Marketplaces are some of the most valuable businesses on the Internet. Uber, Airbnb, Amazon, Zillow, DoorDash — there’s much to learn by studying them. But every marketplace is different, including your own.

At NFX, we are investors and advisors in over 60 early marketplace startups. We’ve also written about how to get your marketplace started, drawing from our own experience building marketplace businesses like Trulia.

But after overcoming the chicken-or-egg problem, we see that marketplace Founders commonly overfit their growth strategies to existing playbooks. And what worked for other marketplace businesses rarely maps perfectly to yours.

The right playbooks, tactics, and case studies are only clear after you’ve identified what type of marketplace you’re building. That’s why I’m making public my framework for custom-building your own marketplace expansion playbook.

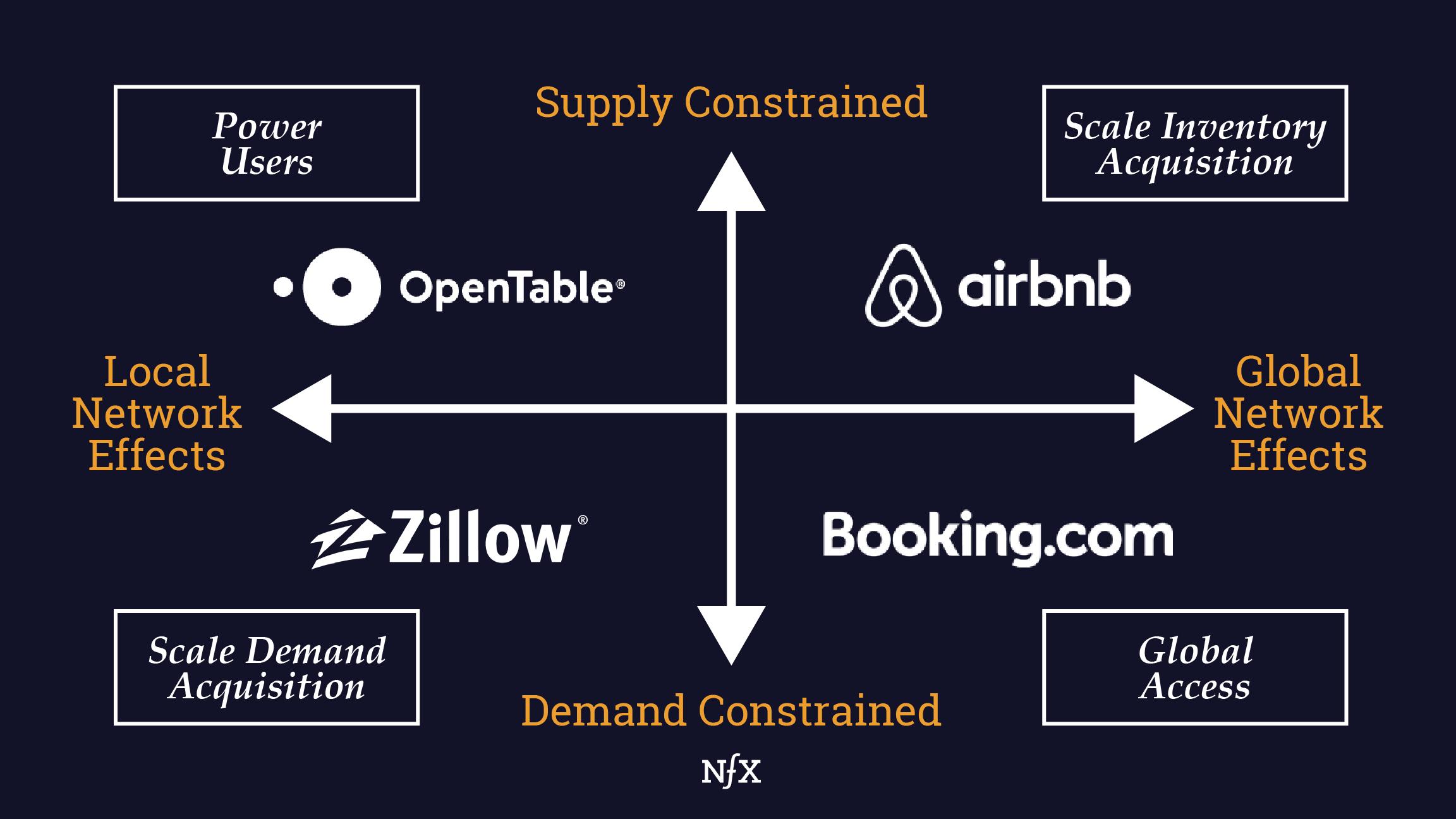

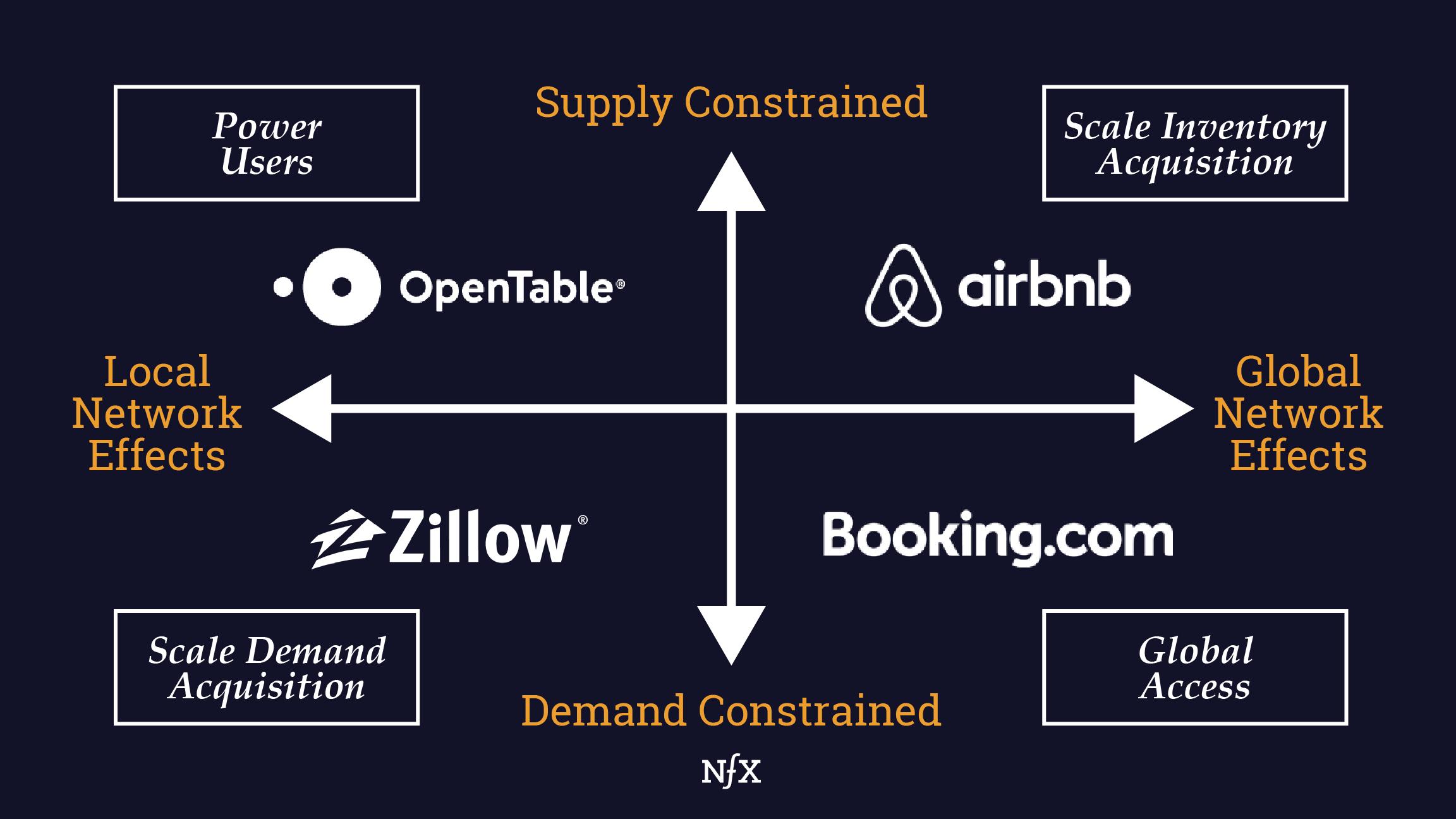

Are You Supply or Demand Constrained?

At any point in time, your biggest constraint to driving growth will either be a lack of demand or lack of supply. That’s why my first piece of advice when talking to marketplace Founders is to determine if you are a supply-constrained or demand-constrained marketplace.

Generally speaking, supply-side users (e.g. Uber drivers) are responsible for performing a service for demand-side users (e.g. Uber riders) to complete a transaction (e.g. an Uber ride).

There’s a simple heuristic for determining where you’re constrained. Which side are you more worried about in the mid-term? Where do you think long-term you will be spending more of your time and money?

Often with marketplaces, you need to kick-start one or both sides, such that the initial constraint is not always the same as the long-term constraint. Skilled marketplace operators develop sophisticated tactics and playbooks to precisely and efficiently drive supply or demand to achieve sufficient liquidity and equilibrium.

As marketplaces evolve and expand, this equilibrium will also evolve and change by segment and geography, as such constraints and playbooks need to constantly be re-evaluated.

Supply Constrained

Examples: Uber, Airbnb, StockX, DoorDash, OpenTable, and Hipcamp.

The best examples of successful supply-constrained marketplaces are those that use some form of innovation to unlock new supply within a market. This could be hiring your own delivery drivers in the form of DoorDash or building a reservation system for OpenTable.

From then on, growing the supply side is often about finding ways to turn infrequent engagement from suppliers into “power sellers” or “power users.” The goal is to increase the number of transactions with these suppliers so that they become persistent users. You want to become their primary channel and source of income.

This could include helping stores onboard all of their inventory or helping Uber drivers make a living. You want them to be powerful advocates who ultimately run their business off your platform. Deepening the relationship enables the supply side to become familiar with the norms of the platform and specific customer needs from this channel which in turn increases the quality of user experience, customer experience, and overall revenue.

You want to give your suppliers enough business to satisfy them. That’s why tactics for growing the supply side are often about pushing as much demand to your best suppliers as possible. If you’re their primary channel, it’s a lot easier to ensure they are deeply loyal to you, which critically reduces multi-tenanting.

Beyond the initial innovation to unlock supply, it is important to dig deep into understanding the unit economics and LTV of supply-side acquisition. Significant supply-side acquisition investments or subsidies can be highly effective if the retention is there and the marketplace is truly heavily supply-constrained. It is necessary to understand your own specific metrics and longer-term economic drivers.

Similarly, building tools to help the supply side run their business more efficiently can be very effective in acquiring and retaining the supply side. After you’ve already embedded with them, you can more easily add an adjacent offering that connects them to demand-side users.

Demand Constrained

Examples: Amazon, Zillow, Expedia, and Booking.com.

Demand-constrained marketplaces need to find new demand they can serve as cheaply as possible. When demand is your scarce and expensive resource, without a series of efficient and scalable demand-side acquisition strategies, you can put a huge strain on your unit economics.

A unique opportunity for these types of marketplaces is in unlocking new marketing channels. One cost-effective starting point is capturing more demand with the same or similar types of supply (e.g. enable your product to be sold to more geographies), then once you dominate there, you can move to adjacent categories.

In heavily demand-constrained marketplaces, there is often significant supply-side multi-tenanting so it is less critical to spend time concentrating demand into a few suppliers because they will go wherever the demand is. Suppliers will be in all of the major marketplaces. As you scale, however, deepening the supply side and reducing multi-tenanting is critical.

Growing the demand-side is often about product innovation to attract users and product expansion at a low cost to capture more demand. This drives personalization and consumer loyalty which increases switching costs. Expanding the supply-side inventory further improves customer engagement. Amazon brilliantly uses this playbook.

Prime is the perfect example with its personalized consumer subscription that increases in value every year. It’s the centerpiece of the Amazon consumer business, driving a retained and growing user base.

Does Your Marketplace Have A Local, Regional, or Global Network Effect?

The Internet has unlocked enormous value by connecting traditionally distant buyers and sellers. This development has created massive marketplaces with global network effects, which are less geographically constrained.

If you have a global marketplace, people from across the world can come to transact with any of your suppliers. These types of global network effects are attractive because the value to consumers in those marketplaces is driven by the total number of users on the network. Although, in reality, many marketplaces are mostly regional due to local tastes and cultures.

If you have a local marketplace, you are by definition more geographically constrained. These types of marketplaces only increase in value as more users in a specific neighborhood or city join the network. While local marketplaces are hard to get going, they can be highly defensible. But you need to be really thoughtful in your geographic expansion.

For local marketplaces, expanding into new geographies too early can leave you vulnerable. You typically have limited supply or demand-side relationships to leverage, which makes expansion highly expensive and also potentially reduces liquidity in the core offering.

However, starting early on, you need to expand to enough similar markets to reach sufficient market coverage in order to satisfy the demand and supply side. This is the best way to achieve scale as you invest in building a best-in-class local marketplace.

Conversely, marketplaces with multi-regional or global network effects that don’t quickly expand into new markets or enable transactions across geographies can miss out on accessing much larger markets and lose out to larger-scale operators.

However, it’s important to note, many marketplaces have both local and global network effects. It is rarely black or white. Think of Uber customers who will use the service 90% of the time in their hometown, but who also rely on the service when they travel to other cities or countries.

Global Network Effects

Examples: Airbnb, eBay, Etsy, and Google.

If you have a global marketplace with strong network effects, blitzscaling is critical because (1) the prize is bigger, and (2) you can’t defend your turf as easily.

Competitors can easily capture valuable supply if you don’t scale quickly enough, which is an existential risk for every global marketplace. Airbnb faced this early on with competitors in Europe. As a global travel marketplace, they didn’t have supply in high-demand destinations like Paris and London.

Understanding the global nature of their business, Airbnb was decisive. They moved quickly to build supply in key European cities — making Europe one of their top revenue-producing markets.

Now that they’ve scaled to these high-demand locations, Airbnb can continue to add to the long tail of available listings across the globe which adds a lot of aggregate value. And by adding different currencies and languages, they are incrementally tapping into new markets.

Moving on from Airbnb, global marketplaces can also be purely digital. OpenSea is an example of a creator marketplace with digital content (NFTs), which can grow very quickly as their ability to scale is less constrained.

But these purely digital, global marketplaces still need to localize their products. Thoughtful personalization and localization are necessary to ensure a high-quality user experience, and you still need to understand what drives liquidity (e.g. selection, price, quality).

Local Network Effects

Examples: Uber, DoorDash, Grubhub, and Thumbtack.

Most of the value for local marketplaces is derived from the addition of more users in the same local market. Take Uber as an example. Adding drivers in San Francisco only adds value to riders in San Francisco. Riders in New York don’t get more value.

The exception is if you scale to enough local markets, like Uber, you can unlock scale advantages and pricing power similar to a global marketplace. Effectively, in these cases, a collection of local network effects triggers regional, national, or global network effects, which puts subscale marketplaces at a steep disadvantage.

Given Uber’s scale, they have more leverage on the supply side which is where they’re naturally constrained. This leverage lets them close favorable deals with international brands like McDonald’s, attract talent internationally, and build a prominent brand.

Still, highly localized network effects are hard to unseat. Grubhub is a great example. They remain a major player in New York while having limited power in other markets.

To grow beyond your dominant market, a common strategy for local marketplaces is to achieve market leadership (typically #1 or #2 player) on the constrained side of the market first, then replicate this extremely quickly in other geographies.

Yet another food delivery network, DoorDash, created a novel go-to-market for local networks. They diverged from many other marketplaces and didn’t follow Uber’s well-known go-to-market (city-by-city expansion with local GMs).

While high density, urban markets fit Uber’s value proposition, DoorDash started in the suburbs which was a contrarian move at the time.

By doing this, DoorDash captured the less competitive suburban markets, acquiring users who retained better and purchased more food per transaction. Now, suburban markets are DoorDash’s cash cows. These markets are giving them the capital to expand to the more competitive urban markets.

This DoorDash example proves that there’s another go-to-market in local marketplaces. They demonstrate that you can critically assess your opportunity from first principles and arrive at a unique growth framework for your marketplace.

A Look Ahead

Marketplaces are enormously valuable yet many Founders fail to capitalize on their early success and expand in the wrong way. They are a dynamic type of business. They require new playbooks and a unique growth framework for every opportunity. And they are only getting more dynamic with time.

Looking ahead, digital trends will only continue to accelerate from Covid, users will be less constrained to single geographies, and increasing digital adoption will unlock new local networks. Our networked lives are being reshaped and digital marketplaces will create new opportunities for Founders.

If you are starting or building an early-stage marketplace, NFX would love to hear from you.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.