Even if you’re not ready to sign deals right away, you need to be thinking about business development. Now.

Too many founders drag their feet on business development until they need to sign a deal or see a competitor moving in. That’s too late. You have to build your network early, or you’ll be far behind when it’s time to close.

In the TechBio world, we’re coming up on one of the biggest opportunities to start building those relationships: the JP Morgan Healthcare Conference. It’s not the only opportunity out there, but it’s a place where the seeds of many deals get planted.

Here is a three-part guide you can carry with you to any major event.

I recently sat down with two experts in the field: Yael Gruenbaum-Cohen, a partner at aMoon fund, and Peter Nell, the former chief business officer and head of therapeutics at Mammoth Biosciences, to talk about business development in TechBio. That conversation informs the below guide.

Also listen to our Deal or Die episode on the NFX podcast for more insights.

Part 1) Set the Stage: How to Build a Strong Business Development Network

How do I build relationships from scratch?

Peter Nell: It’s very important to have this mindset of relationship building. It starts with the very first call and the very first meeting. Maybe even a beer at JPM. That’s the very first point of relationship building. You have to orient your whole life around this – you will see these people again.

Start connecting when you don’t need the partnership yet, so you have the network.

Be very honest and transparent. Tell them what you are planning to do, what is still required, but you can come back. But be known in the field.

Yael Gruenbaum-Cohen: Make sure, if you don’t have a head of biz dev or a CBO, that your board of directors is very well connected. If they’re not, get a bunch of advisors. Pay the best people to get advice on who to reach and how.

The Takeaway: Always be in the relationship-building mindset. Go out to events with people in your field. Connect before you are looking to make deals. If you are not connected, find advisors or investors who are.

Where do I start building these relationships?

Yael: Go to Boston. Go to JPMorgan. Go to these meetings and be kind, nice and patient. Never neglect the process. These are long processes.

Peter: We have these wonderful tools like LinkedIn and it’s not all about going to partnering meetings. It’s not that stiff anymore.

There are other partnering events. There are research building openings and so on. I’m always surprised that there aren’t many companies there. People always say its a waste of time, you’re just going for a beer. But it’s relationship-building. It’s networking.

The Takeaway: Conferences are great places to meet people. But you can also look for smaller scale gatherings like research building openings, or events in known centers of excellence (Boston, the Bay Area etc). Use tools like LinkedIn to find out which events mean something in your network.

How do I stand out to a big pharma company?

Yael: The most important word is “trust.” If you know someone who trusts you, that should be one of your first choices. Signing a deal is the first day of a long-term relationship.

You have to know the company. Pharma BD are pretty brilliant people, they understand company strategy, they understand what’s going to happen in the company five years from now and ten years from now. They know what they are looking for.

As an entrepreneur you know your company and you know your technology, You should know how your technology compliments theirs. Come with that.

The Takeaway: You have to build trust through patient, and authentic network building. Then, you have to come prepared. Know how your technology fits in with the company’s existing products and goals ahead of time.

How do I maintain relationships?

Peter: More and more people are moving around from one company to another. Being very respectful is very important. If there’s a negative decision about your technology, maybe it was at the highest level of the company. That person you were talking to will be at another company tomorrow.

If you meet them again, they’ll talk to you again. Don’t take it personally [if a deal fails].

Never talk negatively about companies. You can ask questions: say “I don’t understand why they are doing this,” but never say, what they are doing is bad.

The Takeaway: People don’t stay at one company for long. Never be negative, even if a deal doesn’t go your way. And don’t assume that a failed deal means you can’t contact that person again in the future.

Part 2) Making Strong Deals as a Platform Company

What do I have to know before I start pursuing deals?

Yael: It’s a lot of homework learning the landscapes and advantages, and disadvantages, and gaps in therapeutic areas. What’s your real added value? What medical gap are you answering that others haven’t?

That’s the homework you should sit and do before choosing which indications to partner.

The Takeaway: Know how your technology fits with your intended partner’s. Look for your unique value add. Look for gaps in therapeutic areas that are likely pain points for your partner and show how you address them.

What makes a deal “right”?

Omri Amirav-Drory: I really want to highlight the importance of the right deal. My partner James calls it the huskies in front of the sled. The right deal helps push the company in the right direction, because everybody is aligned. It’s not just us thinking about our next indication; we have a deal, we have to do what we said we will do.

Peter: Don’t do a deal if that’s not the right technology for the company you’re talking to. A deal not done is not as bad as a terminated deal. That’s very important, especially for small companies. We see it right now: some clinical trials fail and the company goes down immediately.

One of the big mistakes I see is only looking at the numbers of the deal. It’s not [about just that]. It’s about value making. It’s about the contributions for both companies and the benefits for both companies. I think that can be more important than the initial early value of the deal.

Yael: There is never a one-size fits all deal. Look at what the deal is worth for you and what the real value of the deal is. Do your own homework, and then come from the table. Don’t look at other deals and say: “this is what we have to do.” Many of the numbers that are published are fake news.

The Takeaway: The “right”deal isn’t just about the number. – though non-dilutive funding is great. It’s about making sure you are getting many forms of long-term value out of that relationship. What does this deal allow you to do in the future? How will it align your team toward that goal?

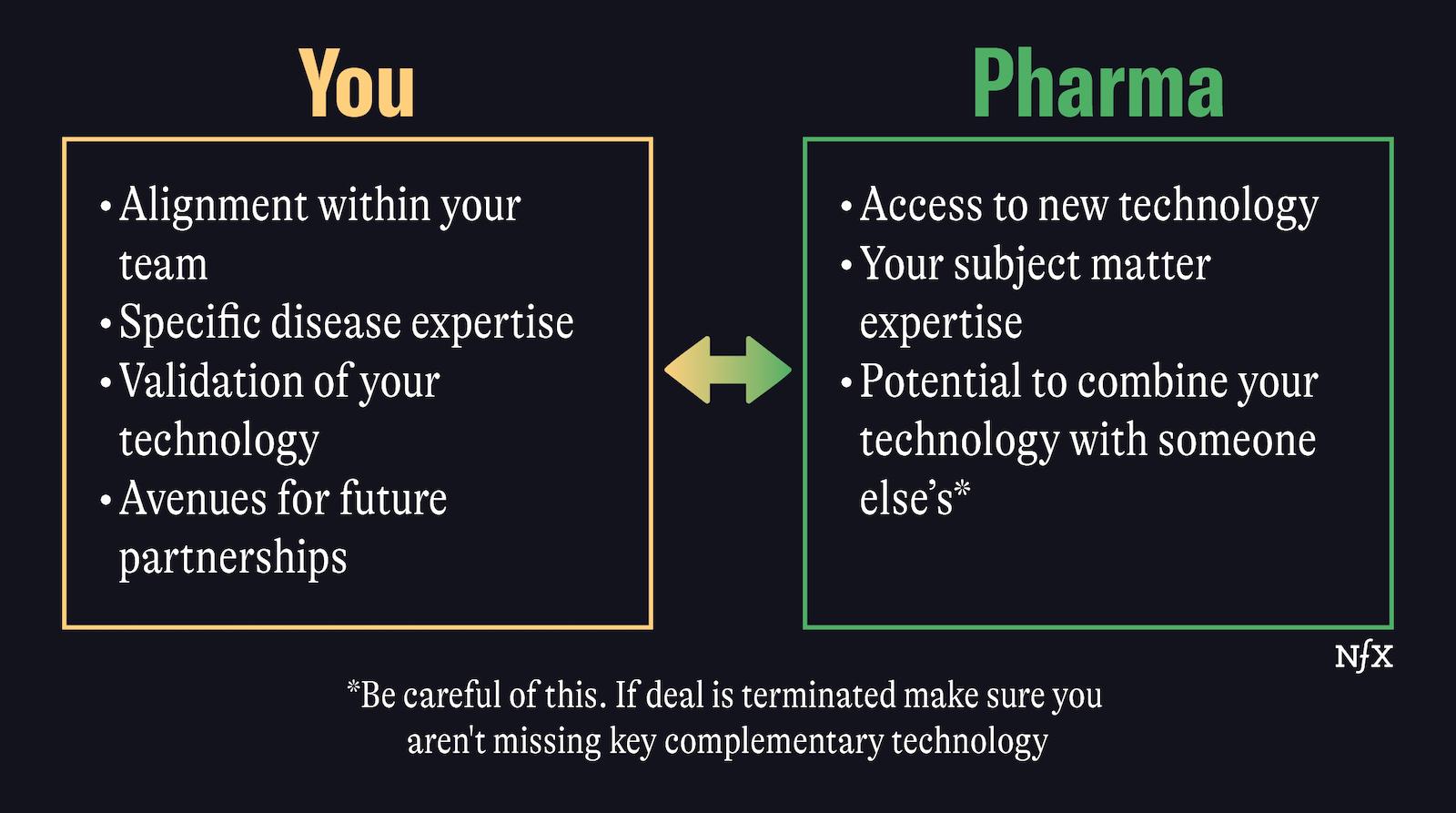

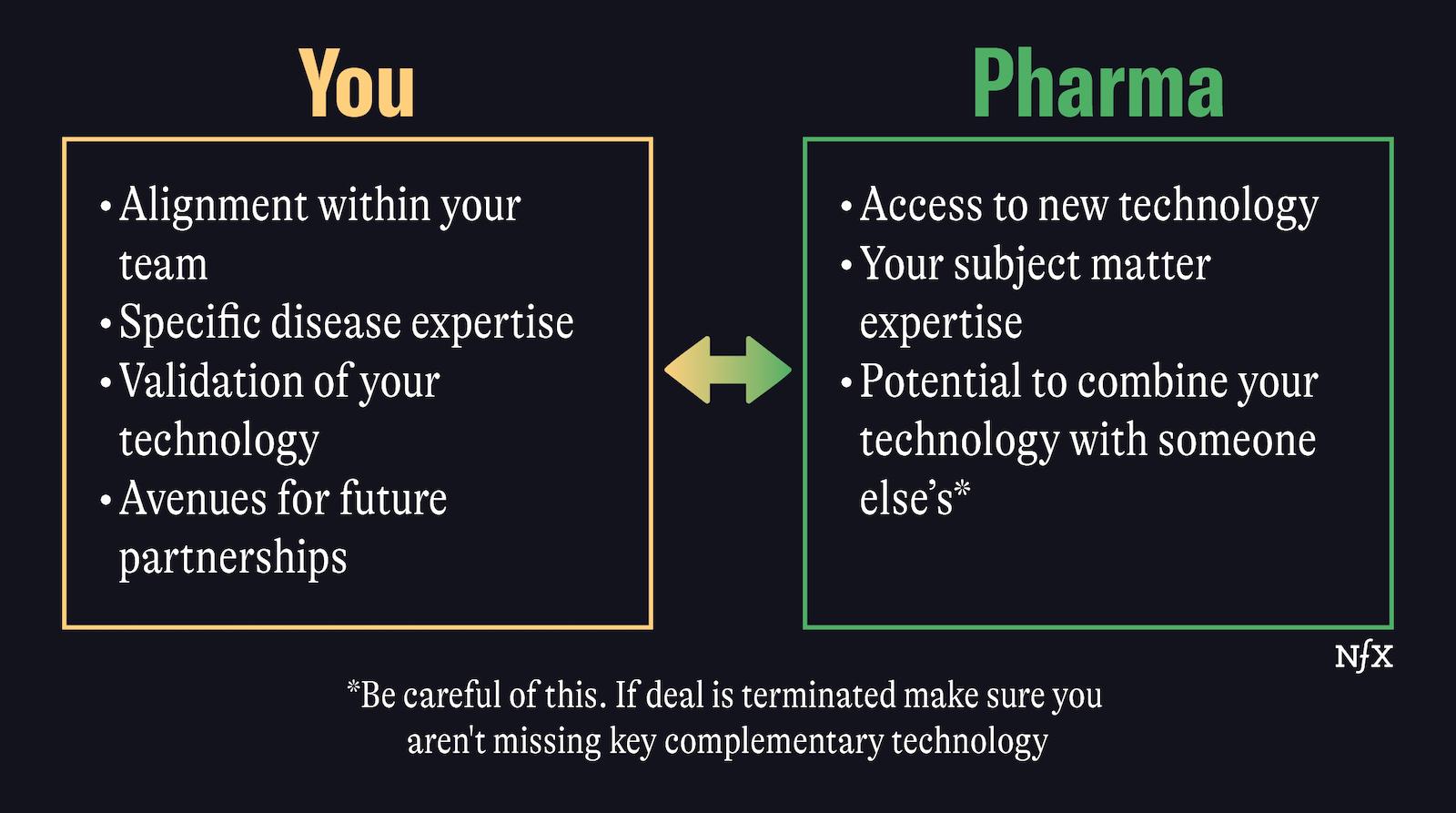

What Should You Get Out of Deal?

Peter: Big pharma benefits from the technology and the expertise. You benefit from the disease expertise. That’s not easy to build up and the pharma company already has it.

It’s also early validation of your technology. If these projects work then there will be more pipeline projects but also more partnerships.

[When Mammoth closed its major deals with Bayer and Vertex] it was a matter of getting the company into a new mindset. We were coming out of academia, and now you’re in this professional setting where you need project management….[that alignment] is a benefit that comes to the company from the deal.

The Takeaway:

What types of deals can you make?

Yael: The true art of a platform company is knowing what to sell and for how much. Everything has a price tag.

You can sell the company, you can sell the platform, you can sell a part of the platform, you can sell a therapeutic area, you can sell an indication.

There isn’t one answer. If one company holds several platforms, like your portfolio company Eleven, if they carve out one, the company is still sustainable and holding its value. If you’re a one-trick pony, and you create one platform, if you sell that, it’s like selling the company.

Omri: We have some companies that have deals around the platform as a service, but then they have their vertical application, the drug they’re trying to get to market. Platform companies don’t have to sell the future for the present.

The Takeaway: You can sell your platform as a service, sell off a specific part of your platform, a therapeutic area, license an asset. Platform companies have many options. Everything has a price tag. But be careful of selling the future for the present: think about how you can continue to build value after the deal is made.

Deciding when to partner

Peter: People forget that there’s new discoveries everyday. You have to balance: if I do this on my own, am I getting to a stage where I’m really differentiated? Might there be other approaches that are then considered the top choices? And what if others move ahead?

In a rare disease, for example, do I still have a position in starting a clinical trial if there are three or four already in the clinic? Instead, what if I partner with a strong company in that field already? Then we might succeed, because they can accelerate clinical development. They have the knowledge and patient advocacy. They have those relationships.

You have to balance when and what to license. But if you want to go into this vertical application you have to keep something for yourself.

The Takeaway: Remember that new discoveries are made every day. If you are going to stay vertical, make sure you are very differentiated in a space. Also be aware of how fast your competition is moving, and whether a partnership might accelerate your pace (but remember to keep some things for yourself).

Ways to Become Differentiated

Peter: You could also consider other technologies that are just evolving that you might be able to combine. Big pharma will usually go for the more obvious ones. Let’s take gene editing and delivery as an example. They will look at proven delivery technology and combine it with your editing technology.

Maybe you can take the risk to go into new editing and new delivery technology. That’s when you can create something really differentiated compared to what is out there.

The Takeaway: Be on the lookout for complementary technologies that might not appeal to pharma (too early stage), but could make your platform very differentiated.

What kind of data do you need to show?

Peter: That depends on the platform….[but] to convince upper management very often in-vivo data is required. That means a mouse model should be done. That’s what people want to see. I’ve seen it in the past where ex-vivo editing companies want to see in-vivo editing because they want to see that the system works and is safe.

Even if you think from a science perspective there’s no real link, they’ll feel more confident. And that’s what you have to provide: confidence.

The Takeaway: In-vivo data is often what it takes to convince upper management. Animal models are increasingly needed to instill confidence in a platform’s safety and efficacy, even if it’s not exactly scientifically relevant.

How long should a deal take?

Peter: During the pandemic we definitely saw an expansion of dealmaking process – it took much longer than usual with no face to face. In general, three to six months is a good guideline to shoot for. But it depends, of course, on the deal.

Yael: A very short deal could be an m&a. If it’s a very complicated deal where the pharma company is risking anything from their knowhow, it could be a long, complicated deal. It can take up to nine months and one year.

In the mindsets of entrepreneurs, we need to make a distinction. It’s not three to six months from when you start the discussion. Those discussions can take up to a year. You go to JP Morgan and have a beer, you have scientific discussions. Then you find the right terms and find the right way to work together. That can take up to a year. Then, the deal itself is three to six months.

The Takeaway: Timelines vary, but three to six months after up to a year of informal discussions is a good benchmark.

Part 3) Building the Right Business Development Team

When Should You Bring a Biz Dev Person on Board?

Yael: You should bring a great CBO or a VP BD person when you are ready to actively pursue partnerships. However, if you have a really strong CEO, then a talented VP biz dev at an early stage company can support in the shadows.

If you’re an early stage platform company, you really need a strong VC to support that. It takes time to build these trusting relationships. And that time can be shadowed or bridged by a strong VC.

Peter: You should ask yourself: What expertise do you need in addition to what the leadership team already has? If you have less experienced co-founders in the leadership team, you will need this network to be brought in.

Same for negotiations, if you’ve never done it, you need someone who has done it before. In my case, for example, I may not need a CBO as early as a company that has a scientist as a Founder.

The Takeaway: Bring on a business development expert when you are ready to actively pursue partnerships. But be aware of the strengths and weaknesses of your existing team.

What’s the difference between a CBO and a VP of Business Development?

Peter: With title inflation we often mix up a CBO with a head of BD. Business development is really the licensing part. CBO is, in addition, corporate strategy: a licensing strategy and maybe even pipeline strategy.

To me, a CBO is this overarching role. If you need that earlier you might hire a CBO. But if you really just need to do some deals, and it’s a platform where every deal is very similar, you might go with just a VP of BD.

The Takeaway: A CBO deals with overarching corporate business strategy as part of the leadership team. A VP of business development may deal with individual deals, but not necessarily chart the company’s overall course.

How do I know if I have the right BD person or CBO?

Omri: A good business development person will fill the funnel and get the meeting. A great business development person will close the deal.

Yael: I think it’s all the mindset. A really successful CBO has to be a really good team player. They know how to work with business people, science people and operational people. They have to have good strategic thinking. They have to have perfect communication skills. They have to be bilingual between business and science, and have really good people skills.

Negotiation skills are the difference between good and great. That’s the person who wants to get the deal done. They understand that the most important thing is a win-win situation.

Peter: Trust is a very important thing. I want to make sure for a business development person going out [and speaking to partners] that we are not overpromising.

Omri: Soft skills are so important. Founders, you want to find the right BD: the first step is: do you like him? The right BD is someone you want to go for a drink with. People think it’s all about the brain, and being calculated.

The Takeaway:

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.