It’s been about 1 year since the current economic downturn began, with several challenges along the way. Most recently, the fall of SVB introduced yet another stressor to the startup ecosystem.

During the week of March 14 2023, just days after SVB’s collapse, NFX surveyed 870 Founders in our network-at-large to gauge confidence levels around their startup’s money management, fundraising plans, investor relationships, remote teams – and the overall fundraising environment. Founders who subscribe to NFX’s newsletters and products were selected to participate in the survey. The majority of our sample was early-stage Founders (pre-seed and seed), and 14% were Series A+ companies.

This report is part of an ongoing community initiative to track Founder sentiment and their critical company-building decisions over time.

As Founders ourselves here at NFX who have been through several downturns and crises before, we understand the challenges that you may be facing right now. What makes this community so strong is our unusual support of each other.

Use this information to navigate what lies ahead.

Tough times ahead for 2023 fundraising

Fundraising confidence is low for early-stage founders right now.

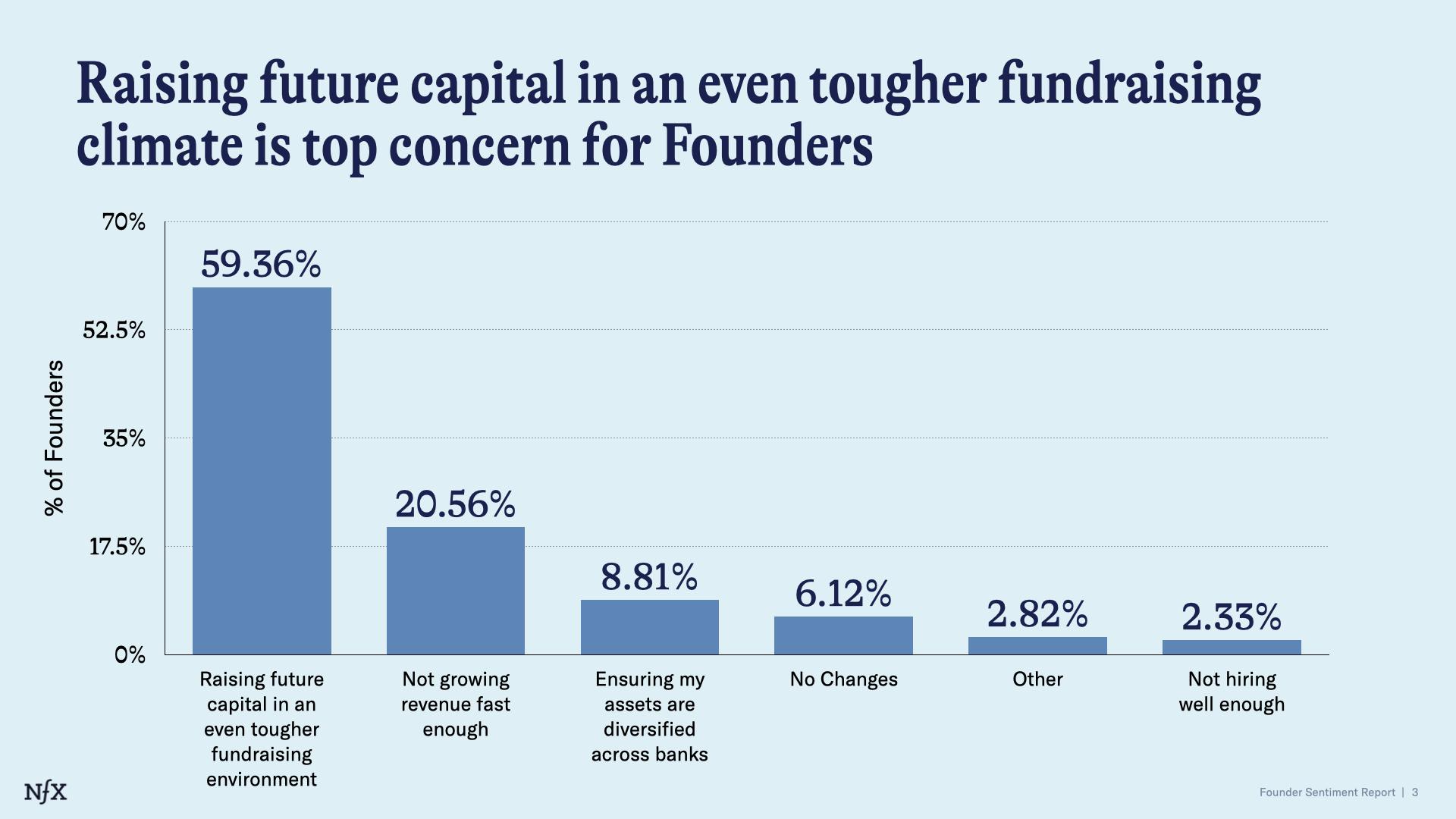

- 59% of Founders think the fall of SVB is going to make an already tough fundraising environment, even tougher. They cited it as the biggest concern as a startup Founder in the biggest months.

- They feel that market conditions for the rest of 2023 won’t be optimal for Founders.

- Another 22% are concerned they won’t be able to raise capital at all this year.

Fundraising over the last year

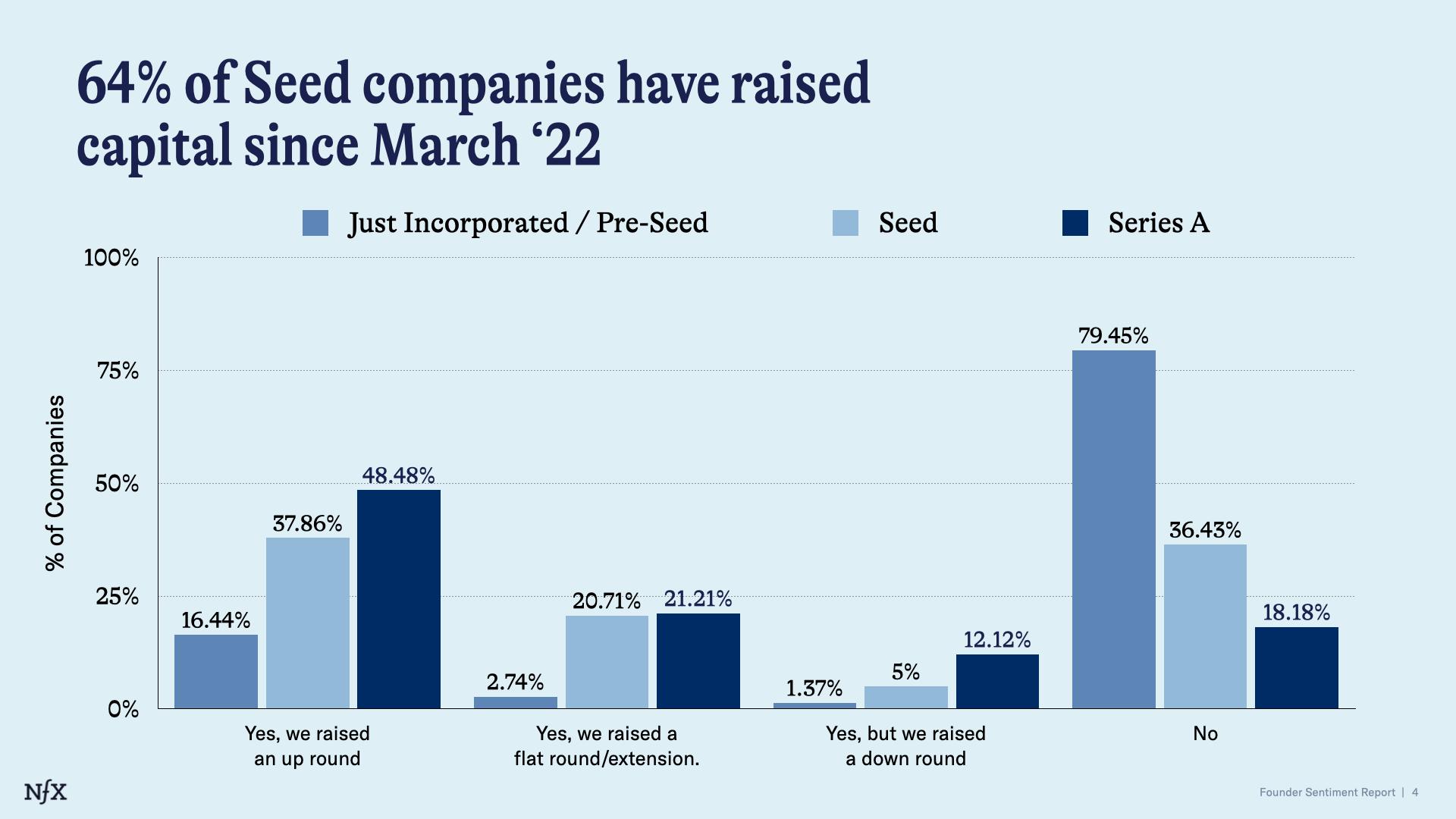

Newly-incorporated companies and those who hadn’t yet raised any money at all have had the hardest time fundraising since the downturn began in March 2022. But Seed-stage founders have been notably more successful.

- 60% of Founder respondents across all stages said they have attempted to fundraise in the last year, since March 2022.

- Of those, 49% of Founders across all stages were unsuccessful.

- Of the Founders across all stages who did successfully raise capital, 32% raised an up round, 15% raised a flat round / extension, and 4% raised a down round.

- 30% of Founders who successfully fundraised over the last year, raised less than $500K. 22% raised between $500K and $1M.

- 40% of the Founders who successfully fundraised over the last year said it took them 3-5 months to do so. 31% said it took 6-12 months.

- A healthy majority 64% of Seed-stage founders, specifically, reported that they successfully raised capital since March 2022.

- 82% of Series A companies have successfully raised since March 2022.

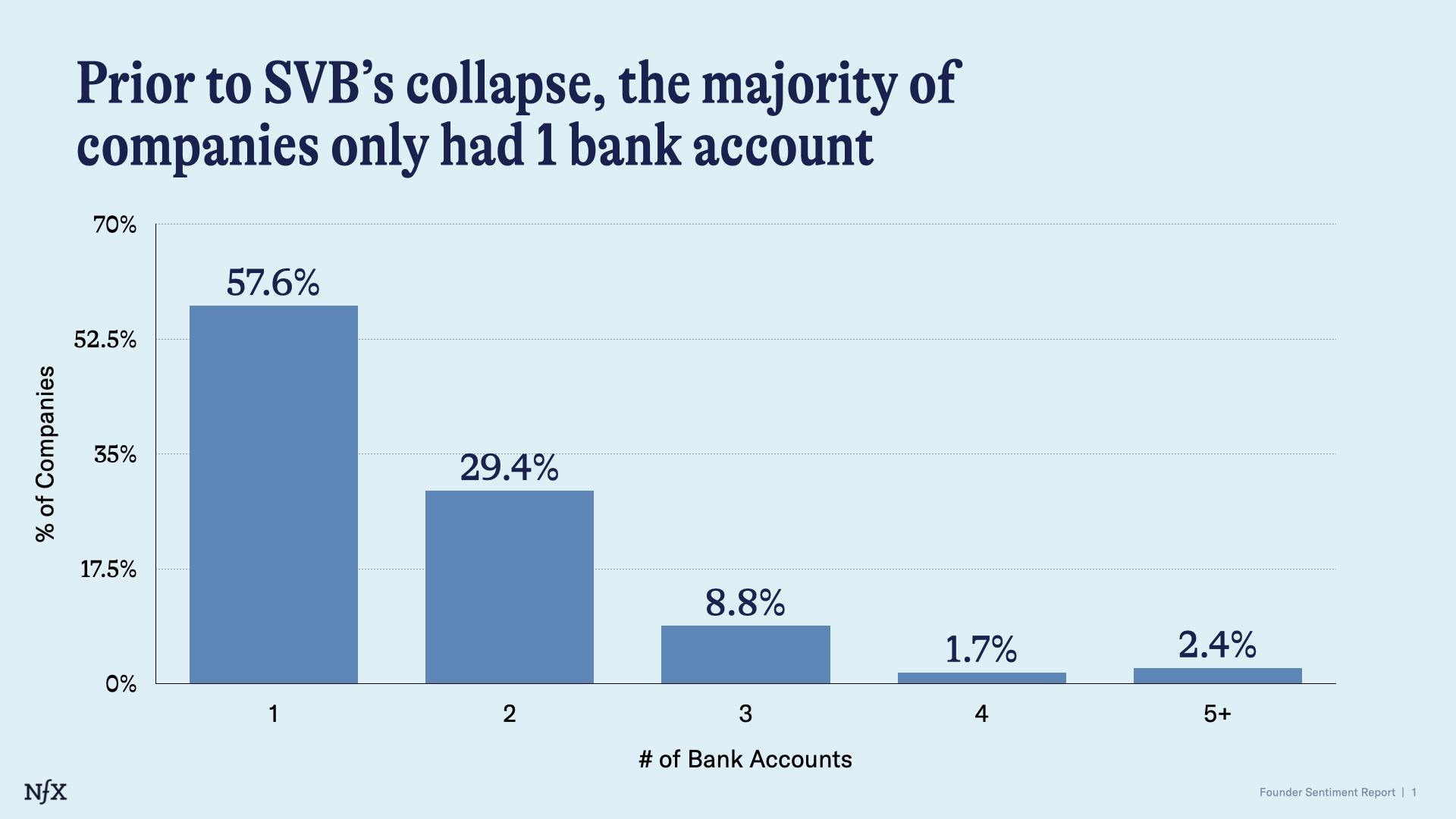

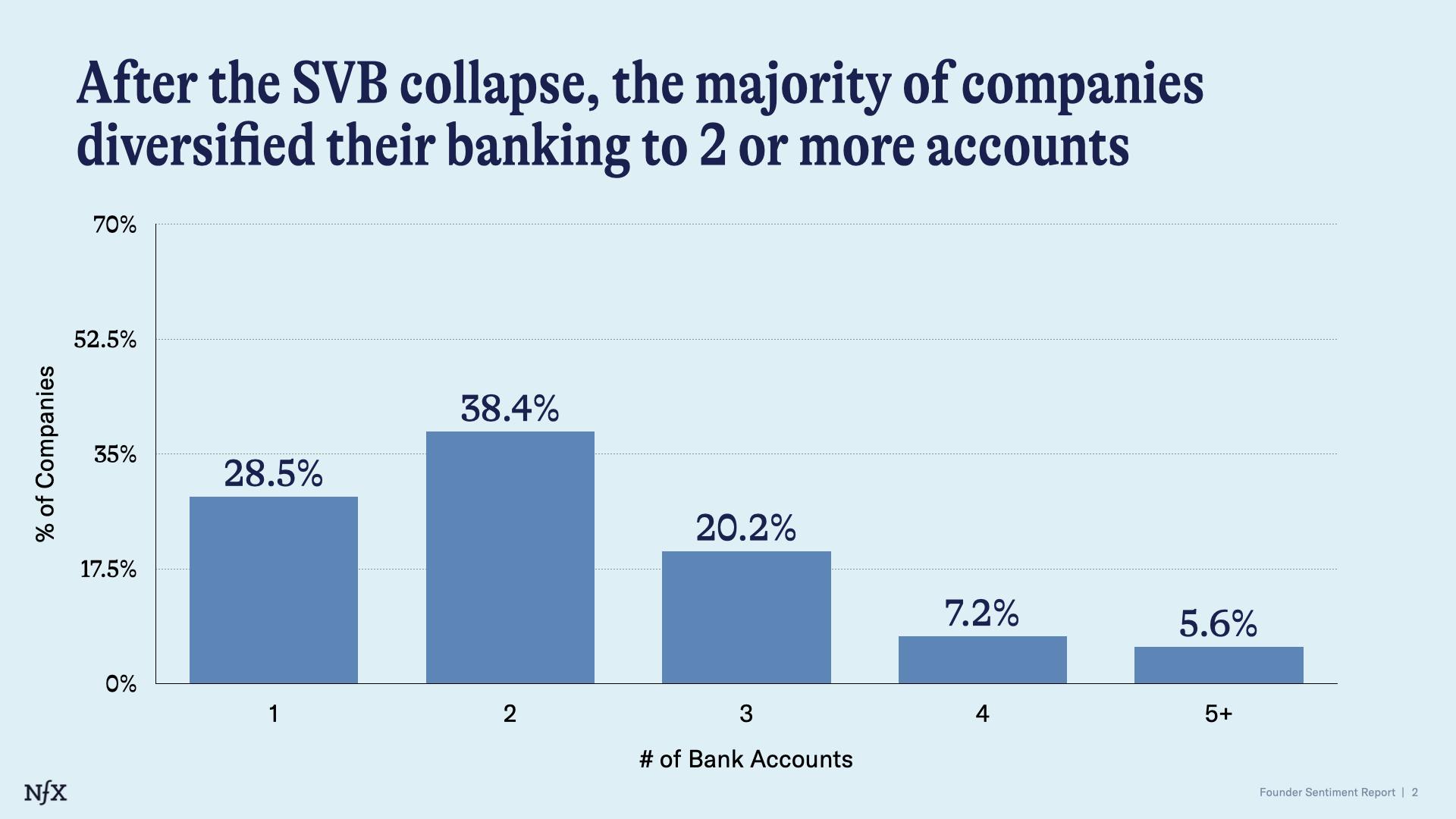

Banking: Before & After SVB

The vast majority of startups weren’t well-prepared for SVB’s collapse. And very few of them have confidence in SVB going forward – at least as it stands today.

- 58% of Founders surveyed had just 1 bank account for their company.

- 26% of the Founders surveyed banked at SVB before the collapse.

- After the collapse of SVB, the number of companies choosing to open an account with a big bank nearly doubled, from 31% to 57%.

- Fintechs (Arc, Mercury, Brex, Capital.xyz) grabbed some benefit from the collapse, but to a lesser extent. They got about a 4% bump in market share.

- Just 3.8% of Founders say they will bank with SVB moving forward.

Founder-Investor Relationships

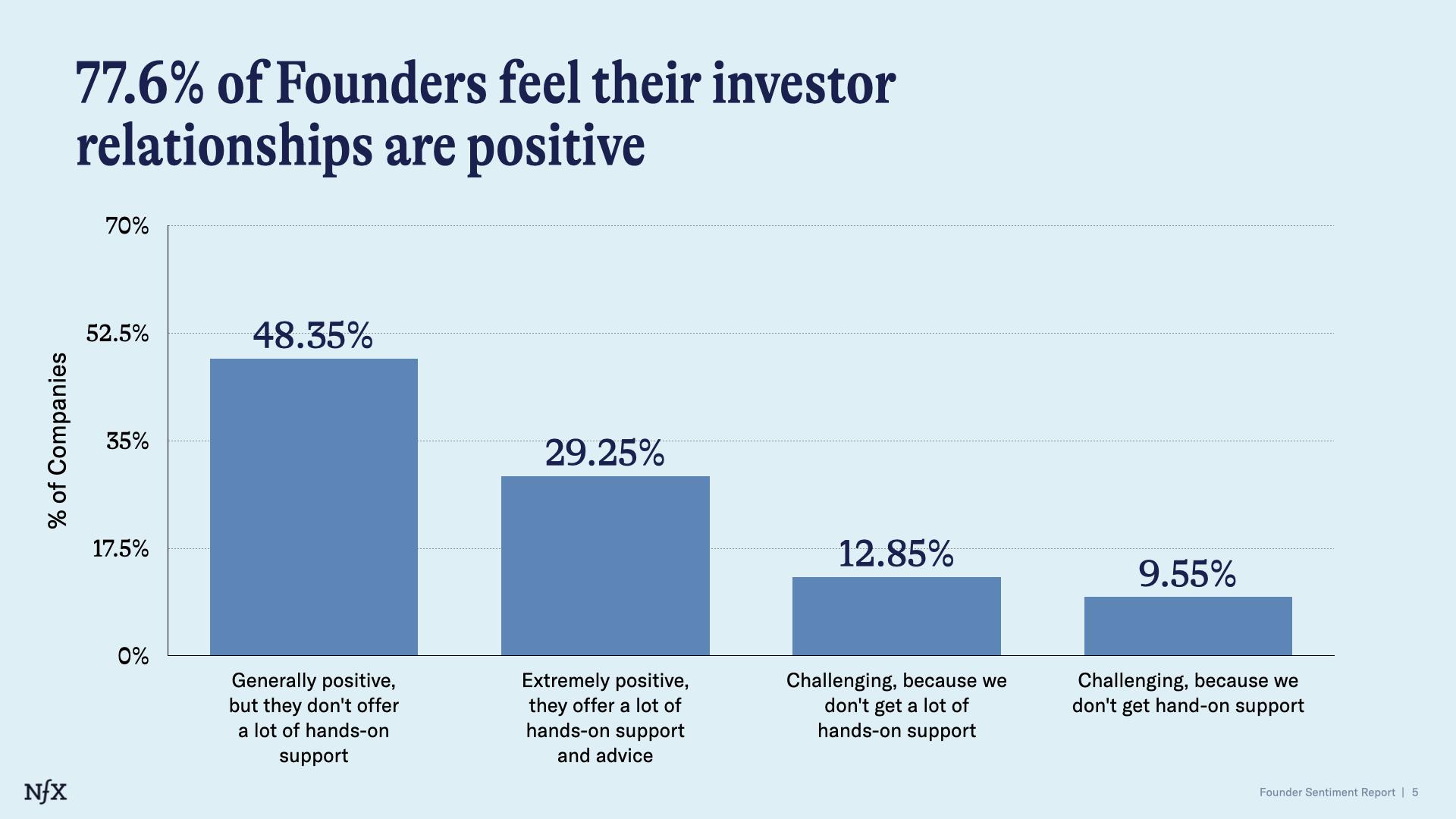

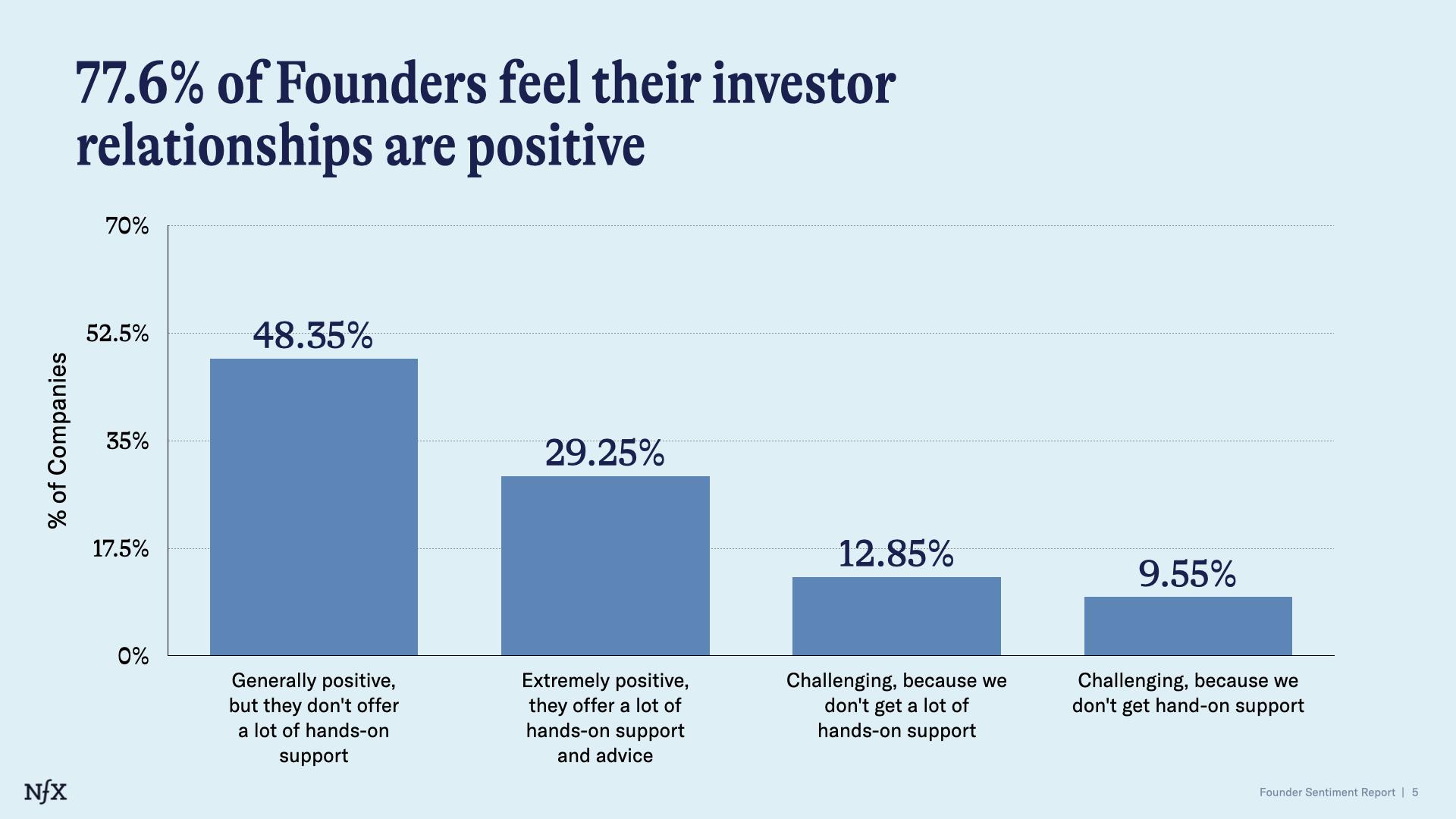

Overall, most Founders feel positively about their investor relationships right now – even if the “value-add” support from investors is still hit or miss.

Relationship scoring

- Nearly 78% of Founders surveyed across all stages describe their current relationships with their investors as positive, either “extremely positive” or “generally positive.”

- Nearly half of all Founders describe their relationship with investors as “generally positive – but not a lot of hands-on support.”

- 30% of Founders feel they do get hands-on support from their investors.

- 9.55% get no support at all from their investors.

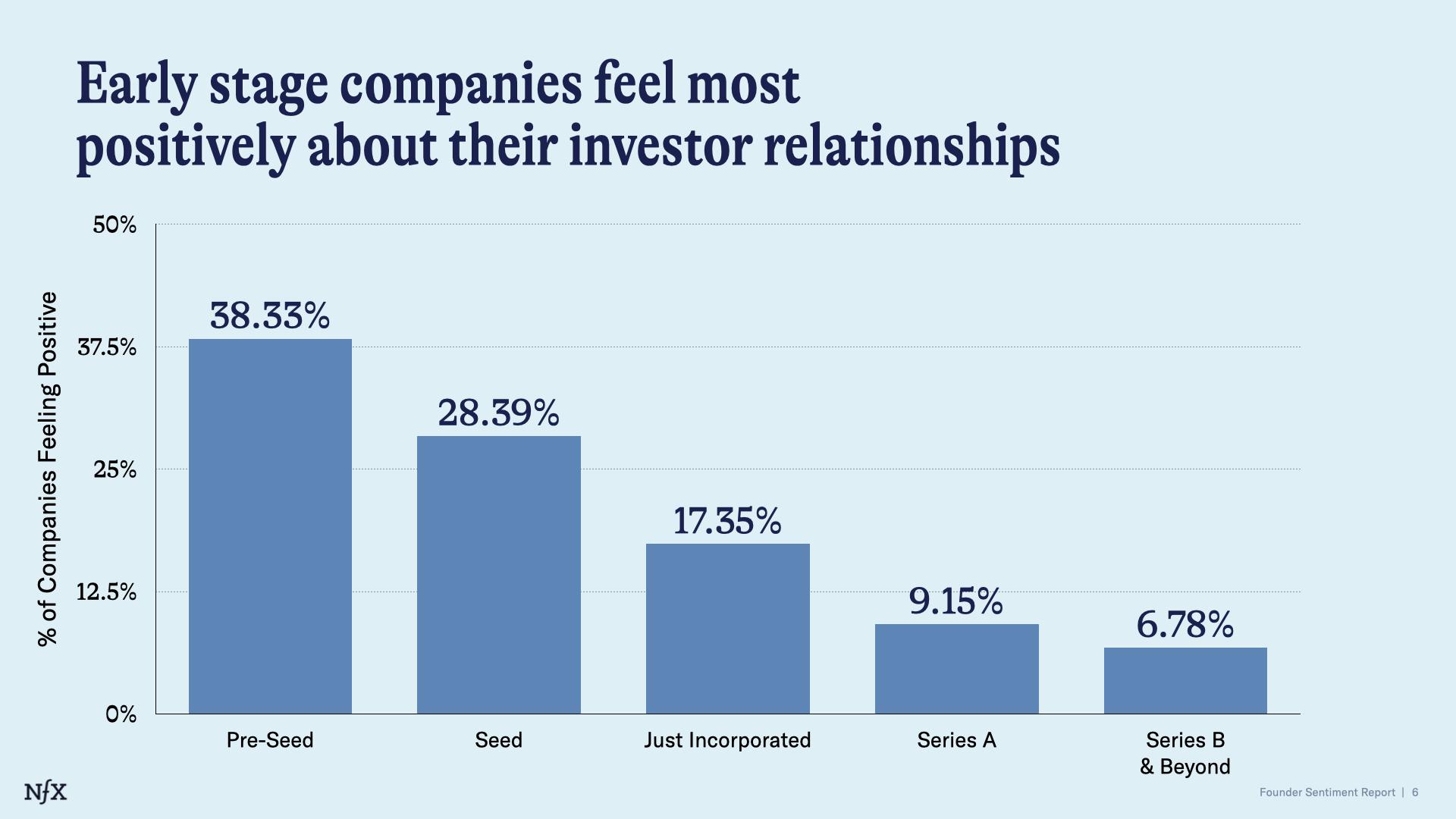

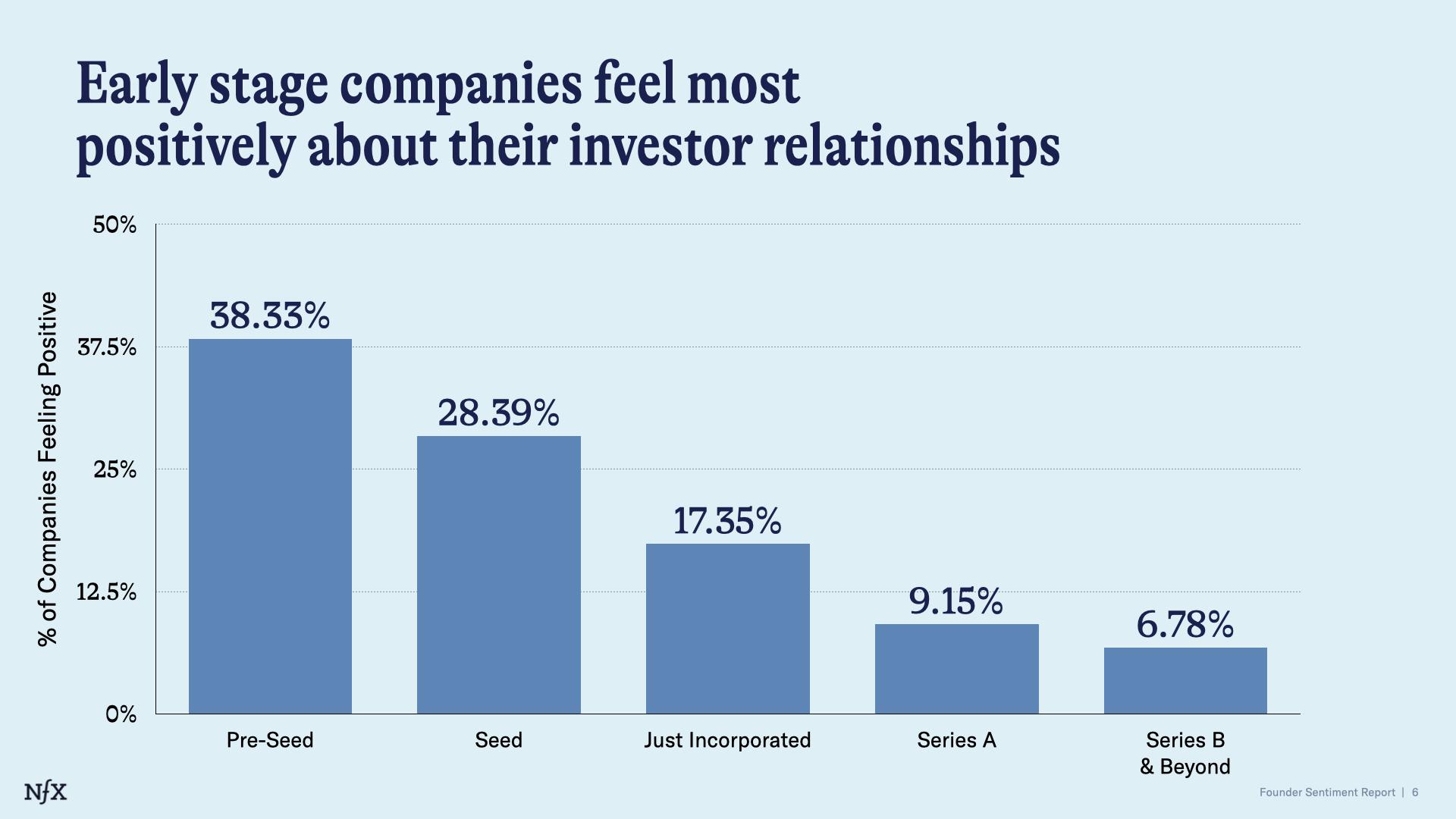

- Good feelings, early on: When analyzed by stage, Pre-Seed companies (38%) and Seed companies (28%) feel positively toward their investor relationships. At Series A and B, only 9% and 7% of companies feel positively inclined toward their investor relationships, respectively.

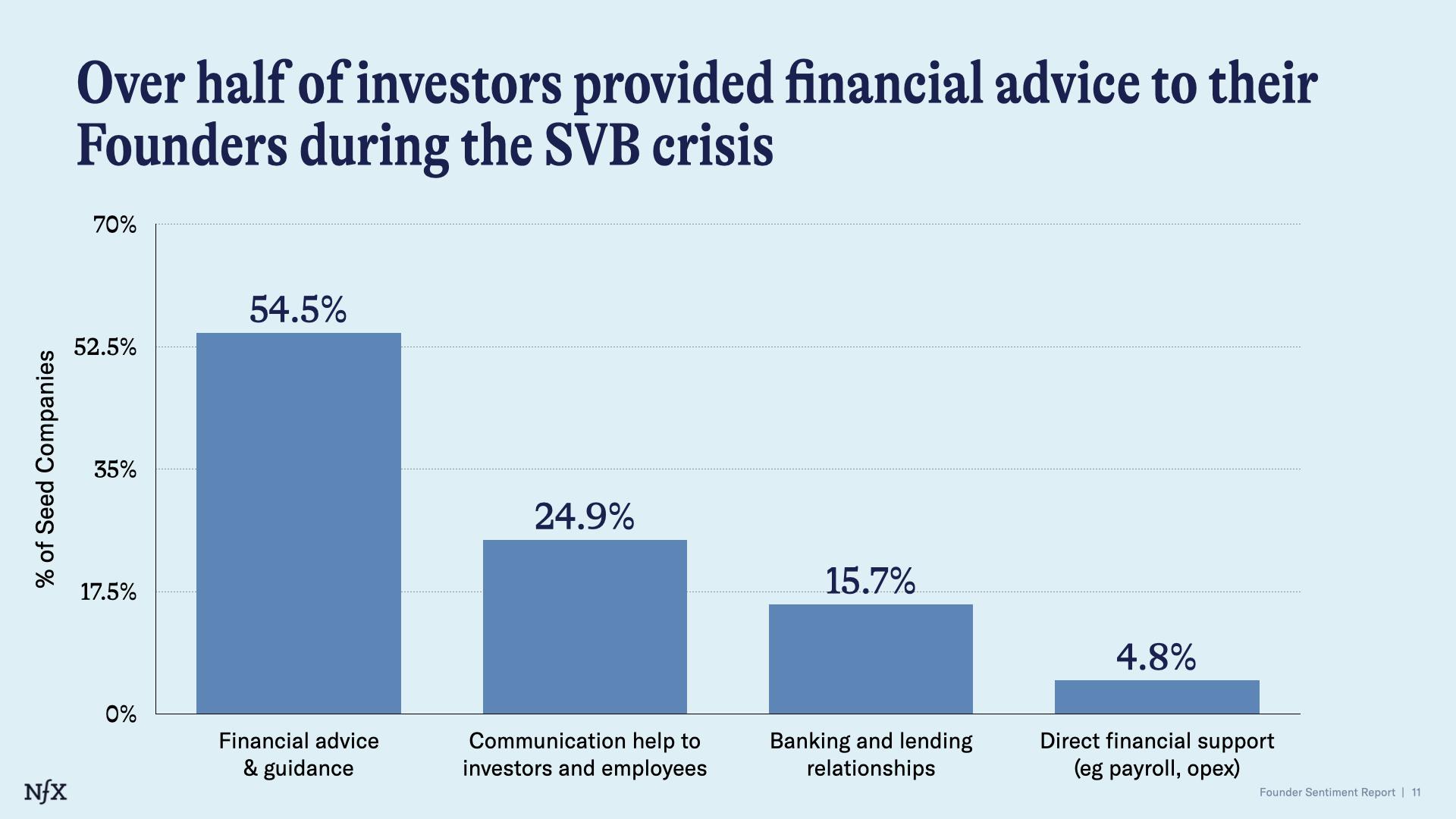

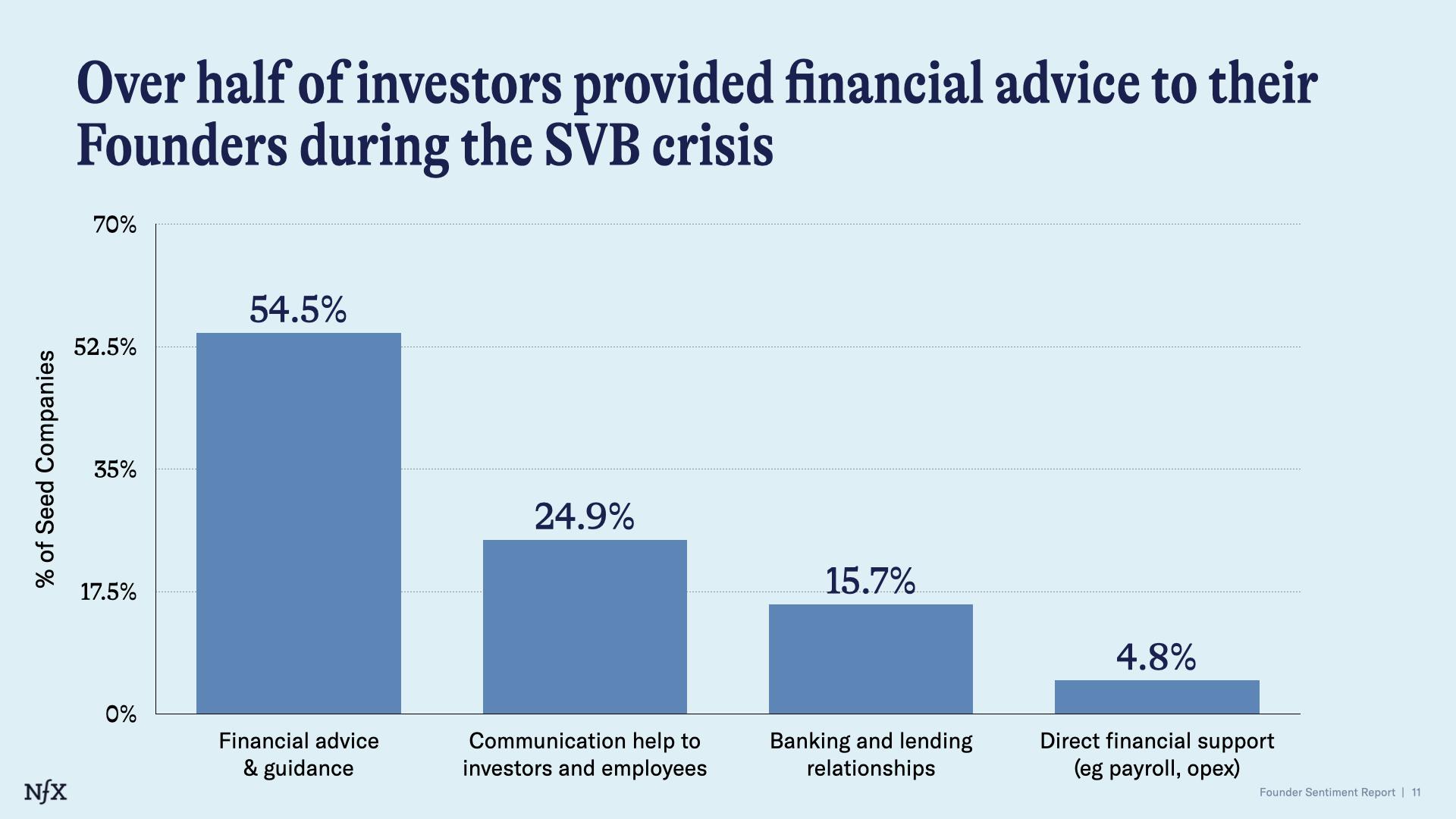

Support from investors during the SVB crisis

- During the SVB crisis, a little more than half (54%) of Founders say they got financial advice & guidance from their investors.

- 16% of Founders who received support from their investors in that time got it in the form of referrals to banking and lending institutions.

- 5% of Founders received direct financial support from investors (to cover payroll, operating expenses, etc) during the SVB crisis.

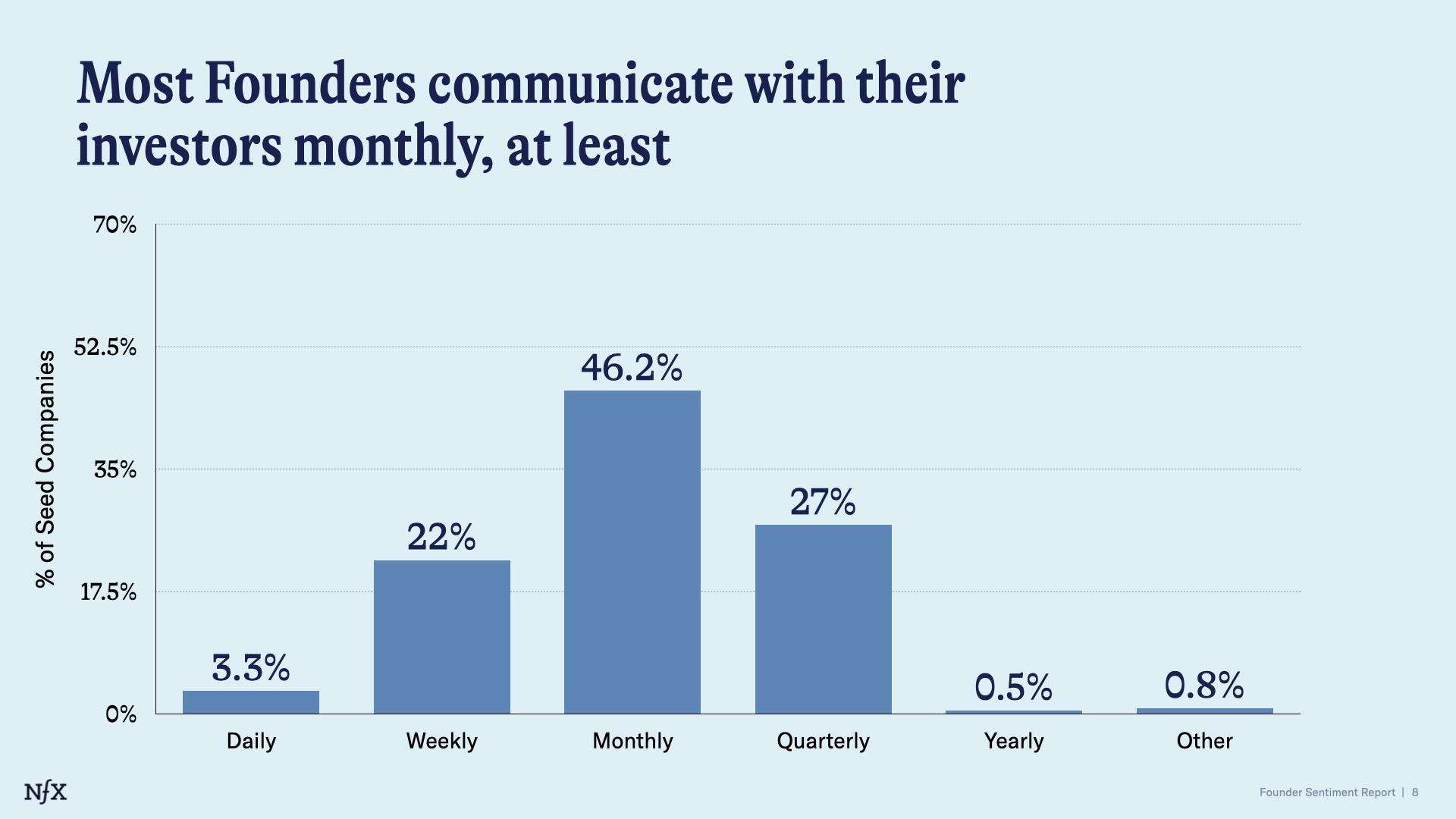

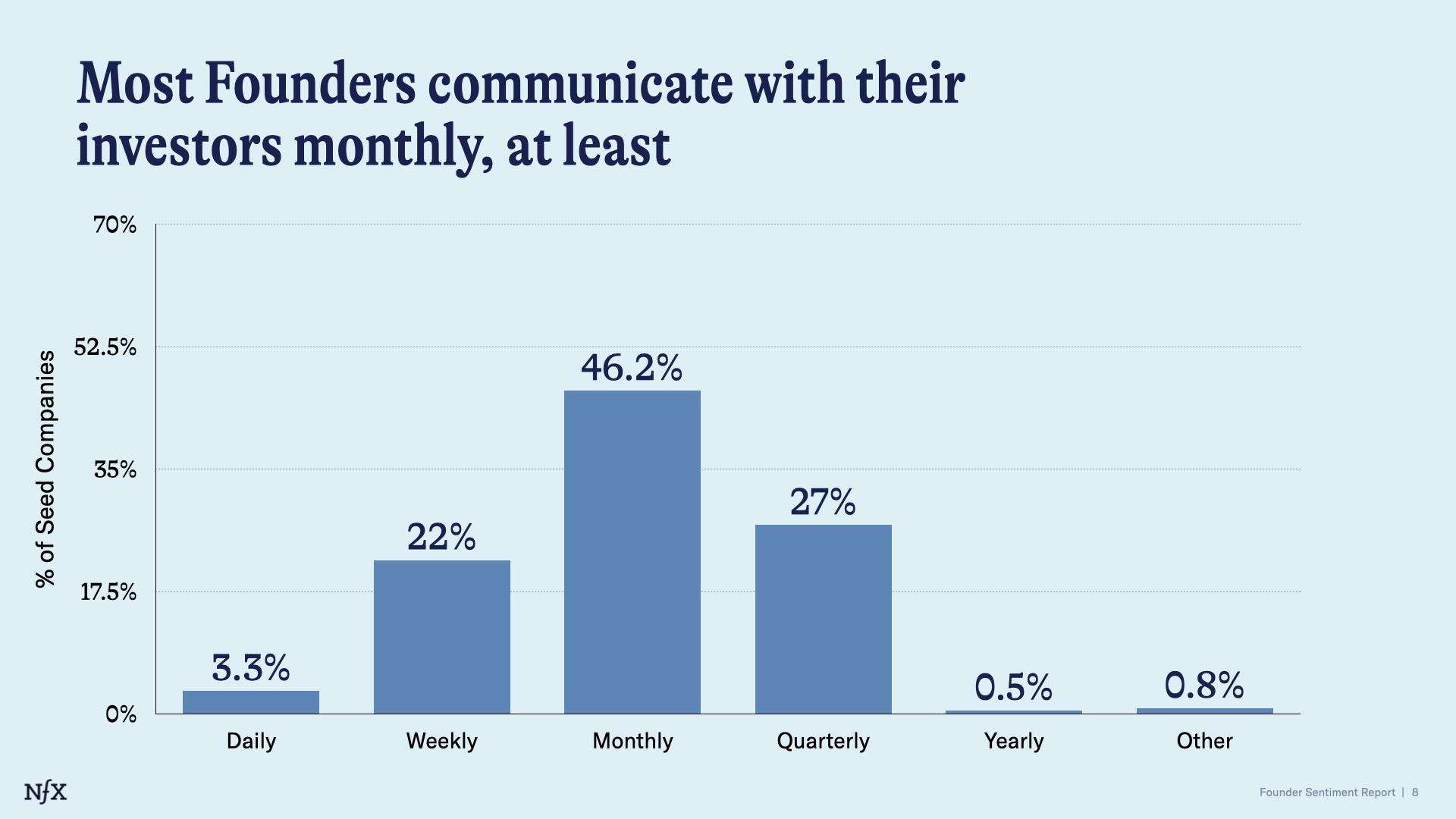

Founder Communication Habits

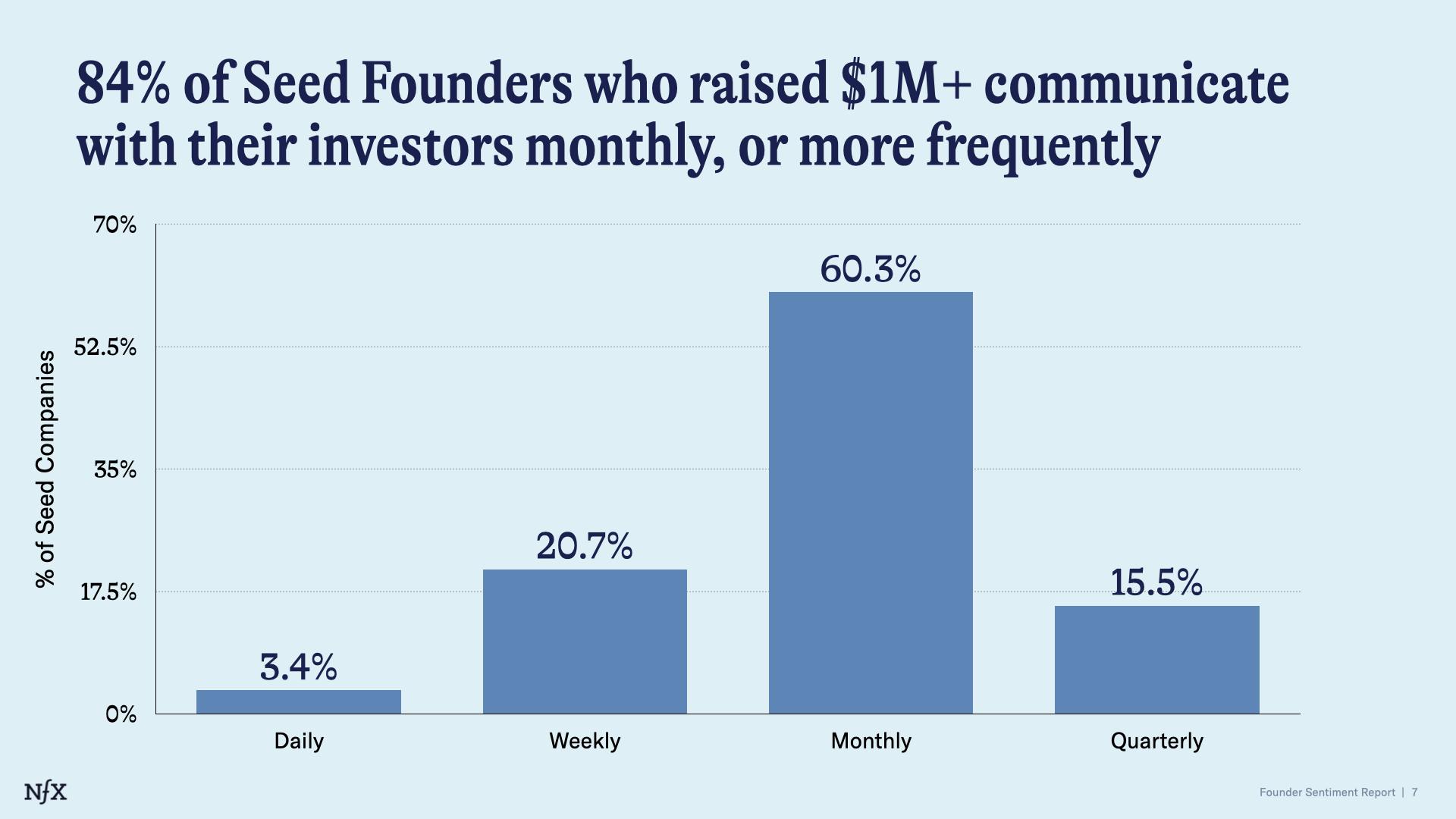

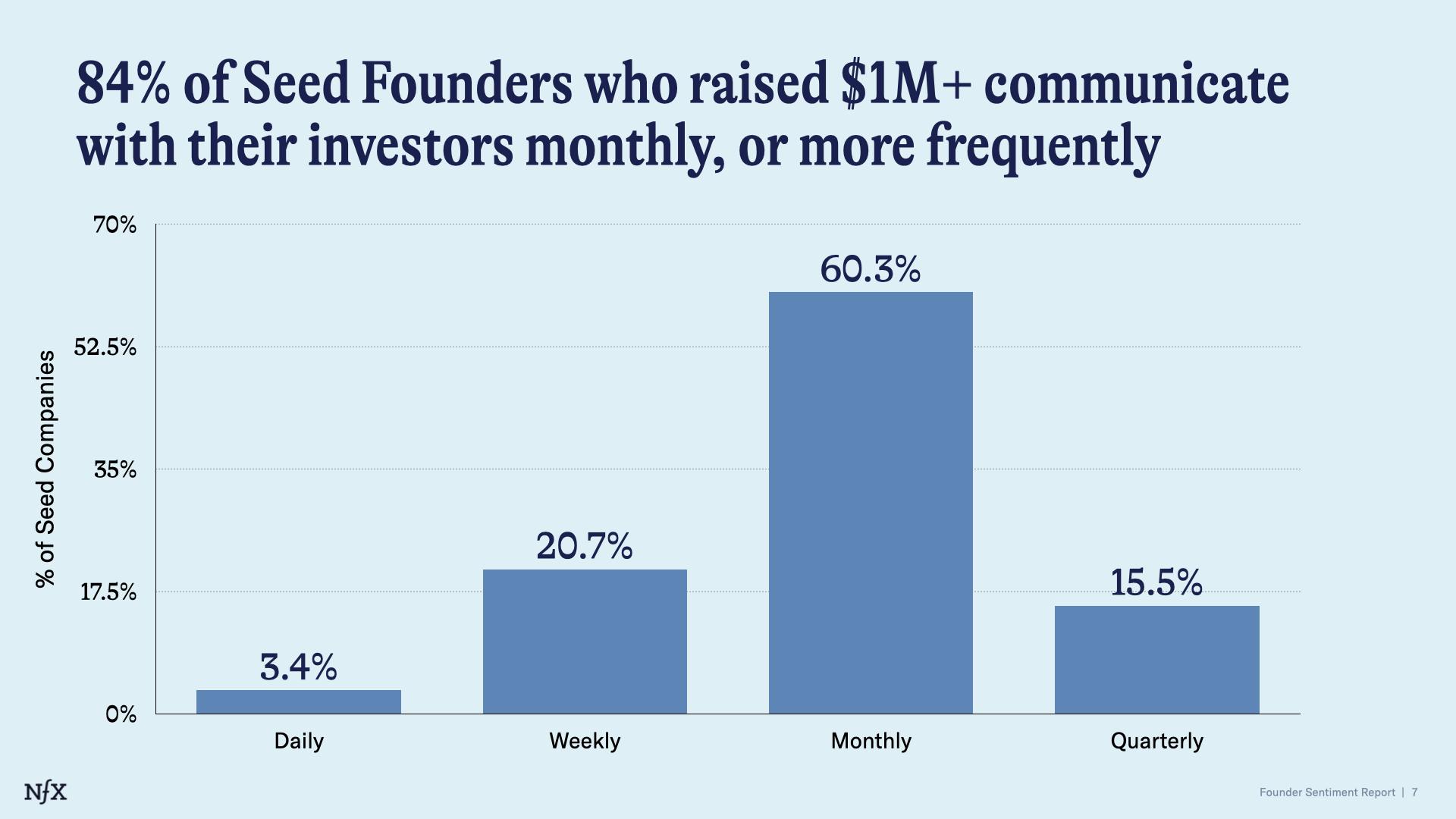

- Most Founders, across all stages, communicate with their investors monthly (46.2%), followed by quarterly (27%). 22% communicate weekly.

- When analyzing Seed-stage founders who have raised $1M or more, 60% of them communicate with their investors monthly. (This is NFX’s recommendation, too.)

Imbalance of Power

- 82% of all founders surveyed think investors have more power in the current environment; 18% say founders have more power.

Early-Stage Hiring Trends

Most Founders in this survey haven’t done layoffs (68%) over the last year, but they hired slowly, too.

- 32% didn’t hire anyone in the past year, and 27% hired just 1-2.

- Most are hoping to hire more, though. Nearly a third said they plan to hire 3-5 employees in 2023.

- Nearly half of Founders said the hardest role to hire is an Engineering lead. Sales lead came in second at 28% and Product third at 21%.

- Specifically within the Generative AI sector, Founders report that Marketing roles are the #2 hardest to hire. Engineering roles are #1.

- While Founders don’t feel they have the advantage in fundraising, they do feel like they have the advantage in hiring. Nearly three quarters claimed employers have the advantage over employees in today’s economic environment.

- Only 7.5% claimed hiring as their biggest challenge since March ‘22.

Remote vs. In-Person

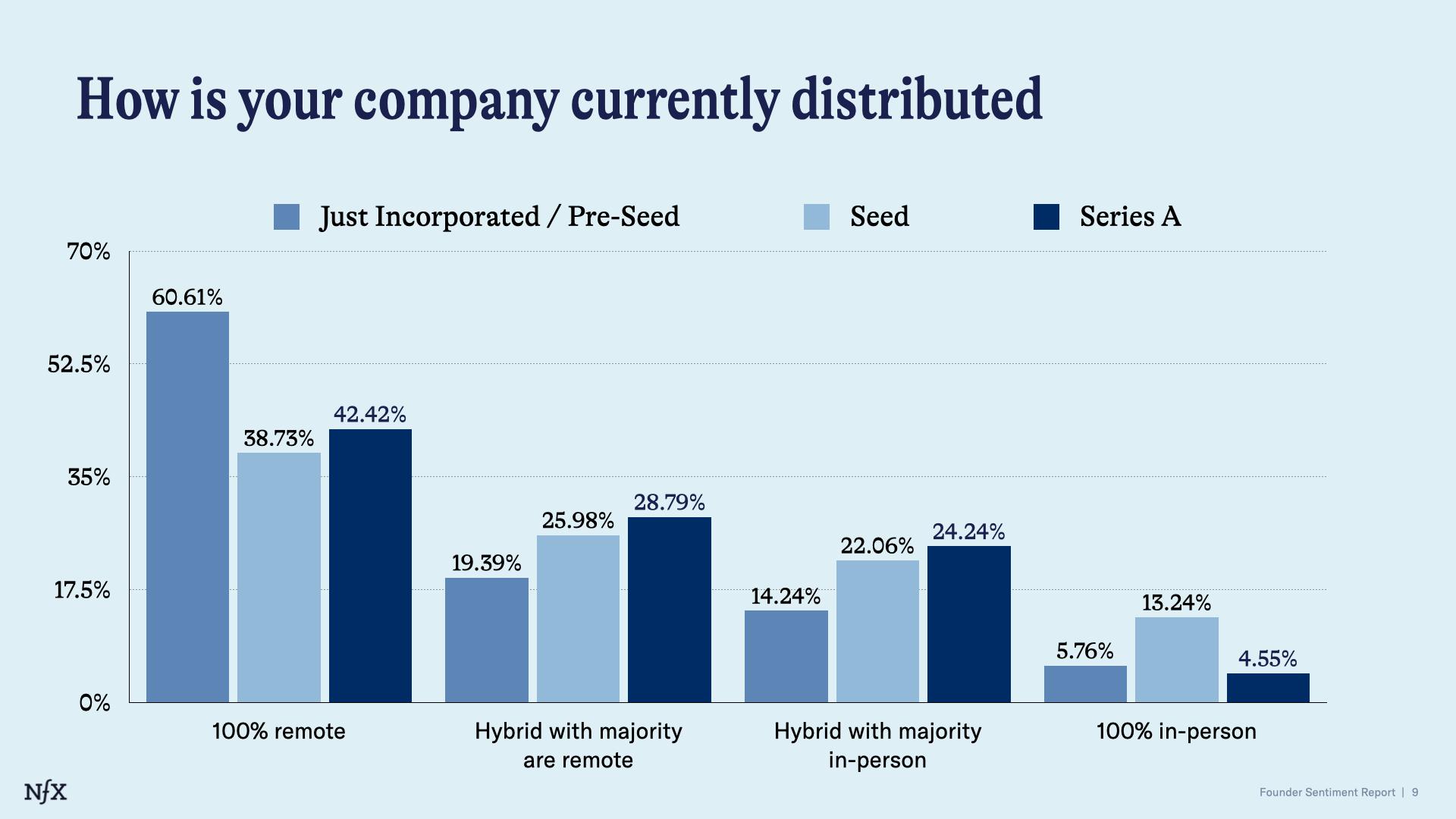

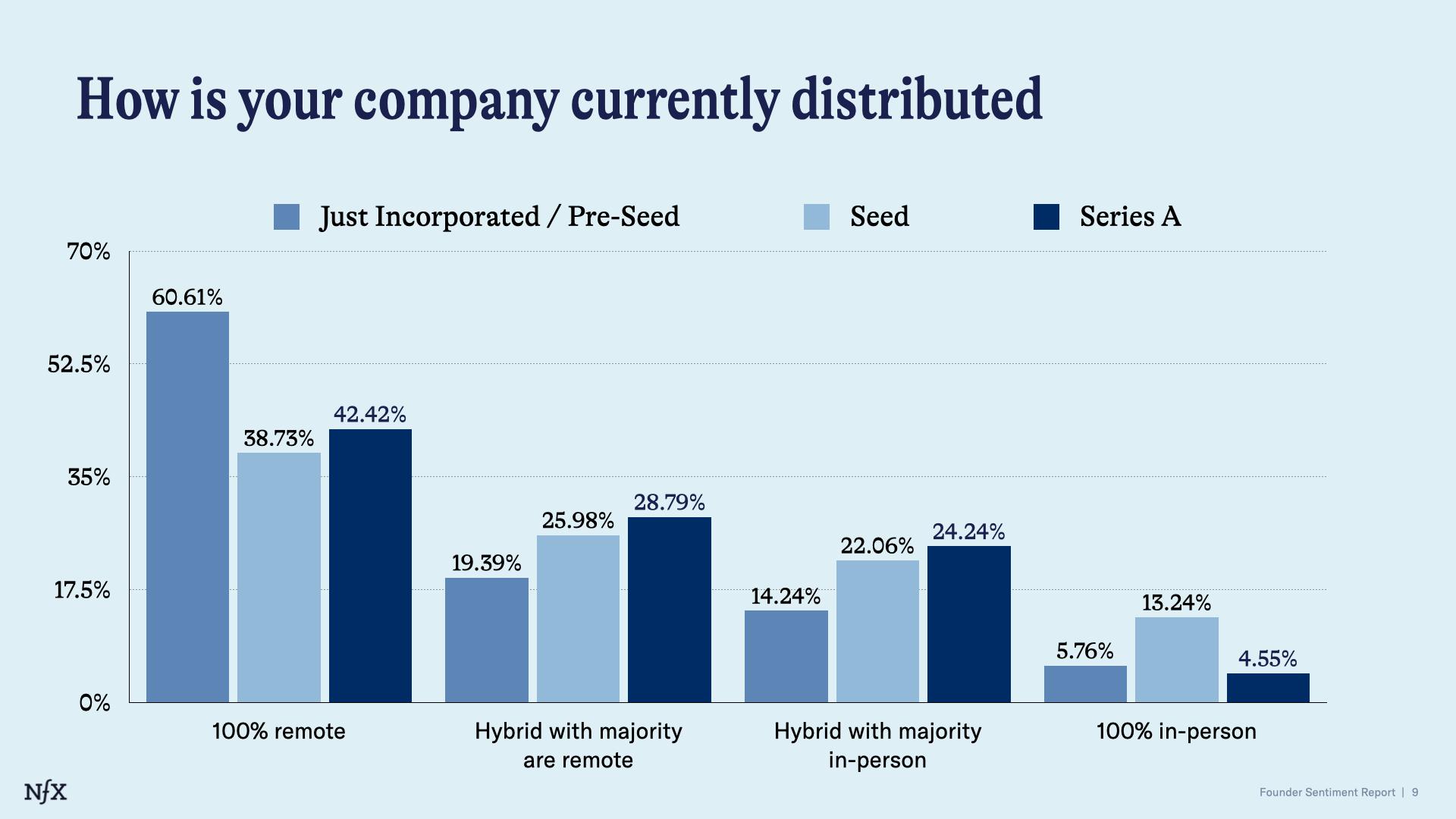

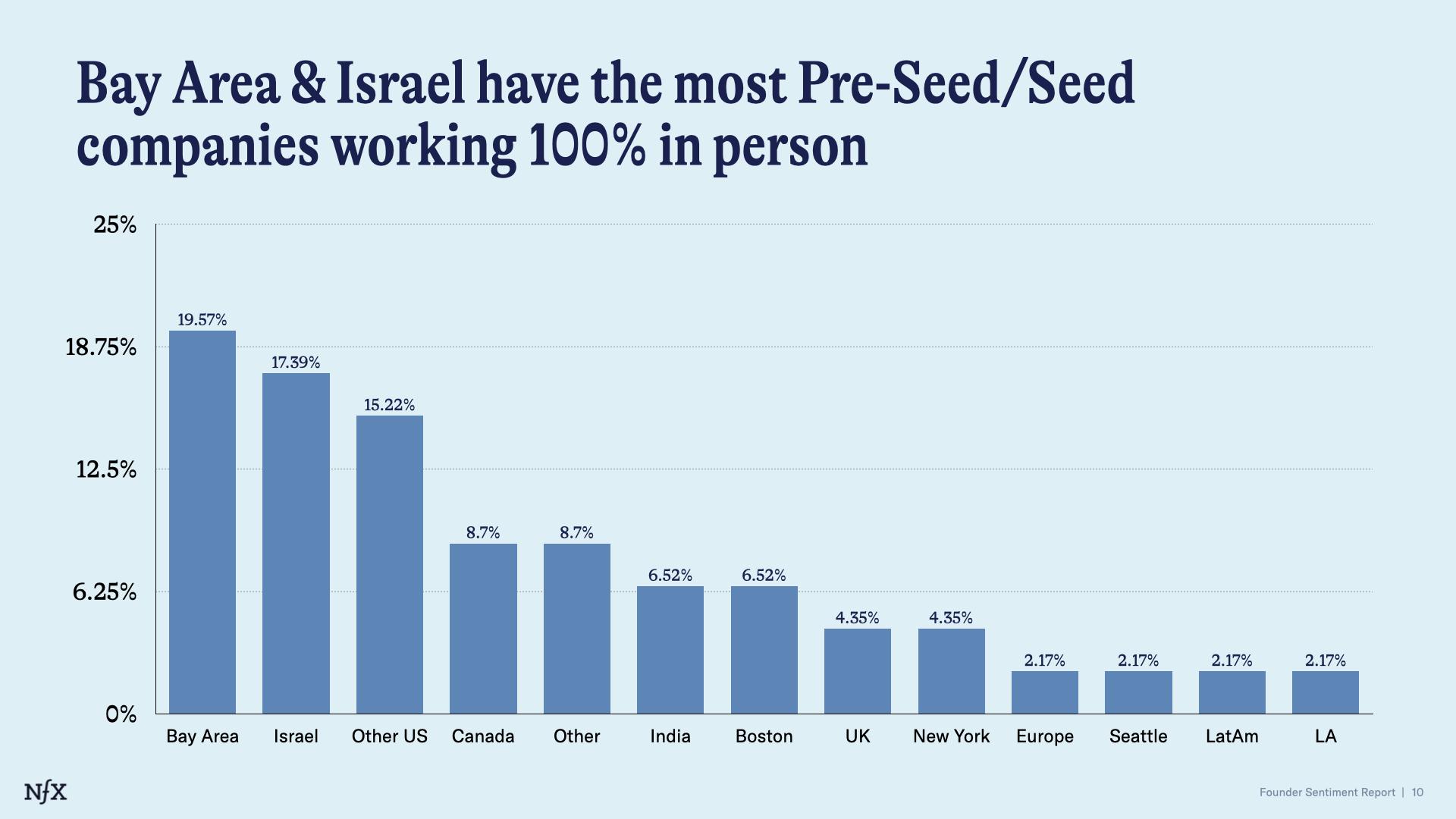

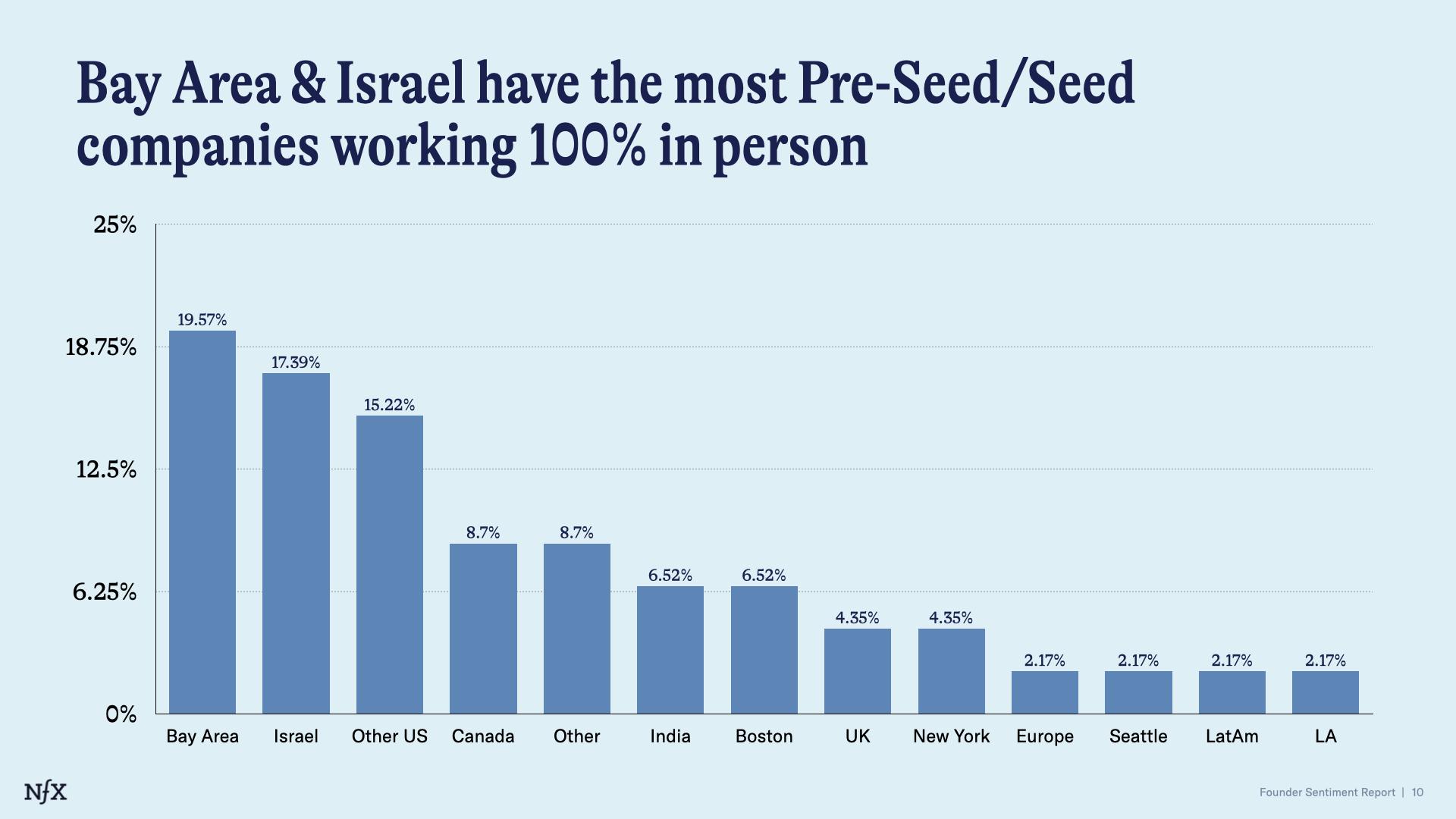

We also asked Founders how their teams are distributed, whether distribution of team talent is 100% in-person, hybrid, or fully remote.

Notably, Bay Area and Israel companies have the most pre-Seed and Seed stage companies working 100% together in person.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.

Try ChatNFX