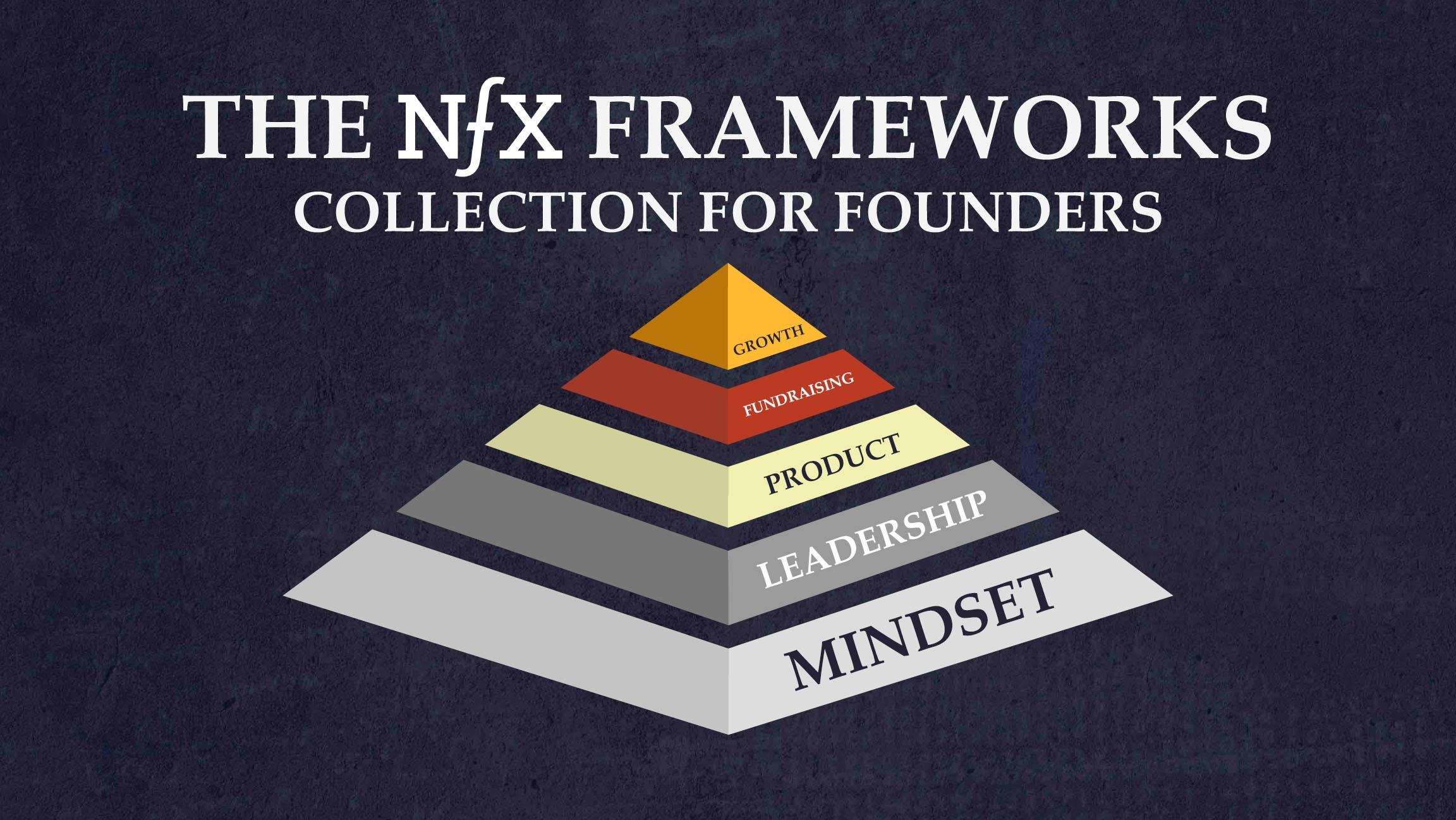

We’ve found time and again that the best Founders seek to understand the frameworks underlying success, much more than the tactics. While tactics vary, frameworks are often maps that lead to foundational truths and North Stars toward building great companies.

At NFX, our goal is to create and share frameworks that help our Founders see their challenges and competitive advantages in ways that others do not.

The startup community’s greatest gift to each other is that we all share our learnings, both at points of failure and in moments of success. So today, we are publishing a collection of our frameworks for product building, fundraising, idea generation, leadership, and more.

It’s our hope that Founders everywhere can browse this curated list and find mental models and practical solutions for whatever challenges they are facing right now.

The NFX Frameworks Collection for Founders

I. Product

II. Fundraising

III. Leadership

IV. Crisis Management

V. Network Effects

VI. Marketplaces

VII. Idea Generation

I. Product

Early-stage Founders are often deeply focused on product. Here is a shortlist of NFX essays that include (often counterintuitive) product frameworks to help you make your best product decisions, fast.

1. The Product Thinking that Built Slack & Twitter, with April Underwood

Twitter and Slack are two of technology’s most talked-about companies. They are both category-defining products marked by hypergrowth, each amassing a large base of deeply loyal users and a valuation of more than $20B. But Founders rarely get access to the product decisions being made behind the scenes, or the strategy and frameworks that guided them. | See Framework

April Underwood’s framework for identifying category-defining companies.

April Underwood’s 3-part framework for hiring product managers at Slack.

2. The Next Social Era is Here: Why Now Is the Time for Social Products Again

In this essay, James Currier and Josh Elman (Greylock) lay out 3 things a social startup must have if it is going to be successful: 1. Own a new habit, 2. Be super sticky, 3. Find a Strong and Obvious Growth Hook. | See Framework

3. Does Real Identity Matter for Networks?

We’ve observed a very strong correlation between tying profiles to real identity and a higher probability that a network endures and becomes a valuable business. This essay shares actionable lessons for creating defensible engagement at your startup. | See Framework

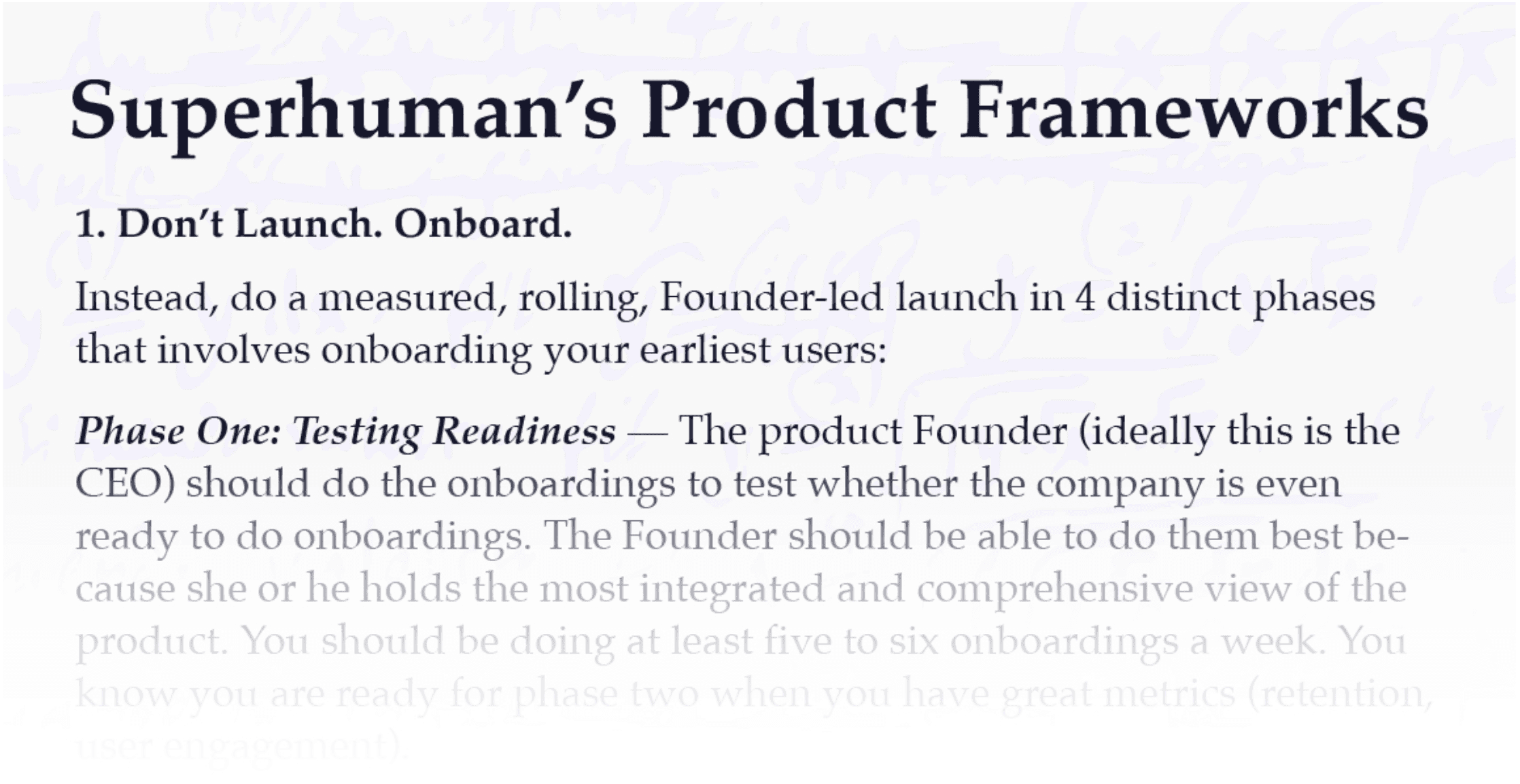

4. The Product Frameworks Behind Superhuman

While most companies are focused on building a beautiful machine — a 100% tech-driven, algorithmic, human-free experience — by contrast and even by name Superhuman is oriented in the opposite direction. When others talk about automation and breakneck scale, Superhuman talks about spending time with customers and launching small. It’s a counterintuitive approach to building product that works. This essay dives deep into Superhuman’s frameworks for: Customer Onboarding, Product Development, Positioning & Pricing. | See Framework

II. Fundraising

One of our goals at NFX is to shine a light on the fundraising process, to help Founders and VCs communicate clearly — which means being able to see from each other’s perspective. Here are frameworks to help you see from both sides of the table.

5. The Ladder of Proof: Uncovering How VCs See Your Startup

Most investors have a mental framework that lets them evaluate a startup based on a core group of predictors for risk and success that we call the “Ladder of Proof.” Each rung represents a predictor of risk or success. The further up the ladder a startup climbs, the more signals it’s sending to investors that it’s a sizable opportunity and a worthwhile investment. Your job as a Founder is to know where you are on the Ladder of Proof, where you need to get next, and how to clearly communicate that. | See Framework

6. How I Raised VC from Top-Tier Funds

Iman Abuzeid, CEO & Cofounder of Incredible Health (an NFX portfolio company) breaks down the complicated process of fundraising. This essay lays out what she learned from fundraising including “The Two Components of a Strong Raise,” “How to Identify The Right Investors” and other frameworks. | See Framework

Iman Abuzeid’s decision tree for fundraising.

Iman Abuzeid’s pitch deck structure.

7. How VCs See Your KPIs

Everyone knows that KPIs are critical, but often Founders are not looking at KPIs from the right angle. It’s all too easy to make mistakes in choosing KPIs, and we often see Founders making the same kinds of mistakes repeatedly, like tracking vanity metrics or no metrics at all. It’s equally tough to set the right goals based on those KPIs. And tracking towards the wrong goals can be even more counterproductive than failing to track anything at all. So NFX compiled The KPI Checklist with 10 guidelines for developing KPIs that help startups breakthrough and win. | See Framework

8. The Fundraising Checklist: 13 Proof Points for Series A

To give Founders every chance at success, NFX made public our Series A checklist. While it’s focused on raising a top Series A, it’s applicable to all early-stage fundraising. For startups to succeed in clearing that increasingly daunting Series A hurdle, they must retain focus on their long-term vision while simultaneously hitting their near-term milestones. It’s worth noting that in general, having product-market fit and a minimum amount of scale are usually prerequisites for raising series A funding. But here are 13 additional proof points that investors look for in startups looking to fundraise. | See Framework

III. Leadership

Running a startup is hard. Really hard. Being a startup manager and CEO requires strong mental models that help you grow alongside your company and culture. Understanding the psychology of startups and your constituents just might be the most important thing you can learn.

9. What Makes a Strong Startup CEO

The first step in developing your leadership skills is to understand that as a startup CEO, you have two different tasks that may seem like one but are actually different – being a manager and being a leader. And you must excel at both to succeed. NFX partner Gigi Levy-Weiss shares his frameworks for wearing both hats. | See Framework

10. How CEOs Think: 5 Mental Models to Shift from Founder to CEO

Founders know that as their companies change and grow, so too will their own roles, responsibilities, and opportunities for leadership growth. They want to know what’s next and how to mentally prepare for it. If you’re a Founder of a company that reaches real scale, there are two distinct phases you go through. Phase One (which is the Founder phase) is all about building a great product and finding clear product-market fit. Phase Two (which is the CEO part of your journey) is about building an enduring, sustainable company. This essay shares NFX partner Pete Flint’s insights on transforming from Founder to CEO, based on his experience leading Trulia from idea to IPO to $3.5B merger with Zillow. | See Framework

11. The Physics of Startups: Using Slingshots to Defy Gravity

At early-stage startups, one of the fundamental challenges you constantly face is balancing between speed and quality of outcome, two competing priorities that often come into conflict. There are four basic “zones” which companies can fall in with respect to speed & quality of outcome. This essay presents this framework– with the “Target Zone” being your goal–along with a 4-part process for keeping a constant watch on the long term. | See Framework

12. Entropy: The Unseen Threats to Startups

Entropy is the tendency of ordered systems to move towards disorder if left unattended. Startups tend to be vulnerable to entropic drift in three critical areas: role-employee fit, building rituals, and product focus. Day to day, entropic drift in these three areas is hardly perceptible. It happens bit by bit, like a ship slowly losing its bearing. No one notices until, one day, instead of smooth seas ahead, there’s a massive iceberg — a looming disaster that should have been easy to avoid if it was noticed early on. This essay presents frameworks to help you avoid entropy in your own startup. | See Framework

13. 9 Habits of World Class Startups

Startups that grow into transformative companies do two things: (1) they nail the basics and (2) they cultivate the right habits (core operating principles). When we see these habits in companies, we take special notice. This essay unpacks the 9 habits of world-class startups, including “Make It A Network,” “Find the White Hot Center,” “Start with Language” and many more. | See Framework

Habit #2: Make It A Network

14. A Founder’s Guide To Taking Advice

Investors, advisors, customers, employees, roommates, parents of college buddies…everyone has an opinion. Some of it is highly valuable. Most of it is not. And that’s the challenge with advice: high variability of value combined with high volume. Here are four key areas of focus for navigating the advice you receive as a startup Founder. | See Framework

15. The Psychology of Startup Growth

Growth never comes in the form of an overnight, silver bullet shortcut. It comes from adopting the right mindset. From an approach you bring to your daily work consistently for years. Tactics change and become outdated, but growth is an endless creative endeavor. We’ve seen that high-performance growth psychology has five hallmarks: Language first, empathy for users, always be moving, data love, sustain pain of failure. | See Framework

16. How Contrarians Think: The Early Days of Square, Yelp & PayPal with Keith Rabois

Silicon Valley loves patterns and playbooks for executing on market disruptions. Take a great startup, break down its wins into a series of actions and reactions, and then follow that blueprint. Simple, right? What rarely comes to light is that the great Founders do not study rules so they can follow them. They master the rules so they can break them. Underlying their vision are mental models that get at the key question: Which patterns do you violate, and why? | See Framework

17. Why Founders Should Take More Risk

This essay presents a sophisticated framework for all Founders to evaluate startup risk – broken down by market risk and execution risk. Market risk is the risk that people may not want what you’re building. Execution risk is the risk that you might not be able to execute your idea better than the competition. To help Founders truly calculate how they should assess the risks involved with their startups, we take a deeper dive into what these two types of risk mean and where they really come from. | See Framework

18. How Second Time Founders Can Win and Avoid Common Mistakes

As a second-time or repeat Founder, you have lessons and networks from your first experience that set you up for success. But with these advantages come disadvantages. It turns out there are commonalities in second-time Founder behaviors that you can look to and leverage – or prevent – before it’s too late for your new startup. | See Framework

19. The NFX Company Culture Scorecard and Playbook

At NFX, we are committed to helping world-class Founders build lasting companies that achieve rapid growth and make an impact. The NFX Company Culture Scorecard & Manual is a playbook for simple approach to laying the foundation of exceptional company culture. It includes 4 main parts: How to Find Your Company Values; How to Ship Your Company Values; How to Program Your Culture; and How to Measure and Iterate. | See Framework

IV. Crisis Management

Today it’s more important than ever to learn how to lead through a crisis. Here is a collection of recent NFX essays that we hope can bring some light and clarity to some darker times.

20. The Psychology of Founders Who Win in Downturns

The CEO’s psychology is the greatest point of leverage in a company’s success or failure. In this essay, we’ve noted 8 mind shifts of CEOs of companies that survived, then thrived, despite downturns. Once you have mastered your capacity for these mind shifts, however, you will be well-positioned to manage through nearly any period of crisis that might come ahead. | See Framework

21. 28 Moves to Survive (& Thrive) in a Downturn

In the face of a global pandemic and a financial meltdown, Founders are confronted with a new reality. The world has rapidly shifted under all our feet. Seemingly overnight, the economic dialogue has changed from measured confidence to murky chaos. If you are running a startup today, this will likely be one of the most challenging climates you’ll ever face. This essay is jam-packed with frameworks for leading through a crisis, including 28 steps for managing losses, gaining ground, and a list of insights for managing psychology. | See Framework

22. The New Rules of Growth vs. Profitability

This essay is a guide to help Founders build iconic businesses during this challenging time and navigate the new rules of growth vs. profitability. There are multiple frameworks embedded in this piece that will provide deep insight for startups, but the summary is: In a downturn, the name of the game is to not run out of cash and give yourself the runway to figure things out until the market recovers. Rule number 1 is to survive. Rule number 2 is to win and build a category-defining business. During a downturn, Founders should focus on taking the opportunity to improve your position and capture market share while maintaining a strong cash position and efficiency. | See Framework

23. Why Startups that Survive are “Learning Organizations”

Speed is your one advantage as a startup. During a market downturn, this is even more true. While your competitors can become slow or fearful when markets drop, downturns open a clear pathway for you to gain ground and come out stronger. But this requires upping your game — and one of the critical ways to do so is to become a faster learner. To implement learning loops correctly, there are 3 important and highly nuanced components. First, a learning culture is built upon a series of company-wide rituals and rules. Second, transparency must be seen as an organizational imperative. Third, scrutinize your wins as much as your losses. This essay further describes frameworks for how to succeed at each component. | See Framework

24. It’s Time to Start Playing Offense

In truth, there is no such thing as a simple breakdown of a “wartime vs. peacetime” CEO. Time and again, we’ve seen that top Founders quickly learn that real life is not an “either-or” scenario — it is both. You must play defense as the common advice dictates, but you must also play more and more offense as your defense strengthens. This rapid context switching between defense and offense can take years to learn and decades to master. But you as Founders do not have that time. This is a guide to get you there, fast. | See Framework

V. Network Effects

Network effects (nfx) are core to us at NFX because we’ve built 10 network effects businesses ourselves that exited for >$10B. But network effects are more nuanced than most realize. Here are just a few essays that have frameworks for understanding and developing network effects to your startup’s advantage.

25. 70 Percent of Value in Tech is Driven By Network Effects

Our three-year study shows that nfx are responsible for 70% of the value created by tech companies since the Internet became a thing in 1994. Even though they are only a minority of companies, companies with nfx end up creating the lion’s share of the value. Founders who deeply understand how they work will be better positioned to build category-defining companies. | See Framework

26. Defensibility Adds the Most Value for Startups

“Competitive advantages” help your company become successful. “Defensibility” helps you stay there. Both add value to your business. Here are eight competitive advantages that are currently working well in the digital world. | See Framework

27. The Network Effects Bible

This reference for Founders includes a comprehensive collection of terms and insights related to network effects, all in one place. | See Framework

28. The Network Effects Manual: 13 Different Network Effects (and counting)

Many people talk about network effects, but few understand the hidden complexities: what they really are, how they work, the many different types, and how to build and maintain them. This manual is the most comprehensive network effects map that we know of. | See Framework

29. Reinforcement: The Hidden Key to Building Iconic Tech Companies

Every iconic company to come out of Silicon Valley in the last 25 years has done the same three things: Product-market fit. Scale aggressively. Reinforcement. Of the three, reinforcement is the least talked about and possibly the most important for Founders to understand. The idea behind reinforcement is this: whenever a company adds a new defensibility — either scale, brand, embedding, or network effects — its existing defensibilities become even more powerful. On top of that, reinforcement makes it easier for that company to add further defensibilities — leading to compounding returns. This essay walks through the defensibility frameworks of iconic companies including Amazon, Salesforce, Uber, and Facebook. | See Framework

30. The Next 10 Years Will Be About Market Networks

Market networks combine the main elements of both networks and marketplaces. They will produce a new class of unicorn companies and impact how millions of service professionals will work and earn their living. This post details “7 Attributes Of A Successful Market Network.” | See Framework

31. What Makes Data Valuable: The Truth About Data Network Effects

Data is not inherently valuable. Most data doesn’t produce a real data network effect, and most data network effects aren’t that powerful even once established. Consider the idea that your data strategy, in terms of value creation, is overrated. That said, data network effects can be built and data can be used to create defensibility. So how do you actually do it? There are at least 3 broad approaches to using data to give your product an advantage. Additionally, this essay shows us 6 ways that data network effects work at Waze. | See Framework

32. The Next Frontier for 2-Sided Marketplaces: How Fintech Will Unlock Enormous Value

Fintech-enabled marketplaces have the potential to upend both traditional offline industries and incumbent marketplaces alike. This essay describes the patterns in marketplace evolution, as well as four catalysts which make it the opportune time for Founders to work on fintech-enabled marketplaces. | See Framework

VI. Marketplaces

We’ve founded and invested in 60+ marketplaces. Here’s a quick primer on what we’ve learned along the way, and what trends we see for future marketplaces.

33. See Your Score: The NFX Marketplace Scorecard

In this essay, we share the current internal methodology we use to invest or advise a marketplace. This is the system we use to score marketplaces. The higher the score, the higher the potential of the marketplace. Not only does it help us make decisions about which marketplaces to invest in, but once we’ve invested, it helps us advise the teams while they are “flying the plane” – operating and growing fast. | See Framework

34. 24 Ways B2B Marketplaces Win

Just as the last 15 years have seen tremendous consumer marketplace success stories, we expect to see the same level of success for B2B marketplaces over the next 10 years. In this post, we’re sharing 24 ways to make B2B marketplaces work. Founders who can execute using these lessons will be in a position to revolutionize B2B markets. | See Framework

35. The New Generation of Labor Marketplaces and the Future of Work

There has rarely been a more opportune time to build solutions for the changing labor market. The next revolution in labor will be much bigger than the one we saw with the rise of the gig economy that came out of the global financial crisis. At NFX, we see 4 trends in the next generation of online labor marketplaces. Founders that can understand and capitalize on these trends will be well-positioned to build the next generation of iconic labor marketplace companies and help redefine the future of work. | See Framework

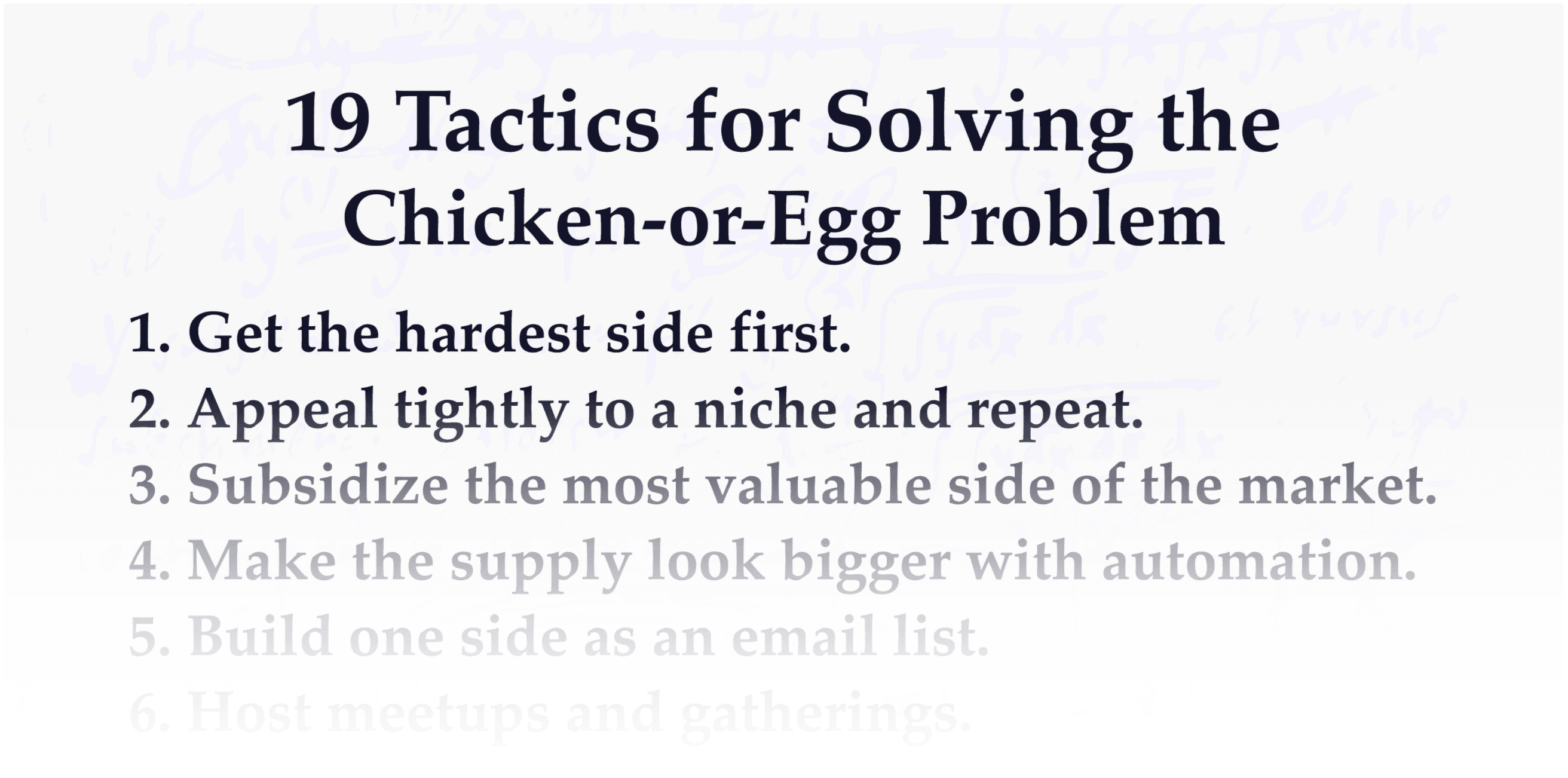

36. 19 Tactics to Solve the Chicken-or-Egg Problem and Grow Your Marketplace

We’ve paid close attention to what it takes to get marketplaces started. Which comes first, the supply or the demand? Chicken or egg? We’ve noticed at least 19 distinct, executable tactics Founders can use to solve the chicken-or-egg problem, including “Appeal tightly to a niche and repeat,” “Make the supply look bigger with automation” & “Only make one side change their behavior.” | See Framework

VII. Idea Generation

How do you know if you’re developing the next billion-dollar idea? Here are the hidden patterns and evaluation criteria of great startup ideas.

37. Why Startup Timing Is Everything

In startups, timing is everything. Enter a market too early and, no matter how strong the founding team, you could be stuck waiting for a day that never comes. Enter too late and you’re fighting an uphill battle against incumbents with greater scale. To help better understand startup timing, we developed a framework we call the Critical Mass Theory of Startups. It’s the tipping point for when a product or market goes under rapid transformation, seemingly overnight. | See Framework

38. The Hidden Patterns of Great Startup Ideas

As Founders who have started >10 companies that exited for >$10 Billion, we at NFX feel a responsibility to share what we discovered about great startup ideas so you’re not wasting your life energy on a mediocre idea. Here we identify 5 frameworks to help Founders refine their startup ideas, including: “Innovate Just Enough,” “Leverage Technological Shifts,” and “Market Risk vs. Execution Risk” among others. | See Framework

39. 10 Places to Find Product-Market Fit

Product-market fit is a prerequisite for sustainable growth. There’s no point in pushing a product which brings no real sustainable value to customers. Here are 10 frameworks for looking at startup ideas through the lens of PMF potential, including “Taking an existing activity and making it 10X easier”, “Create new inventory to be sold in a marketplace,” and “Discover new willingness to pay” – among many others. | See Framework

40. The 4 Signs of Founder-Market Fit

Most of the discussions around “Founder-Market Fit” tend to focus on the more tangible concept of industry expertise. But there’s a lot more to it. We see four dimensions that contribute to Founder-Market Fit: Obsession, Founder Story, Personality & Experience. Ask yourself if you have Founder-Market Fit. It allows you to see yourself from an outside point of view and form a realistic estimate about how you will do in terms of having a real disruptive insight, executing on that insight, and raising capital. | See Framework

Do you have suggestions for frameworks we should include? Let us know at qed@nfx.com.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.