[**Note: a shorter version of this article appeared on TechCrunch.]

[**Disclosure: we are advisors and/or investors in many of the companies mentioned in this post including Honeybook, Houzz, Lyft, Angelist, Poshmark, Doordash, Patreon and Goodreads]

Most people didn’t notice when a 35-person company in San Francisco called HoneyBook announced a $22 million Series B in March 2015.

What was unusual about the deal is that nearly all the best-known Silicon Valley VCs competed for it. That’s because HoneyBook is a prime example of an important new category of digital company that combines the best elements of networks like Facebook with marketplaces like Airbnb — what we call a market network.

Market networks will produce a new class of unicorn companies and impact how millions of service professionals will work and earn their living.

What Is A Market Network?

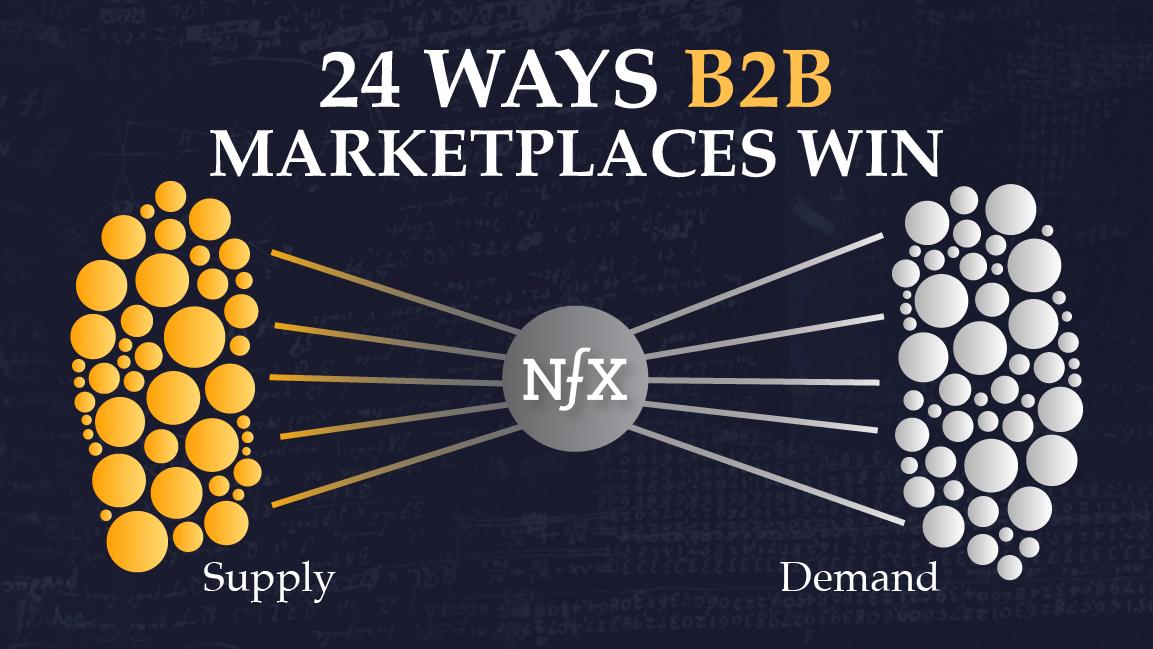

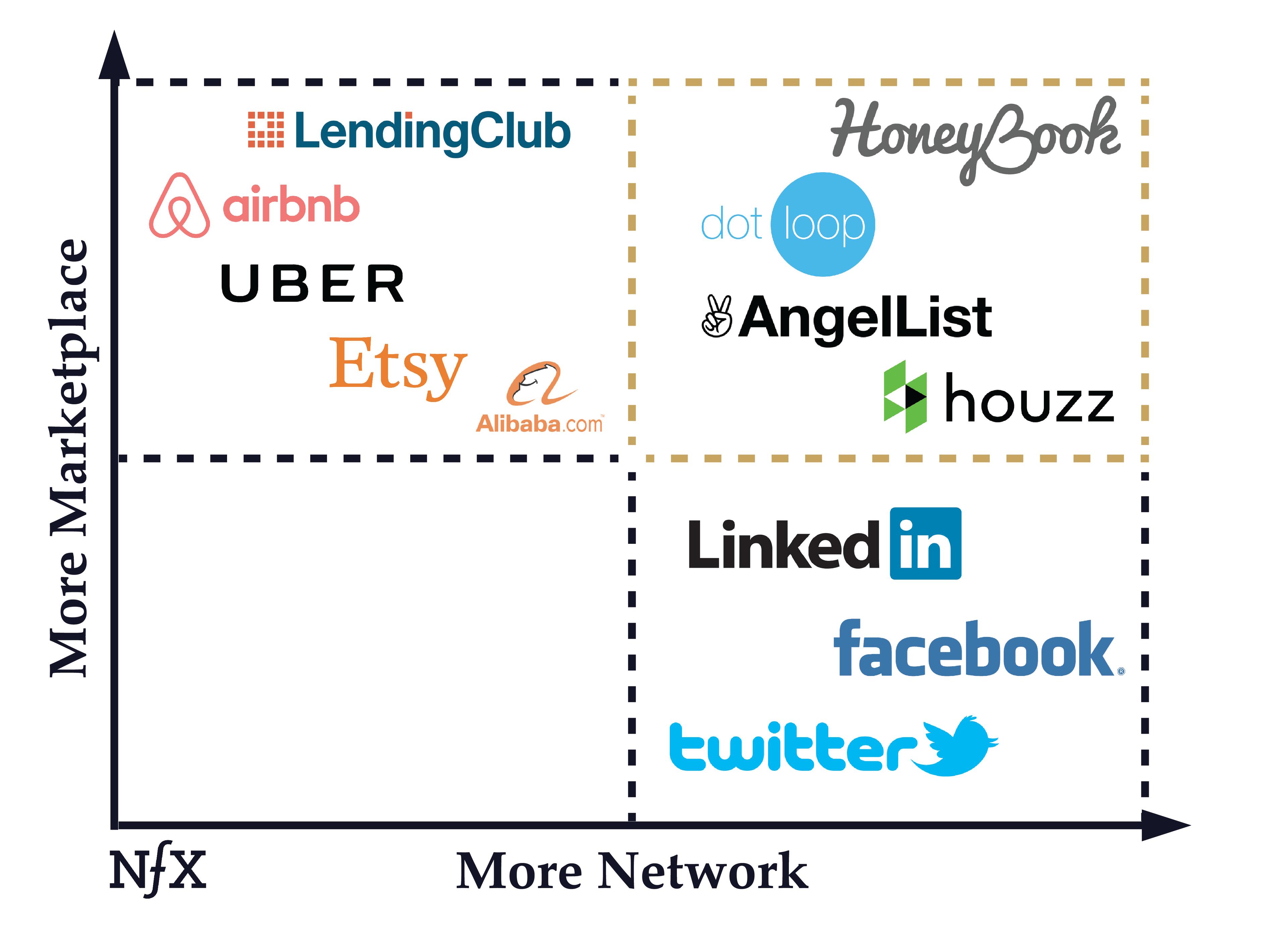

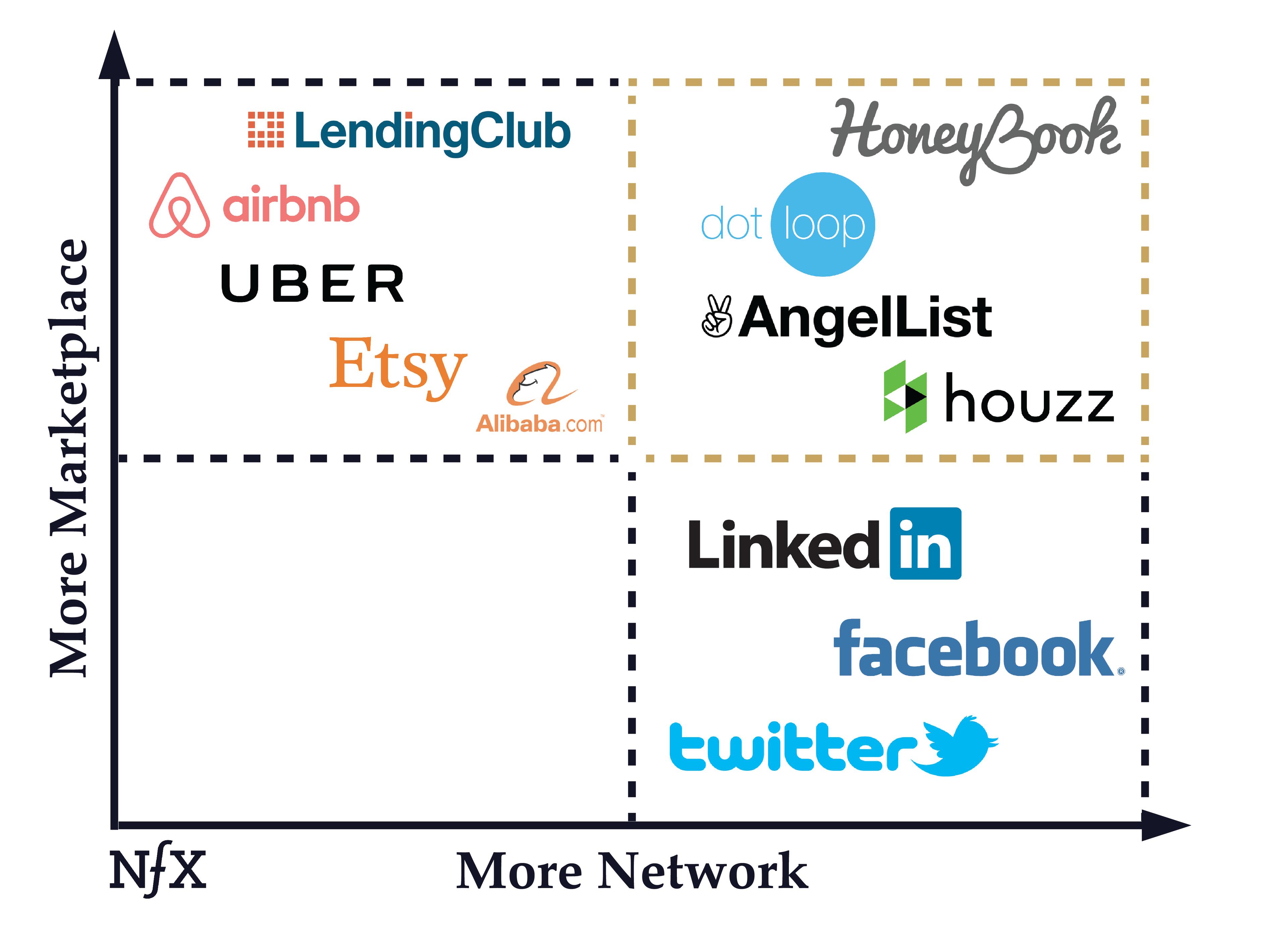

Marketplaces provide transactions among multiple buyers and multiple sellers — like Poshmark, eBay, Uber, Patreon, and LendingClub.

Networks provide profiles that project a person’s identity and then lets them communicate in a 360-degree pattern with other people in the network. Think Facebook, Twitter, Goodreads, and LinkedIn.

What’s unique about market networks is that they:

- Combine the main elements of both networks and marketplaces

- Use SaaS workflow software to focus action around longer-term projects, not just a quick transaction

- Promote the service provider as a differentiated individual, helping build long-term relationships

Market networks are also unique from a monetization standpoint. They combine the strong network effects defensibility and scalability of direct networks like LinkedIn or Facebook together with the lucrative revenue models of SaaS or marketplace businesses.

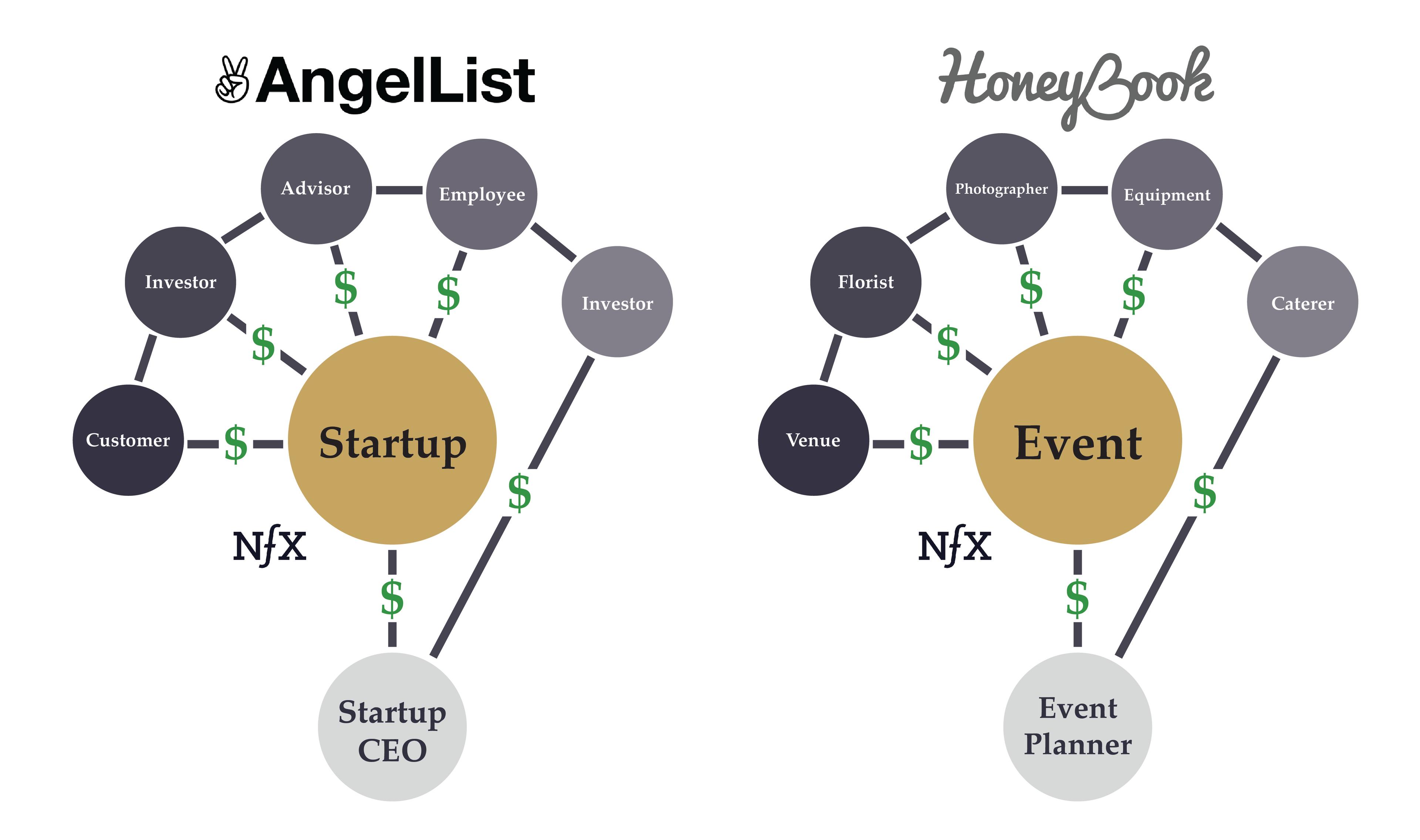

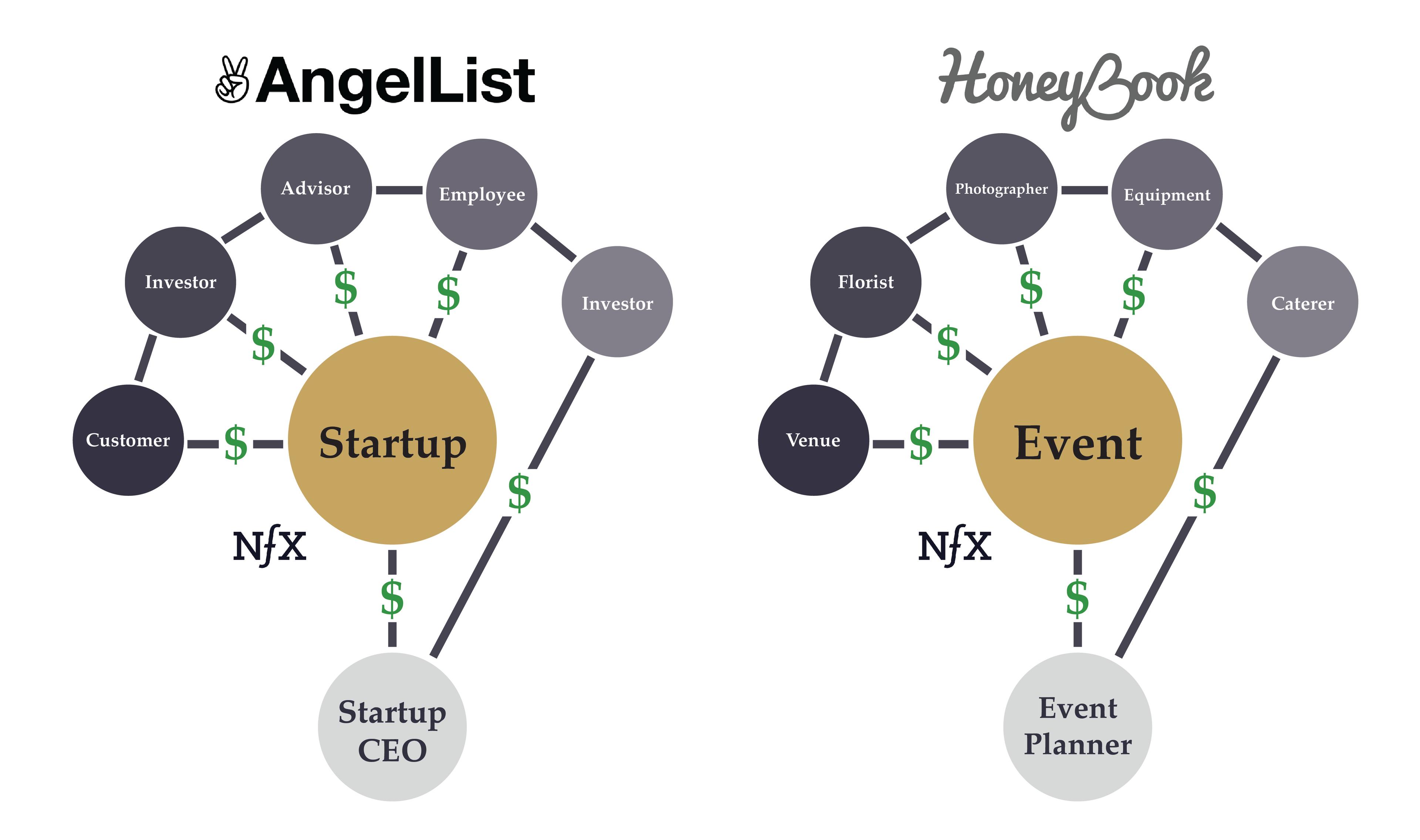

An example will help: let’s go back to HoneyBook, a market network for the events industry.

An event planner builds a profile on HoneyBook.com. That profile serves as his professional home on the Web. He uses the HoneyBook SaaS workflow to send self-branded proposals to clients and sign contracts digitally.

He then connects the other professionals he works with like florists and photographers to that project. They also get profiles on HoneyBook and everyone can team up to service a client, send each other proposals, sign contracts and get paid by everyone else.

This many-to-many transaction pattern is key. HoneyBook is an N-sided marketplace — transactions happen in a 360-degree pattern like a network, but they come here with transacting in mind. That makes HoneyBook both a marketplace and network.

A market network often starts by providing a SaaS tool to a professional that lets them perform a critical task. That same SaaS tool then also lets the professional connect better with their network as it already exists offline today, whether they be clients or other professionals or both. Many of the people in these professional networks have been transacting with each other for years using fax, checks, overnight packages, and phone calls.

By moving these connections and transactions into software, a market network makes it significantly easier for professionals to operate their businesses and clients to get better service.

We’ve Seen This Before

AngelList is also a market network. I don’t know if it was the first, but Naval Ravikant and Babak Nivi deserve a lot of credit for pioneering the model in 2010.

On AngelList, the pattern is similar. The CEO of the startup creates her own profile, then prompts her personal network of investors, employees, advisors and customers to build their own profiles. The CEO can then complete some or all of her fundraising paperwork through the AngelList SaaS workflow, and everyone can share deals with everyone else in the network, hire employees, and find customers in a 360-degree pattern.

In 2013, when I met Oz and Naama Alon, two of the founders of HoneyBook, they were building a beautiful network product — a photo-sharing app for weddings. We sat down and I walked them through the new idea of a market network. They embraced it immediately, and have taken it to a whole new level – from the design and workflow to the profile customization and business model. They are now able to become a horizontal platform for transactions and workflows, working across many professional sectors.

Houzz is a third good example. Houzz connects homeowners with home improvement professionals and with products they can buy for their home. They have a product that is very nearly a market network. The company raised $165M in its last round (update: since the time of this article’s initial publication, Houzz went on to raise a $400M round valuing the company at a reported $4 billion. Further, they acquired Ivy, an NFX-backed company, which gives them the full market network capabilities with interior designers).

DotLoop in Cincinnati shows the same pattern for the residential real estate brokerage industry. DotLoop was acquired by Zillow Group for $108M in August 2015 as part of the Zillow Group’s evolution into a market network.

Looking at AngelList, DotLoop, Houzz and HoneyBook, the market network pattern is visible.

Seven Attributes Of A Successful Market Network

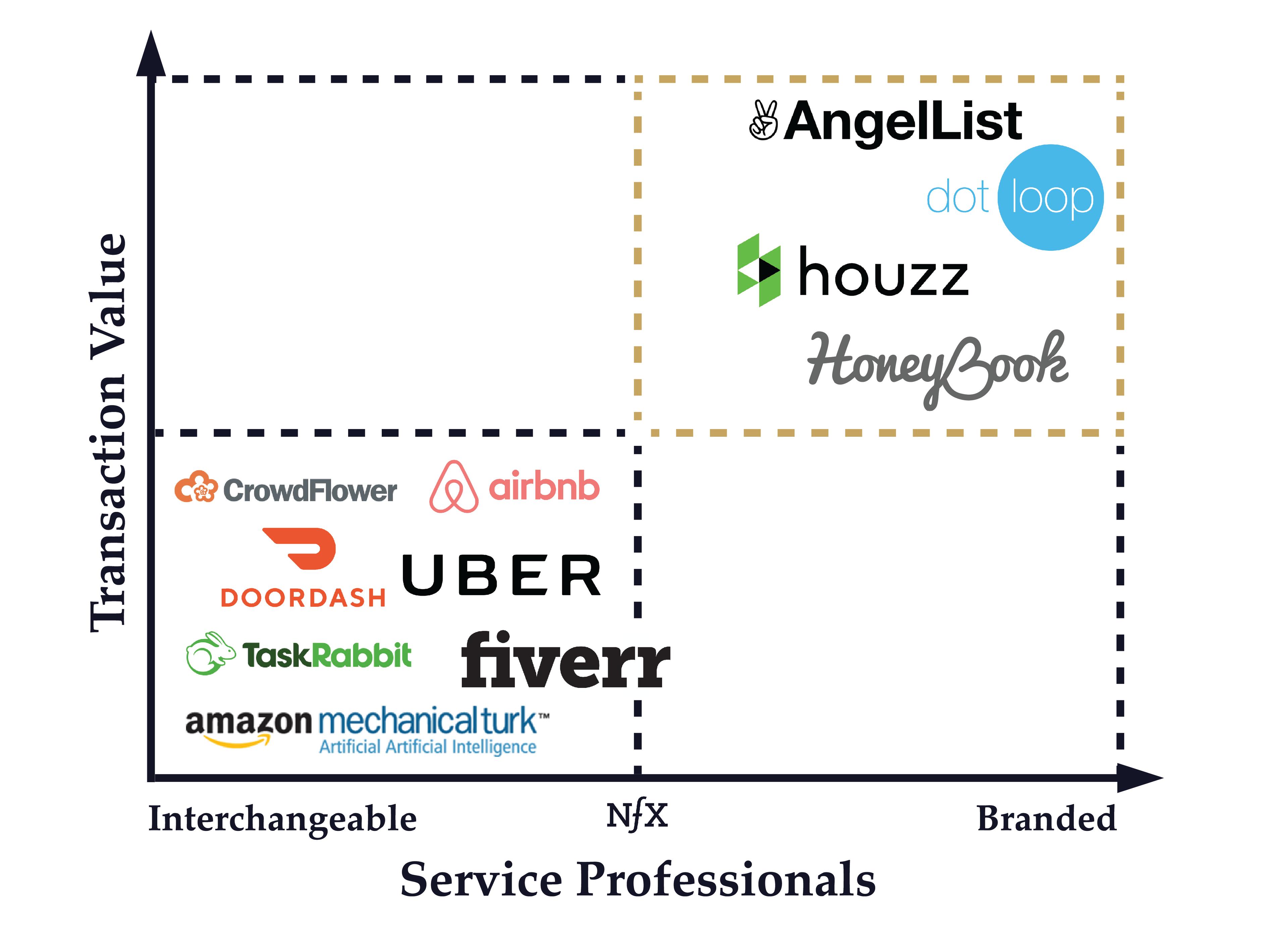

1. Market networks target more complex services

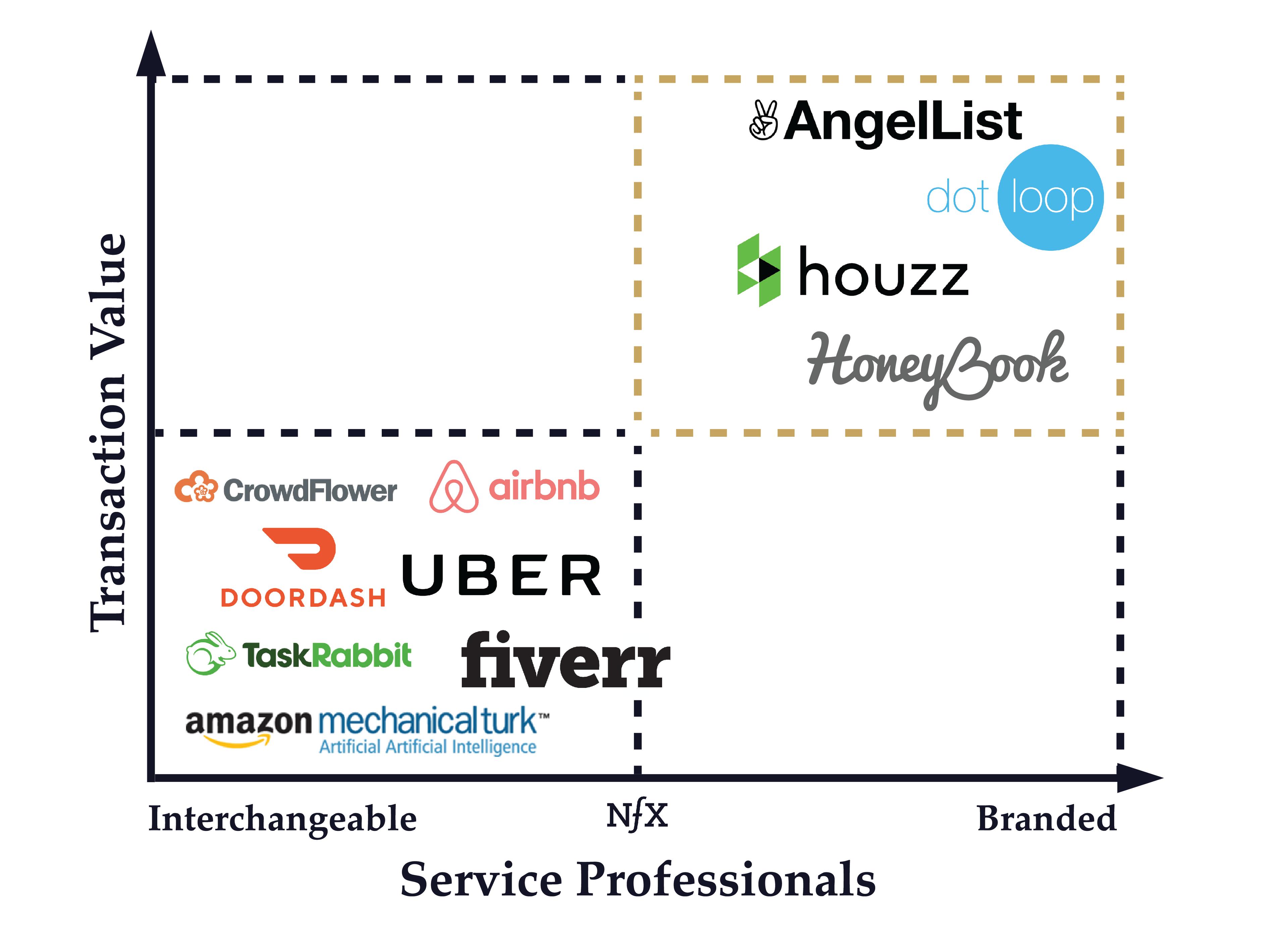

In the last decade, the tech industry has obsessed over on-demand labor marketplaces for quick transactions of simple services. Companies like Uber, Lyft, Mechanical Turk, Thumbtack, DoorDash and many others made it efficient to buy simple services whose quality is judged objectively. Their success was based on commodifying the people on both sides of the marketplace.

However, the highest value services – like event planning and home remodels — are neither simple nor objectively judged. They are more involved and longer term. Market networks are designed for these.

2. People matter

With complex services, each client is unique and the professional they get matters. Would you hand over your wedding to just anyone? Your home remodel? The people on both sides of those equations are not interchangeable like they are with Lyft or Uber. Each person brings unique opinions, expertise, and relationships to the transaction. A market network is designed to acknowledge that as a core tenet and provide a solution.

3. Collaboration happens around a project

For most complex services, multiple professionals collaborate among themselves—and with a client—over a period of time. The SaaS at the center of market networks focuses the action on a project that can take days or years to complete.

4. They have unique profiles of the people involved

Pleasing profiles with information unique to their context give the people involved a reason to come back and interact here. It captures part of their identity better than elsewhere on the internet.

5. They help build long-term relationships

Market networks bring a career’s worth of professional connections online and make them more useful. For years, social networks like LinkedIn and Facebook have helped built long-term relationships. However, until market networks, they hadn’t been used for commerce and transactions.

6. Referrals flow freely

In these industries, referrals are gold, for both client and service professional. The market network software is designed to make referrals simple and more frequent.

7. They increase transaction velocity and satisfaction

By putting the network of professionals and clients into software, the market network increases transaction velocity for everyone. It increases the close rate on proposals and speeds up payment. The software also increases customer satisfaction scores, reduces miscommunication, and makes the work pleasing and beautiful. Never underestimate pleasing and beautiful.

Social Networks Were The Last 10 Years. Market Networks Will Be The Next 10.

First we had communication networks like telephones and email. Then we had social networks like Facebook and LinkedIn. Now we have market networks like HoneyBook, AngelList, DotLoop, and Houzz.

You can imagine a market network for every industry where professionals are not interchangeable: law, travel, residential real estate, commercial real estate, media production, architecture, investment banking, interior design, personal finance, commercial construction, residential construction, consulting, and more. Each market network will have different attributes that make it work in each vertical, but the principles will remain the same.

Over time, nearly all independent professionals and their clients will conduct business through the market network of their industry. We’re just seeing the beginning of it now.

Market networks will have a massive positive impact on how millions of people work and live, and how hundreds of millions of people buy better services.

I hope more entrepreneurs will set their sights on building these businesses. It’s time. They are hard products to get right, but the payoff is potentially massive.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.