The best networks start small and high quality. They build value and return confidence to the network with every additional node. There’s an energy you can feel in emerging networks — it takes a form. That’s what we are seeing in Latin America right now.

NFX has been increasingly active in LatAm over the last few years, largely drawn there by an incredibly talented pool of Founders in the region. We have led investments in Nuvocargo, Zubale, LaHaus, and Melonn — and our NFX GP Pete Flint has an especially strong connection with up & coming startups there. LaHaus founder Rodrigo Sanchez-Rios recently wrote: “In 2018 (before LatAm startups were cool) only one VC made the trip to Medellin. Now LaHaus is by far the market leader.” That VC was Pete.

To understand the unique challenges and opportunities of LatAm, I talked with Antonia Rojas, the youngest female partner at ALLVP and a rising star in the startup ecosystem there. We co-led the Nuvocargo Seed round together. Based in Mexico City, she has a “boots on the ground” view of Latin America that I love. Methods for building network effects there is not what one might think — and as a result, go-to-market in Latin America demands building trust bridges and leveraging confidence networks.

Understanding the psychology of LatAm consumers is a powerful unlock for new Founders entering the region.

The below conversation is highlighting parts of my recent NFX podcast conversation with Antonia Rojas of ALLVP.

A Positive Funding Cycle for LatAm

- We are thrilled to have international funds entering the region more. We are seeing that every day more and more, and that means we’re having funds like Andreesen Horowitz, like NFX, like Lightspeed, coming to the region and seeing what’s going on and seeing that there is so much competition in the US, right?

- ALLVP and other top VCs here in LatAm can be the local players with the boots on the ground. We bring an understanding of what’s going on internally in the country, in the regulations, in the politics, in the culture. But now we get to add to that the bigger international and U.S. fundings that can open up the next stage of capital.

- Valuations are up and I’m sure you have seen it in just the last couple of years. But the upside has also never been larger. The fact that the countries of LatAm are so connected today and you can actually operate a whole entire company in Latin America from Brazil or from Mexico, it’s just like an increase in the upside that you can have on one front.

- And then there’s the confidence that all this funding builds back into the system. Seeing an international company like Uber buying LatAm company Cornershop for $1.4B is an outcome that we weren’t expecting even two years ago. There weren’t many companies that could buy another company at a $1 Billion valuation. Now there are.

- LatAm Founders are really benefiting from two things.

-

- They’re benefiting in terms of their valuations. They’re benefiting from the fact that the valuations in the US are skyrocketing, and the firms like NFX and Sequoia are now coming down to LatAm. It’s possible to look at the valuations, even though they’re climbing, and say, “Oh, it’s like a 20% discount to the US company.” That seems cheap right now — when in fact it might not be depending on what the exit valuations can be because the markets are different-sized, and the friction in LatAm is greater than in the U.S.

- More and more international investors are reaching out to understand the region and to either co-lead a round or understand more of a market. That is something that we just didn’t see three years ago.

Where Are Your Expansion Countries?

- The action in LatAm right now is mainly in Brazil as number one, and then Mexico, Colombia, then Chile.

- The question for most startups is usually what geography to go after next. We did research on this – we wanted to learn where most companies were going for their “expansion countries.”

- Mexico was the extension country preferred by most entrepreneurs. We’ve seen this change, particularly in the last four years, whereas before Chileans or Colombians or Peruvians wanted to expand to their neighboring countries, so they’d go to Colombia or go to Chile, and so on.

- But what’s new today is they are all having Mexico top of mind. So it’s a mix between this interconnection that we’re seeing with different countries. And that’s where we see a strong tie between Mexico and Brazil.

- On the other hand, talent is moving to Mexico, which means more companies starting here, not just expanding here.

- Our aim for the future is that we can connect all of Latin America. It’s not trivial to scale from Brazil to Mexico. This is where we want to tap in.

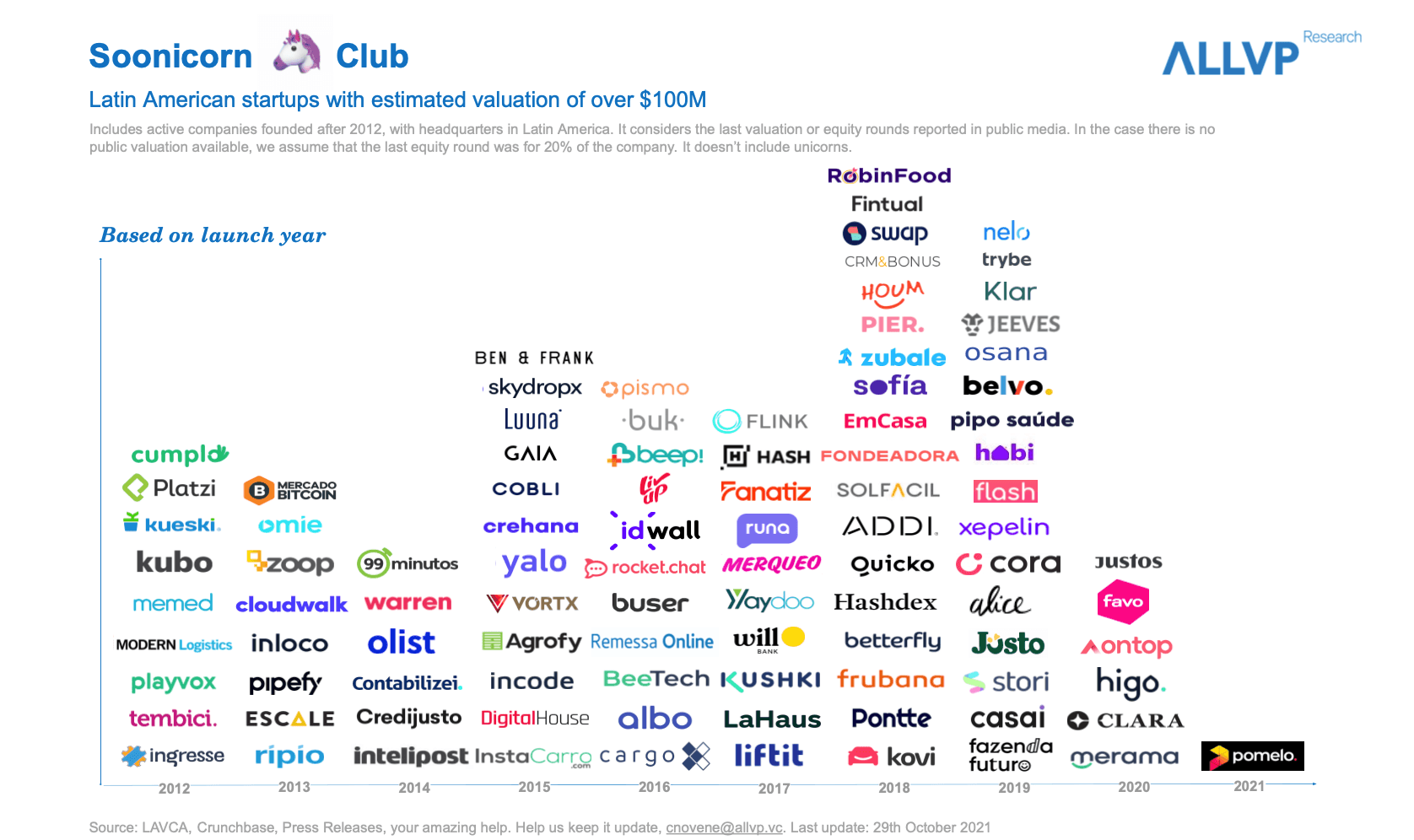

- You can see this happening in our Soonicorns charts.

The Soonicorn Club as an Overlay for Grokking LatAm

- At ALLVP we published our Soonicorn Club research along with diagrams on Twitter.

- “Seeing the Latin American venture ecosystem’s unprecedented momentum, we asked ourselves: which Latin American company would become the next unicorn? To put it another way, which of them would enter our Soonicorn Club? To better answer this question, we have been tracking down startups with an estimated value of more than $100M which are not yet unicorns, but might be soon.”

- These charts give you a geographic layout as well as a time layout about when these soonicorns were all born, and the amount of activity in the last three, four years is really impressive to see what’s happening.

Soonicorns By Launch Year:

Source: https://www.notion.so/Soonicorn-Club-21-54cd9bbed46545afa6c4a546bc6dadce

Building Networks of Confidence

- We have our small startup “mafias” here depending on the type of network we want to tap.

- For example, we have our so-called Chilean mafia; I have a group of only Chilean women that are in Mexico City and we share a lot of tips. Then we have the Chilean entrepreneurs helping each other out. Then we have the Latin American entrepreneurs that are expanding to Mexico, etc.

- All of this is organized through WhatsApp. It’s very connected and intentional.

- But it works because it’s small. It works through these small networks of 6 people and then 10 people and then 20 people.

- We’re fostering those networks of confidence and sharing of knowledge that helps these ecosystems evolve and actually take root.

- It’s a close network and we are more coordinated than ever before. It’s like you not only just know someone’s name, but you can also easily reach out to them, and coordinate and are willing to collaborate.

- There is this energy of small groups collaborating, of connecting, that is probably what Silicon Valley was a number of years ago.

- And that’s because now we have many foreigners needing to build up their own networks. They need to navigate the country even from small things like where do I live, how do I pay different accounts? And just these tiny little things you need support, otherwise it can be a bit overwhelming. And that’s what we’re building, that’s what we’re aiming with all these small mafias that we’re building.

- It’s a subtle thing. It’s like, what will give you the edge and what will help you avoid a lot of pain? The techniques of these groups help our businesses go fast, not slow.

- Being in that network to get that information is so critical.

Go-to-Market: The Borders of Trust

There are big cultural differences playing out in terms of go to market in LatAm. Two elements are Trust and Timing.

1. Trust

- I think one of the largest challenges, particularly in Mexico, is the border of trust. It’s hard to get trust from people, particularly if you think about a financial ecosystem, or if you think about anything that has a transaction where the other side can disappear.

- This is a very important thing to understand here. Everyone asks: Is this company trustable? Is this person trustable?

- That’s something that you don’t necessarily have in San Francisco, for example, where people just download any app and try it out, nothing to lose.

- That’s not the case in Latin America and particularly in Mexico.

- I think about “hacking trust” — you need to be careful about using those words together in the same sentence — but in essence, it’s how do you speed up this building up of trust so people can actually test your product.

- Then you get to smoother sailing — if the product actually works, etc – which is similar in other parts of the world. But the main point is how do you build that trust in order for people to actually use your product and use it more than once?

- As a Founder you need to really see what are the symbols of trust for your target population. You need to ask: “For this type of client that I want to have, whom do they trust in, or which companies do they trust in, and how can I relate to that? How can I build a trust bridge to them?

- That’s when understanding the local ecosystem is so important. That first client is going to provide you with the social proof that your product works, and proves to others that you’re not going to run off with their money.

- That’s why it’s so hard for someone from the outside to go out and win the entire market, because you need to understand these local cultural trust intricacies.

- Certain words are triggering for trust and triggering for distrust, certain phraseology.

2. Timing

- The other key factor is timing. In San Francisco people are very direct. It’s either you want the product or you don’t want the product and that’s it. With fundings too.

- Mexico is not like that. You need to have several meetings. You need to be able to understand — again, going back to the trust — that a person or company is trustable. You build up with meetings or with contacts and recommendations and social proof and so on. So timing can take a little bit longer. Your first no might be a no with a yes and you just need to keep building up trust over time.

- It’s complicated psychology that you need to understand and know how to navigate. You need to know when you need to move on to the next client instead of wasting that much time with that particular client. Or when to stick and give a potential client more time.

- This plays out in terms of sales cycles and sales motions, and understanding the differences there and experimenting around that is critical.

The New Digitization Of Latin America’s Population

- The first thing that excites me a lot about this is that there were a lot of people in the Latin American population that were never going to embrace the digital trend. They weren’t going to use WhatsApp for anything. But then with COVID they were forced to use WhatsApp and other digital products more because there were no alternatives for connecting offline. So the scope of the population that you can actually reach now is way higher.

- Once you have more people using products, you have more data. With more data, you can build better products and better insights and more customization around it.

- In the US, people were already largely digitized before COVID. But in LatAm, people were just not digitized as much, and so they’ve all just become newly and completely digitized over the last almost 2 years. So now they’re more comfortable in their daily lives using WhatsApp or using Zoom or using Skype. That then translates to them being comfortable using SMB software in their work during the week.

- Think about an owner of a small shop. You’re selling groceries to the neighborhood, and then they were doing everything by phone or manually and so on. Now, they use either WhatsApp or an app, and they operate their entire business like that.

- There is also this fear of digitization making formal your business. There is a lot of informality in Latin American economies. The fact that you are online now makes everything formal, and that adds a bit of constraint. But COVID just destroyed that barrier because people needed to be online. They couldn’t go out.

- So culturally, it felt like it was very impersonal and kind of an insult to be shown a piece of software rather than given the human interface, human eye contact, the respect. So people’s digitization was going slowly because they didn’t want to insult people.

- Now that COVID gave you a socially acceptable excuse to move to software, everyone’s just gotten used to it and they realize, “Hey, it’s not that impersonal. It’s actually useful.”

“Need To Haves” vs. the “Nice To Haves”

- What’s exciting in LatAm right now is we look at the largest problems of the population. The education system in Latin America is broken. The insurance space in Latin America is broken. The logistics space is broken. The financial space is broken. You have all these broken industries that happen to be large, but they also happen to have a high impact.

- These are need-to-haves. Another way of saying it is that these are need-to-have products in proven markets. They are not nice-to-haves.

- We can make major societal change here.

For more insights about LatAm, listen to the full conversation with Antonia Rojas on the NFX Podcast

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.