Evaluating companies has felt very different in the last twelve months from the prior 11 years because consumer is back. We’re seeing some really interesting consumer companies for the first time in forever. The creativity, the opportunity, the energy. It feels good!

No one talks about it, but consumer software startups had been “over” in the West for 11 years. At least if you’re trying to start and build a big company.

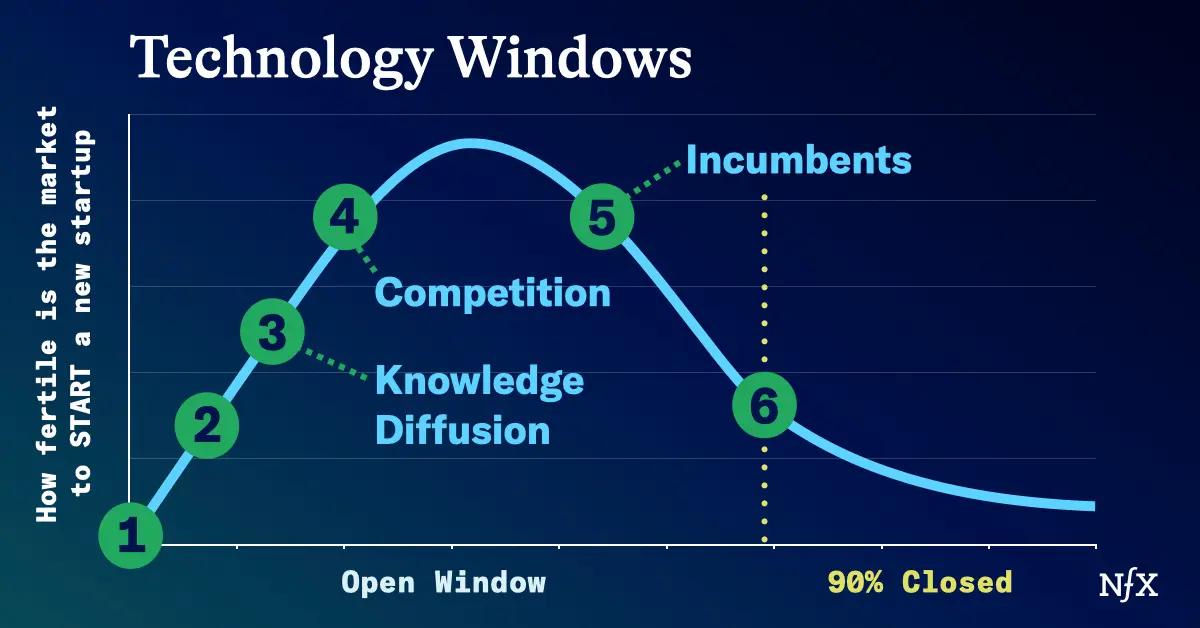

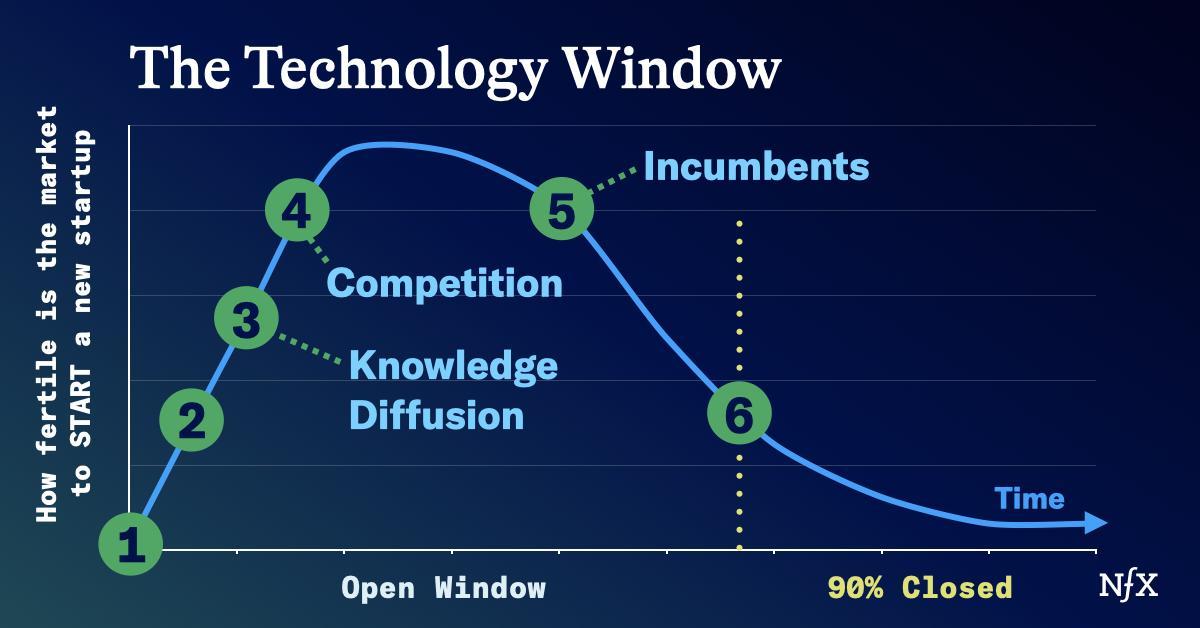

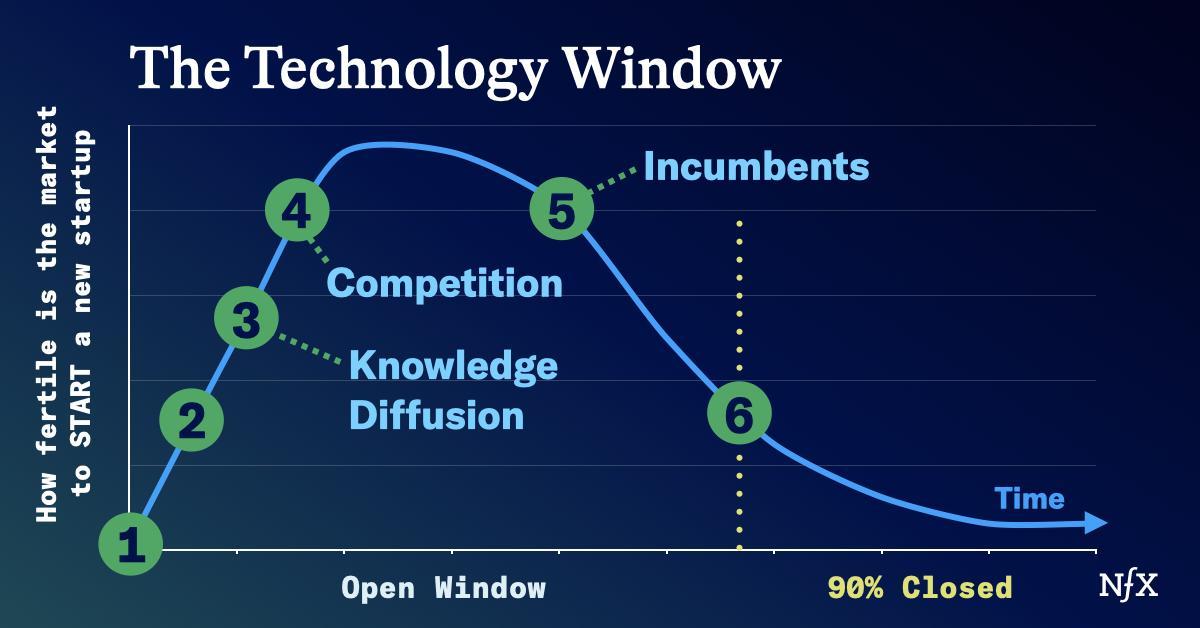

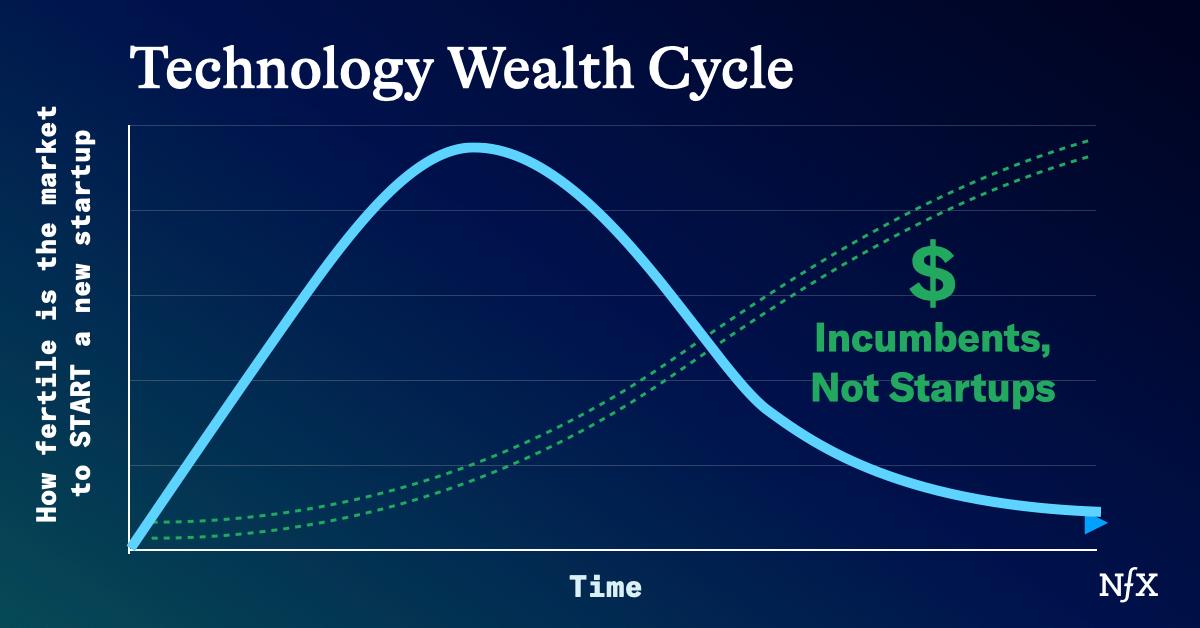

The reason it’s been so hard is simply that the technology window closed 90%, like it does for all technologies. We detailed technology windows in this essay, which is required reading to understand this essay.

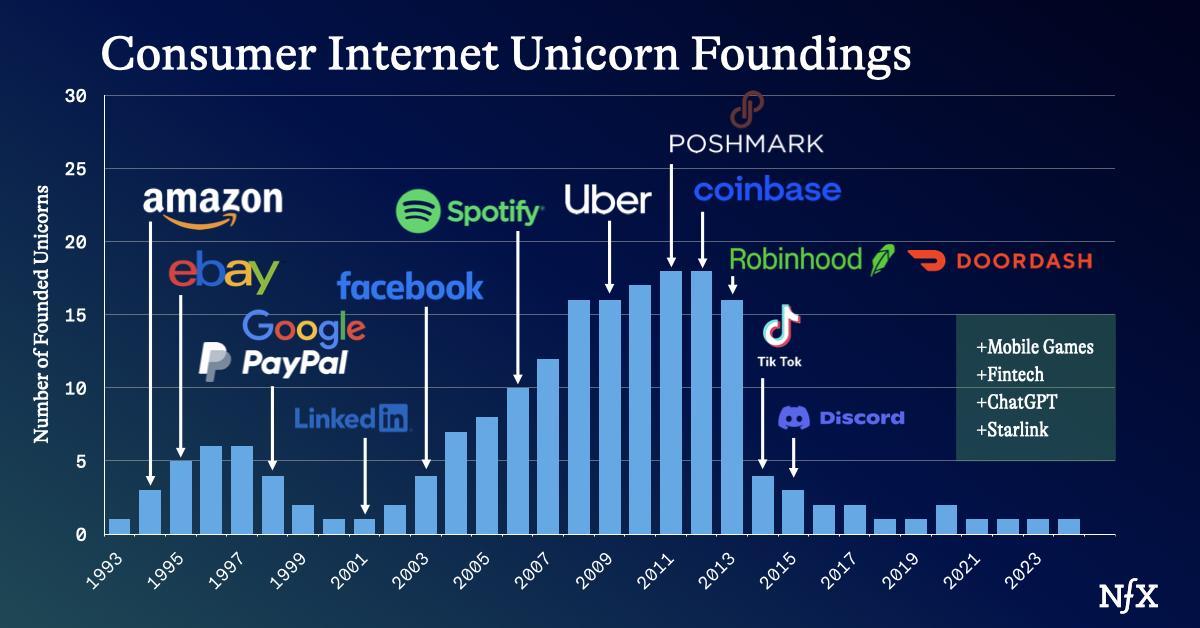

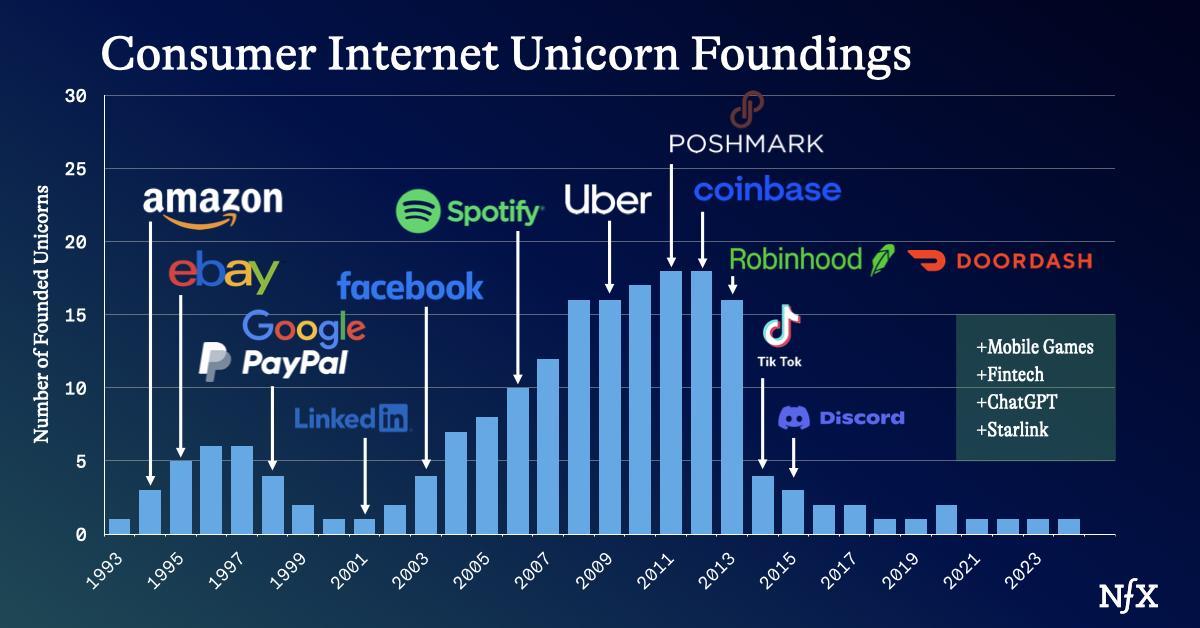

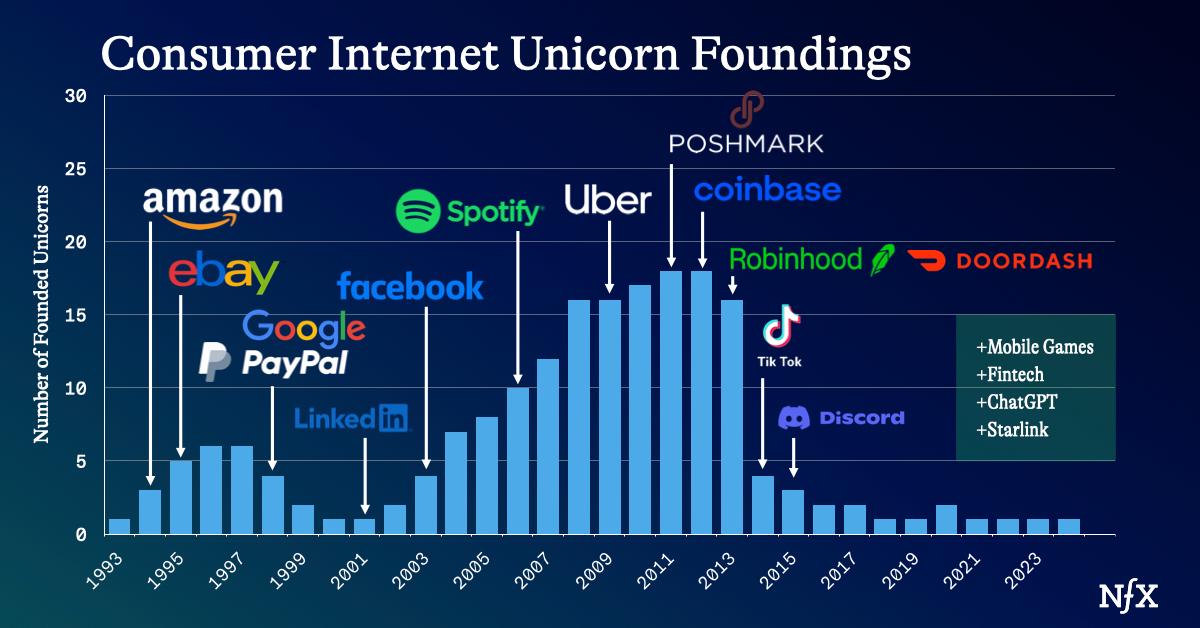

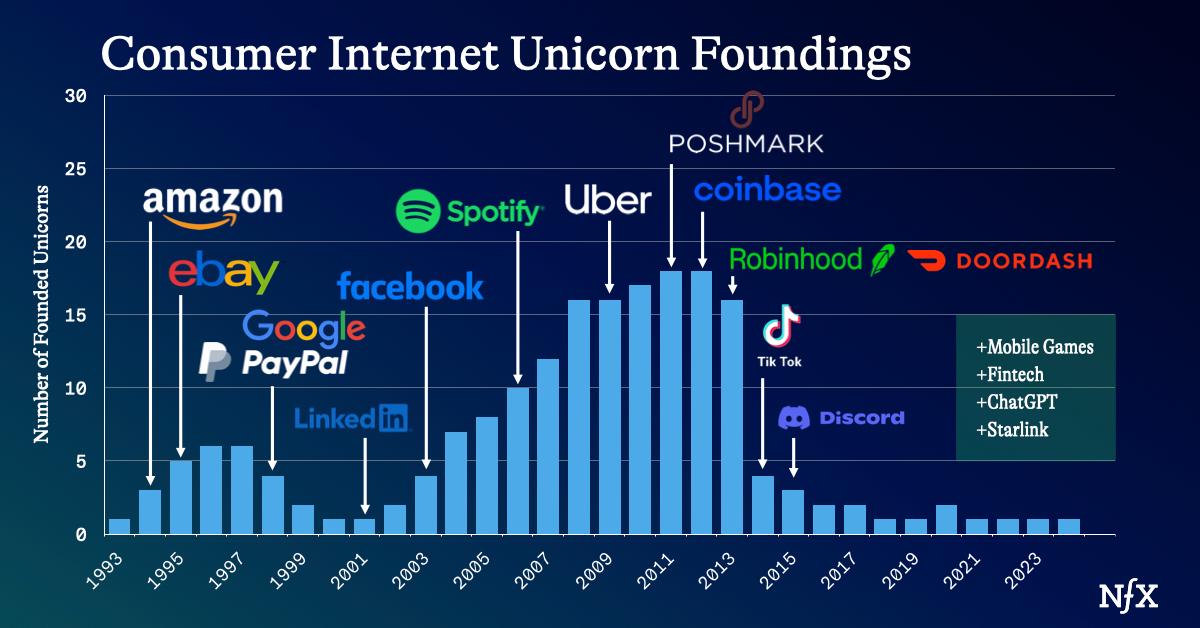

If we look at the years when the unicorn consumer software companies were founded, you can see the classic curve of the technology window at work.

At first we got the “database reading” startups of Amazon and Google. The dip you see in the curve in 2000 was due to the macroeconomic business cycle. Then we got the “database writing” startups of LinkedIn, Facebook and Twitter. Then the mobile companies like Uber and Poshmark. Lastly, some laggards like Doordash and Robinhood which could have been started 5+ years earlier but the right teams didn’t get there until late in the consumer technology window, 2013.

But by 2014, the window was closed 90% for building important consumer software startups.

We didn’t know it at the time. We didn’t have the concept of technology windows then. Now we do. I think now, we would notice it more quickly than we did back then.

In the following 11 years, we only got a few more consumer software unicorns in the West (US, Europe, and Israel).

- Discord.

- A few mobile games companies like NFX’s SuperPlay, which just sold for $1.9B in Oct 2024.

- A couple of fintechs.

- A couple of rewards apps like iBotta and Fetch

- Musical.ly which sold for $800M to ByteDance. (BTW, Bytedance then spent billions of dollars driving downloads of the renamed TikTok to brute-force a consumer win after the technology window had closed. It was a very unusual situation.)

- Whatnot?

- Go ahead and include Starlink and ChatGPT. I would argue that those are fundamental technologies for enterprise and military that happen to have a side door for consumers to play with them. But sure, count ‘em.

Count them all, and the chart above is accurate and its message is clear. The consumer software window was closed 90% in 2014.

(We can have a discussion about crypto and whether that falls in this bucket of “consumer.” I haven’t included it in this analysis.)

Why is No One Talking About the Closing of the Consumer Software Window?

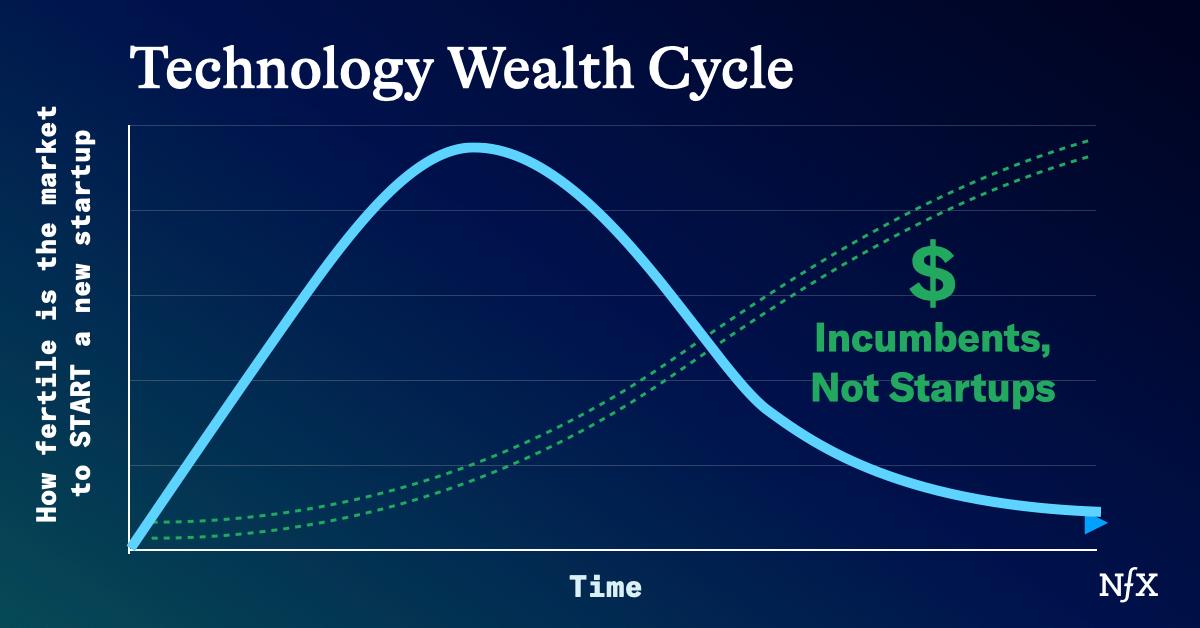

The reason is simple: we’re distracted by consumer software companies like Meta and Uber making a lot of money and their market caps continue to grow significantly.

We’re staring at the growing market caps of these old incumbents, and thinking “consumer software is doing great.” But only if you started 15-20 years ago! Meta was started 20 years ago. Uber 15.

One barrier founders have for realizing how hard things have been in consumer software for 11 years is the movie The Social Network. This generation of 20-something founders grew up on it. They think the opportunity in consumer software is still like it shows in the movie. It’s not. That movie came out in 2010, a story about something that happened in 2004. Snap out of it, people.

Consumer software is doing great for public market investors today but hasn’t been great for founders starting something new, nor for Seed and Series A investors investing.

The other reason no one talks about the consumer software window being 90% closed is that consumer is a lot of fun. Founders don’t want to admit the window closed. And of course VCs who have staked out “consumer” as their sector have their relevance to their firms on the line.

Let’s unpack some of the elements that caused the consumer software window to close, and then I’ll talk about what founders can do about it, given AI.

Why the Consumer Technology Window Closed

As we said in the technology windows article, each window closes with somewhat different mechanics. Here are six of the mechanics that caused the consumer software window to close by 2014. These need to be overcome or avoided if you are starting a consumer tech startup today.

1. The hardware interfaces to software haven’t changed in a long time. The Internet browser on a desktop or laptop hasn’t changed in 30 years, and the mobile touch screen hasn’t changed in 16 years.

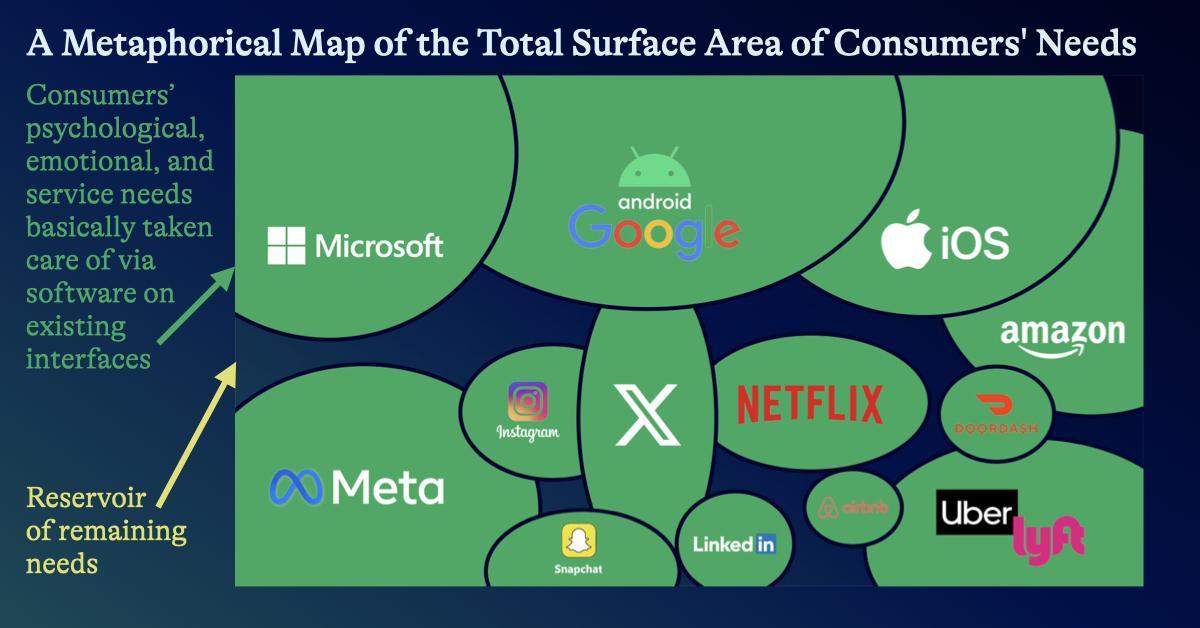

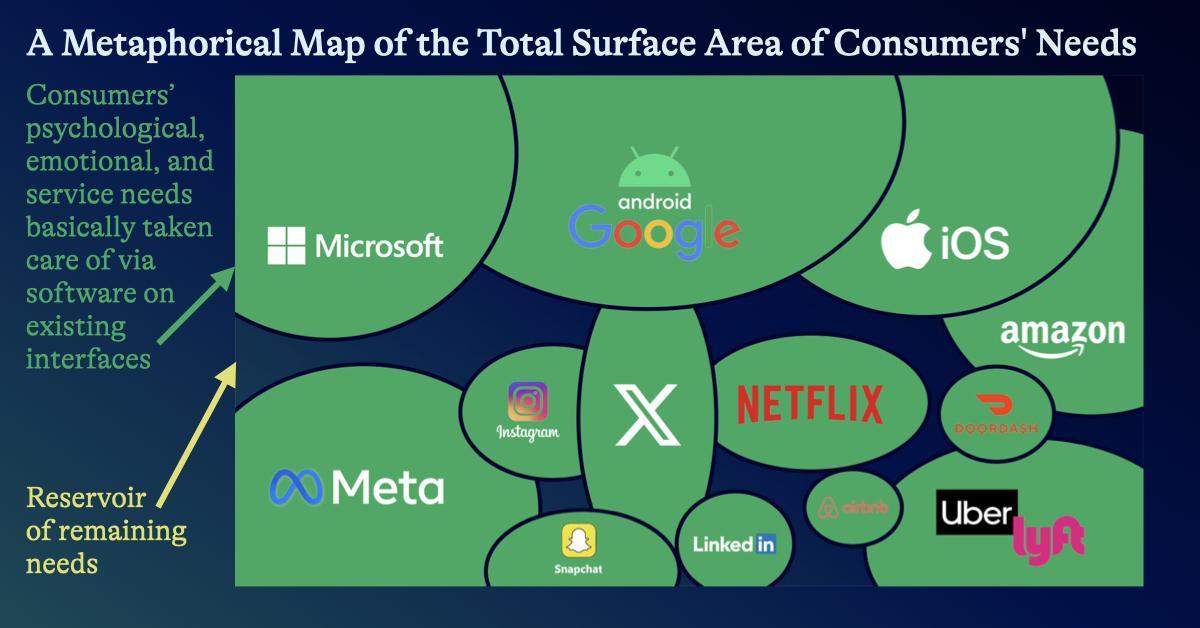

2. For what can be done on these interfaces, the psychological and emotional needs of consumers are largely taken care of. The number of things to do through those old interfaces aren’t infinite. Founders early in the technology window grabbed the low hanging fruit. The reservoir of unmet needs of consumers is now small enough that there isn’t enough potential energy to create a giant movement. This diagram illustrates it.

All that’s left is the black, and if you build a product in there, you quickly bump into an incumbent and their network effects, which sucks the energy out of your movement.

Certainly, you can think of small product ideas that haven’t been done in that black area. But those will take 100% of your time too, so why not do something with bigger potential? And NFX certainly can’t invest in small ideas.

Or you might notice – as many have for 20 years – that a consumer product like LinkedIn is, indeed, crappy. We all agree it’s maybe a 4 out of 10 and could be improved. But LinkedIn satisfies 80% of people’s needs, even if done badly. So the 20% of need left might not be a big enough reservoir on which to build something new and important. You have to really rethink it from the ground up to find a big enough new, unexpressed need or delight.

3. Incumbents can block you because they have all the defensibilities: network effects, scale, brand, and embedding.

Here’s an essay on how Facebook achieved defensibility, another on how Uber does it, and here’s an essay on the mechanics of how every important company does it with reinforcement.

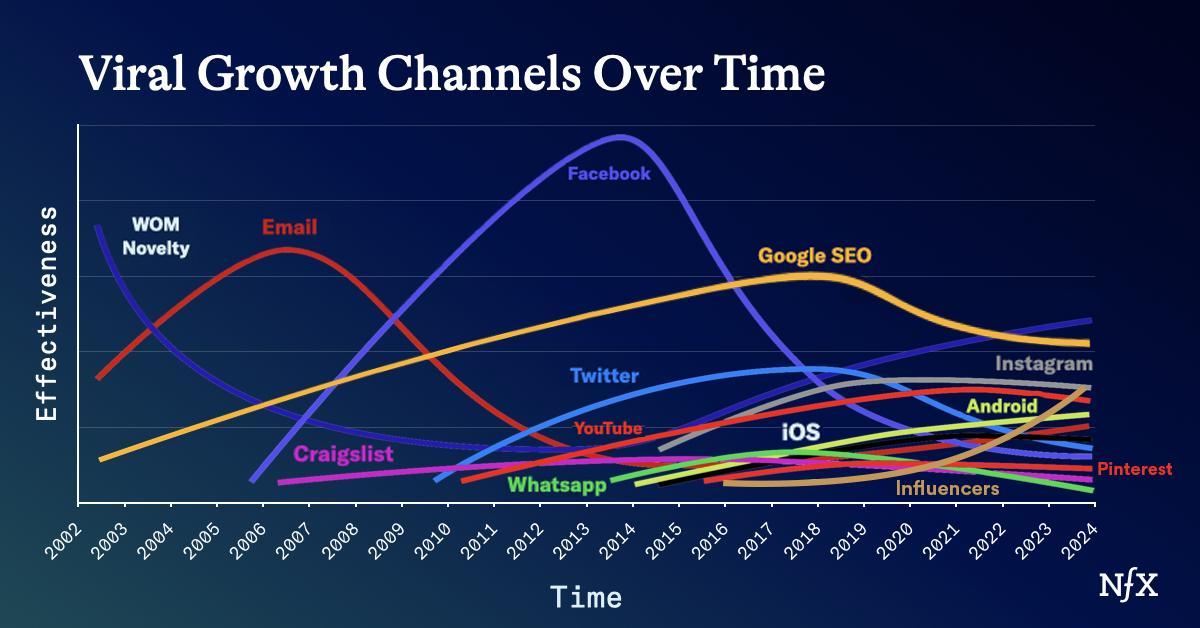

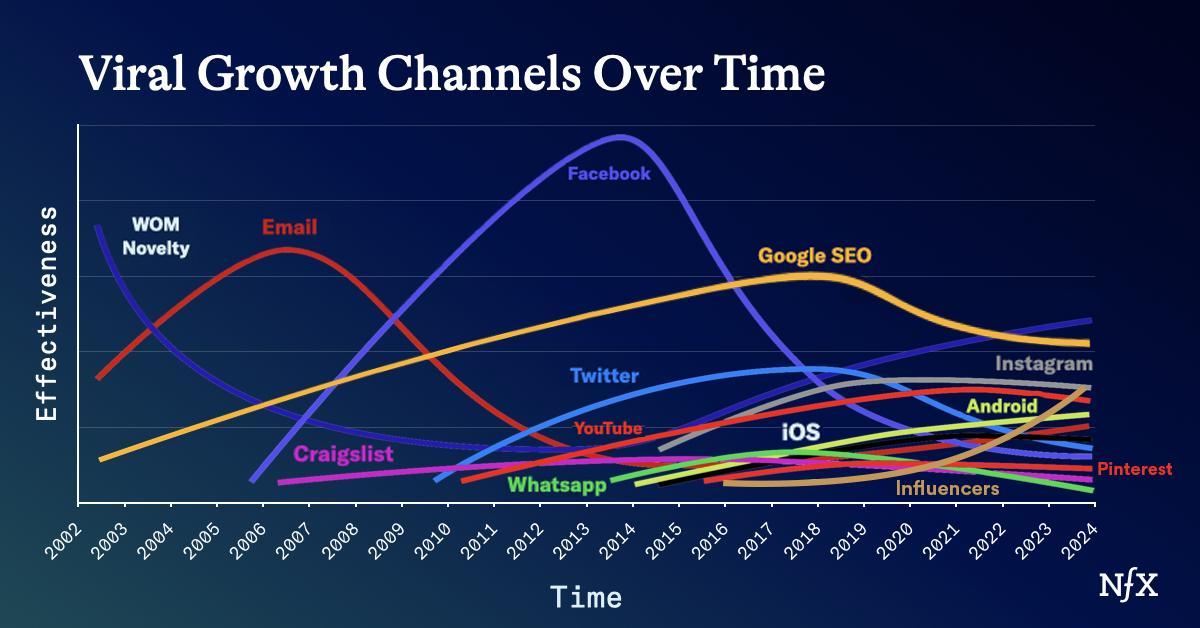

4. Incumbents own, or have clogged, the growth channels. There are few free growth channels left.

The biggest consumer channels are owned by Meta and Google and those are optimized/expensive. SEO is very competitive. AI searching is taking share from SEO and reducing click throughs. Email and LinkedIn are clogged. SMS doesn’t scale well. Influencers is the channel with the most recent successes. Check it out. Unfortunately, influencers are inconsistent, and they are getting more optimized/expensive every month.

Here is a chart I published in 2021 in this essay talking about the different types of channels for free user growth. It illustrates how the incumbents have put toll booths on all the consumer growth channels to their own benefit and closed the window for startups.

5. Incumbents will actively copy or block any startup that gets momentum. They are not asleep at the wheel. They are like the eye of Sauron. Realize that if you’re on your way to being big, they HAVE to stop you, not because they are scared of you. They are not scared of you, Trust me. What they are concerned with is their fierce battle with each other. It’s like King Kong vs Godzilla. Do they care about the guy with the gun on the ground? No. But they are focused on each other, and in that battle, they can’t afford to cede any ground. They have to grab all the visible ground or their big competitor will.

6. Incumbents get laws passed that benefit them. Typically it’s Federal or State laws that “protect consumers,” but then only the big companies can afford to implement those protections, which locks out smaller competitors.

Some Implications For Your Consumer Startup Fundraising

VCs have largely moved to B2B and enterprise software over the last 11 years. Their consumer investing has dropped significantly because they slowly realized something was no longer working. So there are few consumer investors left, and funds are shy of “consumer,” given the abysmal track record in the last 11 years.

For instance, in 2017, with NFX’s first fund, we planned to invest 50/50 in B2C/B2B. After all, most of the 10 companies we ourselves had founded were consumer, and we loved it and knew it well. But after 5 years of investing, we discovered we were closer to 85% B2B because as we considered each company individually, we couldn’t see most of the consumer companies getting big. Turns out that was about right.

[Side note about VCs: It’s harder to build a new VC brand without great consumer successes because everyone knows the consumer brands. Benchmark, for instance, built their brand overnight with their eBay investment (founded 1995, Benchmark invested 1997). Then Benchmark famously invested in Twitter (2009), Uber (2011), and Snap (2013). Can you name Benchmark’s big B2B successes? Far fewer people know about any VCs infrastructure and enterprise successes. So it’s been harder to build a VC brand since 2014.]

It’s a New Consumer Software Age

There is more opportunity to build a consumer Unicorn than there has been since 2014.

The main reason is AI, of course.

Another reason is fintech. Another is games. Another reason is crypto companies learning to hide the fact they are crypto, and becoming more “consumer.”

After not investing in consumer companies much between 2017 and 2023, NFX has found itself investing in many more in 2024. I personally have invested in four consumer companies in my last five investments.

So first admit to yourself that the 1994 – 2013 consumer technology window closed eleven years ago. Then think what would be required for there to be another open window now.

What is Required Today?

First, you need to leverage AI. It’s a fantastic wedge that – still today – few startups other than OpenAI have used to discover new consumer behaviors, delights, needs, wants, and loves. It’s still sitting there for you to grab. The technology window for consumer AI is still early with all its openness and creativity.

Second, you need to be better and more talented. Better in design, marketing, community building, PR, growth, A/B testing, metrics, driving retention, etc.

Back when the consumer software technology window was open, it was easier to get better. More things worked, so it was easier for teams to get in more reps, to hone their intuition and skills. In the last 11 years when there haven’t been many new successes, we’ve seen a general decline in skills and intuition among founders for startup consumer software products. Basic things that we learned in the 1994 -2013 window have been gradually forgotten.

Today, winning in consumer software is as competitive as winning in Hollywood. In the 1950s and 1960s, it was pretty easy to make it in Hollywood. But by the 1990s, the technology window had closed on film and television technology, and you had to be a 0.1% top talent to get anywhere. The same is now true of consumer software.

You have to dig deep. Be honest with yourself. Become the best talent. Or recruit the best talent.

Third, you must study history. So many ideas have already been tried. It’s not 1994, it’s not a blank slate. You need to find out why those efforts in the past didn’t work. Talk to the people who were there. Hear their detailed stories and KPIs. Save yourself months or years of experimentation.

Key content for educating yourself:

- How to name your consumer company and why it matters so much.

- Media marketplaces and the future of digital media and advertising.

- Understand the patterns of consumer startup success here and here.

- Study consumer growth and more consumer growth.

- NFX podcast with Josh Elman where we talk about the talents needed to be good at founding a consumer software company.

Fourth, speed. I can’t emphasize this enough. Incumbents will be on you in a few months, and 100s of VCs will be open to fund 6-10 competitor startups within weeks of your startup showing signs of life. The Startup Industrial Complex helps you, but it also helps your competitors. So speed is absolutely necessary to get big fast enough to defend against incumbents AND new competitors.

Speed can be increased by keeping your team small using AI tools. It can also be increased by having the right advisors who help you pinpoint the next priority and most efficient movement toward the goal. NFX works very closely with its teams to help with speed.

Fifth, you have to be a growth monster and have distribution DNA on your team. Digital marketing, viral marketing, influencer marketing… all the marketing. What works to get new users changes every month, so you must constantly evolve your tactics – and you have to be in love with constantly evolving or you won’t make it.

Sixth, you have to build network effects into your product from day one to give you a chance against the incumbents. Understanding network bonding theory helps a great deal.

Seventh, pick your geography carefully. A city is a network, and the right network gives you unfair advantages, particularly for consumer companies where the details matter greatly.

Eighth, everyone on your startup team should work in the same office, in-person, together, daily. Consumer is so very competitive. The details of consumer products matter so much. Speed matters so much. Only being in person gets you there.

Every remote founder who pulls their team into one office says the same thing to us, “I had no idea it would make such a difference. It’s night and day. I hope all my competitors stay remote.” Don’t be loser roadkill because you were optimizing for your significant other, or some rent controlled apartment, or because you like the food better there. Are you playing to win, or not?

NFX is All In On Consumer

Before we founded NFX, we founded and ran very large consumer software companies. We love them. Because of that, and because of the challenge for consumer startups in the last 11 years, our bar for investing in consumer startups is very high. We see 10,000 companies per year and invest in 25.

We are looking for very specific founder types that we’ve seen be successful in consumer. Sometimes we call them “savage.” They are obsessive, competitive, disagreeable, opinionated, insanely smart, and neuro-divergent. They are fast, confident enough to take in new information and change, and sensitive to the nuance of psychology and language. They think small on the details and big on the business. A bit angry, a bit crazy.

If you are savage, and working on a consumer facing product, contact us. We invest at seed and pre-seed. Checks $1M – $4m, avg $3.2M. We always lead. We work with you as often as you like on every aspect of the business, and leave you alone if that’s what works best for you.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.