Something has changed in VC land.

We don’t do a lot of VC analysis here at NFX, but we think it’s important for founders to know the waters they’re swimming in. Here are seven important things for founders to know about how VC has changed, and then at the end, a list of how those changes will impact them — with both pros and cons.

1. It’s never been a better time to raise capital for your ideas

Founders are lucky to be alive right now. It used to be hard to get funding, but what most people don’t realize is that we now have at least 32,000 VCs.

It’s fortunate that we have all these people available just at the time when the number of industries which can benefit from the startup and VC model is expanding exponentially out of just-software into defense, techbio, energy, robotics, space, etc.

How do we know there are 32,000+ VCs? Just go to signal.nfx.com where VCs have their investing profiles. We launched it in 2018 and have been tracking it ever since. Right there on the logged in page, the number of profiles passed 32,000 a couple months ago.

What most people also don’t realize is that in 1994 in the US, there were maybe only 150 active venture capital investors at 40 active venture capital firms. It was a cottage industry. It was kind of a joke compared to the mainstream financial industry.

I joined one of those firms, Battery Ventures, as an Associate in 1994. At the time, Battery was just finishing up their $42M Fund II, and it was one of the more active firms.

I learned so much during those three years. It was a great gift. The Partners I worked for let me learn the ins and outs of startups and technology. I read 1000s of business plans and talked to 100s of CEOs. I was allowed to hone my intuition, learn patterns, and learn how to be a better coach. Because of that training, I’ve been able to co-found three venture-backed companies that all did well. And then I was able to attract great partners so we could create NFX together and make nearly hundreds of investments with 28 unicorns so far.

It’s heartening to know 32,000 people are currently in that same learning process as I was. What they can accomplish with their careers – either in or out of venture capital – is astounding.

Every nation that doesn’t have this kind training program should be jealous. These VCs are a key secret economic weapon for America and Israel. They will provide a foundation for our growth for the next 50 years.

People like to mock VCs for not adding value. I disagree. At the very least, VCs give you money for your crazy idea. That’s a lot.

In addition – in the geographies I know well which are SF, NYC and Israel – the VCs I know TRY very hard to help. Which is not what investors of old used to do. Old time investors wanted control.

Before 1994, money was scarce and cautious. 90%+ of founders couldn’t get equity capital. Founders had to build their $8M ARR companies on their credit cards or by mortgaging their homes. Only then would they approach Battery for expansion capital from our $42M fund.

Now look at you – worried you won’t get a $100M valuation on your Series A. That’s because of the growth of the VC industry and the competition between the 1000s of firms.

Hallelujah! It’s the best time to be a founder.

2. The number of VCs willing to fund you will increase

With so much VC competition, many have suggested: “VC returns will come down and therefore the VC industry will have to shrink.”

This article from the Financial Times of London reports the dire news that “VC firms are dying off, new VCs are not raising funds, and overall funding for US VCs has fallen since 2022.” They note that there is consolidation to the top branded mega-funds. “More than half of the [capital] raised by US VCs in 2024 was pulled in by just nine firms.”

The Pitchbook numbers are accurate, but the conclusions are not.

I think the opposite will happen. Counter-intuitively, I think the number of VCs will continue to grow.

Remember, people said there was “too much money chasing too few companies” in 1998, 2005, 2009, 2014, 2017 and every year since then.. Yet the number of VCs has continued to grow.

This is all good news for founders.

14 reasons why the number of VC investors is going to keep growing:

- Continued inefficiency. VC will still produce higher returns than other asset classes because it is still among the most inefficient asset classes. Certainly, a basket of the top 50th percentile will give strong returns, which will continue to draw in traditional LPs and new types of LPs.

- The asset class is still small. The industry raises roughly $200B per year. $200B is the size of one big hedge fund. Many traditional LPs haven’t even started investing in VC yet. If the non-participants invest just 1-2% of their AUM, we could easily see a doubling of the asset class from about $200B per year to $400B. Further we will get new types of LPs.

- More VCs will be needed because the VC model now applies to all industries. AI will make all companies digital technology companies between 2024-2040 and hopefully accelerate their growth. Thus the surface area where VC investment applies will expand: defense, healthcare, energy, climate, space, techbio, education, government, etc. More VCs will be needed to cover all that surface area.

- International growth. The VC industry is still nascent in many parts of the world outside the US, Israel and Europe. All those regions will see an increase in people serving the role of VC.

- LPs will continue to invest because they have many different strategies. Different firms fit those strategies despite lower returns. For instance, a multi-billion dollar VC fund might only produce only a few percentage points above the S&P, but very large LPs can park a $500M check in them and be happy with those cash on cash returns inside their vast portfolio. For that big LP, this approach is operationally more feasible than writing one hundred $5M checks into small seed funds. Or, for instance, a smaller LP can invest $5M in ten seed VCs even if those funds aren’t well known or have a clear competitive advantage. A diversified portfolio of ten smaller funds can create a good blended IRR as each is a lottery ticket.

- LPs will continue to invest because VC brands are durable despite lower returns. Unlike funds in other asset classes, VC funds build brands that give them a competitive advantage at producing returns. The best founders want to indicate their fitness by partnering with the VC firms with durable brands. LPs thus rationally feel more comfortable investing in VC brands even if there are lower temporary returns. It’s paramount for VCs in this era to have a well known and respected brand, and to have scale to get to some percentage of the best deals per year.

- LPs will continue to invest because they have few alternatives. The alpha in other asset classes has been dropping for decades already. For instance, the alpha in hedge funds has been dropping since 2013. Stocks and bonds are highly efficient and thus trend to the S&P 500. In part, the dramatic rise of the VC asset class in the last 14 years has been driven by LPs looking for better alternatives to the old asset classes which are more efficient and therefore produce lower alpha.

Note: LPs can also invest in PE firms in search of VC-like returns, and they should. That being said, competition in PE is also fierce now, with most companies getting “six or more offers from PE firms” when they are in play over the last ten years, driving up valuations and lowering returns. - New types of LPs will bring in new money to VC. As VC has seen great returns for forty years, more pools of capital want in, creating a whole new potential pool of LP money. Governments, crypto investors, corporations, pensions, small investors, etc. AngelList has started the process of drawing in new small LPs to VC investors, and these efforts will accelerate.

- LPs will continue to invest because opaque reporting keeps VCs in business longer. Unlike other asset classes which mark to market annually, VC doesn’t mark to market. As a result, LPs can’t always tell if a VC fund is working for 5-14 years. So a VC firm can keep raising and have a 20 year run even without great returns.

- More VCs will come because people like the VC job. It’s high status, mentally stimulating, pays well enough in the short term, and carries a constant feeling of optimism that the next investment might be the big one. It’s a lottery, where hope stays alive for decades. And boy, is being on the “buy side” a better finance job than being on the “sell side” like I-banking – you get to be the judge and the decider. You get pitched to, you don’t have to pitch, except maybe every two years to LPs. VC will continue to attract 99th percentile talent. Further, organizations like Decile Group are training 100s of people per year to be VCs, and then connecting them with the LPs near them.

- More VCs will come because AI and data will make them capable of doing the job. First, AI and data systems will make deal sourcing 5X easier for less well-known investors and geographically remote investors, and thus let them access good returns. Second, AI will let each firm analyze more companies so they will need more human investors to meet with founders and make decisions. Third, AI will help young VCs make better decisions and provide better support, so more people will seem quite capable of doing the job.

- Low barriers to entry. Anyone with money can be a VC. And they can be effective if they choose right with their sector, geography or founder community. I often tell people who want “a job” with NFX, “Just start doing the job from your apartment today. You don’t need anyone’s permission to be a VC. If you honestly love it, you would be doing it already. The best candidates for being a young VC at NFX are operators who have been doing VC type work on the side.”

- VCs can be VCs part time, so going forward you will have financial and operating professionals who play the role of VC as part of their job: family offices, hedge funds, crossover funds, merchant banks, crypto companies, etc.

- Special community VCs will flourish. Every city, every university, every state and every nation will want VC entities to help them flourish economically. VC investing and startups is increasingly recognized as an engine of prosperity. If administrators of those communities don’t create VCs in their region, they seem irresponsible. This will also be true of large corporations, who will want Corporate VC arms, to make sure they aren’t being left behind. Universities set up business plan competitions and then, naturally, small VC funds, or their alumni will. Each of these entities will need human VCs taking a salary to attract, coach, and deploy capital into private companies.

For all these reasons, despite incredible competition, the number of VCs on Signal.nfx will counter-intuitively grow well beyond today’s 32,000. The top firms will continue to provide jaw dropping returns from time to time on that part of the power law, and the overall VC industry will do well enough to continue benefitting founders and progressing humanity. It’s a significant competitive weapon for the countries who have it.

Now, what does that mean for you?

3. You are now living in the 3rd era of VC

VC 1.0. “Cottage Industry”

There were less than 150 GPs in the US cottage industry. VCs kept a low profile. There wasn’t really the word “startup.” Only a few law firms even knew how to process the equity agreements between VC firms and tech companies. In the WSJ, only one half of one page out of 64 pages was “Technology and Media,” and that was buried on page 3 of Section B. Founders typically bootstrapped to millions of revenue before raising VC.

VC 2.0 “Software”

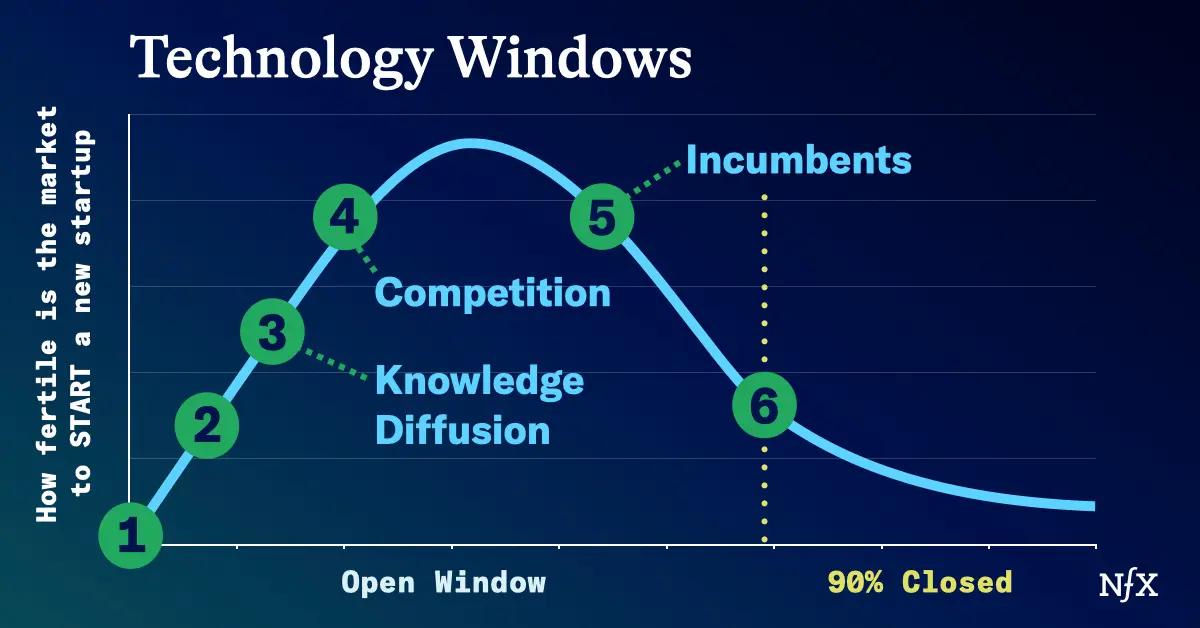

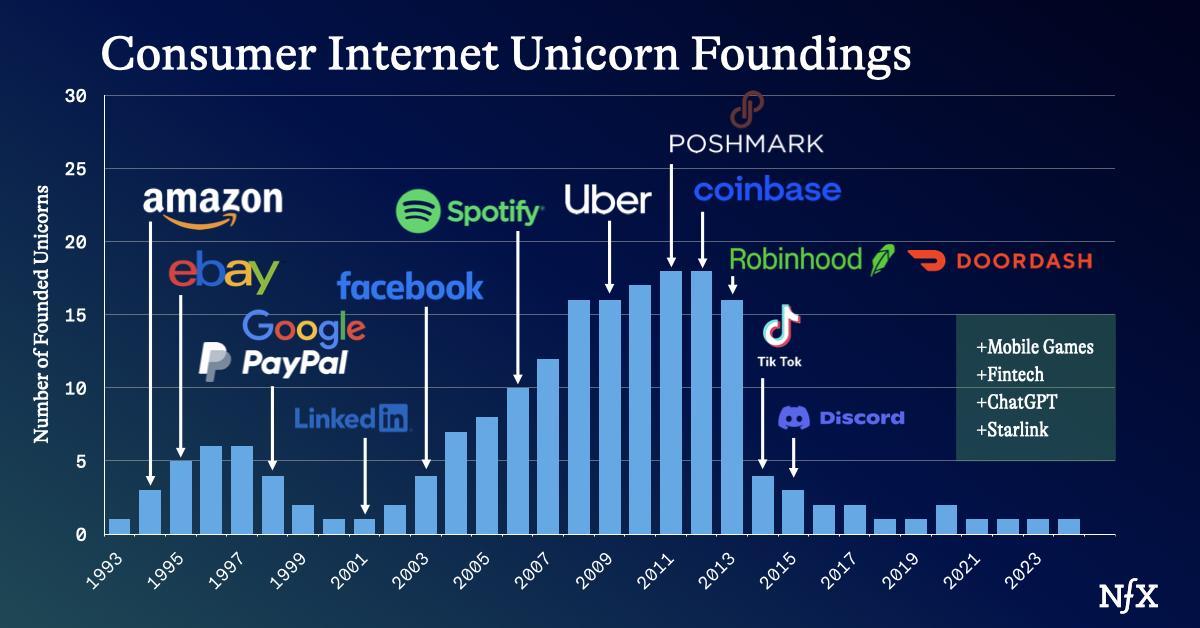

The Startup and VC Industrial Complex emerges on the backs of the software technology windows – both consumer software and B2B software – enabled after the Internet browser emerged. High returns in the VC industry explode. Status and visibility for VC follows.

Wall Street, journalists, and everyone else is now interested in VC and startups, so Knowledge Diffusion follows. Blogs about VC started in 2004 with Fred Wilson of USV and David Hornik of August Capital (now Lobby VC). Accelerators start the same year. Most exciting companies now use venture capital to accelerate.

TechCrunch started in 2005 and became the centerpoint for news for the developing ecosystem. More people understand how the private investment process works legally and financially, and what the investment criteria are. More funds around the world are created around the US model.

Yale’s superior returns as an LP, investing heavily in VC, propels all other big LPs to educate themselves about the VC asset class. VC benchmarks are established. Leaderboards like Forbes Midas List inevitably arrive. VC Twitter gets going in 2008. A16Z launches in 2008 with the goal of being a mega fund. Angelist launches in 2010. Signal.nfx.com comes in 2018 so founders can see all VCs as the insiders do. Altogether, the number of VCs, the amount of capital raised from LPs, and the number of tech startups all explode. Everything about VC firms largely stayed the same from 1994 to 2022, except there was just more of it.

VC 3.0 “Ubiquity”

Now things are really changing. This phase began in 2022 with the end of the bull run and the simultaneous arrival of AI which will transform the operations of the VC industry in the next ten years (more on the changes AI will bring to you below).

A major differentiator of VC 3.0 is the clear ubiquity of the asset class. VC is expanding dramatically in sectors beyond software and expanding internationally.

The arrival of ~20+ mega multi-stage VC funds in the US (Sequoia, LSVP, GC, A16Z, Greylock, Accel, Iconiq, Thrive, Insight, etc.) means we’ve entered the incumbent phase of the technology window. You will start to see declining returns in later stage VC investing where the bulk of the LPs capital is applied due to intense VC competition consistently overbidding entry valuations compared to the public exit valuations. You will see the blending of the VC and PE models (more on that below).

4. Software is very special

Before software there wasn’t much of a VC industry. What we see today of the VC and Startup Industrial Complex is actually a function of the underlying technology window of software that really got going in 1994 with the Internet browser.

There was so much value to be given to customers in such a short period of time, that it was relatively easy for both founders and VCs to succeed.

Going forward, VC firms will have to be far better at what they do, and the founders will have to be gritty as they were pre-1994 because the new sectors aren’t as easy as software.

The VC model of the last 60 years depended on getting one or more 100X returns on companies in a fund. There were plenty of those since 1994, so VCs could flourish – and multiply from 150 to 32,000.

If later stage VCs are entering Series A investments at $90M post compared to $30M ten years ago, it will simply be harder for more VCs to maintain those types of returns. Many can still beat the S&P 500 and thus stay around for all the reasons we listed above, but it will get harder.

Buckle up. And if you’re a VC, be prepared to grind.

5. Some Mega VC funds will start to act like private equity and you will feel the difference

As we move into the incumbency phase of software, the biggest VCs will naturally consider taking on investments that are more Private-Equity-like in an attempt to find alpha. PE firms will start to buy venture backed startups – as those companies become legacy businesses it becomes easier to operate and aggregate. You may start to get more low-ball acquisition offers.

For the largest VCs, as they become multi-strategy platforms, blending with PE models will provide some avenues for them to manufacture wins. But given the dilution characteristics of those roll ups, most of these investments will prove far less attractive than they think. Further, moving to PE mode will put the VC firms in direct competition with the PE firms, who are using AI and software to juice their returns, but from a different mindset and perspective.

In short, the VCs are value creators and the PE firms are value capturers. Both are valuable.

But, there will be a clash of cultures and personalities. You, the founder, will be caught in the crossfire. Sometimes it will be good for you (e.g. higher valuations), and sometimes it won’t (e.g. investors wanting more control).

The VCs typically have a creative and flexible personality and culture. They are generally supporters of the founders. VCs are comfortable treading into new territory where the business models and methods are not yet known. They are trained to create value from nothing. They are there to make the pie bigger. They were attracted to this job because they are creative and the VC business model is fueled by the 100X dream-like outcomes.

The PE partners typically have a different personality. They are hard-nosed efficiency experts. They are not romantic, sentimental, or dreamers. They are realists. They are fixers. They typically change the leadership teams, remove all but the most necessary employees, tightly manage every dollar spent, and they optimize the balance sheet typically by adding debt. They are trained to squeeze out value from existing, well understood machines. They are fighting over pieces of a fixed-sized pie.

Know which personality type you are dealing with when you go to raise capital.

6. AI will change how VCs interact with you

What do VCs do all day? They basically listen, read, summarize, and rank. What does AI already do well? The same things.

So starting last year and going for the next 10 years, AI will fundamentally change how VC firms work and thus how they interact with you in every phase of the VC experience: sourcing, analyzing, deciding and supporting.

Sourcing: AI will change how VCs find you and approach you. They call it “sourcing.” There is currently an AI-fueled race between the top firms like Sequoia, a16z, (ahem) NFX, FRC, and Accel.

For decades, outbound sourcing has been a competitive advantage for late stage VC firms like TA (1978), Summit (1983), Battery (1983) and Insight (1995). But until last year, most firms stayed “inbound,” where they received warm intros from personal connections to the best founders. But in the last 6 years, more data on startups and founders has been digitized, making more early stage companies visible to computers. In the last two years, AI has made it easier to process all that data into signals to drive outbound deal sourcing.

So you can expect to get called by more VCs looking to find out what you’re up to. Many firms are now 1) developing outbound deal sourcing motions to get ahead of other firms, and to 2) moving that outbound motion down from late stage into seed and pre-seed.

You will have to learn how to process those inbound signals and be careful how you use your time talking with them or not. You have plenty of other things to do, but they don’t. Talking to you is their only thing. Some conversations will be worth it for you, others won’t.

For instance, you might change your LinkedIn to say you are “working on something new” or “stealth,” and if you are a “high-potential founder,” you might receive 10-30 emails and LinkedIn messages from VCs within 48 hours. Or you might close your 3rd customer and the VCs will have an AI sniffing contracting software, or payments networks to alert them you’ve hit an inflection point.

This has already been happening in Silicon Valley in the later stages but will expand to every corner of startup land over time as the “asset class” of VC becomes “more efficient,” meaning everyone gets the same information.

Analyzing: AI will change how the VC firms analyze you because they will use AI to capture all your digital effluent into a more detailed picture of you, your team, your product, your customers and all the sentiment around any of it.

Deciding:AI will change how VCs make decisions to invest in you. They won’t want to say it publicly or to their LPs until societal norms evolve to accept it, but AI will increasingly be part of the VC decision phase. First, AI will help a little, and in several years it will be a lot. Google Ventures very famously was using AI to help them decide on investments and to set valuations. About six years ago, they publicly announced they were stopping that practice. The new AI platforms available today will make it inevitable that many VCs will start to experiment with it.

Support: AI will help VCs support you and monitor your progress. This could be very positive for founders. It will make VCs more attentive. They can take more into account as a board member giving advice. They will be more able to connect you with help in real time if you want it.

7. The bear case for venture capital

It’s only fair to give you the counterargument. The bear case we hear from others goes something like this:

- At 32,000, there are now far too many VCs competing for a limited number of great companies per year. Their entry valuations have gone too high for the VCs to get 3-8X funds.

- The technology windows that are now open will not be as profitable for VCs as the software technology window was for the last 30 years.

- AI will eliminate information inefficiencies in the market, and essentially let every VC see every deal, further driving up prices and lowering returns.

- AI will lower the cost of doing a startup, so some good percentage of founders will not need VC money, or will need far less of it, selling less of their companies to VCs.

- AI will replace many VCs just as AI will replace engineers, SDRs and customer service professionals. Fewer VCs will be needed to review more deals more deeply.

- Crypto will allow some percentage of entrepreneurs to essentially tokenize VC and allow non-VCs to invest.

- The AI technology window will be better for incumbents than for startups and their VC backers. Perhaps 7% of the gains will go to startups. (7% is the rough amount of value that went to startups and their backers during the mobile tech window. This is calculated by adding the market caps of the unicorn VC-backed mobile startups and dividing it by only 50% of the market cap gains – just the gain, not the total – of just the biggest four incumbents between 2008- 2023: Apple, Amazon, Alphabet, and Meta.)

- Eventually, LPs will see too many VC funds returning less than the S&P 500 index, and VC will fall out of favor as an asset class.

- Only the big 20 VC funds that reached incumbent status will survive, and the rest of the startup community will be angels who invest mostly for sport.

- It will stop being cool.

- The VC ecosystem will then shrink and right size to the true opportunity, taking its small place in the overall financial industry.

Many of these make sense at face value, and together they weave a reasonable story. But we think the 14 reasons listed earlier will be a much stronger force pulling us in the other direction. VC will continue to grow, and will continue to be a core economic weapon for the Western Economies.

What All This Means for Founders

The bear case for VC doesn’t mean the end of VC, or even the dire predictions of the Financial Times, but it does mean that VCs face more pressure to compete with other VCs, and that will have impacts for founders.

Positive Impacts:

- Higher valuations due to more competition.

- Even better support from their VC investors who need to differentiate and spread good word of mouth. They need to make founders happy to compete.

- VCs will spill more secrets and insights for free on blogs, X and LinkedIn in order to get attention.

- Founders will be funded to pursue increasingly outlier ideas and markets. VCs will need to support further outlier ideas to find reasonable valuations and higher returns. In short, all 32K investors have learned that non-consensus ideas drive the returns, which means non-consensus ideas are now also consensus, meaning even outlier ideas will have 100s of VCs who might want to invest.

Negative Impacts

- More startup competitors to compete with you, funded by more VCs with more capital.

- Some VCs will start to take on personality types more like PE investors. Rougher. Less supportive. Be ready.

Unclear Impact

- Fewer IPOs:

With all the money in private capital VCs and PE, your company will have the chance to stay private longer. That can reduce the hassle for you of being public, but it can also stunt your personal growth and the growth of the culture of your company. It might also give you a large and political board that becomes a threat to the success of your company.

2. Dilution will be about the same, because while your valuations will increase for each stage, the % ownership demanded will remain the same to make the VC business model pencil out. So in most cases, you will simply get more money than you would have in the 1994-2020 period. You will have more money to spend to pursue your goals, but dilution will remain similar in most cases.

Go Get ‘Em

Venture Capital 3.0 is mostly great for founders. It’s going to be a great 15 years.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.