Longevity is the biggest market in the world.

The ROI is huge, almost too big to see. Many people also don’t realize that longevity businesses are critical for the future of humanity.

Imagine not being resigned to growing old, frail and sick. Imagine being able to extend your peak earning years. Imagine being able to delay having kids safely (if you choose!) to allow yourself more time to pursue a career. People could have second or third careers. People could invest their money over longer periods of time, accumulating more wealth. People could have the opportunity to actually enjoy that wealth before they die.

If we can extend the human healthspan, it will not just save tons of money (think of all the money dedicated to playing whack-a-mole with age-related diseases). It will also make almost every other industry bigger.

From a business perspective, this all increases the “L” in LTV (lifetime value of customers). More people living longer, more fulfilled lives has the potential to increase returns across many industries, and will probably create new ones over time. The TAM for Longevity is everyone.

Society has a choice: spend trillions on early death, or make trillions in longer life.

Reason 1: The Market is Everyone

Drug companies make money when there’s a lot of demand for their drug (lots of sick people), or there are limited treatment options available (only drug in town). But the best bet is to go for the big market. As a result, most of the blockbusters come from pursuing diseases that affect nearly everyone eventually.

For example, the top ten leading causes of death in the US are:

- Heart Disease

- Cancer

- Accidents

- Cerebrovascular disease

- Chronic lower respiratory disease

- Alzheimer’s

- Diabetes

- Kidney Disease

- Liver Disease

- COVID-19

In turn, some of the top-selling drugs include:

- Lipitor, one of the best selling drugs of all time, is a cholesterol drug intended to help prevent heart disease – the #1 cause of death in the US.

- Keytruda, for treating multiple cancers, is projected to be the 2nd best selling drug by 2028.

- GLP-1 Drugs, like Ozempic, which treat both diabetes and aid with weight loss (a risk factor for many of these causes of death) are projected to be among the best sellers of all time.

Addressing just one of the leading causes of death in the US is enough to make a blockbuster drug. Addressing all of them at once is the biggest blockbuster of all time. And that’s what longevity medicines can do.

When we break down the top ten cases of death, you can see that aging is a primary risk factor for most of them. Between the ages of 1 and 44, the thing most likely to kill you is an unintentional injury (wear your seat belts). But past that point, heart disease, cancer, and COVID are the biggest threats. (Remember COVID is typically harmless to younger people, but is dangerous for people over 45).

Treating aging would be like addressing the heart disease, COVID, cancer, and diabetes markets all at once. It’s like a prophylactic for dying from preventable causes. And who wouldn’t like to take that drug? Nobody.

That’s mega-blockbuster potential.

Reason 2: Longevity Makes Every Other Industry Better

If you ask people if they want to live forever, most will say no. And that’s not the value proposition here.

But if you ask someone if they want to:

- Spend more years with their loved ones

- See their grandchildren and great-grandchildren grow up

- Learn new hobbies and skills they never had time for before

- Read thousands more books!

- Travel to every country in the world

- Feel like they’re 20 when they are 80…

… then most will say yes.

But here’s the problem.

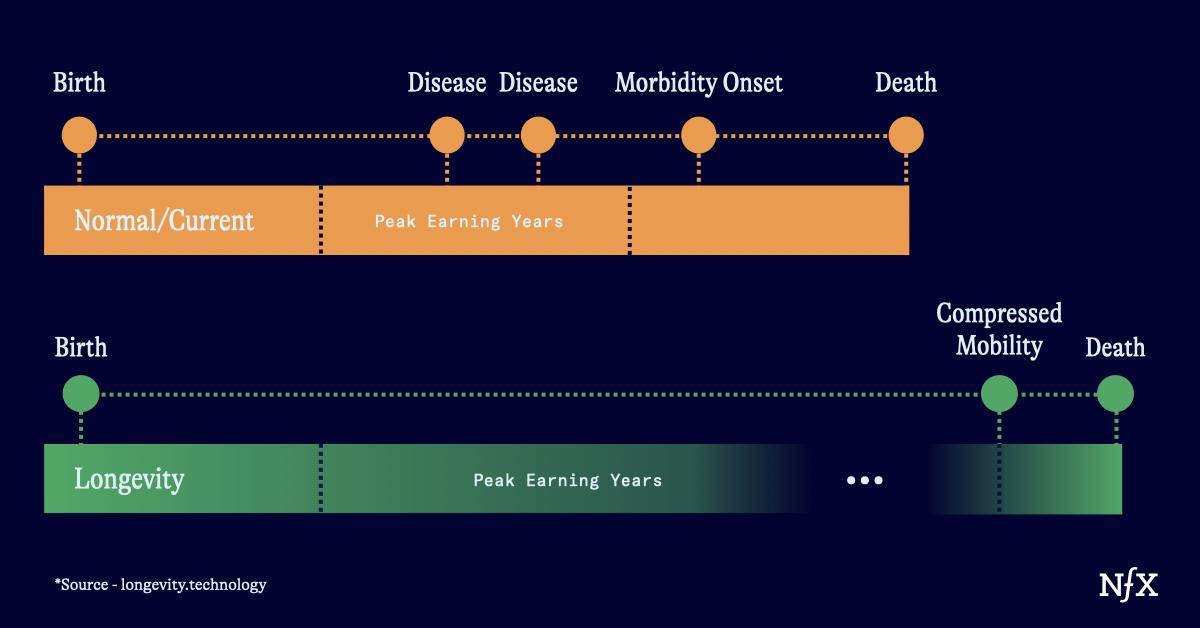

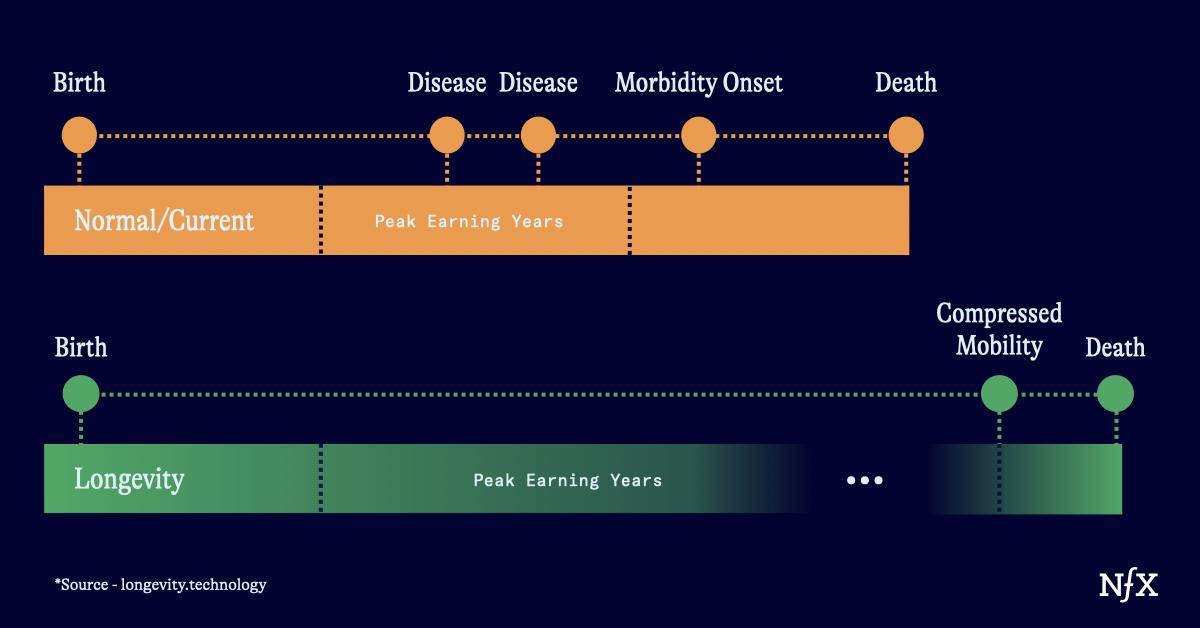

The average life expectancy of a human in the US is about 77 years. The average healthspan, defined as the years you have a healthy body, is shorter, around 66 years.

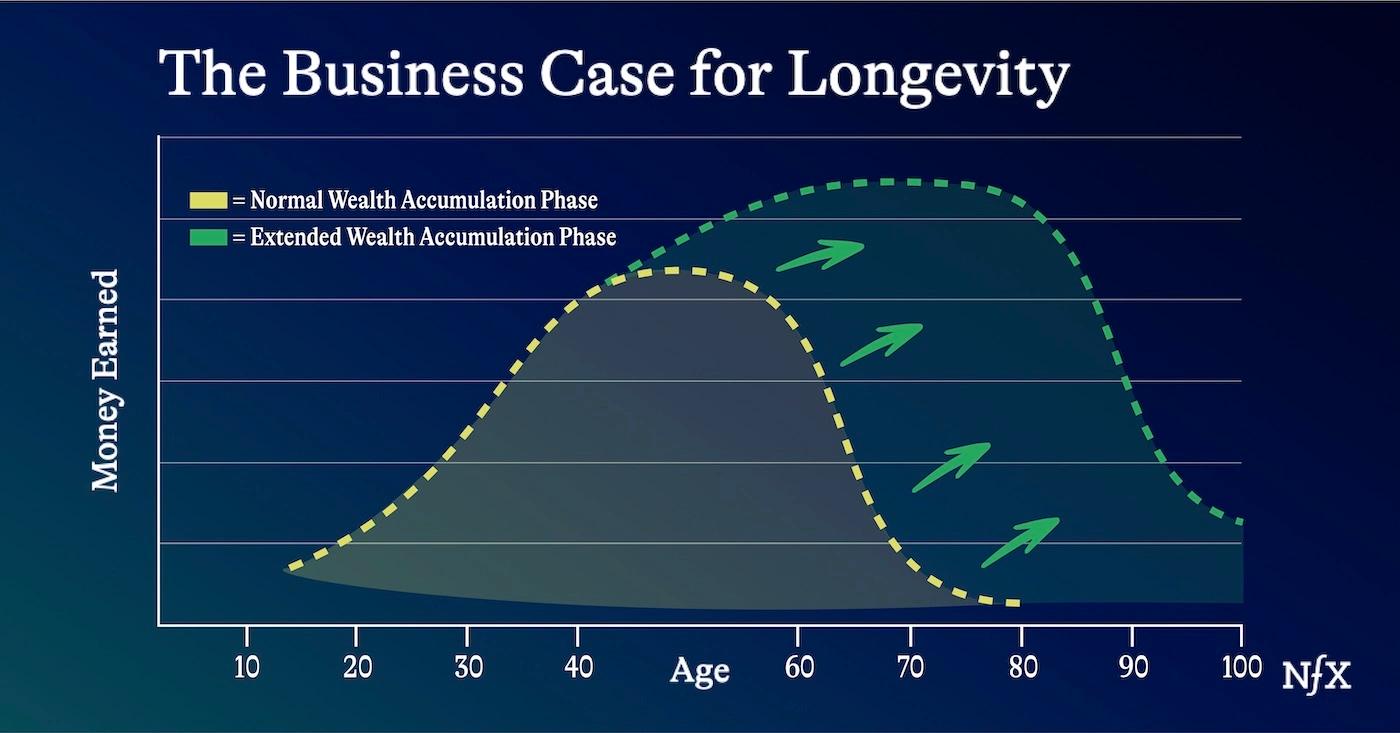

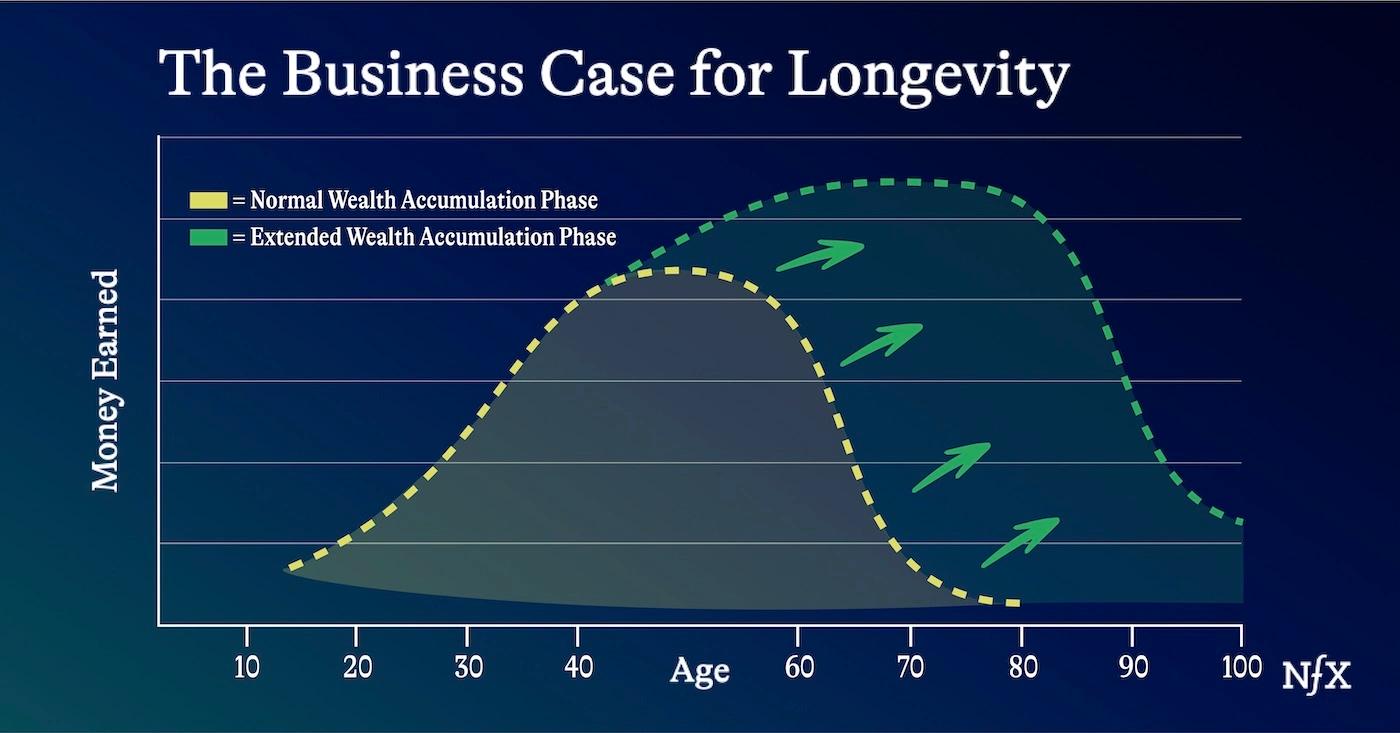

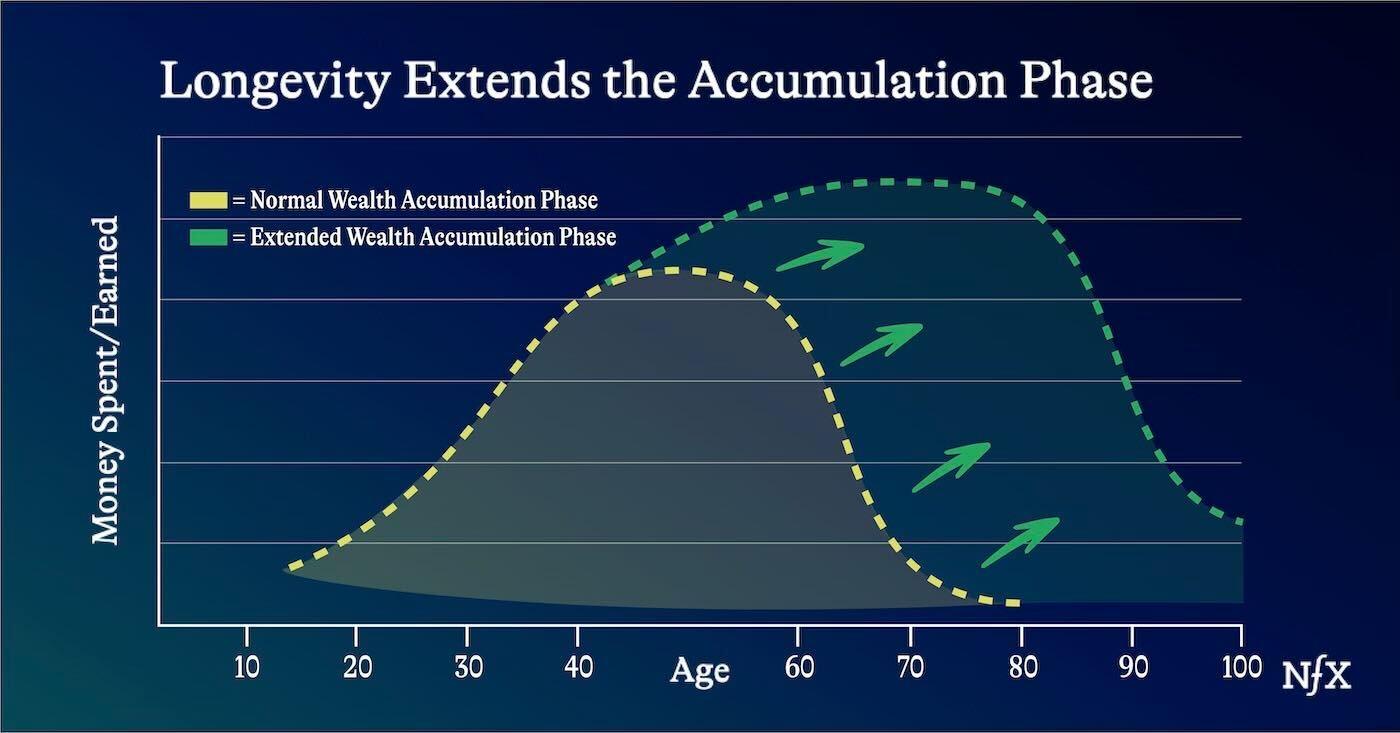

The first twenty or so of those 66 years are spent in school. You have perfect health, but not many financial resources – low paying jobs, student debt, etc.

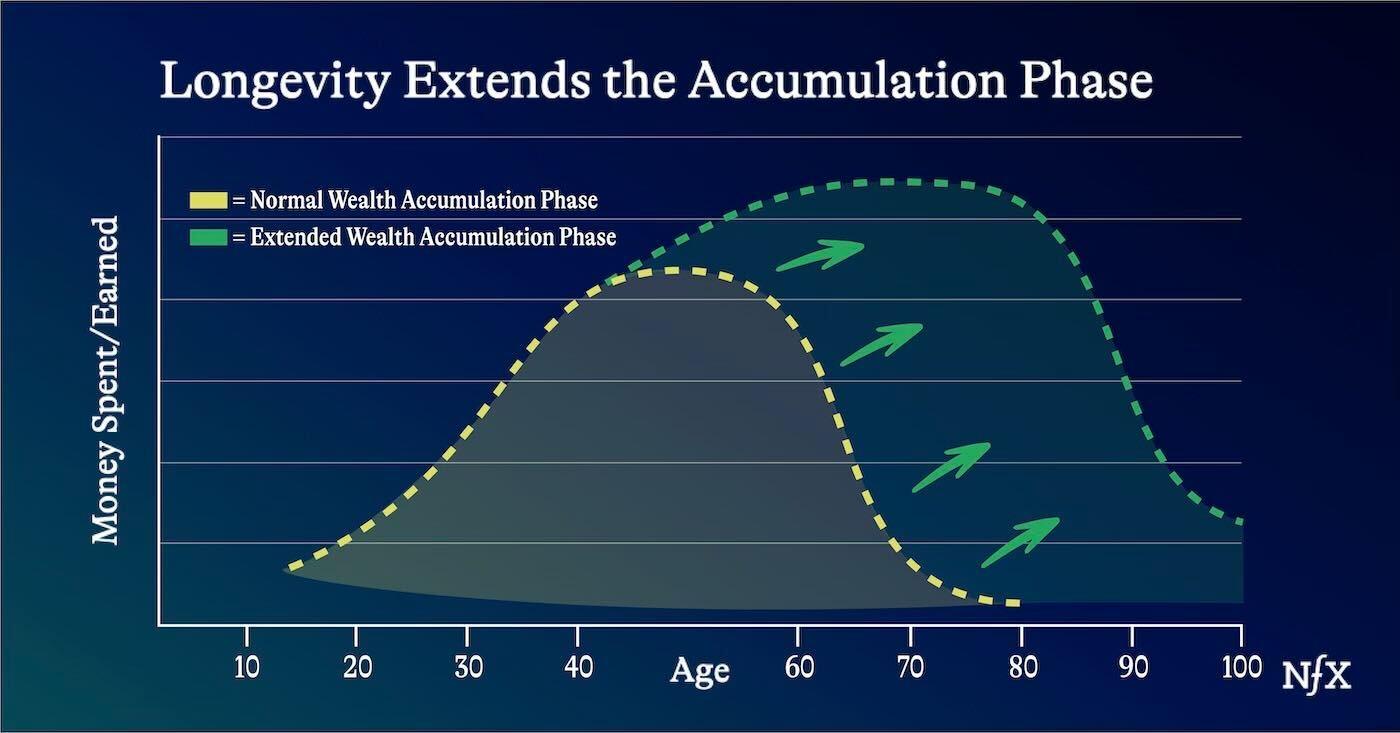

The next forty or so of those years are an “accumulation phase.” This is when you enter your peak earning years. You spend most of that time working, building a family, and saving what’s left over for retirement. During this phase, most people earn more than they consume. That means you have both your health and resources at your disposal.

Then, you reach the next phase. Retirement age is usually between 62 and 64. During this phase, people tend to have reached their peak savings. They then begin to consume more than they earn.

It sounds great. The kids are out of the house. You don’t have work. It’s time to travel and enjoy life…for about 10 years.

During this time, you may have maximum resources, but you are running out of time and health.

Most Americans retire in their early sixties. If you compare the retirement age (62, to be conservative) to the human lifespan (77), that gives most people about 15 years to enjoy that time. If you compare retirement age to the healthspan (~66), it’s more like 4 years.

But if we can extend the healthspan, so much opens up. You could travel more, see more, spend more, learn more…

From a business perspective, all this means growth in nearly every industry (except funeral home and adult diaper businesses). Longevity makes every other business better by keeping your customers alive for longer.

You already know about “LTV” – the Lifetime Value of your customer. Longevity will increase the “L” in LTV, making almost every other industry better.

The economic value of delaying aging is well documented. Some estimates suggest that delaying aging enough to add just one year of life expectancy is worth about $38 trillion.

And we can do even better than that.

Reason 3: Society Can Spend Trillions on Early Death or Make Trillions in Longer Life

By 2050, three quarters of countries will not have high enough fertility rates to sustain the population size. That means more older people and fewer younger people.

In most societies, young people grow up and support older generations. Without new generations we have 2 problems: increasing costs of care, and not enough working people to fund that care.

This pretty much sums it up: In Japan, the sale of adult diapers outpaces the sale of infant diapers.

These declining birth rates are well known. But what no one talks about is that there are very good reasons why this is happening.

For most of human history, most children were unlikely to make it past childhood. Many would die of illness or accident. In response, most families would have more kids, increasing the odds that one might make it. But with the creation of modern medicine, more kids started making it into adulthood. Today, there’s less reason to have more kids because odds are, they’ll grow up. This is an amazing thing.

Second, progress in women’s rights, education, and access to contraception has let women decide when and how they have kids. As late as the 1960s, the average number of children per woman globally was 5. Today, it’s more like 2, partially because of these reasons.

It’s true that an aging population, without a new generation to support it, is going to cost major healthcare systems trillions of dollars. But we can’t (and shouldn’t) go backwards.

Instead, we need to keep people healthier for longer. We can extend people’s peak earning years, allowing them to accumulate more savings. We can prevent chronic diseases that cost the most money to treat. We can give women the option to have children later in life, by extending fertility windows.

We need to invest in life, rather than waiting to spend trillions on sickness and death.

That money will be spent either way. Now is the time to make that choice.

What We Need Now

Over the course of the 20th century, we almost doubled the human lifespan and healthspan. But since then, we’ve stalled. Life expectancy even went down in the USA in the past few years, partially thanks to COVID.

Most of these gains were made thanks to breakthroughs like sanitation, vaccines, and antibiotics. But we can make a similar leap again.

It is biologically possible. If you survey nature, you see signs that nature has found a way around aging and senescence – after all, all babies are born with fresh lifespans (no matter the age of their parents), lizards can regenerate their tails, some tortoises can live to be 190 years old. We even catch glimpses of humans with uncharacteristically long lifespans: there have been a handful of people who lived past 110.

With the tools of techbio, we can untangle these mechanisms and turn them into medicine.

So what is holding us back? It’s talent and money. (But mostly the money).

The longevity space has had a reputation problem. People think it’s all about billionaires trying to live forever by eating strange diets or having young blood boys. But it is actually about preserving our economy, investing in life for future generations, and making every industry better.

This is an incredibly valuable place to spend your time. The best scientist-founders are starting to see it, but we still need more of you.

That’s why the problem is mostly money-related. Most of the money in the techbio space goes towards “sick care” companies. Maybe that’s because that’s how it has always been done. But maybe it’s because people don’t realize just how big the longevity opportunity is, and the businesses reasons to put your money there long-term.

Hopefully now, you see that the value is huge. Not just in “sick care” costs saved, but in future markets that will be expanded in education, travel, health, entertainment…etc.

Companies are constantly calculating the lifetime value of a customer. We can increase the L. The longer someone lives, the greater your LTV will be, no matter what.

Anyone who has played tournament poker knows that you don’t want to be the one who bursts the bubble. It’s the same here. We are so close. We have so much science to follow. We don’t want to be the last generation living with outdated science, the generation that bursts the bubble, the generation that dies at 70 when the very next generation gets to live in perfect health far into the 100s and beyond.

Let’s make it happen. May we live long and prosper!

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.