Over the last 10 years, we’ve seen a transformation of the seed and series A financing environment that has changed the game for Founders – the hurdles are now higher. To give Founders every chance at success, we’re making public our Series A checklist. While it’s focused on raising a top Series A, it’s applicable to all early-stage fundraising.

Here’s what’s happening that Founders need to understand:

- Series A rounds have gotten bigger and are being done later on in a company’s lifecycle.

- To fill this gap and help companies in this formative early stage, seed funds like NFX have also grown bigger and more established as well.

- Alongside the expansion of capital into each Series A financing, the expectations on companies looking to raise their Series As have heightened.

- With a growing number of startups in many different sectors, raising a top series A has become a growing challenge.

For startups to succeed in clearing that increasingly daunting Series A hurdle, they must retain focus on their long-term vision while simultaneously hitting their near-term milestones.

It’s worth noting that in general, having product-market fit and a minimum amount of scale are usually prerequisites for raising series A funding. But here are 13 additional proof points that investors look for in startups looking to fundraise.

1. Show Traction

One of the most important things Series A investors look for is traction. How you determine whether a company has traction varies widely by context, but relatively small differences can lead to order-of-magnitude differences over even a 12-month time scale.

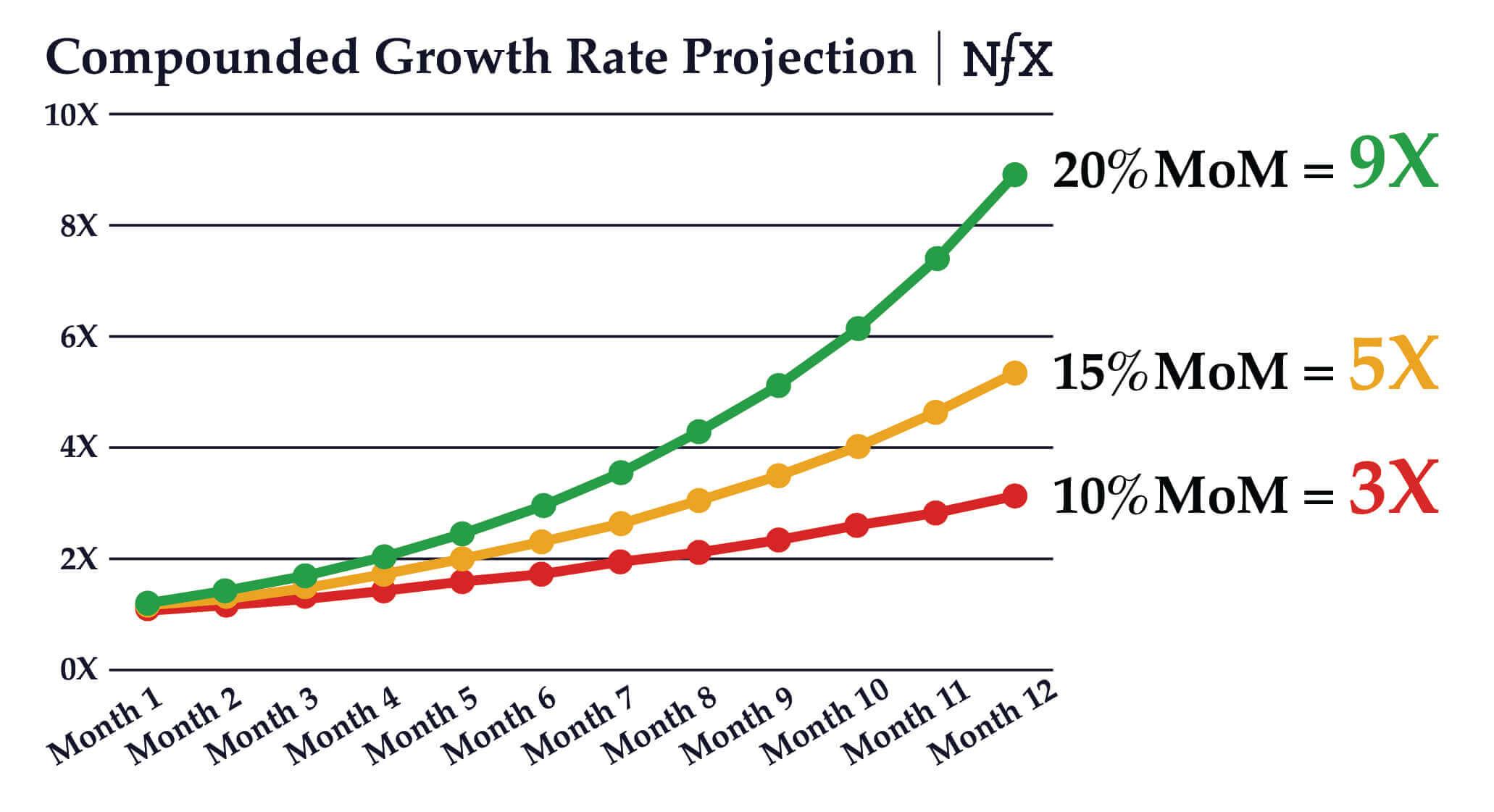

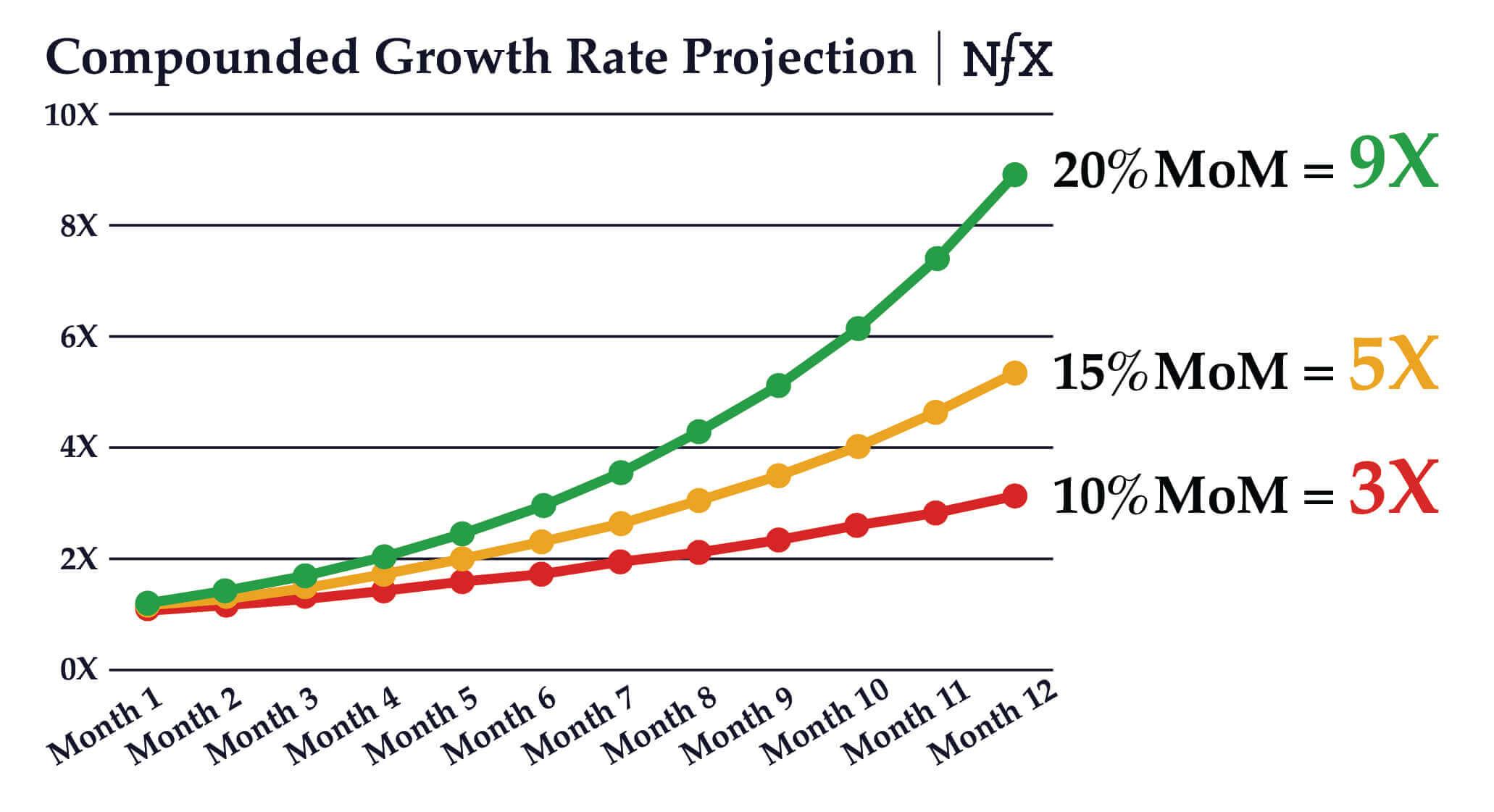

Below, you can see the difference between a 10%, 15%, and 20% MoM growth rate after 1 year.

You see here the difference between a 10% growth rate and a 20% growth rate is the difference between ~3X growth and ~9X growth over the span of a year. That’s substantial.

Investors looking to see if you have traction are looking for that hockey stick curve. A more linear trajectory isn’t as appealing, they want to see you approaching an inflection point. When they invest, they want to see their investment as rocket fuel.

The point from a Founder’s perspective is that you should be figuring out how to operationalize your growth engine for 10%+ per month, which means you’ll fall into that 3-10X growth trajectory. This can apply to topline KPIs like active users or traffic, but optimally revenue.

Startups that can demonstrate that kind of trajectory in a sustainable way usually have no trouble raising money. When you check that traction box in the investor’s mind, they’ll write the check.

Naturally, the starting point for this kind of growth is very important. For example, 50% monthly growth off $10k monthly revenue is a lot less impressive than 30% monthly growth at $100k a month. So identify with your investors and peers what the minimum scale you need to be to even consider raising a Series A.

Furthermore, having 6 months+ of somewhat consistent month to month growth is important to show a trend that investors can extrapolate from.

2. Demonstrate Product-Market Fit

Showing product-market fit is both an art and a science.

The science comes from cohort analysis, retention curves, organic adoption, etc. This is where you can look to data to show that the market is starting to adopt your product. Being diligent about that data is critically important not just to show you have product-market fit, but also in cultivating and showing that you’re data-driven as an organization.

But the art of judging product-market fit comes from the ambient noise that surrounds your company. Buzz in the press. Glowing customer feedback and testimonials. Fanatical users. All these contribute towards the feeling that you’ve found product-market fit.

As my colleague James Currier likes to say, “when you get product-market fit, it’s like when someone puts two fingers in your nostrils and yanks your head forward.” That feeling of being drawn forward is qualitative evidence to back up your data that you have indeed hit product-market fit. An anecdote about that feeling can sometimes pack more of a rhetorical punch than your data can.

3. Prove Scalability & Unit Economics

At the series A stage and later, investors are looking for a clear path to growth and scale.

For scale, a minimum scale that investors are looking for is very company-specific. To find benchmarks it’s best to triangulate from peers and investor conversations.

For growth, it’s about showing that you have a credible path. During the seed stage, you experiment with maybe half a dozen channels. Typically at this stage you’re going to double down on one or two, with a well-understood strategy to achieve scale — whether that’s with product, marketing, or sales. Clearly communicating what are the growth levers and how you can profitably scale them is critical.

One of the top things investors look for is proof of latent demand, a demand pipeline that’s just waiting for you to unlock it if you can just scale out your supply or services with more funding. The more you can frame your request for funding in these terms, the more of a sure bet it looks like for the investor and the easier their decision becomes.

4. Have a Big Vision (but OK to Start Small)

As my partner Gigi Levy-Weiss wrote in How VCs Think, the economics around VCs make it so that early-stage investors are looking for really large exits.

To raise a top series A, be able to show a path to $100M and then potentially $1BN in revenue. But as we frequently tell our portfolio companies, it’s a good idea to “find the white-hot center” and then bleed into adjacent market segments from there.

Start with a well-defined, well-understood, and well-executed niche — but be able to point to a bold, inspiring, grander vision.

5. Build a Clear, Compelling Narrative

What’s your reason to exist?

Why now? Why was this impossible just a short time ago? Why does the world need your solution today?

To us, startup timing is everything. A compelling narrative starts with identifying a credible opportunity that hasn’t been tried before. It presents an unaddressed, important problem and envisions a solution. It paints the picture of a world without that problem.

The key to building a clear, compelling narrative is to frame the problem, describe how to solve it, and explain what has changed that makes right now is the opportune time for your solution.

6. Build Out Your Team

A big signal to investors that you’re ready to move to the next stage is that you’ve been able to build out your team and plug gaps in the key areas where your founding team is deficient, in the form of either employees or advisors.

You want to be able to show an ability to hire and bring on talent from centers of excellence, whether it’s individuals from top universities, top companies, or just remarkable people that can benefit the critical early DNA of the company..

The investors that you want to lead your next round should recognize that top companies only succeed if they are able to build out a diverse talent pool. The later you leave this task, the harder it gets. So by the time you’re raising a Series A, you should be able to demonstrate your ability to hire people that bring perspectives, qualities, and experiences beyond those of the founding team. No one is expecting the United Nations, but some thoughtfulness moving beyond the seed stage shows the team is building a strong foundation.

Attracting talent from places like these is a signal to investors that your company has some real magnetism, and that you’re able to convince people with a lot of optionality to choose to come and work with you. When elite talent is willing to stake themselves in your company, it’s a reliable heuristic for investors. Don’t forget to highlight and showcase your hires and their backgrounds.

7. Chart a Path to Defensibility

Top investors want to back you when you can show why you’re the category leader in a winner-take-most market. That’s what generates the greatest returns. Defensibility — especially network effects — is the biggest factor in value creation, and investors know it.

Because of this, you have to be able to show a strong defensibility strategy to investors if you want them to be interested. You also have to show either that you’re the category leader or that you’re on a path to be.

8. Create Scarcity

When it comes to deciding how much to ask for when fundraising, it’s often better to be conservative. If you think you can raise a large round, set expectations a little bit lower and let competition drive the amount up. Nothing appeals to a VC’s FOMO like an oversubscribed round, and top VCs are always ok putting more money to work.

When you’re raising, be transparent about your fundraising timeline to help create that feeling of urgency and scarcity. It’s best not to mention the names of other VCs, but signal that you’re going to make a decision on a certain time-frame, allowing all your investors to participate and as necessary time their diligence process.

9. Build VC Relationships Early

You don’t want your first touchpoint with a VC you’re looking to raise from to come right before you’re looking to raise. Ideally start VC relationships 6+ months in advance of raising to maximize your chances of getting the ones you want. This is important for founders to find the right partner for this journey and also for investors to get to know the company.

As a benchmark, you can hope to get on average 1 term sheet for every 20+ introductions. So in building your relationships, identify why the VC is right for you and express that to them. Make sure your follow-up is quick, and be ready with detailed responses to any questions they might have, day and night.

As an additional buffer, you should aim to close your Series A when you still have 6 months or more of cash on the balance sheet.

10. Project Momentum

A proven way to get investors excited is to project a sense of forward momentum, whether that be in your business metrics, hiring, PR, marketing, etc. You want to show that your business is accelerating in as many ways as you can.

This means managing and exceeding expectations. If you have a meeting where you say you expect 15% growth next month but come back with 20%, it’s a lot more exciting than if you set an expectation of 20% growth and meet it.

A typical mistake I see from Founders is that they’ll oversell in the first meeting: “we’re going to sign huge deal X next month and have revenue Y, etc.” More often than not, things don’t go to plan.

By contrast, there is nothing more exciting from an investor’s perspective than to hear from a founder that the business just keeps getting better and better with every interaction.

Find the “minimum viable excitement in a future vision” that you can set expectations with, and then consistently beat those expectations to create a feeling of acceleration. The more you can exceed expectations and project a sense of momentum, the more excited people will be about your company — investors and employees alike.

11. Climb the Ladder of Proof

As we’ve written about earlier, VCs have a mental framework we call the “ladder of proof” that helps them judge a startup based on a group of predictors.

Whatever “rung” of proof you were able to climb to in your last funding round, climbing to a higher one than that is a good sign of progress for a VC. It’s a signal that things are moving in the right direction on the right track. If you’ve been able to turn a customer waitlist into active users, for example, that’s a good sign.

12. Make a World-Class Pitch Deck

For your seed pitch, the design and data presentation in your pitch deck aren’t always difference makers. But when you’re pitching for your series A, having world-class design and data makes a difference.

Make your decks look simple and awesome. Have lots of data available in an appendix or within the deck. You want to leave an impression of your outstanding knowledge, analysis, and insight.

13. Build Social Proof

Social proof is another important signal that most investors pay attention to. As much as you can, bring on top advisors, influencers, and angels into your circle to gain social proof, and make sure you showcase them.

It also helps to get the best possible intros, and ideally you want to find multiple intros to the same investor from people who know your company.

Lastly, it’s important to highlight endorsements from top customers, business partners, press stories, and other sources.

Series A Checklist

Below, we’ve provided a checklist for your startup so you can evaluate your readiness for series A fundraising.

Making the leap from a seed to series A company isn’t easy, but we hope these resources will help pave the way.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.