Overmoon is a vacation rental platform with a new model that combines the best of hotels and Airbnbs. After several years in stealth, recently they announced in TechCrunch that they raised $10M in VC funding from NFX, Khosla Ventures, and others, along with $70M in real estate capital to continue expanding their portfolio, having already hosted 4000+ guests and quadrupled their revenue in 2023.

Overmoon’s model is built around acquiring homes in vacation destinations popular with groups or families, redesigning them to meet Overmoon’s more premium standards, and then using tech to manage the portfolio efficiently, ensure a high-quality customer experience, and keep houses rented out year-round.

Here’s why we’ve backed them since seed:

1. Experienced Founder

NFX has known founder Joe Fraiman for several years and backed his last startup, Lyric. It was a promising company that focused on furnished apartments for business travelers, but ultimately fell victim to the pandemic when business travel cratered for the better part of two years.

Throughout that experience, I was impressed by Joe’s deep understanding of real estate and technology, something he picked up at Lyric, Bridgewater, and other leadership roles at proptech companies. He also has a unique ability to surround himself with experts in real estate, capital markets, technology, product and operations with experience in companies like: Roofstock, Opendoor, PayPal, Facebook, Offerpad, American Homes 4 Rent, Compass, WeWork, Progress Residential, Bridgewater, and Credit Suisse.

Overmoon Founder, Joe Fraiman

I also admired the way Joe communicated with everyone during tough times for Lyric and knew that I would back him again in the future. When he came to me with the idea for Overmoon, I was immediately excited – for all the reasons that make their model so unique. But also because of Joe himself.

2. The Market is Right

While certain segments of the real estate market have struggled over the last few years, this is actually a great time to build a vacation rental company in a sustainable way.

COVID created an accelerated boom and bust cycle in vacation homes.

The boom: when nationwide work-from-anywhere policies went into effect, millions of city dwellers either bought or rented homes in vacation destinations and worked remotely, causing a huge spike in prices.

The bust: rising interest rates have also pushed off a lot of individual buyers who can no longer afford to buy a second home. This has caused a shortfall in buyers, as noted by this Redfin report saying that “demand to purchase vacation homes sits near 7-year low.”

All this has allowed Overmoon to buy vacation homes at steep discounts. In fact, Overmoon paid 17% below asking price on average for the homes they bought in Q4 2023, which nets out in strong returns for the real estate investors in the platform.

Overmoon’s model also speaks to an interesting time in the vacation rental space, where the consolidation of individual homes under the umbrella of a sophisticated, scalable, and tech-enabled brand echoes an earlier shift in hospitality, when the unreliable “motor inn” era of hotels gave way to enormously successful chains like Marriott and Hilton that could guarantee the standard of your stay no matter where you were in the country.

3. Forward Thinking

Overmoon is also leveraging AI and other tech to meaningfully grow their advantages and product differentiation.

Joe and several of his senior leaders came from Bridgewater, one of the world’s most successful hedge funds. They’ve been able to use their experience in advanced data analysis and predictive models in their acquisition strategy, which allows them to buy the right home on the right block at the right price, every time. I know from my own experience in Proptech that this is a hard problem to solve, and the technology they’ve built can’t be easily duplicated.

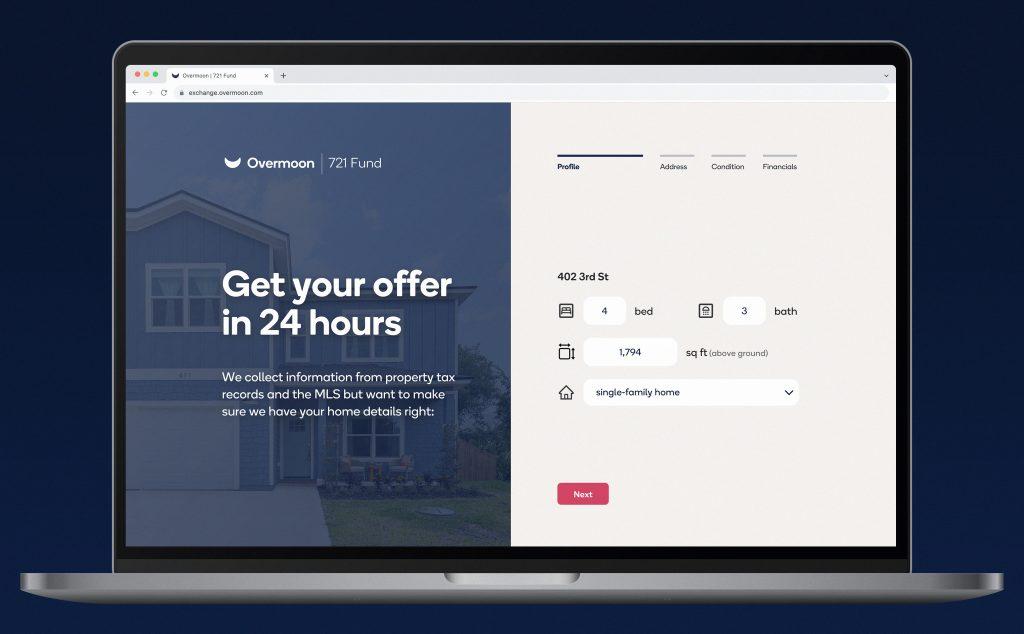

Another example of their innovation mindset is the recent launch of their Overmoon 721 Fund, which allows homeowners looking to sell their home to reap significant tax, time, and investment benefits via the little-used 721 tax code.

Under this program, homeowners can exchange their house for shares in the Overmoon 721 Fund, converting their home into a more diversified investment that maintains passive income and appreciation potential.

While Overmoon would own and operate the home, the seller would be able to defer the capital gains tax, shed the burdens and costs of property management, while maintaining regular passive income in the form of monthly fund distributions.

There are many other areas of product and technology investment that lead to significant operating efficiencies, scalability, and improved returns for investors.

All of this underpins the idea that Overmoon is fundamentally a technology company building advanced proprietary technology with an efficient operating model to ensure a high-scale and high-margin business.

To learn more and book your first vacation with Overmoon, visit them here.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.