AI is about to make the vertical SaaS pool 10x deeper.

There are two major factors driving this trend. First, there’s the opportunity created by AI. Initially, we wondered if AI would lead to the consolidation of many vertical companies under one umbrella, or allow industry incumbents to build their own software. But that’s not the case for one large reason: A generalist model is good for everyone, and great for no one. Great AI products need to be trained by teams with specificity, data, and expertise.

Delivering “great” is where a startup can begin to gain ground among many “good” legacy options.

Second: many horizontal B2B SaaS companies are vulnerable to unbundling right now. With a great UX, powerful vertical specific features and AI that significantly cuts cost or delivers exceptional value, startups may be able to complement or displace legacy systems.

A model that is trained on a specific problem, by a team who intimately understands each industry’s control points, with an excellent user experience focused on a specific vertical, can gain a lot of traction in today’s SaaS world. More traction, in fact, than many are giving it credit for.

We’re at a pivotal moment where several factors are converging to create a perfect storm of vertical SaaS innovation. The endpoint of this shift is what we call “the verticalization of everything:” AI empowered vertical companies are going to unbundle and dominate compared to horizontal SaaS.

Furthermore, the market for these companies is not the existing SaaS markets, but the cost of doing the entire work itself, a market we believe to be at least an order of magnitude greater. Previously ignored niches are becoming multi-billion dollar opportunities.

The Verticalization of Everything

There are two things that go into a market reorganization: first, there has to be opportunity created by incumbents in the space (usually through some form of neglect or underserved niche).

Second, something must be newly possible thanks to technology. That technology will have strengths + weaknesses that can exploit the incumbent weak spots.

The opportunity we are seeing in B2B SaaS right now has four prongs:

- The basic infrastructure level for most ERPs is commoditized.

- The UX of horizontal solutions is generally bad or underwhelming. And customers really care about UX.

- Vertical AI tends to outperform generalist AI with sufficient, high quality training data and vertical specific features.

- Increasing interoperability and ease of integration between enterprise systems. Customers are demanding that data flows between their applications enabling new applications and products.

- The cost of building software has become significantly cheaper, particularly for features that are well understood and established.

This translates to both market opportunity and technology advantages for startups. If most user experiences in this space are non-memorable, poor fits, or bad, startups that can better serve those niche audiences. From there, AI excels in all the ways that horizontal ERPs are weak. It delivers uniqueness at scale: instant, customizable solutions for every business/person. It performs even better in a pool of industry-specific documentation and unique data. And it’s faster than ever to build software thanks to AI.

But it goes beyond even these elements. Great companies are changing the way they look at software in general – it’s not just about incorporating algorithmic intelligence. It’s like hiring a superstar employee. The ability to understand and execute job tasks at a high level is only the beginning. Those hires distinguish themselves by understanding the larger context of the organization, and the domain you’re operating in, and fluently translate that understanding to others.

AI-powered companies with deep vertical expertise should be like superstar employees. Perhaps we may even think of them that way in the future.

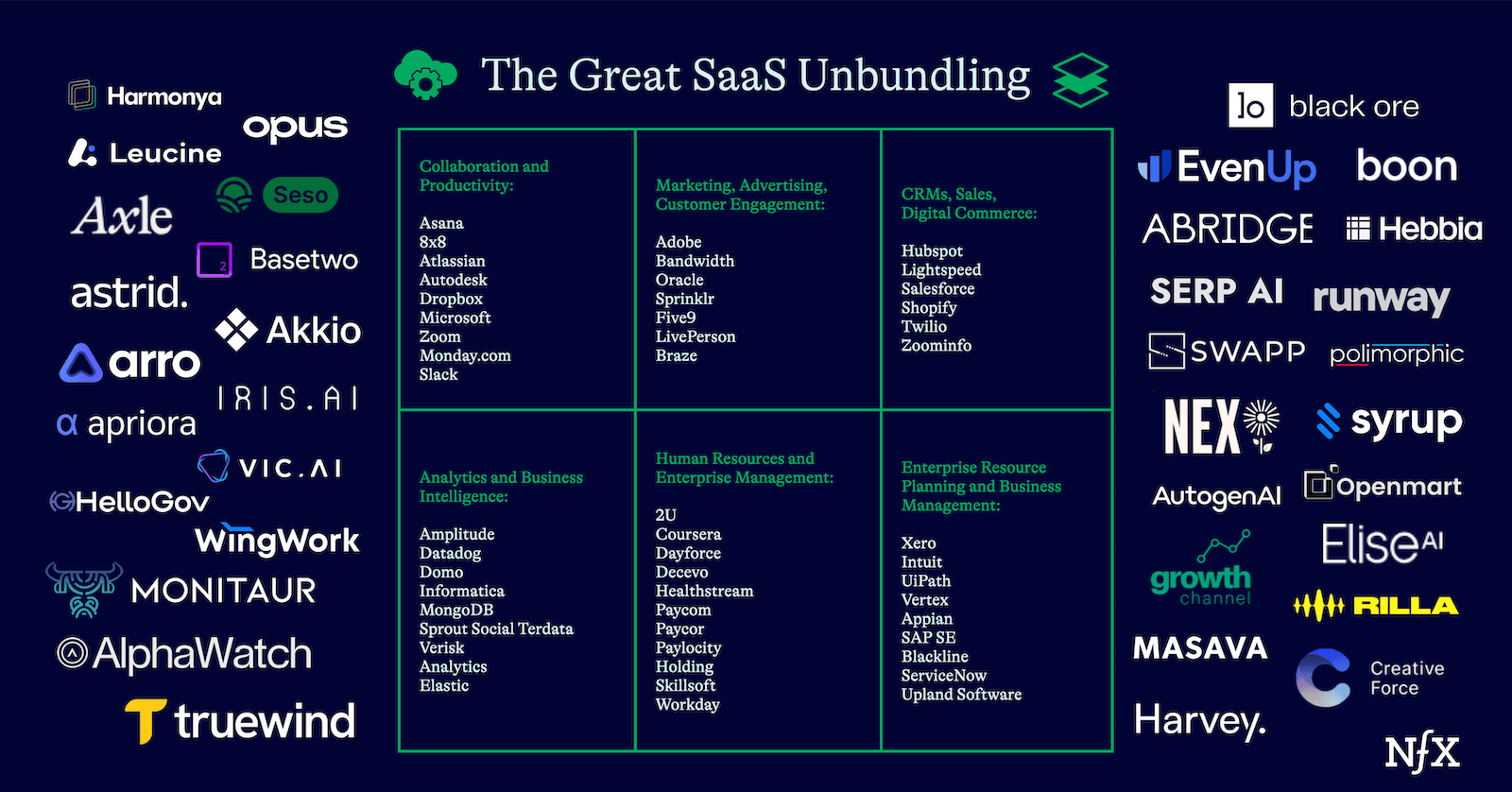

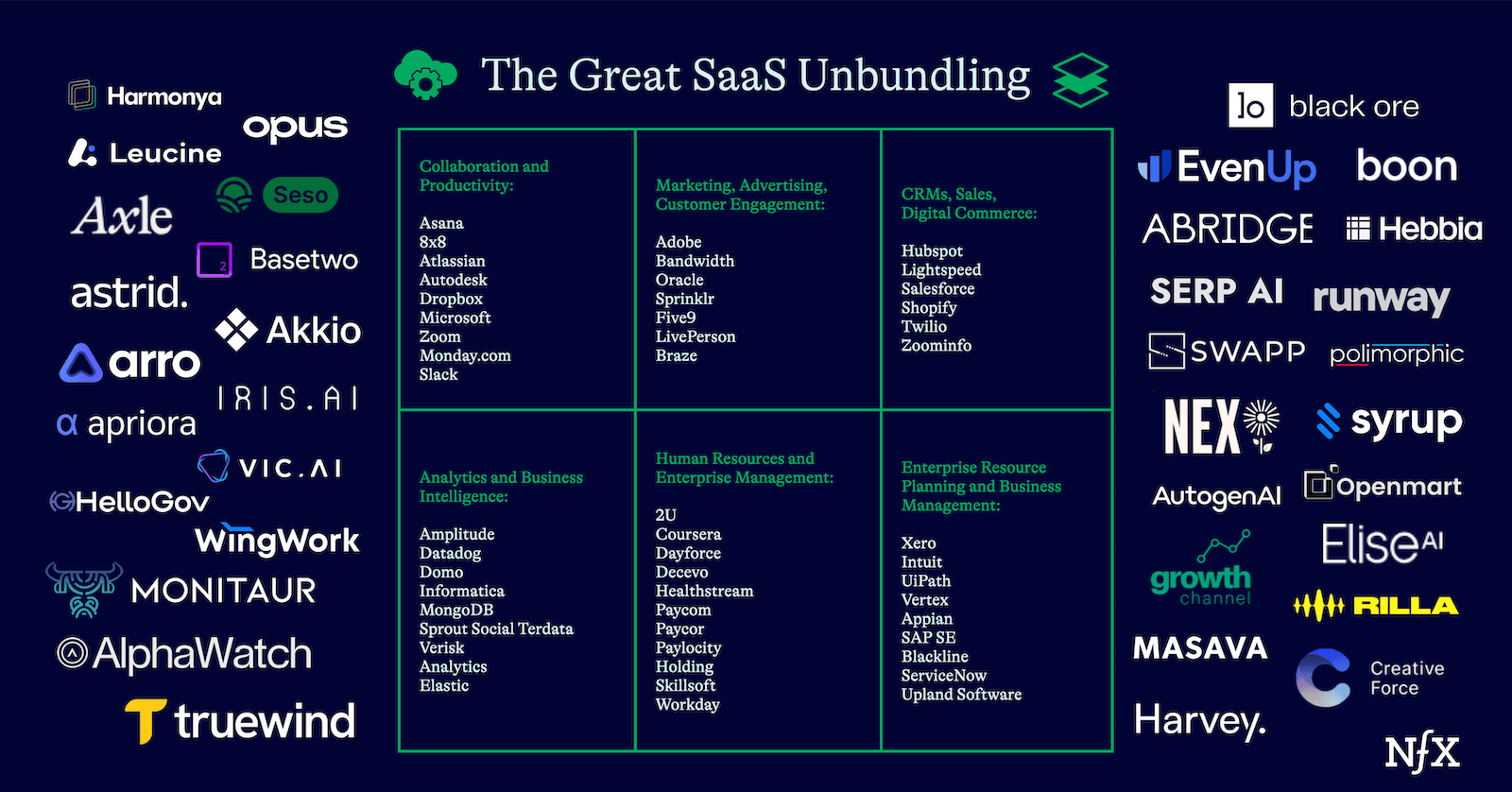

Taken together, this suggests that we may see an “unbundling” of major B2B SaaS categories, like ERPs, or CRMs, by verticalized, AI-powered solutions that behave like superstar employees in their given fields.

Rather than creating industry-agnostic mega-platforms, we will see the rise of highly trained industry specialist platforms. This is particularly true in document-heavy fields, AND will pay dividends for companies that build around a central knowledge database in that field. Those companies will distinguish themselves with the ability to execute high level tasks with superior competence and intuition.

In fact, we are already beginning to see this happening. A number of new AI-powered B2B companies with momentum currently contain a strong vertical element:

- Zocks: A meeting assistant and CRM for financial advisors

- Lev.co: financing platform for the commercial real estate sector

- Norm.AI, AI compliance agents for AI Agents themselves. (Imagine if the US regulatory codes were made into an interactive entity capable of policing AI agents)

- Cargado: Logistics focusing specifically on the US-Mexico border.

- EvenUp: Legal products specifically for personal injury law firms.

- Jobwise.com, a jobs marketplace for the technical skills sector

- Akooda: AI powered-enterprise search

- Darrow: AI powered-legal claims mining

- Smith.ai, AI customer interaction service for SMBs

How Big is This Opportunity?

Even today, vertical SaaS companies command a total market cap near $325B. These markets are often bigger than many believe them to be, and they’re getting bigger for three reasons.

-

AI will allow us to capture more of the customer experience in each vertical

We’ve seen this dynamic emerge across a variety of spaces. In marketplaces, we saw companies increase their value in each vertical by bringing more of the customer experience on-platform.

The first wave of transformation in marketplaces was the transition from horizontal marketplaces (eBay, Craigslist, etc.) to vertical transactional experiences. The next wave of evolution was largely via embedded fintech (insurance, financing, and banking products). The more of the “purchasing experience” that was brought into the marketplace, the better it was for everyone. Customers got a better, more comprehensive experience, and marketplaces were able to capture more value, either by increasing scale or take rates in tandem.

This dynamic also played out in hospitality. It used to be that you could search for a hotel online, and then contact that hotel directly to book. The next evolution was on-platform booking, payments, etc. The entire process was brought online.

We expect AI to take this to another level in B2B SaaS. You could imagine AI that handles customer service, shipping, price optimization, and sales in a specific industry. Or AI that handles inventory management, demand forecasting, and personalized product recommendations for complex B2B manufacturing and distribution operations.

Within certain verticals, some of the traditional services components that were completed by human labor are beginning to become partially or fully automated, resulting in a much larger market opportunity. We’ve outlined this dynamic in depth in our essays on the rise of AI workers.

Taken together, AI is going to make the pool of value in each vertical deeper by allowing more of industry-specific processes to be not just brought on-platform, but optimized.

2. AI will “unlock” historically stagnant verticals

We are seeing a unique opening to sell into historically stagnant industries. Industries like law, govtech, healthtech, or education, which have historically been challenging, are likely to be more open to change now, than ever before.

It’s not often that an industry realizes that they’re in the midst of an “adopt or be left behind scenario.” But we’ve seen several in the past fifty years (the internet, cloud computing, etc). These paradigm shifts create a temporary reorganization where certain services can become embedded. Then, these industries largely return to their slow-moving ways.

For example, in 1992, just five percent of top law firms used online legal search services like LexisNexis and WestLaw. By 1996, 77% of large firms used them. Today, these services are still at the heart of many large law firms (AI is just begging to reopen this window, however, and we are seeing new platforms emerge that capture more of the user experience than simple search tools).

It’s basically a foregone conclusion that every industry will be using AI in some form in the next decade or so. That window is opening. Someone will win in each vertical. And it will be the person who figures out in-industry distribution the fastest.

3. It’s easier to sell 100x better in any field

It’s been said that the vertical sales cycle is uniquely hard. We recognize that vertical sales do have challenges, but a lot of this difficulty is short lived. Customers are far more mobile than people like to believe.

First, if you truly have a breakthrough AI product, you should be selling 100x better (not 10x better). It’s very hard to find a customer that is not willing to at least consider that option.

Second, management teams are under pressure to show that they have an AI strategy, even if it’s not clear exactly how AI will impact every industry right now. That puts pressure on companies to be more open-minded about talking to vendors and moving quickly. In short, there are more engaged sales prospects, which will improve closer rates and shorten the sales cycle.

Taken together, the vertical SaaS market is only getting deeper, and more diverse.

The Timing for an “Unbundling” of Horizontal SaaS is Ripe

In startups timing is everything.

Tech ecosystems often have cycles of bundling and unbundling. A classic example of this is the unbundling of Craigslist’s horizontal marketplace into many niche, vertical marketplaces (a number of which are still major public companies today).

It’s been about 20 years since the very first round of horizontal SaaS companies exploded. It’s natural that an unbundling pattern would begin to follow after that time period.

We’re seeing something similar in AI that looks like this:

Naturally, we expect this unbundling to look different depending on the vertical. Some verticals will benefit from the creation of autonomous AI agents, capable of fully replacing human labor. Others will demand an AI-centric services approach, where AI takes the place of a traditional BPO.

Of course, there is more incumbent competition today than there was during the unbundling of Craigslist years ago. But there are signals suggesting that startups are making significant headway.

Incumbents are both rushing to onboard AI (a slow process for many), or acquiring vertical AI specialists. For example, Thomson Reuters recent acquisition of CaseText and Docusign’s acquisition of Lexicon. Both strong signals that vertical AI products have strong PMF, and expertise that incumbents may struggle to showcase, despite their distribution advantages.

The Construction of The Next Generation of Vertical SaaS Companies

At the core, the structure of these companies will look like this:

New Database of Record + Incredible UX

Any new, AI powered vertical SaaS company must have the capacity to eventually tackle an entire workflow (it’s just the general rule for AI right now, it has to be 100x better, not 10x better). It has to capture as much of the user experience as possible. And the best way to do that is to build around a database of record or a single source of truth.

Large, horizontal companies may have more data in general. But they’re unlikely to have the highest quality, contextual data that truly delivers insights to each specific vertical.

In many verticals, the best data may be unstructured (AI solves this problem), or in hard-to-access silos. If the database of record is hard to get, and you have the domain expertise to get to it, you have a unique edge over any horizontal incumbent right out of the gate. Legacy software companies see your industry in black and white, next generation vertical SaaS companies will see it in color.

Your plan of attack is to build around that database, improving your AI, and UX as you go. (Remember, data is not an effective long-term moat).

The Verticalization of Everything vs Software-Led Rollups

The verticalization of everything only represents one half of the total conversation regarding vertical SaaS in Silicon Valley right now. There are plenty of people who argue that vertical SaaS companies will struggle in the age of AI, and the best option is to go for a software led rollup: rather than trying to sell a new approach from scratch, buy the distribution, then infuse technology from there.

We think this approach is flawed for two reasons:

The first is that there is an inherent mismatch between companies with a technology-centric approach, and those with deep vertical expertise that have always behaved the same way. People vastly underestimate how hard it will be to rip out legacy systems from an established company that has already gained success using those systems in the first place.

It’s forcing people to change who don’t see a reason to. It’s unlikely to work. Largely because you’re dealing with conflicting mindsets. You are trying to rethink an entire experience – they are trying to refine what already exists.

The opposite approach is to approach companies that are already seeking change, but are just looking for the right way to implement it (which is what you’re after when you sell into a vertical instead). You will attract people who are of a similar mindset to you.

Second, as we noted previously, customers are far more mobile than many people give them credit for – especially now.

Customers are used to having exceptional user experiences on the consumer side. (Think about how easy it is to get an Uber or order DoorDash). People have come to expect that level of service during their work hours as well – but these systems lag behind from a UX standpoint.

Startups that deliver great UX, and cut major legacy costs, have far more leverage to win over buyers (even in specific verticals), than people tend to believe.

What We’re Looking For

In the next decade we’re going to see the emergence of several dominant AI-powered platforms in a significant number of verticals. The window of opportunity is open right now. We’re looking for Founders who are able to move fast enough to capture it.

Specifically we want to see Founders with:

- Deep industry knowledge: you read the trade journals, you know the pain and control points in your industry. You live and breathe it

- A clear perspective on leveraging AI to improve that industry 100x

- An obsession with exceptional UX

- A plan of attack for building or accessing unique, vertical-specific data

- Clear, efficient and scalable go-to-market tactics with ease of integration

- Pricing and packaging that enables you to get paid for the value you deliver

The world of one-size-fits all solutions is dying, and the verticalization of everything is on our doorstep.

We’re ready to back the next generation of founders who see that future coming, and want to be on the ground floor with you to build it.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.