Twitter. Amazon. Apple. Meta. Uber. Salesforce. Tesla. These are some of the most impactful and significant companies in the world.

Each one is very different in a lot of ways, but there’s a single property that defines them all and lies behind their success: Network effects.

Network effects are the #1 way to create defensibility in the digital world. Companies with the strongest types of network effects built into their core business model tend to win, and win big.

Our three-year study shows that network effects are responsible for 70% of the value created by tech companies since the Internet became a thing in 1994. Even though they are only a minority of companies, companies with network effects end up creating the lion’s share of the value.

We believe in network effects so strongly that they inspired the name for our firm: NFX. For Founders looking to build truly impactful companies, few areas of expertise are more valuable.

Still, misconceptions abound. Many people talk about network effects, but few understand the hidden complexities: what they really are, how they work, the many different types, and how to build and maintain them. Moreover, very few companies want to share their valuable playbooks around network effects, so most founders don’t even recognize different types of network effects when they see them, much less understand their complex inner workings.

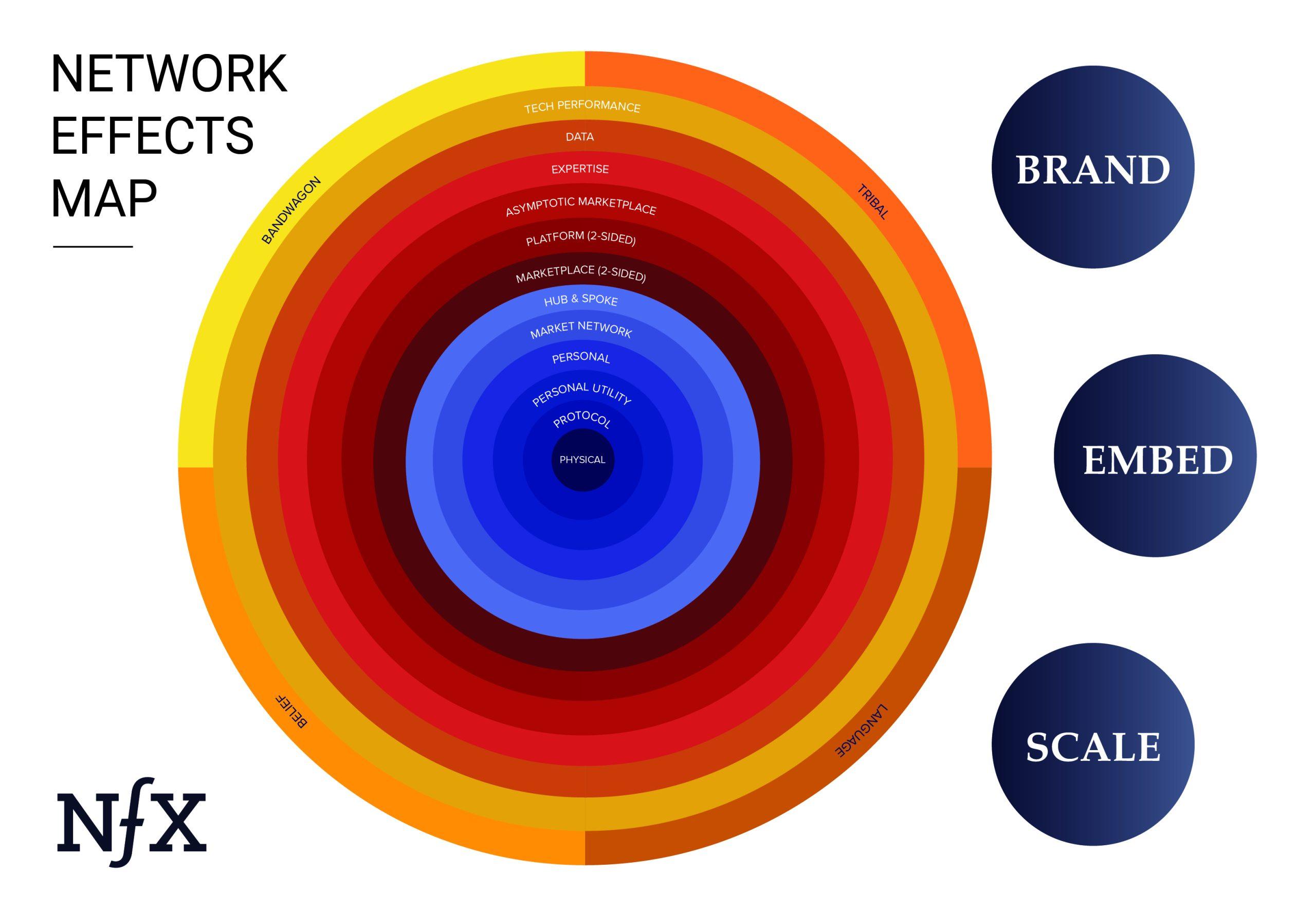

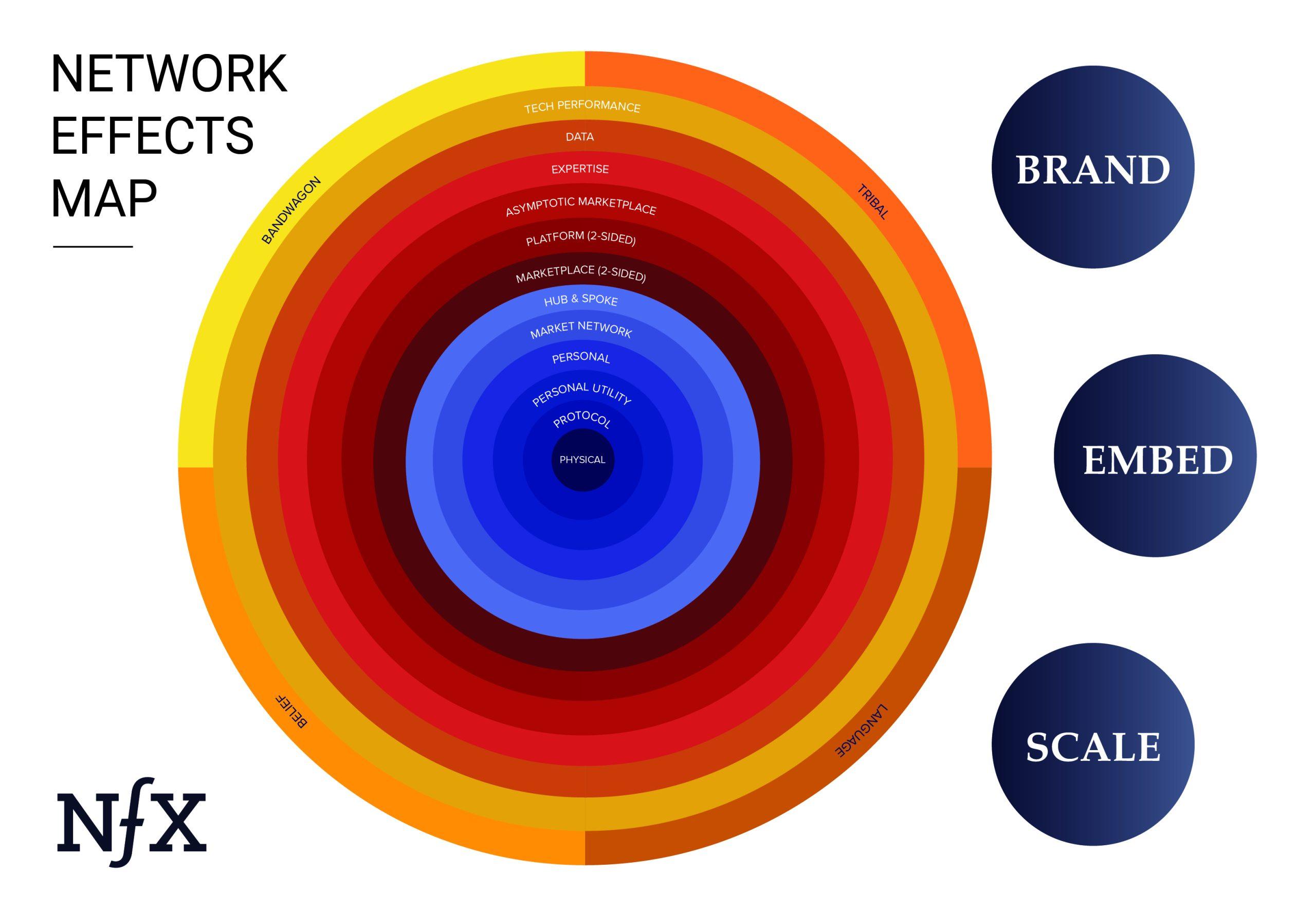

Here we present our network effects map and accompanying manual. It’s an ever-evolving effort, and we’re continually making changes and updates. So far we’ve identified 16 types of network effects, each with their own playbook. This manual is intended to be a starting point for discussion around network effects (we’ll shorten it to nfx, for speed). In addition to reading this manual, we encourage you to check out these companion resources:

- The Network Effects Masterclass, a 3-hour course bringing together all of our learnings on network effects from over 20 years of research and investing.

- The NFX Bible, which describes the most important network effects concepts and terms

- The NFX Archives, a compendium of the most insightful articles even written about network effects and network science.

Network Effects Basics

As you probably know, the simplified definition of network effects is that they occur when a company’s product or service becomes more valuable as usage increases.

By this definition, network effects seem deceptively straightforward. But when you take a closer look, you start to notice that different types of networks are very different in how they behave. As a result, not all nfx are created equal — some are stronger and tend to produce more value than others.

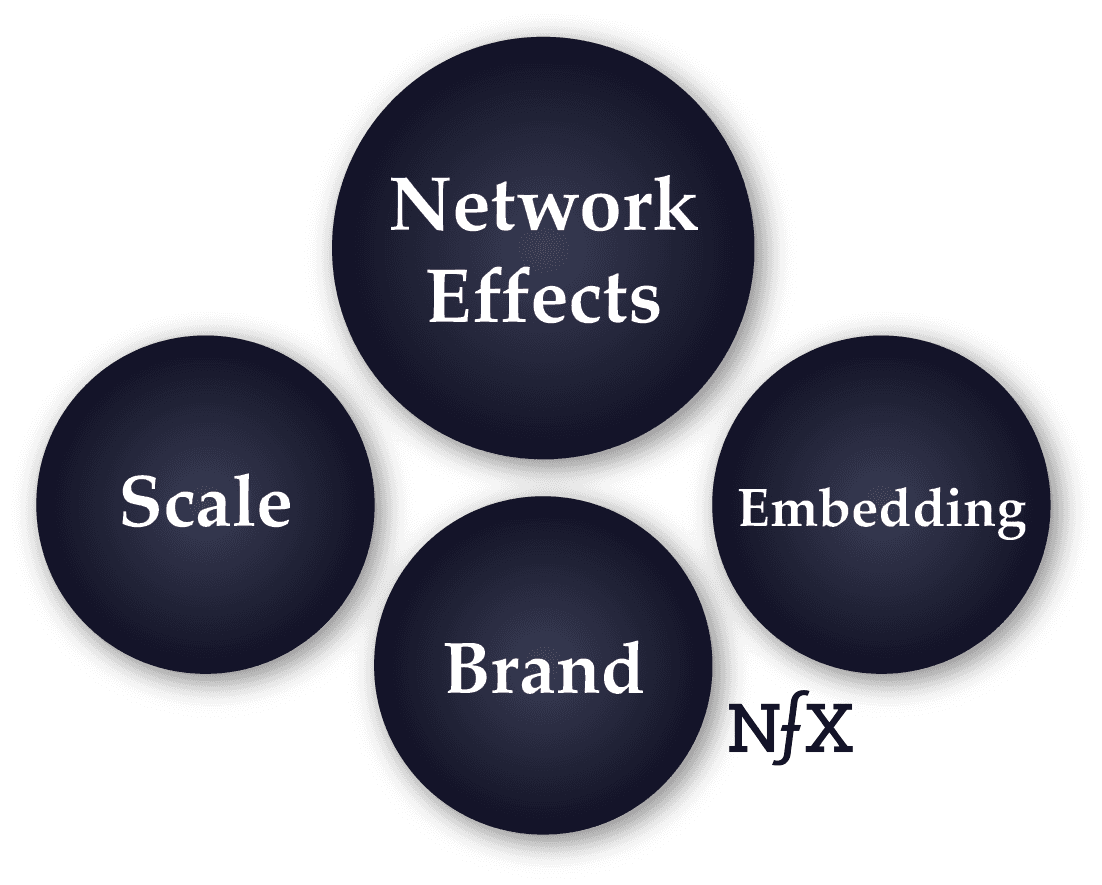

Network effects are one of the four remaining defensibilities in the digital age, including brand, embedding, and scale. Of the four, network effects are by far the strongest. To date, we’ve identified 16 distinct types of nfx that fall under five broader categories.

In the map below, we’ve depicted the various nfx types (labeled) and categories (organized by color), with the strongest and simplest network effects at the center of the map. The other three defensibilities are also shown on the right.

We developed this map as an exercise over the years to help bring greater clarity to the subject. But before we dive in, there are a few things we should point out:

- The map we’ve laid out here isn’t meant to be taken as an incontrovertible truth — it’s a beginning point for discussion and understanding. It’s one of our evolving methods to help Founders recognize and make use of powerful forces to build great companies. Because for Founders looking to build a strong competitive moat, the ability to identify and understand nfx is invaluable.

- Network effects are not viral effects. Network effects are about creating defensibility, and viral effects are about getting new users for free. They have totally different objectives and playbooks.

- You’ll often see the same companies have several nfx at play simultaneously, meaning that the different nfx types are not mutually exclusive. They are like colors, and your company is like a work of art. It helps to be familiar with the full palette as you paint.

With that said, let’s turn to the Map itself. Below each of the various nfx on the Network Effects Map are described, with relevant examples.

Direct Network Effects

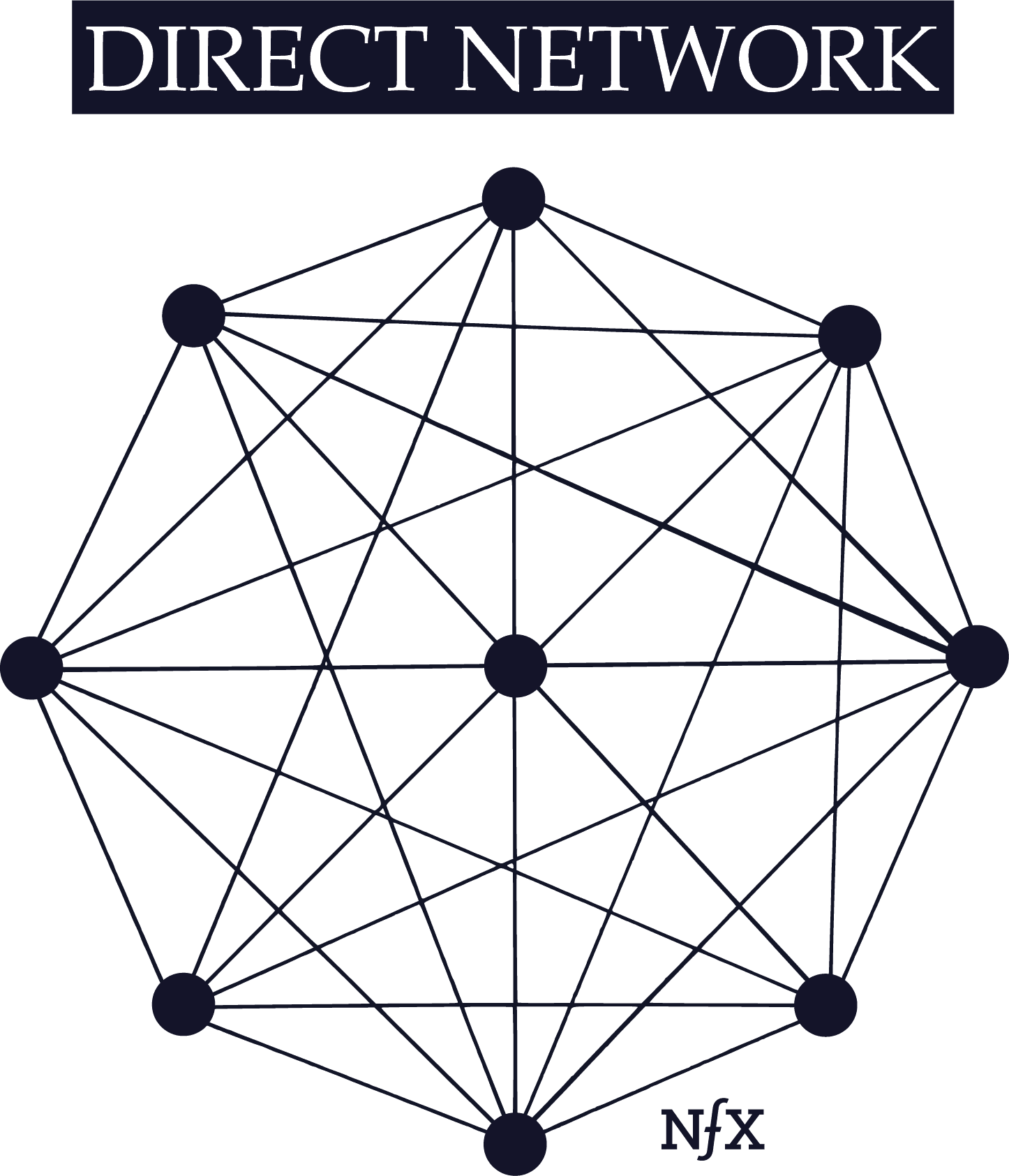

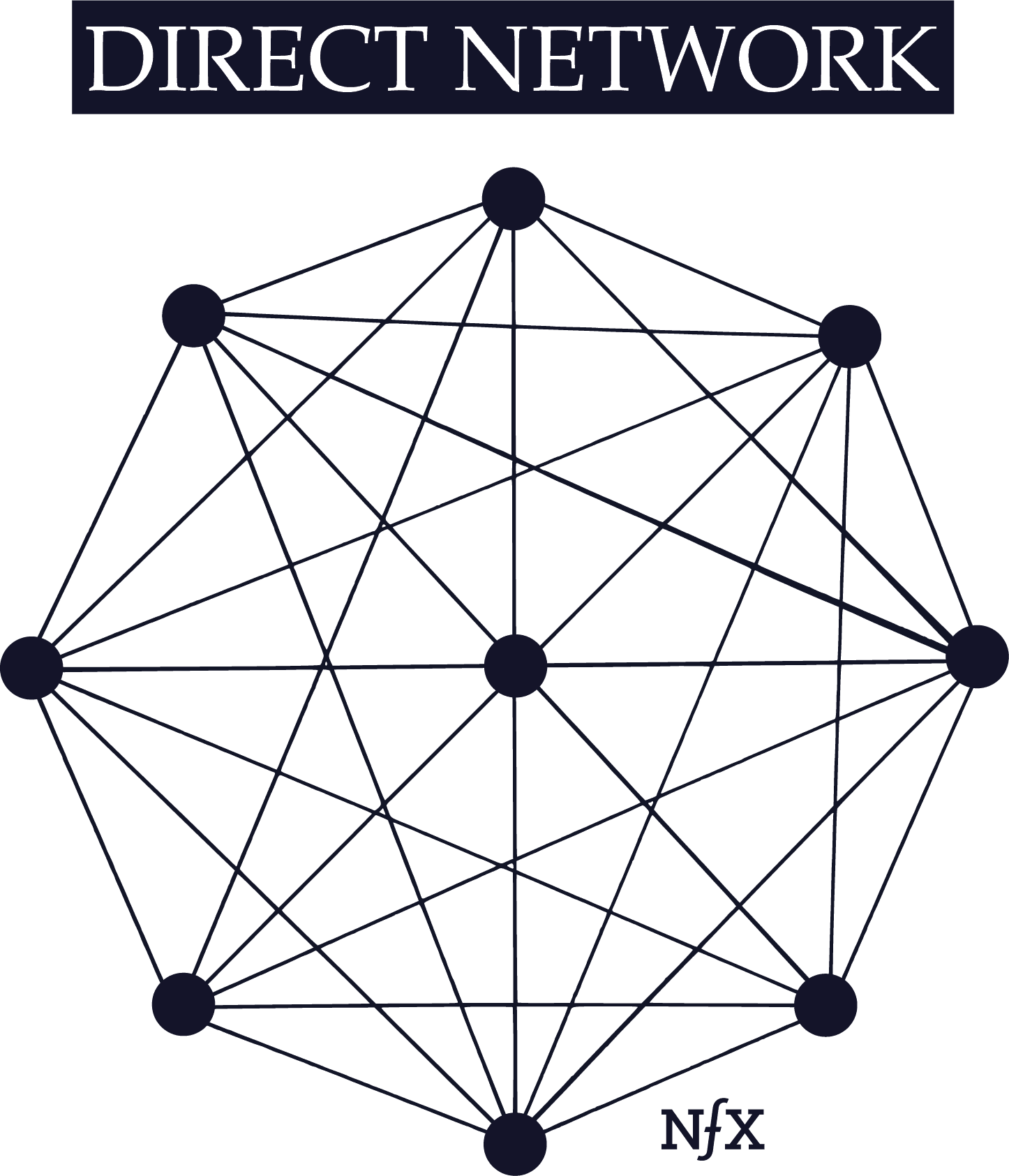

The 1st broad category of nfx, shown in blue on the Network Effects Map, are direct network effects. The strongest, simplest network effects are direct: increased usage of a product leads to a direct increase in the value of that product to its users.

The direct network effect was the first ever to be noticed, back in 1908. The Chairman of AT&T at the time, Theodore Vail, noticed how hard it was for other phone companies to compete with AT&T once they had more customers in a given locale. He pointed this out in his annual report to shareholders, writing that:

“Two exchange systems in the same community, cannot be… a permanency. No one has use for two telephone connections if he can reach all with whom he desires connection through one.”

Vail noticed that the value of AT&T was mostly based on their network, not their phone technology. At the time, it was a revolutionary insight. It showed that even if a new telephone was clearly superior to their old phone on a technical level, no one would want the new telephone if they couldn’t use it to call their friends and family.

In other words, a better product wouldn’t come close to making up the lost value of the network. A new entrant would have to achieve a comparable network effect to realistically produce a comparable amount of value for its users. In Vail’s words:

“A telephone — without a connection at the other end of the line — is not even a toy or a scientific instrument. It is one of the most useless things in the world. Its value depends on the connection with the other telephone— and increases with the number of connections.”

Below are the full texts of the relevant pages of that 1908 annual report. You’ll notice that Vail never uses the phrase “network effects”, although that’s the concept he’s describing. The term itself would only emerge later.

72 years after Vail first described direct network effects, the father of the Ethernet standard, Robert Metcalfe, took the concept a step further by proposing that the value of a network is proportional to the number of connected users squared (N^2). This is now known as Metcalfe’s Law.

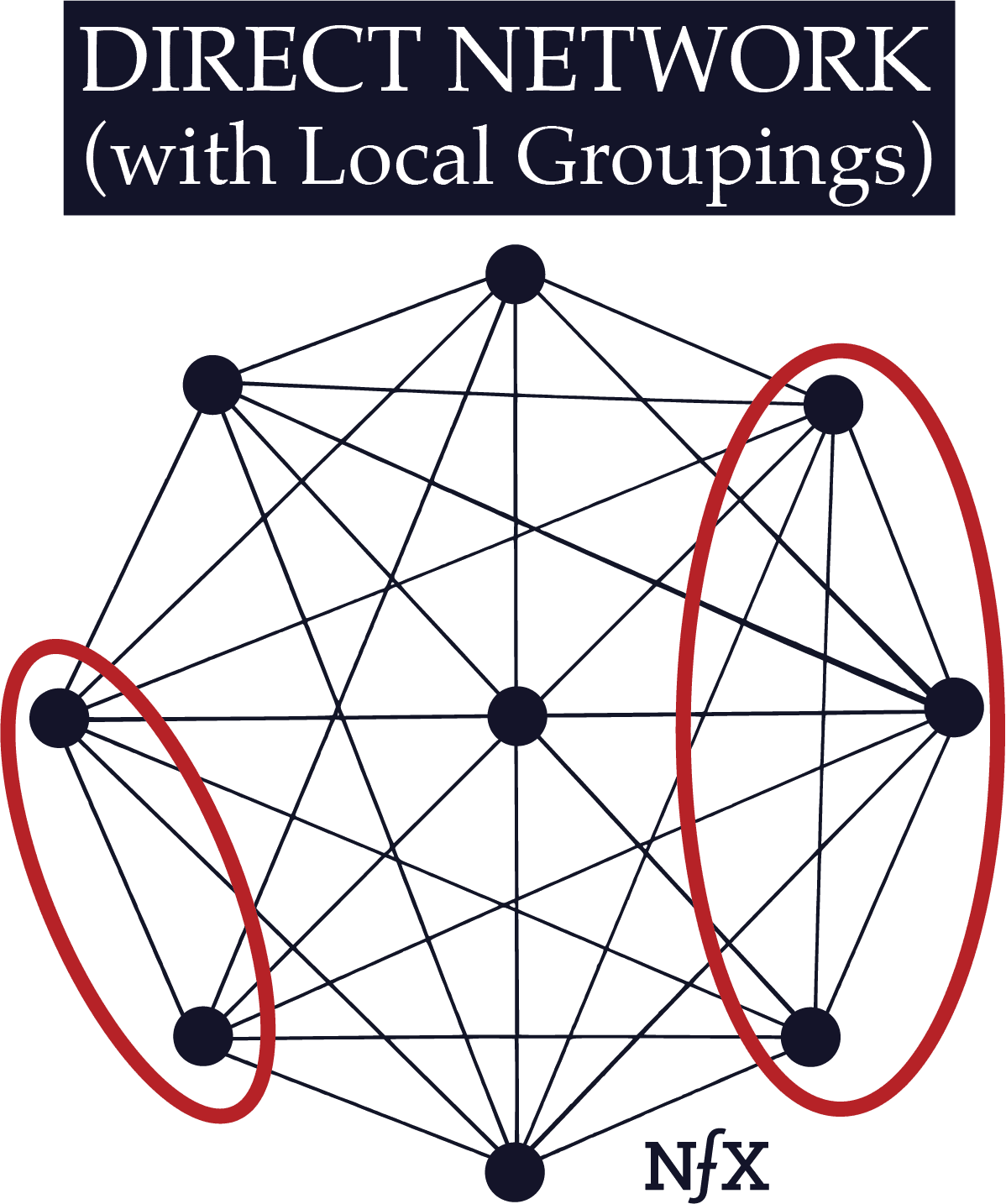

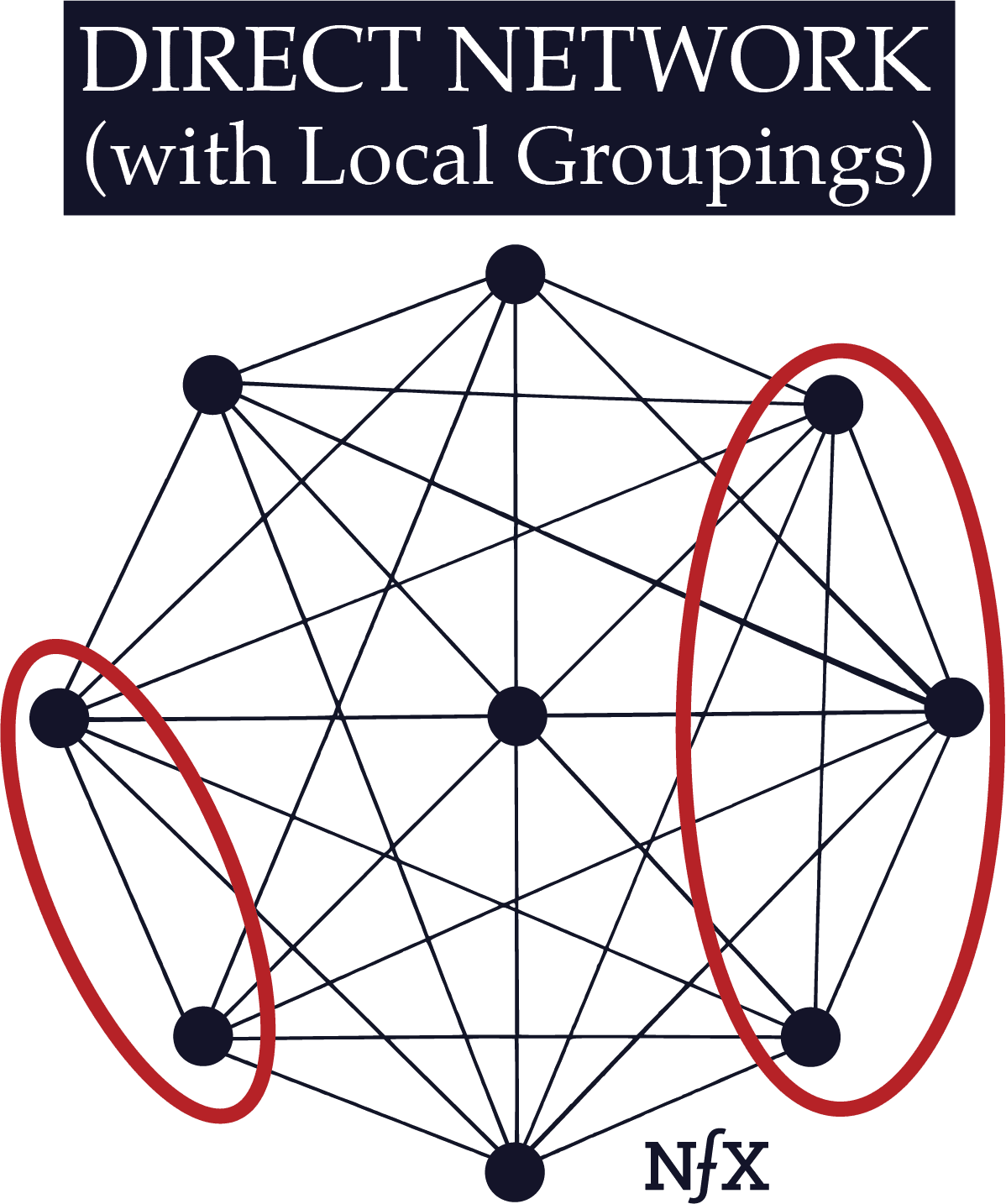

The diagram below illustrates the basic concept of a direct network as described by Metcalfe’s Law:

In 2001, an MIT computer scientist named David Reed went even further, declaring that Metcalfe’s law actually understated the value of a network. He pointed out that within a larger network, smaller, tighter networks can form: for example, the football team within a high school network; siblings within a family network; tennis players within a co-worker network.

Such connections, and the potential to join other subgroups, cement people’s commitment to the overall network in deeper ways that the overall size and connection density of the network would imply by themselves. Because of this, Reed believed that the true value of a network increases exponentially (2^N) in proportion to the number of users, much faster even than what Metcalfe’s Law described. We now call this Reed’s Law.

The details of these laws can be debated academically, but for Founders, they provide a tangible way to conceptualize an operational truism — nfx are powerful. They are a law of nature.

Within the broader category of direct nfx, there are many different types. So far, we’ve identified five: physical, protocol, personal utility, personal, and market network.

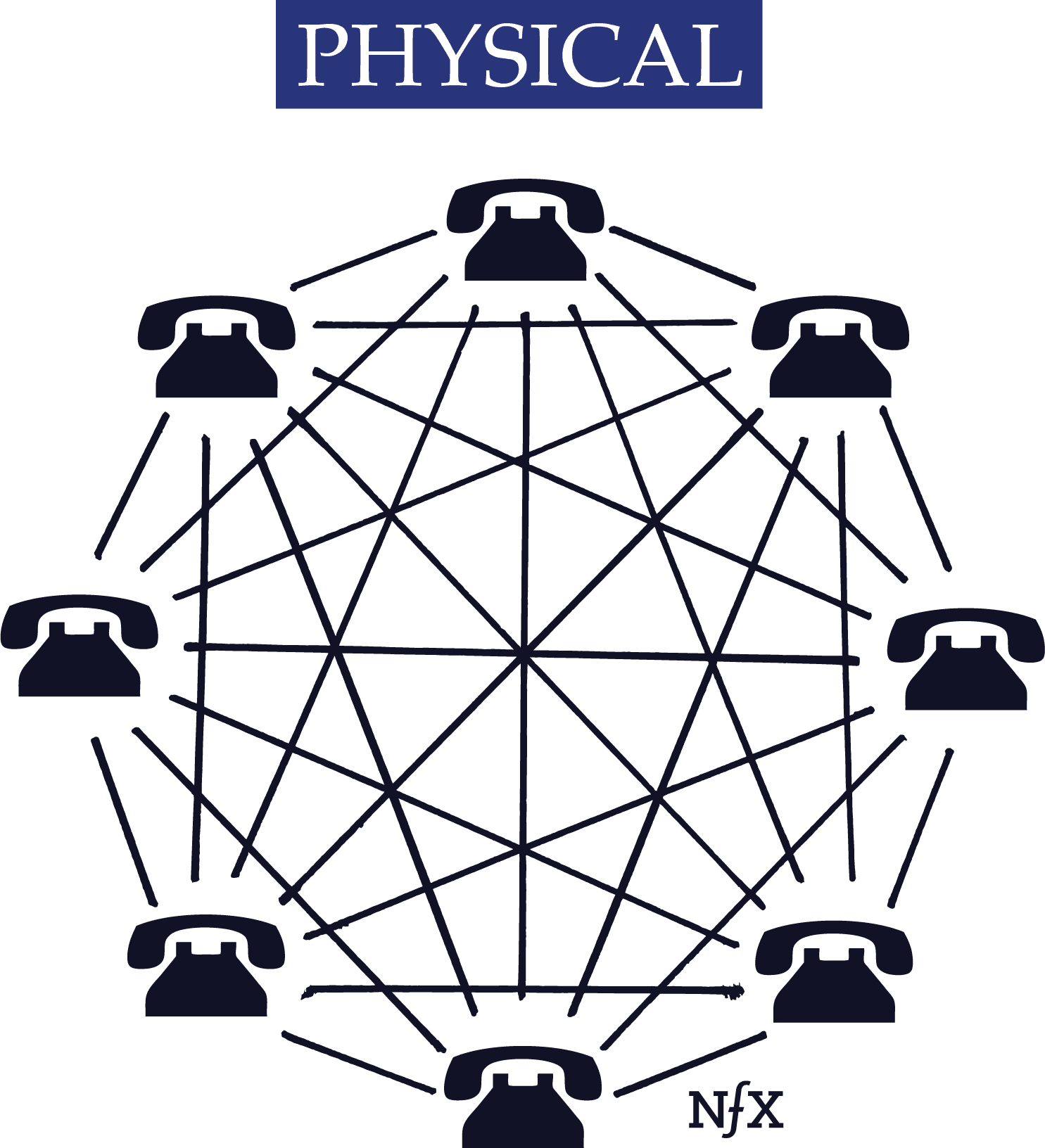

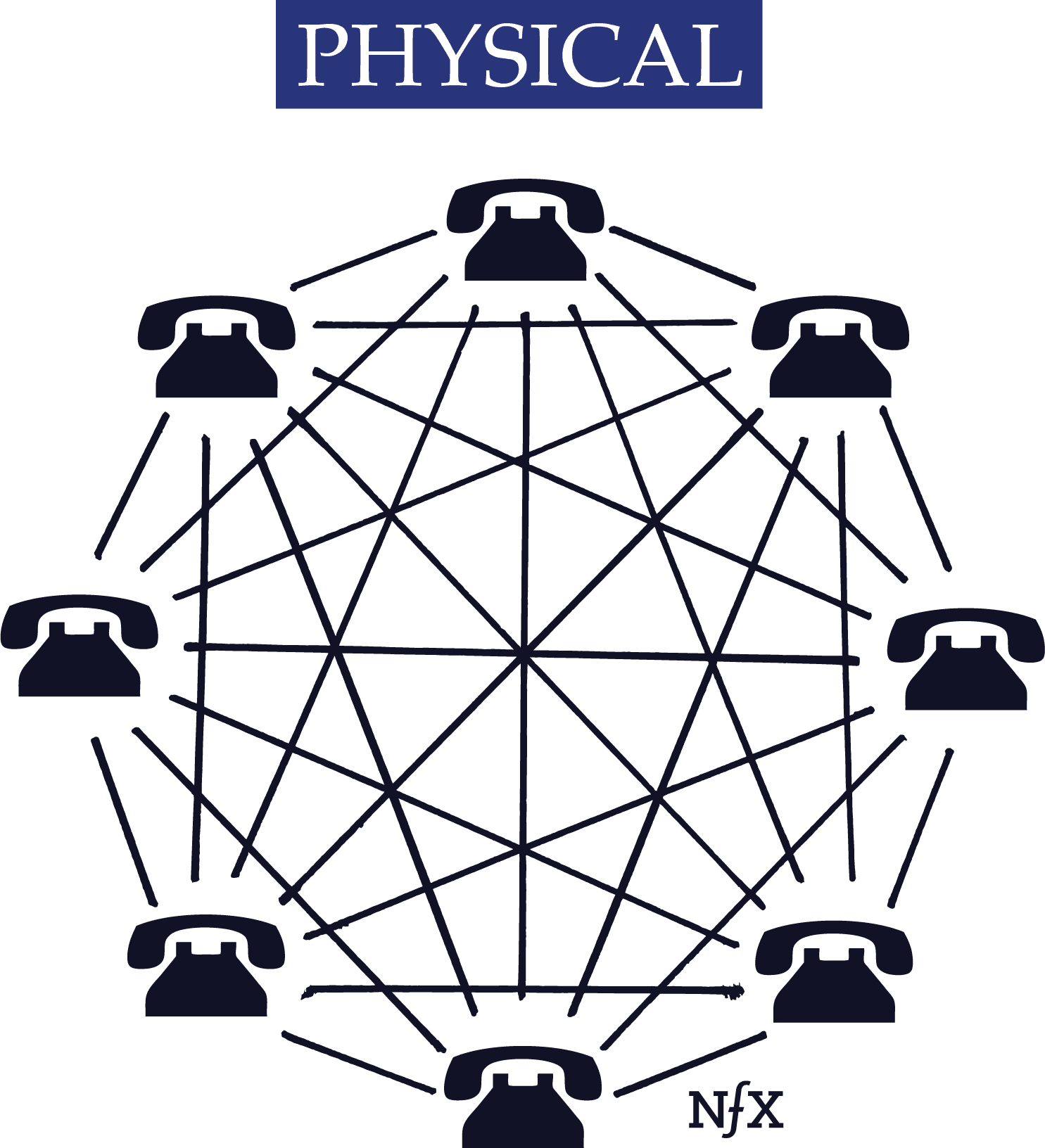

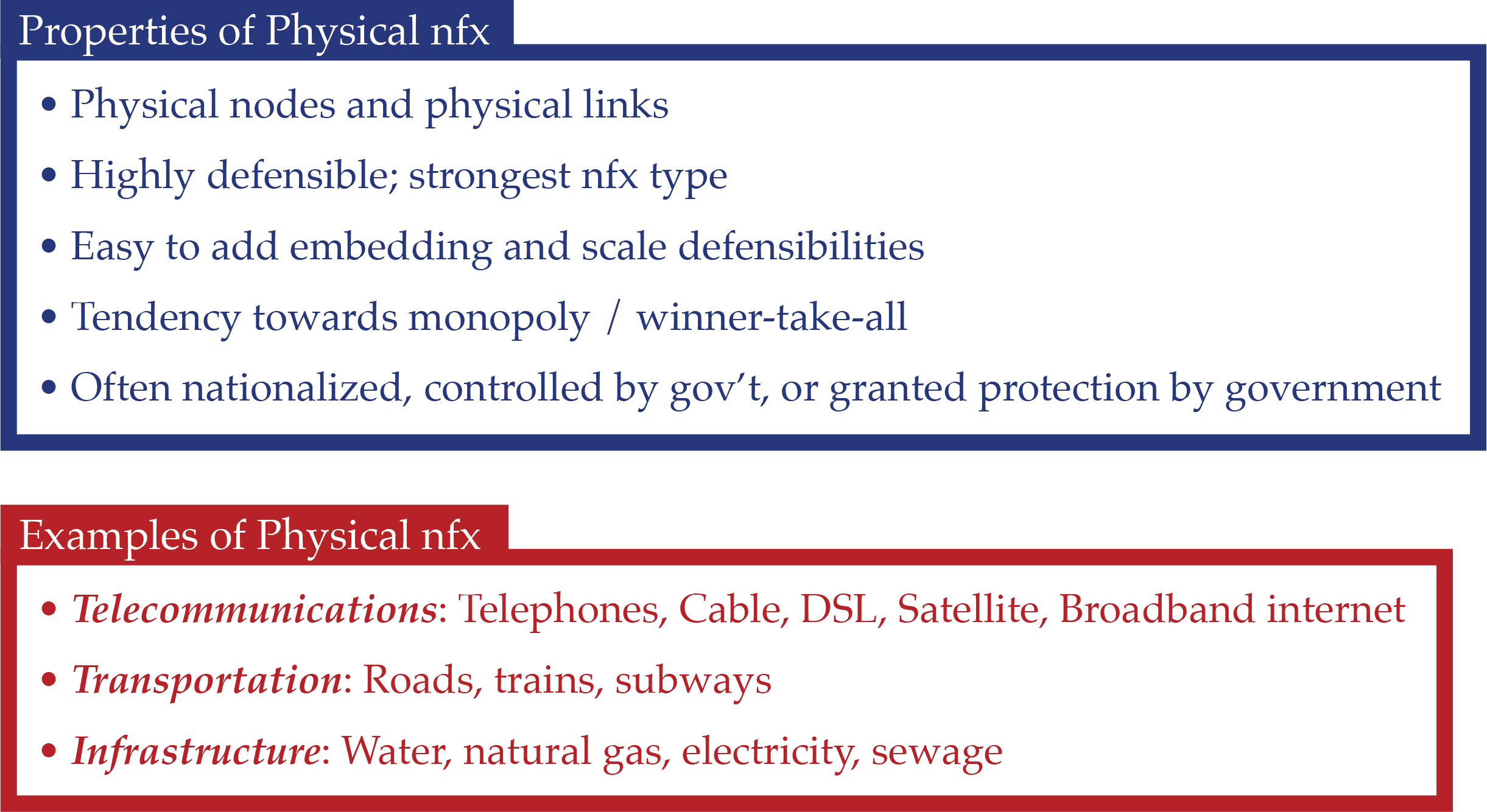

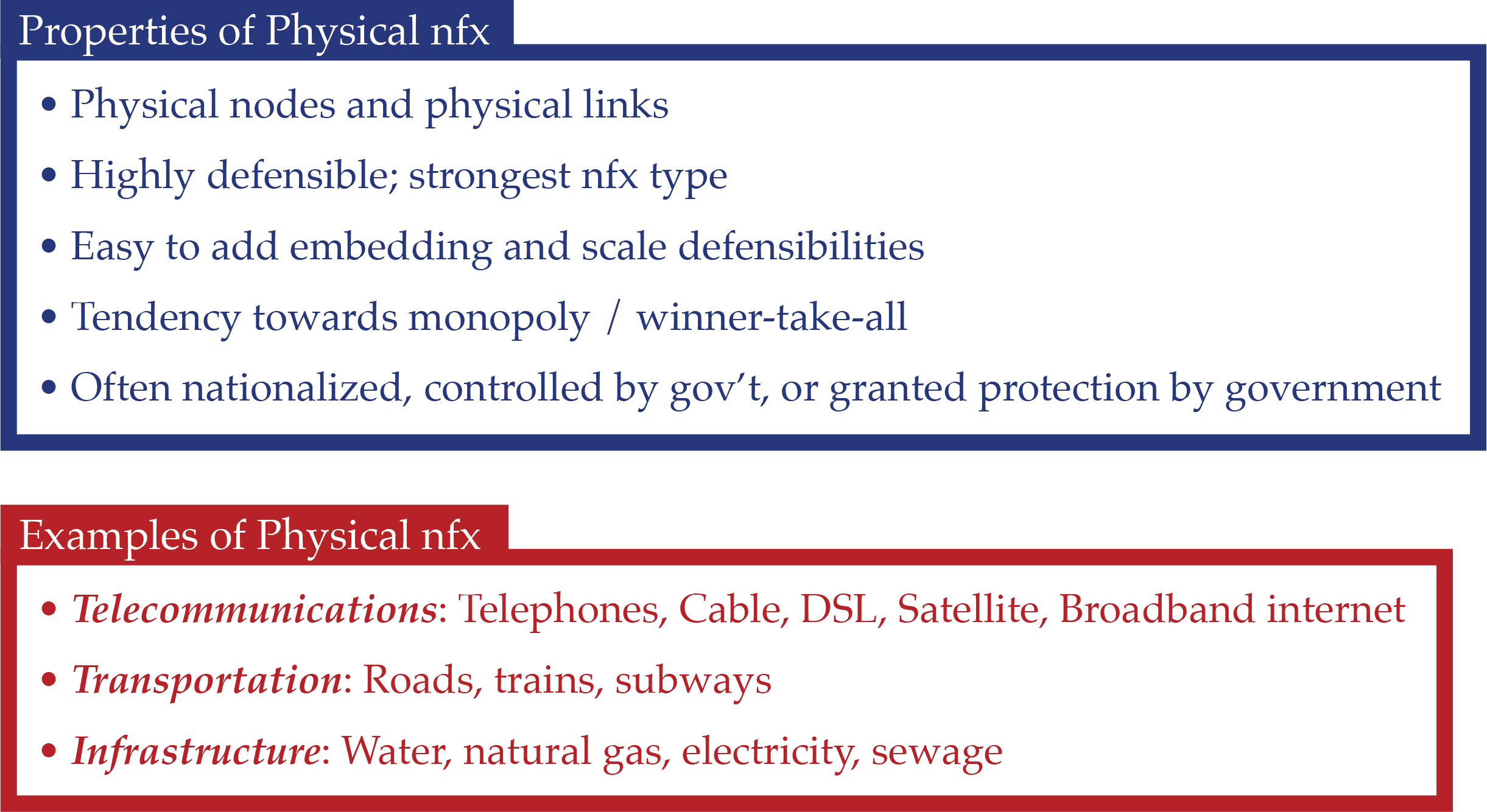

Physical (Direct)

Physical Direct nfx are direct network effects tied to physical nodes (e.g. telephones or cable boxes) and physical links (e.g. wires in the ground). This is the most defensible network effect type because it not only has a direct network effect, but it also lends itself to the addition of other defensibilities; namely, scale effects and embedding. Competing with a company that has Physical Network Effects requires a large upfront investment of capital and physical constraints.

Roads, trains, electricity, sewage, natural gas, cable and broadband internet are examples of businesses with physical direct network effects. In fact, most Physical Networks are utilities: winner-take-all markets that develop into monopolies and end up being nationalized.

The best evidence for the strong defensibility of Physical Networks is that so many of them have poor or substandard services, and yet continue to lead the market. Think of Comcast and Verizon. Why do they have the lowest customer satisfaction in the US? Because they can get away with it at no risk to their bottom line. No one can compete with them. Who could spend the money to lay all that cable? And with no competitors, frustrated customers have nowhere to turn.

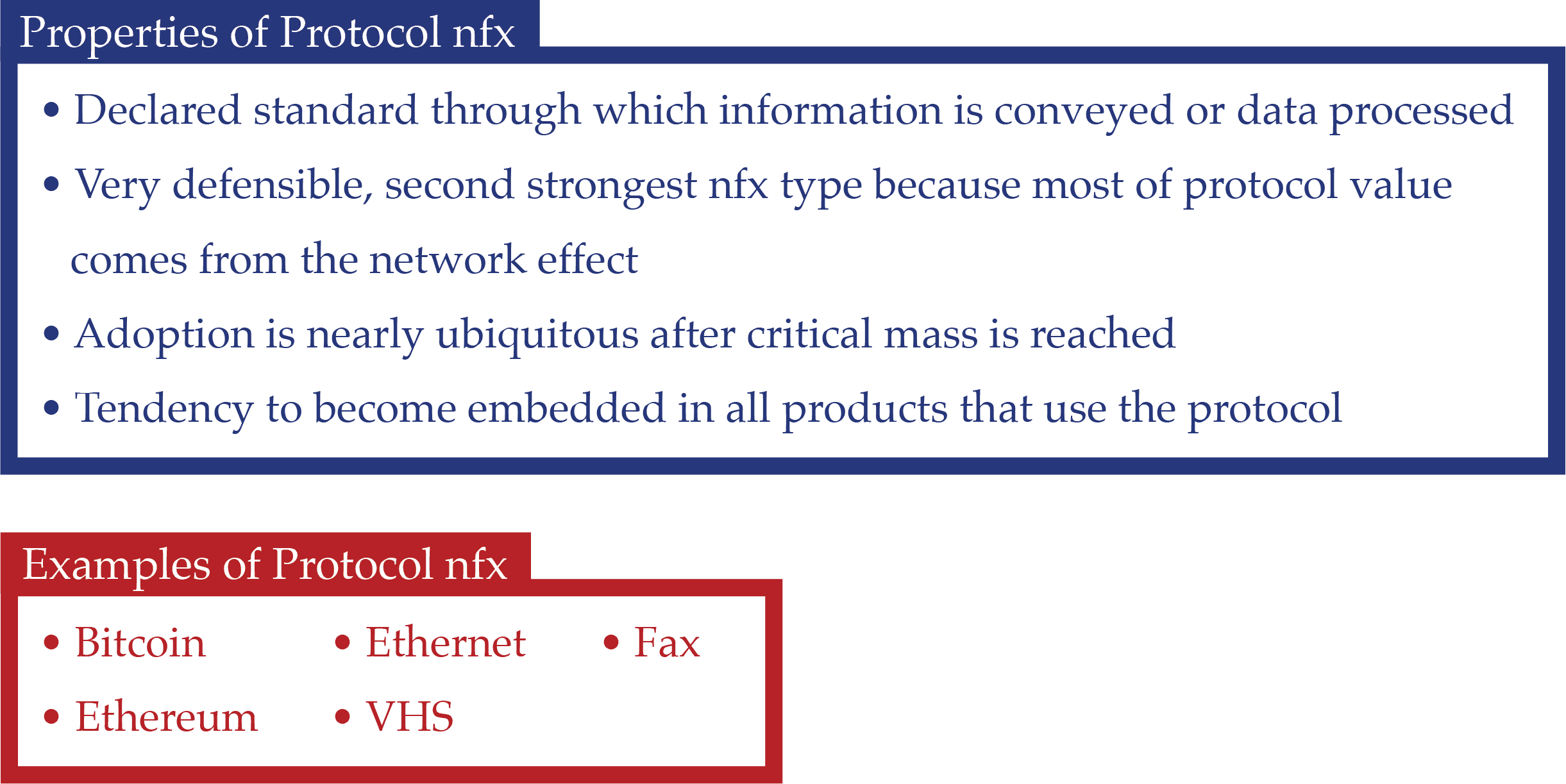

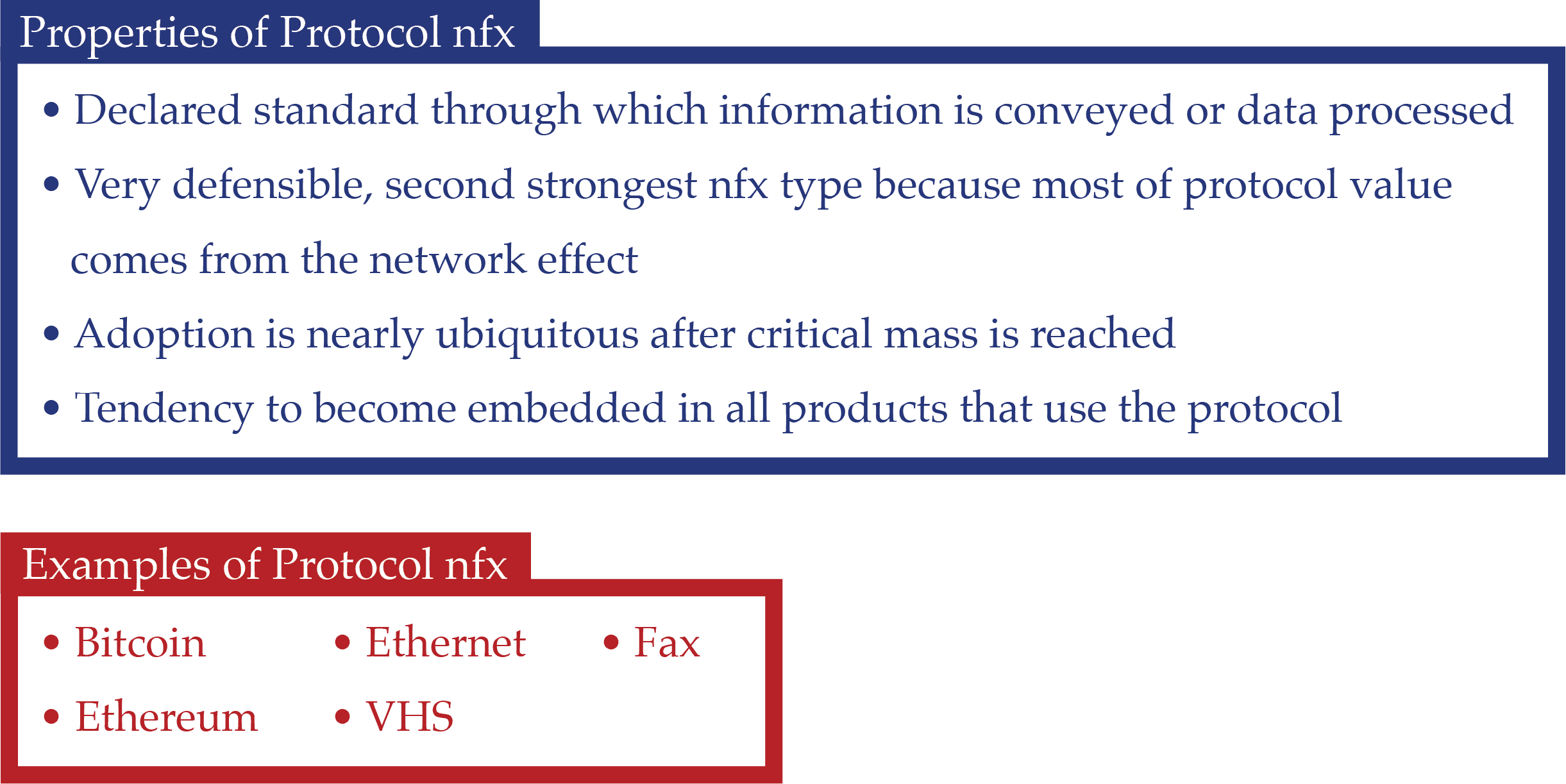

Protocol (Direct)

A Protocol Network Effect arises when a communications or computational standard is declared and all nodes and node creators can plug into the network using that protocol. Bitcoin and Ethereum are recent examples of protocol networks. The protocol setter can be either an individual company, a group of companies, or a panel.

Ethernet is another, more traditional, example of a Protocol Network Effect. When Robert Metcalfe founded 3Com, he persuaded DEC, Intel, and Xerox to adopt Ethernet as a standard protocol for local computer networks, with a standard speed of 10 megabits per second, 48-bit addresses, and a global 16-bit Ethertype-type field. Competing proprietary protocols existed, but as Ethernet pulled away and began to capture more and more market share, Ethernet-compatible products flooded the market. This increased the value of Ethernet at a compounding rate and decreased the value of competitors, regardless of their relative performance. Soon, ethernet ports became standard features of all modern computers.

Once a protocol has been adopted it is extremely difficult to replace. Note how the fax protocol is still in use, or the TCP/IP protocol (even though other, better protocols now exist for those purposes).

It’s also true that the protocol creator doesn’t typically capture most of the value from the development of the network, as they normally do with other direct nfx.

This distribution of value in a Protocol Network can be shifted if the protocol creator can maintain ownership of a significant percentage of the tokens within a token-enabled network, or maintain central control over addressing, identity, wallets, naming, or prioritization and still get the network to adopt the protocol.

The success of such an adoption strategy is often less about technology and more about marketing, social engineering, and choice of market niche. That’s why VHS beat Betamax, even though Betamax was arguably a better standard. It’s also part of why Bitcoin has taken off as a digital store of value, when it is costly to operate and less transactional than many other digital currencies.

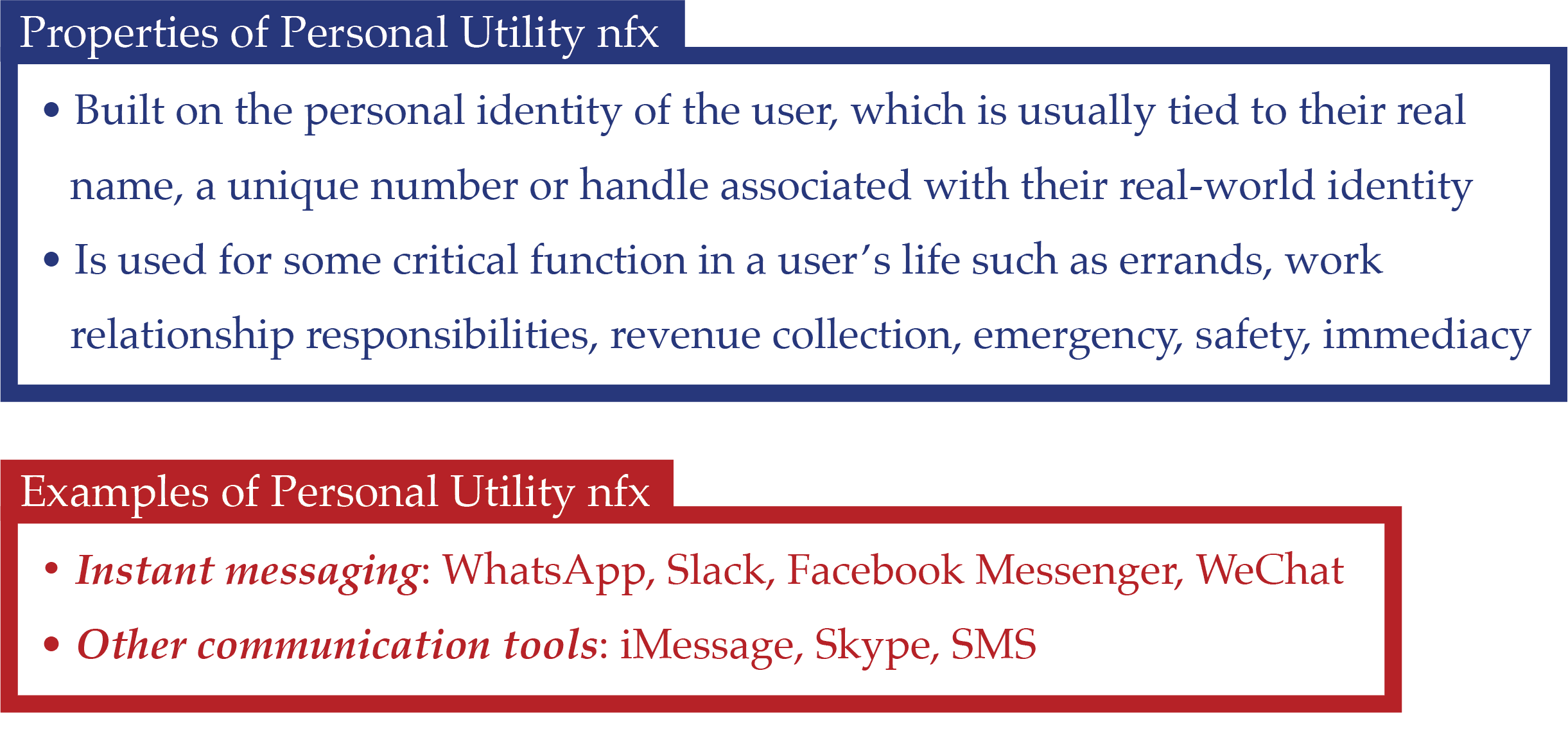

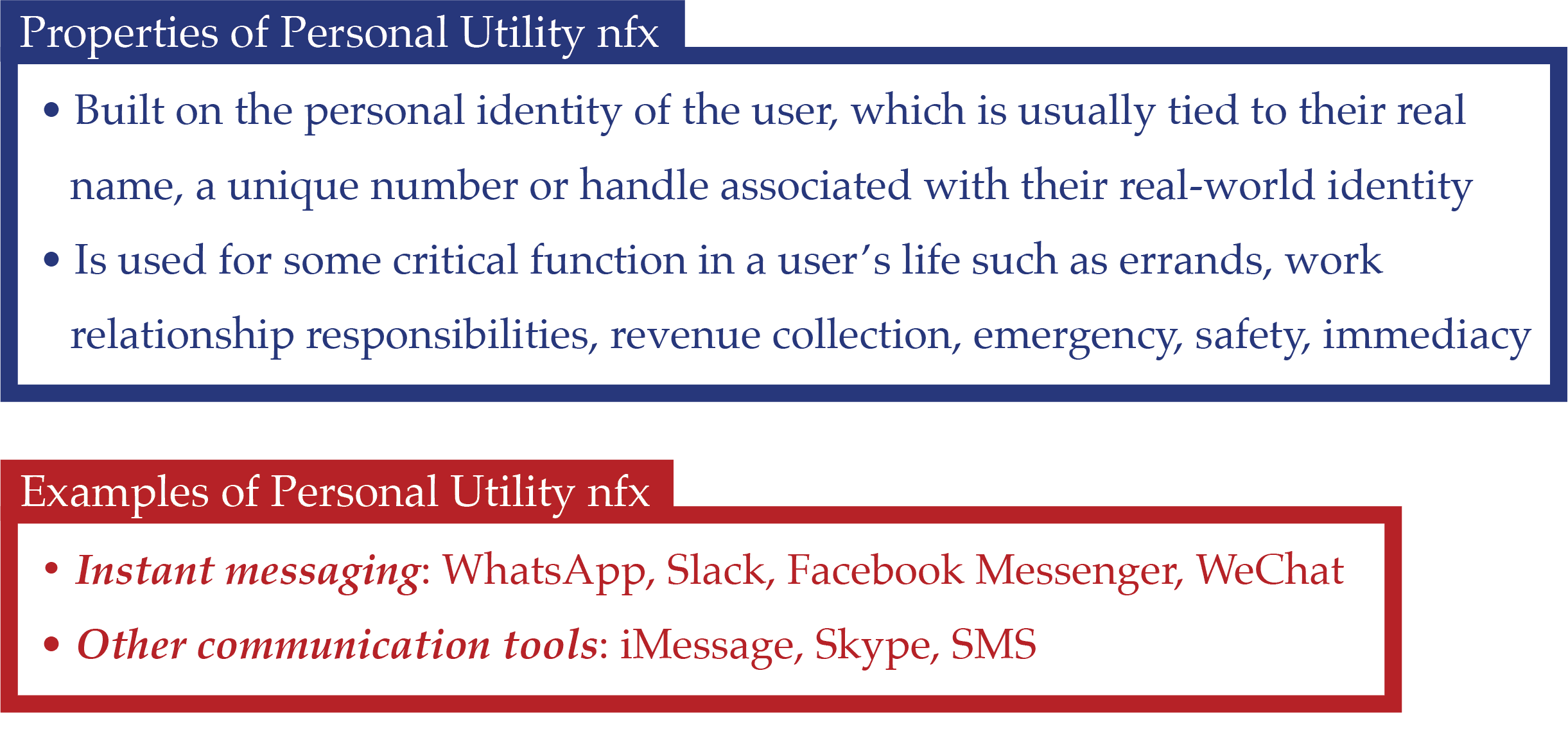

Personal Utility (Direct)

Personal Utility Networks have two distinguishing qualities. The first is that users’ personal identities are tied to the network in question, often with usernames tied to their real name as with Facebook Messenger. The second is that they are essential to the personal or professional lives of users on a daily basis.

People use Personal Utility Networks to communicate and interact with their own personal networks, so not being online or being part of the network has a steep downside. Opting out would become a significant impediment in daily life and could greatly harm people’s important personal or work relationships.

Personal (Direct)

Personal nfx are in play when a person’s identity or reputation is tied to a product. Often people on a Personal Network are influenced to join by people they might know in real life. If people you know from the real world are all using the same product to house their identity and reputation, there’s a large value add (to you) if you join the network yourself.

Personal Networks differ from Personal Utility Networks in two main ways. As explained in the previous section, Personal Utility Networks are typically used for things that need to get done. There is a substantial amount of practical utility to the user. Second, Personal Utility Networks are typically more for private communication, rather than public communication. Personal Networks are less vital. You can stop using them and your life won’t alter that much. Networks like Facebook or Twitter or Linkedin (when you’re not job hunting) aren’t usually essential for your day-to-day life.

However, Personal Networks are still very strong. You aren’t running to join another friend network or professional network now that you have FB and LinkedIn. It’s also true you could stop using both and be fine on a daily basis.

There’s a difference between sending an IM to your significant other telling them to not miss picking up your Mom at the airport and posting a status update about your Mom visiting on social media. In both cases, your own identity is tied to the communication and your audience is your personal connections. But one is a private need-to-have and the other is a public nice-to-have.

The Personal Network Effect arises from the interpersonal, tribal impulse to build connections with others. It’s this impulse that compels people to join and stick with a network (e.g. Facebook, LinkedIn, or a religion) because their friends/co-workers/neighbors are also part of that network. A user’s “social graph” in a personal network are usually closely mapped to their in-the-flesh relationships.

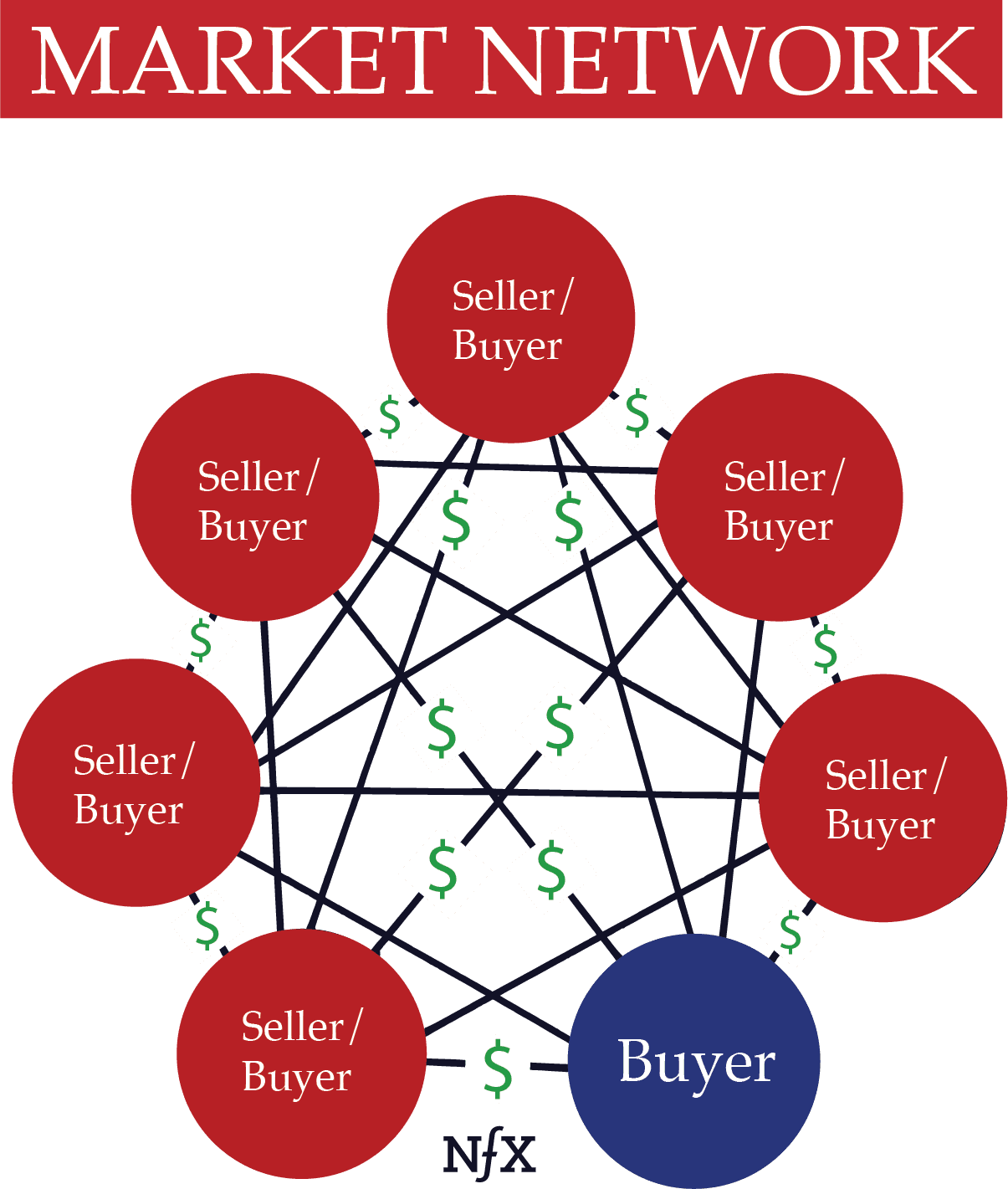

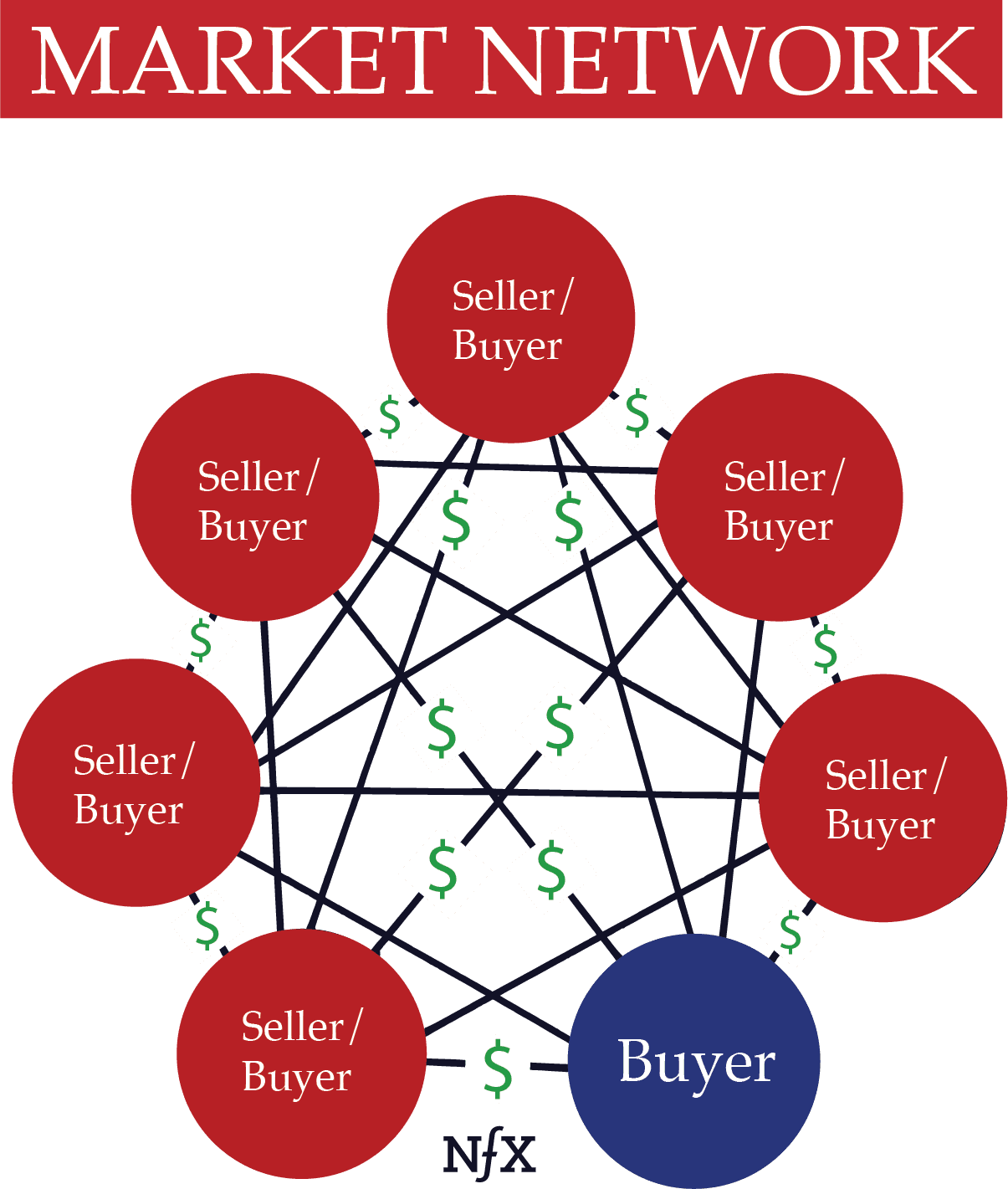

Market Networks (Direct)

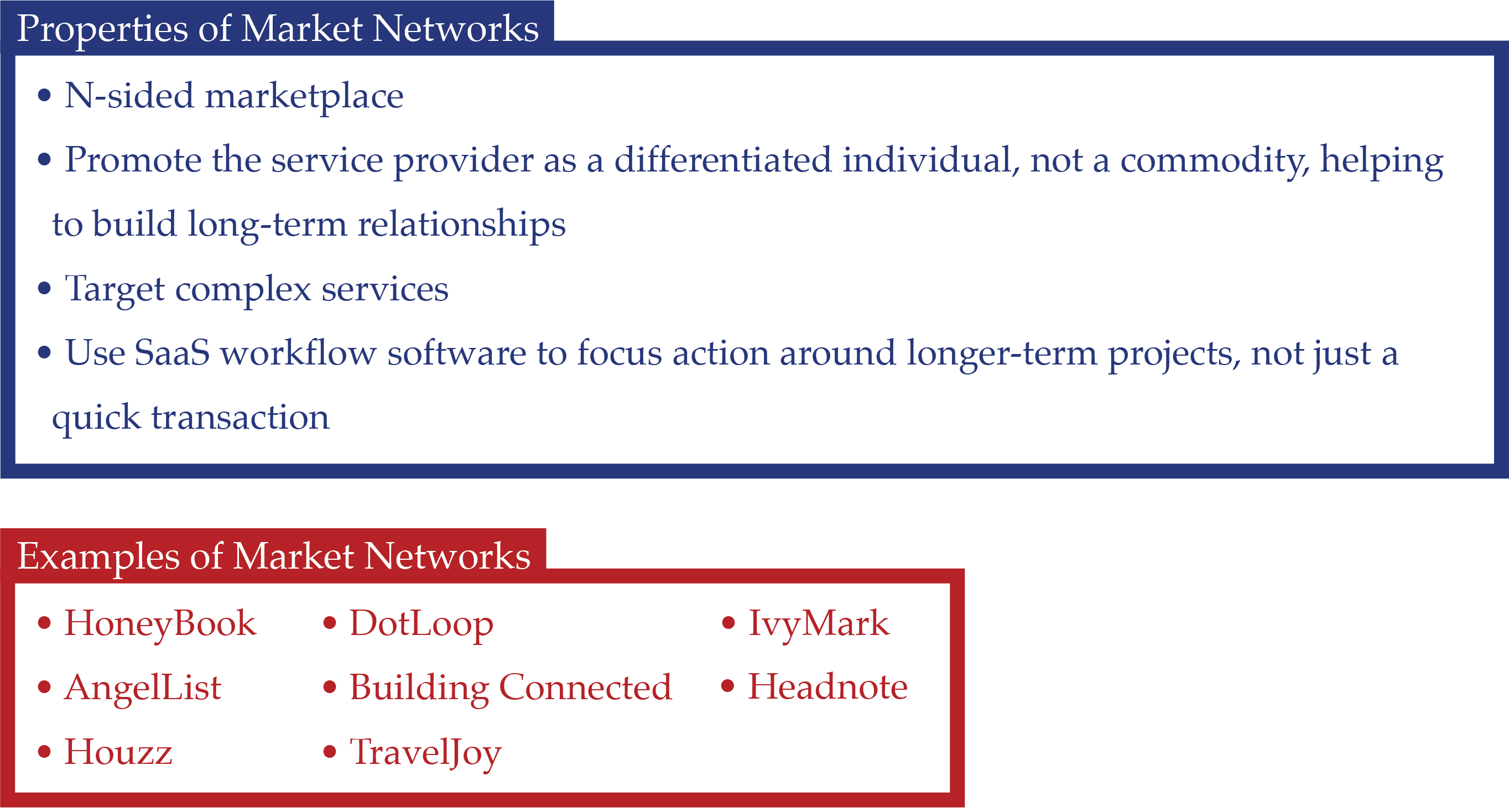

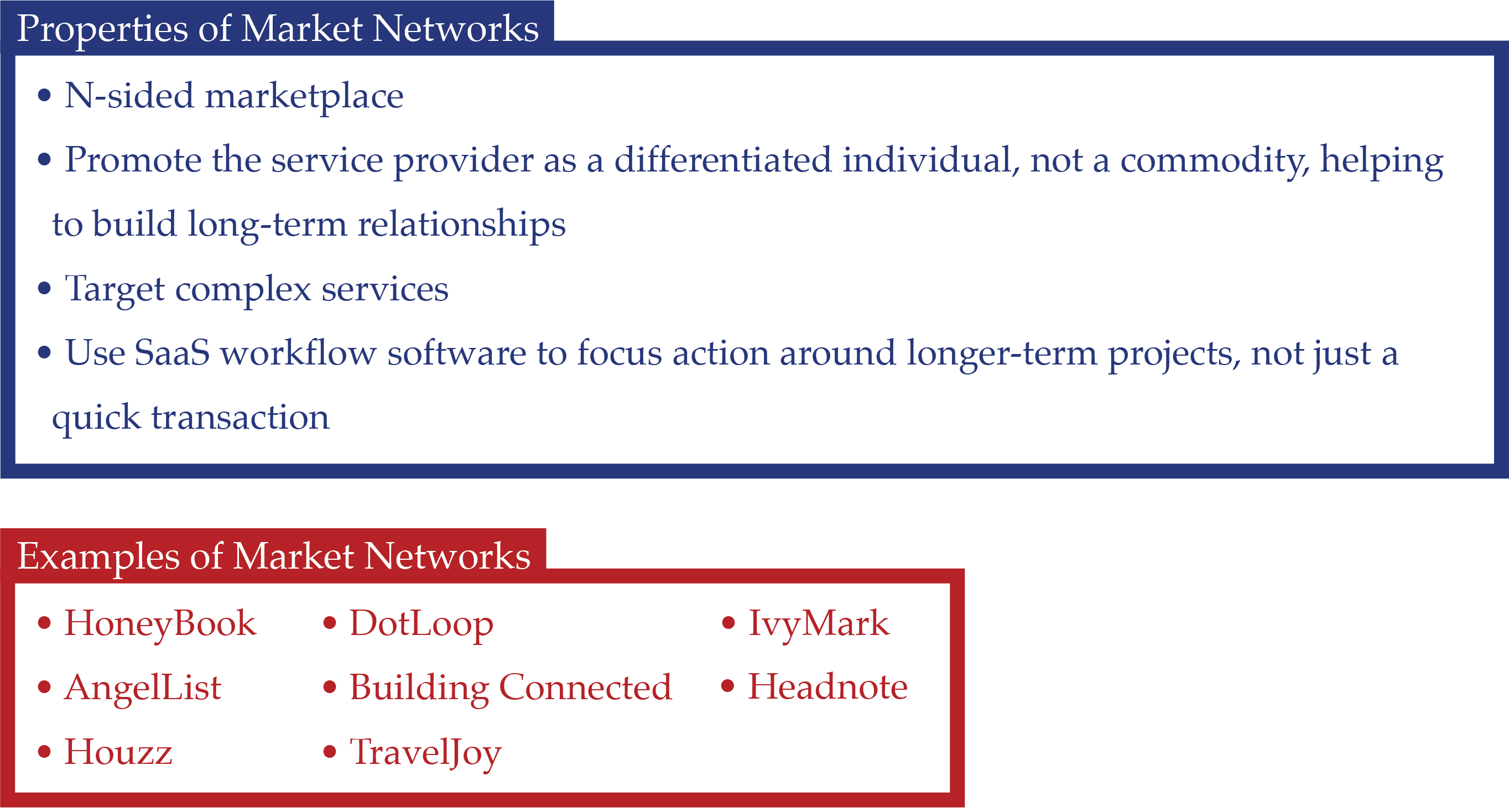

A Market Network combines the identity and communication aspects of a Personal Network with the transactions focus and purpose that typify a marketplace. Usually, Market Networks start by enhancing a network of professionals that already exists offline. We consider Market Networks to be a form of direct network effects because the relationship between nodes is direct, as shown below:

Market Networks are very different from 2-Sided Marketplaces, although the two are often confused. Most people think companies like HoneyBook and Houzz are marketplaces, but they’re not. In reality, they’re Market Networks, which combine the main elements of both Personal Direct Networks and 2-Sided Marketplaces, as well as being many-sided as opposed to 2-sided — often with the addition of a dedicated SaaS workflow software. For a detailed description of Market Networks, see our article on the subject.

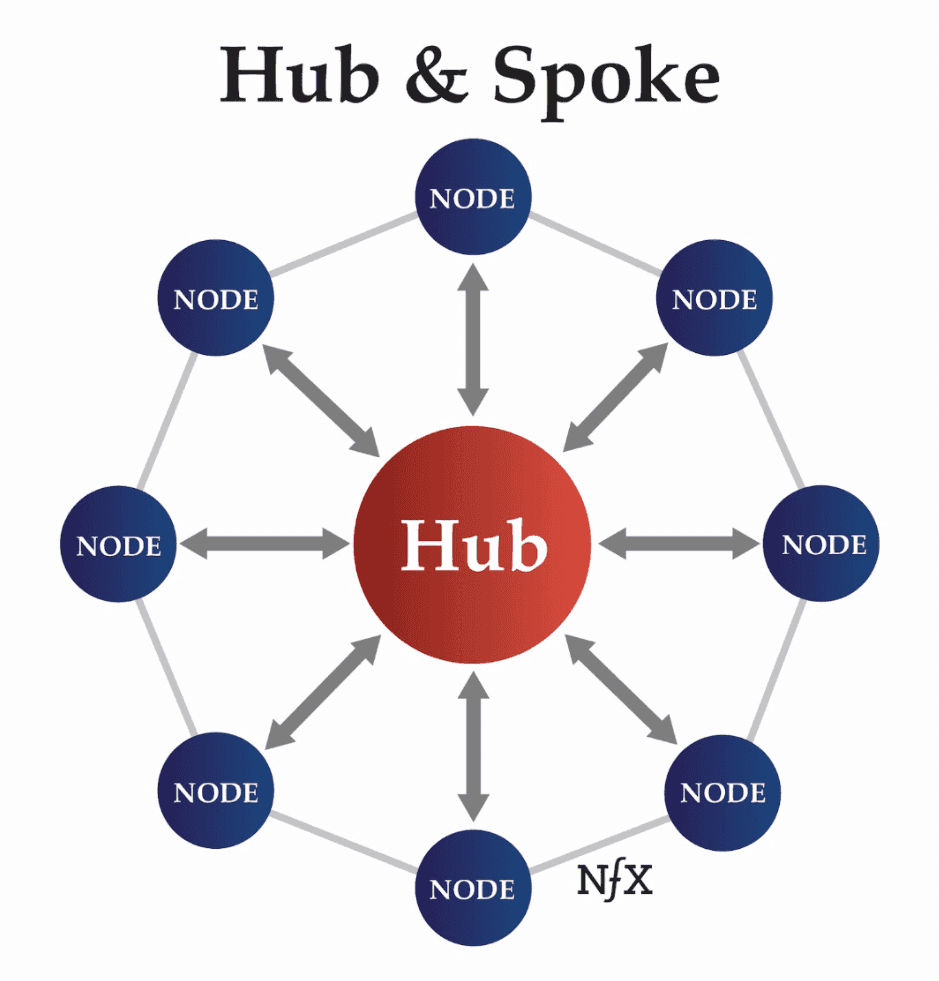

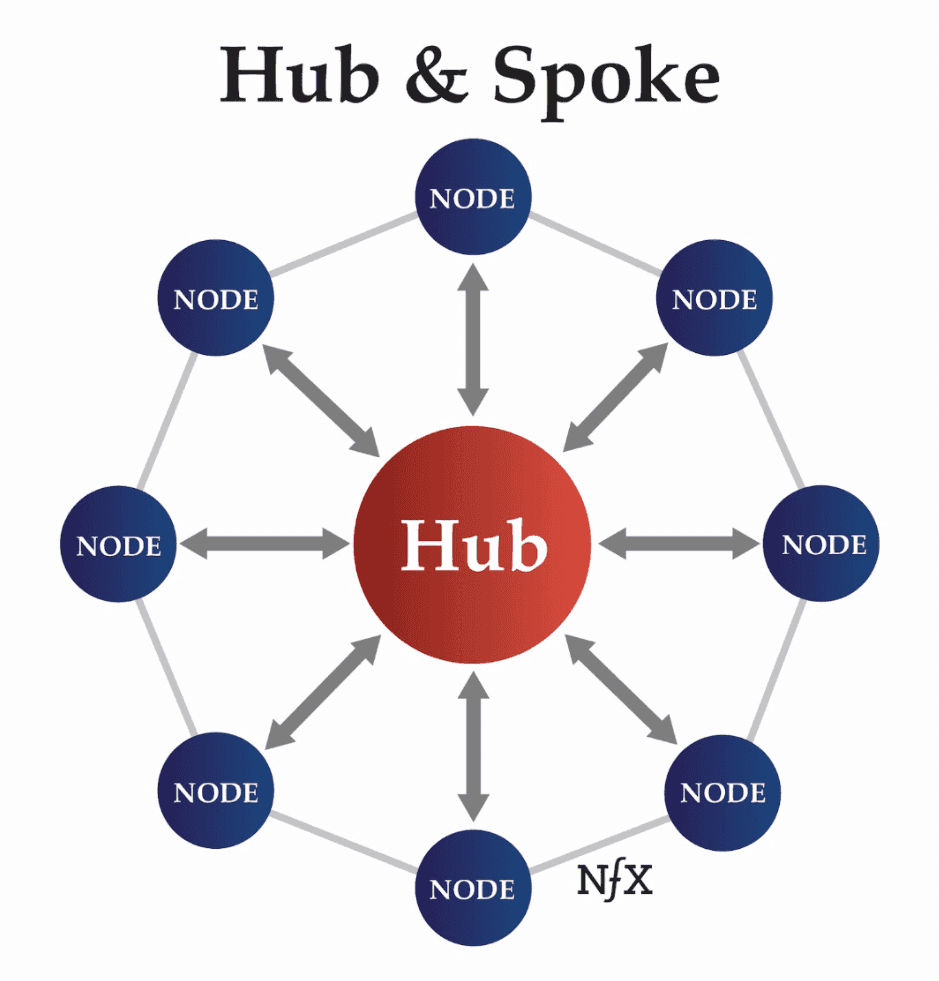

Hub-and-Spoke

A Hub-and-Spoke network effect occurs when equal nodes submit content or goods to a central Hub. Then the Hub “pushes” a chosen few pieces out to all – or nearly all – of the nodes.

That elevation of the pushed content drives tremendous attention and value to those few lucky nodes, asymmetrically benefiting them relative to others in the network. In other words, it directs a power law within the system.

To a node, that process of selection feels like a lottery, and the benefits of selection are sudden and extreme compared to other direct networks like FB, Twitter, Snap. Because of that potential positive impact, nodes are incentivized to work hard to produce something of extreme quality hoping to be noticed, thereby adding a lot of value to the network in a short amount of time.

To the Hub, that selection is an algorithmic internal process.

As shown above, the network structure looks like a hub and spoke, thus the name. But unlike an old hub-and spoke-network like a TV or radio broadcasting network, which grows in value only by Sarnoff’s Law, this network grows with the power of Metcalf’s Law because it 1) harnesses the many nodes to create the content/products rather than take that burden itself, and 2) allows the nodes to connect with each other like a typical social network, driving more interactions and value.

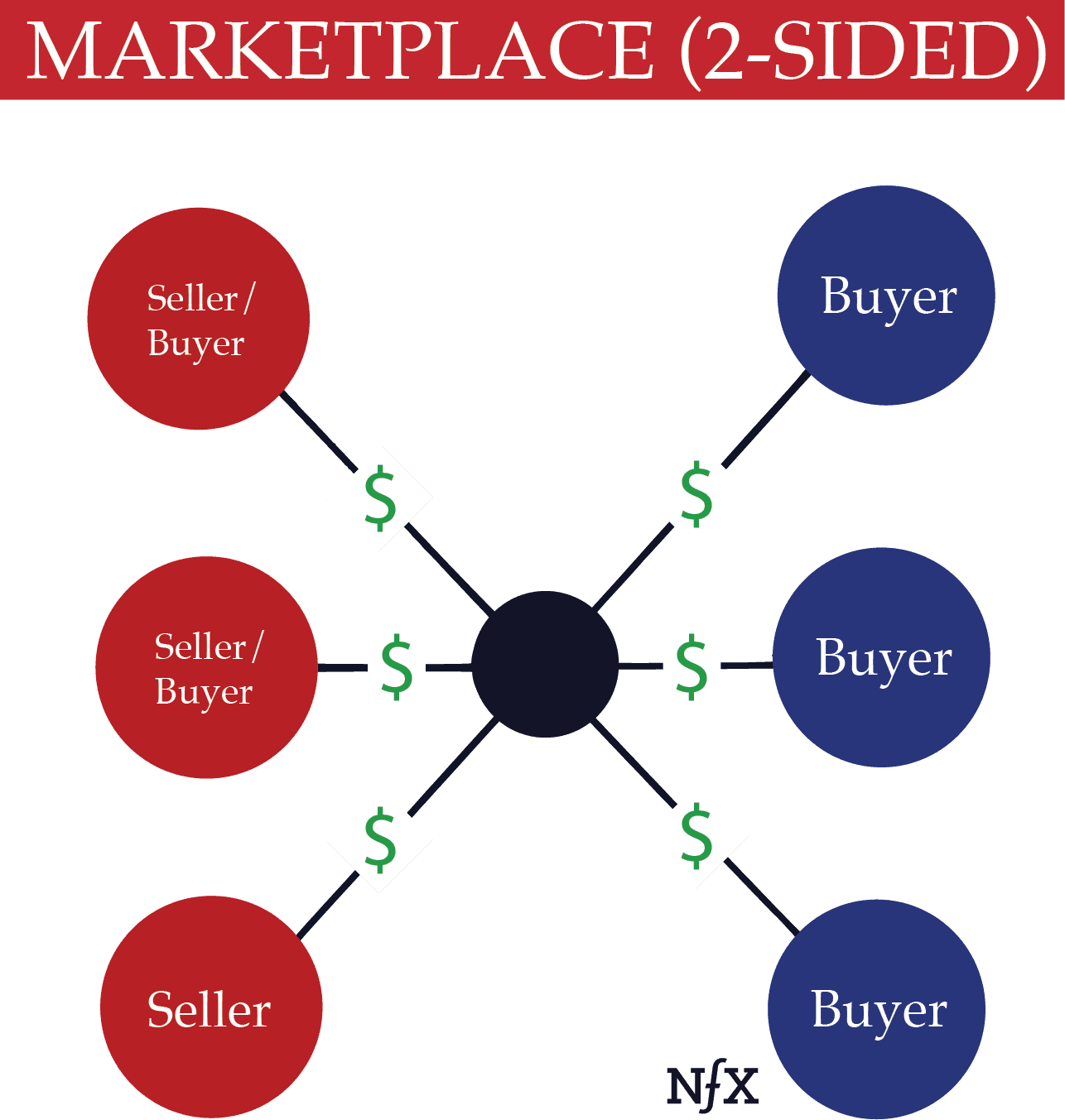

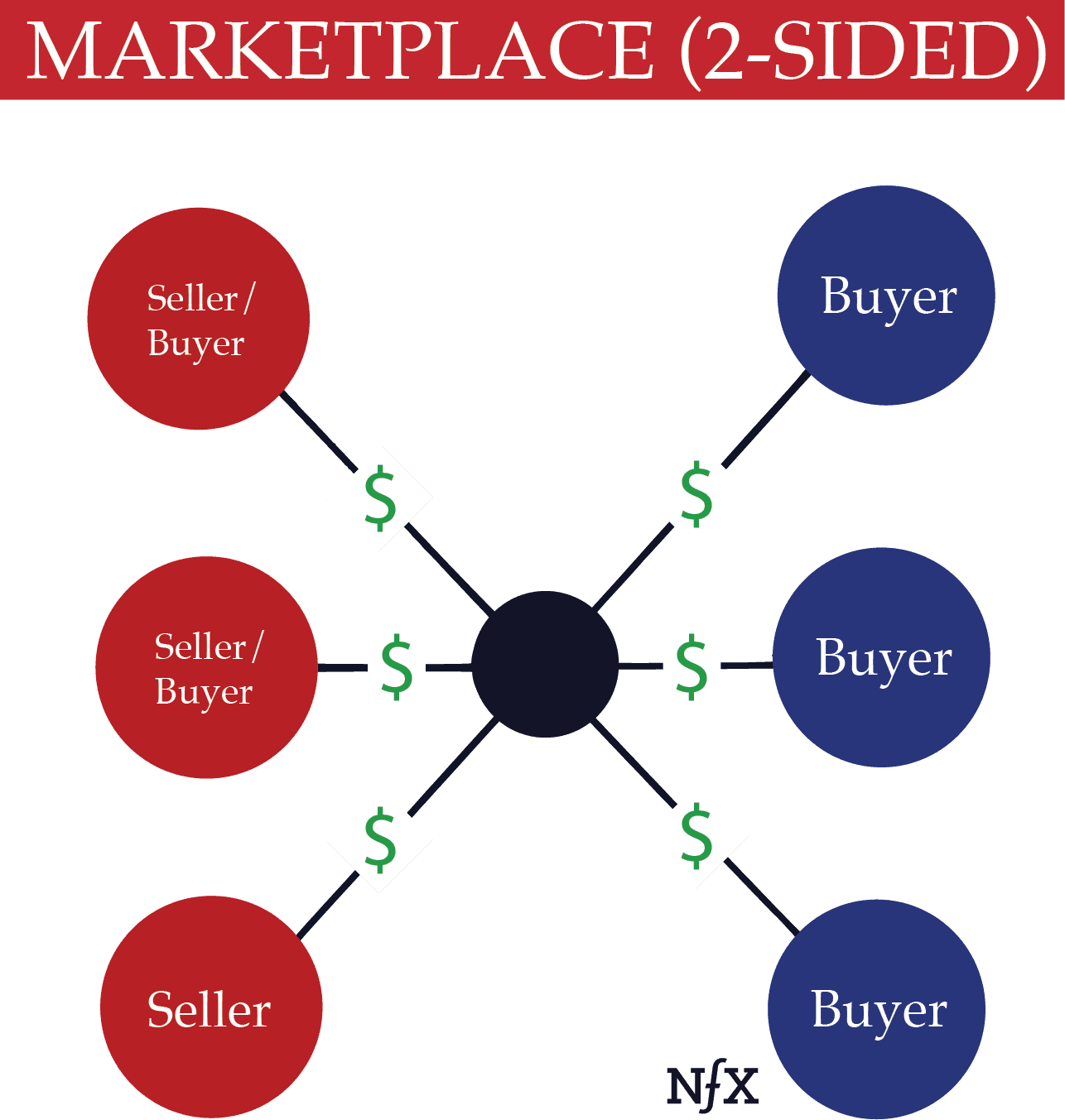

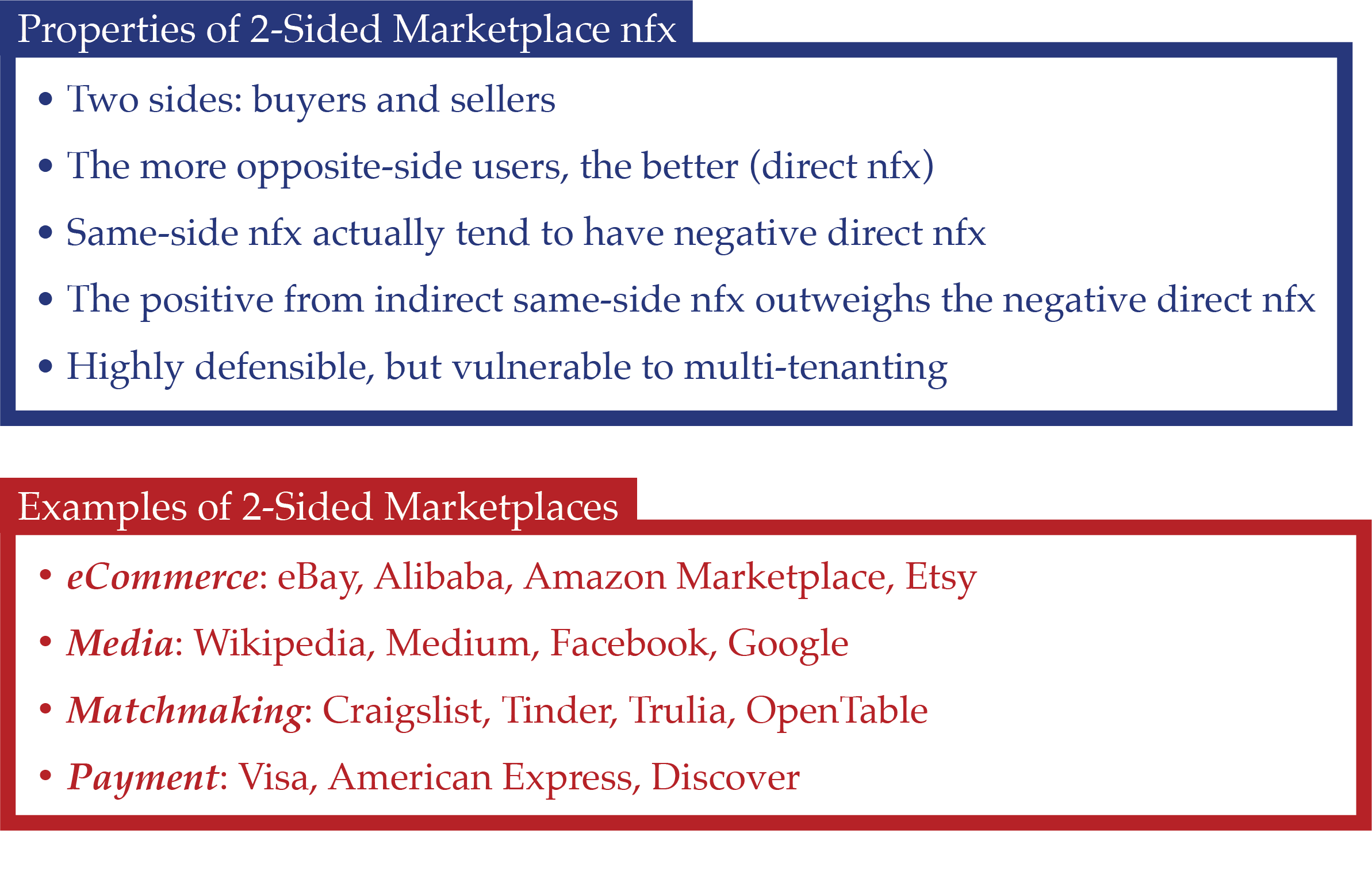

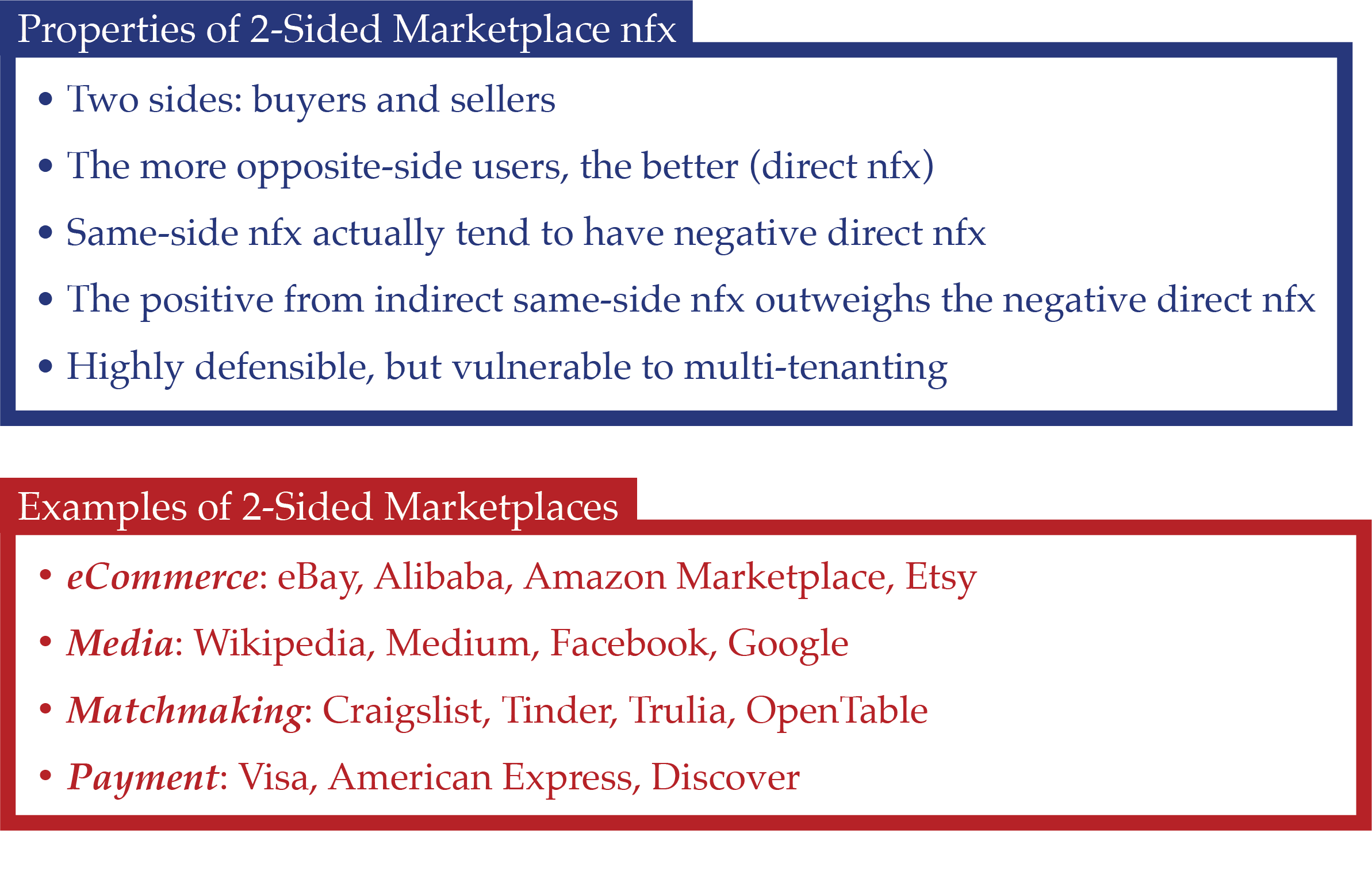

2-Sided Network Effects

The 2nd broad category of nfx, 2-sided nfx, are often called “indirect network effects” in academic literature. However, we think this is misleading since 2-sided networks can involve both direct and indirect network effects.

Instead, the real distinguishing characteristic of a 2-sided network is that there are two different classes of users: supply-side and demand-side users. They each come to the network for different reasons, and they produce complementary value for the other side.

It’s relatively simple to see how each new supply-side user in a 2-sided network directly increases the value of the network for demand-side users, and vice versa. For instance, each new seller (supply-side user) on a 2-sided marketplace like eBay directly adds value for buyers (demand-side users) by increasing the supply and variety of goods. Likewise, every additional buyer is a new potential customer for sellers.

It’s more complicated when we look at how same-side users interact. Most of the time, users on the same side subtract value directly from each other. For instance, core sellers on eBay create more competition for other sellers. More Uber passengers at rush hour mean surge pricing. Both are examples of negative direct same-side nfx.

At the same time, indirect benefits usually end up outweighing those direct negatives. The fact that there are many sellers in the marketplace attracts the buyers to be there in the first place. And that is ultimately more valuable for the sellers, even if they have to sell at more efficient prices. The same is typically true on the buyer side.

This positive indirect effect of 2-sided networks has been discovered and rediscovered throughout history. In the late 1600s, for instance, all the violin makers moved to work and sell their violins on the same street in Venice. Although the proximity of the competing violin vendors drove down prices, it was worth it for the suppliers as a group because it was more important for them that people in the market for violins would take their business to that particular street, not some other street in some other city.

In the 1980s, malls in the US discovered the same thing. By aggregating competing sellers in one location, sellers were able to get much more business than others that were spread out, making it practical for competitors to co-locate.

What we’re seeing now with the preponderance of online 2-Sided Networks is the same effect, but with software instead of a physical location.

Note also that there are cases of positive direct same-side nfx, where more same-side users add value to each other. These are very powerful and should be sought out as you design your products. This is the case with Microsoft OS, one of the most enduring 2-sided nfx products the world has seen. Microsoft OS users benefit other users because they can share files more easily with co-workers and friends. This is a positive direct same-side network effect (adding to the core 2-sided network effect) that is typical of operating systems.

At present, we’ve identified three types of 2-sided network effects: marketplace, platform, and asymptotic.

Marketplace (2-Sided)

The two sides of a marketplace are buyers and sellers. Successful 2-Sided Marketplaces like Craigslist are very difficult to disrupt. To break them apart you must have a better value proposition for both parties simultaneously, or else nobody moves. Customers are there for the vendors, and vendors are there for the customers. One won’t leave without the other.

With a 2-Sided Marketplace, the network is what provides the majority of the value, not the app or website itself — which explains why marketplaces products like eBay and Craigslist can afford to look essentially unchanged after 16 years.

But there’s one big weakness in marketplace defensibility, which arises from the phenomenon of “multi-tenanting”. People can sell their products on eBay and Etsy at the same time. Landlords can list their apartments on Craigslist and Trulia, and renters can check both marketplaces to browse for inventory. It’s hard to lock out competition from new entrants when the members of your network can use competing networks as well as yours without a penalty. The goal of the marketplace is thus to design the product/service to add so much value or “lock-in”, particularly on the supply side, that members won’t be tempted to multi-tenant.

Further, marketplaces come in more shapes than we might think. Media companies, for example, are essentially 2-Sided Marketplaces. Audiences (supply) come to the marketplace and sell their attention for content experiences. Advertisers (demand) on the other side buy the attention of the audiences. The greater the audience of a media company, the more likely advertisers will be to spend any money on that media company at all, and then the more money they will be willing to pay the company when they do. “Sellers” i.e. readers/viewers have a direct positive network effect for “buyers”, i.e. advertisers. And vice versa, because (in theory) more advertising revenue gives a media company the resources to produce better content.

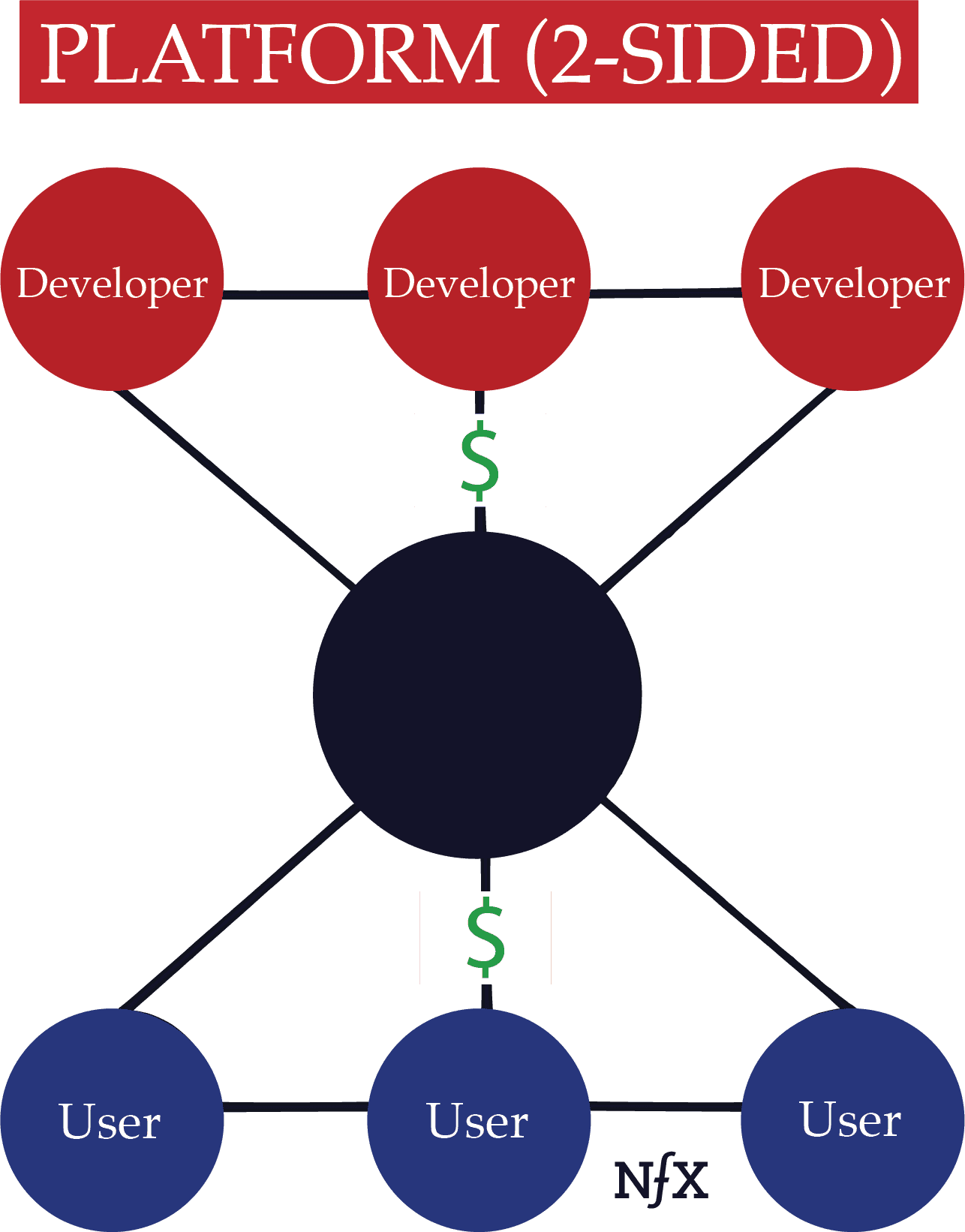

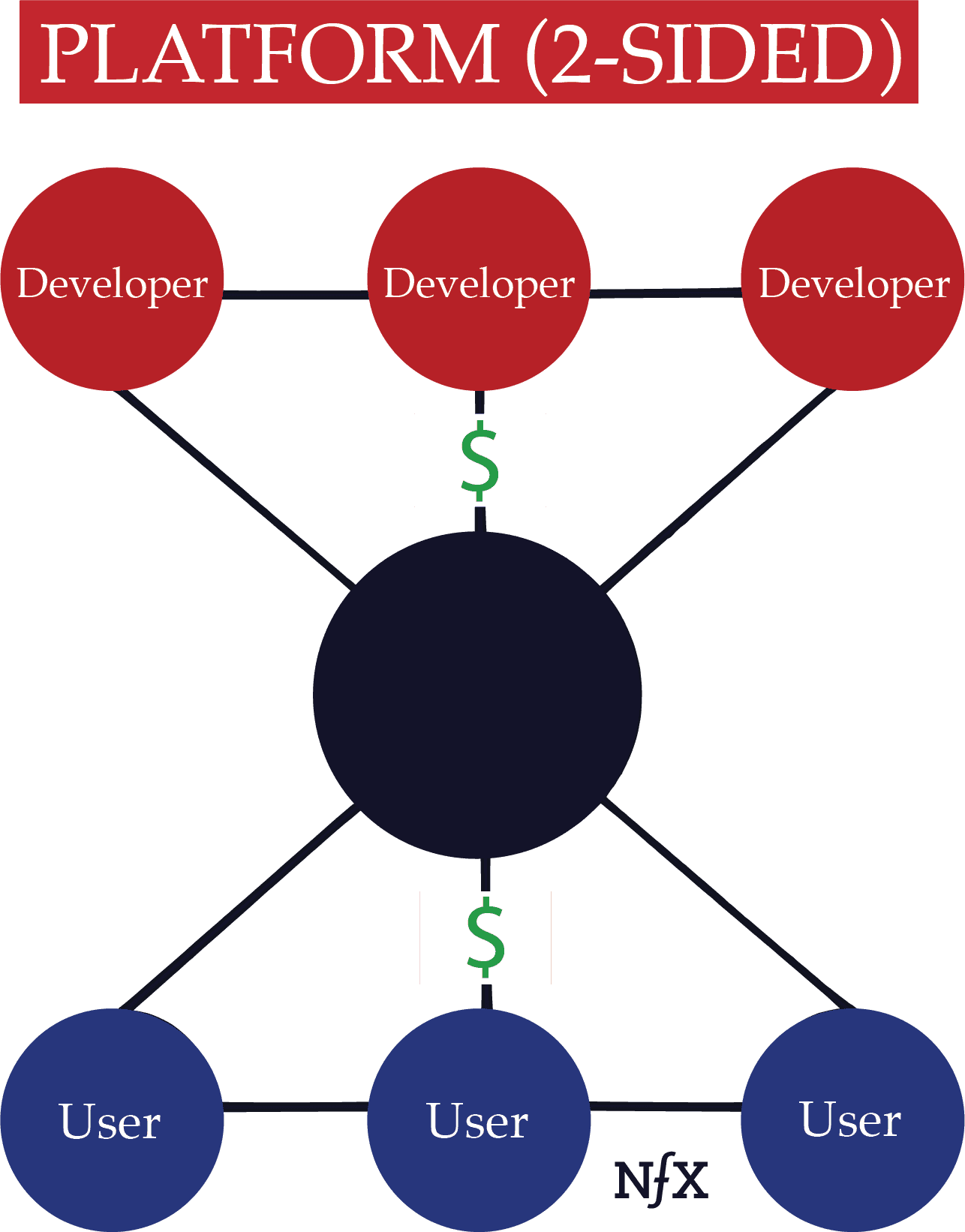

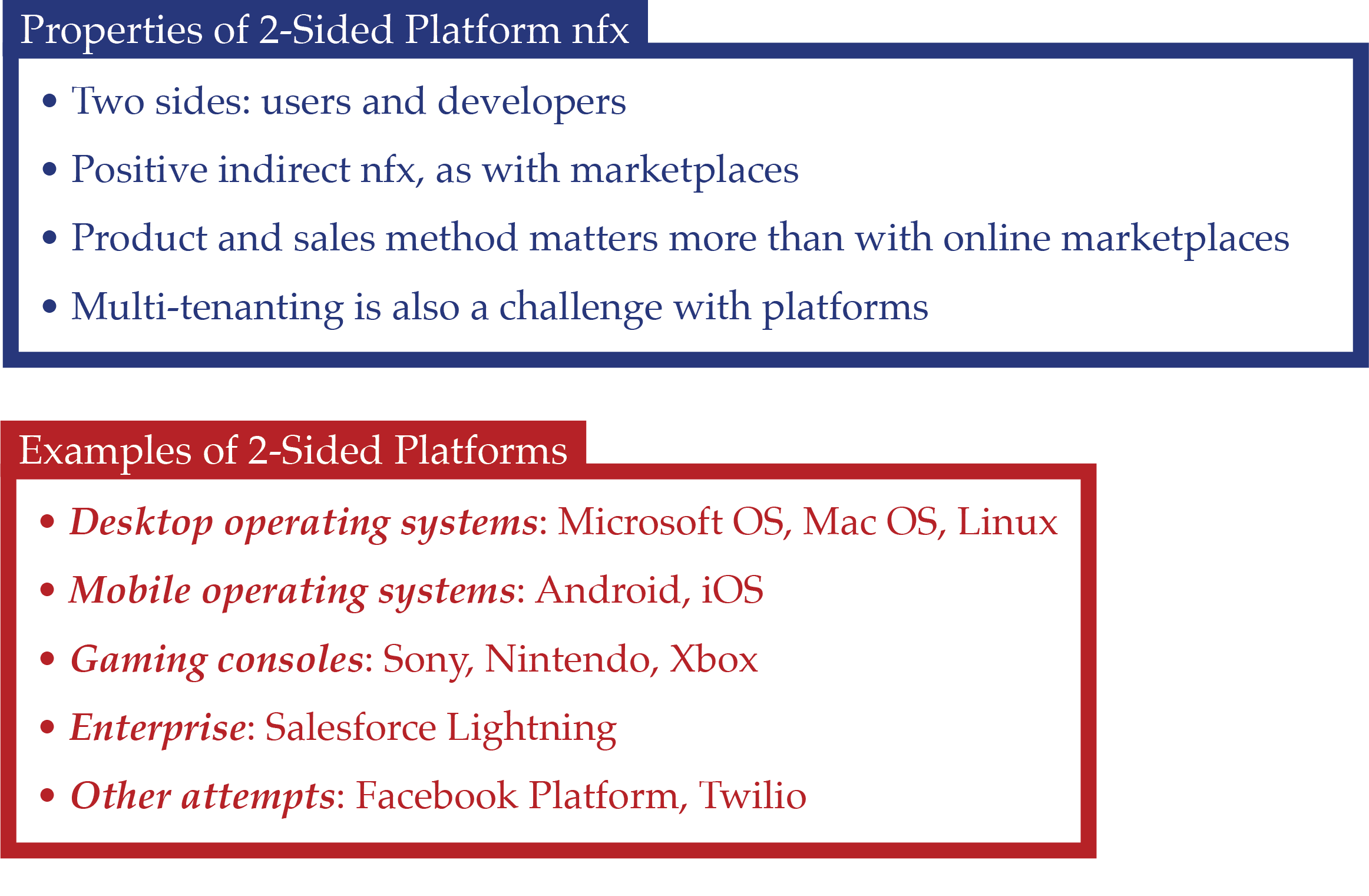

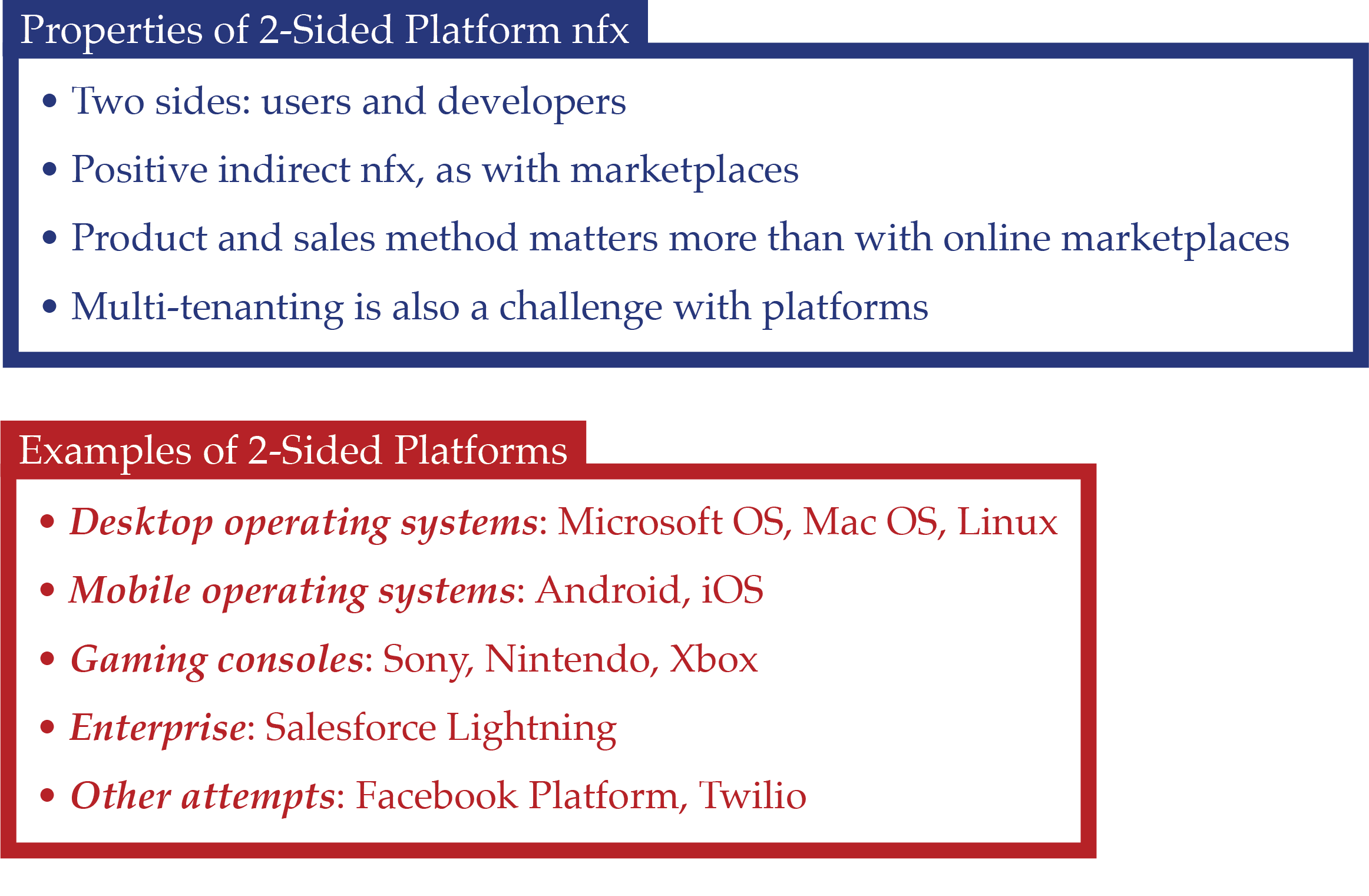

Platform (2-Sided)

What we call 2-Sided Platform nfx are similar to 2-Sided Marketplace nfx, in that they have two sides with very different interests that directly benefit each other. The difference is that the supply side actually engineers products that are only available on the platform. The supply side has to do work to integrate to the platform. The products created and sold by the suppliers are a function of the platform, not independent of it.

Microsoft OS, iOS, and Android are prime examples of products that have achieved this type of nfx. Xbox, PlayStation, and Wii are also examples, although they’re slightly different.

Another difference platforms have from marketplace nfx is that, compared to online marketplaces, the features and benefits of the platform itself can play a greater role in the utility of a platform relative to the network. People buy iPhones and thus iOS for the brand, design, technical features, and performance of the phone as much as they do for the app ecosystem. People might buy Xbox and PlayStation consoles for the graphics and performance of the system as much as they do for the library of available games. This in contrast with marketplaces, where the product itself comes in at a very distant second compared to the value of the network.

How a platform is sold can also matter a great deal to how well adopted it becomes by both sides. For instance, Microsoft has an army of salespeople who sell their platform to large corporate clients, and they often give the platform away for free to universities so graduates learn to standardize on that platform.

One vulnerable point for platforms is that, just like with marketplaces, both sides of platforms can also multi-tenant. App developers can create versions of their app for both iOS and Android. Game developers can syndicate their games to PlayStation as well as Xbox. Likewise with the other side — gamers can own a PS4 and an Xbox One simultaneously, and people can own both a Dell and a Macbook. However, the pricing makes this more prohibitive than with online marketplaces, where multi-tenanting is usually free. So from that standpoint, platforms often have a leg up.

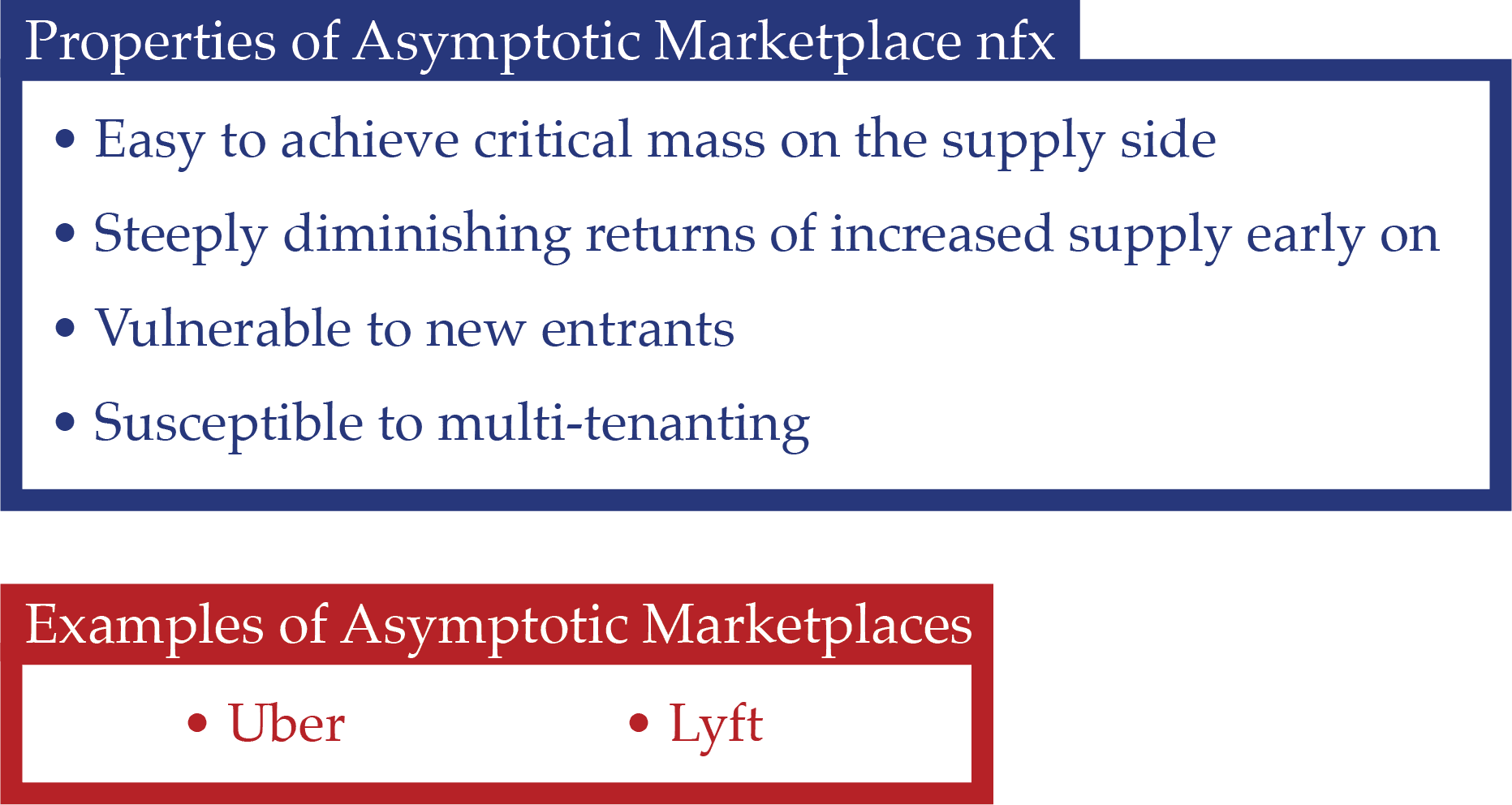

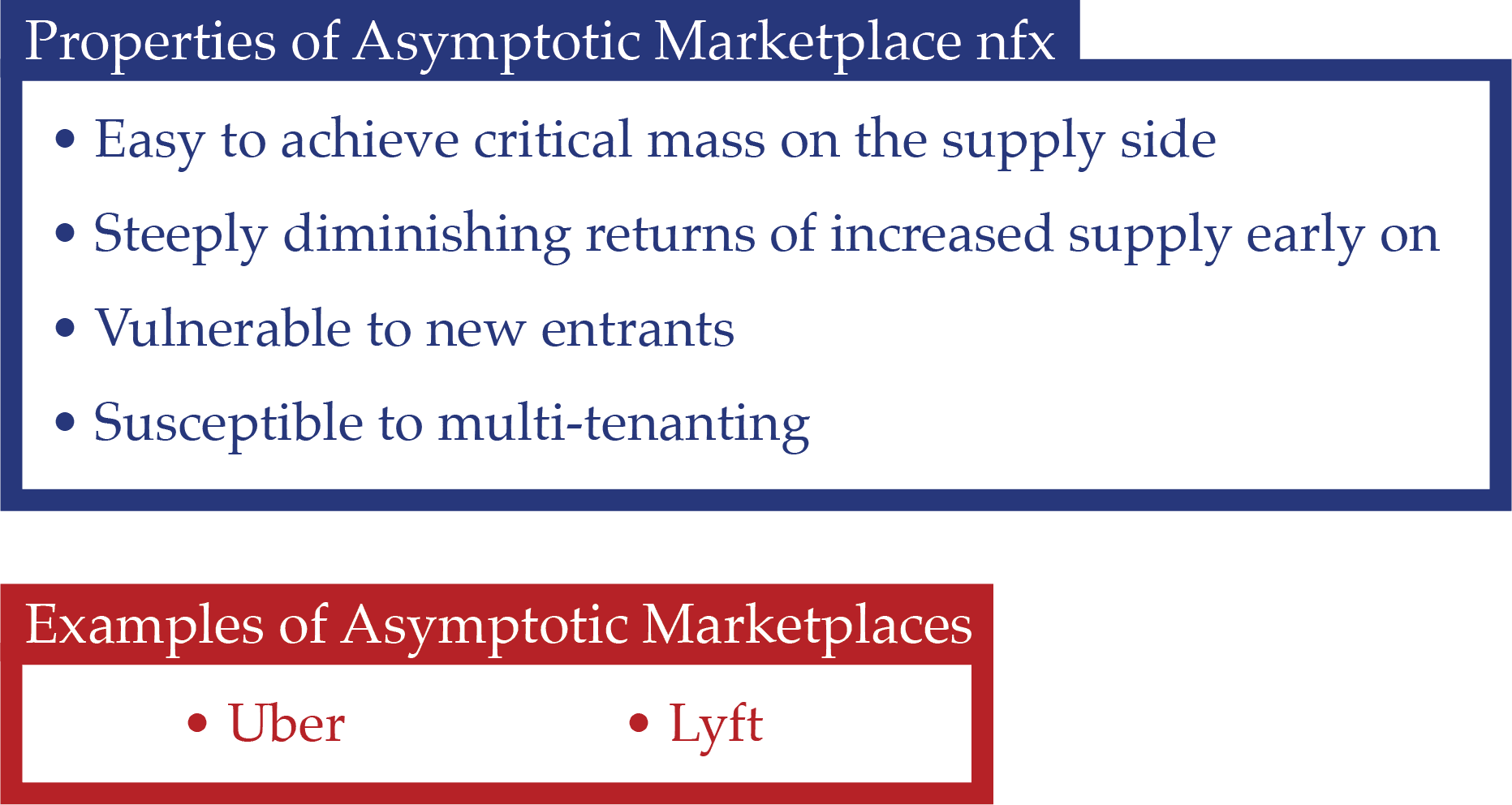

Asymptotic Marketplace (2-Sided)

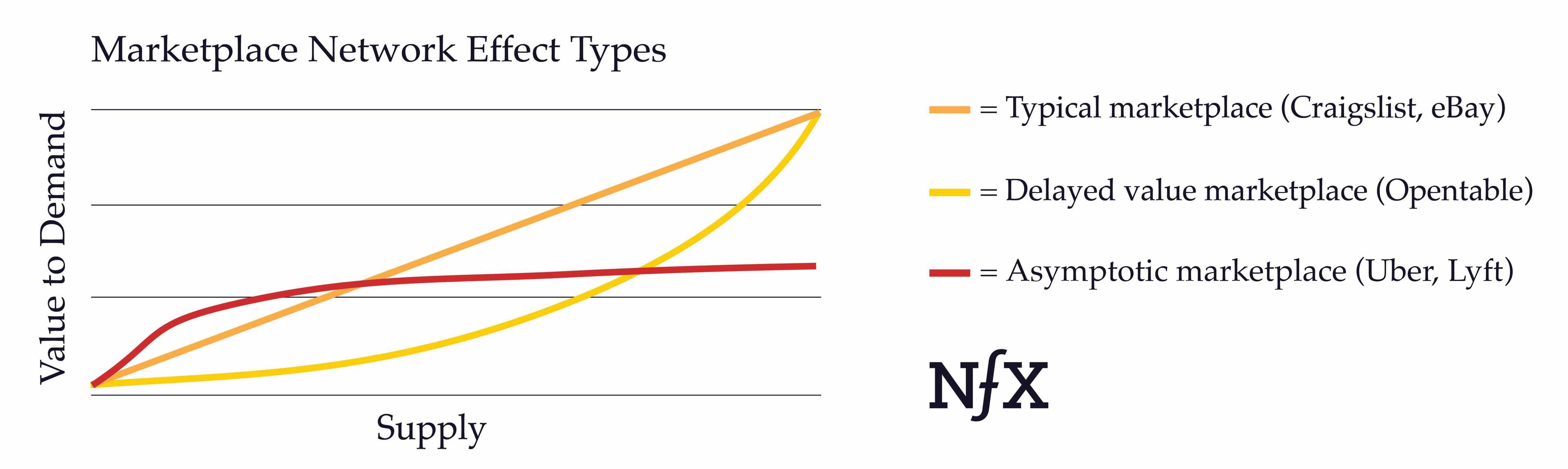

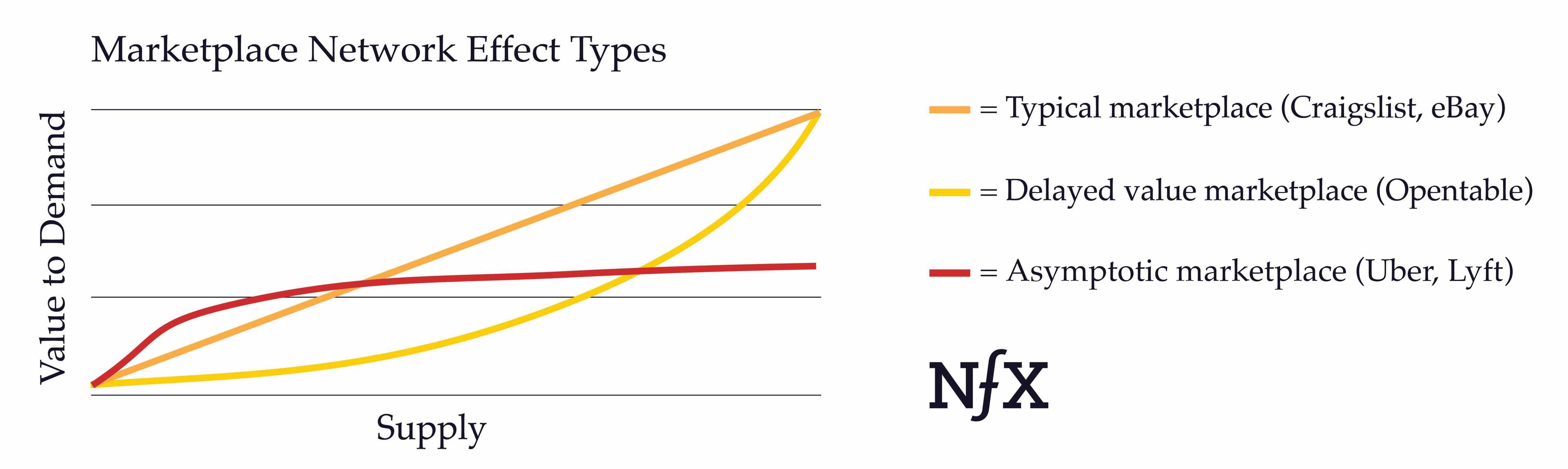

Of course, no two 2-Sided Marketplaces are exactly the same. One way they can significantly differ is in the “value curve.” This refers to how fast the value to the demand side increases as supply increases, and how strong the nfx get when critical mass is reached.

The “Value Curve” diagram below illustrates the supply and demand curves for three subcategories of marketplace nfx..

The straight line (orange) in the middle is what you would expect with Craigslist or eBay, where generally, the growth of the supply side produces value to the demand-side at a relatively proportional rate. Marketplaces like this get very strong over time.

The “Value Curve” diagram illustrates it below.

The lower curve (yellow) is what you saw with OpenTable, where the value is delayed. OpenTable had to grow the supply-side of restaurants to a very high level before there was any value to the demand-side. Once that critical mass was achieved, however, the network effect became very powerful.

The third subcategory of marketplace nfx, illustrated by the red curve on the graph above, is what we call Asymptotic Marketplace nfx. It has the inverse properties of OpenTable’s delayed value curve. The initial supply quickly adds value to the demand side, but soon the value of increased supply starts to diminish.

The most famous examples of an Asymptotic Marketplace are ridesharing companies like Uber and Lyft, as we wrote about in this Uber case study. Up to a point, more drivers benefit riders because of reduced wait times. But beyond a certain point, the value to the rider steeply diminishes. Waiting 4 minutes for a ride as opposed to 8 minutes is a huge difference. But 2 minutes instead of 4 minutes? The value of increased supply diminishes drastically around the 4-minute mark.

Asymptotic Marketplaces are more vulnerable to competition than other marketplaces for this reason. If Uber has 1000 drivers in a certain area, a competitor might be able to provide comparable service with half as many.

Adding to this vulnerability, Asymptotic Marketplaces can be very susceptible to multi-tenanting. Many people use both Lyft and Uber to get around, depending on which one has lower pricing and faster waits at any given time. On the supply side, many drivers use both Uber and Lyft, depending on pricing and wait times.

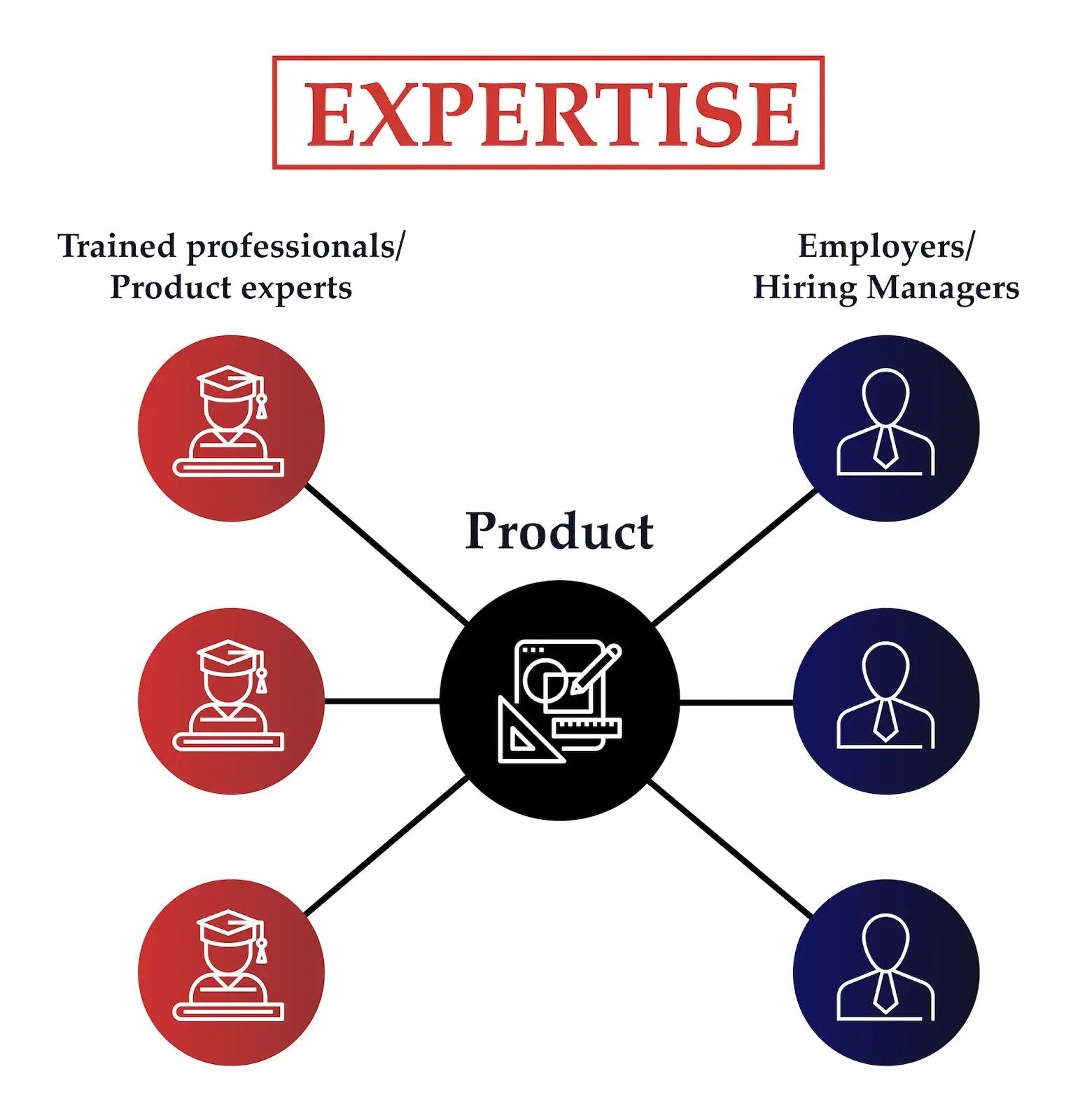

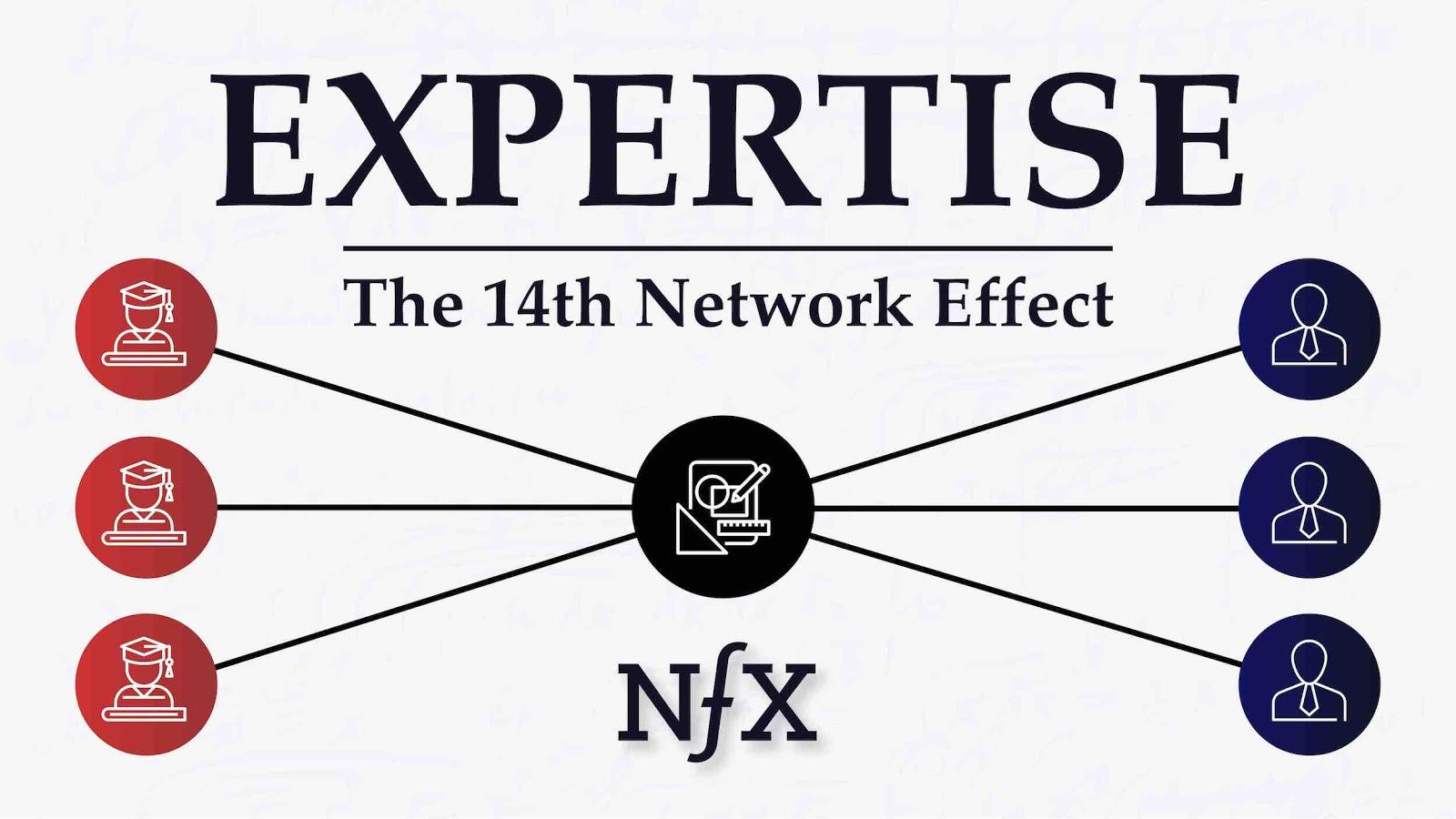

Expertise

Products that can develop “expertise” network effects are typically tools used by professionals to do their job — the instruments with which they ply their craft. As professionals become more skilled in their jobs, they also level up their expertise in tools required to do their jobs. If the tools are sophisticated enough, the tools require particular expertise of their own.

Employers often require proficiency in such tools when hiring, and so professionals have a strong incentive to develop expertise in tools with wide adoption that they can list on their resume and use as selling points on the labor market.

Companies likewise become more likely to employ the tools with the widest adoption by professionals because a) they want their employees to be able to interface to other companies in the industry, and b) they want to be able to attract the top talent who likely will want to use the most popular tool, and c) they know they can more easily replace the professional with someone else trained on the most popular tool.

And this is where the network effects kick in — for every new person in the labor market that develops expertise in a given product, the more valuable that product becomes to all players using or integrating that tool; i.e. all the other skilled users of the product (see the Appendix at the end of the article for a more detailed explanation of the mechanics of this network effect).

Here are some examples of industries and products where you see strong expertise nfx:

- Accounting Software (Quickbooks)

- CRMs (Salesforce, Hubspot)

- Analytics (Google Analytics, MixPanel)

- Computer Languages (Python, React)

- Spreadsheets (Microsoft Excel)

- Architecture (Revit, Autocad)

- CMS platforms (WordPress)

- Design software (Adobe, Figma, Invision)

- Video editing (Adobe, Final Cut, Avid)

- Mechanical Engineering (SolidWorks, CAD, Avid)

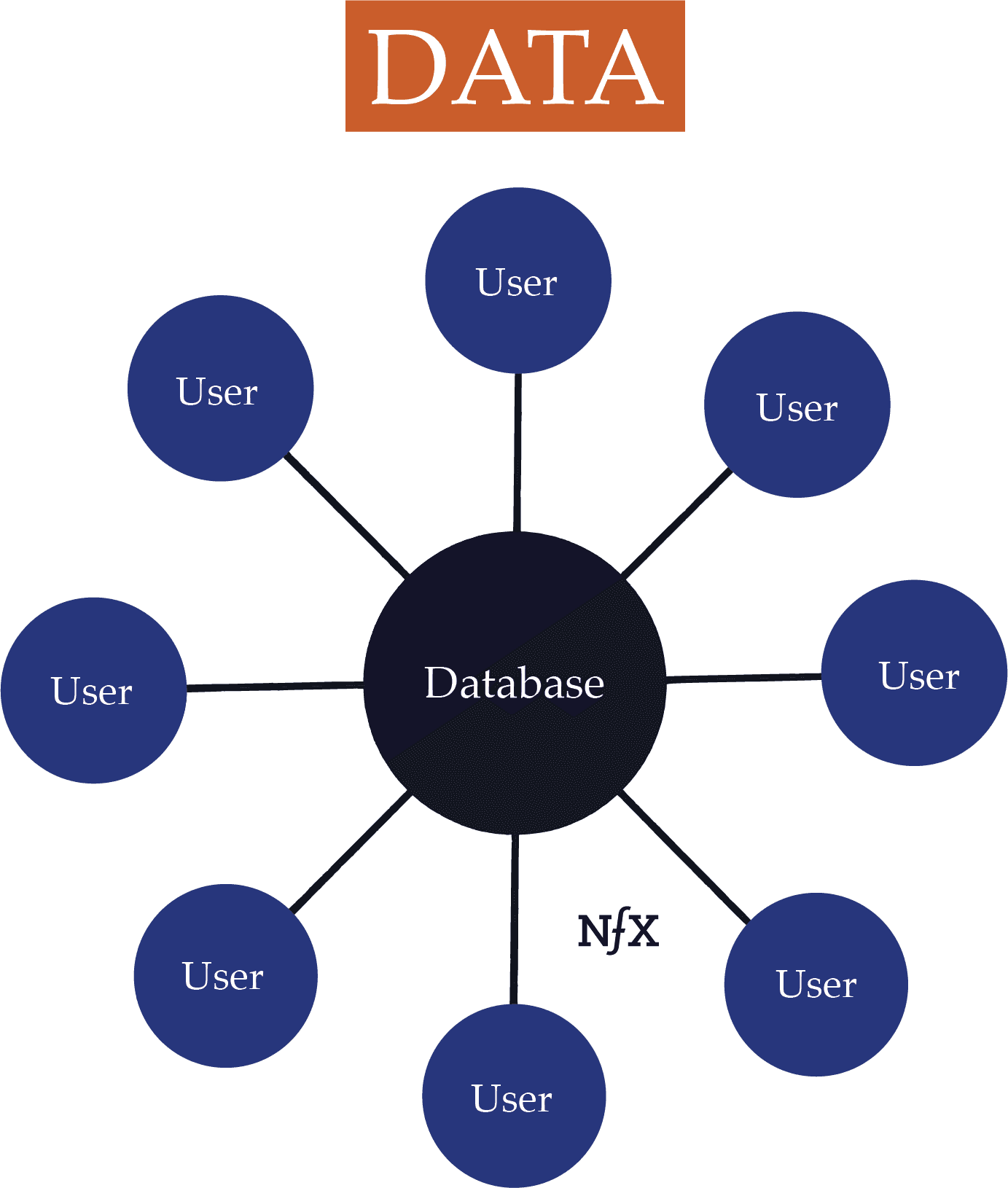

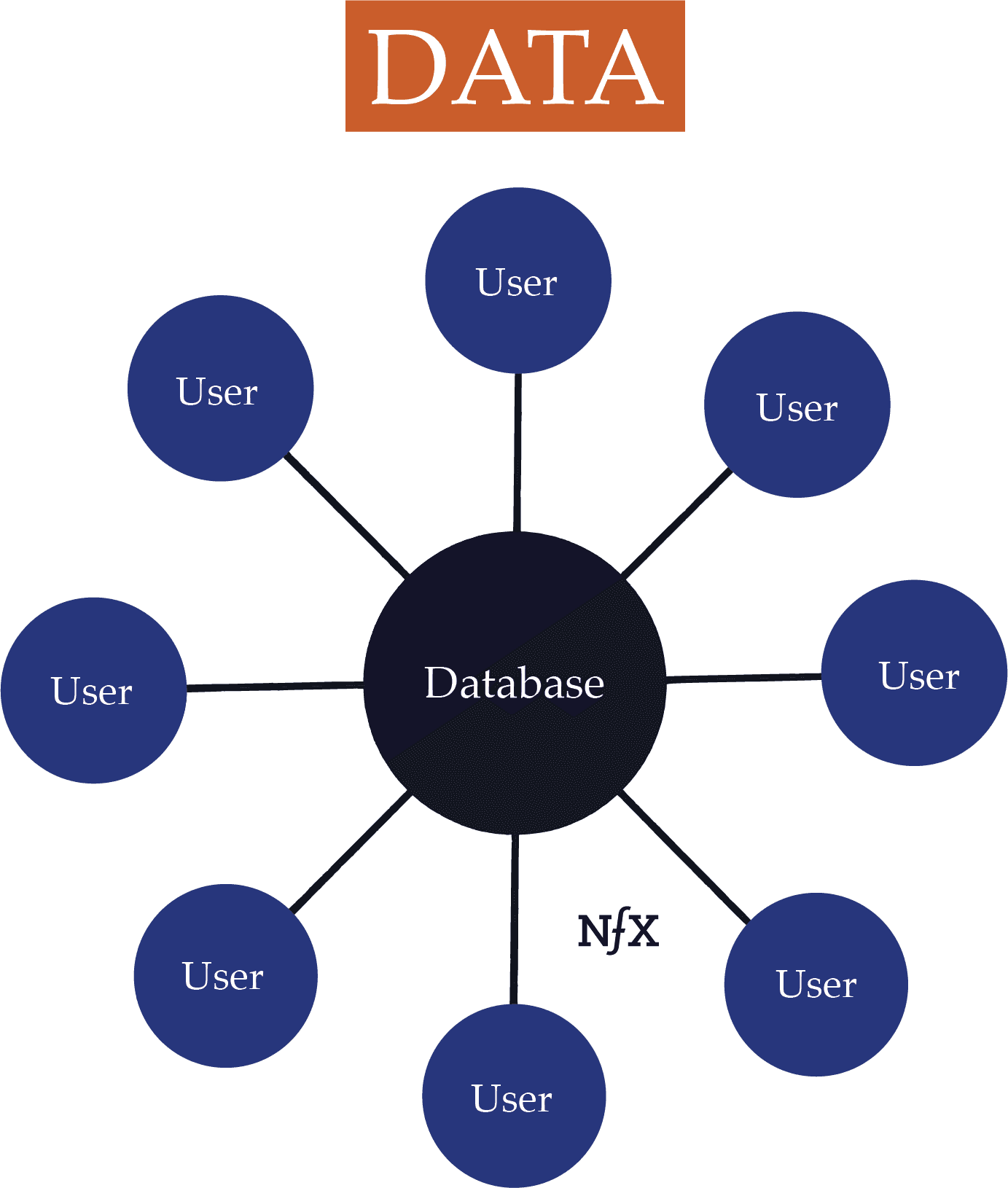

Data Network Effects

When a product’s value increases with more data, and when additional usage of that product yields data, then you have a Data Network Effect. This is the 3rd broad category of nfx.

With a data network, each node (user) feeds useful data to the central database. As the aggregated data accretes, the value of the data for each user also grows.

Data nfx tend to be weaker than many people — particularly venture capitalists — often want to believe: having more data doesn’t necessarily translate to value, and gathering more useful data isn’t always easy even if data is central to the product.

Data can increase product value in different ways. If data is really central to the way the product benefits users, then the data nfx of that product has the potential to be very powerful. If data is only marginal to the product, the data nfx won’t matter much. When Netflix recommends a show to you, the algorithm is basing that recommendation on user viewing data. But Netflix’s discovery function is marginal; its real value comes from the inventory of tv shows, movies and documentaries. So Netflix only has a marginal Data Network Effect.

Likewise, the relationship between product usage and the amount of useful new data gathered can be asymmetrical. Yelp has a Data Network Effect because a greater number of reviews for a greater number of restaurants makes the product more valuable. But its network effect is weakened by the fact that only a small percentage of users produce the data; most people read from the Yelp database but don’t write to it.

At the same time, Yelp is also a good example of a common weakness in Data nfx. Its Data nfx are asymptotic. The 5th review adds a lot more value than the 30th. Past a certain low level, more reviews on a restaurant don’t increase the value to you, the user. (Breadth of reviews, on the other hand, is very helpful and leads to solid nfx, which is why Yelp is still so prevalent.)

If a product has no relationship between increased usage and more useful data production, then there is no network effect; it’s merely a scale effect. Credit reporting agencies like Experian have a scale effect because even though more data makes their credit scores more valuable (i.e. accurate), usage of the product by consumers doesn’t naturally increase the amount of data they have.

Data nfx are easy to confuse with the data advantages that come from scale. Large companies have more data by definition. The question is, does that data create meaningful value for customers/users? And if so, does increased usage lead to more useful data?

A good example of a service with a strong Data Network Effect is Waze. Not only does nearly everyone consuming data on Waze also contribute useful data, but because the data is consumed in real time, the dataset needs to be continuously updated. So the larger the network, the more accurate that data will be at any instant for any given road. More data continues to produce value almost indefinitely, so there’s less of an asymptotic data nfx with Waze than almost any other service we can think of.

Data nfx are possibly the most complicated nfx category. There are as many different data nfx as there are ways to use data. We’ll be mapping out data nfx in greater detail in the future.

Tech Performance Network Effects

When the technical performance of a product directly improves with increased numbers of users, it has Tech Performance nfx. This is the 4th broad category of nfx. For networks with Tech Performance nfx, the more devices or users on a network, the better the underlying technology works. This makes the product/service become faster, cheaper or easier.

Networks with tech performance nfx become better (faster, cheaper, or easier to use) the bigger they get. As more nodes (devices) join the network, the performance of the whole improves.

Consider peer-to-peer file sharing services like BitTorrent, or VPN providers like Hola, or object finding mesh networks like Tile. These services get faster for all users the more nodes are on the network. Every person downloading a file from BitTorrent is also seeding files to the network. The more people who have a Tile app installed, the greater the chances that you can locate something you lost since every phone on the network is constantly scanning for tiles. Skype also claims that the more people using Skype, the better the video streaming quality (it’s not clear if this true, but it’s the right idea for them to have).

Tech Performance Network Effects are different from technological advances, and we would argue they are superior. Technological advantages have a short half-life and aren’t very defensible anymore. If you’re the first to come out with a technology, the rate of innovation ensures that it won’t be long until the competition either copies your technology or develops it themselves. But with Tech Performance nfx, your product gets a runaway advantage for being the first out of the gate. You don’t have to fight to keep your head start. Your lead tends to lengthen, not decrease, over time.

The other common point of confusion with Tech Performance nfx is to assume its presence when increased usage produces revenue that can then be re-applied to produce more tech advances, driving even more usage. If a performance improvement comes from an increased volume of revenue or data … it might be a good thing to have… but it’s not tech performance nfx.

”Social” Network Effects

The 5th and last broad category of network effects are what we’ve called “social” network effects. They work through psychology and the interactions between people.

Here’s how we think they work.

Networks are nodes and links. With a landline telephone system, it’s easy to see the physical phones and wires connecting them.

However, there is an unseen network among people, where our physical bodies are the nodes, and our words and behaviors with each other are the connections. These are the original networks, if you will.

Like digital network effects, these social nfx can help create more value in your product for users the more people use it. People add value to each other by influencing them to think or feel differently. By providing triggers and confidence to use your product. By reinforcing their choice to continue using your product.

Social nfx are usually the hardest to deploy for long-term defensibility. However, if you can successfully get various forms of psychology on your side against a competitor, they can represent a significant advantage.

Now you may be asking yourself “Aren’t these social nfx kind of like brand defensibility?” And you would be partially right. There certainly are similarities. They have to do with language and psychology. But we think there are important differences as well, which is why we’ve broken them out into a separate category.

To date, we’ve identified three main types of social network effects: language, belief, and bandwagon effects. That number could easily expand, since human psychology is complex and there are many kinds of social interactions that work very differently, and we continue to look for new types.

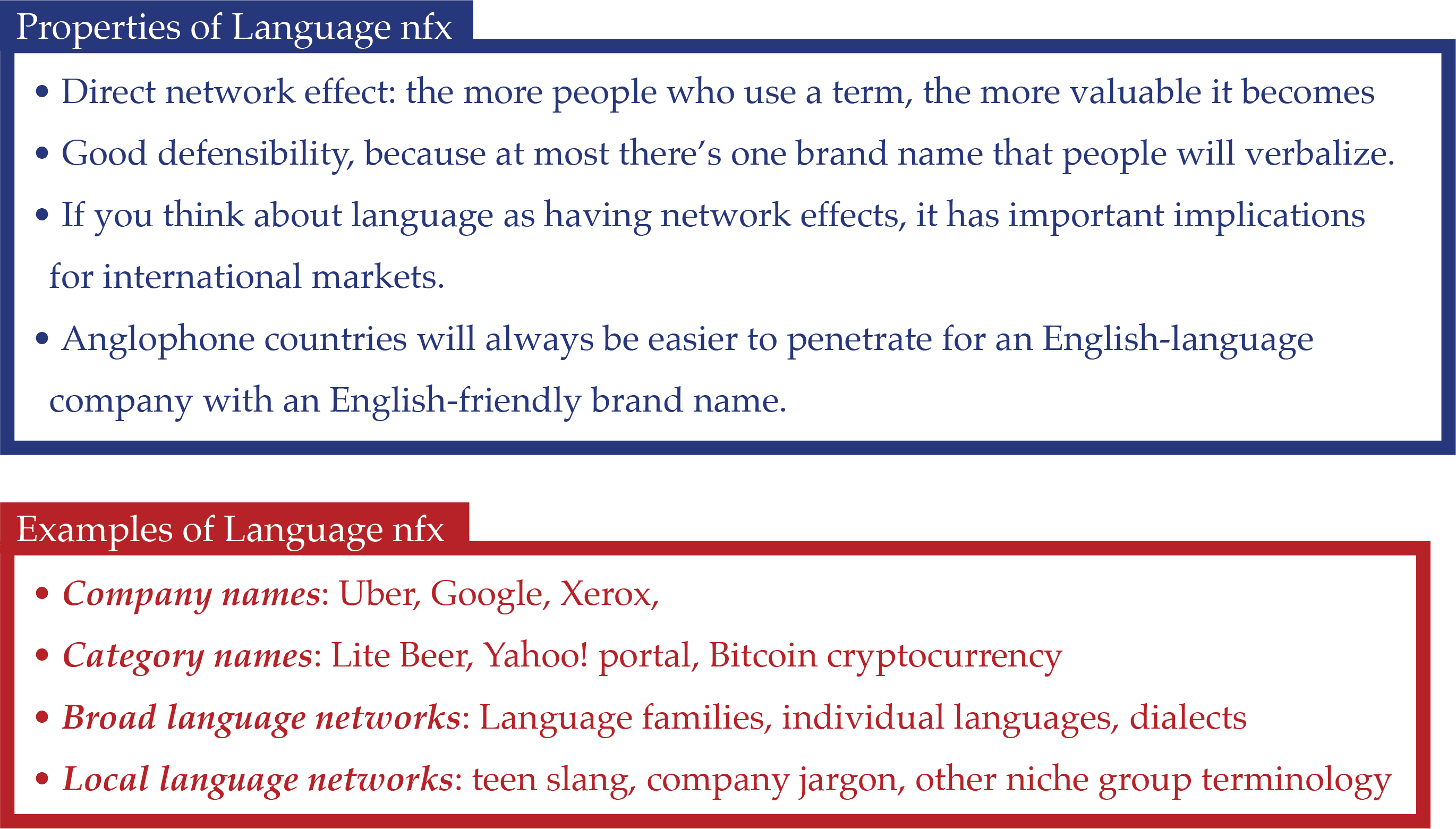

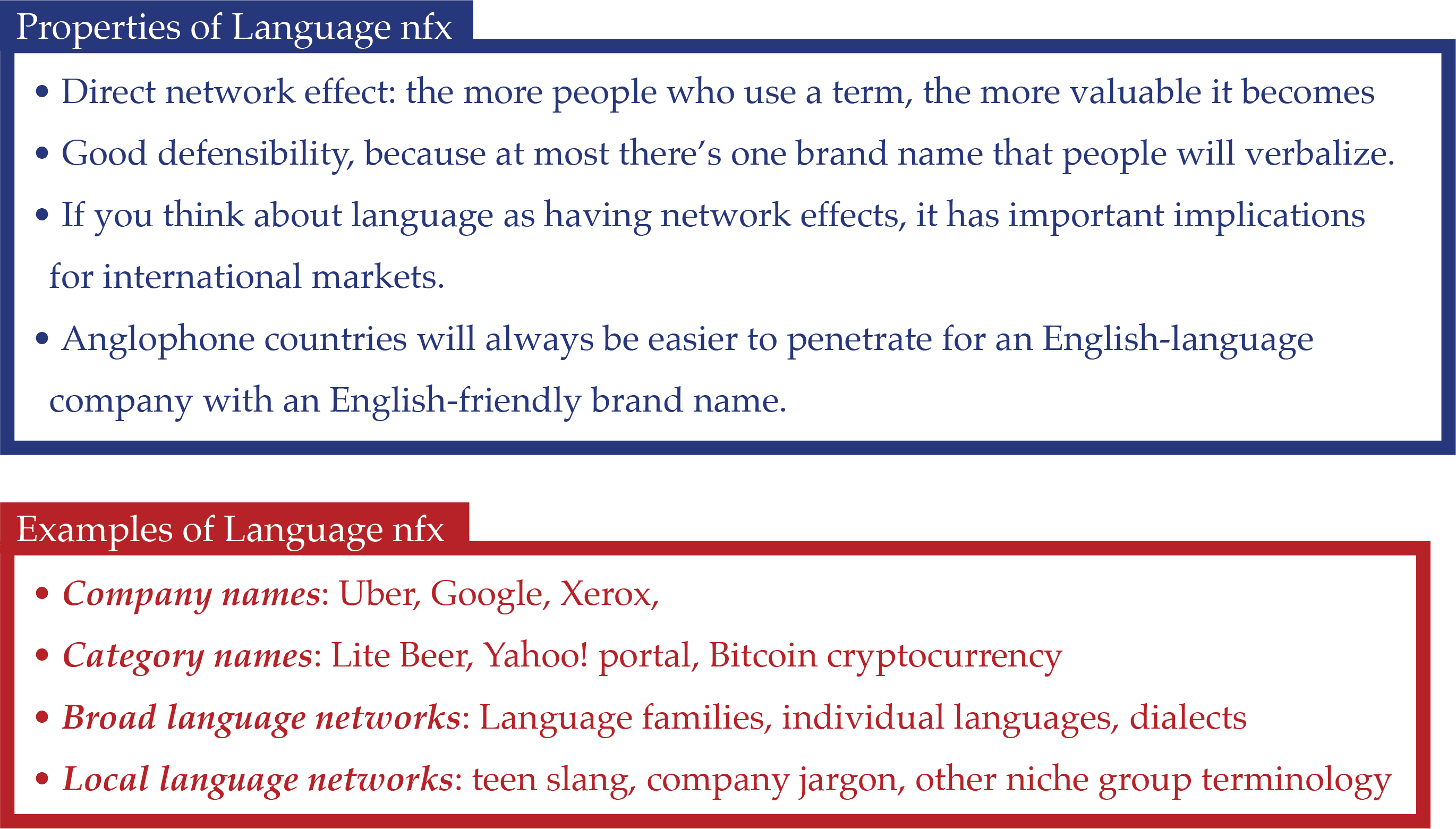

Language (Social)

In any human network, language is the main intermediary. It’s the protocol that all the nodes in a network use to interface with each other. For instance, the English language is a serviceable language, but it’s a lot more valuable considering that there are 1.5 billion people who speak it. That’s more than 15 times as many people who speak German. So even though speaking English doesn’t make you 15 times better at communicating than speaking German, the value to speakers is much higher as a result of the network.

That’s why, throughout history, language has displayed a “winner-take-most” tendency. People in the same political, social and economic units tend to coalesce around one language.

This concept extends to the jargon and vernacular of specific groups, from nations to corporations, teens to hipsters, economists to Google employees. As jargon gets adopted by more and more people, it becomes more valuable to all the other users.

Startups can use the network effects of language to take advantage of that winner-take-most effect in at least two ways: first, in creating business category language; and second, in naming a company or product.

With the first, if a Founder can help create a name for a business category and then be known as #1 in that category, it gives them solid language nfx. Miller Beer did this in 1975 when they created the “lite beer” category. The same thing happened 1995 with the creation of the web “portals” category, which Yahoo! benefited from since it was leading the category at that time. We’ve seen this same language network effect recently with the creation of the “cryptocurrency” category. Bitcoin, being seen as #1, benefited the most: it still accounts for nearly 40% of all the market capitalization despite their being 100s of competing cryptocurrencies.

In all these cases, the #1 lost its crown eventually, which is why Language nfx are considered less strong than others. Nevertheless, for many years, their competitors would certainly complain about the unfair advantage of the company with Language Network Effects they wished they had themselves.

The second way companies typically take advantage of Language nfx is with company and product naming.

For instance, when “Googling” something became synonymous with searching for something on the Internet, it was a huge advantage for Google. The language itself became an impediment to using a competitor. When someone asks you to Google something, it’s both socially awkward and mentally jarring to pull out your phone and start using Bing.

It’s similar when someone says “grab an uber.” They’re giving you a social cue to use Uber, not Lyft. (BTW, entering the vernacular as a noun is probably not as powerful as entering as a verb. It would likely be better for Uber if more people said, “I’m going to uber over there,” which some already do, but If I were Uber, I would encourage that usage as best I could).

Another example: back in the day, to “xerox” something mean to photocopy it.

Getting people to verbally use your company name is a big advantage, but it’s very tricky to do. Your company name has to be memorable and catchy enough to do this, and that’s why getting the name right is so crucial.

Belief (Social)

The 13th network effect on our current Map is belief. The belief network effect is something you can best see with gold, Bitcoin and religion. It’s a direct nfx.

Homo Sapiens is a pack animal. We want to be in the “in group” and be accepted by others. Sharing common beliefs is a critical part of that. If people believe in something, others are more likely to stick with it and believe in it, too. As a result, there are big social consequences for not believing the things your friends believe, and perhaps worse consequences for ceasing to believe in what they believe. This is one factor that makes people stick with group thoughts, making them very resilient to contradictory information.

Most importantly, beliefs become more valuable to believers the more people believe.

Look at gold. Why is it valuable? You can’t eat it or sleep on it. It’s pretty, but lots of things are pretty. It has some industrial uses, but not that many. It’s valuable because — after we were done believing salt was valuable — people decided to believe gold was valuable instead. And for 5,000+ years, it has always stayed valuable. The past gives us confidence that everyone will continue to hold this belief in the future. That belief strengthens over time.

Ipso facto, gold is valuable because we believe it’s valuable.

Belief nfx are like sand. In small quantities, sand dissipates in a breeze. But if you layer enough sand down on top of itself, it becomes hard as stone.

The same is true of Bitcoin. The more people believe it’s valuable, the more valuable it gets for everyone. And we’re seeing that same “sand layering” with Bitcoin now. The more times its price crashes and then bounces back, the more people will believe it has value. And then when you layer some Ethereum “sand” on top of it, and the “sand” of the thousands of other cryptocurrencies in existence — all denominated in Bitcoin on the exchanges — the Bitcoin sand gets progressively more stable as a result of growing Belief nfx. What was once fluid and intangible transforms to something closer to rock.

Bandwagon (Social)

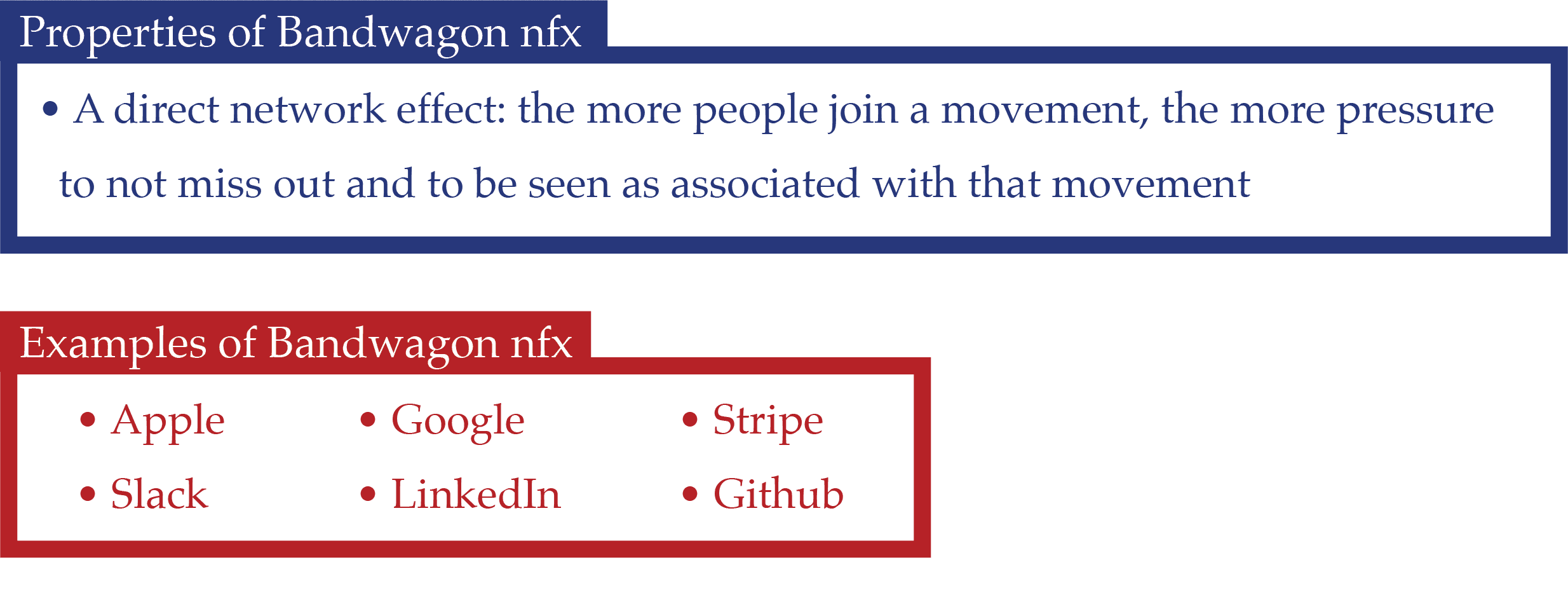

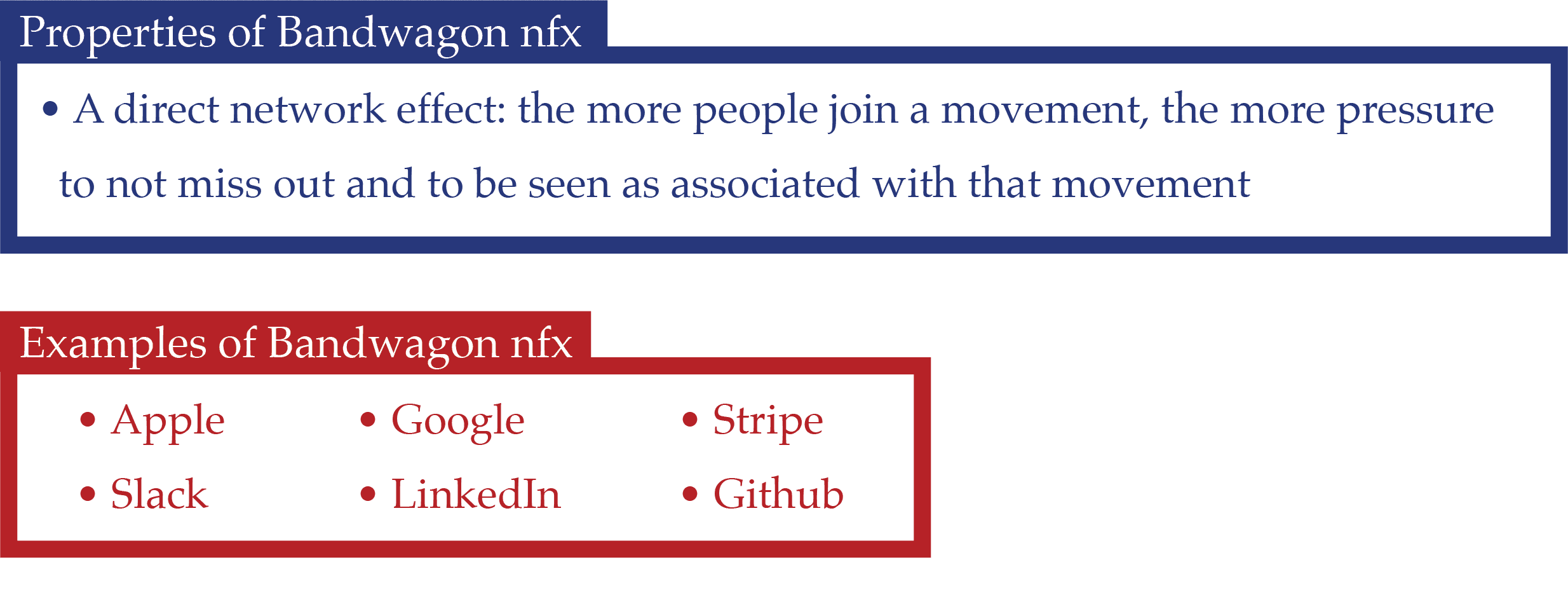

Bandwagoning happens when social pressure to join a network causes people to feel they don’t want to be left out.

One good example is Slack. In tech circles, it’s commonly felt that you don’t have a modern company unless your teams are using Slack. In our opinion, Slack’s notoriety and valuation have exceeded the utility of the product because it’s become somewhat of a movement in the tech industry, and developed a strong Bandwagon nfx.

Bandwagon nfx typically arise when a network first begins aggregating, when people are jumping on early. When people started to use Google back in 1998, there was a general feeling that “the cool kids” were using Google (they had been using Alta Vista before that). If you didn’t use Google, you were left out. Other nfx have since taken over for Google to provide them their core defensibility, so they’re no longer reliant on that initial Bandwagon nfx, but it certainly was there at the beginning.

One company that has made Bandwagon nfx a core expertise is Apple. Every year, with a carefully scripted performance, they re-manufacture buzz and FOMO with their new product demos and launches. This has been extremely effective. These days, if you show up at a meeting in Silicon Valley with an IBM clone instead of an Apple computer, it’s a sign you’re not part of the tribe. You’re seen as an outsider if you don’t use a Mac.

This can be frustrating for competitors who feel they have better products, but can’t beat Apple for reasons that remain hidden to them. Apple’s success goes beyond “branding.” It relies on successfully triggering the psychological need to be part of the cool crowd, to join the movement.

This video from 2010 is a hilarious depiction of the frustration and confusion competitors have about the mechanisms behind Apple’s dominance, and here’s a 2017 Samsung ad campaign which is a cry into the same void: trying to tell consumers it’s time to “grow up” from their childish, emotional attachment to the iPhone given the Samsung makes a “better” product. But what they’re missing is that the value to the user is not just the sum of the product features, not just a function if it’s aggregated utility. It includes the value of the network derived from other product users, and the social value of the bandwagon it lets them join.

Here’s a video which does a good job explaining Bandwagon nfx. Derek Sivers captures the essence of bandwagon psychology when he says “they will be part of the in-crowd if they hurry.” He then goes on to deftly explain that “the rest [join since they] prefer to stay part of the crowd, because eventually they would be ridiculed for not joining.” The whole video bears watching.

Students of nfx will correctly note that Bandwagon Effects can go too far. If too many people join a movement, sometimes the early adopters will abandon it because the group has become too mainstream. That’s why you typically see the Bandwagon nfx at the beginning of products. Smart Founders will navigate that transition from bandwagon to other nfx to maintain long-lasting defensibility.

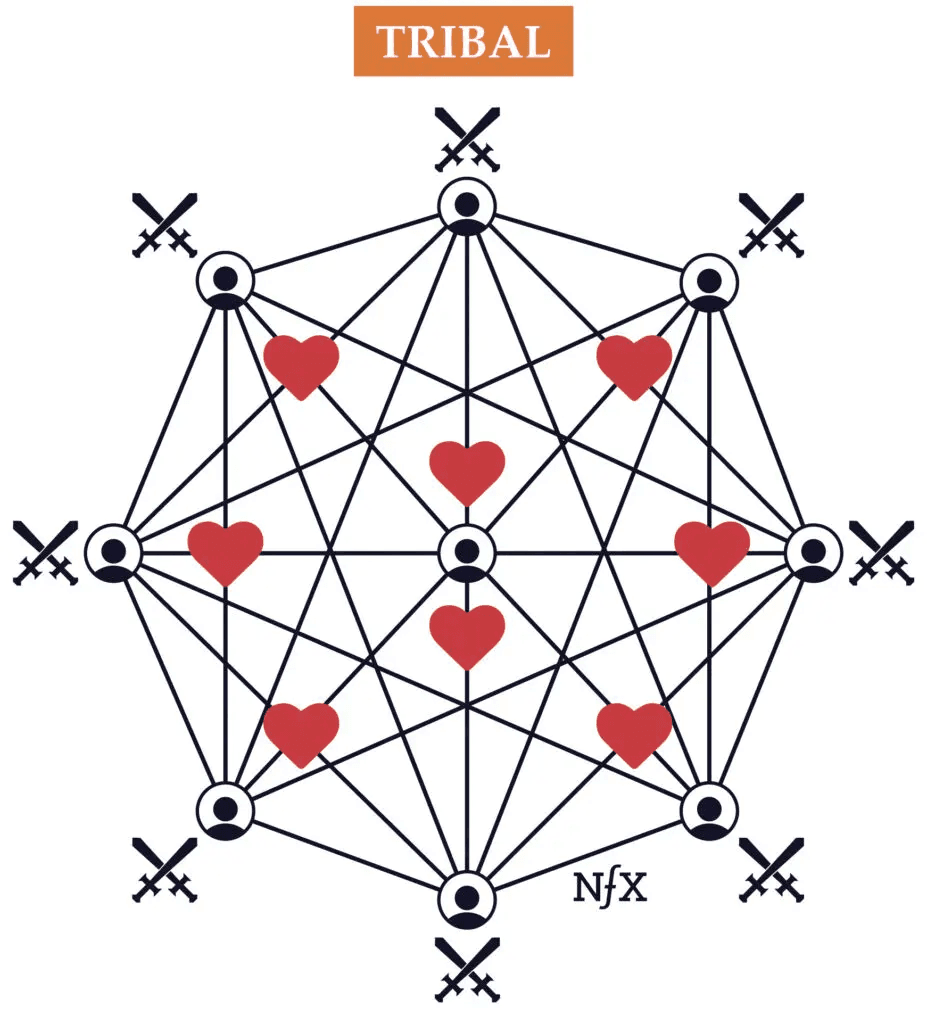

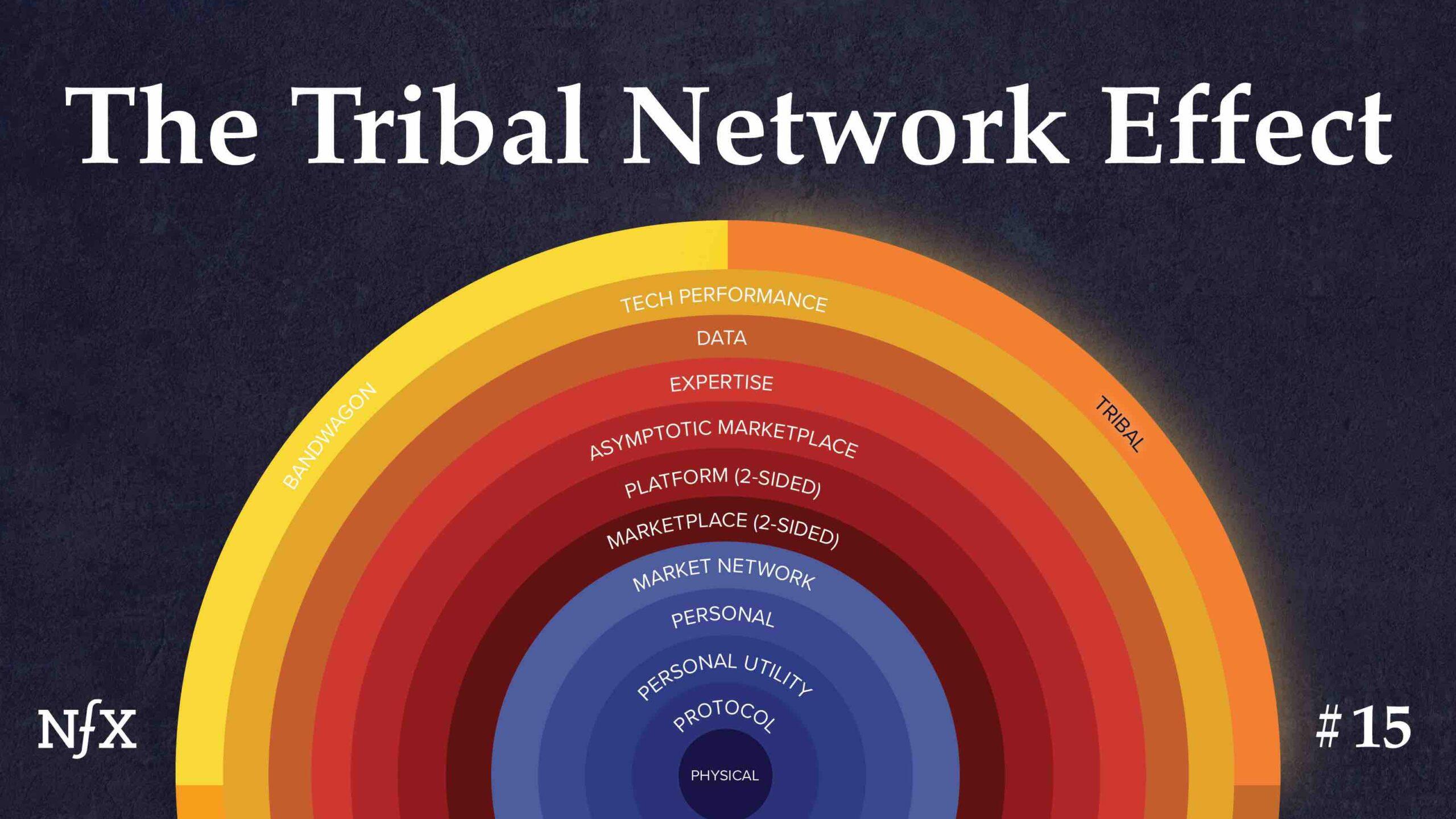

Tribal (Social)

Tribal network effects most often develop in alumni networks of schools, military units, fraternities and sororities, accelerators, languages, regions, and religions.

We suspect this was the very first network effect historically, as Homo sapiens evolved as a pack animal, trying to survive. The ones that built the best tribes survived to procreate, so we are all descendants of the best tribe builders. Those who weren’t good at building or joining tribes died off. Thus, our brains are wired to join tribes.

A few key things contribute to the formation of strong Tribal network effects:

- The tribe is presented as an ingredient of a person’s identity, part of how that person is perceived by others. One might think: “It’s who I am.” This forms a self-concept.

- Network members within the tribe are taught to be intentional about building the value of the tribe by:

a. adding value to other tribe members,

b. defending the tribe’s reputation,

c. receiving value from the tribe members, and

d. growing the tribe.

This intentional value creation and defense of a network is distinct from other types of network effects, where nodes largely contribute value and drive network effects unintentionally. - In contrast to the in-group of the tribe, there is an out-group that the tribe is actively NOT. A different group, a rival, an enemy, a force to be fought.

- A perception of higher-status attributes of members of the tribe, creating prestige and pride. Evidence or reasoning that members of the tribe are more committed, more “right”, more justified, smarter, stronger, etc.

- Members of the tribe endure shared hardship or adversity, such as training for the marines, studying for tests in college, founding a company, or going through a boot camp of some kind.

- Tribe network members overcome a barrier to get into the tribe. There must be a believable reason for your inclusion, and some demonstration of your worth or “fitness” for inclusion. There is often a period of worrying you won’t “get in.” This creates exclusivity and belonging in the minds of the tribe members, reinforcing the other five attributes.

Not all tribes share all six of these characteristics, but the more they do, the more powerful the tribal self-identification becomes in the minds of the tribe members, and thus the stronger the Tribal network effect.

As with other network effects, network size and network density also matter in the formation and strength of Tribal network effects. The larger the tribe, up to a point, the more valuable it becomes because you are more likely to encounter and form relationships with other nodes. College alumni networks, for example, often have clusters in many different cities and companies where alumni seek each other out. Tribal networks also have a higher density of relationships between nodes because self-identification between tribe members causes them to look for shared affinities, and motivates them to altruistic behavior towards other nodes in the network.

That, in turn, leads to a higher proportion of shared connection between tribe members than in other types of networks, which incentivizes further relationship-formation and sets off a virtuous cycle. In a tribal network, people (often unconsciously) recognize that potential connections are more likely to materialize into actual connections, causing a self-fulfilling propensity to try harder to build in-tribe network connections. This creates a denser lattice of links between the nodes, driving network effects, and network value.

The power of network effects

We explained earlier the Network Effects Map is meant to be a discussion starter on the true nature of network effects, not a last and final word on the subject. Network effects are a complex phenomenon that look simple on the surface.

With this manual, we’re trying to communicate the importance, variety, and complexity of network effects. Top Founders will benefit from a deeper understanding of network effects which will translate to better practical business decisions. In the end, defensibility is what will define the success of your business. More than anything else, network effects are the key to that success.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.