Many Founders think they missed the opportunity to leverage what’s happened due to Covid. The acute period of rapid innovation feels, to some, to be slowing down.

But be careful not to underestimate the durability of these pandemic-induced demand curves. This is just the beginning. We’re in a new era for marketplaces.

Here’s why.

Market demand is the ultimate force to harness as a Founder. Changes in demand often precipitate opportunities for marketplaces, which are designed to efficiently connect supply and demand.

Extreme economic, cultural, and technological shifts often unlock new demand curves. They rarely emerge in normal times, because the majority of people are naturally resistant to change.

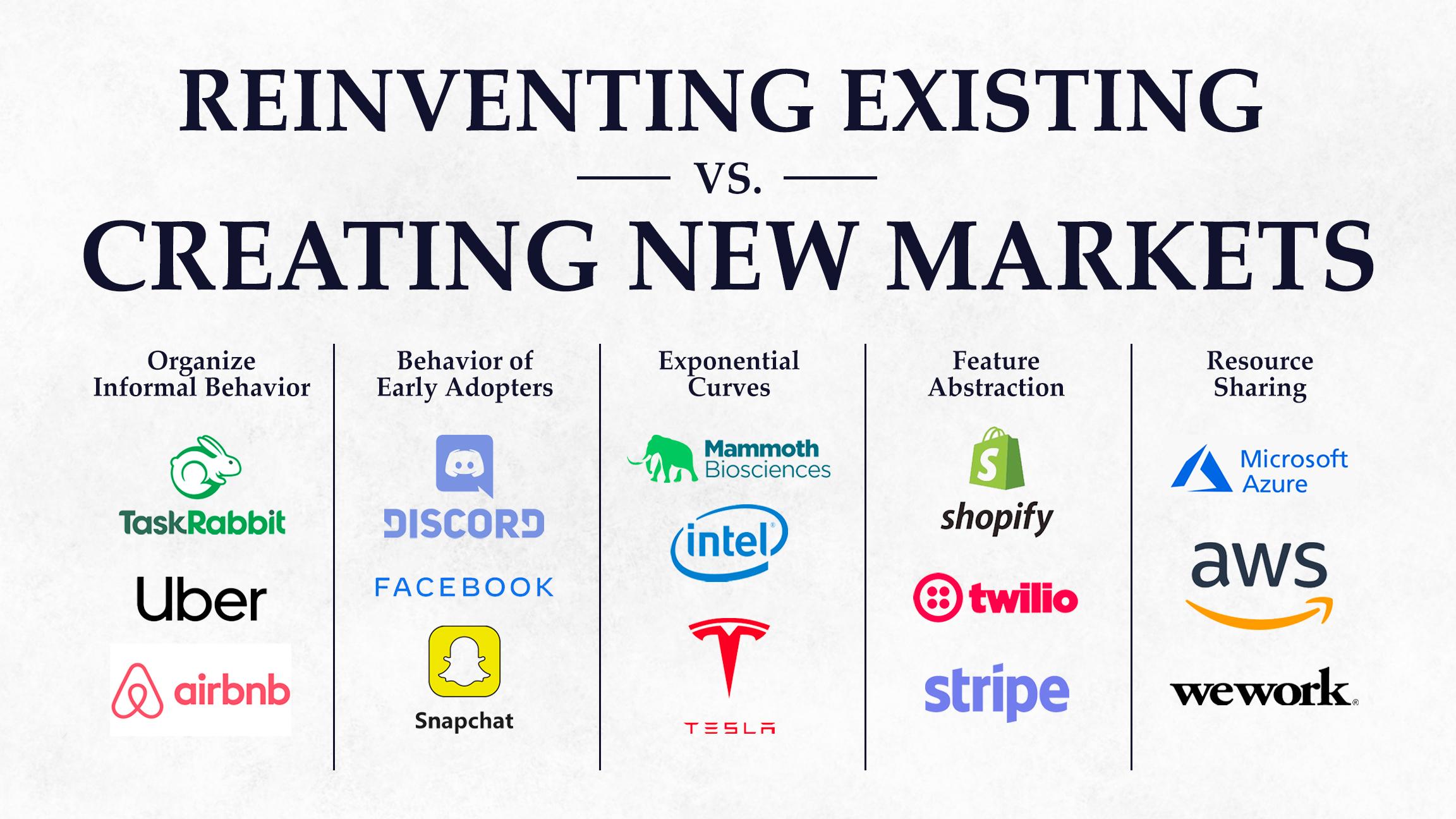

Abnormal events can trigger sizable demand or supply imbalances, which fast-moving marketplace startups can use to build liquidity faster than the incumbents are able to evolve. Thus, massive new marketplaces can be built in a short period of time that are very hard to displace.

For example, the 2008 financial crisis, combined with the rapid and disruptive growth of mobile technology, generated significant consumer demand. Uber, Lyft, Airbnb, DoorDash, and Instacart quickly leveraged those market conditions.

Over a decade later, Covid has again generated economic uncertainty but in new ways. It comes with cultural upheaval and unprecedented digital immersion, shocking our systems with new demand. The pandemic has dramatically accelerated technology adoption in every part of our lives, creating new markets or aggressively expanding existing markets for technology startups.

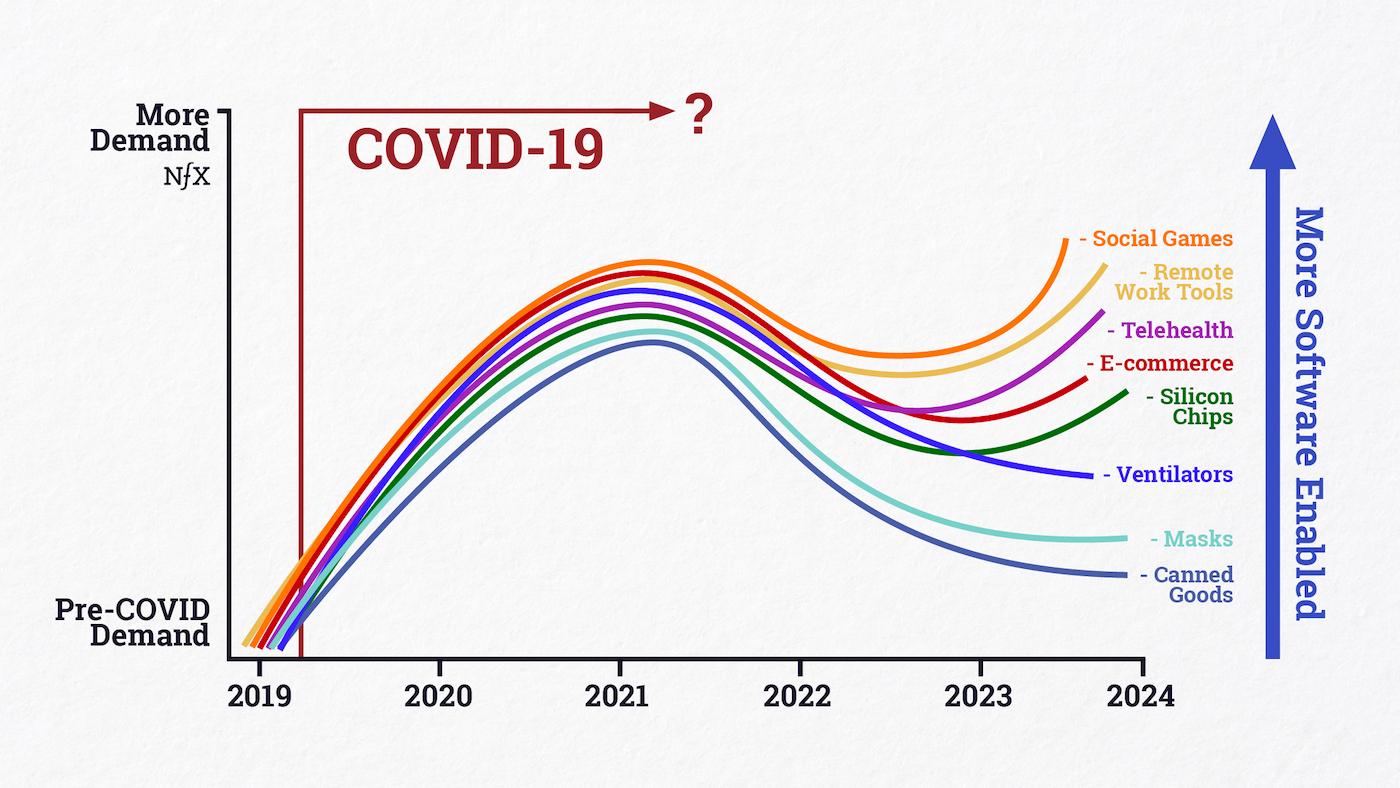

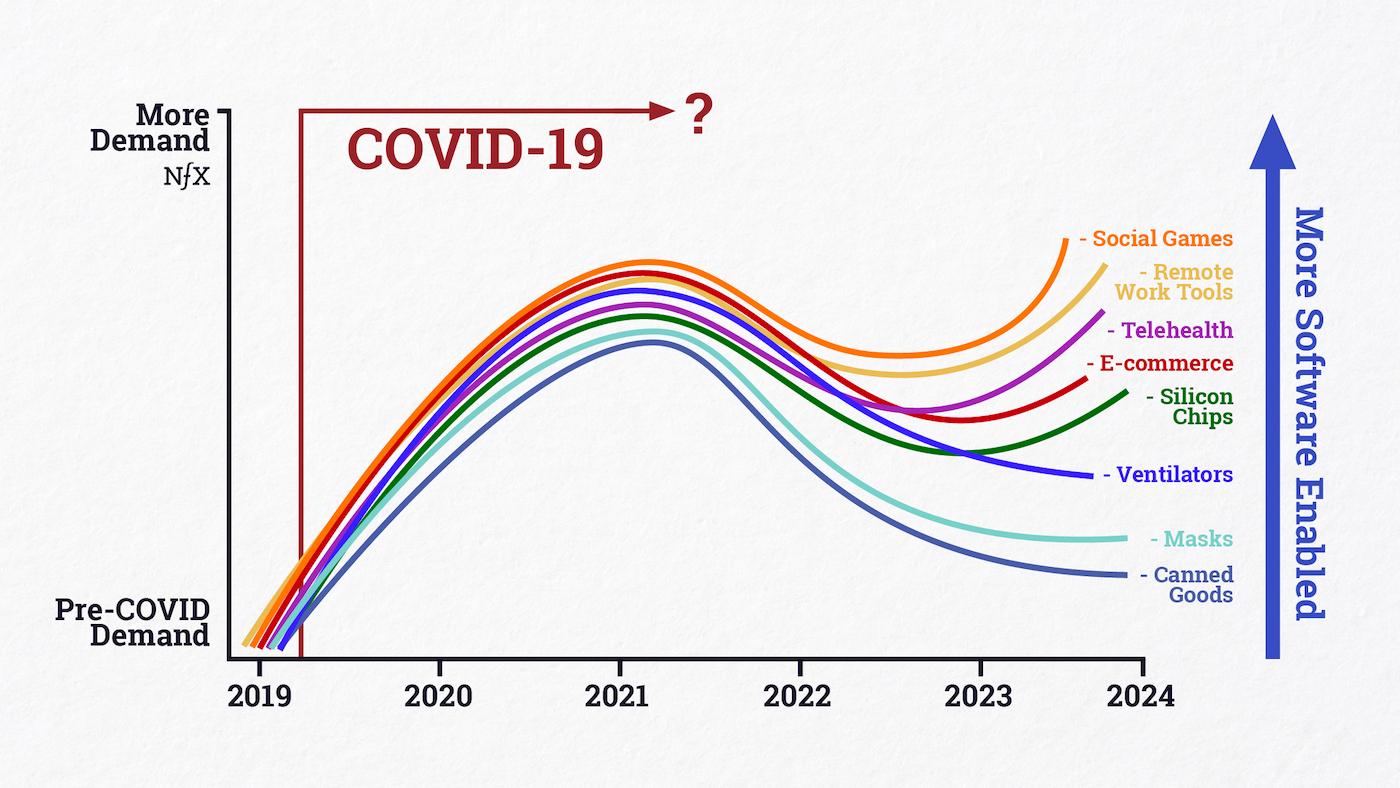

Conventional wisdom says: The demand for e-commerce, grocery delivery, telehealth, certain types of labor, and silicon chips will eventually return to pre-Covid levels.

What we see instead: Covid is producing longer-lasting demand curve changes, which are counter to the textbook definition of “short-lived” demand shocks.

The changes in consumer and business demand will last longer than expected, and in many cases involving software products, the demand changes could even be permanent.

In short: Covid is producing long-lasting demand curve changes that will sustain a new era of opportunity for marketplace startups.

A New Understanding of “Demand Shocks”

As a Founder, tracking market demand will give you early insights into new and developing markets.

One way to track movements in the market is with demand shocks, or sharp, sudden changes in the demand for a product or service. Traditionally, positive demand shocks cause a supply shortage and drive the price higher, while a negative shock will lead to oversupply and a lower price. These demand shocks, positive or negative, are typically short-lived.

We’ve seen positive demand shocks from lumber to toilet paper and silicon chips, and negative demand shocks from commercial real estate to airline travel.

However, many examples from Covid break the traditional definition of a demand shock.

Two things are different now:

- Traditional demand shocks assume scarcity (i.e. physical products, real-world experiences), but we’re increasingly consuming digital goods which are practically abundant. Therefore, we see fewer cases of prices being set based on oversupply or a supply shortage.

- Covid is no longer a “sharp” or “sudden” change. It’s widespread and chronic. Rarely do sudden changes persist, but that’s exactly what’s happening with Covid. These changes are long-lived now, not short-lived like they normally would be.

This extended crisis is as much about human behavior, emotions, and beliefs, as it is about economics. Fear, uncertainty, and doubt loom large in our minds, especially in times of crisis. It’s our evolutionary programming. This FUD won’t go away quickly.

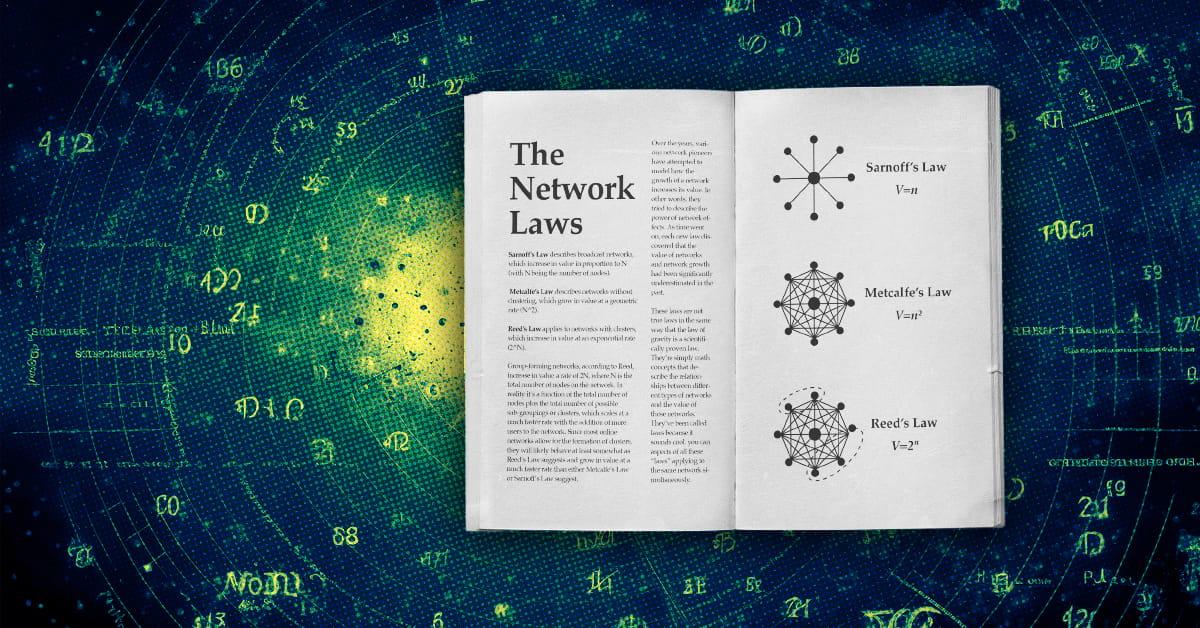

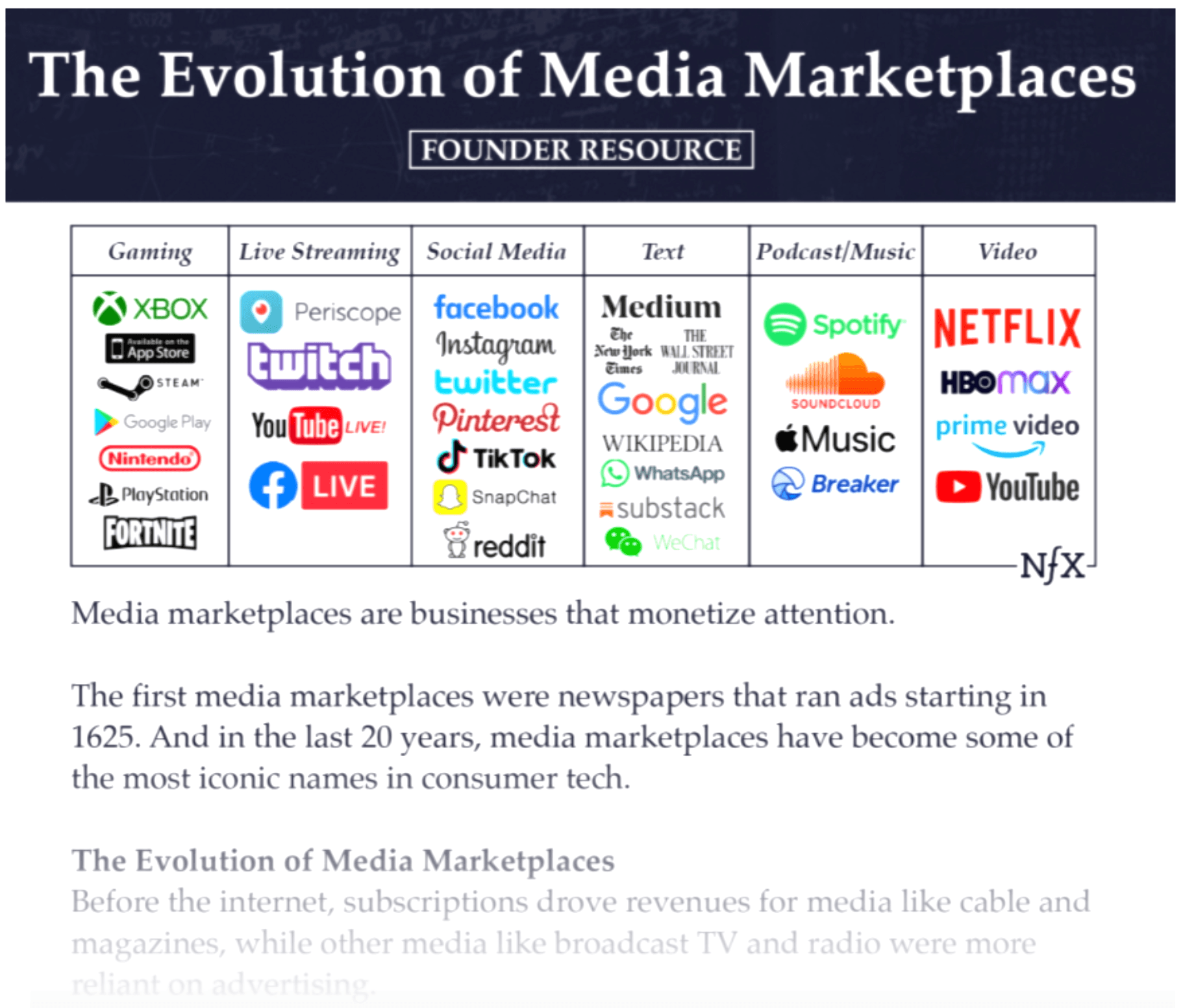

But, even more than our emotional state, economic crises rarely change our daily behavior. Covid was a total digital immersion, introducing new demand for software-enabled, network effect businesses such as marketplaces, which are getting better and cheaper as they scale.

Software-enable marketplaces are operating with zero-marginal costs, or with global access to labor supply, so there are rarely supply shortages or surpluses. While the old-world strategy was to raise prices over time, the strategy in software is to lower prices and increase market share.

Increased demand for these software-enabled products is creating the conditions for fast growth, lower prices, network effects, and a better product experience. And products with lower prices, network effects, and better experiences tend to win out.

We believe consumers will stick with many of their new software-enabled alternatives instead of going back to how it was before. Not only because they’re better and cheaper products, but also because Covid has planted new beliefs, emotions, and behaviors in our minds.

What Demand Curves Are Emerging?

We’ve seen demand for Covid-related commodities like masks, toilet paper, and canned foods surge. They won’t sustain their all-time demand highs, but they will persist longer than most people expect and set a higher demand floor than in pre-Covid times.

Software products, on the other hand, will have both persistent and increasing demand because our move to a world of bits, not atoms, was greatly accelerated by Covid. They have a native advantage over older alternatives — they’re often cheaper and better — because of software’s unique properties: zero-marginal costs, network effects, and scale effects.

Software-Enabled Examples

Will people get socialization and services through the metaverse? We believe that this will continue to happen.

Social gaming is not new, but its demand was greatly increased in lockdowns. Even once we finally reach a post-Covid economy, this product desire will likely persist and increase.

Most kids, for example, have now been digitally immersed with Roblox, Minecraft, and other games. It’s hard to believe that kids will fully revert back to pre-Covid norms. These experiences are informing how socialization happens for this next generation.

Telehealth is another example. Consumers were forced to adopt a new behavior, since many patients could not legally seek in-person care. Patients have now adopted a digital-first experience, often with same-day booking. Moving forward, doctors and patients will likely prefer — if not require — routine check-ups to be done online.

RV marketplaces, such as NFX portfolio company Outdoorsy, also experienced a demand surge from Covid amid widespread travel restrictions. They quickly and efficiently expanded supply to support the demand increase, and we believe this demand trend will continue even as travel patterns return to normal.

And NFTs, which are digitally native, have seen a rapid increase in popularity since 2020. With stimulus money and lower interest rates, alternative asset classes like NFTs are getting more attention. There will be natural volatility, but long term they are here to stay. To many, NFTs are preferable to their bulky, fragile, and cumbersome physical alternatives.

Founders would be wise to look for other demand surges — where beliefs, emotions, and behaviors have shifted because of Covid. As we’ve seen before, software-enabled marketplaces will inevitably emerge to leverage these new demand curves.

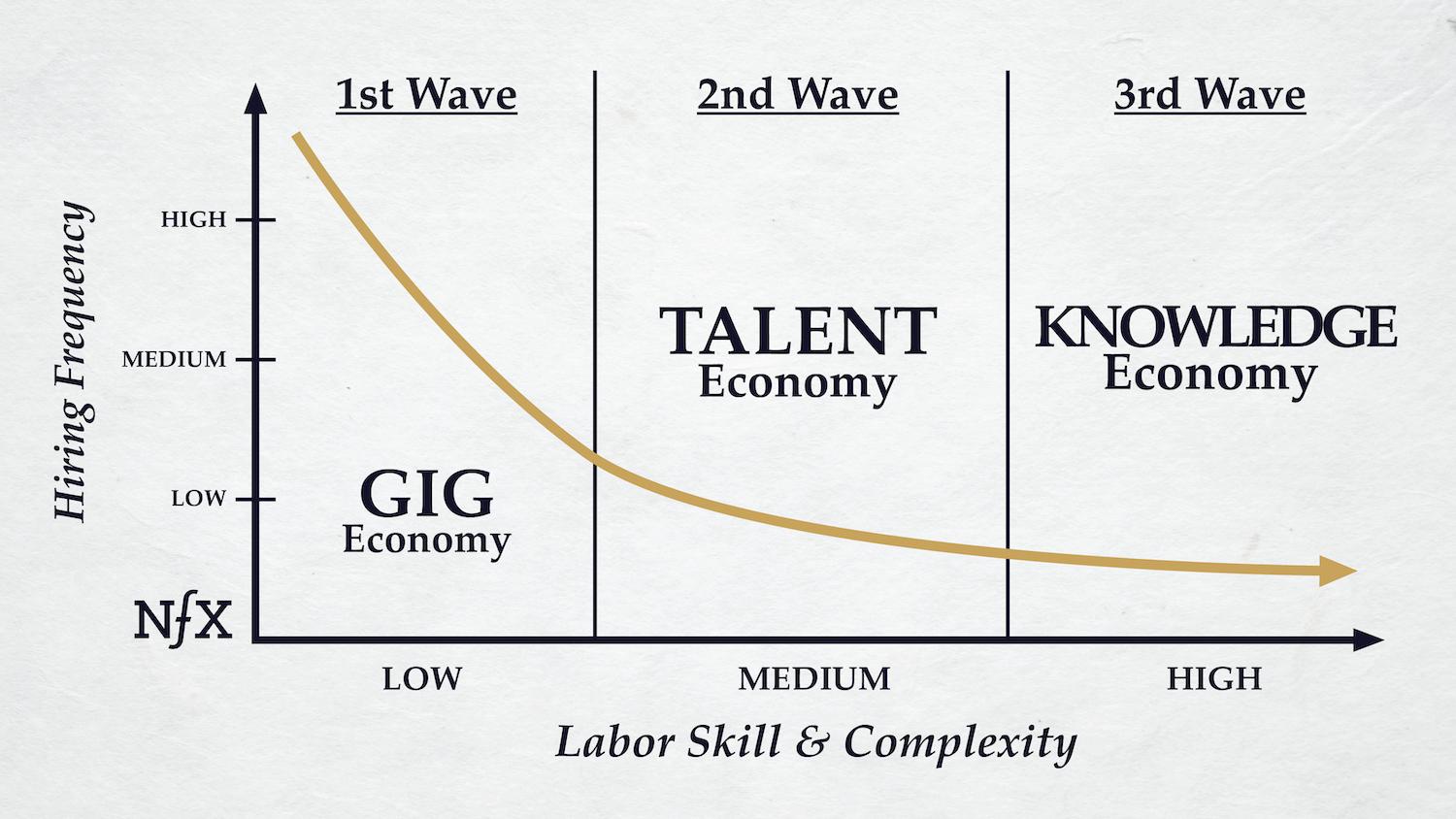

How To Innovate To Meet New Waves Of Demand

Demand shocks force people to move to alternatives because the old way is often no longer possible. Consumers and businesses are suddenly open to new ideas, which solves one of the biggest challenges in businesses: changing customer behavior. For that reason, long-lasting demand curves from Covid will benefit startups, especially marketplaces.

Marketplaces, by definition, exist to more efficiently connect demand and supply. But, at equilibrium, they are often constrained by the demand side. After years of relatively constant consumer and business demand, stimulus dollars and high interest rates (economics), social movements (culture), and forced digital immersion (technology) are fundamentally changing customer behavior.

When demand is increasing, the innovation is typically on the supply-side. You need to create product experiences preferable to the old way, which are often powered by software. Many companies have managed to figure out ways to create new supply very quickly. As a result, they will have massive opportunities moving forward because of this rapid supply expansion.

How can you innovate on the supply side with sudden waves of unmet demand?

- Unlock new supply through technology and/or automation

- Create radical substitutes, not simply alternatives

- Turn a 100% offline behavior to completely or mostly online

One benefit of Covid is that the constraints in time and capital are forcing Founders to push for efficiency to create a better or cheaper way — that will also persist.

Take vaccines as an example. While Covid vaccines may eventually decrease in demand, the fundamental tech and distribution systems can be applied to many other things. The opportunities for those businesses are enormous.

If you can innovate on the supply-side to meet a demand surge, even if the demand for a product won’t be permanent, it can still serve as a wedge into a bigger opportunity. This was Airbnb’s playbook in the beginning.

Airbnb unlocked residential supply in cities with temporary shortages in hotel capacity because of large events. On the supply side, they gave hosts the opportunity to generate income from vacant real estate when the economy was struggling in 2008.

On the demand side, they solved an acute shortage, but also exposed people to the novelty value of staying in local residences — which many people discovered was a cheaper and better alternative to hotels.

Airbnb also demonstrates the marketplace playbook of finding non-obvious substitutes for constrained supply. Vertical farming companies are trying this playbook now, as they strive to solve the supply chain shortages in Covid. They are growing food in a warehouse a mile from where you’d actually eat it. This approach could transform agriculture and is a radical substitute to traditional farming.

The Marketplace Basics Still Apply

While Covid-induced marketplaces feature some specific tactics, the marketplace basics still apply. Founders should look for:

- Large and/or increasing demand

- Highly-fragmented markets

- Non-commoditized product offerings

- Strong margins

- Lack of disintermediation

- Repeat usage

At NFX, we’re looking for marketplace businesses that are not only responding to this new Covid reality but also exhibit these qualities.

A Decade of Opportunity

Be careful not to underestimate the durability of these demand changes. This is just the beginning.

There are still multiple demand curves that Founders can leverage to create new markets or wedge into existing markets. As we’ve seen in the past, marketplaces emerging in turbulent times start on the fringes, but can quickly grow into behemoths.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.