How much should you fundraise? How high should the valuation be? How aggressively should you spend on growth? Should you be a tough leader, or an empathetic one?

Until I was halfway through my second startup, I used to think there was one single right answer to each question. Then I began to notice something: I’d hear advice that sounded right, only for someone else to give the opposite advice that made equal sense.

Finally it dawned on me — the right answer is not a simple choice between two opposites. You need to be empathic with your co-workers, but you also need to know when to be tough. You need to raise at a high valuation, but you also need to price your round realistically to get the best investors.

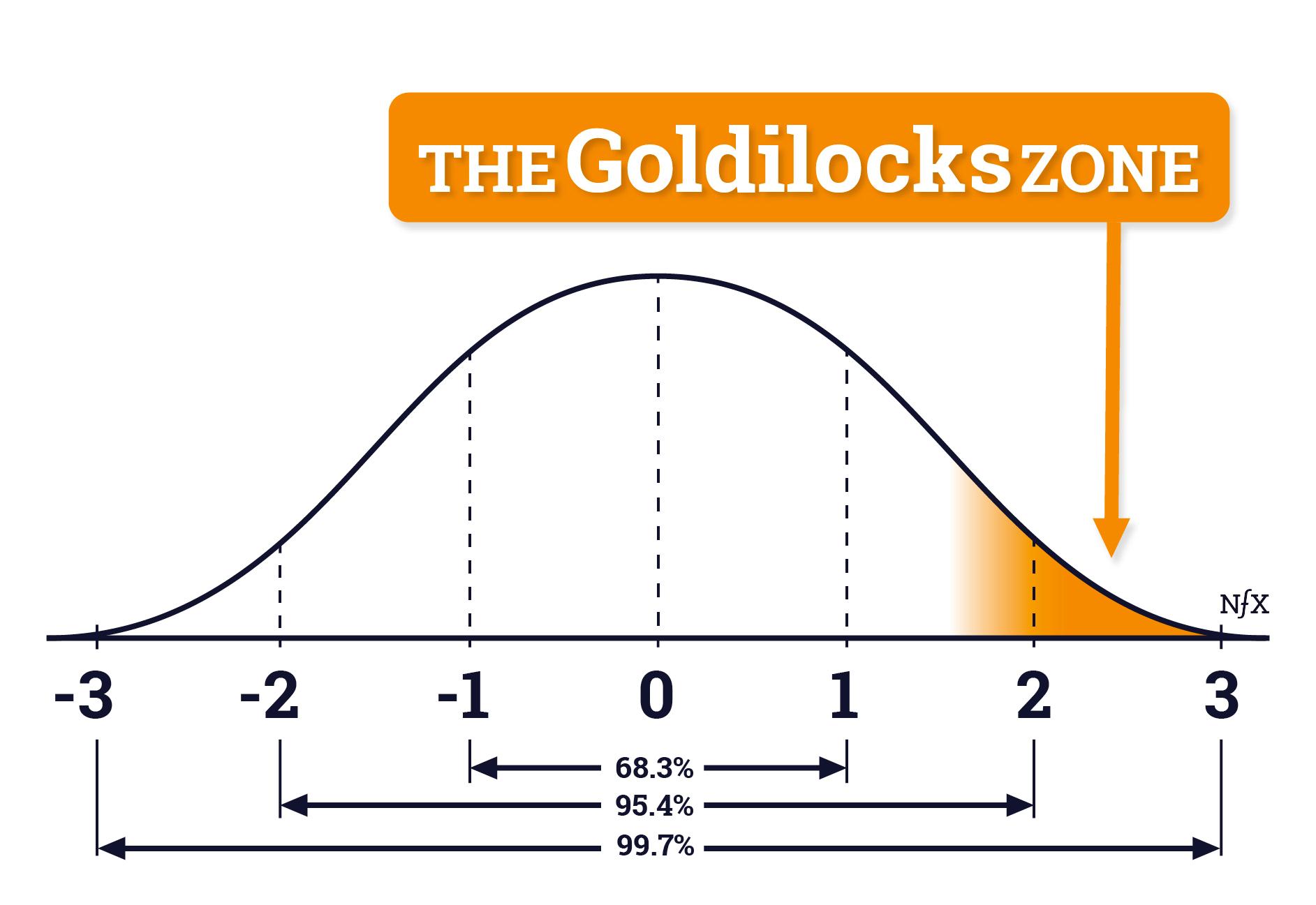

What I realized was that doing a startup is mostly about finding this “Goldilocks Zone.”

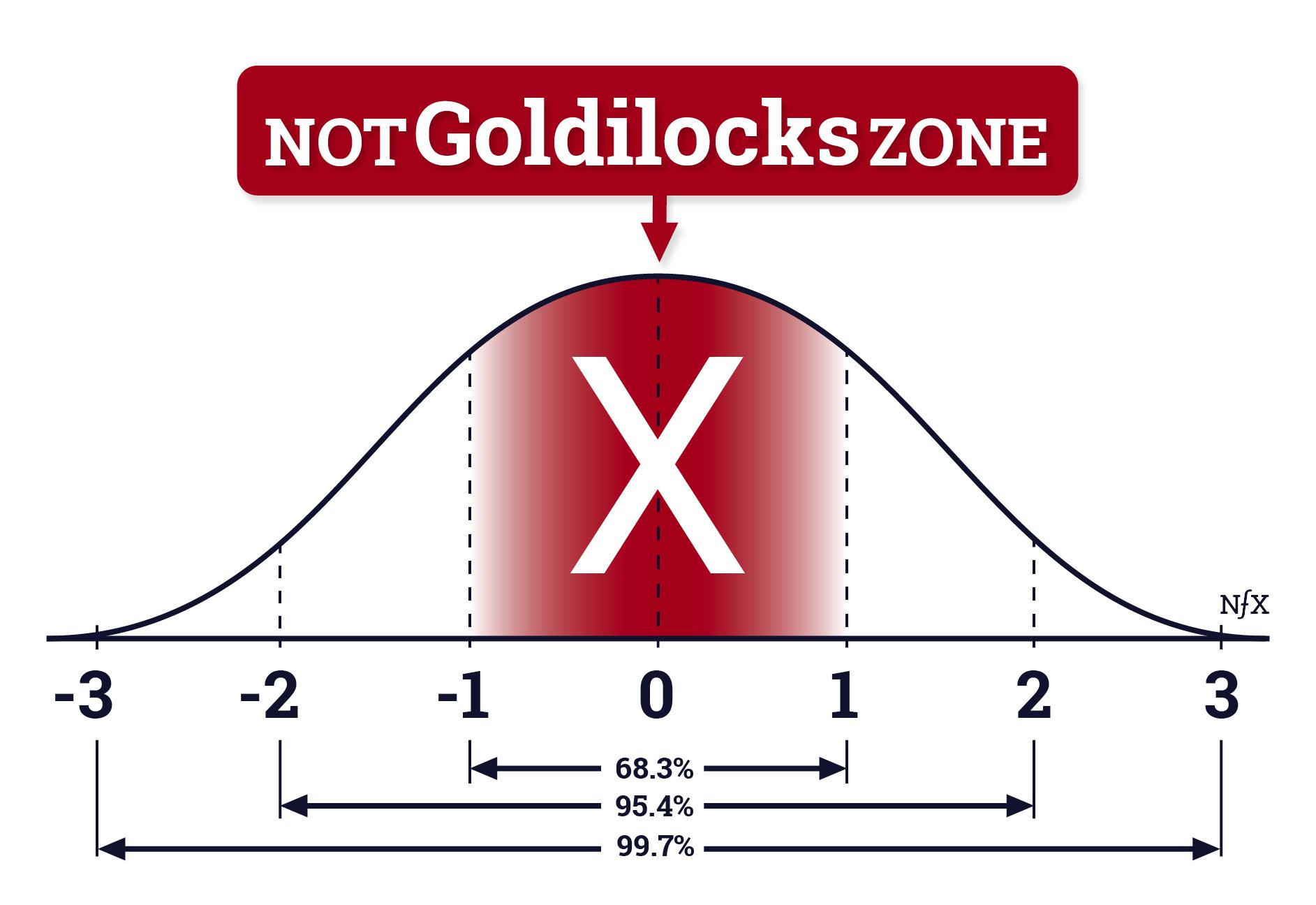

It’s not about “balance” or finding the “middle.” Words like “middle,” “median” and “mean” don’t often apply in our startup world. Averages and norms aren’t for us. The right place to be for us is often extreme, as we discuss below.

The Goldilocks Zone is a powerful mental model. In fact, seeing startups as Goldilocks Zone hunting is a good way of seeing the whole endeavor. In all the major areas of being a Founder — cultivating yourself, managing employees, communicating with investors, navigating the market — learning to recognize the Goldilocks Zone is a non-obvious skill that distinguishes world-class entrepreneurs from the rest.

The Goldilocks Zone Is Not About “Balance”

The Goldilocks Zone is about finding something that’s neither too hot, nor too cold, but just right for your startup.

But it’s not about balance or finding the “middle.” In fact, what’s just right for you can sometimes be quite extreme.

In science, the term “Goldilocks Zone” describes the distance a planet needs to be from the star at the center of its solar system in order to potentially support life with water. Too close, and water will evaporate from the heat. Too far, and it will freeze from the cold.

Earth inhabits a Goldilocks Zone. It’s just right — for us. But in the grand scheme of things, it’s skewed towards an extreme. The vast majority of planets are either far too hot or too cold for liquid water. The Goldilocks Zone, therefore, doesn’t typically live in the middle of the distribution. Instead, the Goldilocks Zone often exists in the tail.

People love saying about most things that “the right answer is somewhere in the middle.” But usually it’s closer to one end or the other:

You Have To Do Edge-Of-The-Bell-Curve, Extraordinary Things For A Startup To Work

“Middle” and “median” and “mean” — these words don’t often apply in your startup’s world. If it were as simple as finding the middle between two extremes on every question, then no question would be truly hard — and everyone could do startups.

Instead, it’s about finding a customized and nuanced answer to each problem you are wrestling with, that fully takes your specific context into account.

Of course, the Goldilocks Zone can move as your startup grows and the market changes. You often need to keep re-finding it. Keep looking for that sweet spot where things work.

Now let’s look at some specific “Goldilocks Zones” to look for in your role as a Founder.

How You Get To The Goldilocks Zone

The first thing is to know it exists for all the things you’re trying to do. That’s why you’re reading this essay. Check.

Second, don’t let frustration paralyze you in your search for it. A common frustration I hear is something like “This board member says one thing and another says the opposite” and then the founder gets frustrated at everyone but themselves. This paralyzes you. Don’t buy into that frustration. It doesn’t help you. Accept you’re not in the right zone, and keep moving until you find it.

Third, try one end of the spectrum first, and if things aren’t going well, try the other end. Do NOT micro adjust. Not in startups. The right zone is not typically in the middle. Plus, small changes take too much time and aren’t understandable by your team or the market. Big changes. Then recalibrate.

Fourth, measure success with outcomes. When things are working, when you’re finding the Goldilocks Zone, the numbers move. Move the numbers. To see the numbers, you might have to start numerically tracking things you aren’t tracking yet, like employee happiness, or customer NPS scores, or the numbers of hours you’re sleeping per night.

How does it feel once you’ve found the Goldilocks Zone? It feels good. You feel acceleration. And others stop complaining or blocking you.

But here’s the rub. You then need to move onto the next thing that needs to be moved into the Goldilocks Zone. There is no rest. There are many more attributes you need to put in the right zone. Further, that first plate will spin in the Goldilocks Zone for a while, but conditions change, people change, the market changes, and things will fall out of the zone. Then you have to go back and find the Goldilocks Zone again for that thing. It doesn’t stop.

This article and podcast with Jeff Wilke, former CEO of Amazon’s Consumer business, is a masterclass in the perseverance to continually push things back into the Goldilocks Zone, which Wilke did for 20 years. Because of that continual care, Wilke gets a lot of credit from Bezos for making Amazon what it is.

The Goldilocks Zone Of Managing Yourself

One of the highest leverage places to start your hunt for Goldilocks Zones is: yourself. It’s a critical and ongoing practice for developing your own qualities as a leader.

Aristotle coined the concept of “the virtue of the mean.” In Nicomachean Ethics he wrote that virtues and vices aren’t polar opposites. Instead, cultivating virtue is about finding the mean between excess and deficiency.

For example, courage — a virtue — isn’t the opposite of cowardice. Instead, it lies between cowardice (deficiency of courage) and recklessness (excessive courage), which are both to be avoided.

Notice that the virtue doesn’t lie exactly halfway in between the two extremes. It’s still skewed to the edge, because courage is closer to recklessness than it is to cowardice.

Similarly, Founder virtues can be found in a Goldilocks Zone which lives more on the tail of the distribution — far to one side, but not all the way to the extreme.

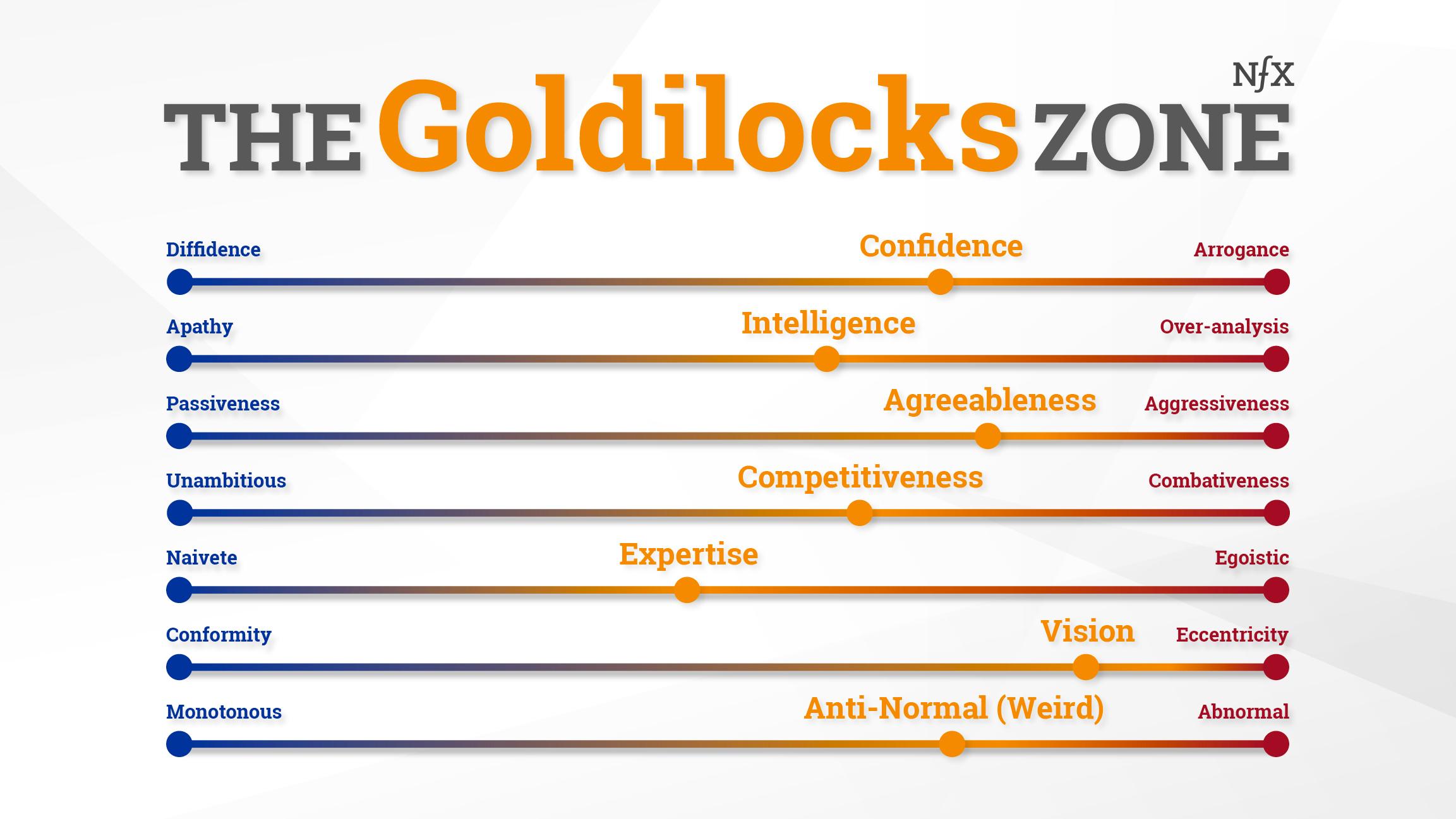

Here are 7 examples of the Goldilocks Zone as applied to Founder virtues. Learning to recognize the Goldilocks Zone can help you recognize and cultivate the characteristics of a world-class Founder in yourself.

1. Confidence

As a Founder, you have to be headstrong enough to be able to smash your head against an industry — almost to the point of naivete. You have to believe your idea can work.

But you can’t be too headstrong. While confidence is important for keeping up morale for yourself and others, you can’t be overconfident to the point of shutting out any feedback. You have to be able to listen to what’s going on and adjust.

Great Founders are able to be confident while also taking feedback. They draw great advice to themselves, and they know the value of attracting and learning from the best.

2. Intelligence

Top Founders obviously have to be highly intelligent. But they also don’t let their intelligence get in the way.

Intelligent people have to fight the urge to overly complicate things to serve the pleasure of their intelligence — which can be very alluring. Sometimes you’re attracted to a more complicated answer just because it’s harder to think of, but that doesn’t make it the best or most effective path forward for the startup.

If intelligence gets in the way of practicality, or if it leads to analysis paralysis, it can be too much of a good thing. There’s a saying at HBS that people who get A-grades at HBS work for the people who get Bs, and the people who got Cs make all the money after graduation. Business is often very simple, and people can become too addicted to their own delicious but complicated intelligence to blind themselves to simple truths.

The Goldilocks Zone here lies in the ability to appreciate complexity and have a vast mind, but not overthink things and complexify needlessly.

3. Agreeableness

As a leader, you have to be able to get people to like you, but you can’t be too agreeable. You have to be willing to stand on your own beliefs and piss people off — and someone is always going to get pissed off if you’re doing something important in the world.

So you can’t be a people pleaser, but you have to please people enough for them to want to support you.

Context matters a lot here. The context of your personality and charisma, for example, can change how agreeable you need to be in order for people to be willing to follow you. Steve Jobs, by all accounts, was not very easy to work for. He was very disagreeable. But people were drawn to his charisma such that he could make it work.

The context of a market matters a lot too. Travis Kalanick was in a fast-moving market and it took a lot of aggressiveness to get Uber into the winning position. But ultimately, he skewed too much towards being disagreeable.

4. Competitiveness

You have to be very competitive in order to be motivated to win, and to be continually aware of what your competitors are doing. But you can’t let it obsess you and spend all your time worrying about your competitors.

You have to play your own game, or you’ll always be anchored at the level of your competition — and you won’t be able to see the winning moves that they don’t. To do that you have to maintain your own mind and way of looking at the world, and have the calm and self-belief to zig when everyone else is zagging.

On the motivation side, that chip on your shoulder is important. Wanting to prove yourself will help you keep burning through hard days and late nights. But you can’t be at the point where you’re willing to do anything to succeed. You can’t be an Elizabeth Holmes and go to any lengths. There has to be a limit.

5. Expertise

Expertise is good, but it can go too far. You have to come up with new ideas — you can’t be bound to the way the industry was going already. There’s a level of naivete you have to have — but too much of it and you won’t know how the industry works. Without that working understanding, you could end up banging your head against the wall.

6. Vision

You have to have a clear vision, but that vision can’t be too far out. Timing matters.

Having a vision about something on a time horizon of 10 years is often not investable, and therefore not a great startup idea — even if it’s eventually proven right. Just because you’re right after 10 years doesn’t make it investable.

But not having enough vision is a problem too. Having an idea that is 6 months ahead of its time is often too late. That’s a consensus idea. Having a vision means being able to see what’s coming far away, but not so far away that it doesn’t make sense to even begin.

Great Founders are also capable of keeping themselves grounded. They pay attention to the detail and the day-to-day, even while anchoring themselves in the broader vision. The best CEOs have to be extremely into the details while also constantly keeping the bigger picture in mind.

7. Anti-Normal

To be an innovator, you can’t be normal. Normal is the status quo. You have to be a little weird. But not too weird.

As our new NFX partner Morgan Beller likes to say, in startups “it’s weird not to be weird.” Successful people in the startup world tend to be weird, either because that strangeness lets them see the world differently and that’s why they were successful. Or their success makes them see the world differently and that’s why they’re eccentric.

Most of the time, you have to be extraordinary to get extraordinary results. But you can’t be too weird or unrelatable to be able to run a business that involves managing employees and talking to investors; you have to understand and relate to people who don’t think like you and can’t see your big vision.

The Goldilocks Zone Of Managing Employees

As your startup grows and your role as a leader changes, you will face a constant hunt for the Goldilocks Zone

There are always going to be certain things you have to do. You can’t delegate fundraising, for example. You can’t delegate crafting the one-sentence description of your company that you use to pitch. You can’t delegate cultivating the cultural DNA of a startup. That’s all on you.

But you also can’t micromanage. As my great partner Pete Flint wrote in a previous NFX essay on making the shift from Founder to CEO, learning when to let go can be quite difficult for Founders to do.

But to bring a startup to scale, you have to be willing to delegate leadership to your team and remove yourself as a bottleneck over time, while continuing to double down on the highest leverage uses of your time — like internal communication, recruiting, building the culture, managing constituents, and driving the vision.

The Goldilocks Zone Of Communicating With Investors

When you’re talking to investors, recognizing the Goldilocks Zone is important in at least 5 key areas.

1. Pitch with energy, but stay grounded

It’s important to develop the skill of projecting the future for investors without straying into a territory we might call lying. You must be positive and optimistic about your startup but willing to consider realistic critiques.

You can’t just be positive about your business all the time, to the point of coming off as unrealistic, untruthful, or naive. We often call that “shark skin” because you can only rub shark skin one way, and it’s not good to be a shark skin founder.

2. Communicate with appropriate length

There’s a Goldilocks Zone of length for each type of communication with investors. Frankly, a lot of Founders don’t know when to stop talking. It’s important that you know how long to talk, and what level of detail you need to get into, without going overboard.

- If you don’t give enough detail in a pitch meeting, it’ll come off as vague.

- But too much detail, and you’ll lose the investor’s attention.

- If you talk too long, you’ll lose them. They won’t be able to ask you questions.

- If you talk too little for the context, they probably won’t grab the greatness of what you’re talking about.

The solution? Give investors enough information to take the meeting with you, but not so much information that you run the risk of either A) boring them or B) exposing details that could damage you if it gets to competitors.

As always, context matters. If you’re a world-class Founder, you want to filter for meetings that have a real shot of getting an investment. In that case, you want to frontload as much information as possible.

3. Create FOMO, but don’t be inauthentic

Making investors aware of interest is one important tool in the fundraising process, but you have to be careful to still maintain a respectful conversation. Don’t give an investor the feeling of putting their feet to the fire — this is where FOMO can go too far and can backfire.

4. Be selective with your cap table

For example, you may want to have some angel investors on your cap table, but you don’t want too many because it becomes much too difficult to manage that complexity later on.

The more angel investors you take on, the more it multiplies the number of people who you need to keep informed and do favors for later on as you add more and more stakeholders. More is not always better. In my experience, having 2-5 angel investors that add value is the Goldilocks Zone.

5. Set prices carefully

If you try to raise too much money at too high a valuation, it disincentivizes investors from letting you sell the company at a low price later on.

You are compromising later optionality that might be really valuable, because the higher your valuation the more investors are going to want to push for really massive outcomes.

Therefore you don’t need to push your valuation to the absolute limit. You want to get a high valuation for less dilution, but not at any cost. It’s a multifaceted decision. In every fundraise I did for all four startups that I founded, I always took the lowest price from the best investor — and that served me well.

The Goldilocks Zone Of Navigating the Market

As a startup, you naturally need to have an aggressive posture towards the market you’re entering. But if you go too far, you run the risk of becoming a Zenefits or an Uber or a Theranos — a cautionary tale of what happens when you become too reckless in your pursuit of growth.

Move fast and break things, but you can’t lie and you have to comply with basic regulations. The Goldilocks Zone is critical here.

This spectrum applies across a few different dimensions including:

- Aggressiveness on capital burn to fuel your growth rate vs. the need to maintain runway.

- Aggressiveness on viral growth strategies vs. user ad fatigue or spam fatigue.

- Aggressiveness on regulatory hurdles without doing anything illegal.

I think Facebook was a good example of doing this right. When they were just getting started, they waited until they were on the cover of the Wall Street Journal before they became one of the most aggressive spammers in history. It was at this moment, when they were the cool new brand, that they opened up address book scrapers on real-time messaging platforms AIM, MSN, and other platforms popular at the time in order to collect contacts from users and automatically send out invites to their friends. They recognized that spam is in the eye of the beholder. Because Facebook was cool, they didn’t get many complaints. What had gotten SMS.AC shut down by the FTC 1 year earlier, was accepted by users and helped Facebook grow.

Facebook got hyper-aggressive strategically and at the right times. They found their Goldilocks Zone at the moment and it was at the very edge of the bell curve.

YouTube also found their Goldilocks Zone in this way. They were very aggressive in allowing copyrighted material onto their website in the beginning, which drove a lot of traffic and allowed them to bootstrap their media marketplace and overcome the chicken-or-egg problem. By the time they started facing lawsuits for it, they had just sold to Google, had already reached critical mass and could then easily afford to pay the fees for their infractions.

The famous examples of over-aggressiveness often make headlines. But far more startups die obscure deaths because they failed to be aggressive. Sidecar, the company that figured out on-demand shared riding before Lyft did, is an example. They were hesitant around regulation and weren’t aggressive at fundraising. They had a business that was working but not scaling incredibly fast. They didn’t feel the pressure to blitzscale, so even though they were first to market, they were quickly eclipsed by rivals like Lyft, who pretty much copied them as they pivoted away from Zimride (their first business which wasn’t working). And then Uber copied Lyft in just 30 days and was even more aggressive on every aspect of their business. Sidecar was no more.

This brings up another point — in different markets, you have different Goldilocks Zones. If you’re doing a healthcare startup, the Goldilocks Zone of how aggressive you should be is different than if your startup puts scooters on the street, because the nature and ramifications of the regulatory hurdles are completely different. So you have to learn to recognize the Goldilocks Zone as it applies to your market category.

There’s A Goldilocks Zone For Every Decision

Realizing there was a Goldilocks Zone for most things in startups let me see things in a new way. It was a powerful mental model that has been helping me ever since.

It was a real psychological relief for me to realize that there’s a Goldilocks Zone for nearly every decision. It takes a lot of work to find that zone. And your teammates and investors might not agree with you about where it is. So yes, it takes work, and is uncertain. But it’s there.

This realization was different from embracing the simplistic cliche about “finding the right balance” and “the right answer being somewhere in the middle.” Because running a startup is not about being in the middle, being balanced, being the average.

Instead, the Goldilocks Zone is about finding your sweet spot. It’s about navigating the extraordinary circumstances of being a startup Founder without getting carried away to an eclipsing extreme. This is much harder than being in the middle.

But the rewards are also much greater.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.