Three years ago, we coined the term “Fintech-Enabled Marketplaces.” Since then it has expanded, and the idea of building tech-enabled financial services directly into your platform has become a core component of marketplaces.

Now it’s everywhere. Nearly every marketplace is getting closer to the transaction by frictionlessly embedding financial services into their product experiences – and creating enormous value along the way.

Since nearly everything digital has accelerated over the last few years – mostly as a result of mobile penetration and platforms and applications improving and further accelerated due to Covid forcing us to lead more digital lives – we wanted to follow up about what’s been working and also what’s not been working since we first published about fintech-enabled marketplaces.

As we said before: The money is in the money. Even more so now. This essay will show you why.

Fintech Is Eating Offline Markets

There’s been a relentless drive to constantly improve the customer experience and move closer to the transaction, which often means extracting or increasing the take rate in these marketplaces. At the heart of this customer experience is the opportunity of “misaligned incentives.”

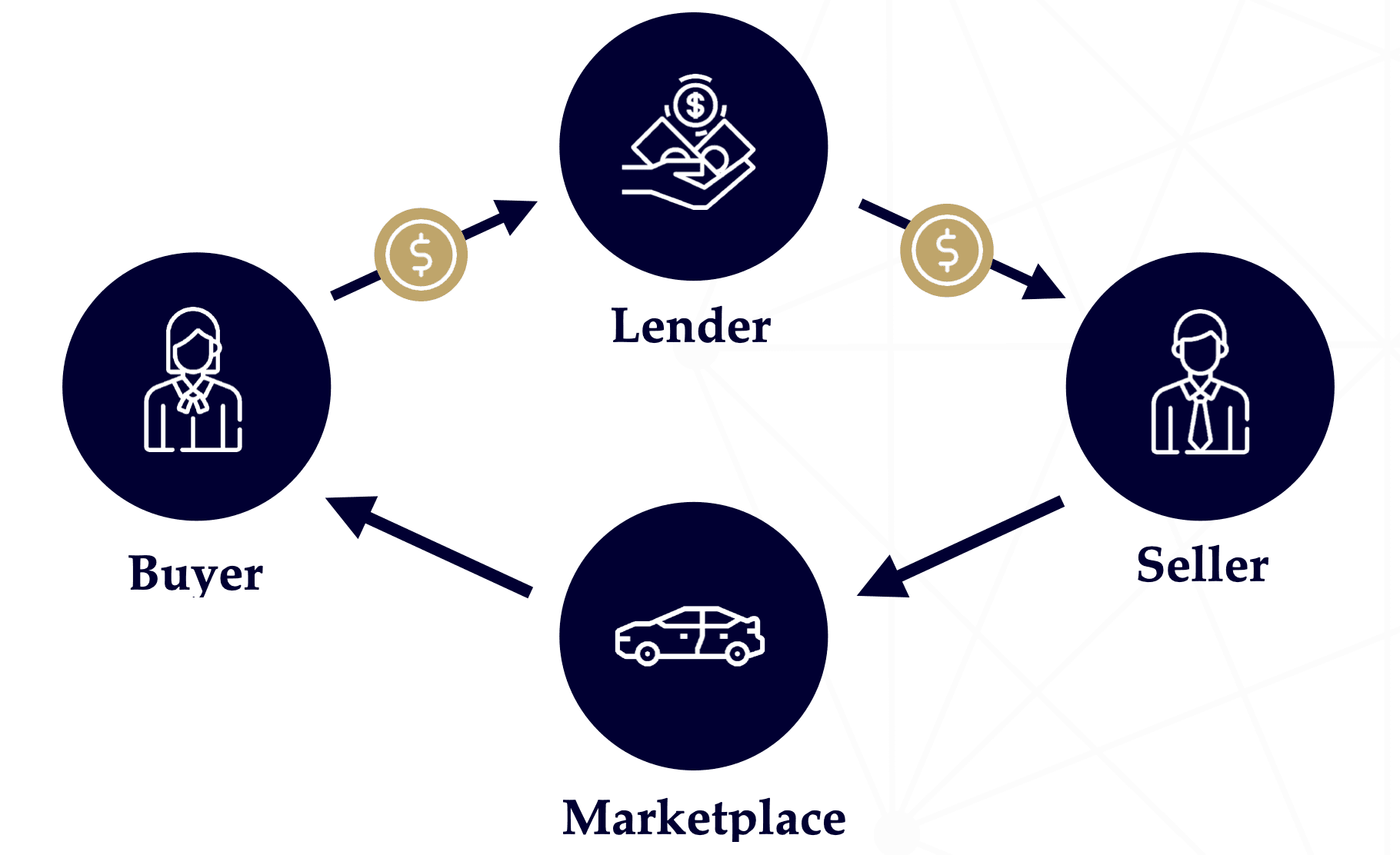

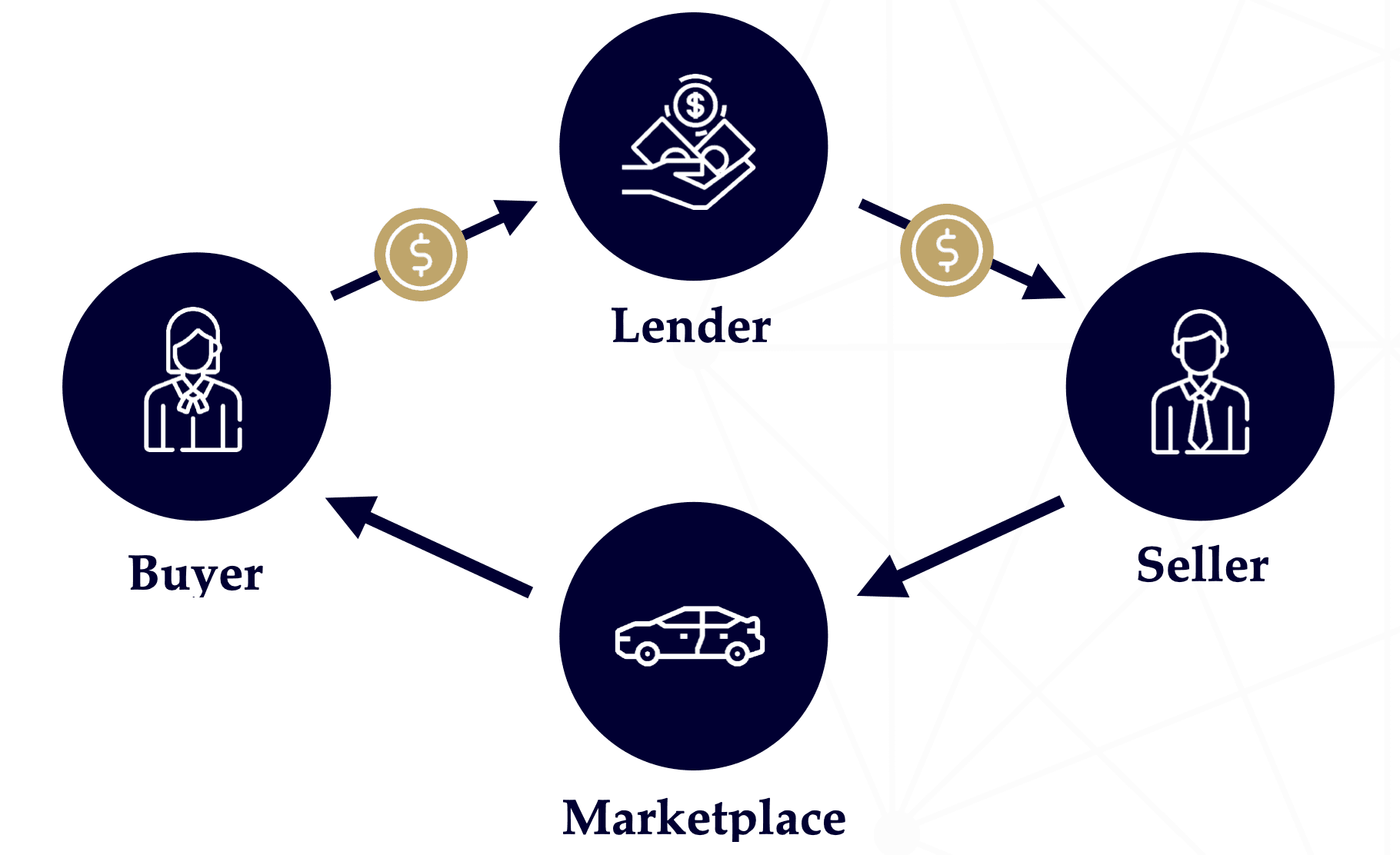

This incentive issue shows up when selling your car, for instance. Most of the participants have different incentives. A dealer will be primarily interested in selling the car at the highest price. The trade-in team wants to buy your car at the lowest cost to them. The financing team wants to maximize the APR. All of these participants have different and misaligned incentives.

This creates massive friction – which is ultimately an incredible opportunity for marketplace Founders.

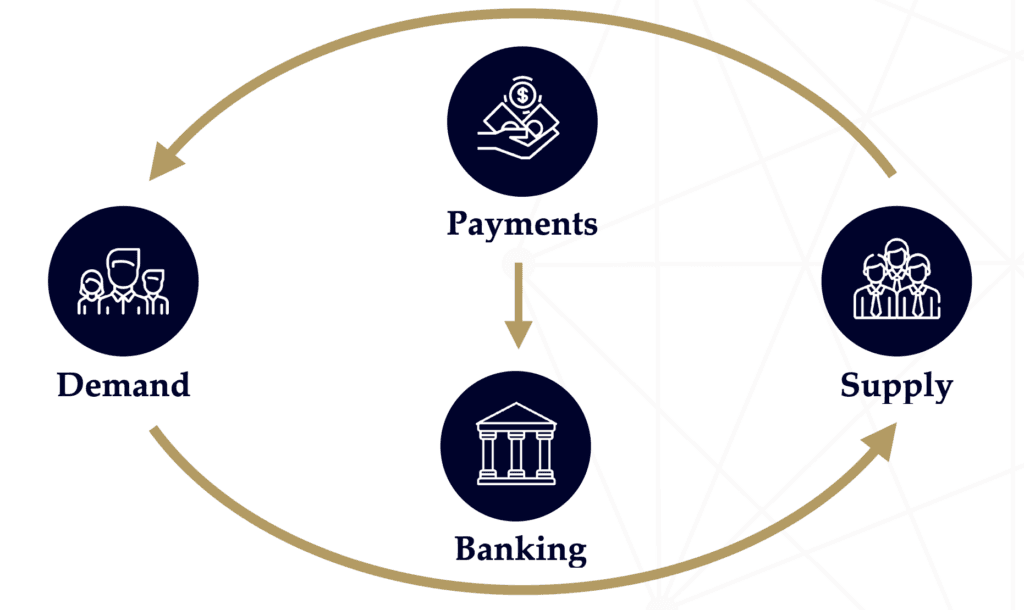

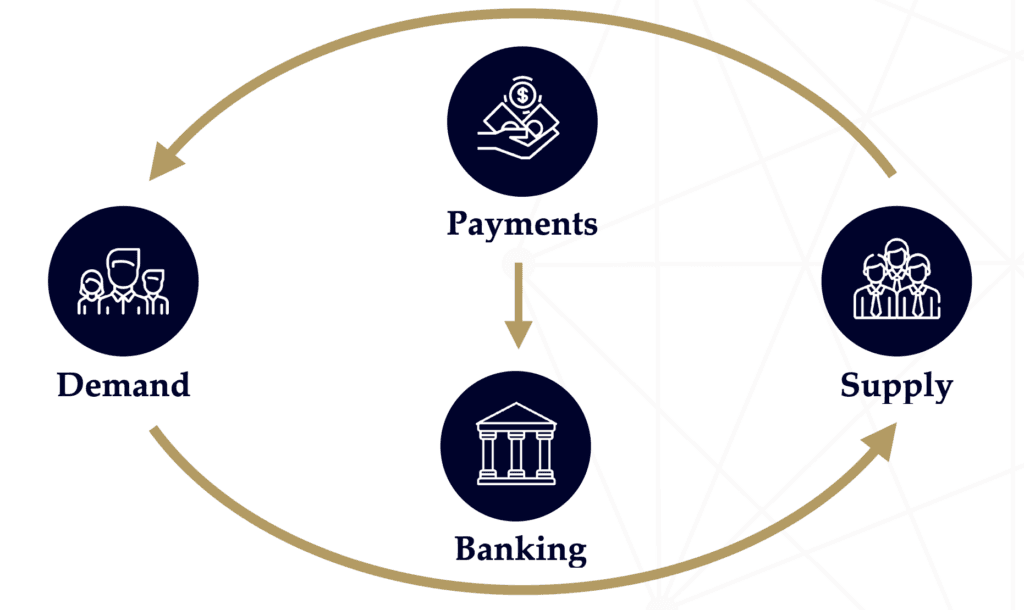

To better align incentives and improve the customer experience, we are seeing marketplaces offer a more integrated stack of services like:

- Insurance: In-house insurance products made possible by better underwriting models and data.

- Financing: Non-traditional financing options such as rent-to-own or income-sharing.

- Banking: Novel and customer-specific solutions to manage transactions, deposits, and payments.

Let’s take a look at some examples.

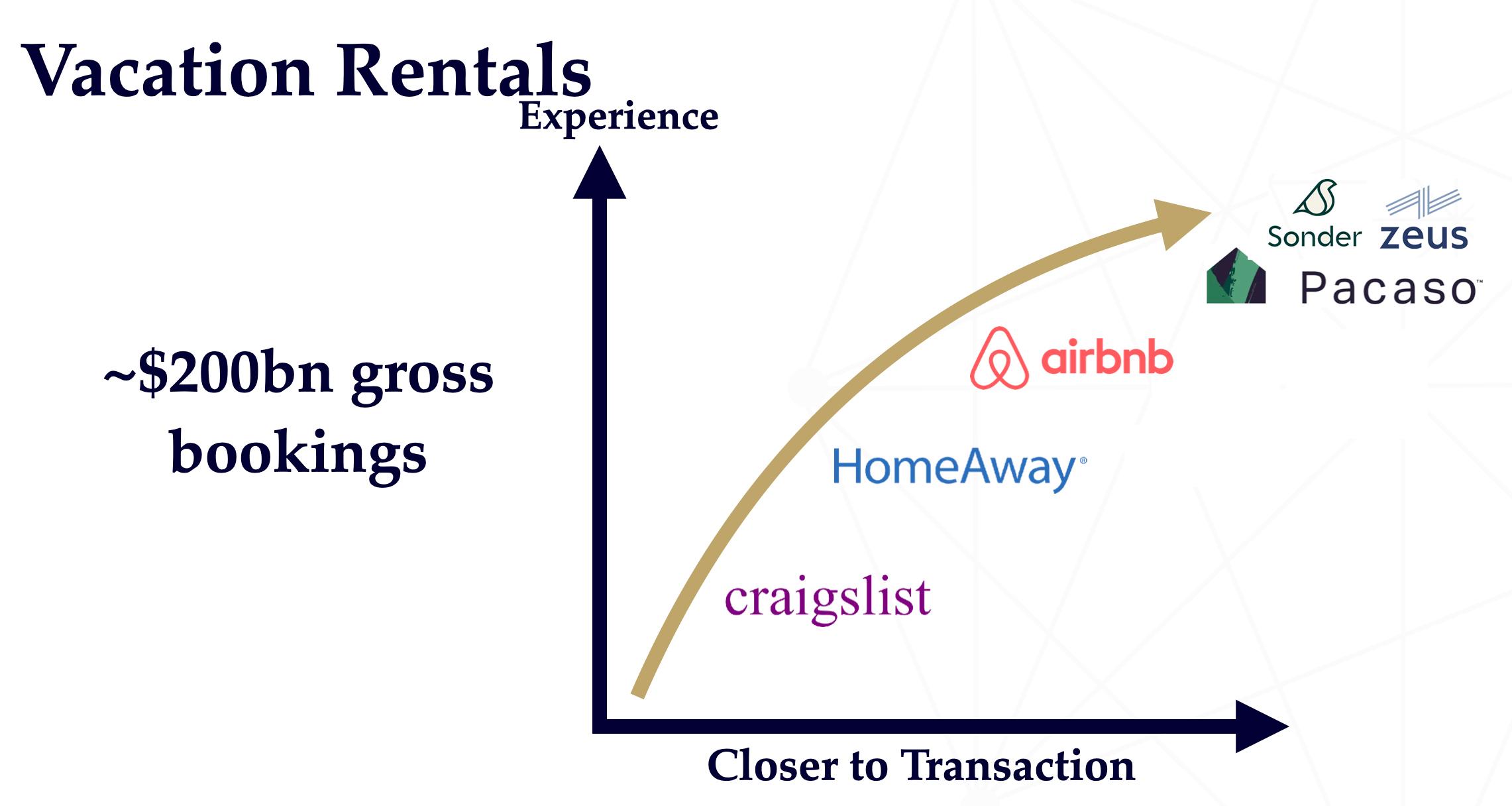

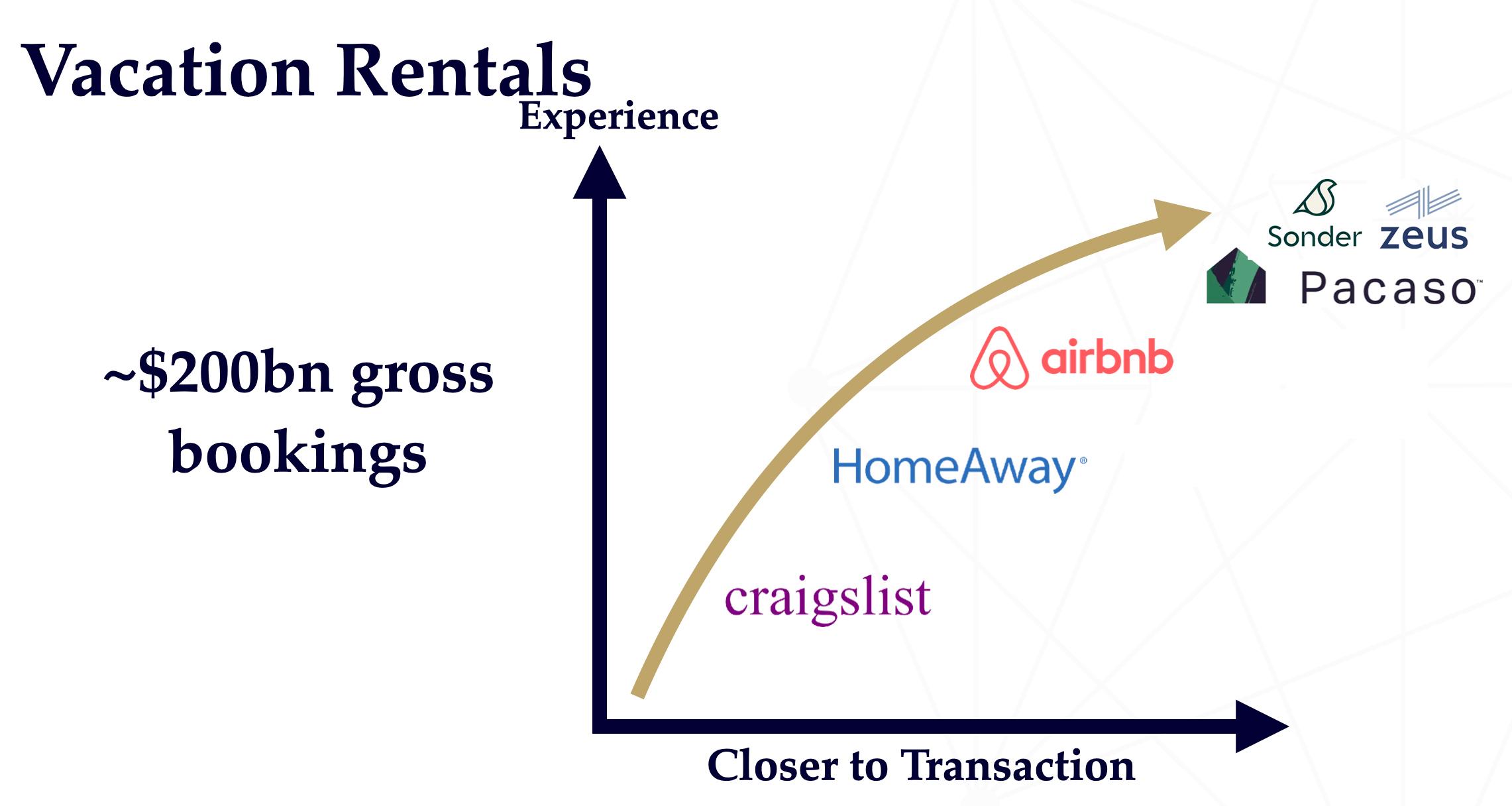

In vacation rentals, marketplaces are trending towards verticalization. They’re bringing more of the listing, booking, and transaction processes online.

We can categorize this trend in 4 phases:

- Horizontal lead generation: Online discovery, offline booking e.g. Craigslist

- Vertical lead generation: Verticalized discovery but offline booking e.g. HomeAway

- Vertical transactional: Booking takes place entirely on-platform e.g. Airbnb

- Tightly managed marketplace: Owning the whole supply experience, e.g. Pacaso

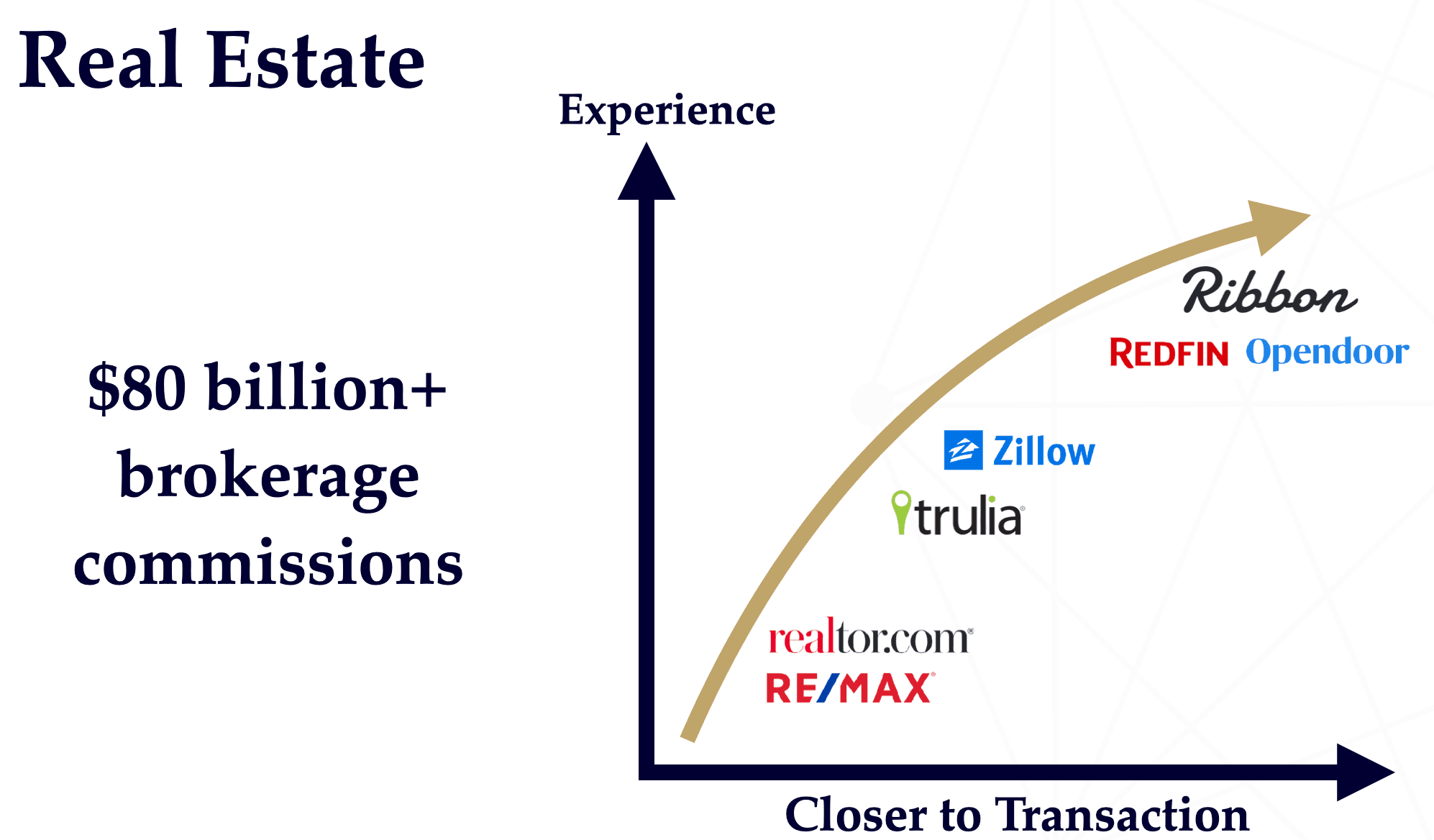

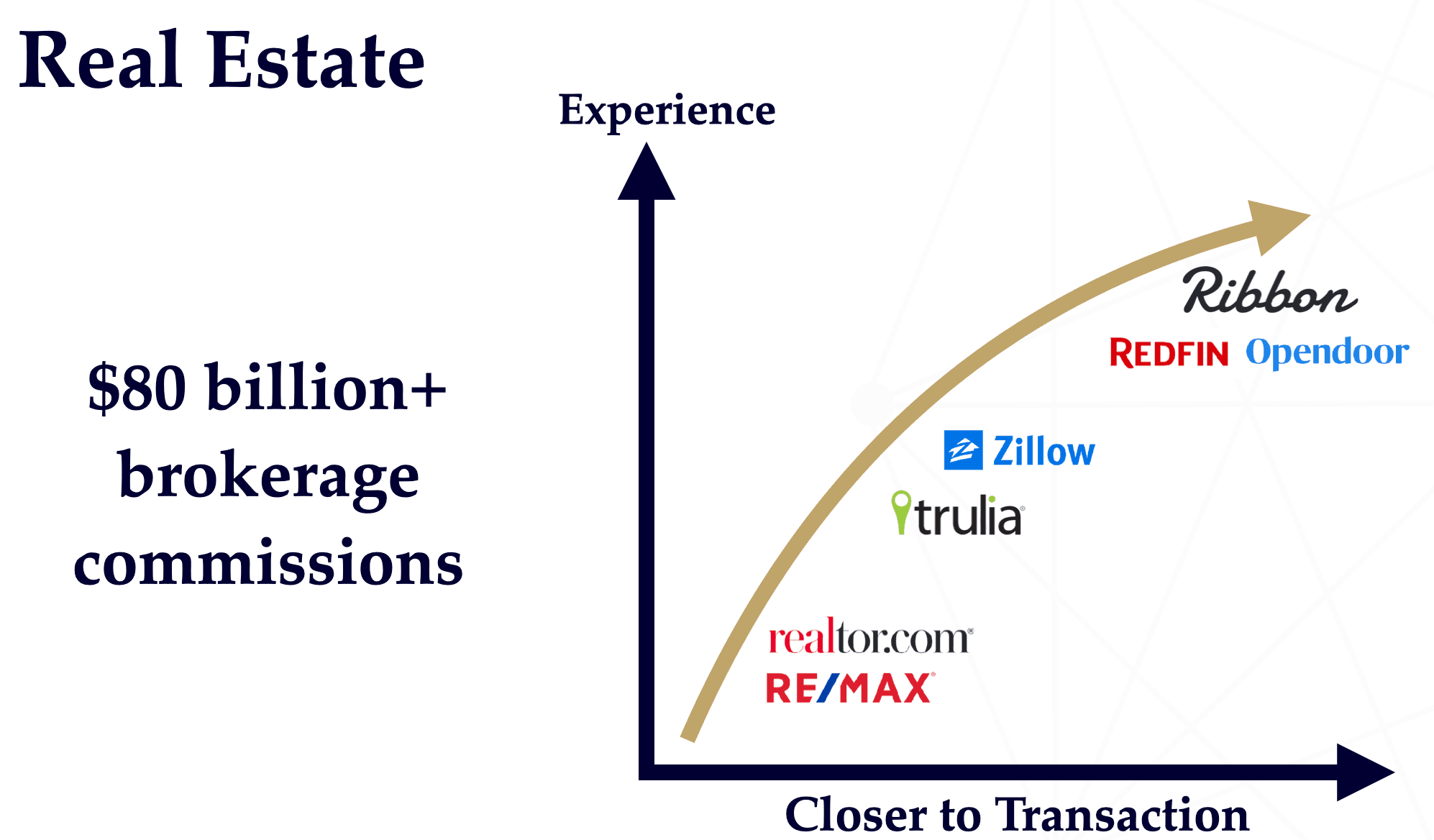

The same pattern emerges in real estate too. There are 3 general phases in this market:

- Industry websites, e.g. Realtor.com

- Lead generation, e.g. Trulia and Zillow

- Transactional platforms with major fintech components, e.g. Ribbon, Opendoor, and Redfin

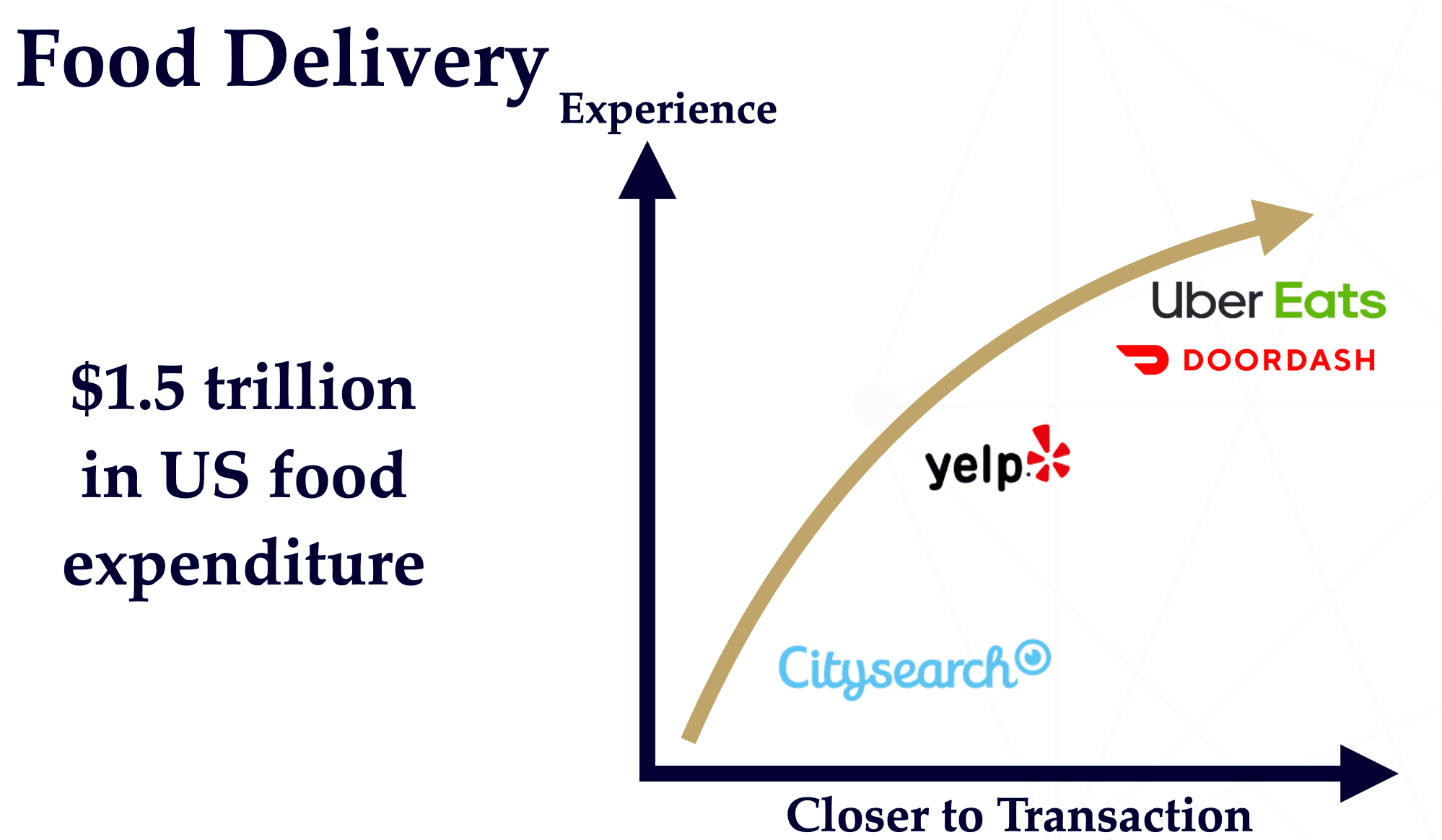

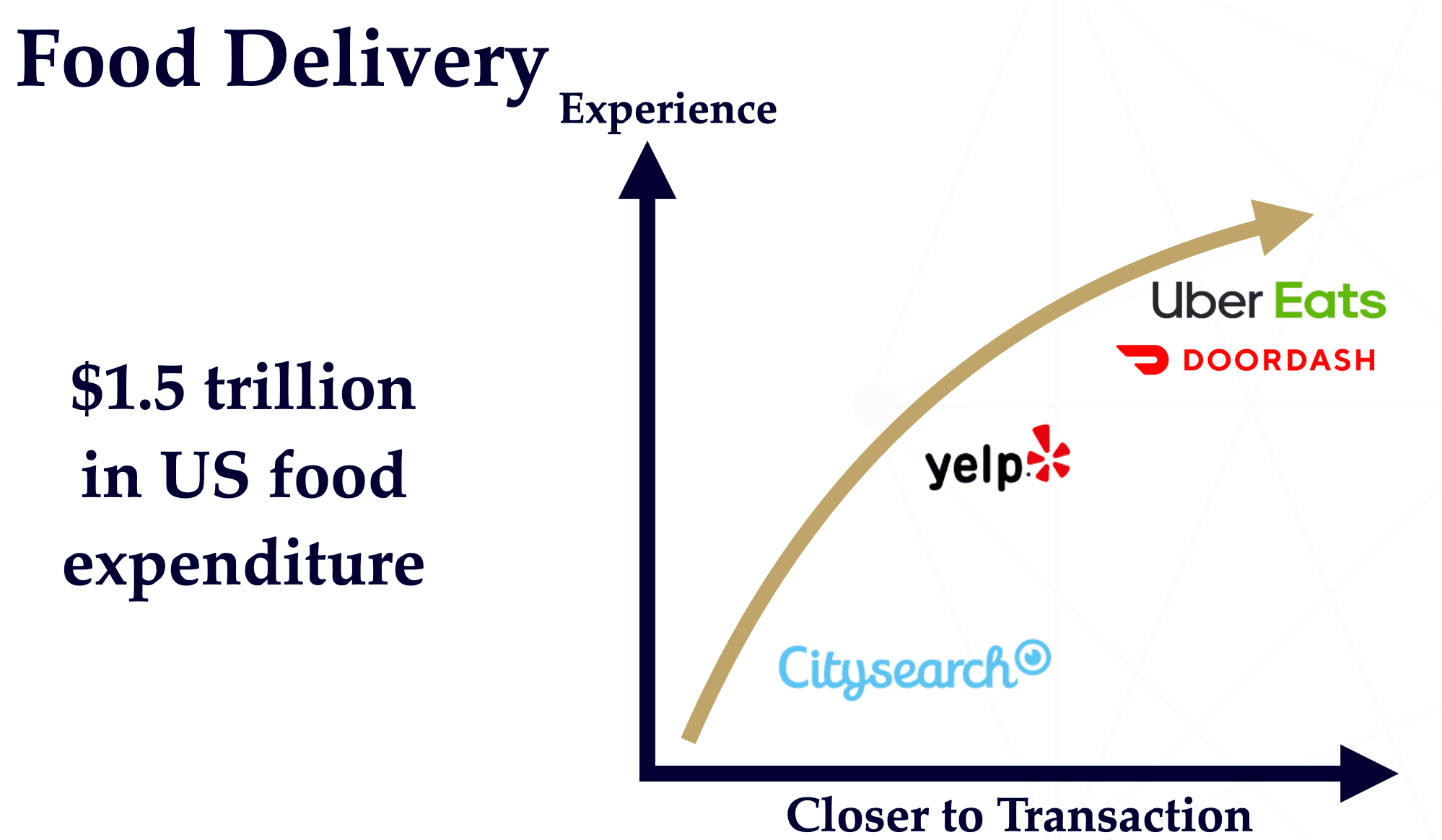

Food delivery also observes a similar trend. It has moved from lead generation to marketplaces owning the entire transaction with a sophisticated build-out of on-demand delivery infrastructure.

A pattern clearly emerges if you look closely at all of these marketplaces, from vacation rentals to real estate to food delivery: they are bringing a bigger piece of the transaction online. Naturally, this means financial services will continue to be bundled in with these product experiences.

We see financial services as a necessary part of these big marketplaces. The data produced on-platform is fueling their underwriting and ultimately creating these breakthrough product experiences.

Macro View: Catalysts of Fintech-Enabled Marketplaces

We have seen a lot of catalysts that have been accelerated in the last few years. While we have noted these before, they’re critical to understand before we move on to what’s been working and what’s not been working since we first wrote about fintech-enabled marketplaces.

- Changing consumer expectations toward better digital experiences and more immediacy — accelerated by the Covid pandemic.

- Money is already flowing through these marketplaces and continues to grow, now that customers have been habituated to spending money online.

- Superior underwriting from ML and new data collection.

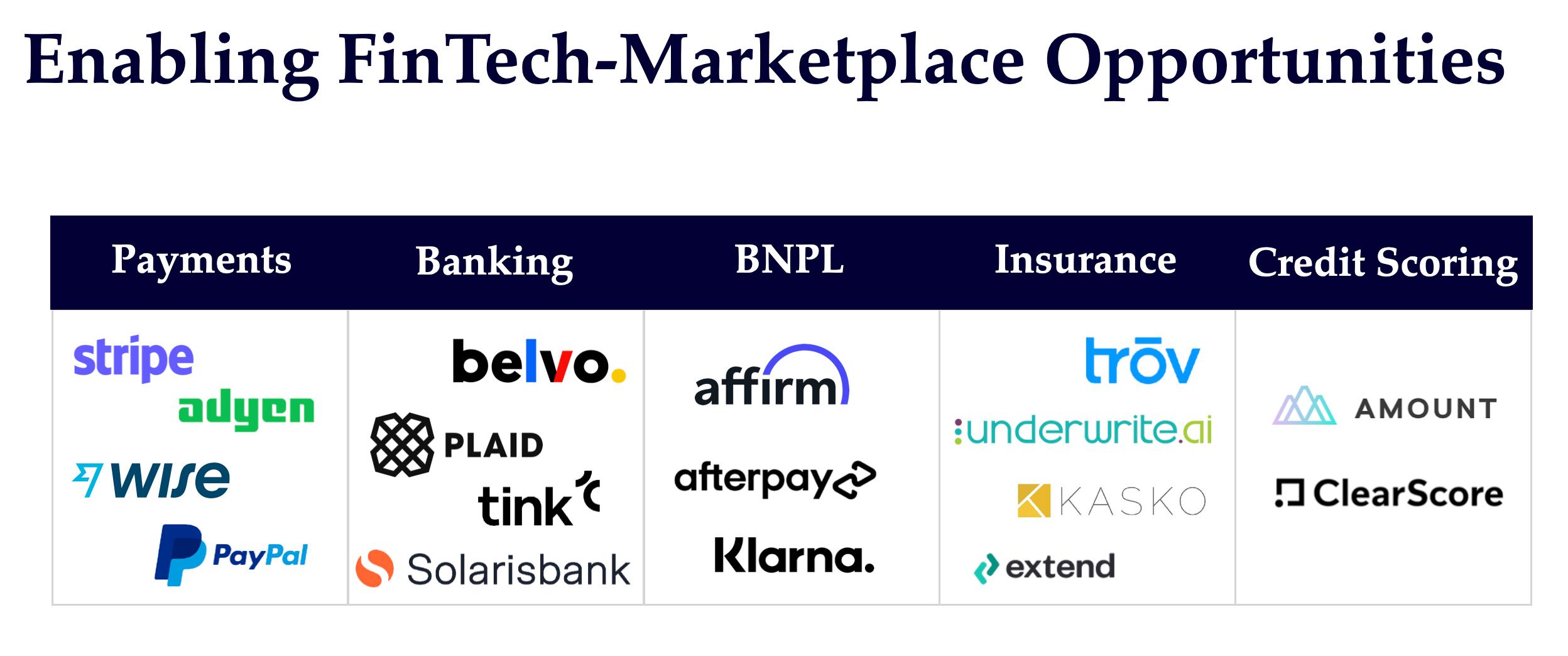

- New fintech-enabling technology (e.g. payments, banking, security, identity)

- And the explosion of both debt and equity capital.

The 5 Native Advantages of Fintech-enabled Marketplaces

While the macro catalysts and tailwinds are useful, it’s also critical to understand the levers that you, the marketplace Founder, will be pulling to deliver a superior product experience. These are the 5 native advantages of building a fintech-enabled marketplace.

1. Capture demand by reducing friction.

Ribbon, an NFX company, is a great example. They’ve built a platform to work with brokers and mortgage lenders to take out this friction by helping you manage your financing so you can buy before you sell, removing the uncertainty from the transaction.

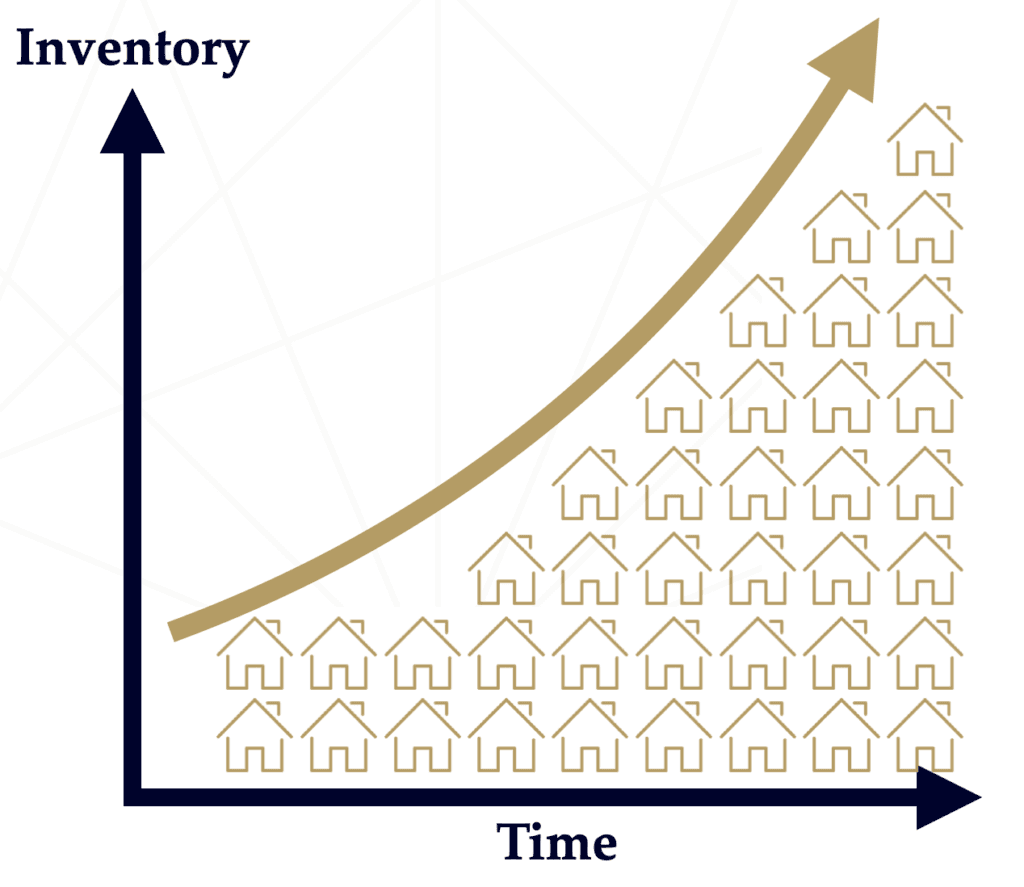

2. Unlock latent supply.

Another NFX company, La Haus, which is the leading online real estate service for Spanish-speaking Latin America, uses capital to unlock supply for new developments coming on board. Capital is one way to unlock supply, but you can also offer insurance services like Airbnb or leverage data network effects like Opendoor.

3. Reduce multi-tenanting by expanding buyer & seller relationships.

The classic example of this has been with Square. They’ve been moving into several services in addition to their core SMB payment services. By offering more services, they are simultaneously driving engagement, increasing customer lifetime value (LTV), and reducing multi-tenanting.

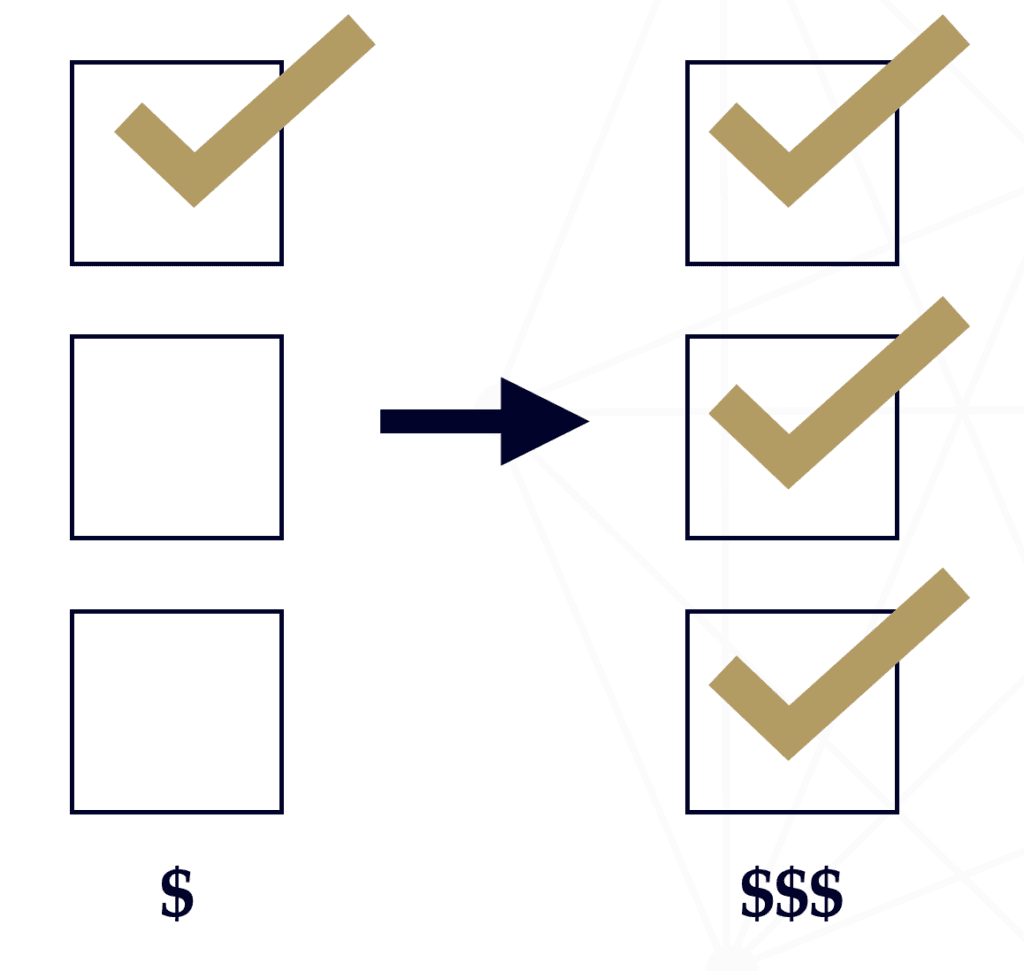

4. Subsidize product or marketing through bundling.

You start to see LTV advantages by subsidizing products and bundling, while achieving some reduction in friction as well. This also enables a new entrant to outspend an incumbent on customer acquisition if they are able to bundle multiple services.

5. Eliminate misaligned incentives.

By limiting the number of different participants in the transaction, it’s easier to align incentives. When a marketplace offers lending or credit services, they can take on multiple activities as one participant, which makes it easier to reach a favorable outcome for everyone.

New Accelerants

Nearly everything digital has been accelerated, mostly as a result of our forced digital immersion because of Covid, improving platforms and applications, and increasing mobile penetration.

- This created a new necessity; consumers need digitization in many things because they still can’t physically be together.

- There’s also been a big desire for cash and flexibility in B2C and B2B marketplaces. Customers are looking for innovative specialty financial products incorporated with transactions.

- Customers are craving convenience. This has produced a dramatic acceleration of digitization, particularly in digital commerce, which is aiding growth of these marketplaces.

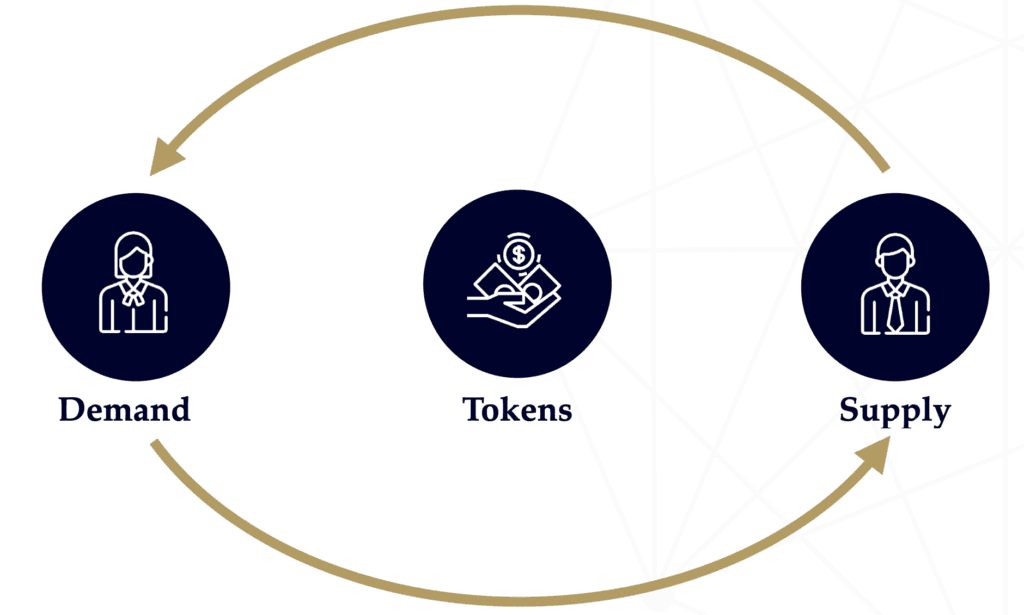

- Finally, a big area we’re excited about is tokenizing the network to align incentives and drive participation.

Tokenization

You can launch a token on the supply side and the demand side to enable the participants of that marketplace to get ownership and often governance in that network. These tokens can reward behavior on the platform, reduce multi-tenanting, and provide an initial kickstart to get liquidity and solve the chicken-or-egg problem.

A lot of the opportunity over the next several years will be adding these web3 components into perhaps what may seem like web2 businesses. There will also be entirely new experiences that wouldn’t exist without this tokenization of the network.

While we already see lots of this early activity in gaming and entertainment where users are more familiar with the concepts and principles, we expect to see this pattern emerge in many other sectors as well.

An example of this is Braintrust, which calls itself a decentralized talent network. It’s somewhat similar to A.Team or Upwork. The talent community relies on Braintrust to find the work and the network is governed by its users. It’s a traditional marketplace in the sense that this sort of model has been around, but they’ve managed to kickstart the network by incorporating a token.

What’s Working

1. Web3

Let’s start with this incredible rise in web3. There is a lot of activity on the infrastructure side with composable building blocks starting to form for this decentralized future. There also have been a number of decentralized marketplaces that are mostly starting with digital native products. You can think of NFTs as the most obvious example.

2. International

The financial infrastructure, as well as the financial products, in many non-US markets has been less developed. There’s a lot more friction in the customer experience and business process. This creates opportunities both for the infrastructure build-out which has been very active over the last several years and for the marketplaces incorporating these financial products.

These marketplaces often have superior economics, principally because the financial services are incredibly high friction and cumbersome to navigate. In some cases, but not in every country, there’s less regulatory burden and that makes it easier to combine these marketplaces with financial services.

I was just in Latin America where I saw a number of examples including: Nuvocargo (an NFX company) a digitized logistics network that’s providing insurance and credit; LaHaus (also an NFX company), the Spanish-speaking online real estate leader which is incorporating finance on the consumer and supply side; and Kavak, the used car marketplace,

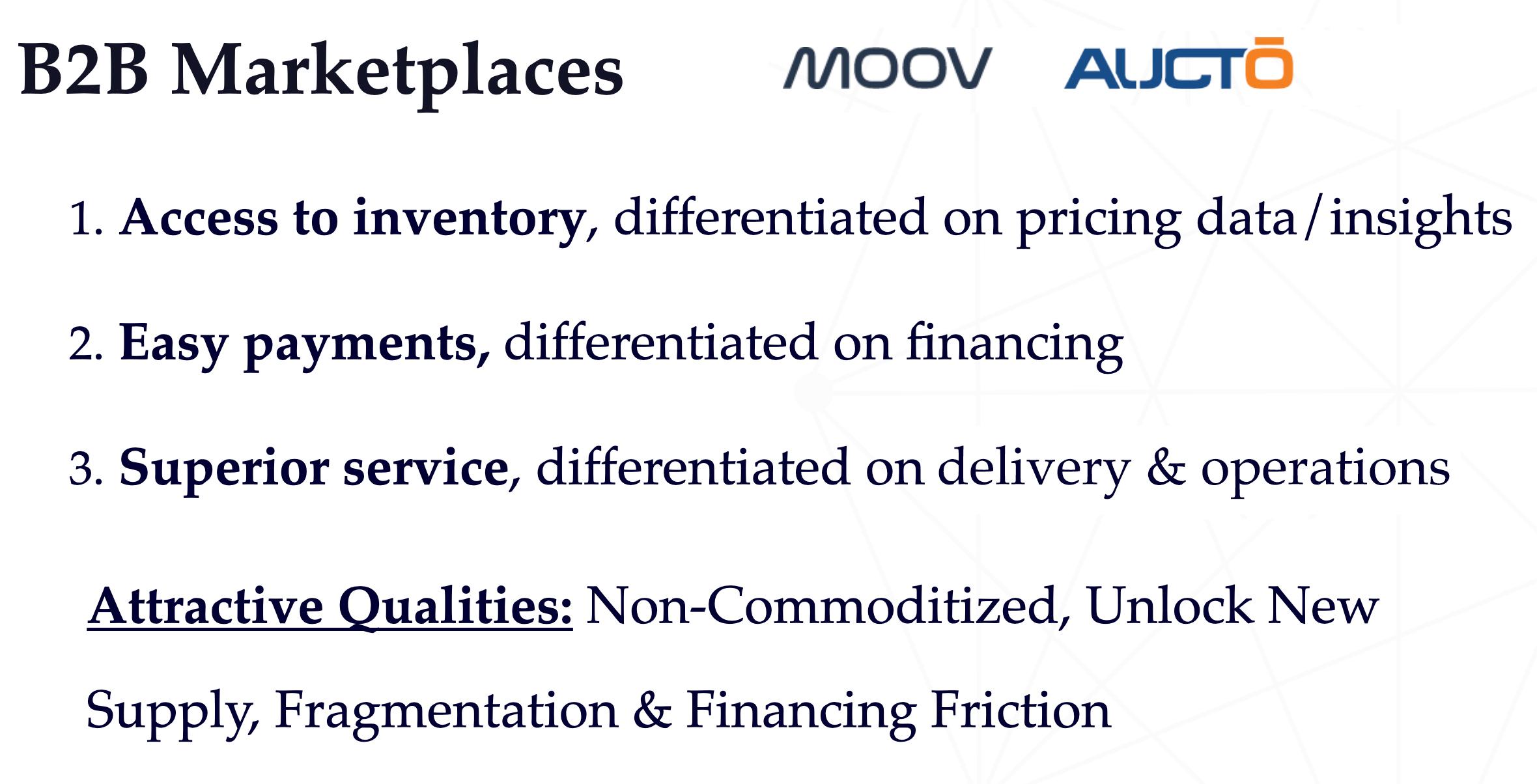

3. B2B Marketplaces

We are starting to see more businesses take consumer principles and apply them to B2B marketplace models. There is now a well-developed playbook here. At its core is access to inventory, which is often differentiated on pricing data and insights. Also, easy payments, which differentiates the financing experience.

These B2B transactions typically involve innovative financial products and integrations with various enterprise payment or approval systems, because they are outside of the traditional credit card system. This payment friction is being removed by financing services, which aids the liquidity in the marketplace and offers a superior service, which for a physical service is often differentiated by delivery options.

The most attractive quality is when the B2B marketplace is non-commoditized, unlocks new supply, and is fragmented with a high degree of financing friction. A couple examples of B2B marketplaces in the NFX portfolio are Moov, which is in the fab space and has experienced tailwinds with the supply chain challenges in the ship industry, and Aucto, which is a used heavy equipment/goods marketplace.

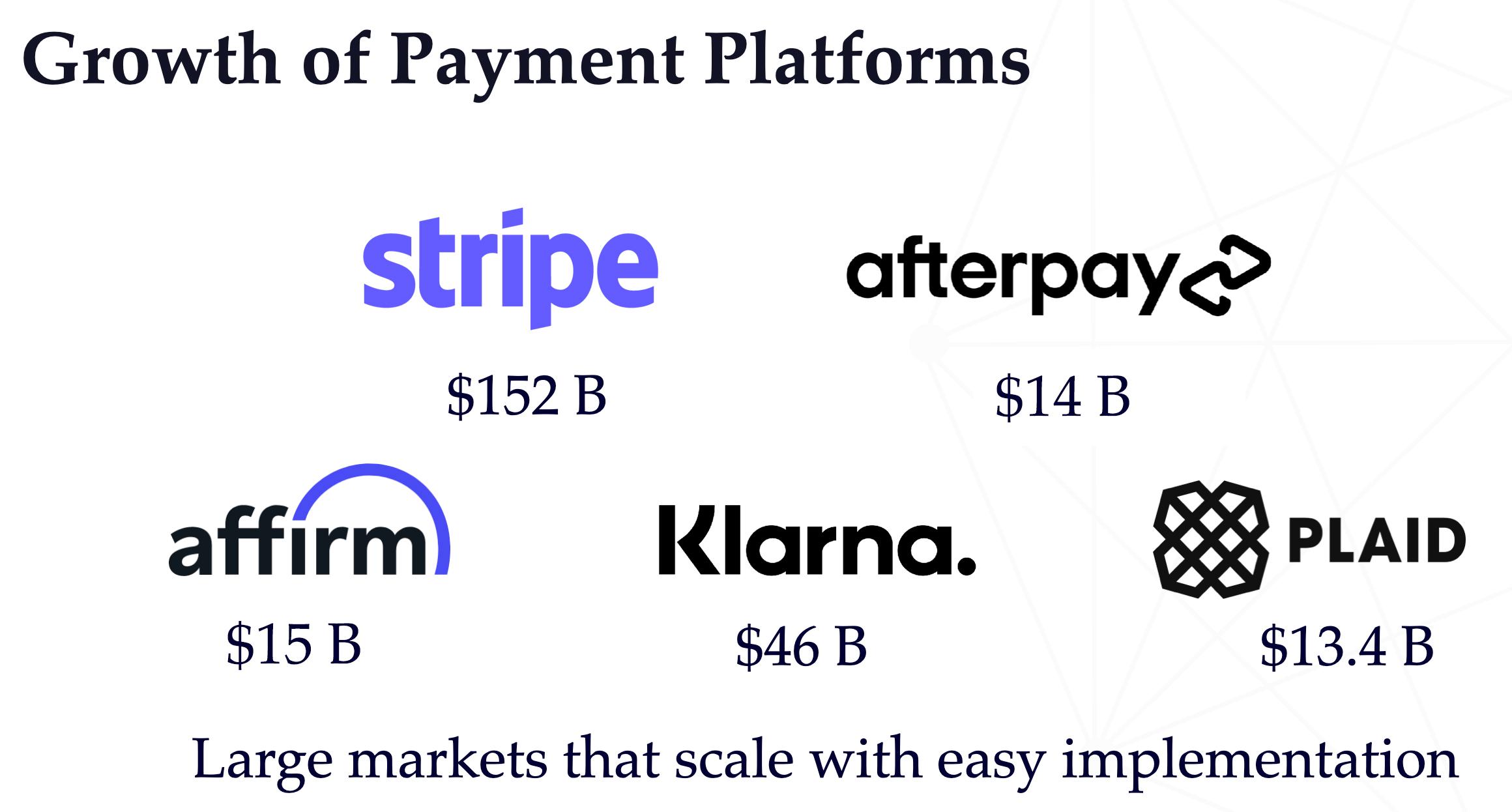

4. Payment Platforms

While we love the marketplace models, there has been a growth in platform opportunities which have been really hard to ignore. It’s staggering to see the growth in the valuations in payment platform companies in the last two to three years. It still feels like these companies and platforms have significant upside to grow from here.

You’re probably familiar with many of these names. I think this is a fairly mature area. Many of these platforms have already become enormously valuable. But there are still a lot of opportunities to explore. The addressable market of marketplaces you can service is only increasing.

Now For What’s Not Working As Well…

Already-at-scale marketplaces can struggle with embedding financial services into their product offerings — especially if there’s a robust set of competitors in the space. To maximize the chances of success, these mature marketplaces need to be intimately aware of various cultural considerations and operating principles. I will use Zillow as a case study since we’re active investors in proptech.

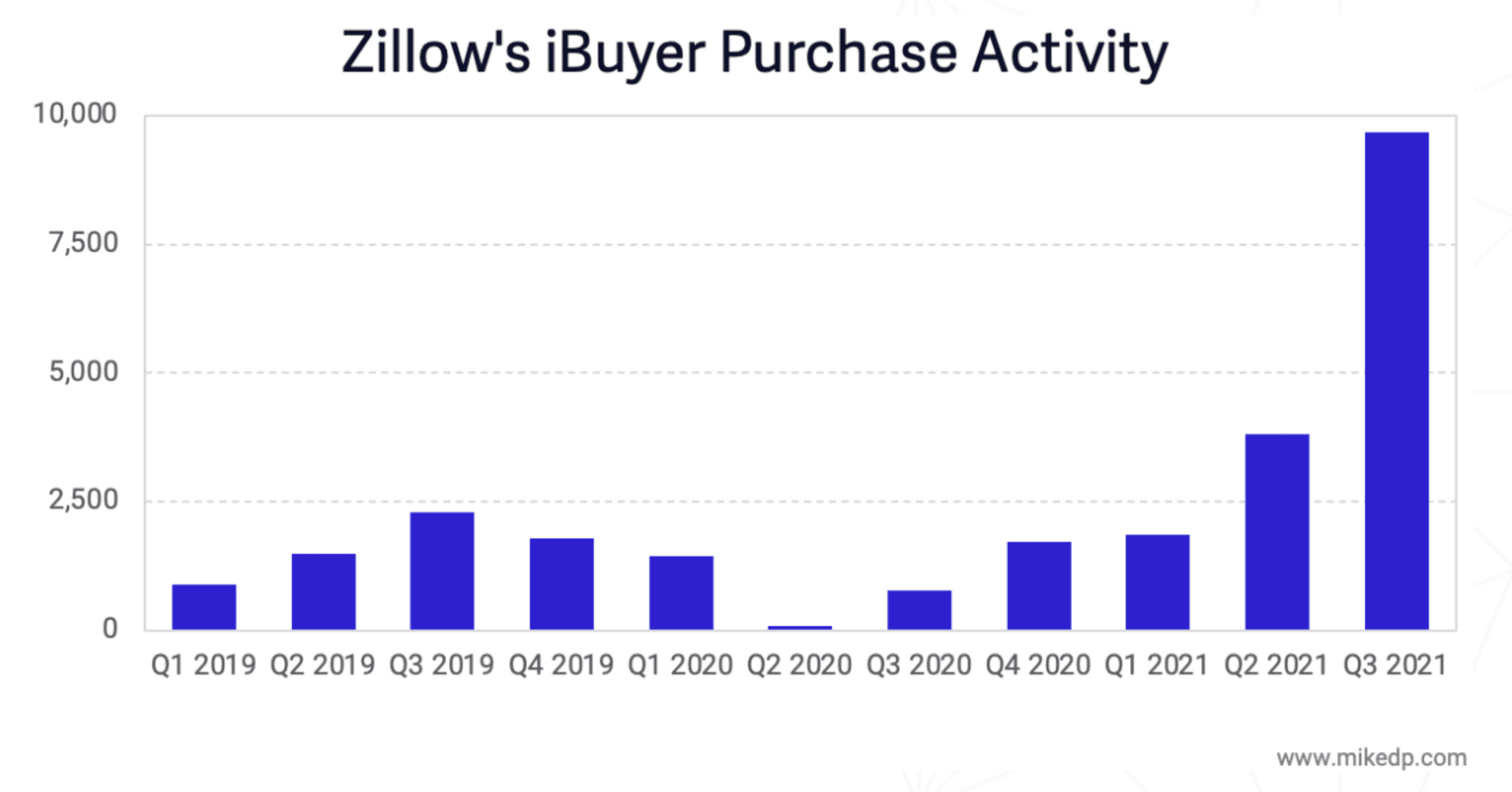

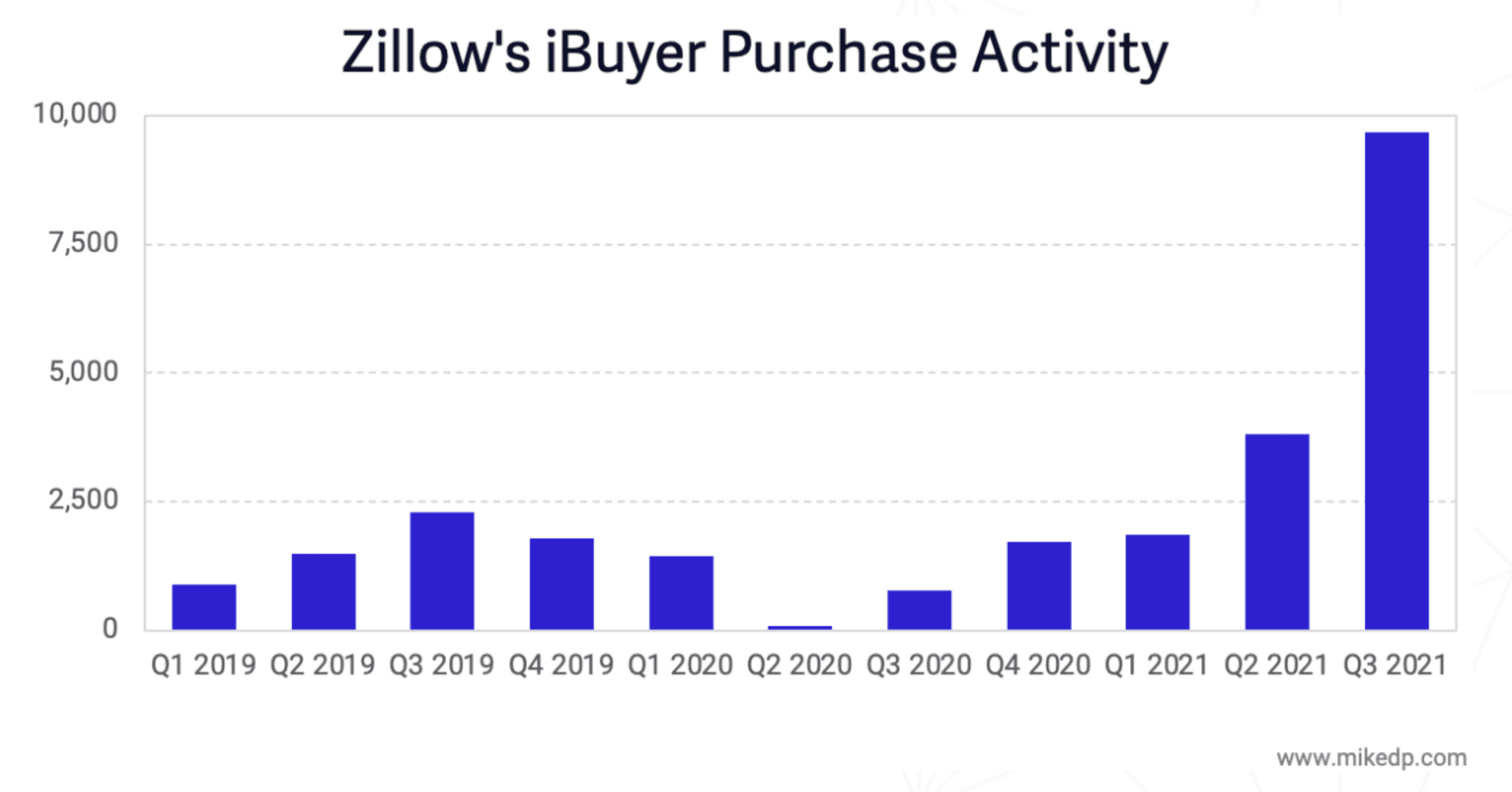

In the fall of 2021, we saw news trickling out that Zillow was shutting down their iBuying program. They cut 25% of their workforce after exiting what seemed like a really exciting, compelling fintech component and improved customer experience to this traditional marketplace. While it was a strategically sound decision, it can be really hard to execute these asset-heavy, capital-intensive marketplaces. What’s often required in these cases is a shift in competency toward finance and operations. Unfortunately, for many mature businesses, it’s really hard to fundamentally change their DNA.

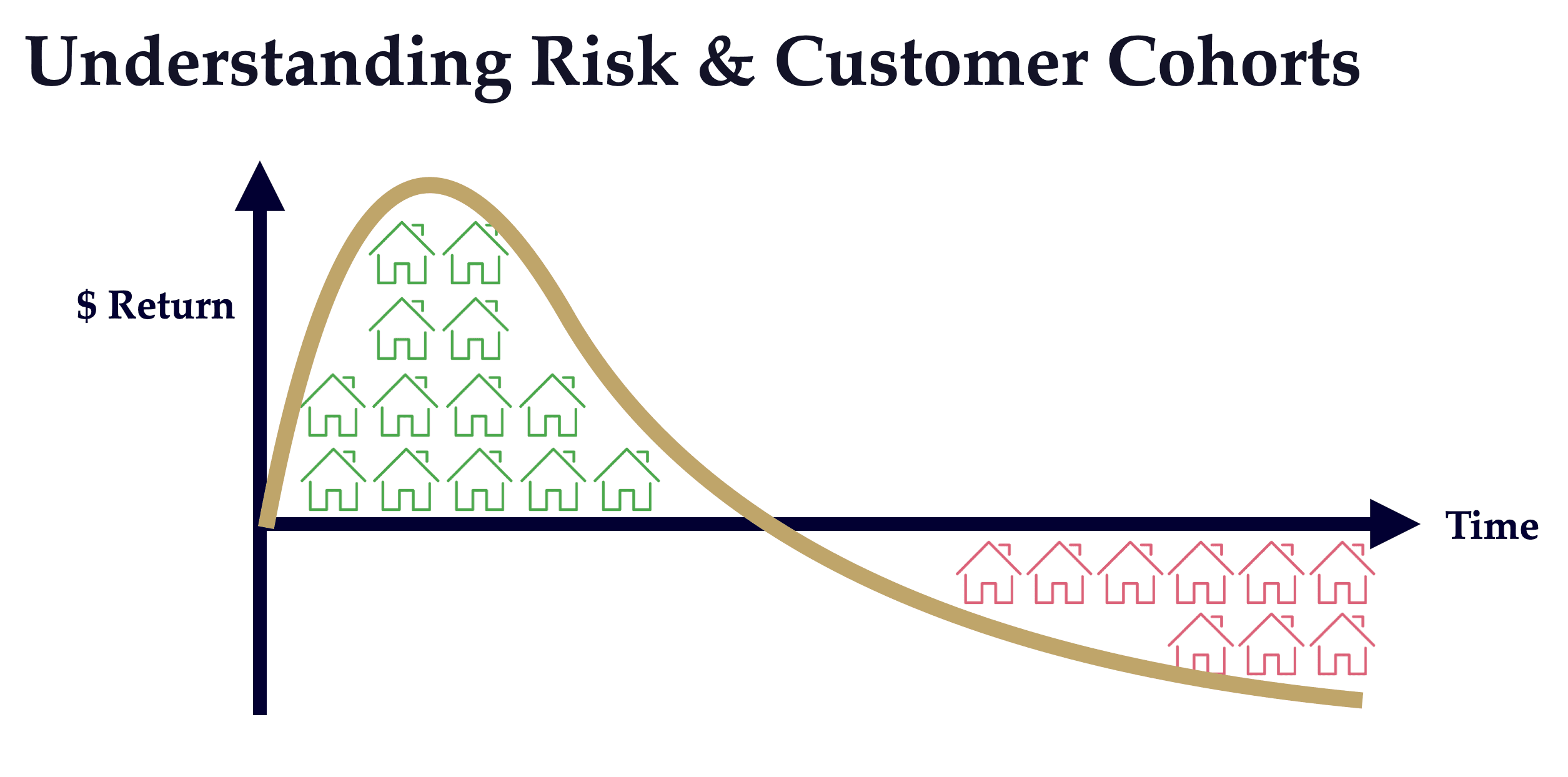

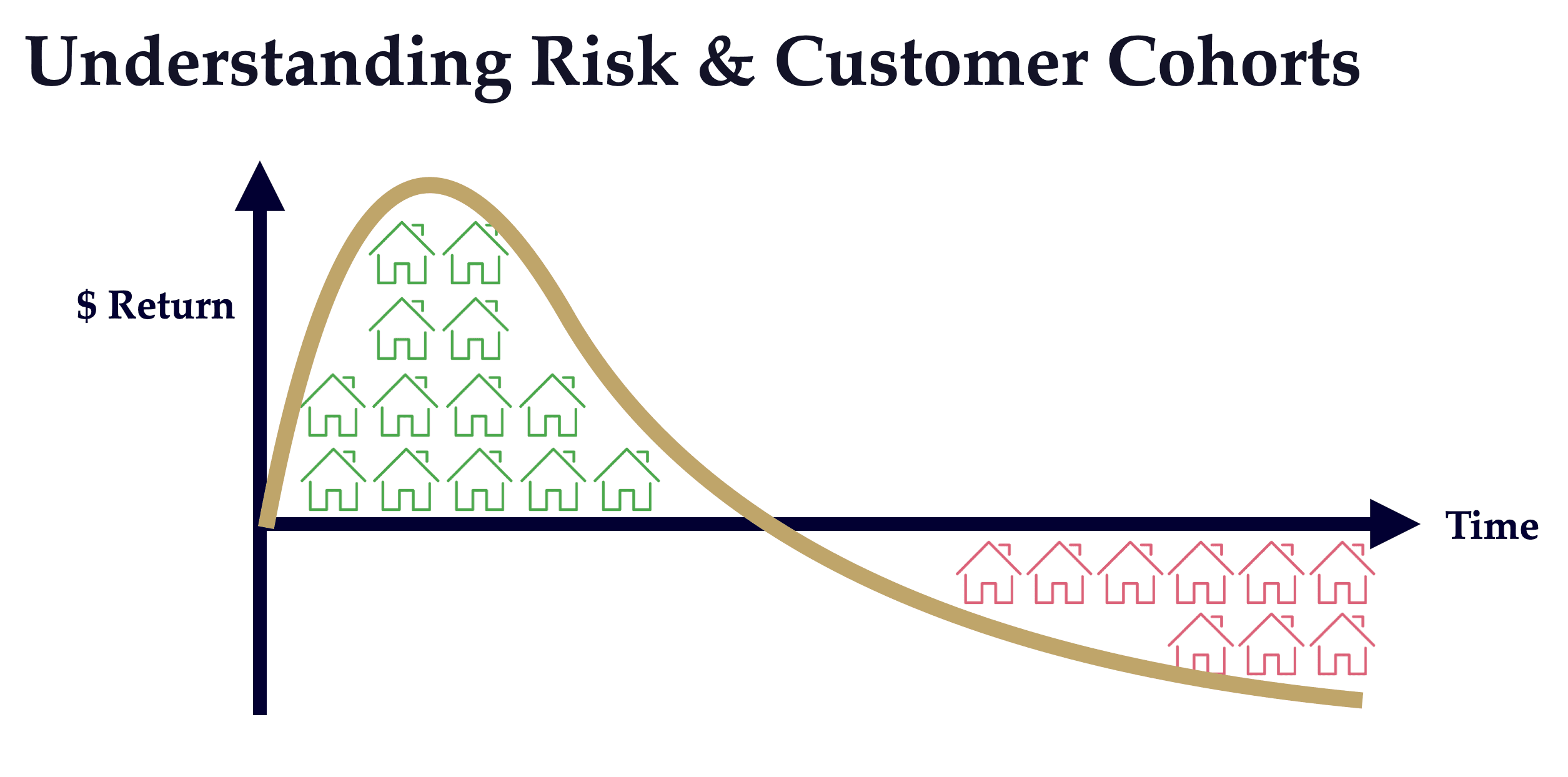

When you look at Zillow’s public statements, they explain that the algorithm to forecast future prices is quite hard to perfect. That is true. It’s also important to note that iBuying has some parallels to a regular lending business. In these businesses, you start to see your winners really early on. You buy a home, you renovate it, you sell it. If sales happen quickly, you can start to see the winners really early on. But over time, properties that don’t sell are still on the market with high carrying costs. Then you have to cut prices to sell them, often below the price you bought at, and you start to see these losses.

In the early days of the cohort, things typically look great. In the latter days, things can start to look very different. For Zillow, their automated valuation model (the Zestimate) is statistically very good when compared to other public AVMs, but it’s really designed for one particular function, which is to give consumers an estimate of what their home would sell for. Opendoor developed an internal valuation model, which is designed to solve the risk-adjusted price of them purchasing a home. Which is similar, but quite different.

If your Zestimate is 1% off, it’s not really a huge deal. You’re expecting it to be a little bit off. But if you’re buying a home for 1% less than it’s actually worth, that means you’re losing thousands of dollars on every sale. And if you’re buying 5,000 homes a quarter, that escalates to a very significant sum very quickly.

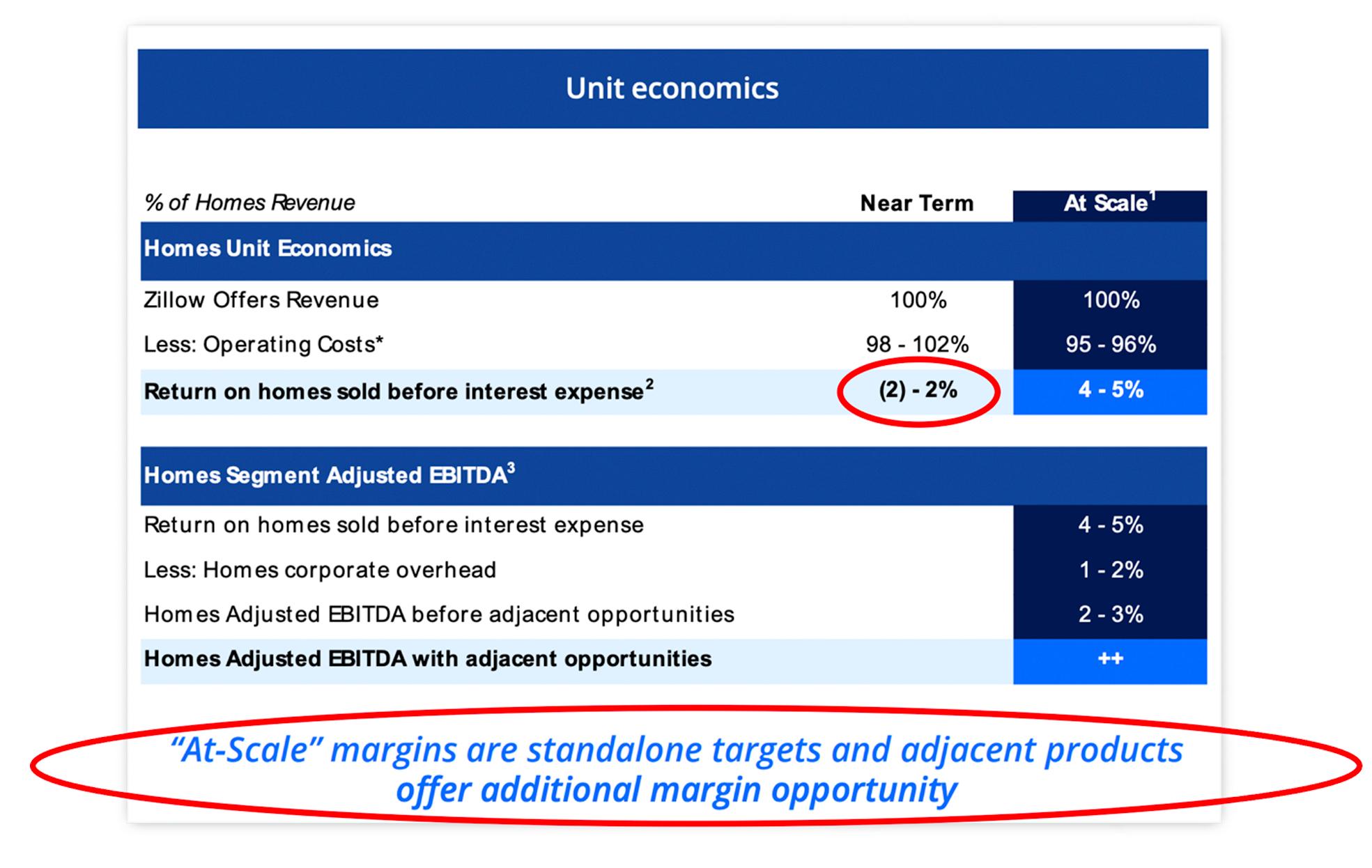

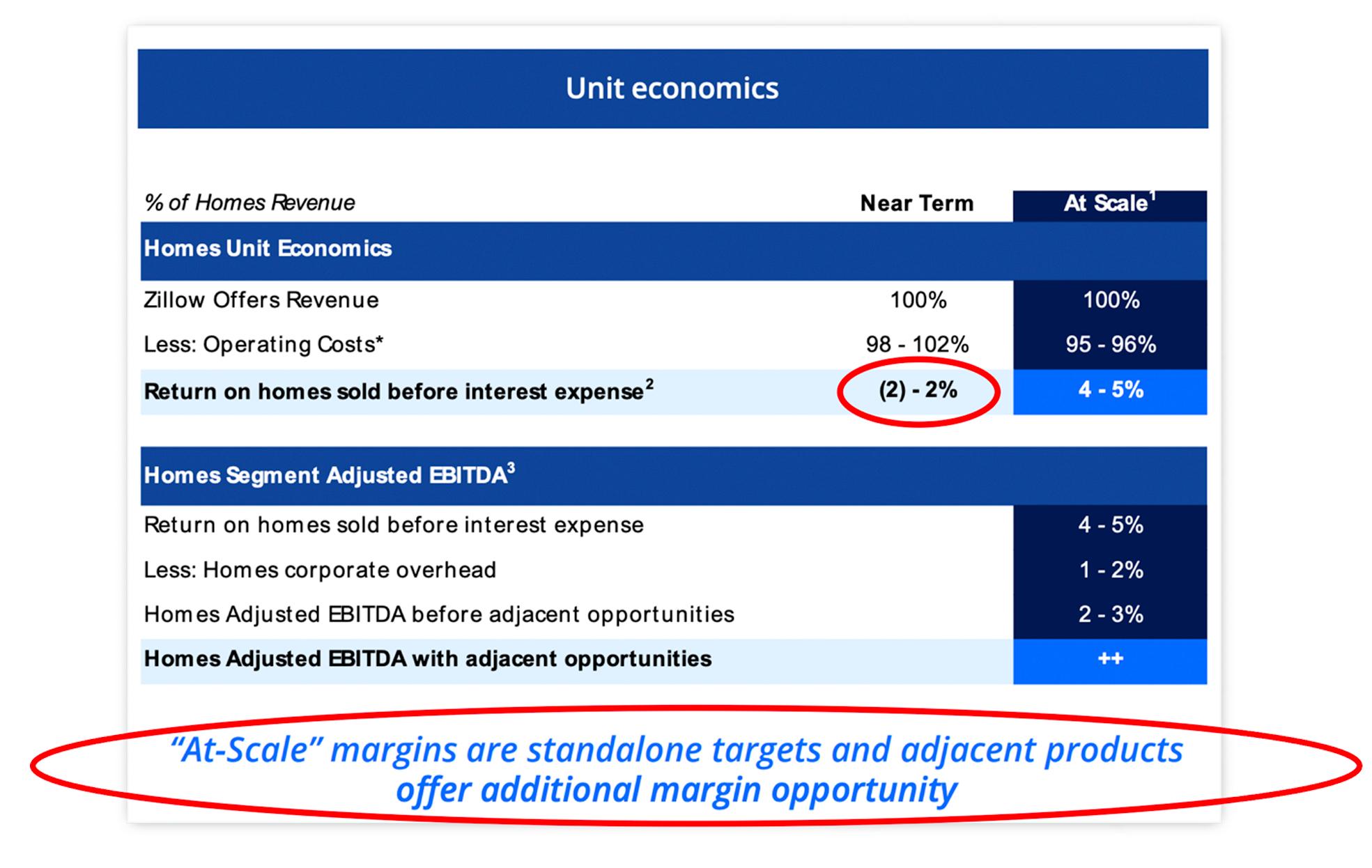

When Zillow originally presented this shift into iBuying, they were buying homes initially at essentially zero margin. The theory it seems was predicated on the ability to upsell, or to get efficiency and scale, as they sell into additional products such as mortgages, renovations, or titles.

You have to put a huge amount of capital at risk to make this work and the cross-selling opportunities can often be overstated in many of these businesses.

They were doubling the volume of homes sold every single quarter. A strategic plan like this can go wrong if you don’t have enough history to fully understand how the cohorts will mature. It can be even more challenging when you add an aggressive ramp and a near-zero margin of opportunity.

Cultural Considerations

The last lesson from the Zillow situation is one of culture. Zillow perhaps saw Opendoor as a threat. They were concerned that Opendoor would build out a proprietary listing database and use this iBuying platform to create proprietary supply. It was appropriate to be concerned. They were determined, as the #1 player, to be aggressive, to grow, and to move very fast. They were very focused on speed to market.

The other issue was just the core DNA component of building these businesses. Marketplace businesses generally have really good software DNA, but building a large iBuying business requires exceptional financial and operational skills. That’s often quite different from the DNA that has helped a marketplace business be successful in the first place.

Ultimately, I think that the question many Founders should be asking themselves in situations like this is: Should we partner? Or should we not partner? Zillow had something like 8,000 employees before the reduction. On the surface, you may think, “Oh, they could do this. They have the resources, they can execute on this.” But because it’s actually such a different business, perhaps partnering is a stronger and faster alternative.

It’s still too early to fully evaluate, but another emerging case study is Amazon’s partnership with Affirm. It appears that Amazon culturally recognized that a partnership was a favorable way to execute, versus expanding their own operational scope. While we will constantly be learning and updating what’s working and what’s not, right now, it seems that one lesson for Founders is that partnering may be the more effective strategy. If you don’t have that core DNA, internal capabilities, and data in place, it can be very hard to add it, even for an established company.

Opportunities Ahead

1. Web3 Infrastructure and Marketplaces

We are very excited about the transition of businesses from Web2 to Web3. As a firm, we have a lot of expertise around Web2. We’ve long been fascinated with crypto and investing in the space. We’ve also expanded our team to go after the opportunity. Morgan Beller, who is part of the team that created Libra and Novi, joined us at NFX to strengthen and deepen our focus and expertise in Web3.

A lot of Web2 marketplaces are incorporating Web3 components to help increase liquidity. Another advantage of tokenizing your network is that you can give ownership and governance to users. This is potentially enough of a wedge to incentivize users of Web2 competitors to leave to join your network. But what’s even more likely is that we’ll see Founders build entirely new, digitally native product experiences that we haven’t seen before.

2. International Growth in Financial Infrastructure and Marketplaces

There are a lot of global opportunities, from Europe, Latin America, Asia, and other parts of the world. Given the laggards in financial services, we see the fintech-enabled marketplace opportunities in those emerging countries as often superior to those in the US where there’s more competition and more established financial services products. This is an extremely large opportunity space.

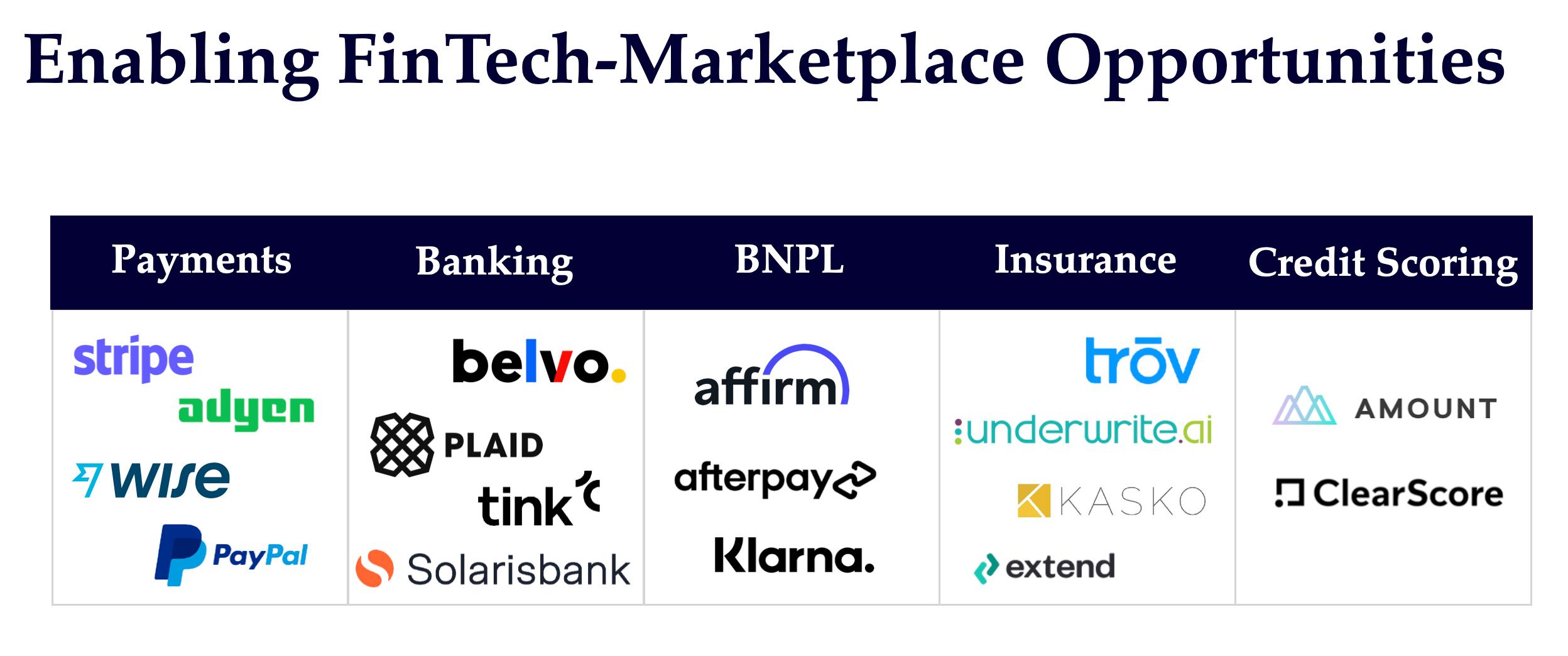

3. Fintech Products That Can Become Platforms

A lot of the opportunities within the fintech infrastructure stack is further enabling marketplaces. They can be very hard to scale. Many of them look almost like mini-consulting projects, which may be a good way to start.

We are especially excited about fintech products that can scale into platforms. This has been done in payments with BNPL (Buy Now, Pay Later) startups (e.g. Affirm, Klarna), which have been productized and scaled very efficiently.

4. B2B Fintech-Enabled Marketplaces

Finally, B2B finTech-enabled marketplaces. The backdrop for this opportunity is classically centered on marketplaces that share these attributes — (1) they offer non-commoditized goods/services, (2) operate in fragmented markets, (3) unlock new supply, and (4) reduce operational and financing friction.

Get in Touch

If you’re building a marketplace with fintech components like the ones we’ve described in this essay, or a platform to enable such marketplaces, we’d love to hear from you. Tell us about your company and we’ll be in touch soon.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.