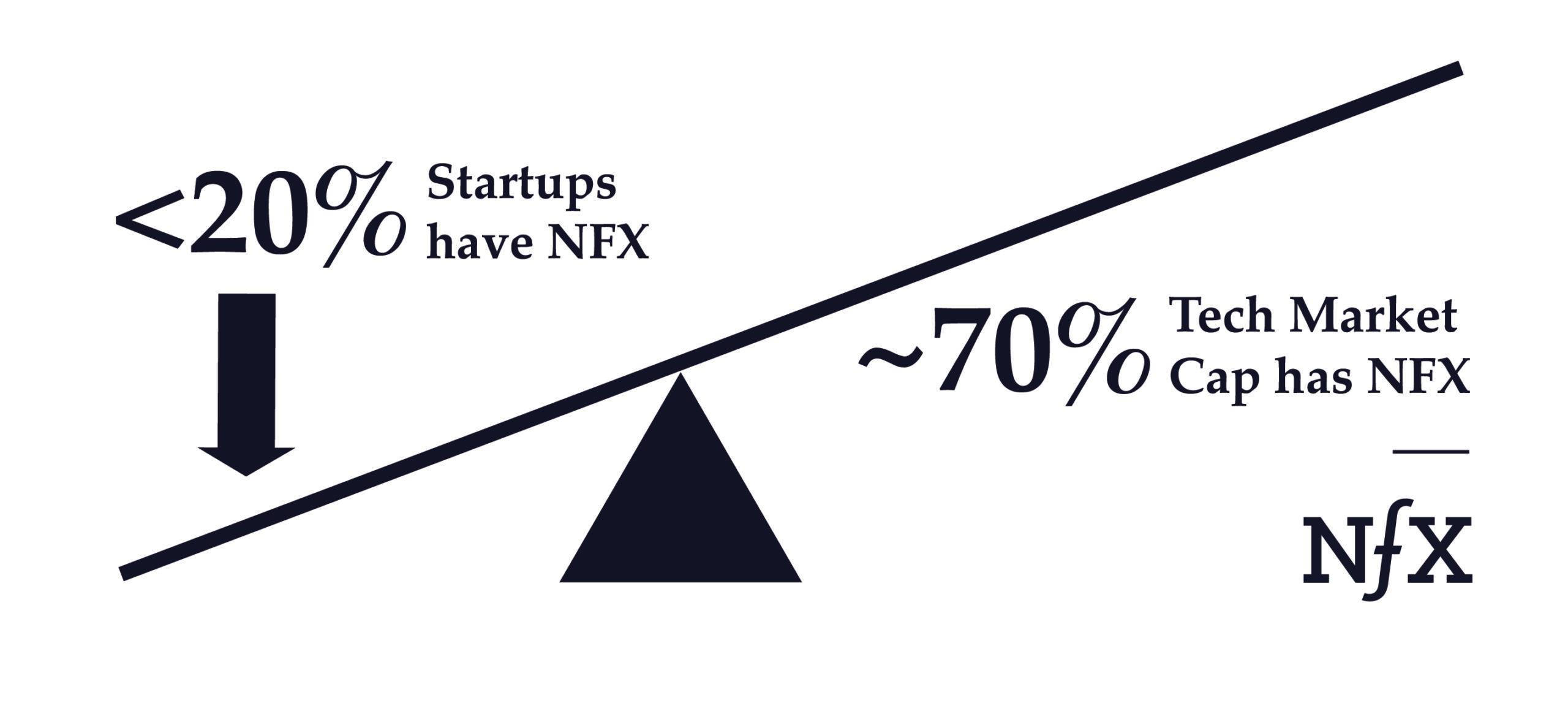

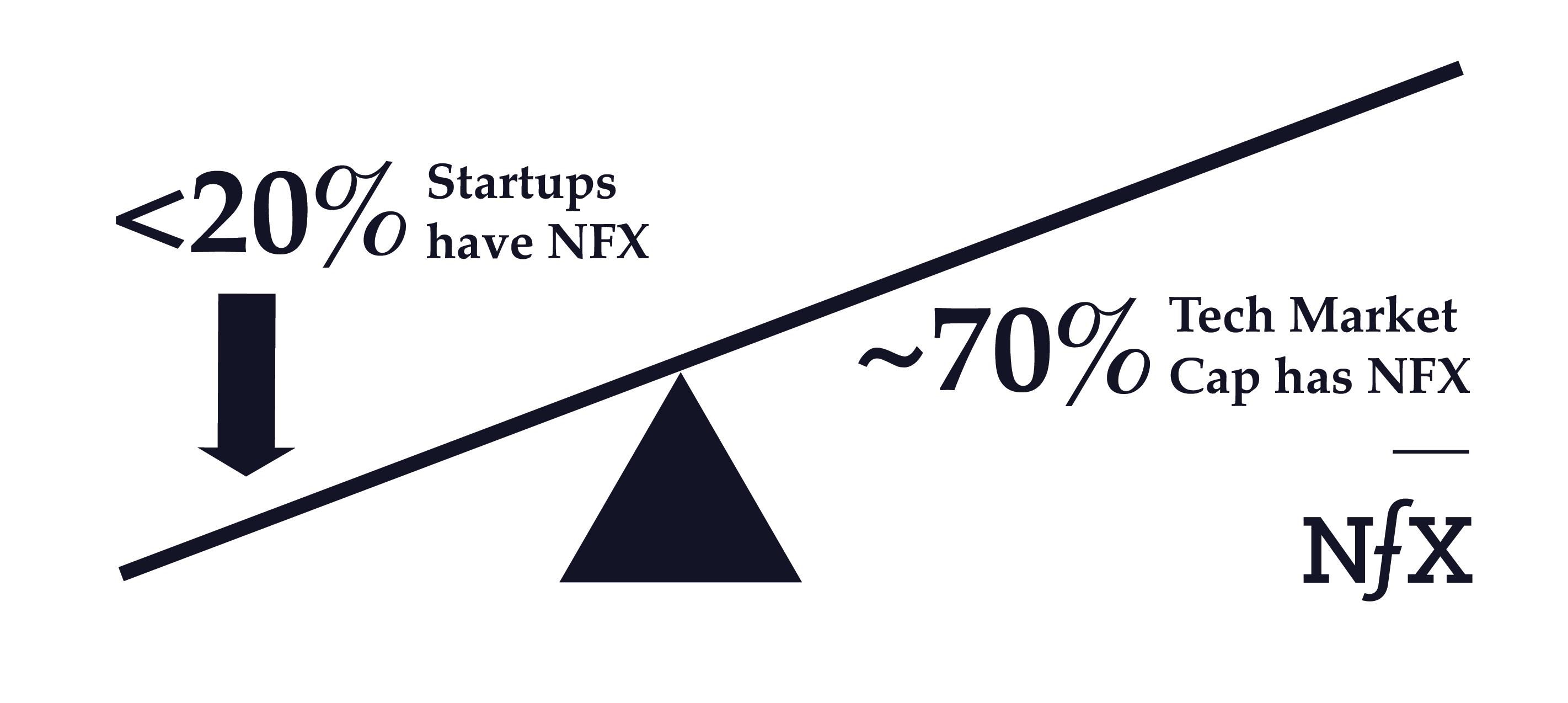

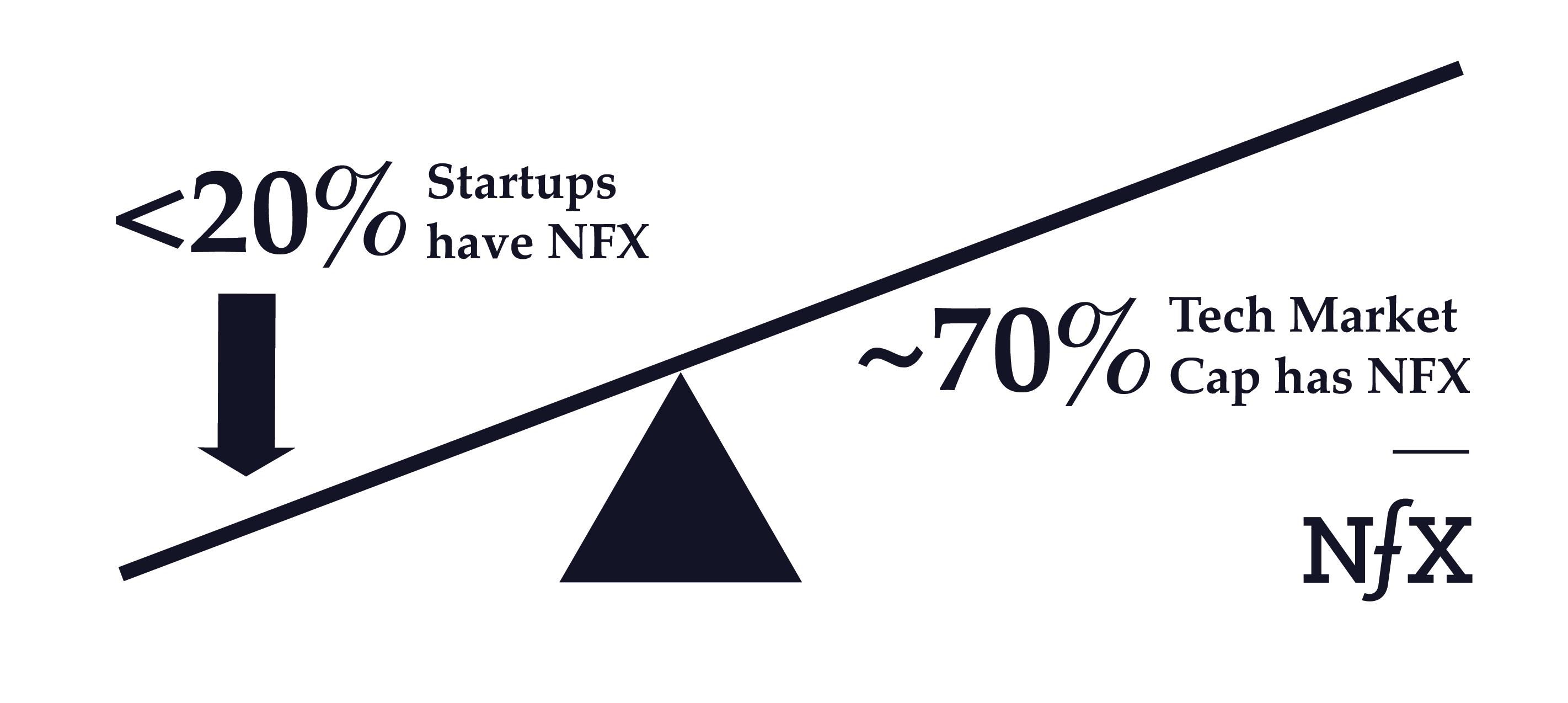

The short answer: over the past 23 years, network effects have accounted for approximately 70% of the value creation in tech.

We did a study of the digital companies that were founded since the Internet was widely available in 1994 and that went on to become worth more than a $1 billion.

336 companies between 1994 and 2017 met this criteria.

By looking at each of the companies’ business models and comparing them to our list of 13 known network effects, we estimate 35 percent of those companies had network effects at their core. They were, however, typically much more valuable than companies without network effects so they added up to 68% of the total value in our spreadsheet.

(Details about the methodology of this analysis can be found at the bottom of this post)

In other words, companies that leverage network effects have asymmetric upside. They punch above their weight. They are the Davids that beat the Goliaths, and then become the Goliaths.

The other 65% of $1B+ companies used other defensibilities to create their value— namely embedding, scale and brand. These are good approaches, and created 219 $1B+ companies. 65% of the total. But those companies’ valuations typically top out in the $1-$2B range, leading to the results of this study.

The Single Most Important Predictor of Tech Value

It turns out that having a network effect is the single most predictable attribute of the highest value technology companies — other than perhaps “having a great CEO.”

And yet surprisingly, only 20 percent of the business plans we came across before starting NFX had network effects in them.

We believe that most founders fail to design network effects into their businesses because they don’t understand them well enough. And not understanding them, they don’t build them in from the beginning.

It’s sad to watch, because just as the Big Five are now consolidating their dominant threat to startups, and just as startups have lost the favorable winds of the Internet and mobile tech shifts, most founders are missing a key ingredient they will need to have a dog in the fight.

Unless founders wise up to the importance and discipline of network effects, the scales will be heavily tipped in favor of those who have.

If Your Startup Doesn’t Have Network Effects, You Need to Rethink Your Strategy.

Given their importance, it’s surprising there are only a few places to learn about network effects. We typically send people to HBS, Platformed, our thoughts on network effects and taxonomywith A16Z, NFX Essays, and other academic sources.

There still remains a huge gap between how little is written and known about network effects and how massive of an impact they have on value creation (to say nothing of their impacts on society and the future of our economics and politics, but that’s a different discussion).

My Partners and I have founded 10 successful venture-backed network effect businesses and invested in over 200 network effect startups. From that experience, we have been able to identify 13 different types of network effects. Each has an ever-evolving playbook. Each can be complex — and they are rarely exposed.

We consider ourselves thoughtful practitioners and students of network effects, always learning. We’re out to demystify the inner-workings of network effects and to work directly with a select few founders.

Network Effects and the Next Big Thing

Some have asked, “The top companies of 2017 have network effects, but many of those companies were founded 5–20 years ago…will the power of network effects continue with new startups?”

Unequivocally, yes.

In fact, network effects will increase in importance because the new platforms — and the re-invented verticals — are being born networked:

– Crypto-Assets

– Synthetic

– Biology

– Augmented Reality

– Artificial Intelligence

– Virtual Reality

– Internet of Things

– Robotics

– Drones

– Transportation

– Smart Cities

– Agriculture

– Health Care

– FinTech

Understanding the principles of network effects and applying them to new companies today should produce the same or greater defensibility and value-creation advantages that we saw in post-1994 companies, particularly because there are now over 3B people networked to the Internet. If I have to design an AI company with or without network effects, I’ll take the one with network effects every time.

Learn the Network Effects Playbooks

When you’re creating your digital business, architect your product to allow users to participate in value creation. Let their use of the product add value to the other users. Let customer 2 add value to customer 1. This makes the company defensible because competitors have a hard time adding as much value to users once you get ahead, and defensibility creates value.

If history tells us anything, the next SnapChat, Airbnb, and Uber will be created in the next twenty-four months. While the next billion dollar startup won’t look just like those companies on the outside, it’s a good bet that they will have network effects on the inside.

Learn the network effect playbooks. It will make a huge difference to your startup.

______

Study Methodology

– We know the list of 336 is incomplete and many numbers debatable. We debated them ourselves. This was an exercise to get a solid estimate, not to be scientific or exhaustive. Given the large number of companies (336), and having played with many scenarios, we feel the conclusion about the power of network effects stands, and the 68% estimate is solid.When we first started building this spreadsheet in 2015, it first showed that 62% of value came from network effects businesses. That number has only increased since then.

– We omitted Microsoft entirely because — although it’s value has been driven by a network effect (a “two-sided platform network effect” to be exact) — it was founded before 1994. If we were to include MS, the percent to network effect companies would be over 70%.

– Amazon was considered 100% NON-network-effect because we consider Amazon’s core defensibility to be based on a scale effect, not a network effect.We included Apple in the calculation because we considered the company reinvented after 1994. However, we estimated that only about half of Apple business really had a network effect (iOS and iTunes). Thus, we put one half of Apple’s market value into the “network effects” pile and half into the “non-network effects” pile.Salesforce value was included, and split 50/50 between network effect and non-network effect. Salesforce is a 2-sided platform network effect.This analysis excluded: Silicon chip and switch companies like Intel, medical device and pharmaceutical companies, and manufacturing companies like FoxConn, which, while they are part of the digital world, were not software driven.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.