In the closing weeks of December 2020, NFX surveyed 526 Founders & Investors in the startup community about their predictions and sentiments for the 2021 year ahead.

Their answers provide an inside view to what private companies and investors really think about Big Tech, upcoming IPOs, hot tech sectors like Blockchain and Biotech, and post-pandemic consumer spending.

They also report on their own continued approach to remote work, personal and startup HQ relocation, and hiring trends. We can begin to intuit which effects of the pandemic might be temporary and which might become a collective new normal.

Some of this data conveys optimism, while other parts are more sober and indicative of discontent. Either way, after one of the most tumultuous years in modern times, this report confirms the saying that the only thing certain is change.

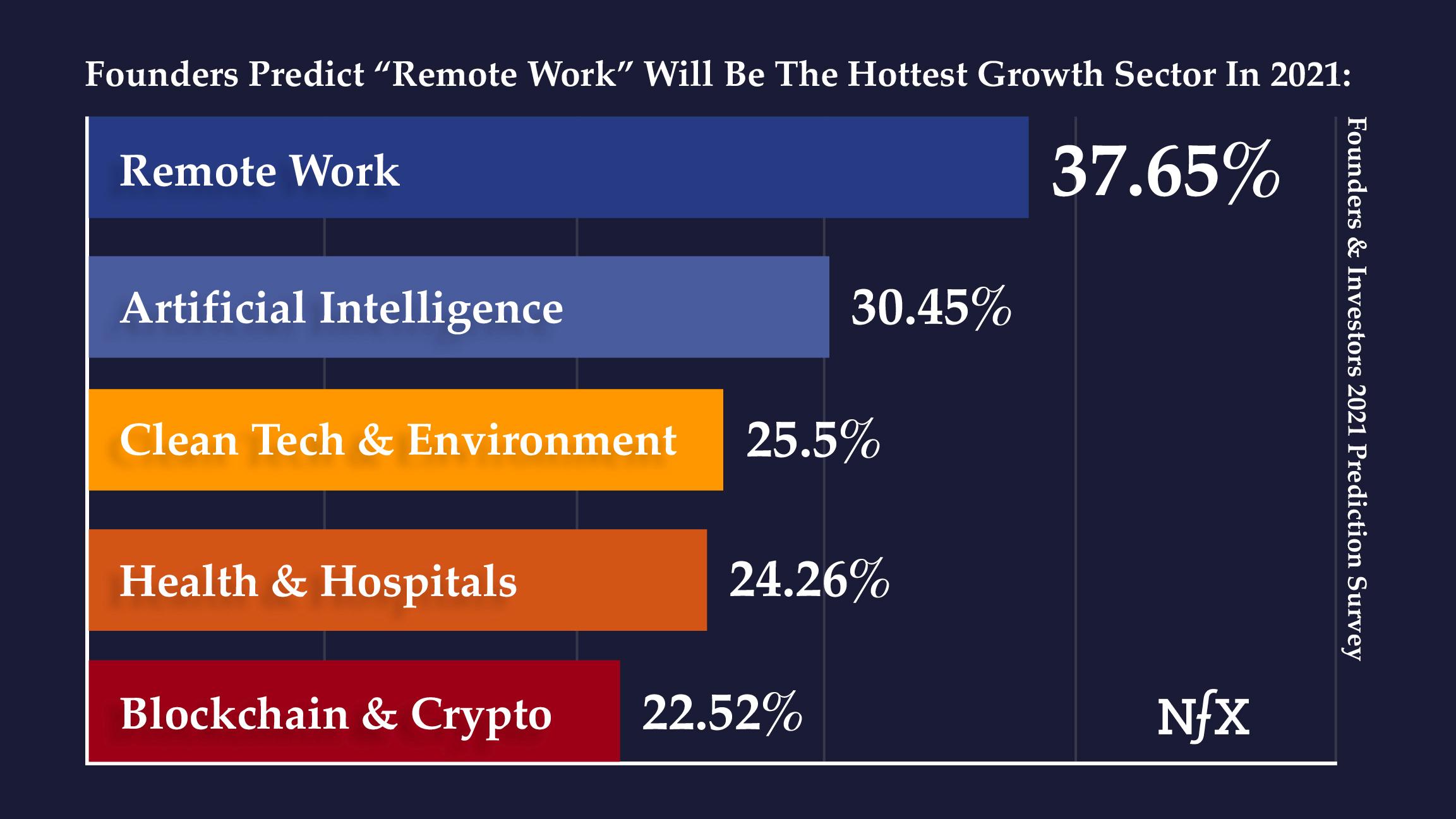

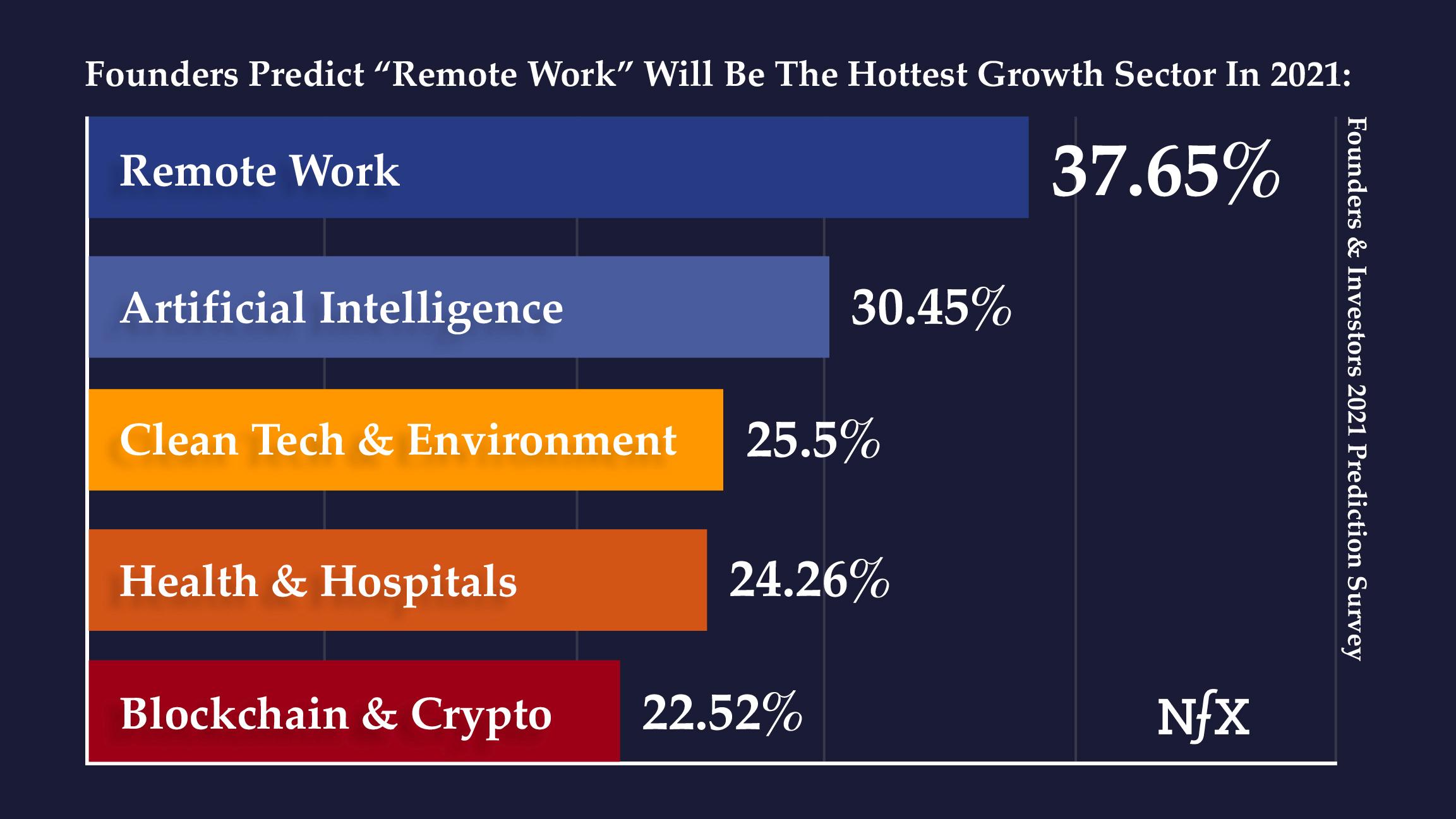

1. Founders Predict “Remote Work” Will Be The Hottest Growth Sector In 2021

2. Investors Vote “Blockchain & Crypto” and “CleanTech & Environment” as Top Sectors For 2021

Summary: Startup Founders identify Remote Work, AI, CleanTech & Environment, Health & Hospitals, and Blockchain & Crypto as the top 5 hottest tech sectors for 2021. Investors generally agree but place a stronger emphasis on Blockchain & Crypto than do Founders, with less emphasis on Remote Work. The resurgence of Clean Tech & Environment is notable, as is the continued rise in Biotech.

3. “The FTC Should Force Facebook To Divest” – According To Majority of Tech Founders & Over One-Third of Investors

Summary: When asked what action the FTC should take regarding Facebook, an overwhelming 53.64% majority of startup Founders surveyed, and a smaller 36.75% majority of tech Investors surveyed, voted for divesting Facebook of Instagram & WhatsApp — what has been popularized as “breaking up Facebook.”

Runner up: 26.75% of Founders and 35.9% of Investors vote for the FTC to “do nothing” to Facebook.

And a lagging 19.80% of Founders and 27.35 % of Investors would prefer to see the FTC force Facebook to “open up” — in essence, shift from a platform to a protocol, where other third-party innovators can participate in the network.

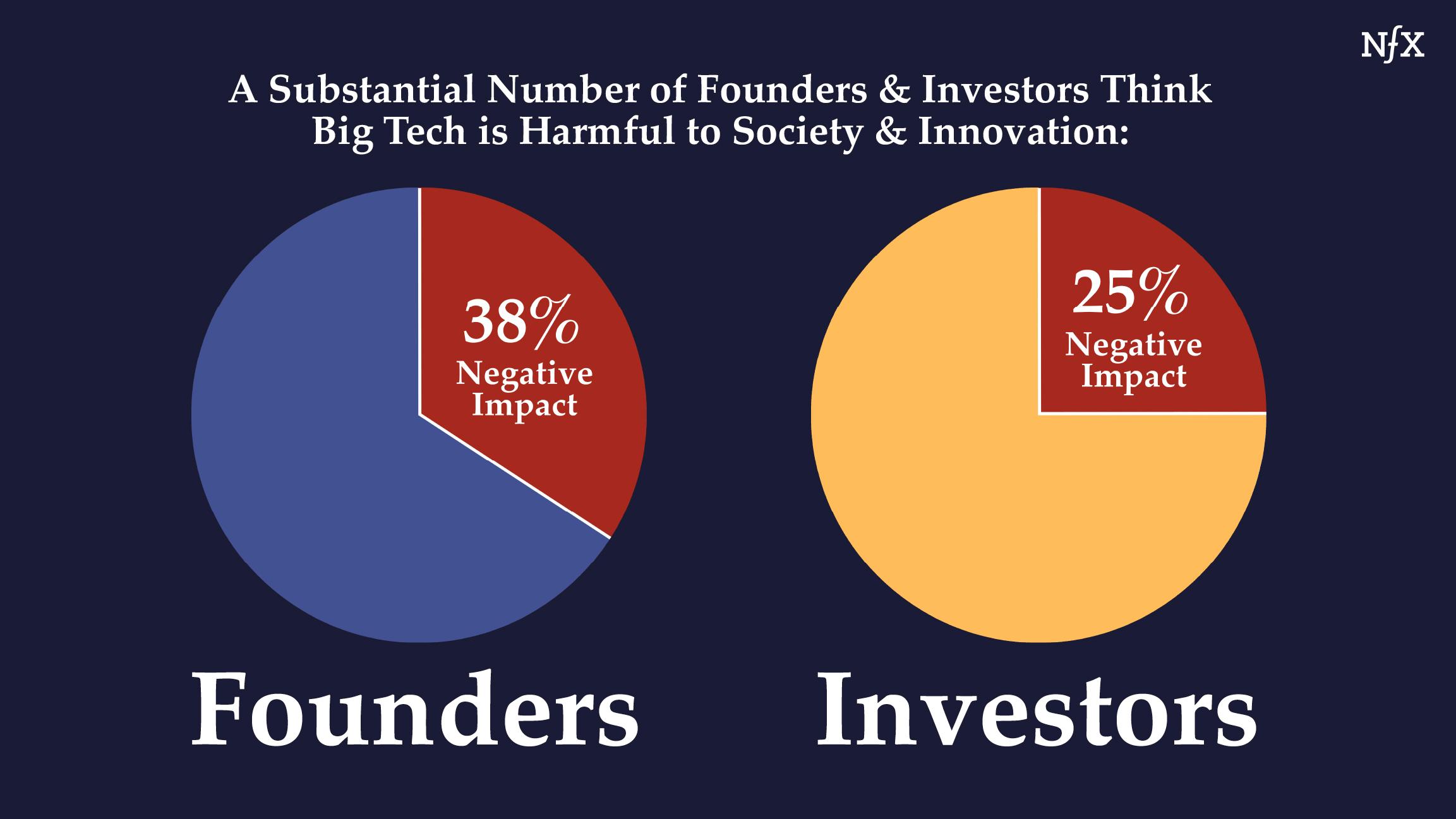

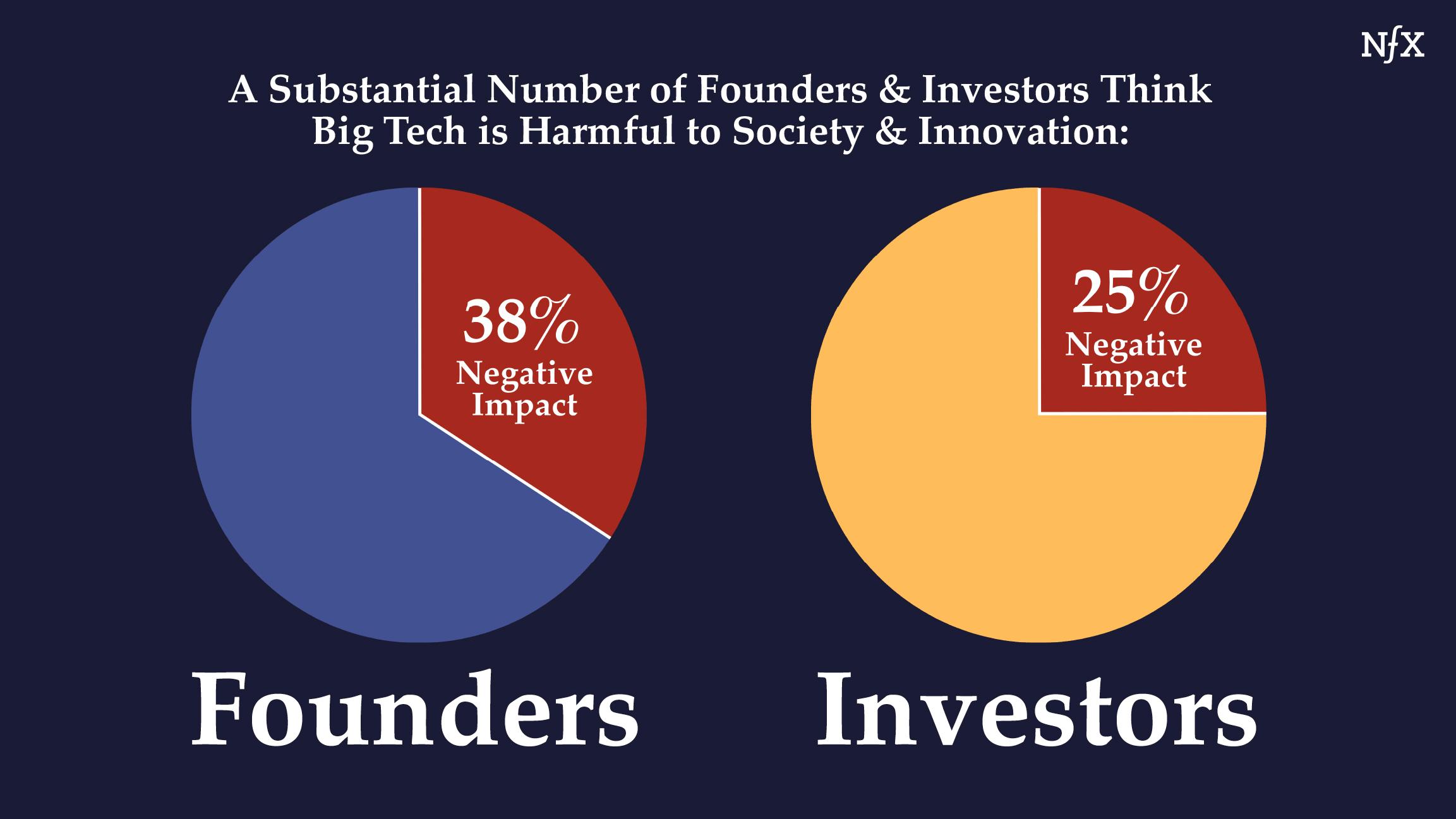

4. A Substantial Number of Founders & Investors Think Big Tech is Harmful to Society & Innovation

Summary: When asked if “Big Tech” (Google, Facebook, Instagram, Twitter) has a net positive, net neutral or net negative impact on society and innovation, Founders (46.02%) and Investors (55.93%) agree that the impact is mostly positive — with Investors having a slightly more positive view than Founders.

However, it’s notable that 37.81% of Founders and 24.56% of Investors do see Big Tech as having a negative impact. The stated negative effect on society aligns with sentiment surrounding 2020’s documentary “The Social Dilemma.” The perceived negative impact on innovation — when combined with data that more than half of Founders want the FTC to break up Facebook — suggests that startups are unhappy with monopolistic Big Tech stifling competition.

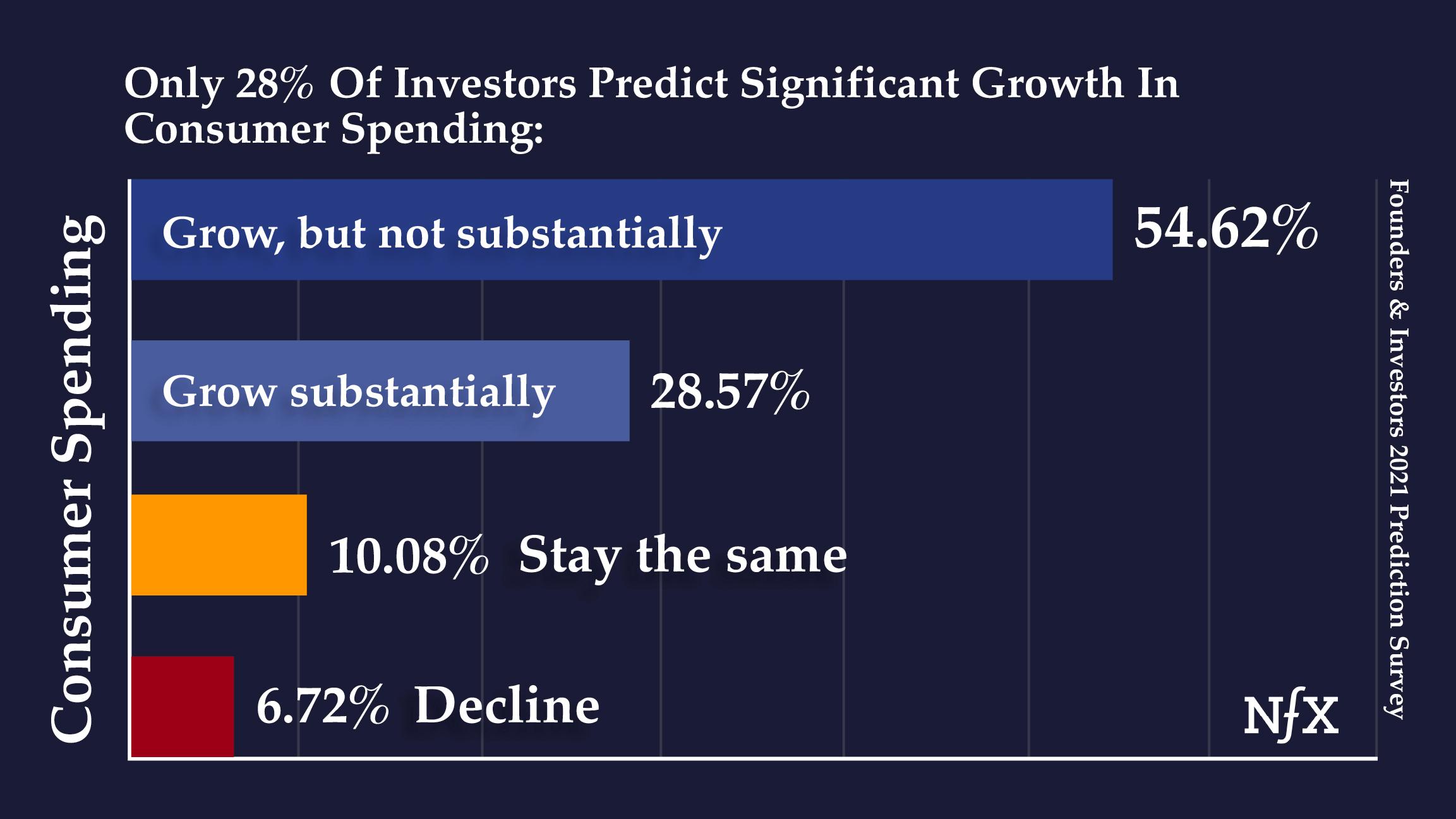

5. Roaring 2021s? Founders & Investors Say Consumer Spending Not Likely to Grow Substantially

Most Startup Founders Think Consumer Spending Will Grow, But Not Substantially

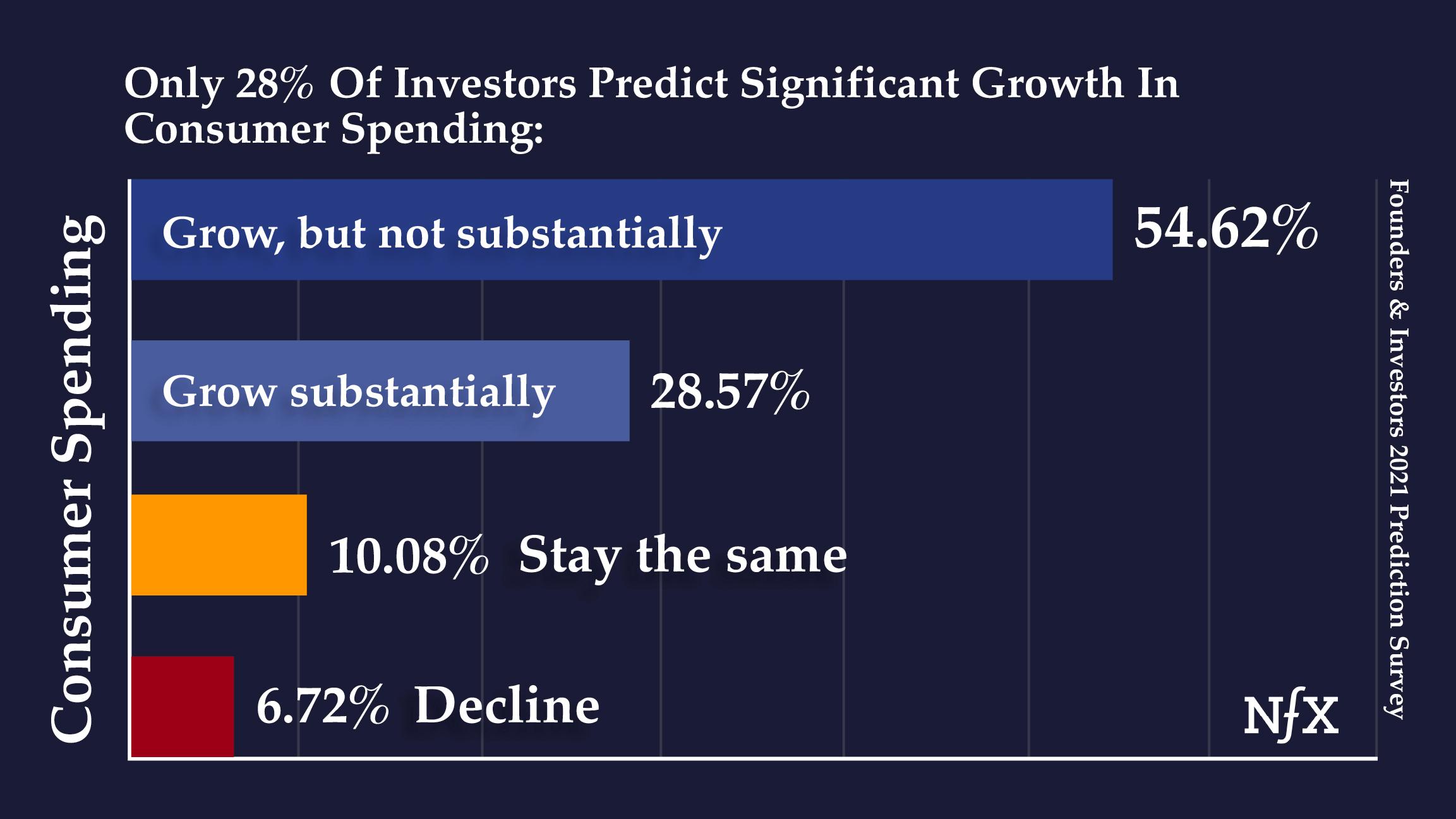

Only 28% Of Investors Predict Significant Growth In Consumer Spending

Summary: When surveyed about post-pandemic consumer spending, most Founders (42.21%) and Investors (54.62%) predict spending will grow… but not a lot.

It’s notable that these representatives of the startup and tech community are somewhat more cautious with their predictions about consumer spending than the mainstream media, where headlines predict a “roaring 20’s” boom in post-pandemic spending.

While they’re not in the majority, a subset of Founders (27.89%) and Investors (28.57%) do predict significant growth in consumer spending, and even smaller subsets fear it will be about the same as 2020 or will decline more.

6. Data Shows A Significant Number of Founders and Investors Are Personally *Leaving* The Bay Area in 2020-2021

Summary: Of Founders surveyed, 65% of those who live in the San Francisco Bay Area are planning to stay where they are in 2021. 80% of Investors who live in the Bay Area are also planning to stay.

But a statistically and culturally significant number are leaving: 35% of Founders are planning to leave the Bay Area in 2021 and 20% of Investors are as well.

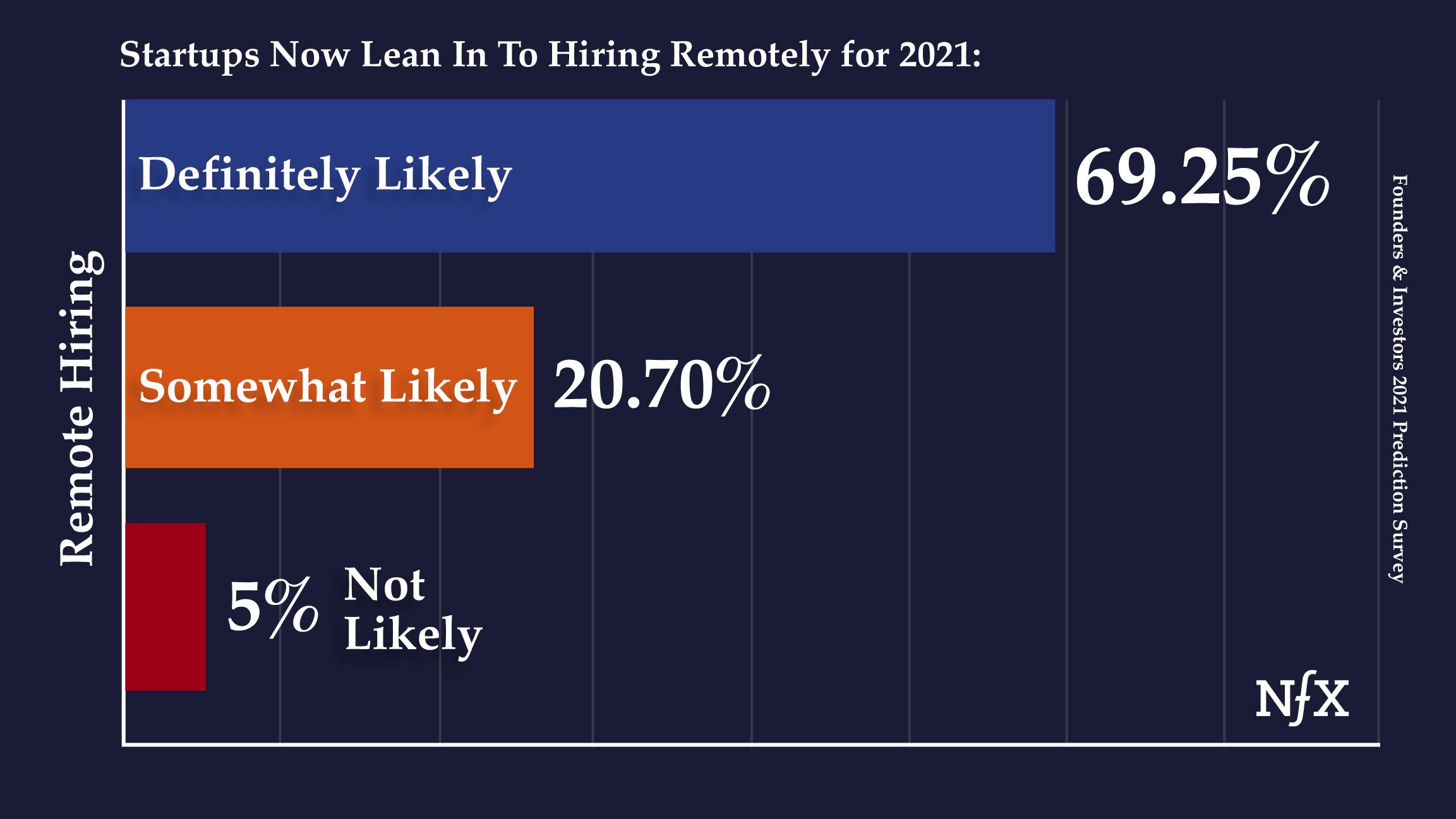

7. Startups Now Lean Into Hiring Remotely for 2021

Summary: At the beginning of the pandemic in 2020, popular opinion was unfavorable toward hiring and onboarding new employees remotely. The shift to remote work was initially successful for many startups because their existing employees had been co-located, logging in-office time together, and those bonds held the team together. But as lockdowns continued, hiring became by necessity a remote activity. Hiring new employees that you might not meet in person for a long time is a big shift for small startups. And paying attention to remote work culture is more important than ever.

8. VC Sentiment Toward Remote Turns Positive, with 68% Willing to Invest Outside Major Tech Hubs

Summary: An overwhelming majority of Investors say they are definitely likely to invest in startups that are outside of existing tech hubs like the Bay Area, NY, LA, Seattle, Austin, and Salt Lake City. Combined with relocation movement of Founders and Startups, a shift to remote work, and continued preference for Zoom meetings, this finding suggests a new status quo for geographically diverse investments.

9. The New Normal: Even After A Vaccine, Founders & Investors Will Still Prefer Zoom Meetings

Summary: Even after a reliable vaccine is deployed, Founders & Investors both predict they will take at least half of their meetings by Zoom, and most of them state they will conduct the majority of their meetings by Zoom.

That Investors would take Zoom meetings as the new de facto is significant in that it indicates the pandemic has successfully removed geographical barriers to getting meetings with Investors, and that this trend will continue for 2021 and beyond. This leads to an increase in “fair access” for Founders, increased volume of meetings and perhaps faster fundraisings.

Only 16% of investors and 14% of Founders claim they would conduct less than half of their meetings by Zoom. 5% of Founders hope to take no meetings by Zoom after an efficacious vaccine is deployed.

10. Despite Zoom & Remote Trends, Founders & Investors Believe Coworking is Here To Stay

Summary: Despite WeWork’s valuation falling from $47B to $2.8B in 2020, Founders and Investors are still majorly optimistic about in-person coworking returning as a trend over the next few years, post-pandemic.

When asked if they predict coworking will regain its popularity over the next few years, 62% of Founders and 70.59% of Investors say yes and believe it is a long term trend.

Still, 37.69% of Founders and 29.41% of Investors predict that coworking will never again be as popular as it was before the pandemic.

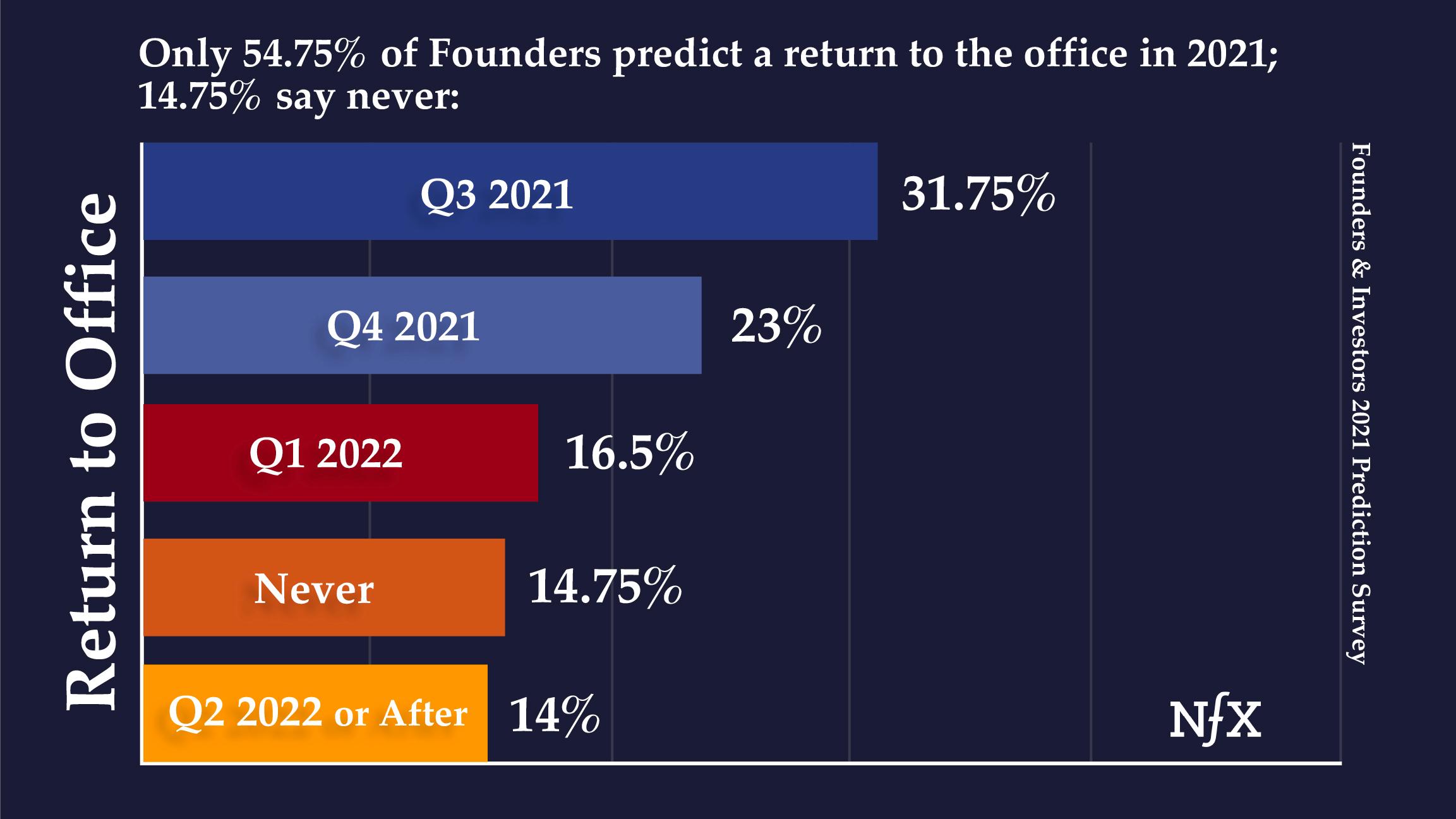

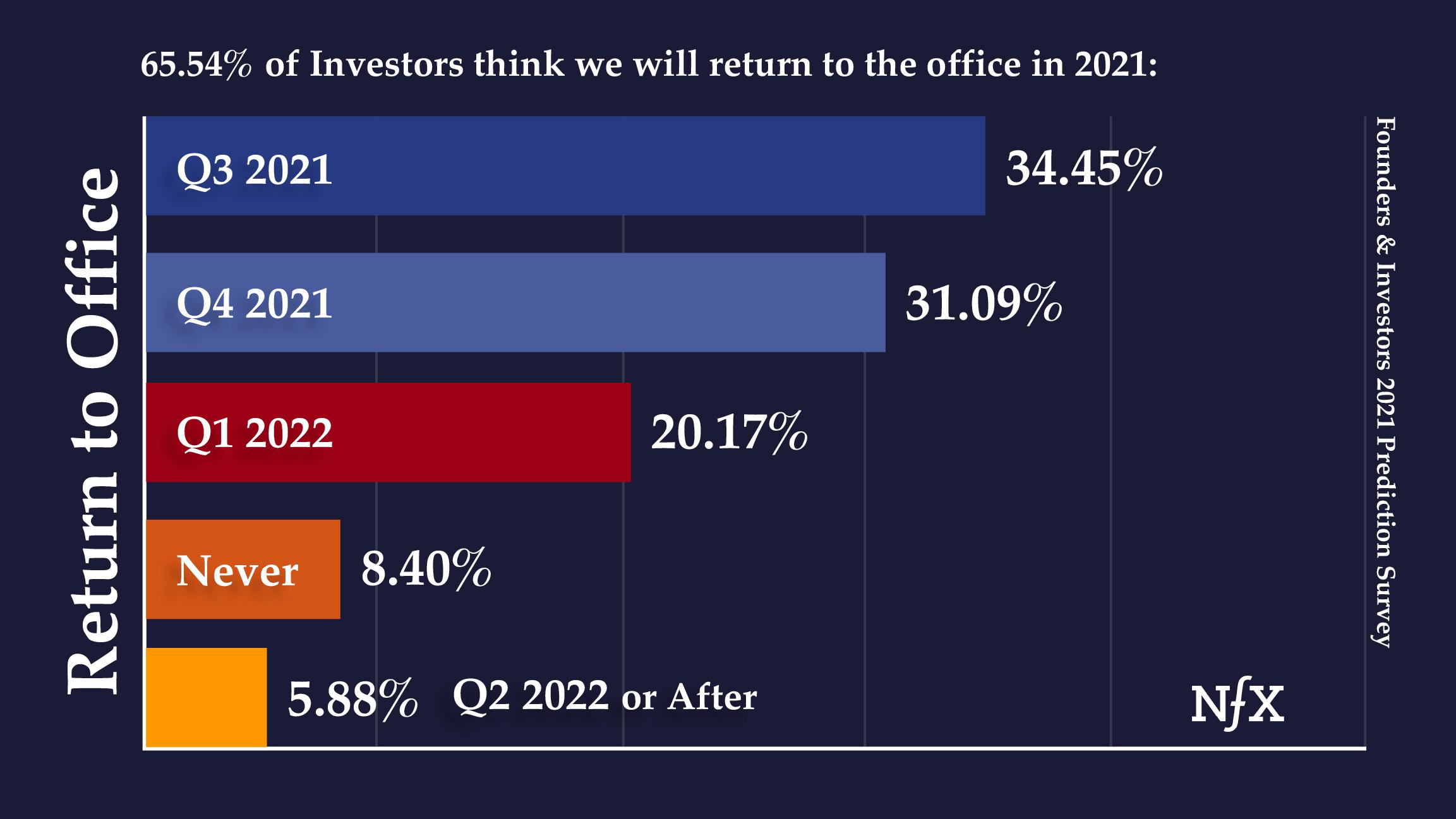

11. Return To Office Is Not Predicted Until Q3 2021, maybe Q4 2021

Only 54.75% of Founders predict a return to the office in 2021; 14.75% say never

65.54% of Investors think we will return to the office in 2021

Summary: Asked when companies will have a majority of employees return to the office, a slight majority of Founders and Investors predict this will happen in Q3 of 2021, with Q4 2021 a close second, and a few lagging into early 2022.

Notably, 14.75% of Founders predict companies will never have a majority of employees return to the office, perhaps indicating the hallmark adaptability of startups as they embrace remote work.

12. Founders & Investors Both Predict SPACs Will Stay Small vs. Traditional IPOs

Founders predict SPACs will be significantly less popular than IPOs

Investors Have Less Confidence in SPACs than Founders Do

Summary: While SPACs are a hot topic in the tech community, Founders and Investors alike are reporting low confidence that the role of the SPACs will ever equal that of traditional IPOs, and very few predict it will ever become the dominant way to take a company public.

13. Bullish On Blockchain: Startup Founders & Investors Think The Next 3 Years Will See Mainstream Adoption

Summary: We asked over 500 Founders and Investors how they feel about blockchain technology (not just the price of BTC) and if they predict it will be used more via mainstream applications over the next 3 years, or less and will fail to thrive.

In a wave of major support for blockchain tech, 64% of Founders and 71% of Investors predict we will see more mainstream blockchain applications over the next 3 years.

14. IPO Excitement: Founders Are Most Optimistic About Roblox; Investors Prefer Affirm

Founders’ Top Picks For 2021 IPOs

Investors’ Top Picks For 2021 IPOs

Summary: Please note that at the time of this survey, Coinbase had not yet filed for its IPO. On the heels of 2020’s year-ending blockbuster IPOs of Airbnb and Doordash, enthusiasm for tech IPOs is strong. In a sentiment survey of upcoming 2021 tech IPOs, Founders are notably excited for Roblox, Affirm, and Instacart. Investors prefer Affirm, then Roblox and Instacart. Upstart, Wish and AbCellera are positively noted as well.

NFX will continue to conduct sentiment surveys. To stay updated on the results of future surveys, you can enter your email below:

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.