There is an unusually active cluster in the network of your customers. Find it, focus on it, and it will be a growth bomb for your startup.

Every new star in the universe is powered by a white hot center.

At first there’s just listless gas and dust. Gravity causes atoms to collide and heat is generated. This small cluster attracts more atoms until the heat is enough to fuse them – creating a small, dense, burning heart of a star. Then the star continues to grow, expanding through the network of atoms, pulling in all the atoms in its vicinity.

At the core of every important company is the same thing: a white hot center – a group of customers who are burning for your product and attracting more users to them.

It is a growth bomb.

It’s not the same as PMF or ICP, and here’s how it works.

What is a White Hot Center?

There is a network surrounding your business. It’s made up of customers, social media, message boards, journalists, potential employees, investors, and so on. A white hot center, if you can find it and stoke it, will activate that network and attract all the customers in the vicinity.

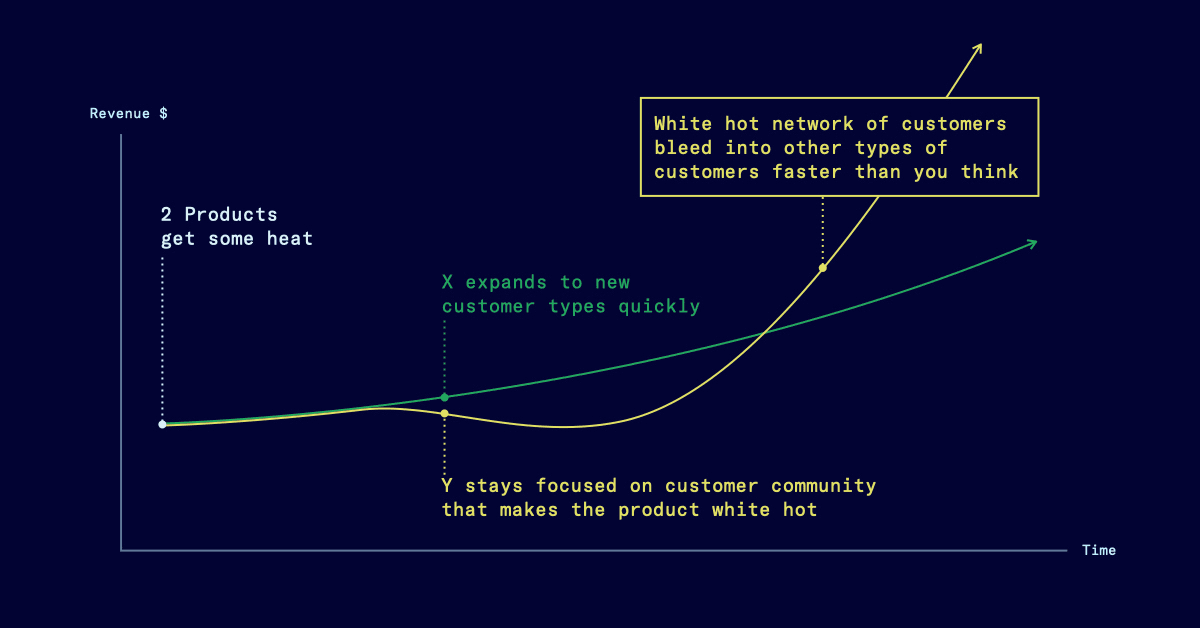

The mistake many founders make is to get distracted before their core customer base burns white hot. They see some heat being generated, maybe it’s even red hot, and they move on to get more types of customers. They switch networks too quickly.

If you stay focused for longer – if you tune the product and the customer usage until it’s white hot – that energy bleeds through the network much faster than you’d think, whereas a merely warm customer relationship won’t.

A real white hot center does a lot of heavy lifting for you.

It drives down CAC, drives up retention, increases willingness to pay and margins, drives press and social mentions, helps your team make the product even better, and through all those numbers, typically makes fundraising easier. And then it makes other customer segments jealous to get access to your product.

The whole ecosystem forms around it

We first started using the term white hot center about a decade ago while coaching early stage marketplaces.

There were certain customers on the demand side, and certain suppliers on the supply side, who created vastly more liquidity. They were distinct groups of approximately 500 within a group of 10,000 or so potential users. Within those 10,000, we could see higher prices paid by certain members of the demand side. Higher volumes produced by certain members of the supply side. The transactions between them were happening faster.

We realized we needed to spend all of our time on those individuals. They drove up the liquidity of the entire marketplace. The whole ecosystem formed around them.

We also saw this happen a few years back with our portfolio company Honeybook, a platform for offline service providers to promote themselves, find work, and get paid digitally. They started by focusing on the events services industry. They then focused more tightly on the wedding event services industry. Within that, there were many types of potential customers including venues, florists, event planners, photographers, caterers, DJ’s, etc.

The Honeybook team looked at usage and found that wedding planners were the white hot center. They stayed focused on that white hot center for 2+ years. Over time, the team noticed in the data that photographers had the next best metrics, so they focused on adding that type of customer for a year. Now they are a unicorn horizontal platform for all offline service providers.

Another recent example is TripleWhale, the leading analytics platform for the Shopify ecosystem. They started out building the tool for themselves, then expanded to other ecommerce vendors using Shopify that were the same size and orientation to themselves. They have stayed focused on that for 18 months, not going to other platforms like Amazon or WooCommerce immediately. The buzz has built in the Shopify community and they have become known as the product to use on the message boards and “top” lists of that ecosystem. Over time, they will expand, of course, but not before securing their hold on the white hot center of the market.

White Hot Center ≠ PMF or ICP

Isn’t this just product-market fit? Or to use the SaaS specific term, an ICP (ideal customer profile)? We’ve found it useful not to conflate the white hot center idea with these two ideas. If you do, you’ll fall into two traps.

First: What’s commonly overlooked is that product-market fit is a discovery process.

It starts with identifying a need in the market, and then is driven by an iterative build-measure-learn process of changing your product until you find a solution that customers really want. We’ve written before about 10 places to find PMF and how to know when you’ve found it.

By contrast, when you look for a white hot center, you don’t change your product (at first). You are searching through your metrics, comments, and customer feedback for a batch of outliers – a niche group of users who already love what you’ve already built. Then you double down on them. You’re feeding the white hot center that’s already here. This will make it grow.

This way of thinking will save you from wasting your time on ideas that have no future. If you have been building for a few years and don’t have a clear sign of a white hot center anywhere, you need to rethink your idea, and/or pivot into fast moving water.

What the white hot center and PMF do have in common is that they are both prerequisites for the kind of rocketship growth you’re looking for.

Second: The ICP concept is a bit closer to White Hot Center, but it’s flawed because it does not lead to network thinking.

If you are hyper-fixated on an ideal user, you will begin to think of your product as a single player game. You’ll develop tools that enable 1:1 interactions between that ideal user and your product.

But once you start thinking of your ICP as a node in a network – with a white hot center that enables you to spread to acquire new nodes of a network – you’ll build tools that enable your ICP to interact with other ICPs. You’ll build a multiplayer game, rather than a single-player game.

Think in networks.

The white hot center is the center of a network of customers, suppliers, journalists and analysts writing about it, investors investing in it, employees working on it, etc. They all react to the existence and intensity of the center.

How to identify the White Hot Center

A white hot center should be obvious once you learn to look for it. There are two main strategies we use to identify a white hot center within a network.

1. Look for irregularities

Back to our star analogy. Stars first begin to form in unusually dense sections of a gas cloud. It’s a blip. An irregularity that kicks off the whole process.

We see this pattern in networks too. Networks are not uniform, symmetrical, or tidy in real life. They are filled with irregularities. You’ll find your white hot center within an irregularity in your network. You can recognize it in positive outliers among metrics that drive liquidity.

Look for:

- Lower CAC

- High retention

- High willingness to pay/sell

- High ratings

- Press and social mentions

- Virality

At Poshmark, the white hot center was made up of women who were on the app more than 7 times per day, who were both buyers and sellers of women’s fashion, who lived in urban settings, who were willing to come to offline PoshParties. Customers in the larger community took their energy and direction from them. This visible white hot center drove a lot of press, lower CAC, higher retention, etc. Over 10 years, the customer base expanded to include men, and expanded to children’s clothes, men’s clothes, furniture, homewares and more.

2. Find the non-transactor

Your white hot center will likely be populated by people who have not been able to transact before your company arrived. Real revolutions typically come from people who have little to lose, everything to gain.

Lyft and Uber opened up a new form of transaction for car owners, not taxi companies. AirTable wasn’t revolutionary for people with deep familiarity with databases. But it allowed people who have never managed databases before to feel comfortable working with them.

Once you focus on the non-transactors, it opens up a new way of thinking for them and you.

So many Founders want to build SaaS products that grease the gears of existing processes. They’ll say: well if you’re a steel company shipping from A to B, how can we build software to facilitate that?

But they’re looking at this problem inside-out. Instead they should be asking: Who should be buying steel but isn’t today? Who is the non-transactor? How do we get other players, maybe lumber yards, the tools to get into the steel business?

For steelmakers, your product might offer some marginal gain, but you also threaten the existing hierarchy. For lumber yards, you’re facilitating a new transaction. They’re more likely to become a white hot center, because it’s all upside.

Get it burning

When you find your product’s white hot center, you have to get it burning so hot that everything around it will catch fire.

This is where network thinking helps you. If you see that your white hot center isn’t just one user, but a group, you’ll come up with ways to make the whole network stronger.

A current example is Generative AI founders building on top of Discord. That’s smart because it turns a single player game into a multiplayer game immediately, and helps identify and nurture the white hot center of users.

With Midjourney, every new user enters the product through a public Discord channel. The most valuable users are showcased within the Discord server. They teach you how to behave and how to become a sophisticated prompter. You can feel the hectic energy of people creating in public every second. You immediately get the culture and see what’s possible. It creates a sense of urgency and momentum. It brings the white hot center together.

You used to have to build such network tools internally and get people to create a new profile ID on your product. Now, Discord and other tools allow companies like Midjourney to showcase a white hot center right away.

Don’t Get Distracted

Founders often conflate growth with horizontal expansion. They’re not the same. Expanding into lukewarm customer segments too early will just kill your momentum. It will pollute your network, fill your product with customers that rate you low, add little value, drive up costs, dilute your message to the media etc.

Real growth comes from the white hot center. Get it burning super hot. Don’t get distracted.

Takeaways

- Finding and building the white hot center will be a growth bomb for you, doing a lot of the heavy lifting for you and driving all your metrics up.

- The White Hot Center isn’t product market fit or an ICP. It’s a way to think about your business as a network and unleash the energy of your most fervent customers to grow all aspects of your business.

- You can find the white hot center in your customer data. Search for positive irregularities in the data. Then you change the product and GTM to adjust to them.

- Enhance the network nature of your business using whatever tools you can, including comms tools like Discord.

- Your white hot center will likely be composed of people who were previously non-transactors.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.