With unemployment expected to reach 20-30%, on par with the Great Depression, the COVID-19 crisis heralds a once-in-a-century moment in the job market.

The shelter-in-place orders from the pandemic have created a massive, but temporary, demand shock to the labor market. They have also accelerated many long term trends that will create permanent changes in the work that we do and how we do it. When the economy eventually normalizes, demand for labor will recover, and work will recover, but the shifts in supply and demand will result in a new and sizable set of unmet market needs for job placement.

When this happens, online marketplaces will be a critical tool in getting people back to work quickly, efficiently, and at scale. They will also enable new ways for people to build the skills they need to succeed, and for them to work in an increasingly remote and distributed fashion.

As I’ve written before, in a crisis Founders should be looking for ways to play to win, not just survive. There has rarely been a more opportune time to build solutions for the changing labor market. The next revolution in labor will be much bigger than the one we saw with the rise of the gig economy that came out of the global financial crisis.

At NFX, we see 4 trends in the next generation of online labor marketplaces.

- Greater complexity: Marketplaces are moving to onboard standardized and attributed human capital with a greater complexity of service.

- Improved experience: Marketplaces are evolving toward increased verticalization and taking over more of the value chain.

- Tech-enabled labor: Startups able to use their tech to add value to their labor will be able to unlock latent supply and offer a better experience to both sides of the market.

- Re-skilling and upskilling: Education and labor have always been closely associated but they will increasingly start to happen on the same platform.

We believe there’s an enormous opportunity here, not just for Founders, but for our society and economy at large. At NFX, we have been long time investors in goods, services, and information marketplaces with operational experience in marketplace creation and network effects. We’ve also been increasingly active in investing in labor marketplaces, from our Pre-Seed investment in healthcare marketplace Incredible Health, to work-from-home AI and call-answering service Smith.ai and a number of other stealth investments.

Founders that can understand and capitalize on the trends we’ll outline below will be well-positioned to build the next generation of iconic labor marketplace companies and help redefine the future of work.

Finding the Sweet Spot: The Labor Complexity Spectrum

The first and most important trend we see in labor marketplaces is towards onboarding increasingly skilled workers and offering greater complexity of service.

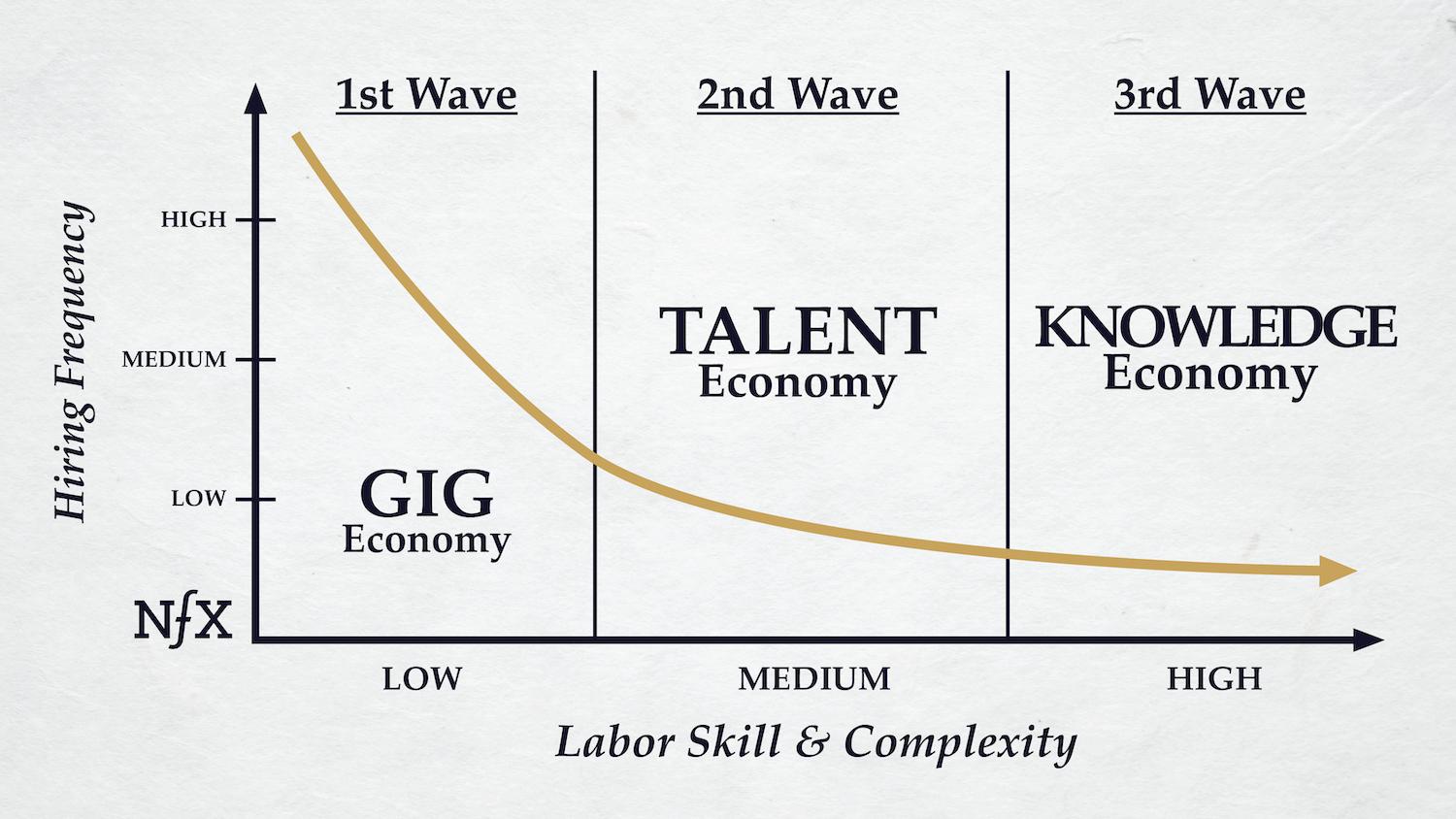

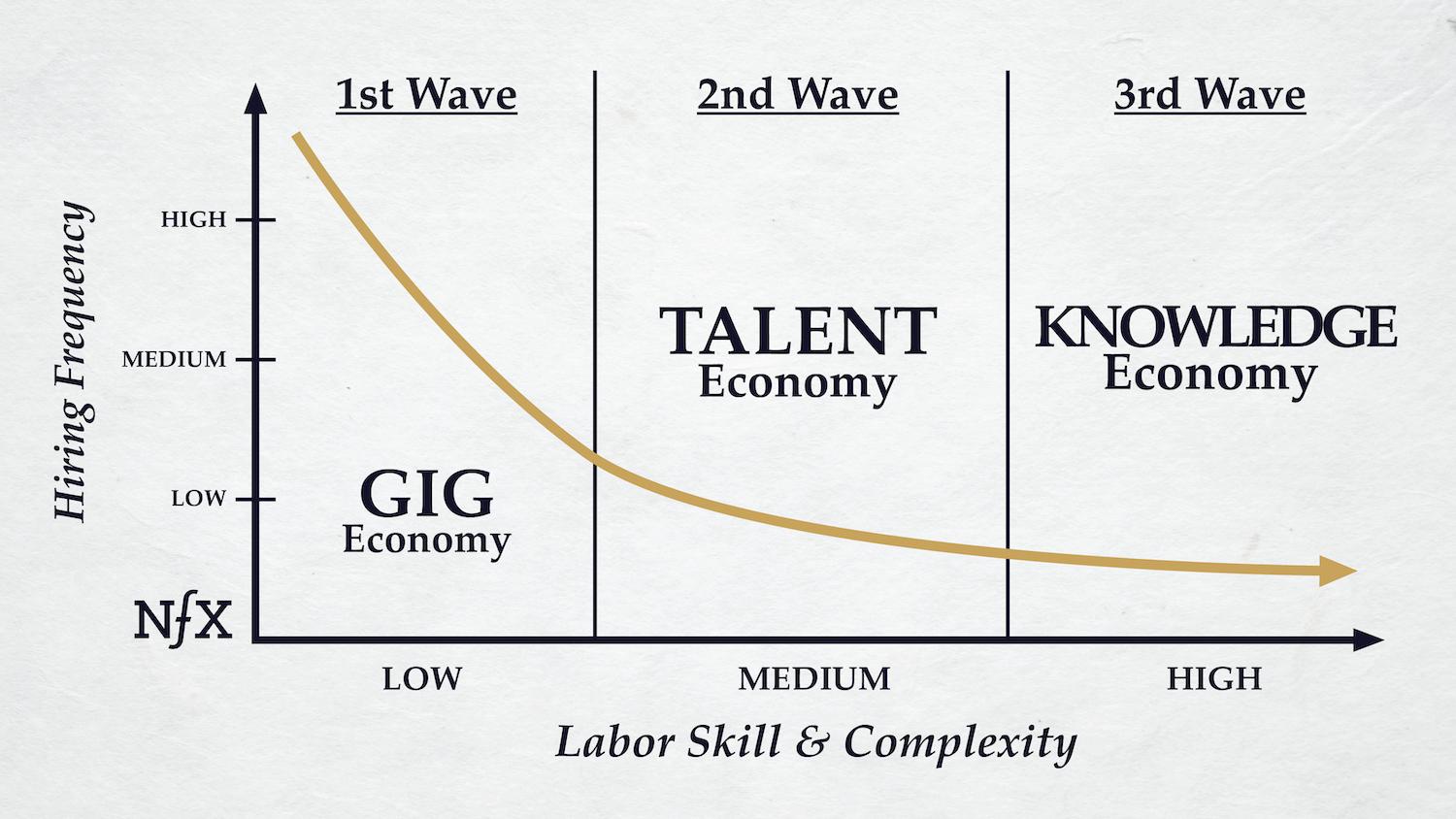

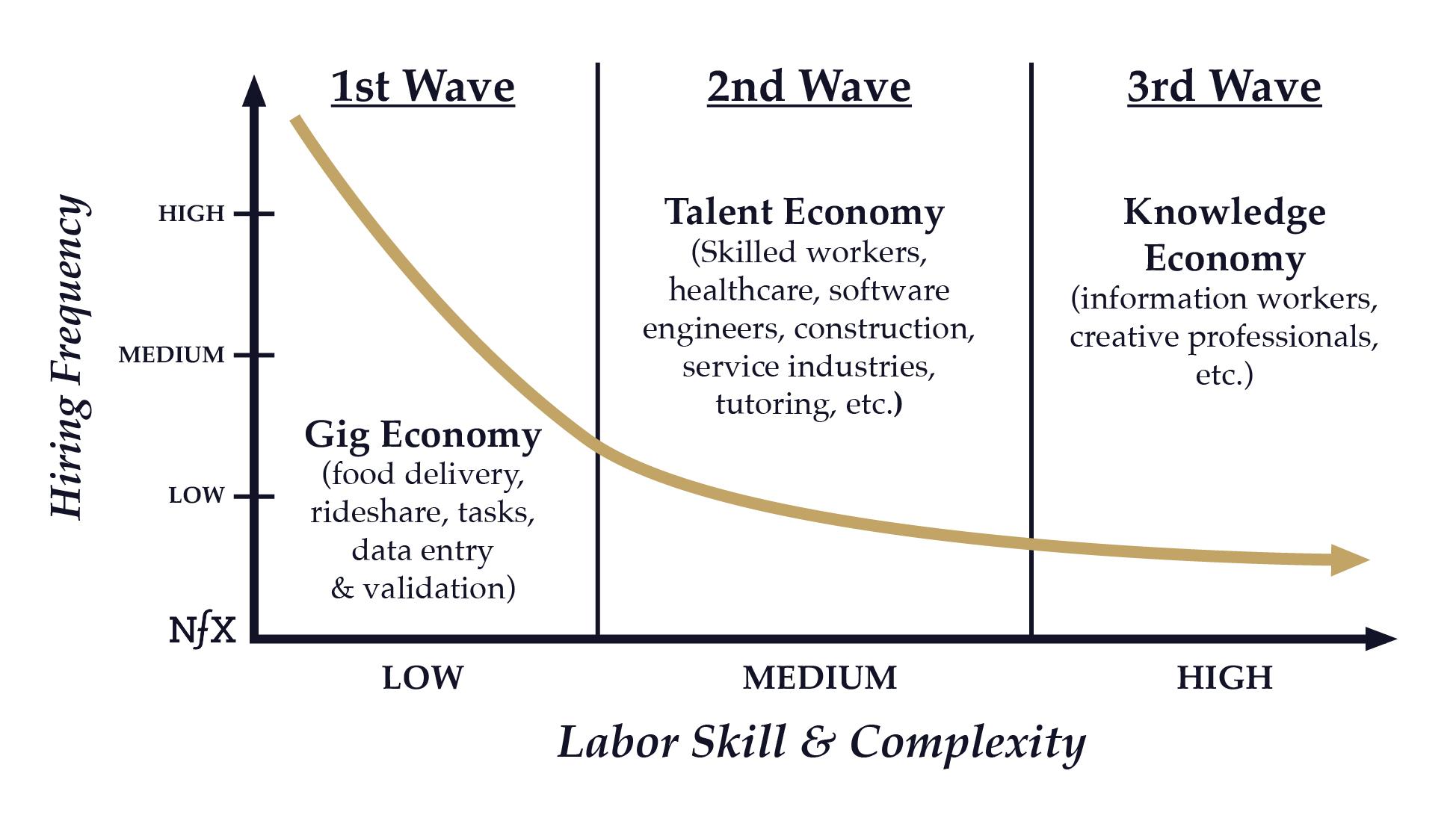

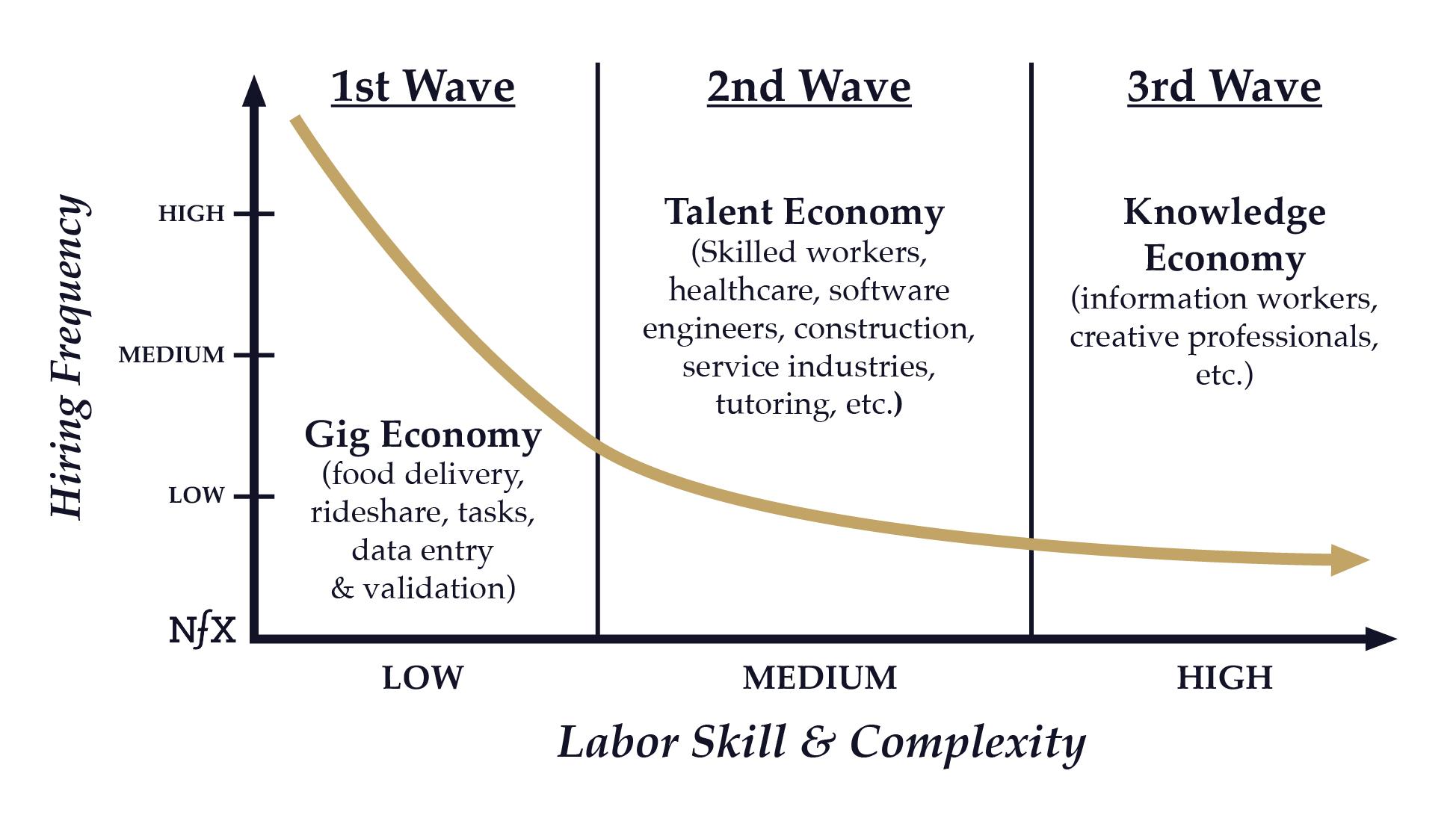

The first generation of labor marketplaces to hit scale — now mature companies like Lyft, TaskRabbit, and DoorDash — allowed demand-side users to quickly and easily match to a delivery person or driver or furniture-builder. These jobs are relatively simple: short in tenure, well-defined, and requiring a low threshold of skill to perform: the so-called “gig economy”.

This meant that the supply side was relatively commoditized with little differentiation between different workers beyond a simple ratings and reviews system, and the demand side was constantly seeking new types of work. The first generation of labor marketplaces was therefore able to easily or even automatically match a commoditized supply base to carry out defined, specific tasks without much threat of disintermediation. The constant changes in demand-side needs drive high engagement and frequency which builds a sustainable business.

With incumbents having taken the low-hanging fruit and consumers and businesses feeling more comfortable with online labor selection, the next generation of labor marketplaces are tackling a greater complexity of service offering.

But there’s a current sweet spot for new labor marketplaces between the well-trodden ground of the gig economy with temporary, discrete jobs and a high frequency of usage and the creative professional, skilled worker or information worker labor market which deals with complex jobs and a high degree of difficult-to-categorize differentiation between professionals. We call this the talent economy, where the internet enables talent with defined and understood skills to be connected to employers potentially in an instant.

The former area is already dominated by verticalized gig economy incumbents like Uber, DoorDash, and TaskRabbit, while the latter is served well by horizontal incumbents like LinkedIn, going after the knowledge economy.

While LinkedIn is almost two decades old, we believe LinkedIn or Indeed will not be superseded by new vertical marketplaces, but rather will be complemented by them. The network effects from its core information workers are just too strong.

It’s also worth noting that a large portion of the labor pool doesn’t have LinkedIn profiles because it’s largely irrelevant to the type of work they do. This suggests that new leading vertical job marketplaces will develop their own profiles highlighting skills and experience related to the particular industry.

The talent economy is about identifying labor pools that are standardized and attributed enough that demand-side users can quickly find what they’re looking for with an attributed search enabled by internet marketplaces. RigUp is one company to emulate in this space. RigUp matches oil & gas workers to temporary jobs at oil rigs. The labor supply has explicit skilling — definable skills that are easy to assess and label. Also, the nature of the work requires a constant hiring effort.

There are plenty of other labor categories that also fall into this category. For example, if you’re looking to hire a nurse or a construction worker, you may be looking for certain skills, certifications, and other standardized attributes that will make a hiring decision much quicker and easier than manually sifting through resumes (or LinkedIn profiles).

While more vetting is necessary to qualify candidates in this category of jobs than would be for hiring someone to mount a TV or pick up your dinner, standardization of hard attributes like degrees and certifications makes it easier to filter candidates. With stronger filtering, the demand side can focus their time on the less easily definable “soft attributes” like culture fit.

It cannot be underemphasized how much demand-side value can be accrued by improving the efficiency of search.

Improved Experience via Verticalization and Owning the Transaction

In our essay on fintech-enabled marketplaces, we observed that the laws of physics in marketplaces push them to relentlessly focus on increasing user experience and increasing a percentage capture of revenue flowing through the marketplace.

That in turn leads to greater verticalization to improve the user experience, and also providing more services to the participants — in particular deepening integration into the enterprise via SaaS tools.

Labor marketplaces are no exception. New marketplaces are wise to adopt a vertical focus, enabling greater participation in the transaction. There is a relentless drive towards offering better experiences for both workers and employers, and in most cases this necessitates building around a specific vertical to address the needs of both workers and employers in that market sector. With increased matching and efficiency through specialization and automation, marketplaces are able to command higher transaction fees.

Vertical focus is key. Skills, attributes, qualifications, and certifications vary greatly by industry, so lack of focus reduces the user experience by adding bloat and inefficiency into the matching and discovery process. It’s much harder to quickly and efficiently find a relevant employment opportunity or job candidate on a horizontal platform than a marketplace purpose-built for your vertical.

Vertical focus also allows marketplaces to expand their offering beyond sourcing and potentially deeply embed into the HR systems of companies or the career paths of workers. For example, RigUp provides a mixture of sourcing workers with a rarefied skill set, while also offering compliance and security.

A step beyond is monetization and supply-side embedding. Marketplaces have a clear incentive and opportunity to improve the experience by adding payroll, financing, and insurance directly to the platform. As long as the demand side has sufficient liquidity, which is easier with more commoditized labor, this decreases multi-tenanting and increases efficiency.

The monetization model itself must vary by industry. There are two basic models: the “staffing agency” model of charging an ongoing percentage of salary, or the “recruiting agency” model of charging an upfront fee. The higher the turnover and the lower the salary, the more the staffing model is appropriate.

Finally, as a labor marketplace, it’s important to note that job tenure and role scarcity is a big variable in deciding which side of the marketplace to focus your efforts. If, for example, workers are hired to semi-permanent or permanent jobs, then it makes more sense to focus on the demand side. That’s where the constraint in the marketplace typically is. Employers will be the high-frequency users, so if you own the demand side, the supply side will come to you when they are in a period of job transition or looking for work.

On the other hand, with short job tenures, focusing more on the supply side first makes more sense because workers will have a higher frequency of usage.

Tech-Enabled Labor Unlocks Greater Supply

Another concept I had written about in my essay on fintech-enabled marketplaces was that unlocking latent supply is key to marketplace success.

One interesting way to do that in labor is via technology and automation. The most interesting labor marketplaces tend to be where you can use technology to increase the value that labor provides. With increased specialization of labor comes the increased relevance of automation.

Any kind of work where tech or automation can be used to incorporate specific guidance on how to do that job through the app at the point of service will create enormous value by unlocking latent supply — making it easier and lowering the threshold of training, skill or experience necessary for workers to be able to perform a job with excellence. This can happen via the worker-side experience or the employer-side.

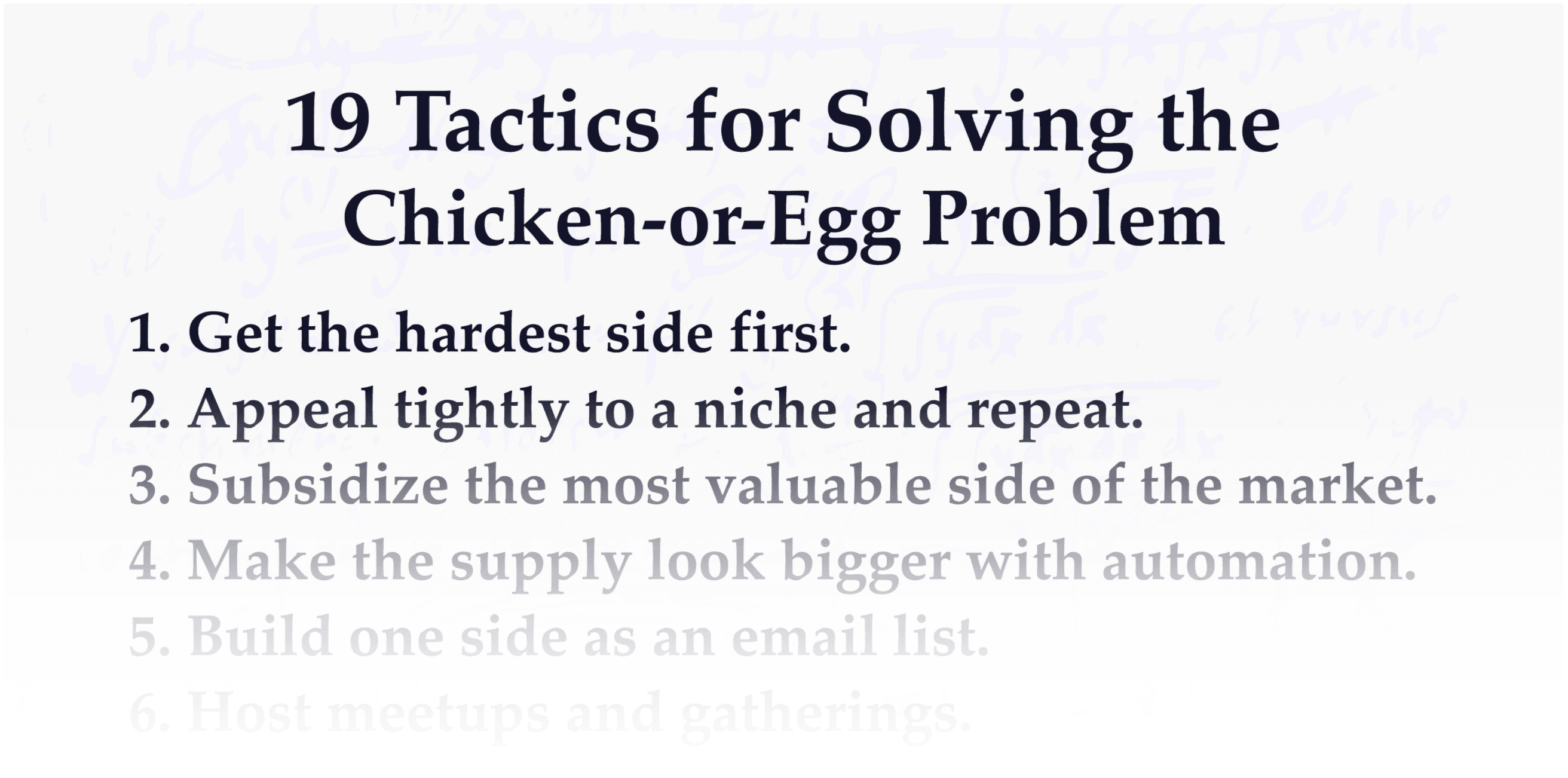

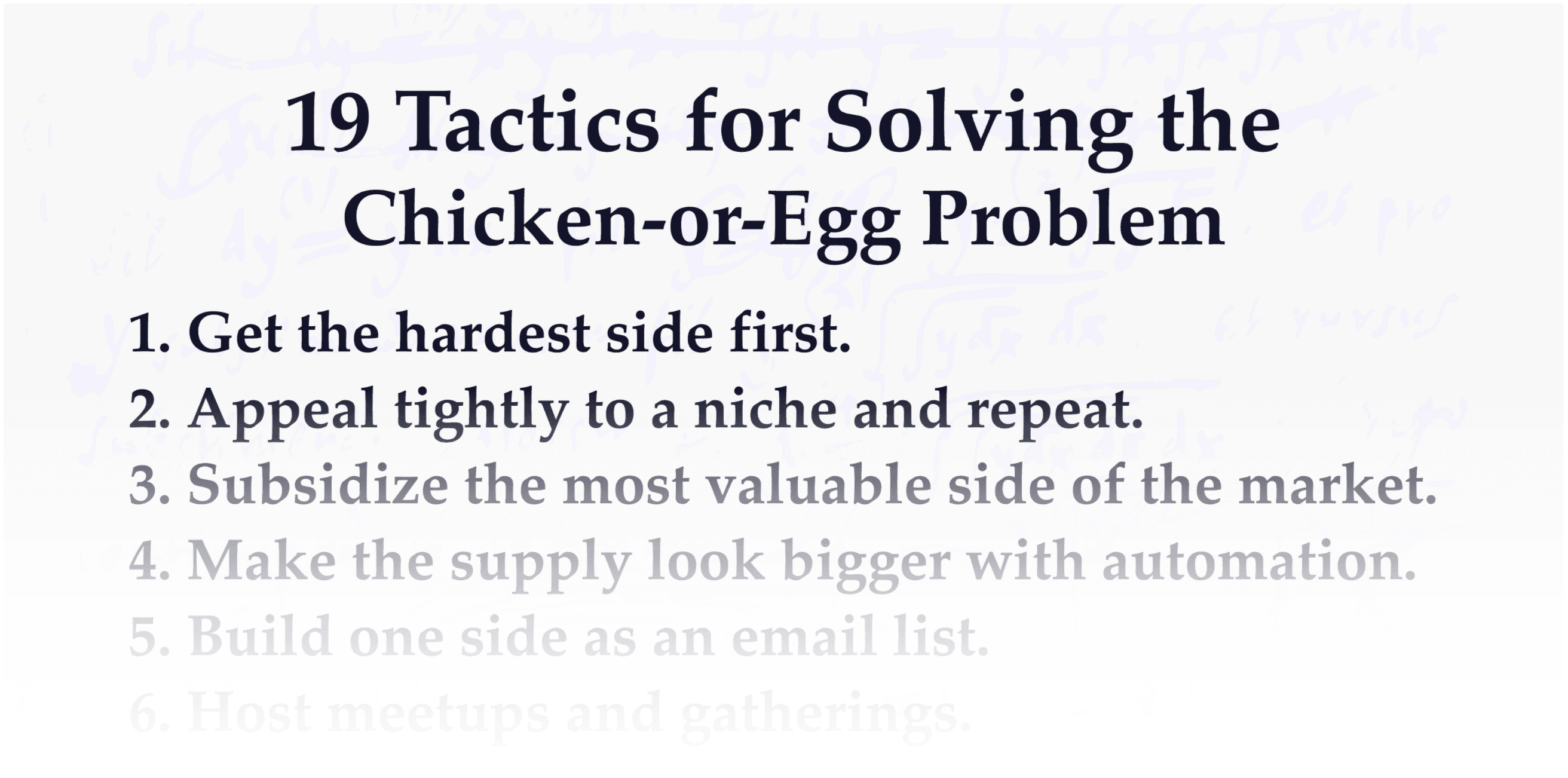

As discussed earlier, SaaS tools are also a good way to power a marketplace. If you’re able to provide a SaaS tool to a business, you can embed yourself into the HR systems running payroll and applicant tracking, for instance by automating compliance or licensing with a SaaS workflow that plugs into HR. This can help to build up the demand side while you’re dealing with the chicken-or-egg problem, a problem we’ve previously written about when we first revealed the 19 tactics for solving this classic marketplace problem.

This is also an industry that is highly fragmented. There were over 20,000 staffing and recruiting companies in the US in 2018, most with very limited technology. This fragmentation is orders of magnitude greater when considering the number of employers.

Reskilling and Upskilling: Labor Marketplaces & The Future of Work

Tech-enabled guidance and training will have the benefit of unlocking a greater pool of supply, which is now more relevant than ever. With the pace of change of the economy only increasing, reskilling and upskilling labor is of pressing importance.

On-the-job training and guidance via technology is now much more viable with large-scale mobile adoption. We’ve already seen how the application of mobile technology has greatly increased the efficiency and performance of labor in everything from food delivery to dog walking, and mobile instruction at the point of service has also unlocked novel labor types that didn’t exist before like Instacart’s shopper network.

This same principle can be applied to more complex and skilled work. For example, NFX portfolio company Smith.AI uses automation to augment their virtual receptionist services, an example of a human-in-the-loop AI application that could be applied to other categories.

Past labor marketplaces have gotten a bad rap for providing a mediocre quality of service or a low standard of labor. Offering tech-enabled training, reskilling, and upskilling is one way for the next wave of labor marketplaces to anticipate this problem while also providing a greater diversity of options for workers.

This benefits the marketplace as well by reducing supply-side churn, as workers stuck doing the same thing with no opportunity for advancement or progress are unlikely to stay put very long. As automation and tech get better, marketplaces may even find themselves in the position of displacing their own workers, as Uber would do if and when they built a fleet of autonomous vehicles as they intend.

It’s therefore a responsibility as well as a good strategy for labor marketplaces to anticipate supply-side disruptions and retool their users for the changing demands in the labor market. Otherwise, all the defensibility you build by aggregating a pool of labor will evaporate with the inexorable forward march of automation.

A Labor of Love: Building a Scalable Marketplace

There have been thousands of attempts at building labor marketplaces in dozens of verticals. What divides the successes from the failures fundamentally comes down to two things:

- Driving liquidity in the marketplace.

- Reducing disintermediation.

Liquidity most easily occurs when you are able to capture the attention of the participants when they are searching for a solution. The higher the frequency of the need, either from the supply or the demand side, the easier it is to retain their attention.

In addition, the more mobile the labor pool or the nature of the work, the easier it is to get to liquidity and hence to successful matching. The early success of Upwork, which relies entirely on remote work, contrasts with the many failures to build hyper-local service marketplaces. In many ways, the acceleration of remote work trends in labor due to COVID-19 will facilitate new marketplaces from forming. Employers are adjusting to working with distributed teams and seeing the value in it and that in itself will open up new marketplace opportunities.

Disintermediation, on the other hand, is the bane of marketplaces. This is where the supply or demand side circumvents the marketplace, typically as a result of failure to provide sufficient value for fees, or because there is greater convenience and confidence for participants to interact directly. Again, verticalization and using technology to build in capabilities where users on both sides derive value from maintaining participation on the platform is critical to addressing the problem.

Some use cases or verticals are just more likely to suffer acute disintermediation than others. In particular, marketplaces where participants demand high levels of consistency and trust are prone to disintermediation. This is especially true when it is easy to set up substitute arrangements without the aid of the marketplace after the initial match between buyer and seller. Babysitting services and home-improvement labor are key examples.

Furthermore, the higher the hourly wage and frequency of hire, typically the greater the revenue flowing through the platform to enable a sustainable standalone marketplace to thrive.

The Transformative Potential of Labor Marketplaces

Building for the future of work in a time of crisis won’t be easy. Founders need to navigate the challenges of building in a crisis — the uncertainty of when the labor market will return to normal — even as they seize the opportunity provided by millions of workers having lost their jobs and looking for work.

But this sudden influx of workers looking for hire is a rare opportunity to overcome the chicken-or-egg problem that makes building marketplaces so difficult under normal circumstances. Furthermore, we are seeing a “re-platforming” of how work is being done across most sectors as employers embrace remote work and distributed teams. Labor marketplaces in every vertical will have a unique chance to gain traction and supercharge their network effects.

If you are thinking of building a labor marketplace, there has never been a better time. There’s a once-in-a-century economic impetus and the enabling technologies are all there. We encourage you to start building — and to come talk to us to help get you started.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.