The partners at NFX are all founders. One of the main reasons NFX exists is to be the kind of investors we wished we had when we ran our own companies.

Each of us had experiences with amazing investors…and some real asshole investors. Our biggest fear is waking up one day and realizing that somehow, we became the thing we hated the most. You know the type: late for meetings, always looking at their phone instead of listening, ghosting founders, stressing founders out for no reason, giving unthoughtful, obvious advice.

That’s an investor that adds negative value (other than their investment). Sometimes, it’s so bad that they add negative value even considering their investment.

I truly believe that investors are generally good and mean well. Most, if not all, go to investing because they want to create value for all involved and change the world. (At least, everyone is a hero in their own mind.) But even with the best of intentions, it’s easy to become an asshole if you’re not careful. Many investors don’t realize all the invisible forces that will push them down this path. And if you don’t know your own psychology, you can start slipping.

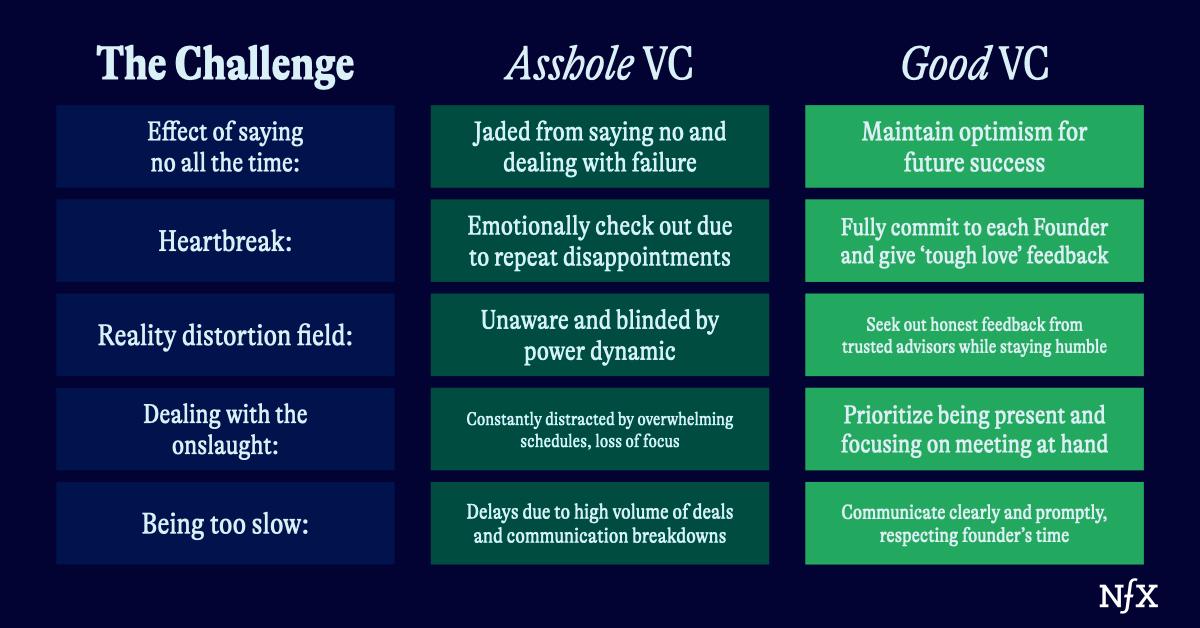

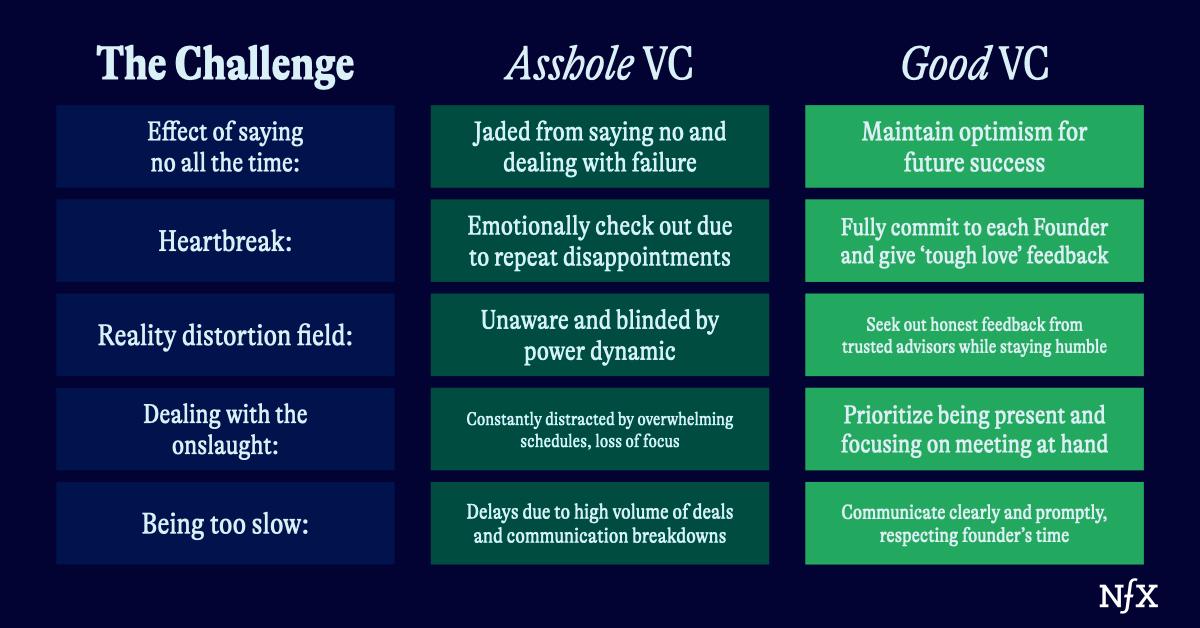

These are the primary ways that investors can become assholes, along with the causal factors. I want founders to understand the inner workings. When you see this happening, you should call your investors out on it. If you ever see this from me, do me a favor and call me out on it – it will be the best thing you can do.

Overwhelmed By Negativity

Sometimes I see investors who have become jaded or overly negative and they often take this out on their founders.

This makes no sense, because you became an investor because you believe in stuff. Being positive is truly the only way to succeed as an investor, because you have to believe that you will find that one big company that returns the fund and makes a huge impact. That core belief is what keeps us going.

But, in pursuit of those few outliers, investors spend a lot of time saying no. At NFX we only invest in less than 1% of the companies we see. When a good investor says no, they should always try to give detailed feedback. A one-word “no” is useless to a Founder. Though it’s true that a quick no is definitely better than a prolonged maybe.

Still, we have to say no to the vast majority of the pitches we see. Many of them aren’t even bad ideas. It’s just that they’re not big enough. I’ve written about this before: but to be venture-backable, your company has to have the potential to return the entire fund… plus some.

Even for the companies we do invest in, only a few will create a massive impact and return the fund over time. That’s part of the game, and we all understand that we’re going to miss more than we hit. But over time, I think this still takes a toll on investors that they don’t always acknowledge.

Lots of investors don’t handle this pressure as well as they think. They feel like they must find the next big thing to justify their fund’s existence. This pressure can contribute to apathy or a “spray and pray” approach followed by cynicism when most of those investments fail. This creates a downward spiral.

First: Our social brains are extremely good at pattern recognition, and when you realize you’re losing most of the time, it is easy to assume that pattern will continue. It’s the “hot” or “cold” fallacy – you believe that your past behavior or results will predict your future results. But it’s not true. The fact that you saw a handful of companies and said no to them today, has no bearing on whether you will get a great pitch tomorrow.

People forget this. They assume the pattern will continue. Because most investors are positive people, a pattern of “mostly no” leads to an uncomfortable dissonance. When will I stop saying no? Will I ever get to say yes? What’s the point? Are all my ideas wrong?

Second: investors who are caught in that downward spiral may subconsciously look for information to back up their negative beliefs. It’s a form of confirmation bias that many don’t recognize.

A good investor will recognize that their positive mindset is constantly fighting against the downward pull of negativity. When investors lose that fight, they become jaded. Honestly, that’s the #1 reason they act like assholes.

You want investors who are winning that fight. Not by being right all the time. That’s impossible. But by knowing that great founders and great ideas are always out there, and you will find your way to each other.

Bringing on the Heartbreak

Being a founder is one of the hardest jobs you can do. We live that life right alongside you. We want to see you succeed, because we are literally and figuratively invested in your success. And remember, we’re invested in dozens of companies. It’s like being a superfan of 20 different football teams.

Not every team is going to win the championship. Sometimes you get your heart broken. Sometimes, you get your heart broken over and over again by 20 different teams. Each process can be very high drama.

It costs a lot of energy. After a series of these, investors get depleted. Those who have gone through especially dramatic ordeals will put up a shell. It becomes harder to emotionally invest and give it your all. Sometimes when investors emotionally check out, it’s due to an abundance of heartbreak.

It is the job of a good investor to get over their heartbreak, and fully and emotionally commit to the next founder who is still in the game. A good investor stays in your corner.

But, listen up. An investor who is 100% in the game won’t make it easy on you. They will call you out when your products aren’t working, or you’re clinging to a losing strategy. They should give you the kick in the ass you need to change course and move forward. You might not like to hear it at the time, but an investor giving you tough love feedback is someone who still believes in you.

The Reality Distortion Field

Some investors truly don’t know they’re being assholes. They live in a reality distortion field.

When you become an investor, and raise a fund, the power dynamic shifts. All of the sudden, you have money to give out, you become the most popular person in a conference, everyone wants to talk to you, and people stop telling you the truth.

It becomes hard to course correct when you don’t know you’re becoming an asshole.

This happens to founders as well. My partner Pete Flint has written about the importance of not believing your own B.S. and says that one of the truest ways to test if you are falling into this trap is to make sure you have 2-3 respected advisors giving you constructive feedback at all times.

This is one of the things I love about the NFX partners – they tell me things right to my face.

Everyone should be so lucky. Honest feedback is the best gift.

Constantly on Defense

When your calendar is double or triple booked with meetings, or your email is going off constantly, you become distracted. When you’re distracted, communication breaks down. You can get short, or not ask the right questions because your mind is somewhere else.

I call this feeling “being on defense” – constantly wading through inbound. It’s the opposite of being on “offense” – trying to find the best science, reading important scientific papers, and talking to the best scientist-founders.

Being on defense is a toxic situation that leads even the best investors to exhibit asshole behavior, like ghosting founders. It’s simple: distracted, overwhelmed people act like jerks.

One of the main jobs of an investor is to sit in the room with founders, and figure out if and how you’re about to build a huge company together. Everything else is noise.

Sometimes the noise overwhelms the signal. Zoom is part of this problem. It’s so easy to disconnect, check your email, allow your brain to wander. But it’s not just Zoom. It drives me crazy when I have to cut a face-to-face meeting with a Founder short because there’s something else booked too tight on the other end. You feel like a jerk cutting an interesting discussion short. But you also feel like a jerk when you’re late to the new call.

Since NFX is an early-stage firm, we invest at the very beginning. Especially at NFX Bio we focus on a combination of the science and the people. We need to be able to deeply understand the science, and gauge the people at the same time.

Let’s be fully honest here: this is a judgemental process. VCs are judging founders. No one likes to say it this way, but that’s just the game. But if you were being judged by someone, wouldn’t you want that person to be fully present with you? Wouldn’t you want them to be engaged, interested, asking questions, giving you a chance to respond or make your case?

To do this, we must be fully in the moment. If an investor is always on defense – reading an endless email pile, answering texts, dealing with inbound – they can’t be present and their diligence process will dramatically slow down.

There is no substitute for deeply paying attention. Once the meeting is over, the magic in the room is lost.

Attention is precious. Your investors should be present with you in the moment – even if that time is limited. If they’re not, you have a problem, and you can call them out on it.

Being Too Slow

There is nothing worse than an investor that drags their feet, especially when you’re fundraising. Most founders have had this experience. You go through one or two meetings and come away with a “maybe” or without a timeboxed sense of next steps.

Of course, there are things like due diligence that take time. But good investors will let you know what to expect, and will communicate the process and progress. The worst thing an investor can do is leave a founder in limbo during a raise.

But there are reasons that it happens. Founders don’t realize the volume of deals that we get every day. There’s always a new company on the top of the pile. It creates a recency bias and a feeling of always getting excited about the shiny new thing.

When you’re on top of the pile, communication is fast and easy. But as a process drags on (either for good reasons, or because we are losing conviction), the communication process may break down.

The hard truth is, if you are a top top company, we will be moving very fast, trying to win the deal or get diligence done. Communication should not break down.

But just because you’re not one investor’s top priority, it doesn’t mean you’re dead in the water. Another investor might think you are that shiny new company that will return that fund.

This is why an investor that drags their feet is so harmful to founders. If someone just says no to you, you can move on and find someone else. If you’re in limbo, you may be wasting time trying to communicate with someone who is going to pass (but just hasn’t told you yet).

Again, no one is trying to be an asshole. Investors drag their feet for lots of reasons..some of which are out of their control. They might be tracking down their partners and advisors to discuss the opportunity. They might be getting on a flight across the world. They might have just lost your email in the shuffle. But you don’t know any of that unless they tell you.

Whatever reason it is, it’s not fair to you. Speed is the #1 advantage you can have as a founder. Your investor should move at least as fast as you.

It’s A Partnership

Founder-investor relationships are high stakes partnerships. People say it’s like getting married. But it’s also like sailing across the world into unknown territories with that person. Unexpected things are going to happen no matter what. If you can’t be straightforward with your crew, you’re lost.

We owe it to one another to uphold the highest behavioral standards during the journey.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.