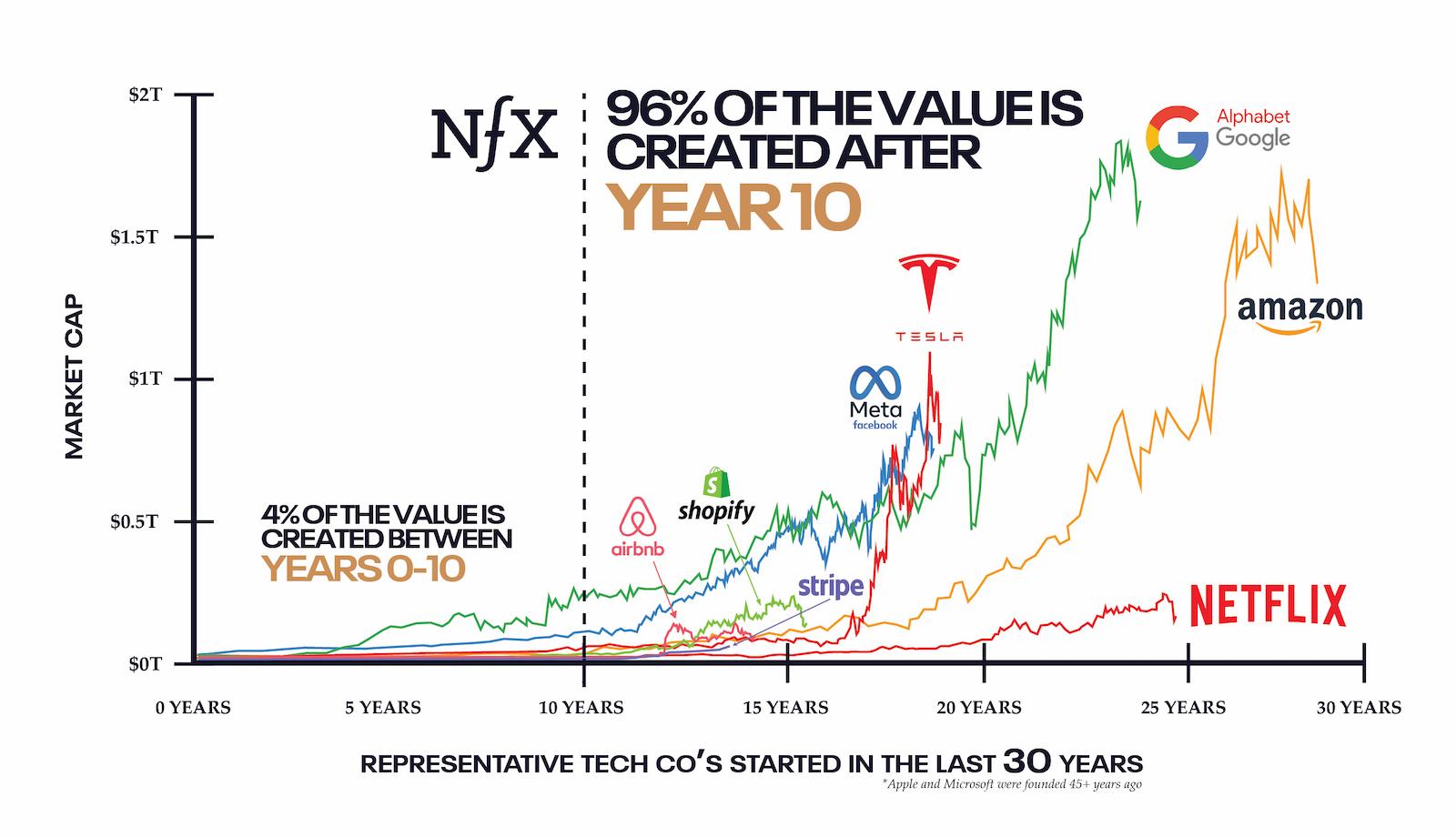

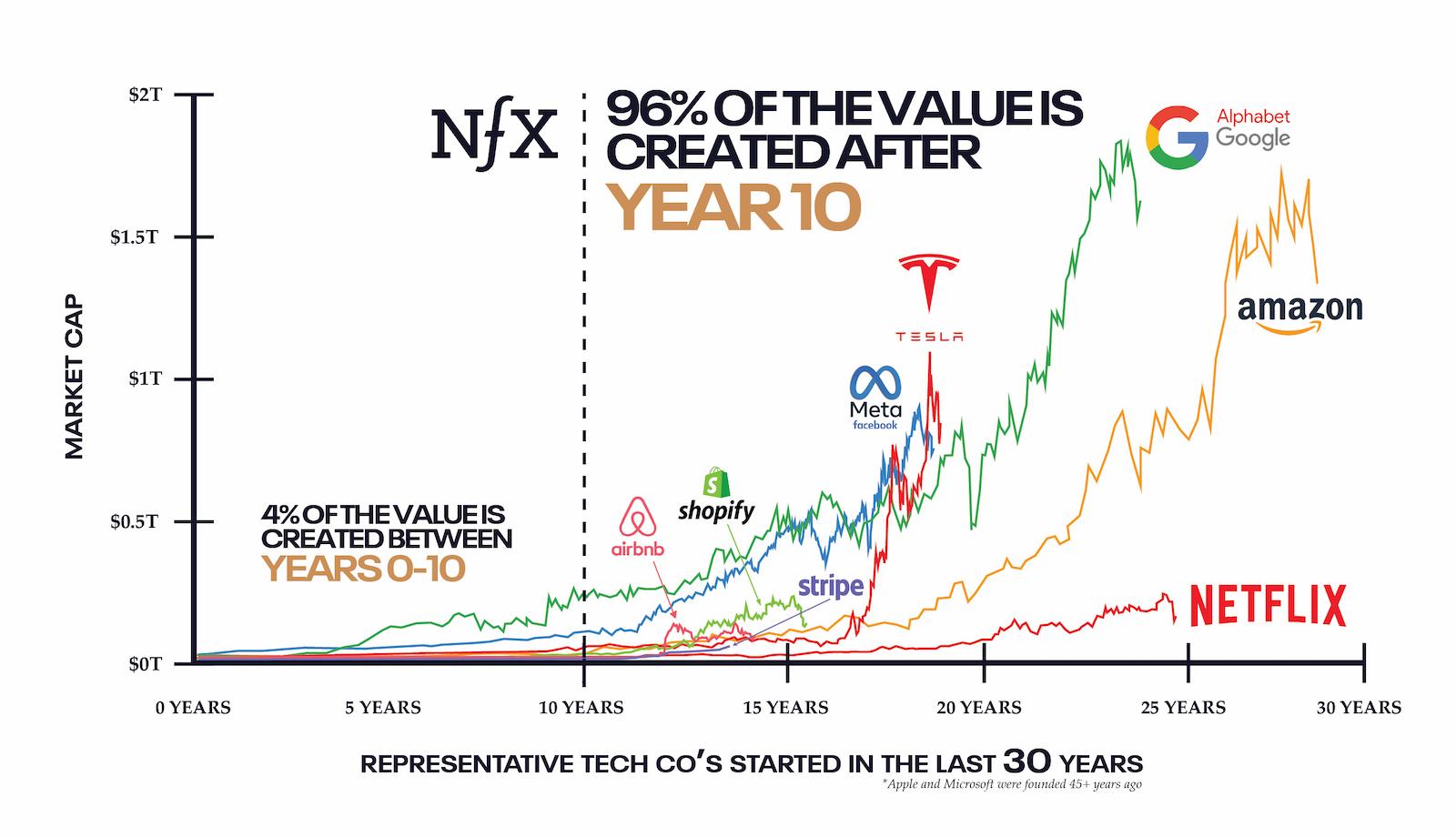

Nearly all of the value in technology companies is created in the out-years, long after you start. But you can only capture the value in the long term if you design for durability from day one.

There are five main factors that build lasting power for startups.

Durability = Network Effects + Economies of Scale + Brand + Embedding + IP

This isn’t a real math formula but rather a mental model for making sure you address these five core forces as early as possible.

These factors are what we at NFX spend a lot of time working on with our Guild companies because we know it drives extreme, long-term value. Over the years, we’ve discovered learnable tactics for designing for durability from day one.

Founders who work through the 26 questions listed below will be well-positioned to capture the compounding long-term value created by their companies. You won’t simply think about creating initial value — you will also think about how to defend & capture value. Once you have a durable business, that’s when you start building 10X, 100X and 1000X value for yourself and your team.

26 Questions To Determine Your Company’s Durability

We’ve written for years about network effects, economies of scale, brand, embedding, and intellectual property, and with this essay, we want to help you be at the top of your game by actively applying these concepts to your own company.

That’s why we are introducing a set of questions straight out of our workshops with NFX Guild Founders. If you and your team spend a little time with this list, your output will hopefully be a breakthrough in understanding the levers responsible for building enduring companies.

Network Effects

A network effect is when one user makes the service more valuable for every other user. Once your company gets ahead, users won’t find as much value in your competitors’ smaller networks. Examples include Bitcoin, Facebook, Uber, and Trulia.

Here’s a starter checklist of questions you must cover in order to assess the network effects at your company.

1. Is your product a “single-player game” or a “multi-player game?” Make it a multi-player game if you can. We say “Make it a network,” or “Make it a marketplace.”

2. Does the value of your product or service increase, decrease, or mostly stay the same as new users join the network?

3. Do you have a clear and effective way to get the first users to join? (chicken-or-egg problem)

4. Where’s the densest, most active part of your network (i.e. the “white-hot center”)? Can you focus your product features and language on activating other users to behave more like that group?

5. Do you have two different types of users (e.g. supply-side and demand-side users) who come to the network for different reasons and produce complementary value for the other side? (marketplaces, platforms)

6. How often do your users take future transactions off the network to transact directly with an opposite-side user they’ve worked with in the past? (disintermediation)

(Example: Labor marketplaces such as Fiverr and UpWork are vulnerable to disintermediation. Many customers use these marketplaces to find contract workers, but once they work with them, they’ll try to cut out the marketplace from future transactions.)

7. Are there low or no costs to simultaneously participating in competing networks at the same time? (multi-tenanting)

8. How easily interchangeable are the nodes in your network? (homogeneous vs. heterogeneous)

(Examples: Uber/Lyft drivers are highly interchangeable. The riders don’t have a strong preference for who is driving them. On the other end, Airbnb listings are quite distinct. Guests have a strong preference for where they stay.)

9. Does increased network usage or greater network size decrease the value of your network? (negative network effects)

(Example: After a certain point, adding more friends on Facebook results in pollution on your News Feed with irrelevant or undesired content from people you barely know.)

Economies of Scale

When you get bigger, a host of advantages accrue to you. More users mean more volume, which means you can get cheaper prices from suppliers, which means lower prices for customers, which means higher conversion rates, which makes advertising more effective than the competition. The numbers all move in your favor, and math is hard to compete with. Good examples are Amazon, Netflix, and Opendoor.

Here is a short list of questions designed to stress-test whether your startup is moving in this direction, and specifically what levers you might pull in order to ensure that it is.

10. Does your per-unit production cost decline as volume increases?

11. Do you get more favorable terms from vendors and suppliers, since you have greater volume than your competitors?

12. Are you able to offer the lowest prices in your market or product category, while still retaining a profit margin similar to your competitors?

13. Are you able to spend more money on marketing/advertising, since you can offset the higher costs of customer acquisition with a higher conversion rate and/or higher customer lifetime value?

14. Are you able to spend more money on R&D and product development, because you’re able to amortize the additional costs across a broader set of customers?

Brand

Certain companies inspire customer retention and a higher willingness to pay because of the recognition of, and preference for, their brand.

Homo sapiens are tribal and emotional. They identify themselves with brands. For instance, those who want to associate with Apple will not comparison-shop. There are deep tribal psychological barriers that make it very hard for competitors to break in. Examples include Apple, Google, and Bitcoin.

15. Do you have a well-established brand identity, which would trigger psychological switching costs for users leaving your product or service for a lesser-known brand?

16. Is there mounting social pressure for users to buy your product, because they don’t want to feel like they are in the out-group?

17. Is your product or service perceived as higher value compared to an objectively identical offering?

18. Is there historic information and/or significant social proof that helps reinforce a customer’s confidence that you are a high-quality seller?

19. How likely is it that a randomly selected person in your target market would be familiar with your brand?

Embedding

Embedding works when you integrate your product or software into a customer’s operations so the customer can’t rip you out and replace you with a competitor. This is obviously more prevalent when customers are organizations, not individuals, and is typically accompanied by a direct sales force to drive the embed. Top examples include Workday, Oracle, and SAP.

20. Do your customers integrate your product or service into their daily lives or operations, such that it would require significant time, money, resources, or energy to rip you out and replace you with a competitor?

21. Do you have high customer retention, or net revenue retention rate?

22. Are there low or no costs to simultaneously using your product, along with other competing products at the same time? Would you consider your product a “database of record?”

23. How many products or services have you cross-sold to your customers, as measured by your net revenue expansion rate? How does this compare to your competitors?

Intellectual Property

In software, intellectual property (IP) is not typically an effective strategy. Software moves too quickly and the patents don’t really stick. However, that’s different in bio and techbio.

IP protection continues to be a durability source in bio and techbio companies, even in the 2020s. Patents can be issued and defended in these sectors. (With bio companies, note that these sectors are becoming techbio, meaning the companies are becoming more software heavy than before, so they are starting to acquire durability factors we typically see in the digital world, namely network effects, scale, brand, and embedding.)

Omri Amirav-Drory, who heads up NFX Bio, asks every Founder he meets: Do you have defensible magic? What systems, network effects, and scale advantages do you have? In the case of techbio, Omri also asks a series of questions about intellectual property.

24. Do you own any patents or have patents pending? Could you create and submit some? How many? How long would it take?

25. Do any prior employers of the founding team or employees/consultants at your company have a potential claim to the IP, or is it solely owned by your company?

26. Was the IP developed at a university or with financial assistance from government grants? If so, what rights do you have to the IP? What do you owe them of your future value?

Durability Adds The Most Value

Value creation mostly accrues in the out-years when usage, revenue, and growth compound. But be very clear – in order to capture all of the compounding value in your business, you need to start at the beginning to position for long-term durability.

Founders who win big spend more time at the beginning, earlier than you might think, on creating products and business mechanisms that follow these five durability factors and thus drive increasing returns at scale. As their companies get bigger, they get increasingly hard to overtake, and thus their value explodes.