A venture scale startup needs to be capable of addressing or creating a giant market. But hopeful TAM slides show a far-off future, not what you can do now. Trying to tackle that giant market on day one can be frustrating at best – a mistake at worst.

Large markets aren’t monoliths. Rather, they’re a network of niches. It’s essential to think about how to intelligently move through each of those niches en route to your larger target market.

Begin with a killer wedge: a product feature or corresponding (small) target market that allows you to rapidly sync with many customers and refine your product or process. The best are an ideal marriage of a captivating feature and a clearly defined market segment.

A wedge is not product-market fit, nor is it a comprehensive go-to-market strategy. Rather it’s a strategic choice that allows you to develop those things over time. Your killer wedge orients your company (either around a feature or market segment). It allows you to try things, knowing that the data you’re collecting is high quality and will inform your strategy later on.

(The opposite of orienting yourself around a killer wedge would be trying to be all things to all people, or trying to intake all types of feedback from a broad market – both unlikely to deliver actionable insights).

Finding a true killer wedge can catapult you to rapid scale and help you move laterally to the next, bigger opportunity. Conversely, being stuck in a low-velocity niche slows momentum and can feel like breaking rocks in the hot sun.

NFX has been studying killer wedges for years. While not exhaustive, here are 12 examples of killer wedges we have seen work well, and how to use them for your company.

(You can find a quick reference guide, including all wedges below. But to get the most out of this, it’s worth reading the full context for each wedge in this essay first).

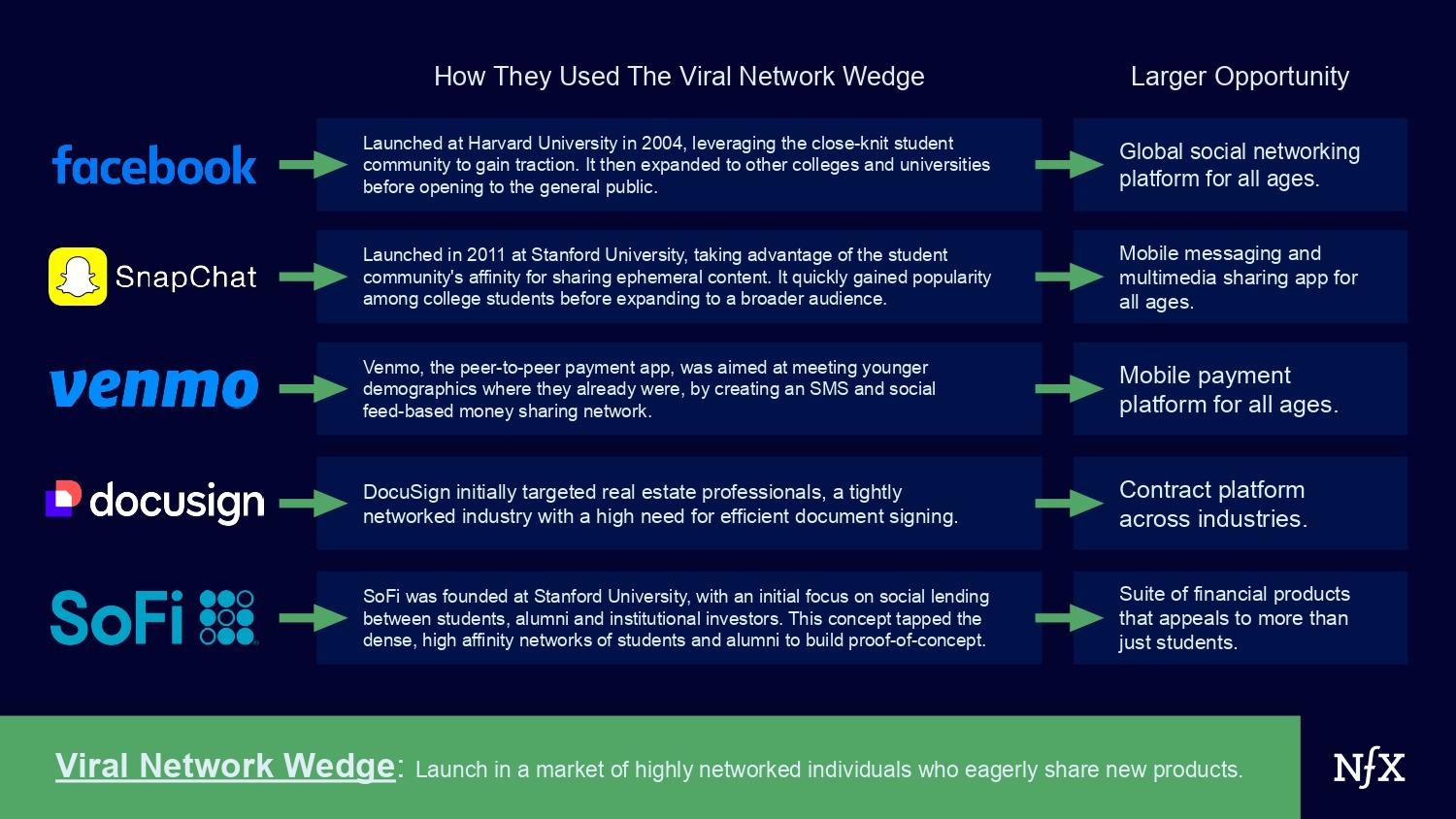

1. The Viral Network Wedge

The “viral network wedge” is a market full of tightly networked, high affinity individuals who are very likely to share new products with one another.

The classic example in the consumer space is the college campus. Students, while they don’t have much money, are willing to try new things. They also create extremely viral networks via close geographic proximity, constant social interactions, and high affinity with university-associated alumni – who may amplify these effects. These are dense networks, so products that take off among students often spread very quickly.

Many large markets have “viral entry points.” Some companies for example will target influencers on social networks that can adopt their products and then share these with their followers and other aspiring influencers (good examples of high-affinity groups).

Critically, viral effects are not network effects. You will have to build both long-term defensibility, and expand past this initial bubble. Many companies forget or are unable to leverage this momentum.

But they can be a perfect initial wedge for early consumer products. Iteration cycles are tight. You’ll instantly get a sense if your branding works or doesn’t work. If there are problems, you’ll spot them immediately.

The biggest advantage of using this approach is speed. Viral networks represent veins within a market where you will be able to move faster.

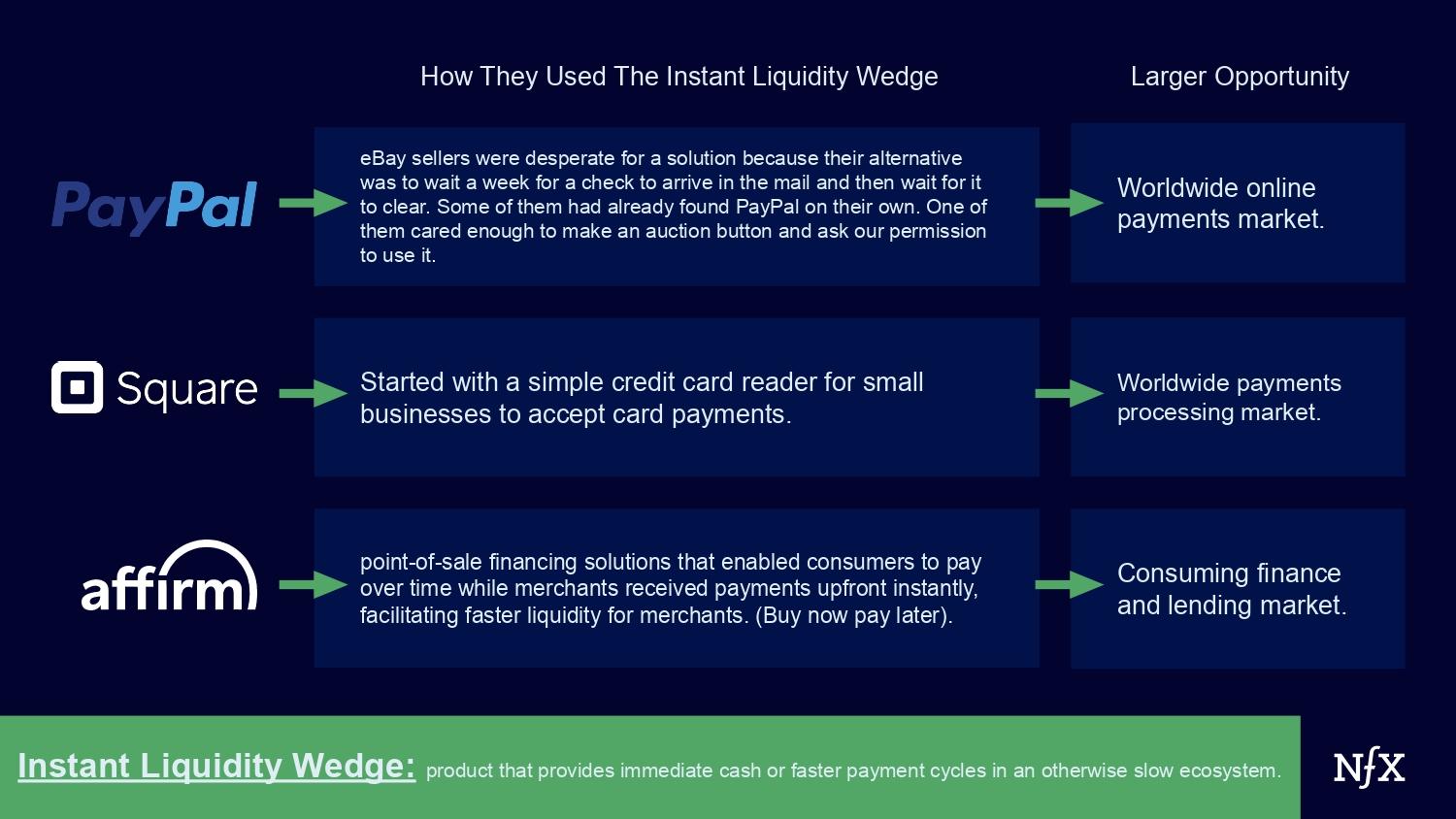

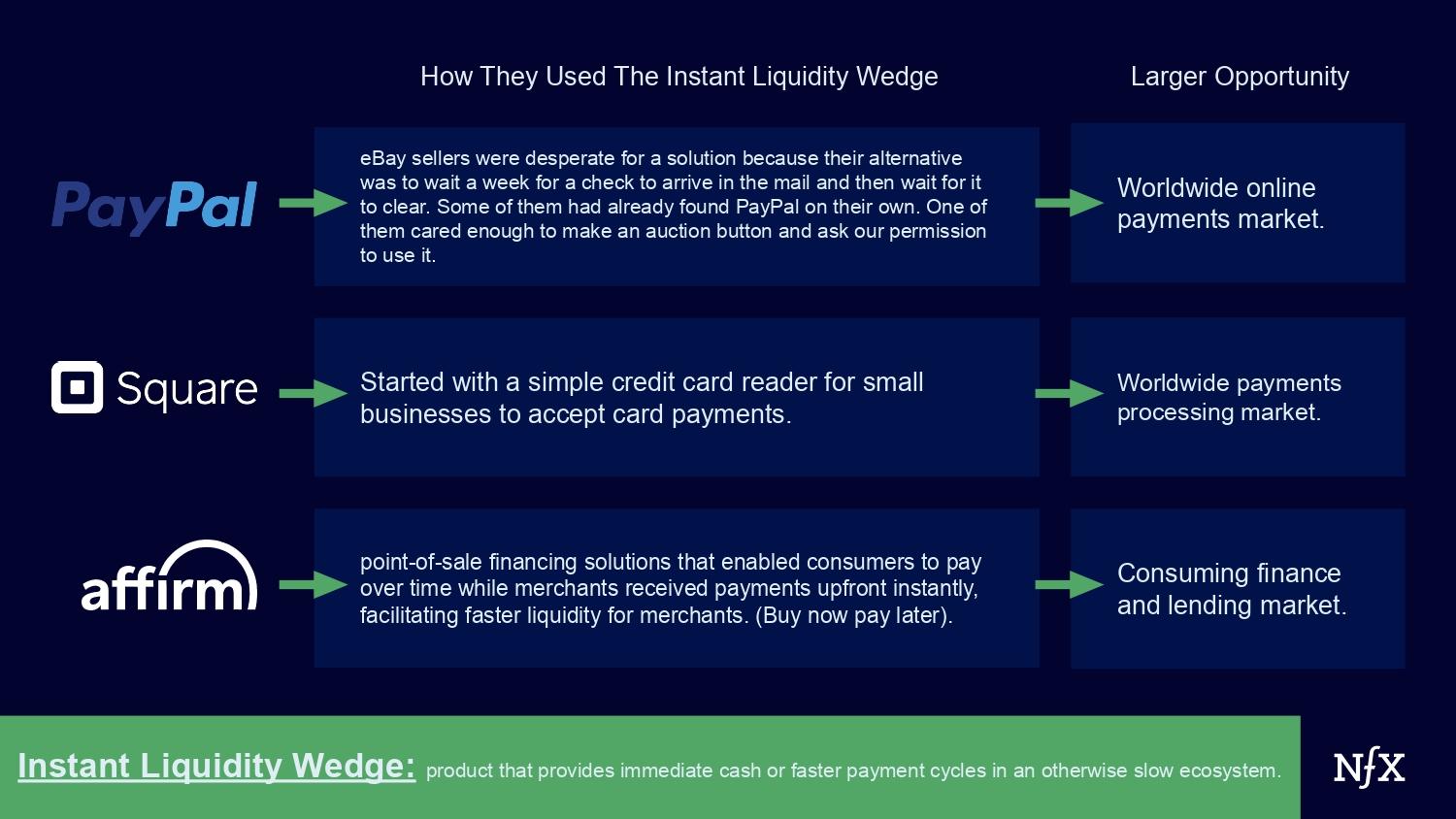

2. The Instant Liquidity Wedge

The “instant liquidity wedge” is a product that provides immediate cash or faster payment cycles in an otherwise slow ecosystem.

Many industries struggle with lengthy payment cycles. Businesses can be stuck waiting for invoices to be paid, creating cash flow gaps and hindering growth. Liquidity is a godsend for these companies. Look for areas of the market where there are initially long, costly, and complicated payment cycles and shorten them. Or find a way to advance future payments and close liquidity gaps.

For example, NFX portfolio company Arc has created a software hub for non-dilutive financing for startups. Arc is shortening the fundraising process for startups, and is using that as a wedge to provide more comprehensive banking service for startups. It began by solving the liquidity problem.

Lending money to people at reasonable rates has almost immediate product market fit, but also presents potentially enormous risk and cyclical challenges not to be underestimated. Remember, this is a wedge and not a long-term growth strategy.

If you can’t use this momentum to shift to a larger market, you will struggle to become a very large company.

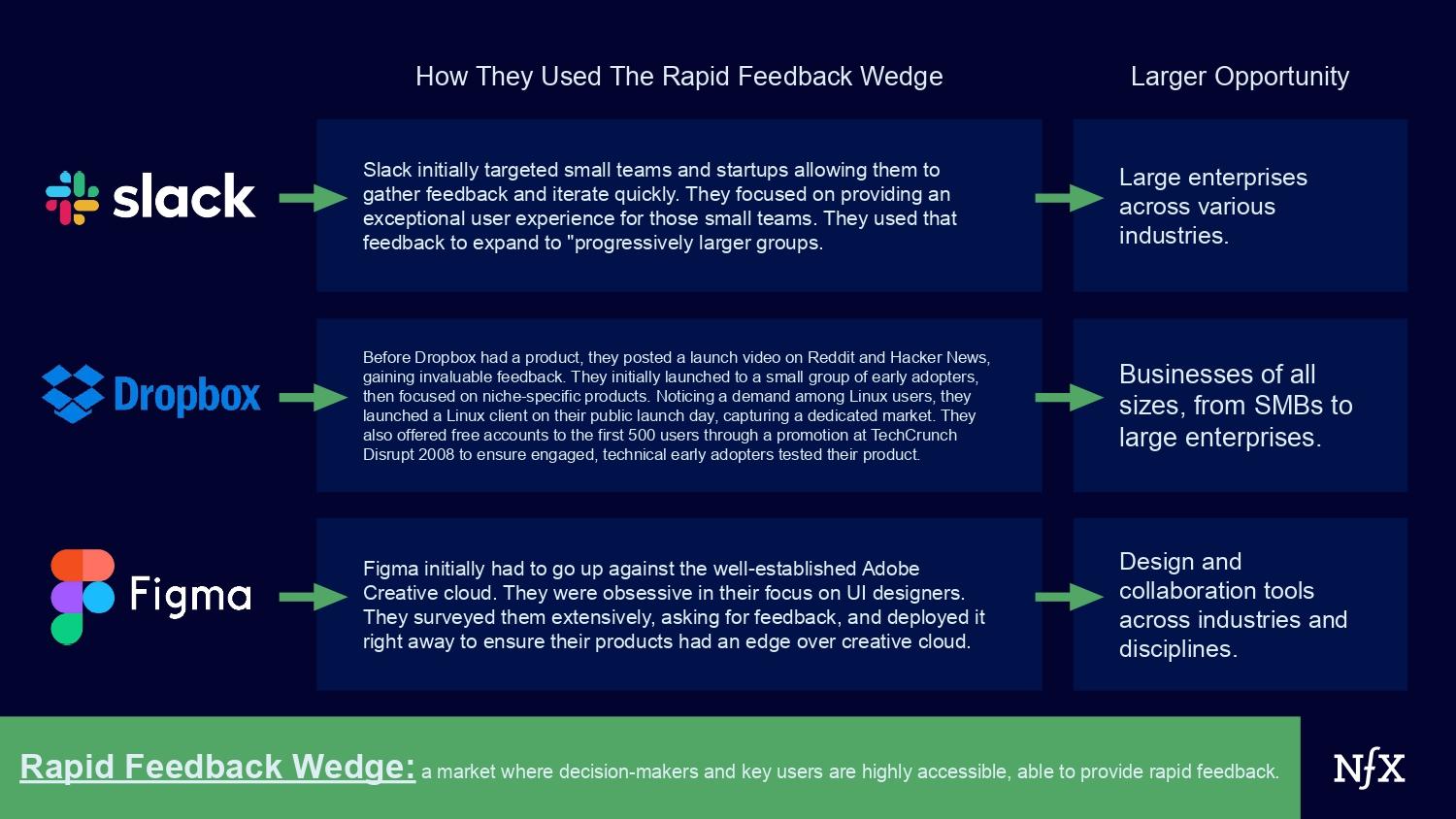

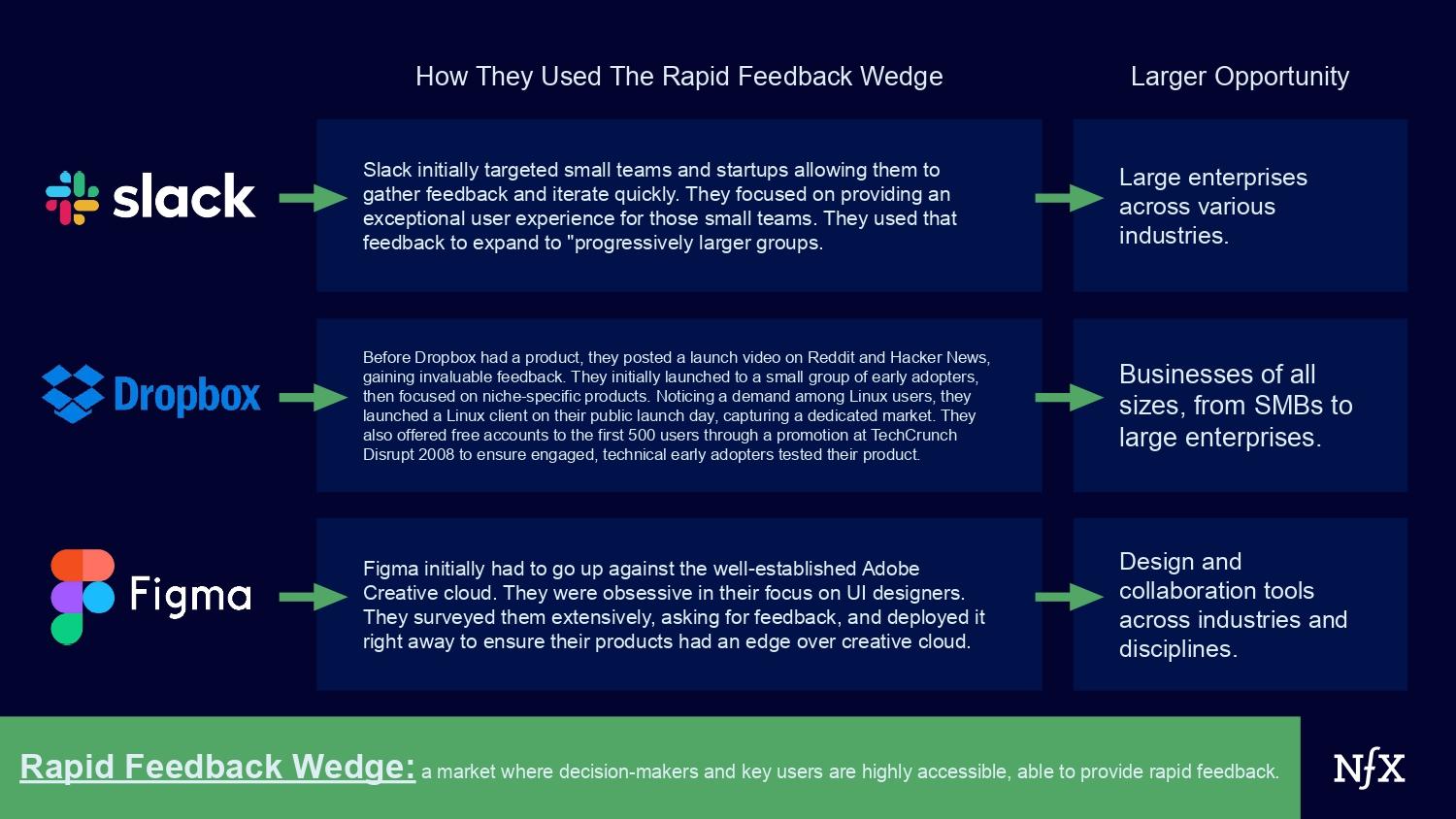

3. The Rapid Feedback Wedge

The “rapid feedback wedge” is a market where decision-makers and key users are highly accessible, and therefore able to provide rapid feedback.

The most classic example of this wedge is the B2B SaaS company that targets SMBs rather than large enterprises.

B2B SaaS companies often struggle to balance market size with agility. Large enterprises offer significant revenue potential, but lengthy sales cycles can hinder rapid iteration and product improvement.

The SMB is the perfect balance of size and speed. SMBs tend to have far more accessible decision makers compared to large enterprises, and often have less complex product needs. You can iterate on your sales and product, and see which approach works far quicker.

The key to maximizing this wedge is to prioritize rapid customer feedback. Interaction cycles must be constant. Or, if you’re deploying an AI-based strategy, this feedback should be constantly improving the output of your AI model.

We’ve seen NFX portfolio company EvenUp deploy this strategy well. EvenUp has started by targeting small and medium sized personal injury law firms. This allows them to perfect their demand letter technology. EvenUp is rapidly becoming the best in the game at automated demand-letter writing, and is simultaneously developing an expert level of knowledge in the medical law space.

Staying focused on SMBs can work for some startups, but typically you see companies evolve into serving larger customers where you have much more attractive CAC/LTV ratios due to lower churn rates and higher ACVs as the product matures.

But only rapid feedback will allow you to gain the knowledge needed to reach these larger targets.

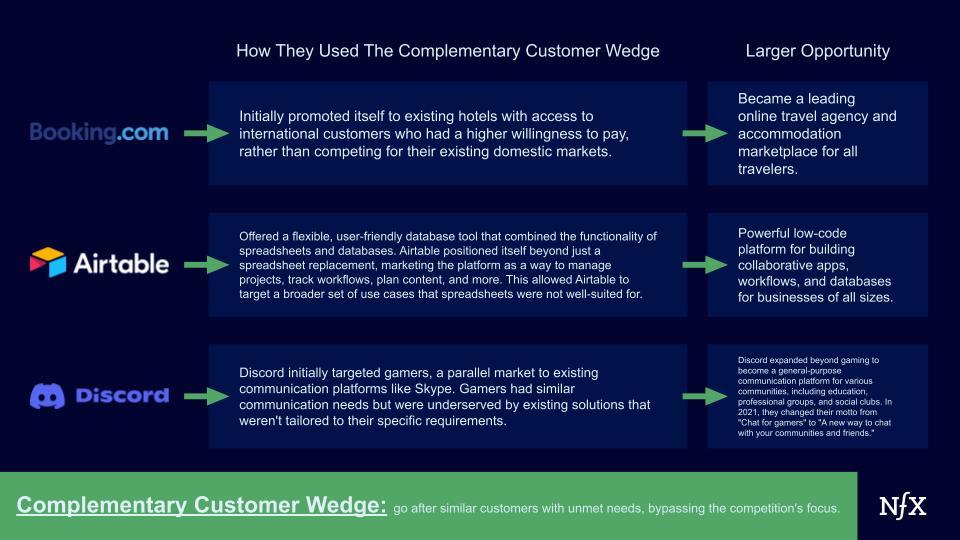

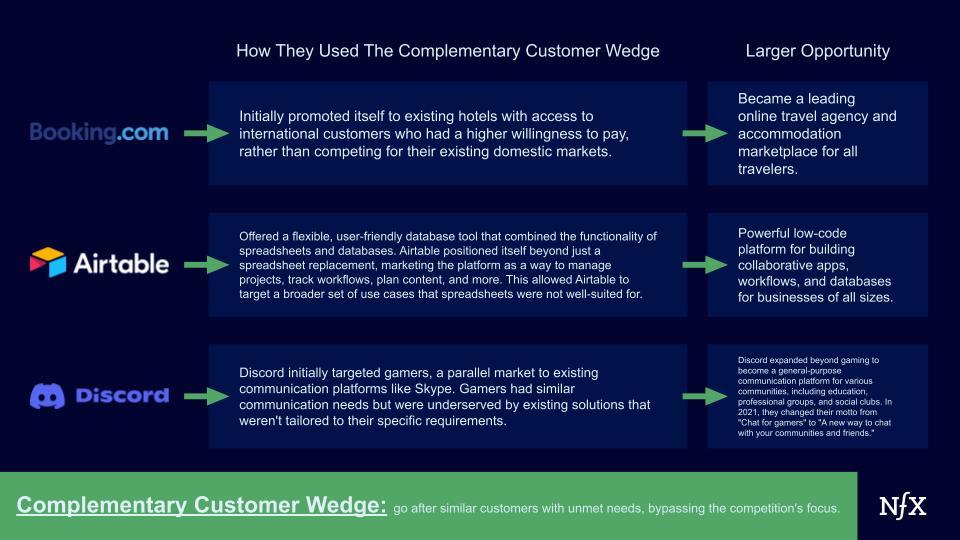

4. The Complementary Customer Wedge

The “complementary customer wedge” requires targeting a parallel market to an existing incumbent or established competition. These customers have the same needs, attributes or style of behaviors as your ultimate target, but are not directly serviced by the existing ecosystem.

For example, imagine you’re a startup developing software for managing vacation rentals. You could begin by trying to integrate yourself with AirBnB or other homeowners. Or, you could target a market with similar attributes (managing many homes, similar booking issues, etc) without major incumbents: like campgrounds or RVs. You can expand into other segments later.

This is a wedge that works especially well in crowded marketplaces as well. Especially if you are initially struggling to win over the supply side.

This wedge was used while building booking.com. Initially, hotels were concerned about cannibalizing their own business. Booking.com used a simple pitch: we can give you access to international customers who have a higher willingness to pay that you don’t currently serve.

By focusing on a specific value proposition for the supply side (accessing new, international customers), booking.com was able to gain a strong foothold. This initial win facilitated faster growth.

Begin by finding a new, non-competitive customer base and offering that to potential supply-side customers. This could be a new geographical market, a different demographic, or a specific customer need not currently met. Use that group to fortify yourself and grow from there.

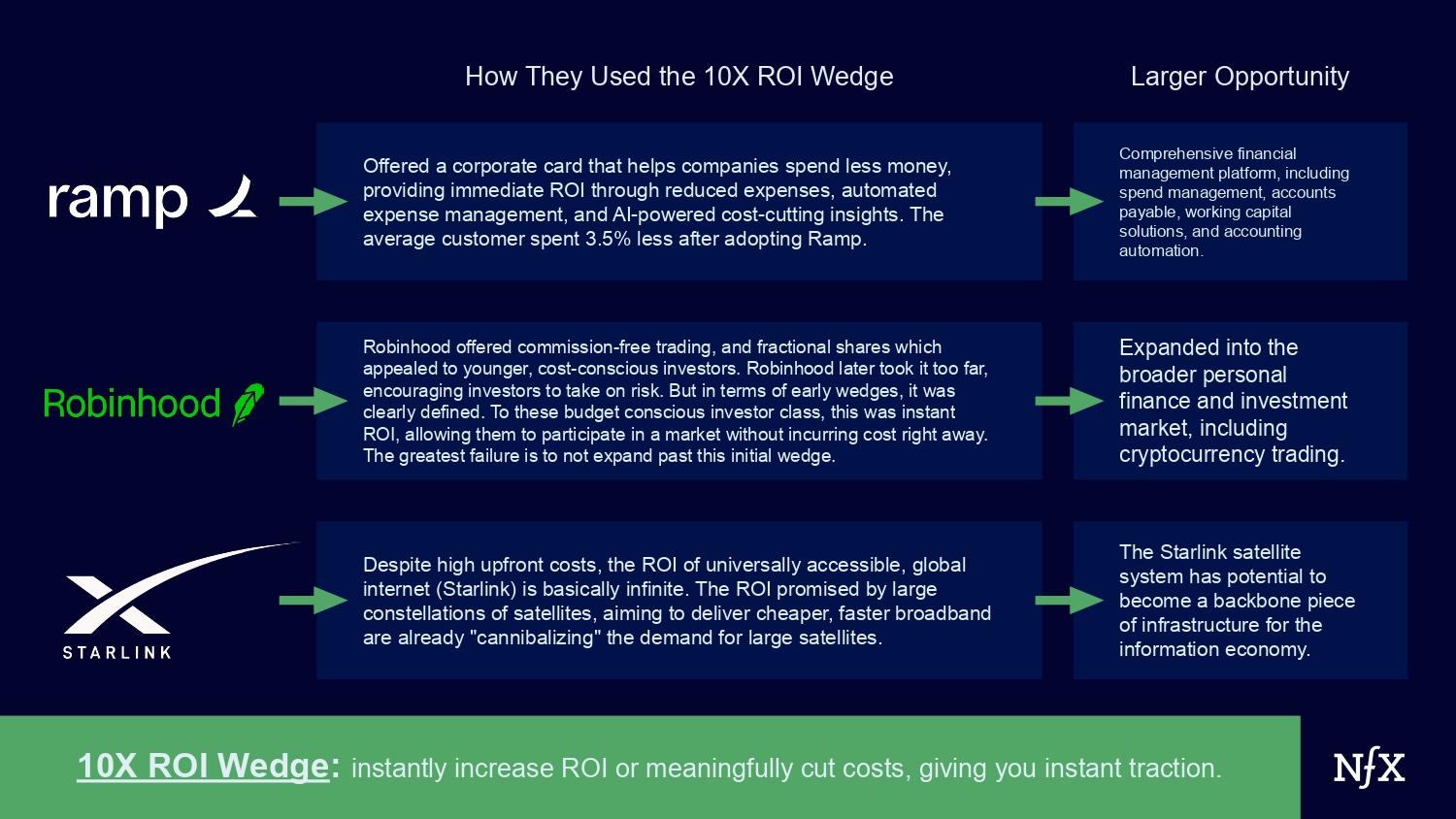

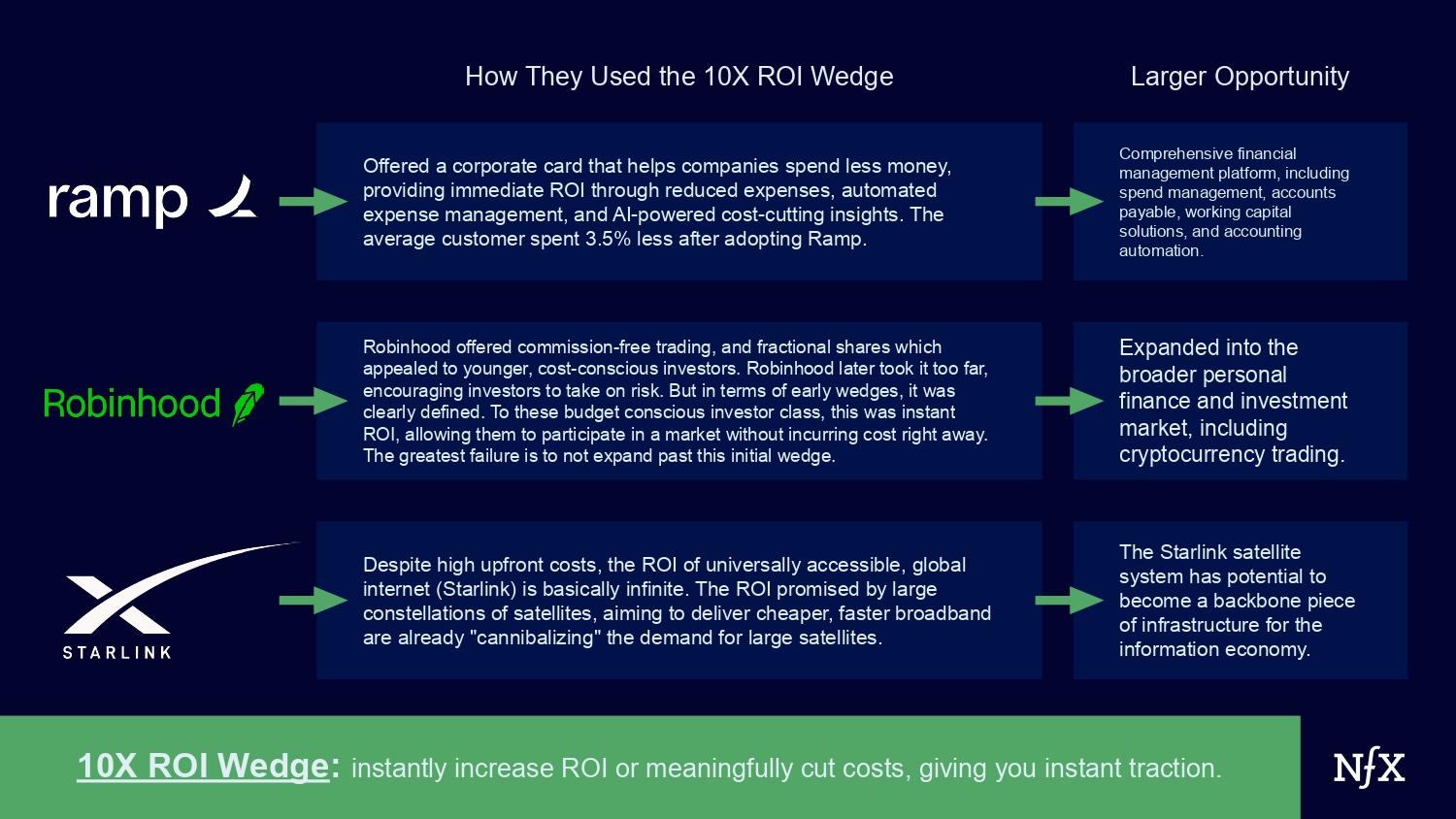

5. The 10x ROI Wedge

The “10X ROI wedge” works if you can instantly increase ROI or meaningfully cut costs. That’s going to give you instant traction.

Many companies make this claim. Few are able to deliver. But those that do, grow fast.

The emerging category of AI colleagues is using this strategy to gain significant ground. This cadre of companies are fusing software and labor, allowing enterprises to reduce spending on tasks that might otherwise be outsourced to a BPO or a freelancer, and increase output at the same time.

This is a strong strategy in the short term. However, as with many killer wedge strategies, it’s not a long-term plan for defensibility.

Especially in the fast-moving generative AI space, we find that this strategy is an effective wedge, not a means of differentiation (everyone in the AI field tends to make this promise). However, there are other industries that are slower moving (e.g. govtech or healthcare). In these cases, generating instant ROI can still feel like magic to a customer.

NFX portfolio company OpMed has used this strategy effectively in the healthcare space. OpMed is creating an AI services platform to streamline the operations of an operating room. The operations arm of the operating room is still largely analog and plagued with inefficiencies. 30-40 percent of operating expenses are generated in ORs, and just one minute of downtime can cost a hospital $50-$150.

OpMed can reduce these costs instantly. Which has translated to a product that sells itself. In just 1.5 years, they’re now in 640 ORs, in 66 hospitals in the US and Israel.

This dynamic exists in many industries, and can become an excellent foothold. But be wary of industries where there are many similar companies making this promise.

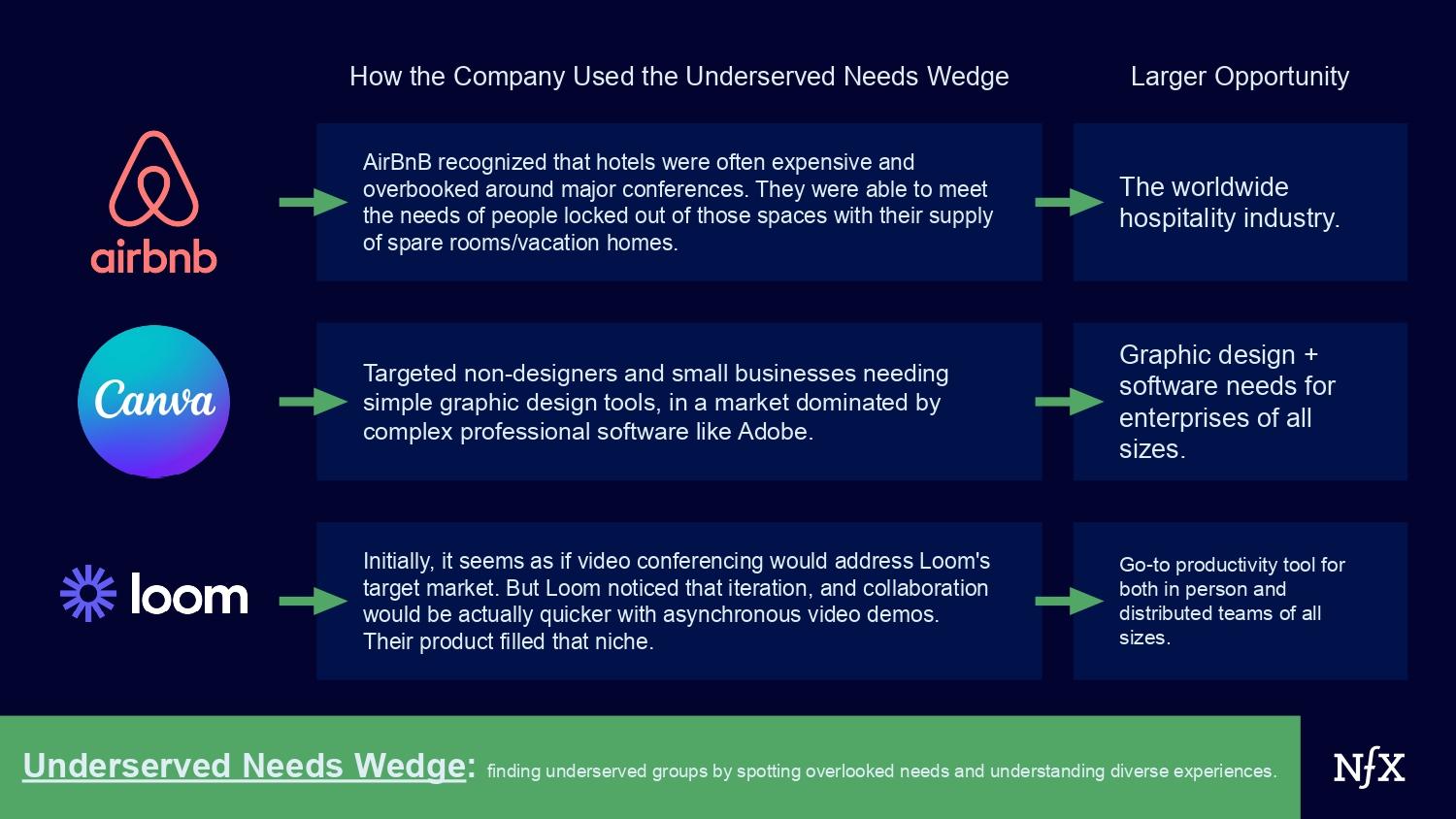

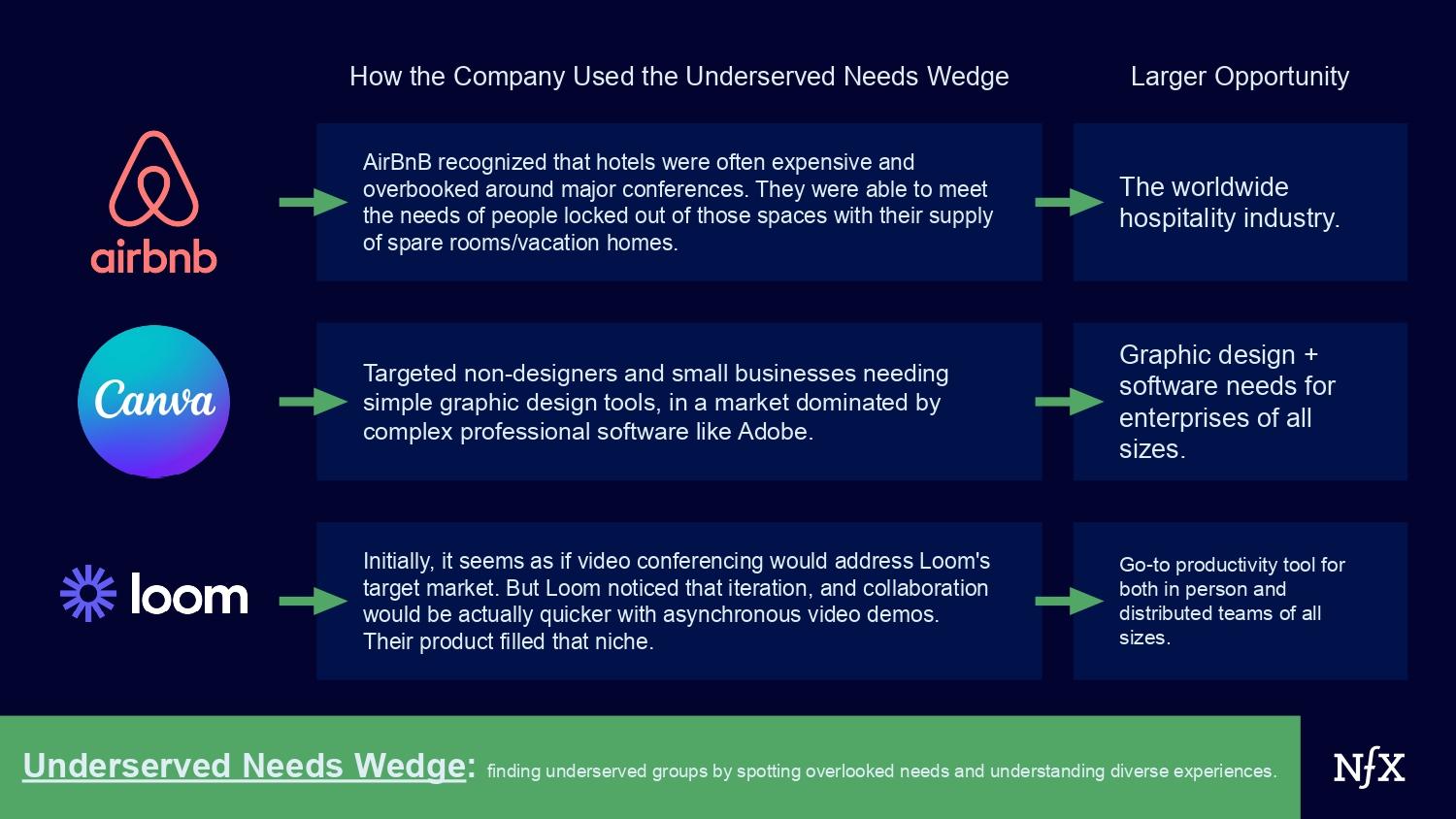

6. The Underserved Needs Wedge

Even in a large market, you will always be able to find a group that’s severely underserved by existing offerings. To find these underserved pockets, you have to read between the lines, and become attuned to the diversity of experiences in even highly saturated markets.

You could see the rise of AirBnB through this lens. Why would anyone prefer an AirBnB to a hotel? It turns out that hotel competition, prices soar during larger events. It leaves many ideal “hotel users” underserved.

Most hotels largely cater to business travelers, or tourists. AirBnB, instead, initially targeted another segment of the travel market: budget conscious travelers who were locked out of hotels during busy conferences.

By targeting periods of high demand (i.e. there are lots of people scrambling to find somewhere to stay), AirBnB acclimatized its customer base to a radical idea: staying in a stranger’s home. It also allowed them to make their product safer, easier, and ready for expansion during periods of lower demand.

NFX Portfolio company A.Team also had this vision when they saw that, despite large freelance marketplaces like Fiverr and Upwork, there were no freelance platforms for hiring teams of highly skilled individuals. Great teams of workers weren’t served by existing incumbents.

This process requires focusing on details. It’s about going beyond how an experience appears to be (everything seems simple, fast and easy at first), and noticing how that experience actually feels to most people. That’s where you’ll find the gaps.

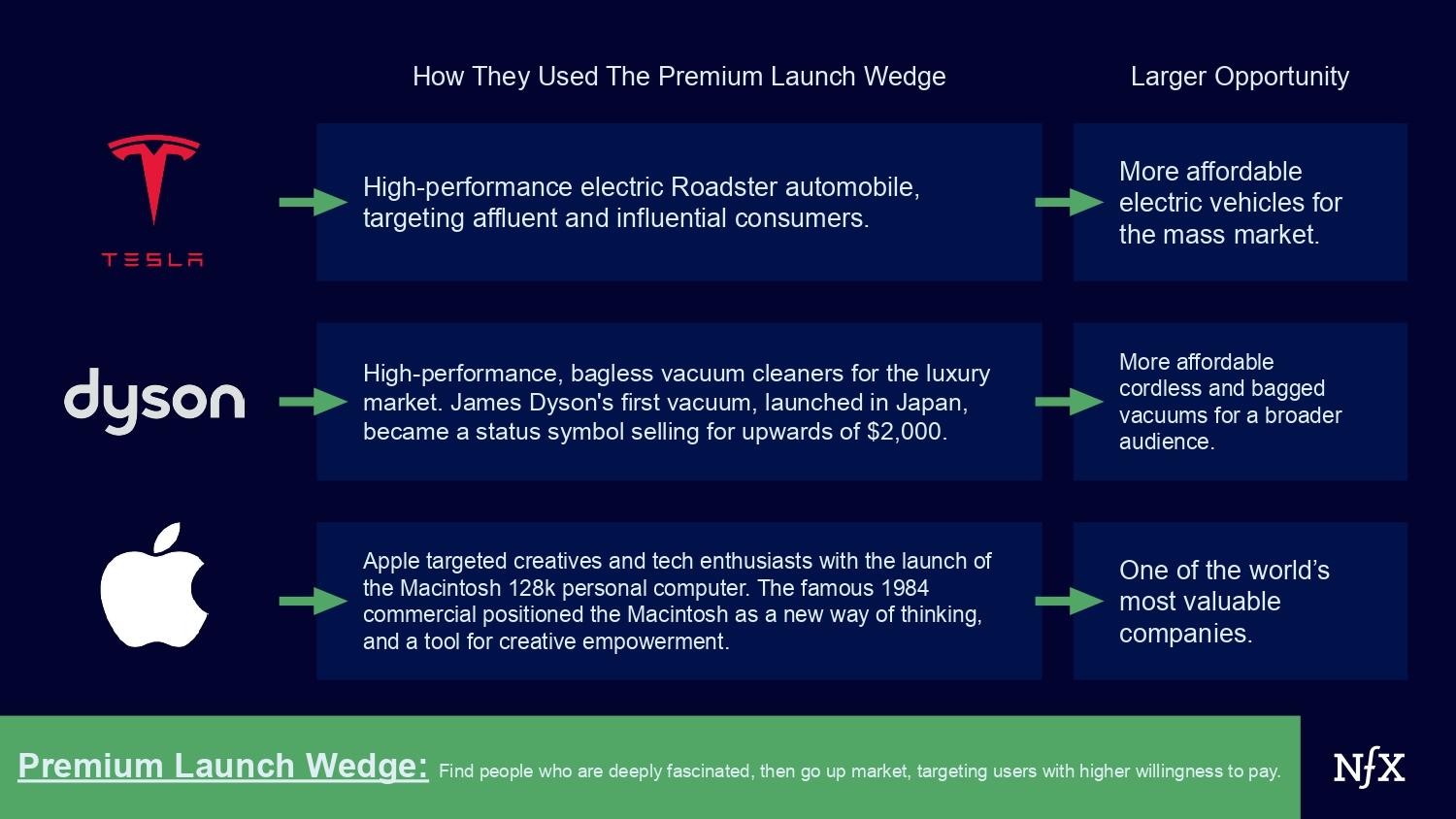

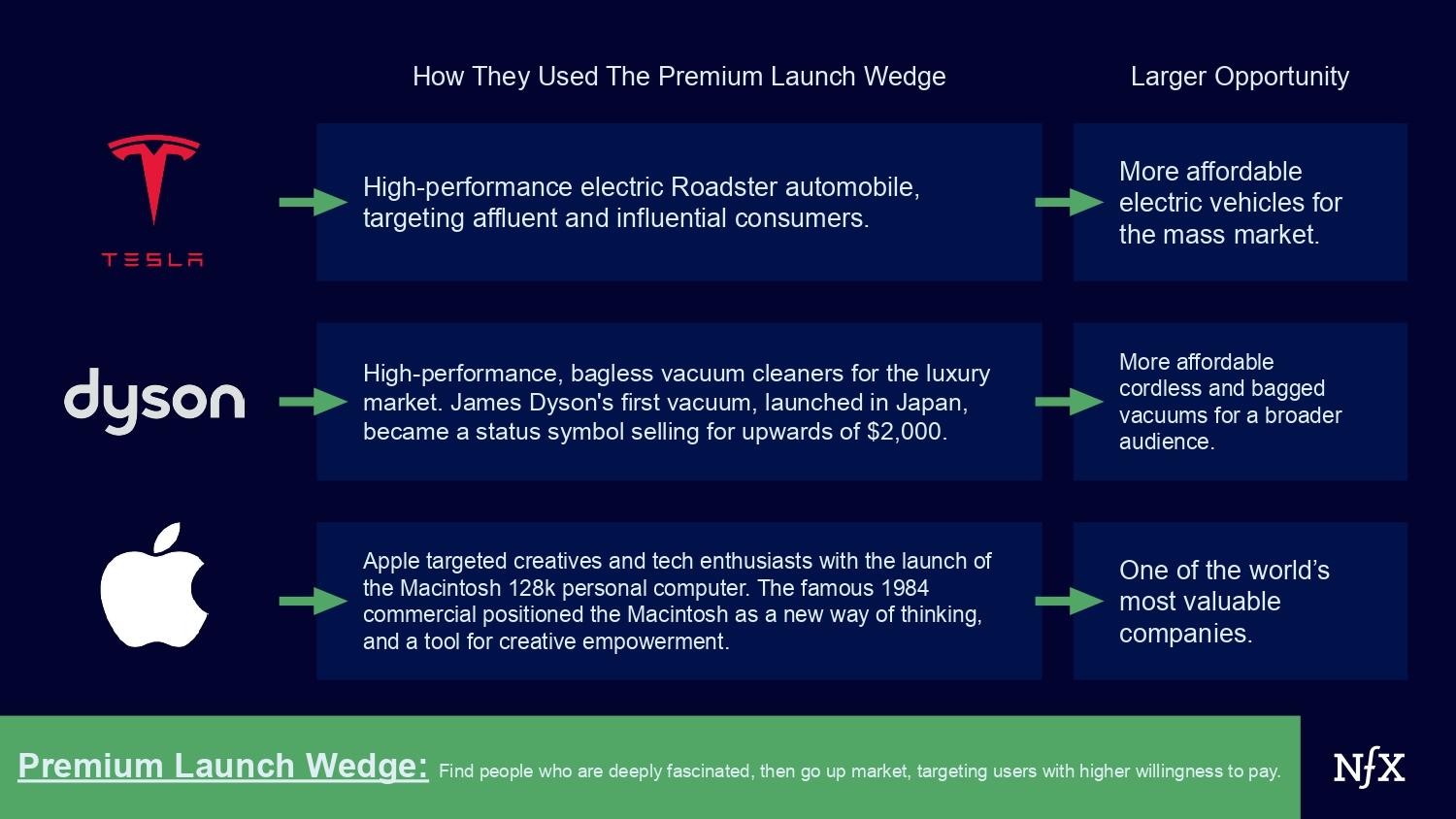

7. The Premium Launch Wedge

The “premium launch wedge” begins by finding a small segment of people who are fascinated by something. So fascinated that they exhibit a high willingness to pay for a premium service right off the bat.

They may be hobbyists, superusers, or unique cases. Either way, they are the perfect launch pad.

You can use these segments to hone your scale and efficiency, allowing you to eventually target the larger market share where there may be lower willingness to pay.

This was the methodology that began with the Tesla Roadster. Tesla was able to target affluent buyers with an interest in electric vehicles. They went upmarket compared to competitor electric cars, and have used that time to refine their manufacturing process aiming for peak efficiency over time.

(This is all articulated in the master plan, part deux, and though it’s been delayed, is still a solid strategy).

This wedge is useful because it allows you to build in an area of reduced competitive pressure – there are likely to be few people creating expensive items for a small market. A high-end launch may provide more up-front revenue for you to build scale capacity, and you will learn the necessary operational procedures needed to serve the larger market.

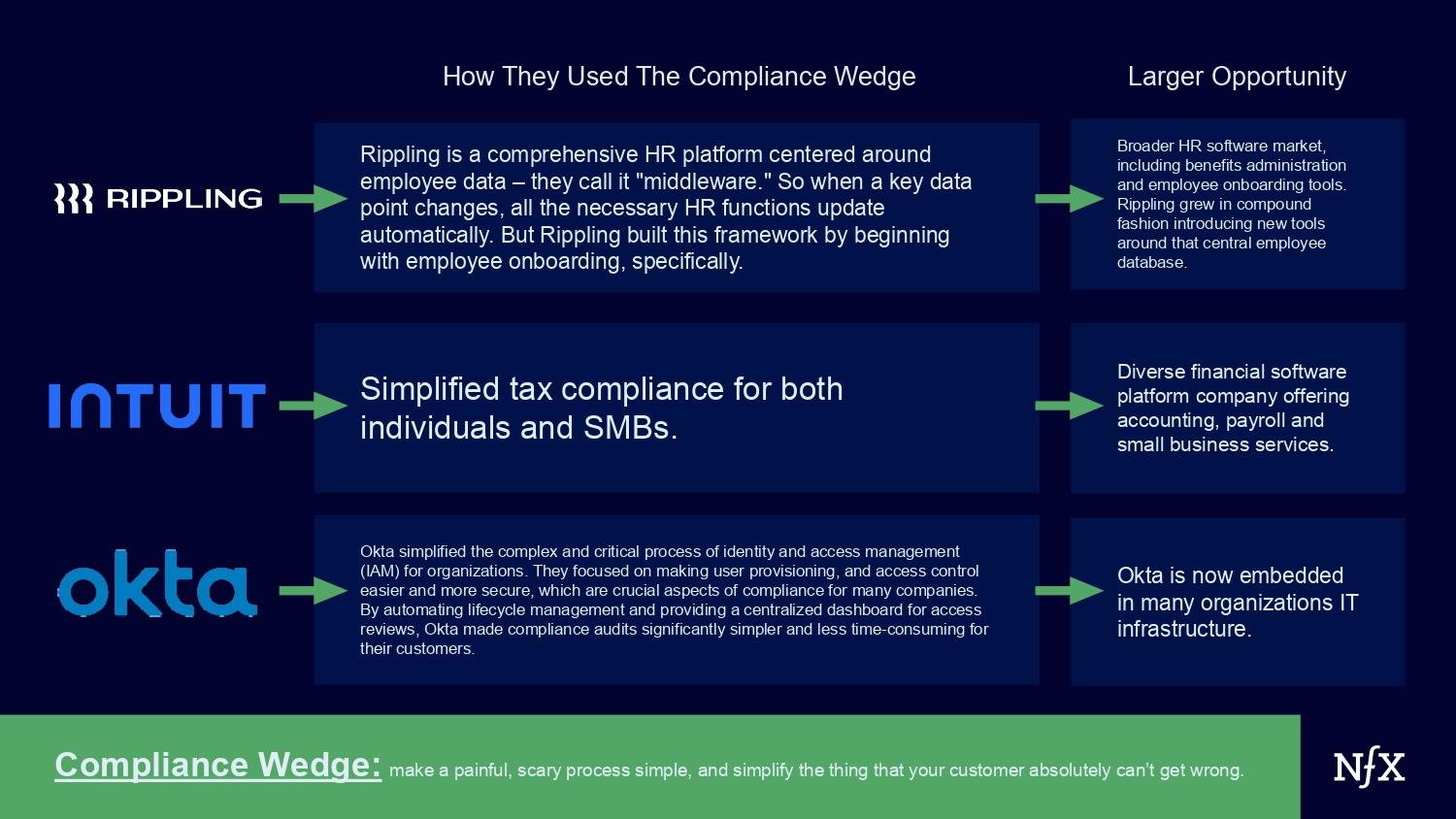

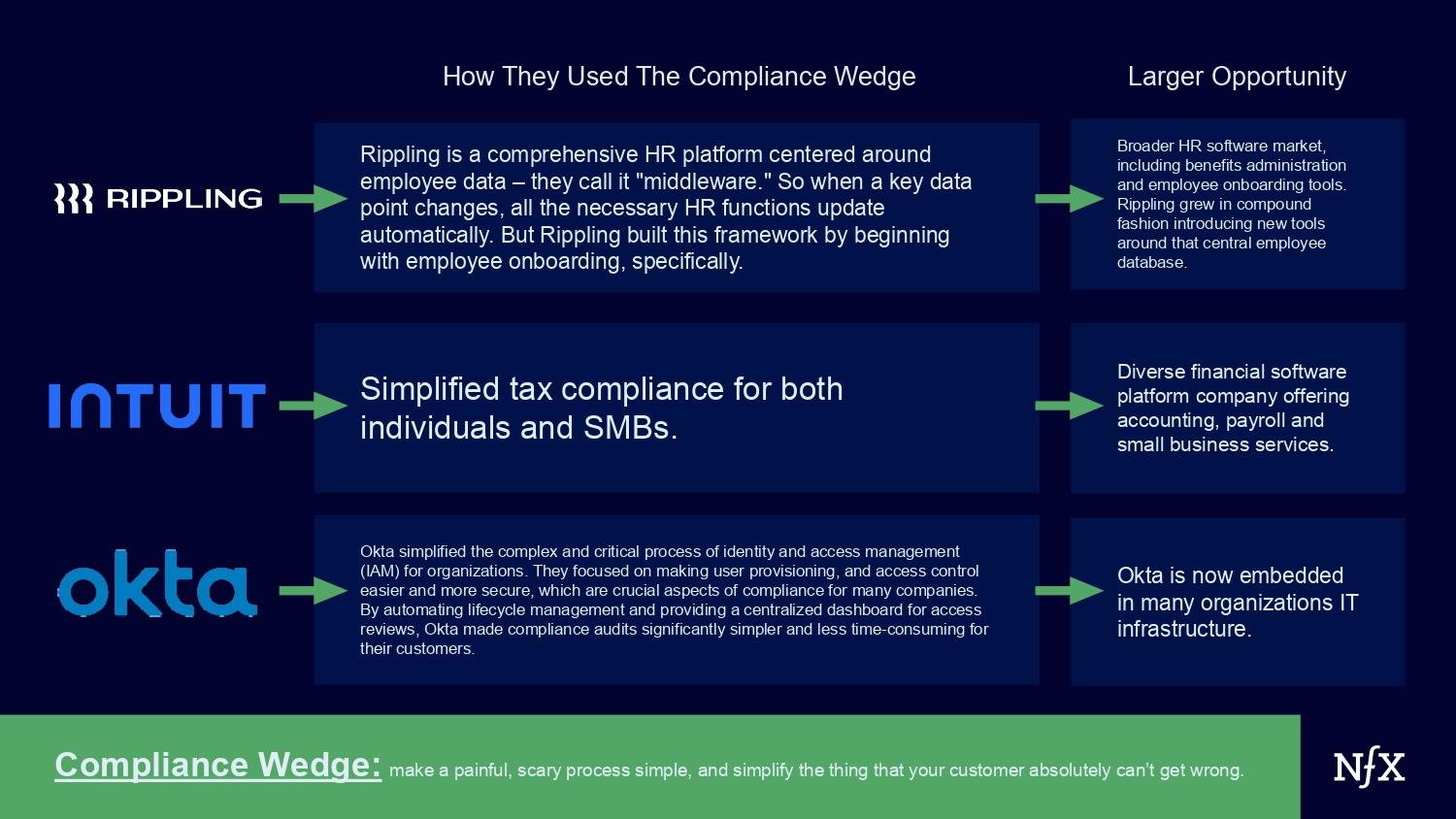

8. The Compliance Wedge

The “compliance wedge” is a simple tool for many SaaS builders: begin by simplifying the thing that your customer absolutely cannot afford to get wrong. Make a painful, scary process simple, and you’ll have a very loyal customer. (Fear is one of the greatest motivators in human psychology.)

Areas like compliance, taxes, legal, or security can often be good wedges for companies looking to gain foothold in B2B SaaS markets. These are areas with complex regulations, where the costs of getting things wrong, if not dire, are frustrating.

This is an on-ramp into many enterprises for two reasons: First, businesses readily adopt solutions that alleviate their anxieties and mitigate potential disasters. Second, they may be more willing to pay a premium for solutions that directly address their critical pain points.

NFX portfolio company Seso has executed this well. Seso simplifies the H2-A visa process for agricultural workers – a highly complex, analog field that is littered with lawsuits if things go awry. By managing this process securely and transparently, Seso isn’t just selling software; they’re selling security.

That said, the real power of this wedge is to move beyond the initial fear to provide real utility. You might leverage customer data to identify emerging regulatory trends, and create products around those learnings. Or, move into adjacent areas like payroll that offer higher ability to monetize and larger market opportunities.

Fear is a good motivator, but it’s up to you to build upon it.

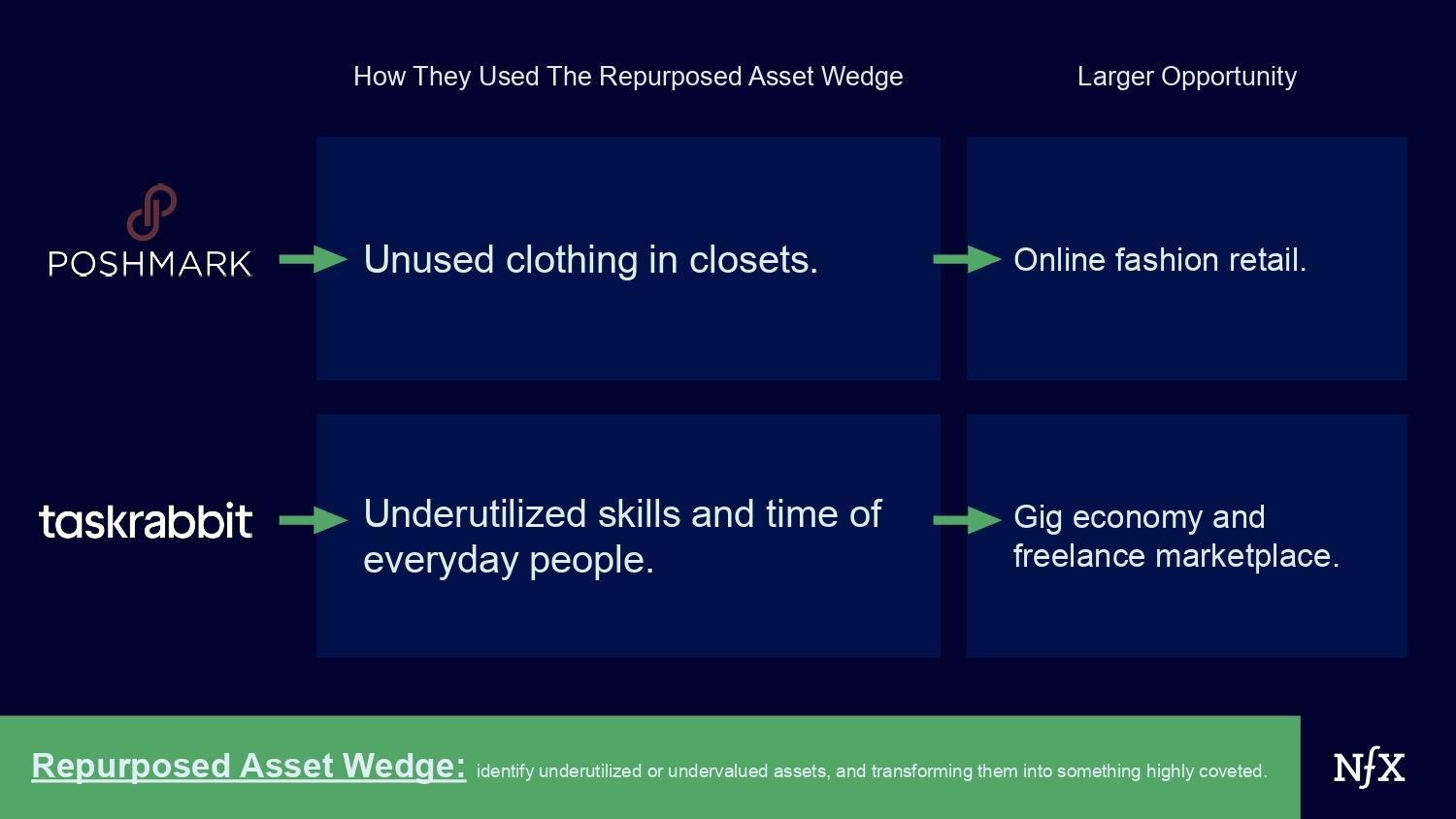

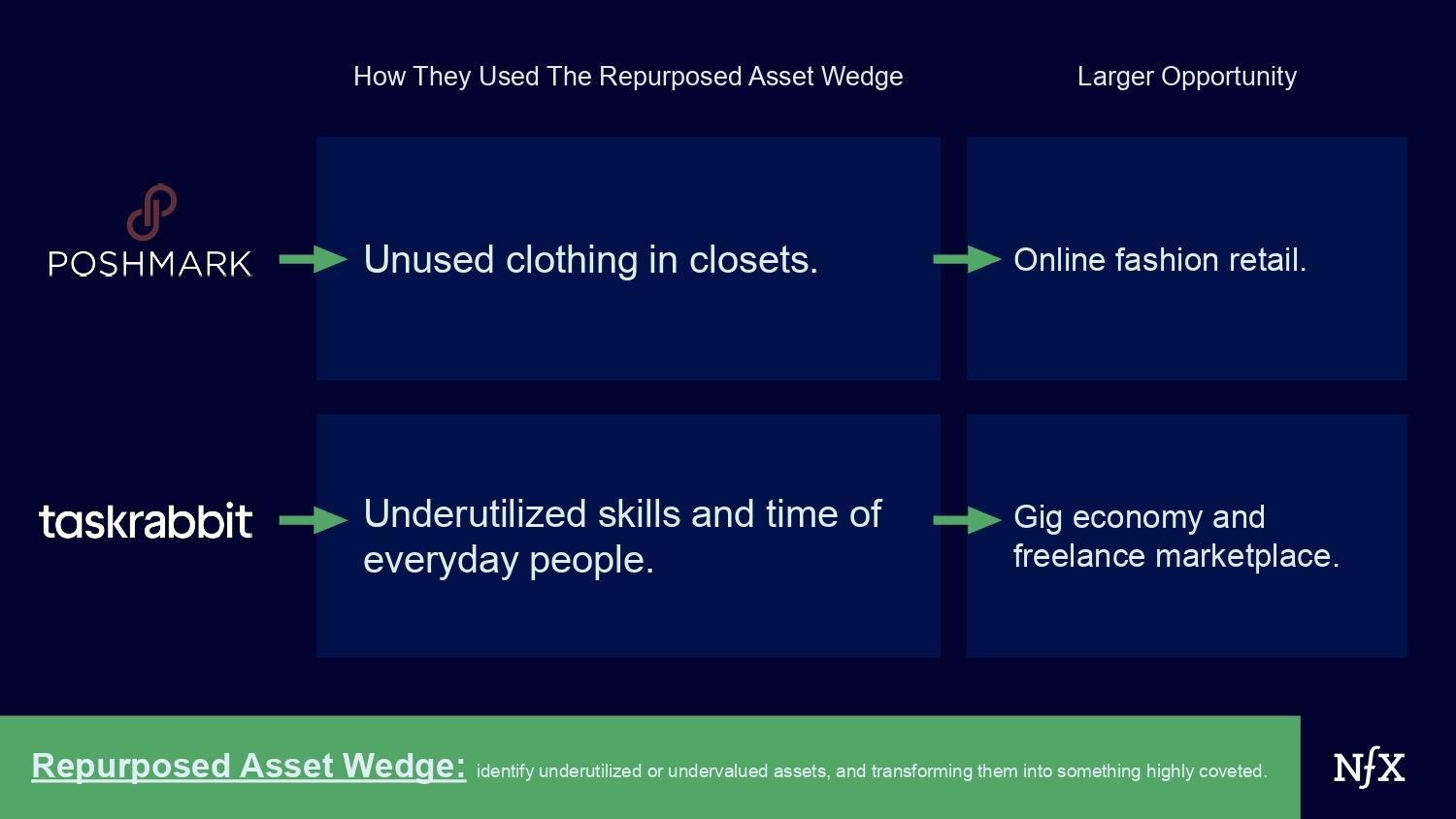

9. The Repurposed Asset Wedge

This wedge focuses on identifying underutilized or undervalued assets, and transforming them into something highly coveted.

Many markets contain assets that are either underutilized or undervalued. Even saturated ones.

This was the approach utilized by both Poshmark. Poshmark transformed unused clothing into a valuable asset (a means for making money). And, these assets don’t need to be physical. TaskRabbit, for example, allowed for people to turn basic handyman skills or even extra free time and patience into a source of revenue.

There are two steps to this strategy:

First, identify an underutilized or undervalued asset: whether that’s an item, overbuilt capacity, underemployed workers. Look for surplus that is often left to rot.

Second, reposition that asset into something that is already valuable: a side hustle, extra space in a kitchen or hotel, etc. That’s how you use this wedge to eventually enter the larger, more competitive market.

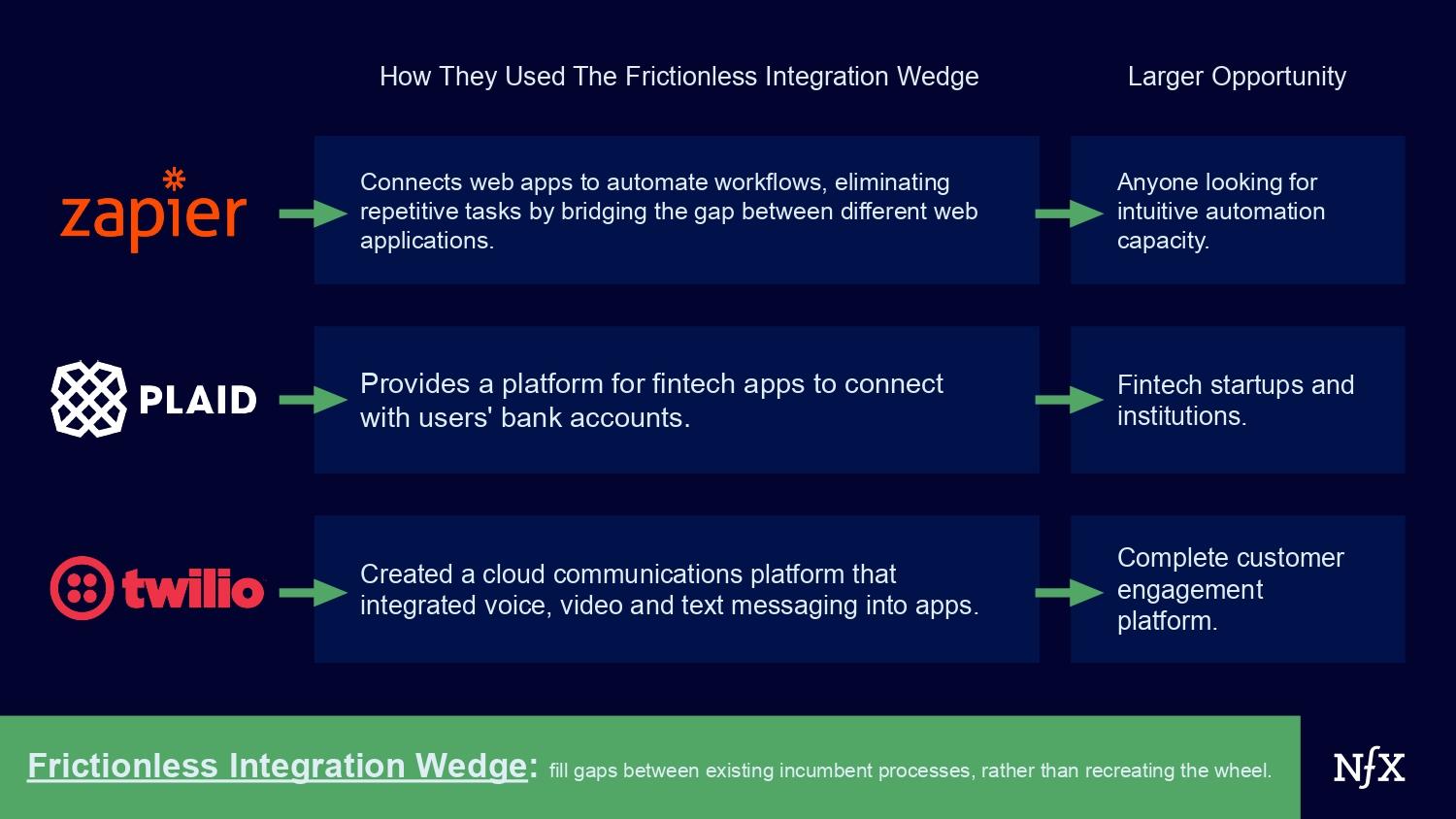

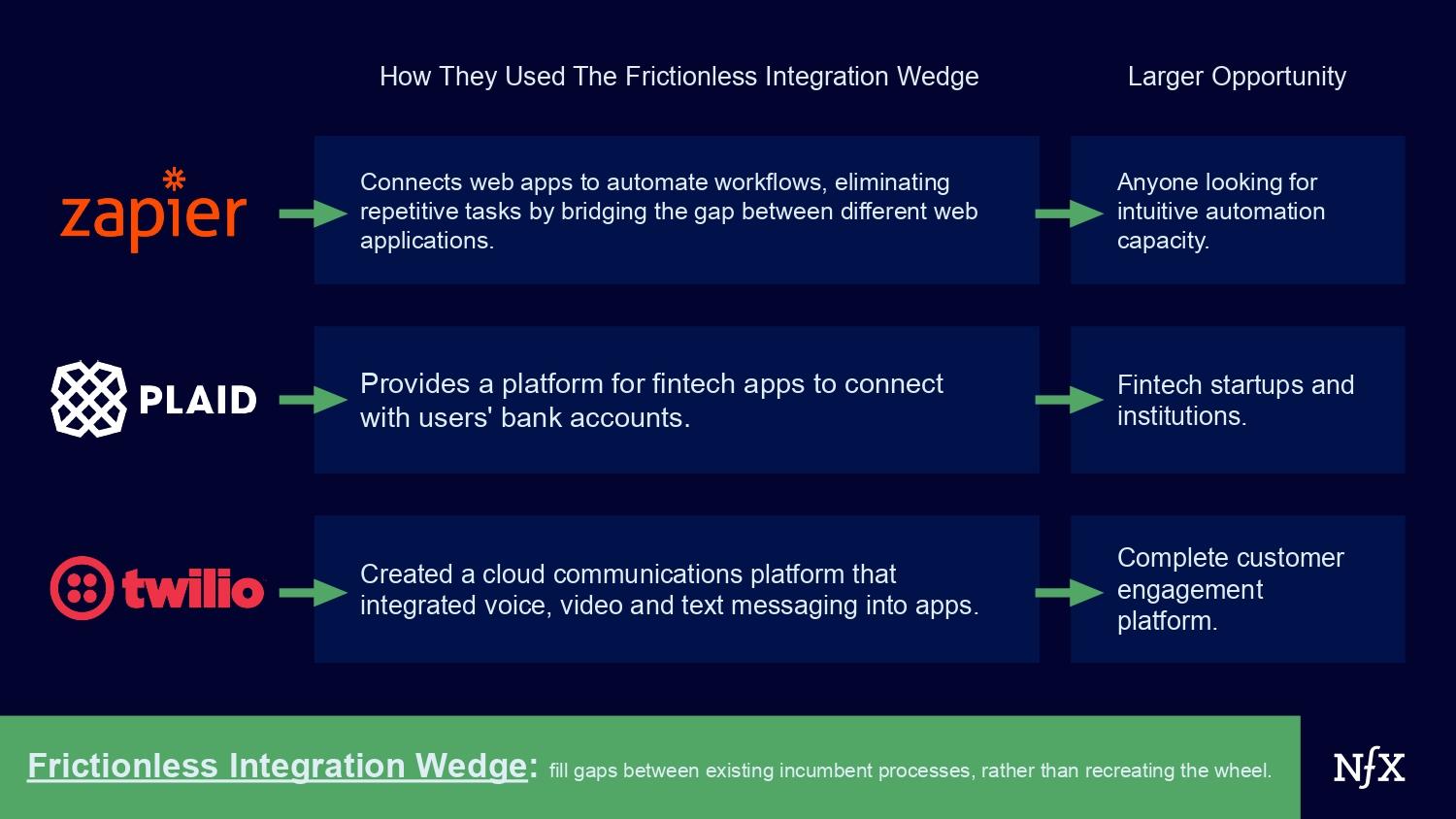

10. The Frictionless Integration Wedge

This wedge is a product that aims to fill gaps between existing incumbent processes, rather than recreating the wheel. By filling gaps between platforms, you can gain market share, and set the stage for building your own tools over time.

We see a lot of potential in markets that have a high degree of fragmentation or manual processes (AI leapfrogging). An especially smart way to enter these markets is to become the glue between these fragmented platforms.

TripIt, for example, has found a foothold in the extremely competitive travel booking market by acting as an intermediary. TripIt automatically gathers travel confirmation emails, eliminating manual data entry for users. All trip details – flights, hotels, car rentals, etc. – are consolidated into a single, easily accessible itinerary. Then, TripIt offers valuable additions like real-time flight status updates, maps, and the ability to share itineraries with others.

Interestingly, all of this functionality is built on-top of an email platform. TripIt automatically generates these itineraries when it detects confirmation emails in a user’s inbox.

In this case, TripIt is not directly competing with any of the services needed to book a trip. Rather, it’s integrating seamlessly with many of them.

In the future, TripIt will be able to build a variety of products based on the data gleaned via that process. But this aggregation is a powerful initial wedge into this competitive market.

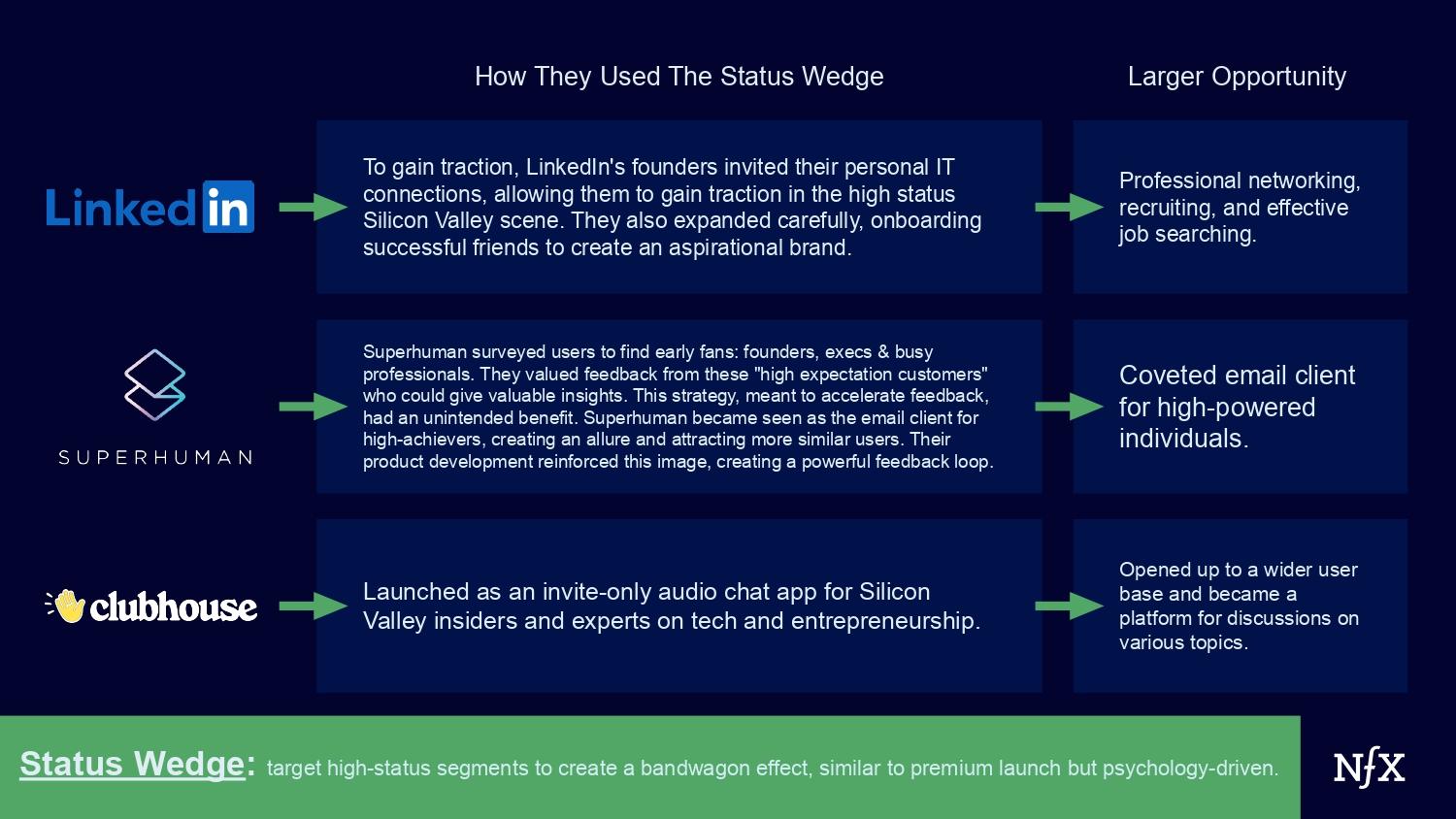

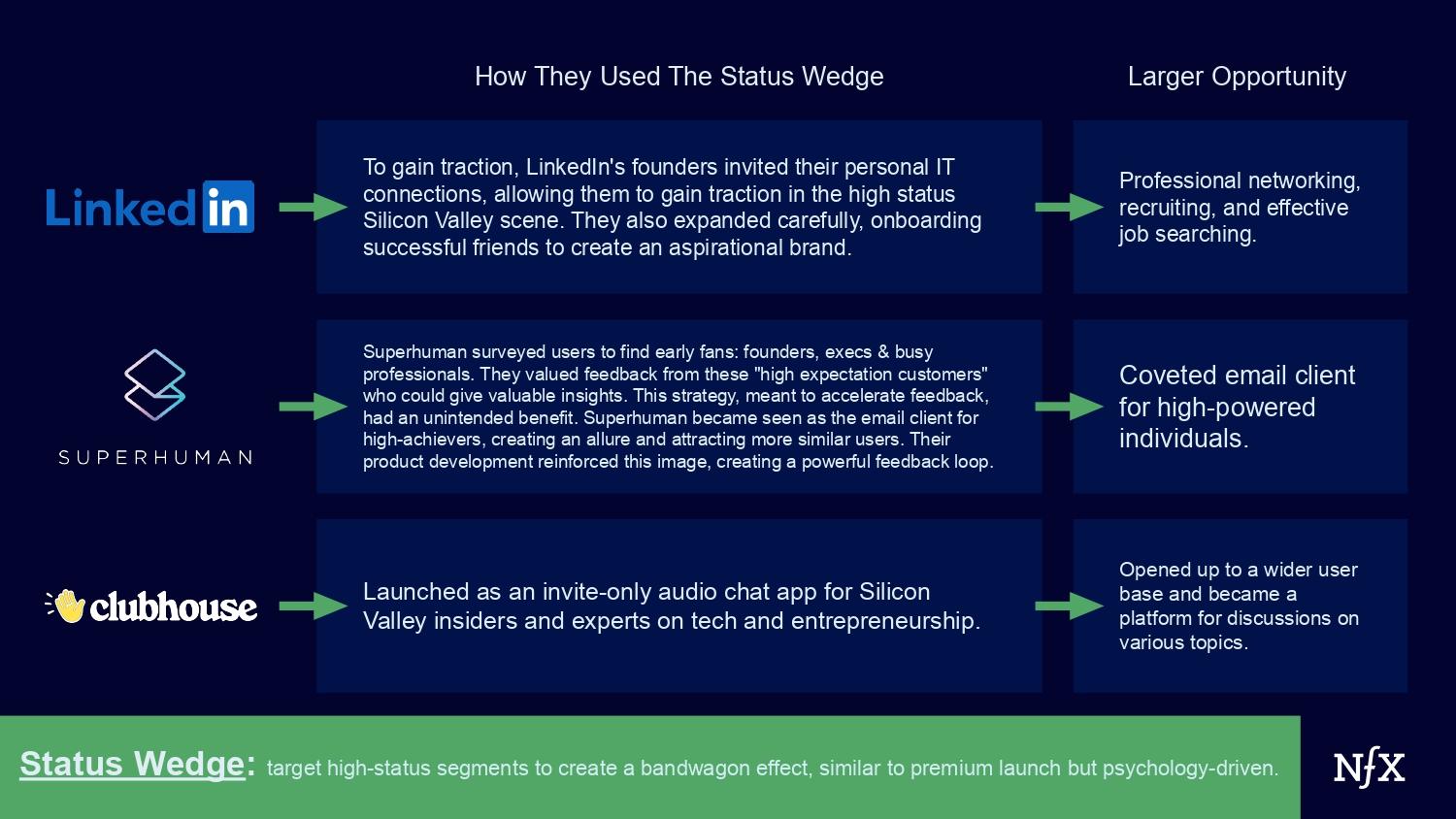

11. The Status Wedge

This wedge is similar to the premium launch wedge, but with a more psychological tilt. Rather than targeting segments with high willingness to pay alone, target a market segment with high social status, and build a bandwagon effect from there.

Recall that status is measured in many ways depending on the network you’re operating in. It might be in followers, or wealth, or sales targets hit. The goal here is to launch your product among groups of highly discerning and visible segments.

If you can use this wedge effectively, it often works as a double litmus test. First, if you are able to provide a uniquely valuable service to high status customers, that says a lot about your ability to adapt, intake feedback, and improve. High status customers are connoisseurs with deep market knowledge: they live and breathe this, and if you can appeal to them, you’re likely on the right track.

Second, this can create an allure around your product that no type of marketing will achieve. The allure and prestige of catering to a high status group is a powerful draw.

It is often easier to move from upmarket to mass market, rather than the other way around. If you can tap into the upmarket segment early, do so.

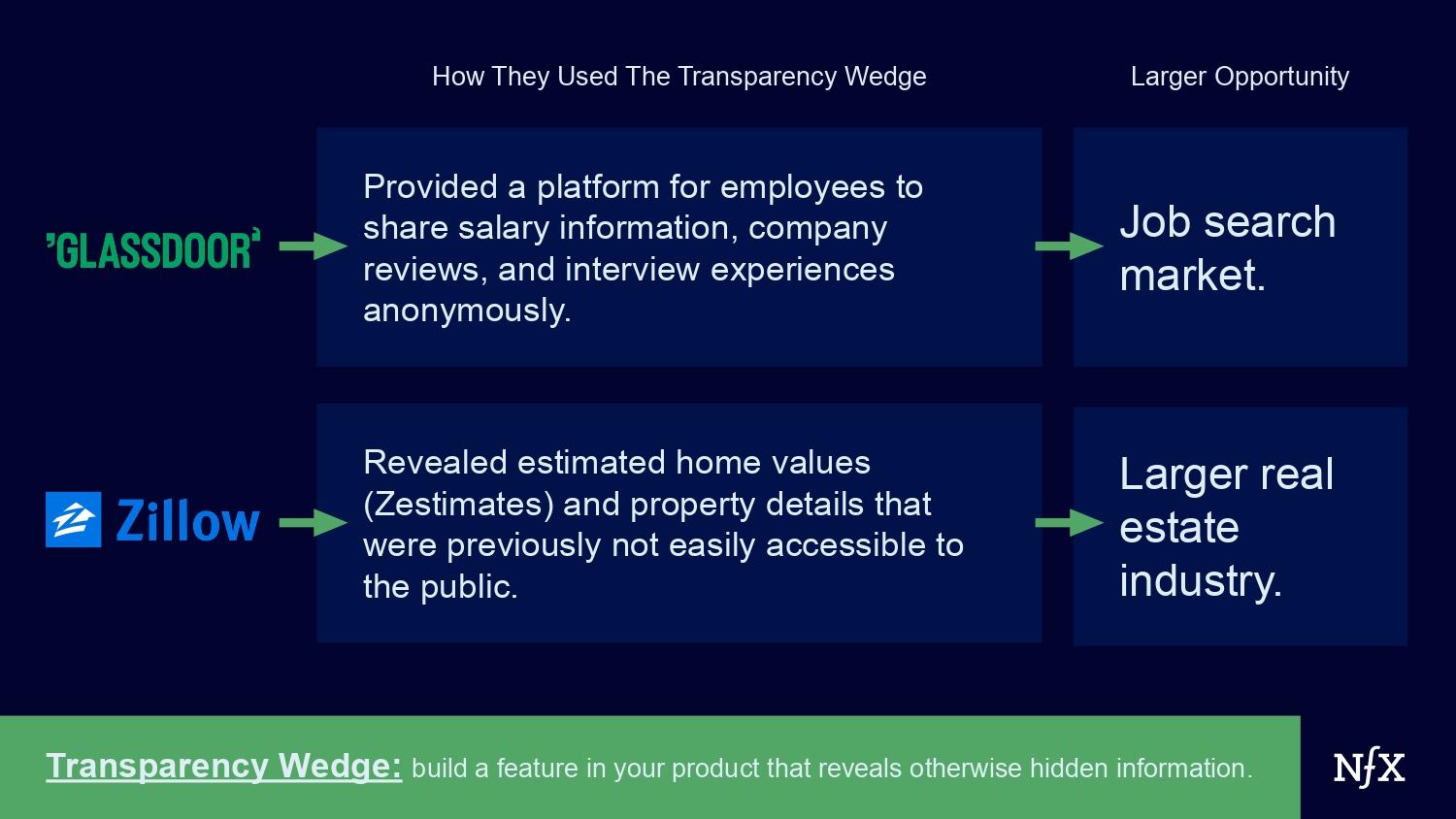

12. The Transparency Wedge

The “transparency wedge” works by building a feature that reveals otherwise hidden information.The key question to ask yourself is: what piece of information do my users crave, but don’t have?

This does appeal to a certain sense of voyeurism – people love to feel as if they have access to privileged information – which can translate to more user interaction with your platform. But it’s also a genuine service in most cases, and helps to build user trust.

Zillow and Glassdoor are good examples of this strategy. In Zillow’s case, information on home prices already existed – they just created a fun, interactive interface that curated that information. In Glassdoor’s case they actually surfaced reviews on specific workplaces through user-generated content.

Through a certain lens, you could view Amazon in this vein as well. Amazon allows sellers to see an entire market in one sector (initially books and now almost anything). This would be nearly impossible to quantify otherwise. Comprehensiveness builds confidence and trust which can translate into a large amount of demand. Once that demand is visualized, you can begin to service it and monetize portions over time. If the marginal cost of providing this service is low, then the opportunity could be significant.

Information is powerful. By providing useful, non-obvious, and above all, valuable information to your users, you begin to build reputation and trust.

Moving Beyond the Killer Wedge

The biggest problem we see with killer wedges isn’t finding them – it’s what happens afterwards.

Remember, a killer wedge is not your target market. Many companies get stuck when they begin treating a killer wedge as a final destination. Many companies fail to “graduate” from their initial market. In the case of wedges like the rapid ROI wedge or the instant liquidity wedge, this can present large problems down the road.

There are three things to keep in mind to continue moving forward.

1. First, remember your long term vision. In your initial pitch (pre-killer wedge) you defined where you wanted to go eventually. Don’t lose sight of that goal.

2. Use your killer wedge to build a long-term launch strategy. Use the data, and customer insights you gleaned in your killer wedge phase to inform your expansion into the larger market you previously identified. Post-killer wedge, you should know how to get there.

3. Third, remain adaptable. The best founders have strong convictions loosely held. If the things you learned during your killer wedge phase don’t move you into your target market as seamlessly as you thought, change tactics. Try again.

Once you find a killer wedge, it’s an amazing feeling. You finally have enough users to generate meaningful data to refine your product and process.

Learn everything you can, but don’t stay there forever.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.