Few things matter more to early-stage startups than traction. It’s the measurable output that takes you from idea stage to actual growth.

Tactics that drive traction are variable, and often rely more on unique counterintuitive choices than a universal methodology. And yet, if you look carefully, there are visible patterns.

We interviewed the Founders, CEOs, and early leaders behind many of the world’s top companies, tracing back to their earliest days to uncover: What tactics led to their early traction?

Every breakthrough company has a collection of insights responsible for kickstarting its early growth. In them lies the inspiration for what will drive your startup’s traction.

PayPal, Keith Rabois, Executive Vice President from 2000-2002

Ultimately, People Drive Growth

The number one thing is to really credit Peter and Max for their recruiting. They had a philosophy of finding the right people and ultimately sourced a huge fraction of the PayPal network through their personal networks. Peter, through his connections at Stanford, and Max mostly hired engineers out of his high school experience in Chicago or from the University of Illinois. They identified people with high potential at scale and mixed everybody together.

Peter was adamant that we were not going to hire people whose skill in life was managing. We were going to promote the best person in each discipline to lead that discipline. So for example, the best engineer would become VP of Engineering, the best designer would head the Design team, the best product person would lead the Product team, the best finance person would be CFO, and that led to a building of craft and gave a meritocratic feel. Everybody knew that their boss was actually pretty damn good at what he or she did. I think that was pretty fundamental to our culture.

Find the Market Pull

Nobody really believed that eBay was a target market for PayPal. But then David Sacks noticed that there were 54 sellers on eBay who had hand-typed into their listings: “Please pay me through PayPal.”

It was obviously a very small number and the first reaction of the PayPal executive team was, “Oh my God. Why are these people using PayPal? We should get rid of them because that’s not what we’re supposed to be doing.”

But then David came into the office the next day and said the opposite: “A-ha! I think I found our market.” So we created a PayPal logo that they could insert, as opposed to type, and then we created an automated way to insert the logo because these sellers had a lot of listings. It basically became both the market for the company to focus on, as well as the guiding light for the product strategy for two years.

Twilio, Jeff Lawson, Co-Founder & CEO

Start With The Problem, Not Your Mission

I think that when you look at companies with a big world-changing vision or mission, those are usually retroactively put in place. To be honest, that’s the dirty secret of every startup ever.

The startups that have this giant world-changing vision on Day One probably get blinded by this: “We have to change the world and we have a vision,” and blah, blah, blah, that they actually miss the business opportunity right under their noses.

The best startups are probably those that aren’t founded with this idea of this giant mission. They’re founded with a relatively simple thing: “I know a customer segment that has a problem and I’m going to go solve it.”

And if you do that really well in the early days of a startup, you earn the ability to say, “Okay, we did that. We’re making money and we’re growing. What’s next? How do we decide how to take our early success and turn it into future success?”

That’s when you start thinking: Okay, so what is the real north star of our company? When we have to pick the next thing we’re going to do. Should it be over to the left or should be over to the right? Well, we need some sort of guiding vision. Now we’re going to install a framework to help us make those decisions. That becomes your mission. That’s how it was at Twilio.

Quickly Transition To A Multi-Product Company

How do I add more value to my customers? And as I grow, is there a way for whatever I’m building to increase the overall product value for all of my customers? There are a lot of ways to do that. One way is to build a comprehensive product that moves quickly.

As I think about Twilio, we very quickly went from a one-product company to a multi-product company. That bucks the conventional wisdom in a lot of ways. Conventional wisdom says to do one thing, and to do it well. Find a niche, get rich. There are a lot of fancy sayings for it, but I’m a believer that in the world of software, you have to try a lot of things because it’s relatively inexpensive.

Twilio Voice was our first product, then we pretty quickly, after 18 months, announced our second product, which was Twilio SMS. It turns out that SMS is now a bigger product than Voice. We unlocked a lot of innovation around what was possible with messaging.

Now, we’ve continued to invest in video, chat, email, as well as data infrastructure. There are a lot of facets to our platform. The idea is once you get to know Twilio, there are so many ways you can adopt us and use us. We just solve a bigger and bigger set of challenges that a developer has.

For a company, what they’re looking for is a more comprehensive solution. That’s where having one platform that shares all of these different attributes instead of having to cobble together lots of different things really helps a company to pick a vendor that they trust.

Square, Keith Rabois, COO from 2010-2013

Real-World Virality

Back when I joined Square, we were just launching. We’d shipped about 10,000 or 20,000 Squares into the world, and we started to grow. Here’s what happened.

We weren’t doing any marketing; we didn’t have money to do marketing. But I remember Jack (Dorsey) pointing to his computer the second week after we shipped the Squares, and noticing that day by day, we were adding more users, growing a little bit each day.

He asked me, “Why is this happening?” I paused because under the standard set of rules it really shouldn’t have been happening. We weren’t doing anything to create this growth. I thought about it for a few minutes and I formulated a hypothesis. It was really only a hypothesis given the constraints.

I thought, “A-ha! Maybe this is a function of people seeing Squares in the real world, seeing the actual device, and some fraction of them that see it, sign up.”

Once you have a hypothesis, then the next question is, “Well, how do you validate that? How do you test it?” If true, there should be a ratio for every new Square we shipped, and every new customer, and every transaction in the rate of growth. It turns out there was a perfect relationship, it’s exactly 1%. So for 1% of all transactions on let’s say day zero, we have 1% of signups the next day, new signups, and they were just perfectly consistent. It was amazing.

We had an actual viral loop in the real world. We had this observability. We’ve been in the real world which was causing growth, but it was not at all obvious.

We decided this word of mouth was partly from the aesthetic appeal of the device, the consistency of the design of the device, with the name of the device, so people could remember it. You see the square, it’s called Square, and that’s easy to remember when you want to go sign up. It worked in the early days.

Waze, Noam Bardin, CEO from 2009-2021

Organic First

One of our core theses was to do marketing, partnerships, and other inorganic activities only when we saw an organic trend. We tried many times to open up a specific city or country, but it never worked. While at the same time, for places started organically, we were able to pour the gasoline on the fire and it would light.

I couldn’t understand exactly why France was one of our strongest markets, but in Germany, nobody would use us. We still don’t understand that. We have all kinds of theories, but none of them work. But it doesn’t matter. When we saw things going well in France, we invested there. When we saw things going well in the UK, we invested there. But in Germany where things weren’t going well, we didn’t invest.

What’s the KPI that drives your business?

Startups usually start with very, very simple KPIs: downloads or users. The KPIs many times represent what investors are expecting to see. Because a lot of times, the KPIs, especially in the early stage, are really focused on trying to raise money. But as a company matures and grows, the KPIs should become more representative of the business and the user experience.

So for us, a few years after we were founded, we realized that driven kilometers was really the most important metric for our business. That doesn’t mean that it made sense to an investor or was comparative to other services. But when you think about what our network produces, the more people that drive with the service, which is what we call driven kilometers, the more data we collect. If they spend more time with us, we make more advertising revenue. And the more people use our product, the more features they discover, which drives more usage.

When you think about the company on the whole, if I had to choose one KPI, I would look at driven kilometers because I think that’s the best explanation of how our business is doing.

That “Aha” Feeling

The very first time I tried the Waze app, I remember my wife saying, “Wow, there are other people using this. I don’t feel alone.” That feeling was very, very important and stayed with me.

For us, in the earliest stage, seeing another Wazer was a ‘wow’ moment. People would go crazy when it happened. Of course, today, that’s not a relevant experience, because obviously there are just so many users. Seeing other people on the map isn’t the ‘wow’ moment anymore – but we still show it to communicate that you belong to a network.

When you think about the technology, there’s the functional side of what it does, then there’s what it makes you feel. And a lot of times, startups focus too much on what it does and the hard aspects of the features, the functionality, and the performance. But you also need to focus on what the user feels when using it. You need a combination of the thing working well and the feeling you get.

“Janky” Is Ok In The Beginning

When you’re targeting early adopters, you don’t need your product to be super smooth and clean. You’re creating the wrong impression. If you have a super smooth, clean, beautiful product that just doesn’t work, you’re going to disappoint a lot of people. If you have a product that’s broken and janky but it has a lot of functionality, and you’re targeting early adopters who are going to help you make it better, they’re going to see how they’re impacting the product. Let them see how they’re making things better. That’s very important for them.

When you’re ready to go mass market, you’ll have a very different relationship with your users than you had with your earlier adopters. At that time, we smoothed the app, made it much more fun and clean. We took out a lot of the raw functionality, which made our core users mad, but for our new consumer, it didn’t matter. They didn’t care what the strength of the GPS signal was, for example, but our early adopters did.

Yelp, Keith Rabois, Board Member from 2005-2014

One Counterintuitive KPI

It was probably the second board meeting we had after I joined the board. I remember Jeremy Stoppelman was finishing his presentation and he basically gave us this vision that Yelp was really building a viral social product, which not everybody appreciated at the time.

I looked across the table and said, “Okay, well, if you’re building a social product, what’s the key metric that’ll tell you whether you’re right or wrong?” And he looked up and down the table and said, “It’s the number of unique, one-on-one personal messages from one member to another.”

Personally, at the time, I thought the answer was ridiculous. But very quickly thereafter, certainly within three to six months, I realized he was actually right; that metric was the key predictor for whether we were building a true community. It was extremely counterintuitive at the time.

Fiverr, Micha Kaufman, Founder & CEO

Start Simple

The first version of Fiverr was a labor marketplace with about seven categories. You could offer anything within those seven categories, as long as it listed for $5. What we did was remove the pricing friction that would come later on by starting with a single price, which made it very simple.

$5 is the price of a frappuccino at Starbucks. Why is that important? Because if your coffee is not perfect, you’re not going to be devastated, you’re going to throw it, maybe get another one, maybe replace it, buy a different one. The risk of offering those services is very low, which meant that the screening process that we had to go through on the supply side was not very high, which simplified things. We didn’t have to put a screening marketplace integrity system in place from the beginning.

Go Up Market, Not Down

When I look at business history, there are very few examples of companies that have been able to go down market without compromising their premium business. That’s why we started at the bottom of the market with microservices for micro-businesses. The vast majority of our early customers were businesses, but when you’re a solopreneur, you act as a consumer more than as a business.

We started there and over time, we went to larger types of businesses with more sophisticated products. This approach also allowed us to do market education as we were going up market. We bought ourselves some time because we were very successful at the microservices. That fueled our efforts in going up market and gaining the market’s trust.

Being able to take your brand and serve enterprises is always going to be a challenge. You need to make sure that there’s still room on your platform for the people that are providing or looking for these niche services. But at the same time, you’ve added layers of trust and layers of seriousness to the brand that are now enabling enterprises to use it. That’s not a trivial challenge.

Changing the perception of the brand, making it more accessible for larger types of customers to consider was something that just took time and took storytelling. We had to prove that we were able to cater to those customers. It was recreating a trust system. We had to bring more high-quality supply and create more professional categories.

Owning Customer Support

In the beginning, you don’t have to automate everything. It’s okay to be high touch. Before you actually build to scale, you need to get to basic product-market fit.

I always tell other Founders that what we have in common is that we build products that we have a very clear understanding of or at least an assumption of how customers are going to use them. And then customers come and they use them the way they want to use them. So that level of understanding in the beginning is more important than scale.

One of the things that I did was spend the first 3 to 5 months at the beginning of the company doing customer support. That was my role, my main role, other than being the CEO of the company. I was doing most of the support at the beginning.

The idea was to have an open dialogue with our community to understand what they like, what they dislike, what is missing, and I think that level of understanding really contributed to how we moved from version 0.9 to version 1 and 1.1 and so forth.

I would say instead of obsessing about scale at the beginning, obsess about figuring out your value creation to your customers. The only way to do that is to interact with them. It’s to listen, to have conversations, and that will give you so many clues on how to scale.

Superhuman, Rahul Vohra, Founder & CEO

Don’t Launch. Onboard.

With any email client, task manager, or calendar app, you have an especially massive surface area for bugs, because you have wide variability in how users want to use the product. If you run a traditional Launch and sign up tens of thousands of users quickly, they will find thousands of bugs and quickly overwhelm your team.

You won’t be able to fix the issues fast enough. Your users will then be disappointed and churn out of the product — and tell everyone about their poor experience.

Instead, do a measured, rolling, Founder-led launch in 4 distinct phases that involves onboarding your earliest users:

- Phase One: Testing Readiness — The product Founder (ideally this is the CEO) should do the onboardings to test whether the company is even ready to do onboardings. The Founder should be able to do them best because she or he holds the most integrated and comprehensive view of the product. You should be doing at least five to six onboardings a week. You know you are ready for phase two when you have great metrics (retention, user engagement).

- Phase Two: Testing Limited Scalability — Another senior member of the team, who is not a Founder, should take the lead. The primary goal of this phase is to show that somebody other than the Founder can do onboardings and still produce great metrics. (In our case, it was the Head of Growth.) The secondary goal is to move onboarding toward something that can scale. We reduced onboarding time from two hours down to one hour, and ramped to 20 onboardings per week, still keeping great metrics.

- Phase Three: Testing Wide Scalability — Build a full-stack growth team. Everyone on the growth team does demand generation, lead qualification, customer support, and onboarding. The primary goal of this phase is to show that somebody other than a senior member of the team can do onboardings and still produce great metrics. Secondary goals are to further evolve the onboarding experience towards something that can scale, and create training plans for the next phase of growth. Expect the growth generalists to be doing 20 onboardings per person per week alongside other responsibilities. This phase usually lasts a few months. We reduced the onboarding time from one hour to 45 mins without a degradation in metrics.

- Phase Four: Scaling Revenue — Build a team of onboarding specialists that should be able to do onboardings better than anyone in previous phases. The primary goal of this phase is to scale revenue while maintaining everything that makes the experience delightful and magical. During this phase, we got onboardings from 45 minutes to 30 minutes.

- On Training: It’s super important to run a comprehensive training program for each new onboarding specialist. They are now the front line of the company. Our training program runs for 8 weeks. Once fully ramped, each onboarding specialist is able to do 35 to 45 onboardings per week.

- On Finding Onboarding Talent: Founders often ask me the ideal background of an onboarding specialist. Sales backgrounds can work well but we’ve found that other backgrounds — teaching and hospitality to name two — also work very well.

Caveat: By all means, do a traditional launch if you need one of the three Cs quickly: capital, candidates, or customers.

Superhuman’s Six-Step Onboarding Approach

I did the first 200 new user onboardings in Phase One. I wasn’t concerned with how long each onboarding took; many took two hours. Each onboarding had six parts.

- Give the new user a detailed demo of Superhuman, and share what makes it magical and delightful.

- Reminder that Superhuman is a paid, premium product and test price sensitivity with the Van Westendorp Test.

- Ask how they currently do their email and take notes on all the Superhuman features they would benefit from.

- Show them how to get through email in Superhuman twice as fast as they were doing before.

- Insist that they do email with you, live, for 30 minutes. Doing it with them is crucial because every time, I would find 5 to 10 bugs that I would send back to my team. We would make sure to fix them within a week. If we didn’t, we wouldn’t be able to surface the next set of bugs that we should address.

- Send them a personalized gift (I would send a bottle of wine or whiskey) to show them how much you valued their time. This obviously slows down as you get out to scale with many thousands of users.

Pricing Starts with Positioning

When we were pricing Superhuman, we talked to Arielle Jackson who was the first Product Marketing Manager on Gmail at Google. She advises using a simple but effective 6-part formula to determine positioning:

- For (target customer)

- Who (statement of need or opportunity)

- (Product name) is a (product category)

- That (statement of key benefit)

- Unlike (competing alternative)

- (Product name) (statement of primary differentiation)

In 2015, we came up with the following positioning for Founders, CEOs, and managers of high-growth technology companies who feel like their work is mostly email.

“Superhuman is the fastest email experience ever made. It’s what Gmail could be if it were made today instead of 12 years ago. And unlike Gmail, Superhuman is meticulously crafted. So that everything happens in a hundred milliseconds or less.”

The positioning makes it clear Superhuman is a premium product. From that, we moved on to pricing.

We asked 4 questions:

- At what price would you consider Superhuman to be so expensive that you would not consider buying it?

- At what price would you consider Superhuman to be priced so low that you would feel the quality could not be very good.

- At what price would you consider Superhuman to be starting to get expensive? (So that is not out of the question, but you would have to give some thoughts to buying it. This is the question we paid most attention to.)

- At what price would you consider Superhuman to be a bargain and a great buy for the money?

Since we were building a premium product, we paid most attention to the third question. The median answer to this question actually turned out to be $29 per month. A few conversations with some pricing experts later, we rounded up to $30 per month.

Rounded prices signal quality; prices that end in a 9 signal a bargain.

That’s how we picked our price.

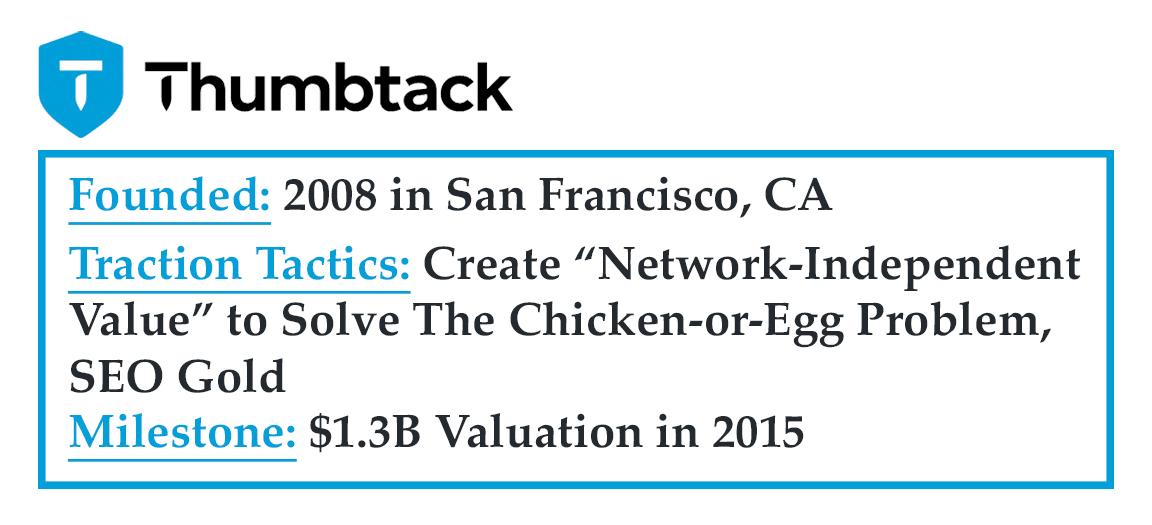

Thumbtack, Marco Zappacosta, Co-Founder & CEO

Create “Network-Independent Value” to Solve The Chicken-or-Egg Problem

As an early-stage marketplace, we asked ourselves: How can we create network-independent value? How can we create value for our pros, the supply side of our marketplace, before we had any network of customers that would ultimately be the draw for them?

Our growth tactic early on was looking for where these pros were and where they were already hunting for customers. And at the time, from 2009 to 2010, that place was Craigslist.

What we built was a very easy tool for them to create a Thumbtack profile that with one click they could republish on Craigslist, importing all of their pictures, reviews, and metadata with a great HTML layout. Importantly, they weren’t interested or capable of doing this themselves but it was instantly valuable to them. Now, we could say, “Hey, you’re on Craigslist or it looks like you want to be on Craigslist. We have this great tool. Just come fill out a profile.”

What that did was attract pros who were motivated to use the internet to find customers. It was exactly who we needed. It also gave us a relationship with them from the get-go. Unlike a typical directory, which has a ton of content about millions and millions of entities that they have no relationship with, Thumbtack from the very beginning has had a relationship with every pro that you find on our marketplace.

We want to connect you with a person, with a pro, not simply with information about a pro. So, this was the early growth tactic that got it all going.

SEO Gold

We got another benefit from pros coming to create profiles with us. Since they were going to use our profiles to represent themselves on other platforms like Craigslist, they were very motivated to create a good-looking profile and to give it a lot of unique content, which for SEO is gold.

For a long time, we’ve had shockingly little overlap with the other platforms that are out there. Think of Google, Facebook, or Yelp, this is a very long-tail category that’s very fragmented with opaque or incomplete information. Our approach not only got us high-quality, high-intent relationships, but it was great for SEO.

Poshmark, Manish Chandra, Founder & CEO

Engagement > Growth

One of our insights in the early stages, which is especially true for consumer products, is that the best way to understand a consumer product is through engagement and return rate of your users. Not growth. That was an incredible insight when we launched.

We only had a thousand or so users. But the average engagement time was 20 to 22 minutes per day, which was 7 to 8 engagements per day. Today it’s like 23 to 27 minutes per day.

This was a very, very powerful insight for me.

When To Stop Growing

By the middle of 2013, it felt like everything was breaking.

We had hundreds of boxes strewn around in our offices. Posh Parties were not scaling, sometimes our servers would crash. USPS had just arrived at our doorstep and said that they might want to take our CEO to jail because we’re violating all of these USPS rules.

All of our payment providers said that we’d have to find another payment provider. The unit economics of the business were deteriorating. Still, the engagement of the users was really high, but just the whole system was not yet there. And in the middle of all of these things, we were trying to figure out what we should do around financing.

So I took a step back, and went back to Naveen at Mayfield and said, “I’m going to cut down our growth by 80%. I’m going to cut down my marketing spend by 80%.” Part of it was that I just didn’t want to get into a place where we were continuing to spend money like crazy, not grow, and effectively get into a bad situation. But it was still a difficult decision.

In that time, we rebuilt our partnership with USPS, found a payment processor that could support our business model, and we just recently launched Posh Remit to create automatic sales tax collection and remittance for our sellers.

At this point, for our sellers, shipping is simple, payment is simple, and all of the government integration is simple. They can now focus on the two things they love to do, which is how to merchandise their product and how to make it easier to have conversations with their customers.

“Traction Tactics” Are Often Counterintuitive

It’s commonly known that traction is the Holy Grail for early-stage startups. But, unfortunately, the real methods for getting traction are not commonly shared.

Now, knowing the “traction tactics” behind Square, Twilio, PayPal, Waze, and others, Founders everywhere can start to experiment for themselves. But be careful not to overlook counterintuitive insights — they’re often the drivers of traction.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.