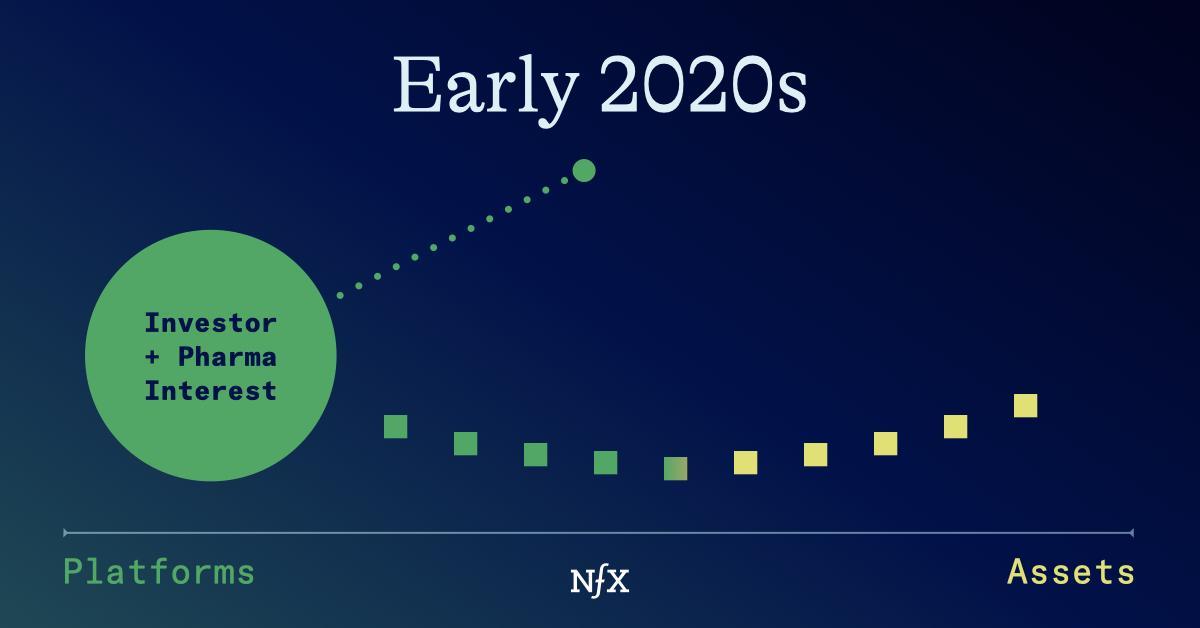

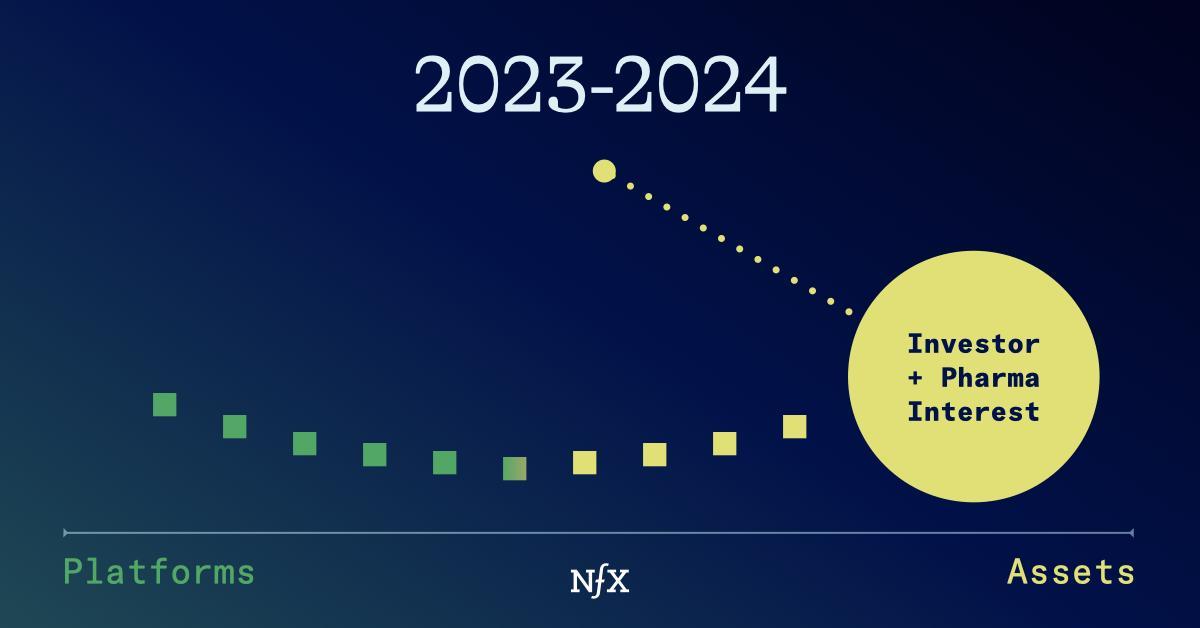

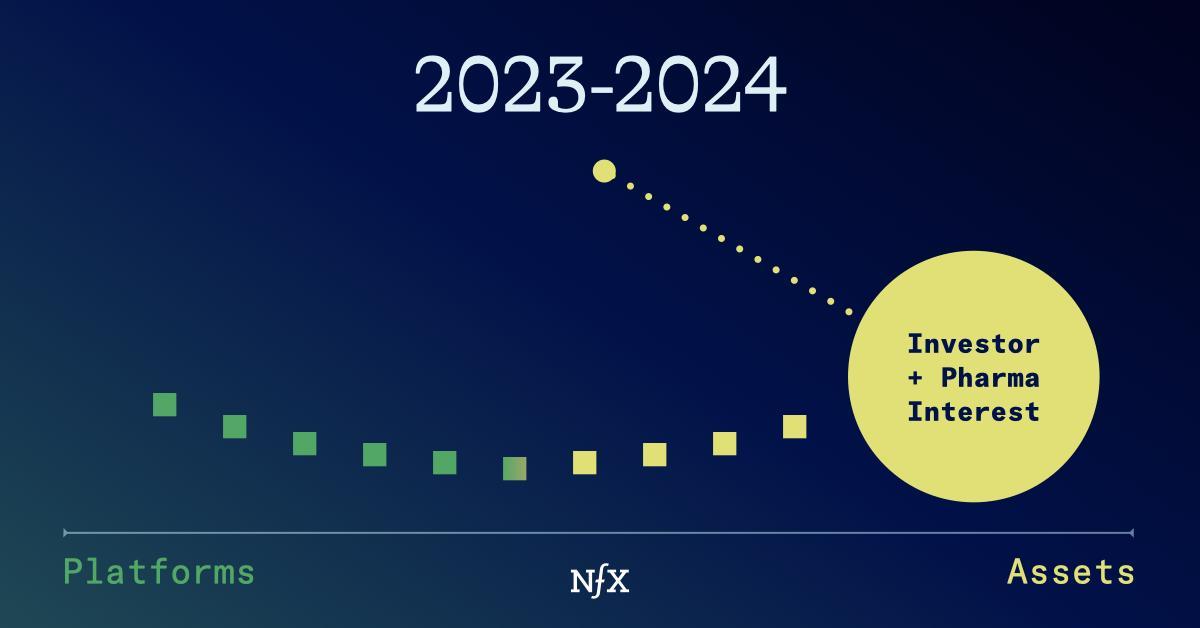

I firmly believe in bioplatforms, even in tough times. But over the years, I’ve noticed that investors swing like a giant pendulum when it comes to bioplatforms.

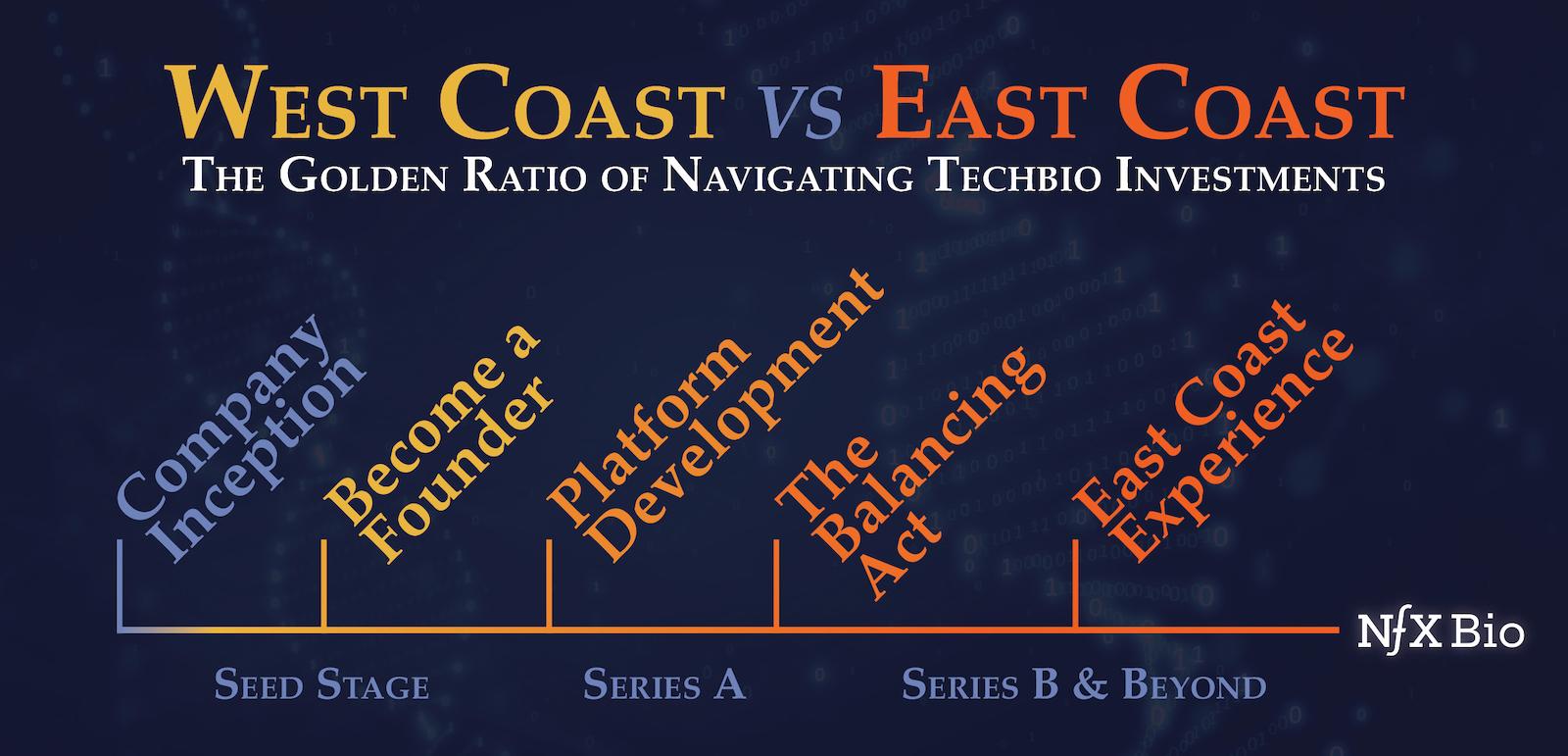

In the early 2020s, everyone bet big on platform companies. The pendulum swung towards those taking multiple shots on goal. Some people even suggested that fixating on assets limited a company’s potential, tethering it to a single product. The west coast approach was the clear favorite.

In the last two years, with higher interest rates, the pendulum has swung backwards – hard. Suddenly, everyone’s fixated on assets. There’s a race to show rapid progress toward the clinic, crucial for securing follow-on funding or striking pharma deals. The east coast approach is in the spotlight and platforms are no longer “cool.”

This debate between platforms and assets is exhausting, and worse – it misses the point. A platform built on stellar IP and backed by a sharp business strategy is always “cool” because great platforms should make great assets. Full stop.

It’s about balancing platform and asset development strategically. One should fuel the other and vice versa.

Founders, here’s how to refine your platform thinking, and break away from the pendulum cycle once and for all.

The Asset-Platform Continuum

I like to tell our platform companies to think of themselves on a continuum.

One end is the “east coast” asset-based approach, where the focus is on bringing a single asset into the clinic. But this approach is binary. You either win or you don’t. If you don’t, it’s all over.

The “west coast” approach involves raising money in stages and building a flexible IP/technology-based platform. A great platform can produce many promising assets with potential to go to the clinic. Then, the business development strategy comes in.

If you’re smart, you can focus on developing a few assets in your pipeline while having the flexibility to monetize the rest (could be other assets, targets, or other services of your platform). That should give you non-dilutive funding and validation. Both are extremely useful to your company, and will push your lead candidate forward.

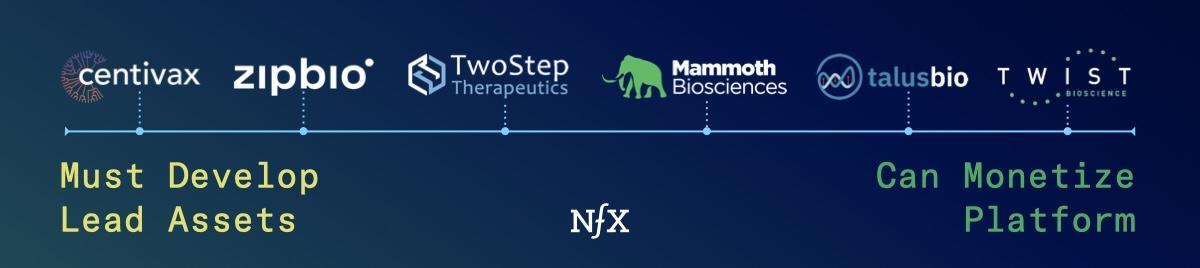

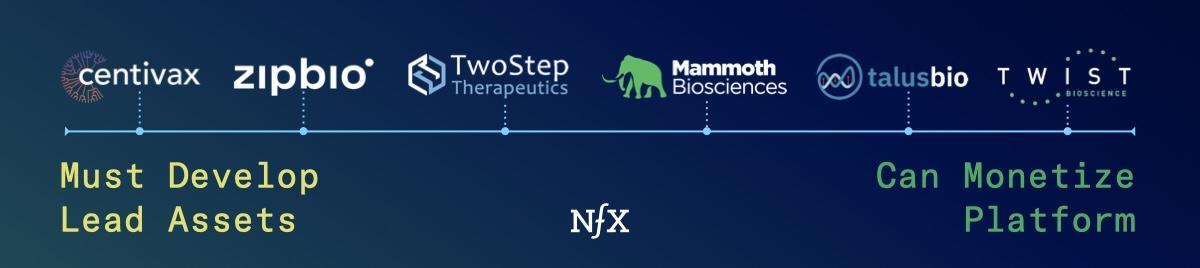

Some platforms can just monetize their core platform, and potentially develop assets later once they’re $B+ dollar companies (like Twist). But, honestly, most platforms can’t do that. Most companies need to develop assets and their platform in tandem – with one set of revenues fueling the other.

When this system works, it really works. Here are some examples from NFX’s own portfolio.

Twist: Twist was uniquely positioned to become a huge business via monetizing their core platform. They achieved a multi $B valuation with hundreds of millions of revenue from a core DNA synthesis platform ( $.07/ per DNA Base pair). They have since used those revenues to move up the value chain towards assets.

Talus: Talus’ MARMOT system can identify druggable transcription factors. This generates many important leads for potential asset development. Talus can choose the most promising ones to develop themselves, while licensing and collaborating with pharma on many other hits. (Meanwhile, those revenues drive the lead assets forward).

Mammoth Biosciences: Mammoth has extremely valuable IP around many small CRISPR systems. They’ve already monetized their platform via licensing deals with Vertex, Bayer, and Regeneron. Those partnerships were critical, giving the company a lot of outside credibility, and allowing for future R&D. Now, they have both pharma connections, and millions in non-dilutive funding to put toward internal pipeline development.

Two Step Therapeutics: TwoStep has a core platform of novel peptide binding integrins that target solid tumors. This peptide is payload agnostic, so it can be used to carry drug conjugates, radiotherapy or immunotherapy to practically any solid tumor. That means TwoStep has many options to both develop their own pan solid tumor therapy or license out the rest.

ZipBio: ZipBio’s AI platform allows the creation of de-novo therapeutic proteins that are significantly smaller than their natural counterparts. This allows these proteins to be delivered via transport technologies that have historically been impossible to use due to large protein sizes. ZipBio is beginning with a pipeline of products targeting eye diseases. Again, they have flexibility to license out aspects of their platform (like the de-novo protein design aspect or part of their large pipeline), while using those revenues to develop their own lead asset.

Centivax: Centivax has developed simple and elegant universal vaccine technology capable of defending against all past and future strains of a certain infectious disease. However, due to the novelty of this technology and complexity of vaccine approval, Centivax has to develop their first vaccine themselves (their universal flu vaccine is already in GMP manufacturing). Then, they can partner with other companies to bring more vaccines to market until they rid the world of all infectious disease for good!

Even as “west coast” investors, we know most of a platform’s value comes from the monetization of assets. But you can find many ways to monetize your platform during your company’s journey. Partner out when it makes sense. Use those revenue streams to fund future development. But always keep something for yourself to develop later – read our advice on that there.

What You Need to Show By Series A

The bar for seed stage platform companies wanting to raise an A round is getting at least one asset as close to the clinic as possible, and proving you can monetize/validate your platform with pharma partnerships. The bar is high and ever-changing, but this is the current reality.

In the pre-seed and early seed stages, focus on your core platform: set up your lab, validate with pre-clinical experiments, build a potential pipeline of candidates. While you do that, talk to partners to see if you can monetize your platform as a service or get partnerships around those early assets.

Everything you do should drive toward those goals. Here are some benchmarks you can use to measure progress:

- You have generated a pipeline of potential assets for partnerships or licensing

- You should have identified a lead asset for your own development

- You have moved that lead asset as far as possible toward the clinic (ideally using revenues generated from your platform: think services, targets, etc).

- Ideally, you are moving toward IND for a lead candidate

- You have hired a CBO

- You have a business development plan

- You’ve reached out to pharma to discuss potential partnerships for some of those assets

- You have closed a deal with pharma

(Note that these are general, they will differ according to your technology. But you can see that these are all proof points that are telling the big story: My platform works. It can develop assets, and I have a plan to develop these in time with pharma partners).

The hardest part of your journey as a techbio platform developing an asset will be getting to the clinic. Nothing is more validating in biotech than human data. This is the arena where the east coast-types tend to have the advantage: they will put lots of money behind validating one asset in the clinic if they’re confident in the pre-clinical data. (But often that money is invested very early, in a highly dilutive fashion).

However, if you’re a platform that has told a good story with your pre-clinical work, and managed to close a deal with pharma, you are far more likely to attract the amount of funding you need to go to the clinic.

(Side note: As an investor, I’m continuously frustrated by how high the costs of getting to the clinic are in general. NFX Bio is currently brainstorming a “Go-To-Clinic” syndicate to help great platforms do it. If you’re an LP, investor, or founder interested in that, reach out to us.)

Great Platforms Make Great Assets

If constructed correctly, I believe that platforms are the best possible architecture for a techbio company. We are all-in on platforms, even when haters start saying they’re “not cool.”

What doesn’t kill you mutates and tries again. A single “good enough” drug won’t stop nature – but a flexible, fast moving platform can.

That said, platform companies need to be smart about proving that they are on the way to creating great assets. Or they’ll be stuck on the starting line forever.

If you have great IP, are developing a platform around it, and need to know how to tell that story to build a great company: come talk to us.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.