One of the best tells that someone is an exceptional founder: their communication rituals. With their teams, their customers, and especially their investors.

Sending world-class investor updates is one of the highest-value rituals you can learn.

This matters because the right investors can be absolute heavyweights in your corner, but only if you are diligent about a) building trust by communicating well during good times and b) communicating even better during the down times.

We’ve seen thousands upon thousands of investor updates over our careers. Here, we’ve parsed the best habits and tactics for the benefit of the founder community, including:

- Common mistakes founders make in their investor updates

- The NFX Way for transforming yourself into a great communicator

Your communication style, especially during challenging times, says a lot about what kind of leader you are out on the battlefield – and your investor updates will be a leading indicator of your success.

60% of seed founders send monthly updates

In late March 2023, NFX surveyed 870+ founders in our broader network (not necessarily NFX portfolio companies) to find out how they were doing after the SVB banking crisis, and in the downturn more generally.

That data reveals the communication habits of seed-stage founders who have raised $1M or more:

- 60% communicate with their investors monthly.

- 21% say they communicate weekly.

- 3% communicate daily.

- And 16% only communicate with their investors on a quarterly basis.

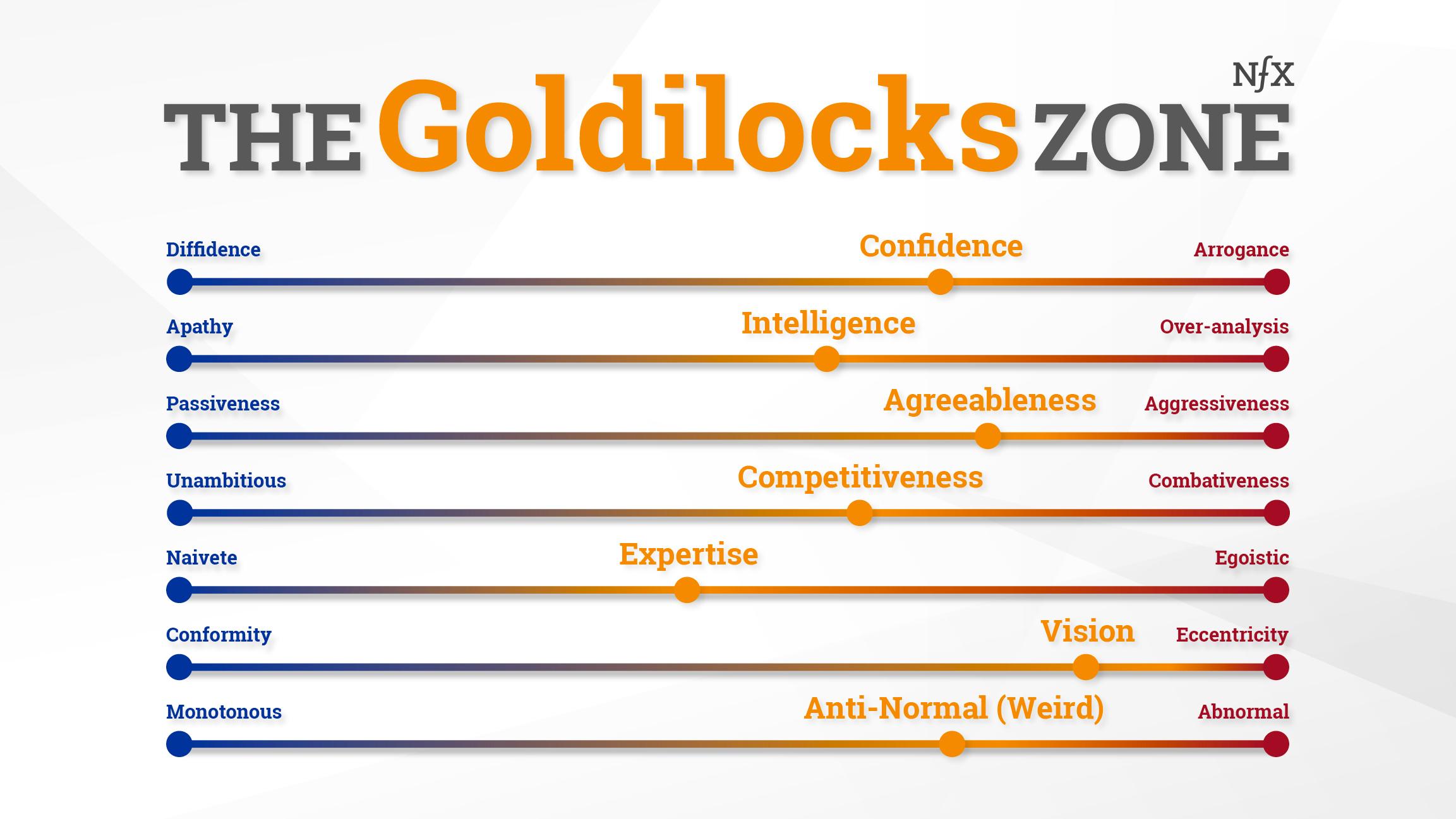

There’s a Goldilocks Zone here. Daily updates are not something we look for – but sometimes that’s the edge you need when you are in an extreme situation and we are in an ongoing conversation about solving it.

But quarterly updates are too few and far between.

Monthly updates are the sweet spot, with perhaps slightly more frequent updates during a crisis, and off-cycle updates as needed when there are big changes.

Common mistakes founders make when updating investors

When you commit to regular, monthly investor updates, you’ll maintain your share of mind. Investors want to unlock value for you, but things move fast and they don’t know your day to day win-loss record – it’s up to you to keep your company in their sights.

Here are some of the common pitfalls that great communicators avoid.

Mistake #1: Not showing up

You’d be surprised by how many founders get too busy to update their investors, and then turn up asking for money when their backs are against a wall.

There is no advantage to not sharing information with your investors. None.

Radio silence gives investors time to ruminate, or wonder why we’re not hearing from you. We will assume the worst if we don’t hear anything. Blindspots breed mistrust.

Don’t go AWOL. Not in good times, and especially not in bad times. Build your routine and update your investors every month, even when you think you don’t have anything big to share.

The rigor of this routine has countless downstream benefits.

Mistake #2: Sitting on bad news

And what if there is bad news? Sitting on it is the worst possible tactic. It’s highly possible that your investors will eventually learn, either by deduction or from someone else in their network, that something is amiss. Make sure they hear it from you first.

Communicate swiftly and honestly, especially when something bad happens. You don’t need to send an update every day, but in times of uncertainty, be extra responsible, available, calm, clear, and data-driven.

And don’t be afraid to seek feedback. Investors who have been founders and operators have been through downturns and tough times before – most likely they will have a key insight that could change your trajectory from down to up.

Mistake #3: Not having an investor update template (& here’s what a good one looks like)

First, having a template brings you incredible speed. The cognitive load of formatting your updates is done. You don’t need to reinvent the wheel for each update.

Next, investor updates should be linguistically concise, and data-rich. We recommend the following structure:

Executive Summary: This should be in the actual body of your email, and in the document you attach. It should include three main sections:

- Highlights: The achievements, wins and milestones you’ve hit in sales, marketing, product, etc. Three to five bullet points.

- Lowlights: What challenges, problems or losses did you deal with?

- KPIs: Call out the only the most important KPIs here.

- Requests: Highlight what your investors can help you with. You can include up to four asks (you’ll lose attention beyond that). Bold the most important ones.

- Runway: Especially in a downturn, include an update on current cash position and months of runway (with and without hitting forecasted revenue). Don’t hide it. We need to know where you’re at.

The Main Update: This can be in the actual body of the email. It should definitely be in the attached document as well.

- All your KPIs, and critical changes to them since the last update

- Achievements: No more than two bullets from each domain (HR, product, etc) Expand on the key achievements from executive summary.

- Challenges: Think of this as an expansion of the lowlights section. Include even small issues like “we’re having trouble hiring.” This will give your investors easy assists.

- Asks: Be clear and ask for what you need.

- Plans: A short description of what you plan to do next. Also include your target KPIs for the next update.

Nice-to-haves: The above were the must-have items for your update. The following are nice-to-haves, depending on your latest status.

- New Key Hires

- Notable Market News: Not necessary in every update, but particularly in a downturn, call out relevant changes unique to your industry. It’s good for investors to see that you’re aware and actively and dynamically mapping your market.

- Thanks: If your investors helped you with a task from a previous update, acknowledge it.

- Other Stuff: This is where you put relevant news that doesn’t fit in any other category. (Media mentions, personal updates etc).

Mistake #4: Not including enough data

It’s easy to fall into the trap of summarizing what’s happening rather than showing it.

Updates that lack tangible numbers feel incomplete at best, and like you’re hiding something at worst. If you can say it with a graph or number, do so.

Including data in your updates doesn’t just send a strong signal about the DNA of your company. It will also help you get your point across quickly.

For example, imagine you find that lots of players are churning from your game platform. Instead of stating the obvious, show the data demonstrating that trend… where are they giving up? Does it fit with any big product changes?

Giving investors firsthand data allows them to see things you may have missed.

Mistake #5: Not calling out major changes

Once you start to regularly send these updates, your investors will come to recognize a pattern. They’ll become accustomed to seeing certain KPIs, or product goals.

If you are going to change these, make sure you call them out.

You’d be surprised how many investors “catch” these changes by looking at past reports. If you don’t point them out, it can seem like there’s something you’re intentionally leaving unsaid.

Mistake #6: Not reading your own previous updates

Many Founders think of these updates as one-off reports. Actually, they’re more like chapters in a story. Investors will go back through your updates to get a full picture of your progress.

Make sure that you read your previous updates, and tie your most recent one into the story. For example, if you mentioned you were having a tough time hiring a top notch data scientist, or you launched a major product feature in a previous update, close the loop on those threads in subsequent updates.

Mistake #7: Waiting for the board meeting

In the early stages of your company, board meetings typically happen every 6 to 12 weeks – and you need to send updates more frequently than that.

Unfortunately, well-run board meetings are still the exception vs. the rule. Most of the time the CEO spends 90% of the meeting voicing over updates, then runs out of time when we get to the strategic conversations that can move the needle. Pete Flint’s favorite board meetings are those where the participants are all well-prepared and there is a collaborative discussion on a particularly thorny problem. Most investors find problem-solving very rewarding.

Don’t save your updates for the board meeting. Keep your own cadence of monthly (or more, as needed) email updates, and then be sure to send detailed pre-read materials in advance of the board meeting as well.

Mistake #8: Not acknowledging feedback

It’s great when a founder writes a powerful update and requests feedback on specific items. Investors can put a lot of time into cogitating and preparing that feedback. Don’t drop the ball when they do.

When your investors give you feedback, make it a priority. Even if you disagree with it, acknowledge it, deal with it fast, or at least set expectations around when you will deal with it.

Advice for communicating acute changes

You don’t have to overshare every major change you encounter with your investors. But occasionally, it’s worth sending an update if you spot an acute challenge or opportunity.

Here are a few scenarios that should trigger a quick update:

1. You have to downsize your team quickly

Our partner Pete Flint has published a playbook for operating in a downturn, based on his experience running Trulia during the 2008 financial crisis. He points out one scenario where communication is paramount: layoffs.

If layoffs become necessary, you’ll want to build out multiple different financial scenarios to determine which are best for you. He outlines how to build those scenarios here.

Once you build these models, you should have a sense of what the strongest options are. Present those options to your trusted investors or mentors to narrow them down.

2. You have a big pitch coming up

When companies join the NFX Guild we are constantly working with them to hone their pitches, generate interest, and refine their decks. By the time you’re ready to raise again, you’ve become a storytelling and fundraising master.

Your fundraising plans should make it into a regular update, but if you are looking to activate special resources, or have a particularly important meeting, call it out specifically.

Follow-on fundraising is where the best seed investors bring you disproportionate advantages. Don’t go at it alone.

3. You’re promoting a big piece of news (product, funding, etc.)

You would be surprised by how many Founders close a round, launch a new product, or debut a big piece of news… and don’t tell their investors when it happens.

Your investor has a powerful network. Allow them to celebrate your wins and cross-promote your success. It’s free PR. Plus, your success makes you all look good.

The Takeaway

TLDR: Send updates to your investors monthly, at minimum. Never dissemble. Always show data. Remember you’re telling a story over time, not sending one-shot reports. Make your updates easy for your investor to scan and even easier to take action on. Use a template. Use ours if you like.

There’s a deep psychology driving the Founder-VC relationship. It goes far beyond sending these updates, and there’s more to know if you want to build enduring, authentic, and enjoyable relationships.

But in order to get there, you have to do the little things.

Your communication style, especially during challenging times, says a lot about what kind of leader you are out on the battlefield – and your investor updates will be a leading indicator of your success.

Of all of the challenging tasks on your plate, sending these updates is probably the easiest thing you can do to keep your company moving forward.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.