For decades, everyone assumed that building a company in bio required enormous capital. You could have a world-class team,”defensible, magical IP” and even strong preclinical data …and still need at least $50–100M before you had an initial inkling of whether it would work in humans.

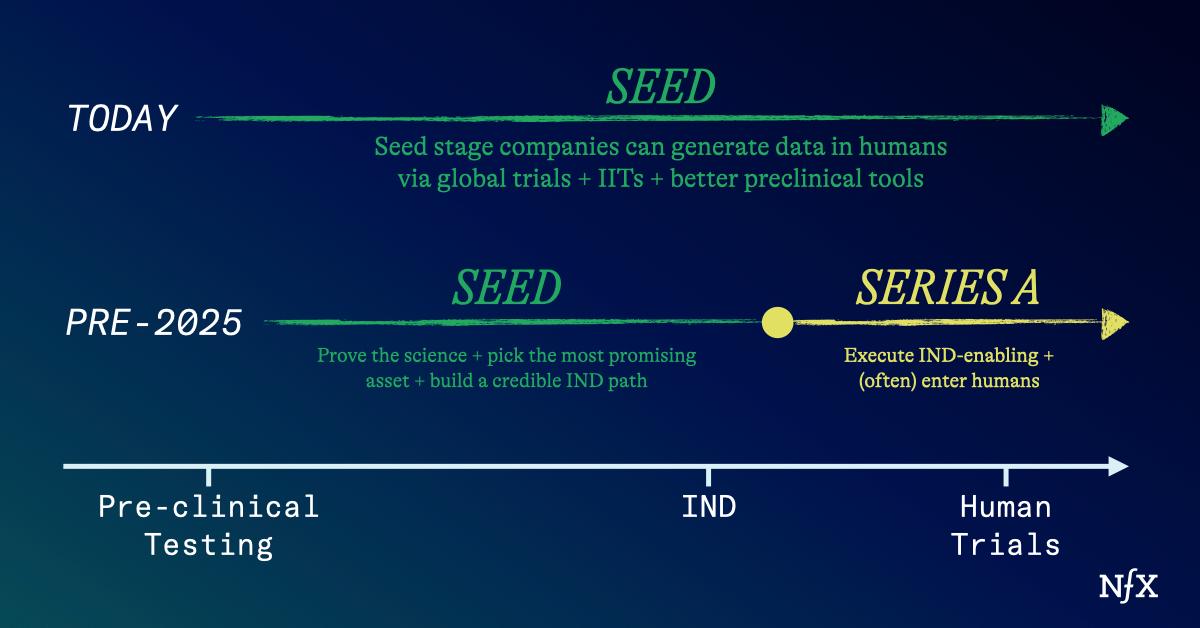

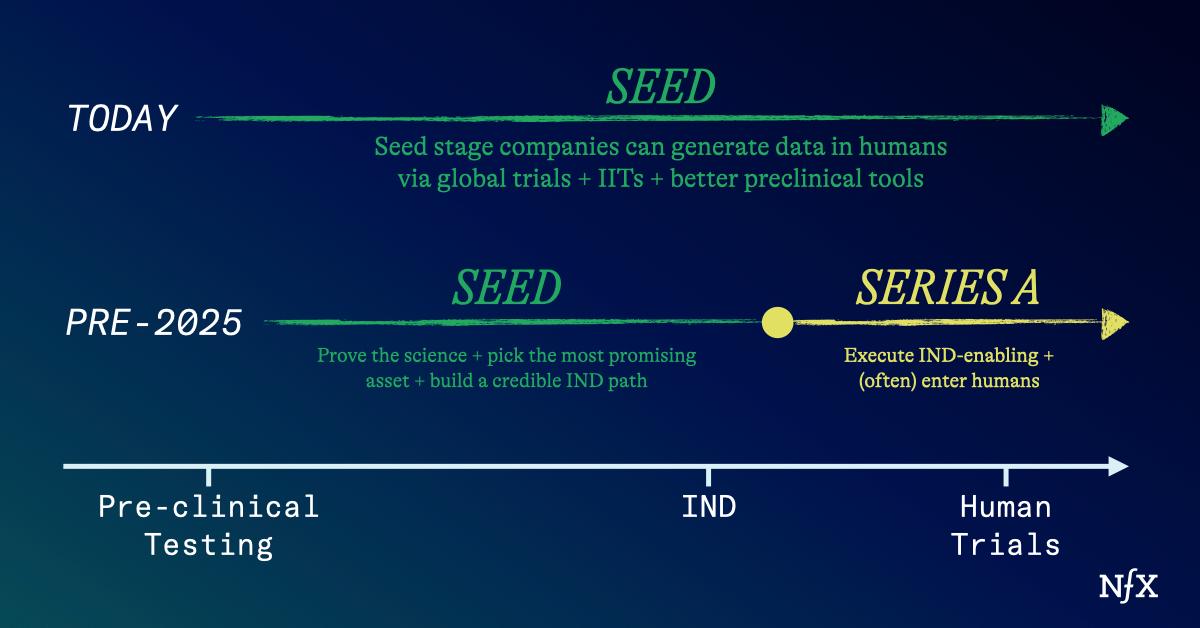

But now the story is changing. Today, bio startups can reach meaningful milestones – sometimes even first-in-human data – on seed-stage capital.

This is a huge moment for bio founders because it means that so many ideas that were truly impossible years ago are now possible.

When the cost of trying goes down, innovation goes up. We saw it happen in software about 20 years ago. Back then, starting a serious technology company meant raising tens of millions of dollars just to buy servers and infrastructure. Then cloud computing arrived. Suddenly, a handful of people with laptops could build a huge company. And today with AI, three people can build a huge company.

This is about to happen for bio. Here’s what’s coming, and how to ride the wave:

Getting into the Clinic Was Always Too Slow

The core problem in therapeutics has always been timing and cost. Unlike software, you can’t sell anything until you clear years of regulatory gates. There is usually no early revenue, no iterative product-market fit, and no way to reduce dependence on capital markets.

Progressing through early clinical stages used to cost tens to hundreds of millions, just to get an initial glimpse of safety, tolerability, and efficacy. You were still far away from a product you could sell.

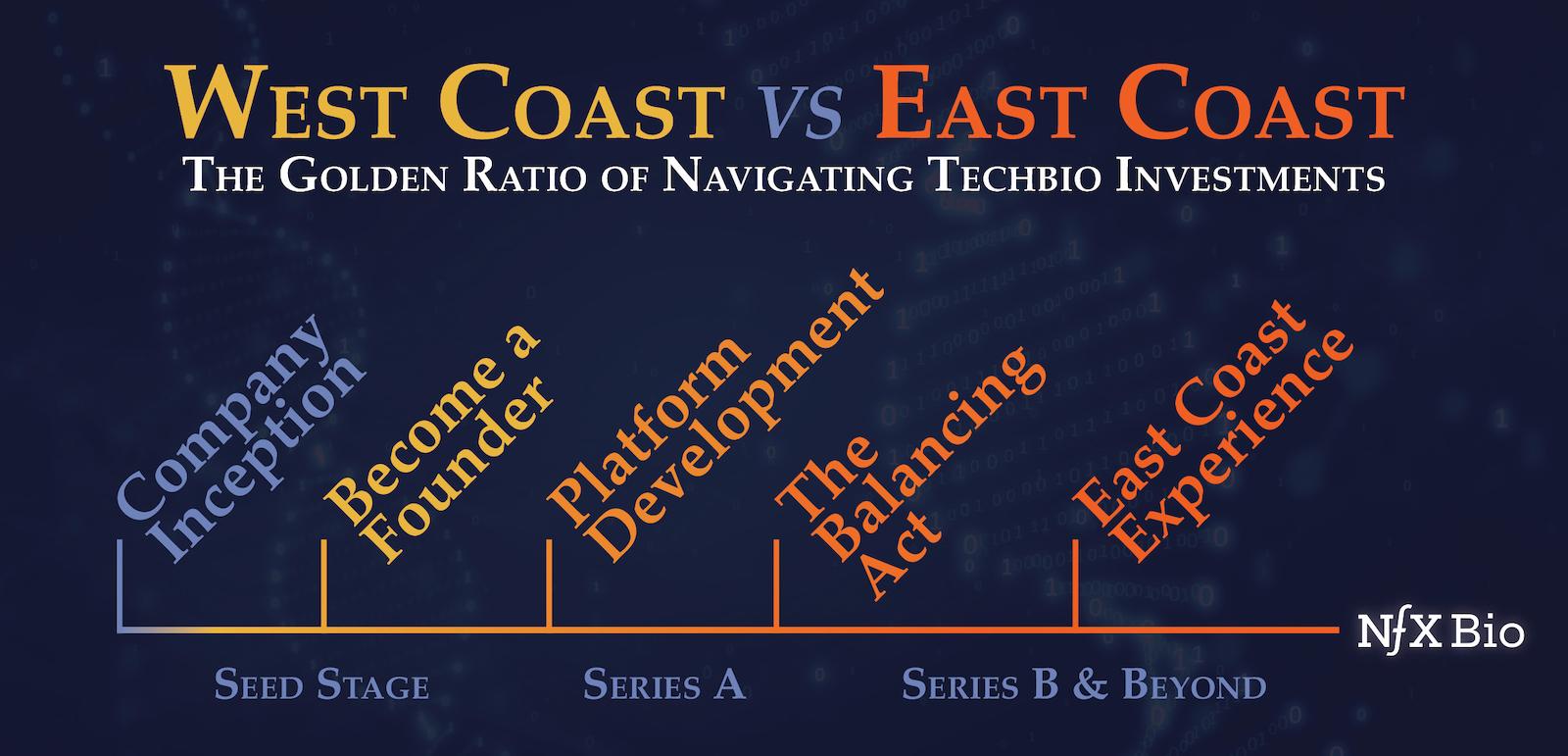

For many years, the only way to manage these costs was to raise large rounds early, usually tranched to clinical milestones at low valuations (we call this the East Coast approach). It works fine, but it’s not optimal for founders or employees – only management carve-outs and late-stage investors consistently made money.

This is why the West Coast model has been taking off in the last few years. We believe you should be able to learn if your technology works in the clinic without selling off most of your company to late-stage investors.

But we admit, it’s been hard – the cost of getting to the clinic always created a barrier.

That’s why our bioplatform companies have always been strategic about generating interim revenues. Often they do this either by monetizing their platform as a service or by collaborating with pharma early via licensing assets or targets.

(We have guides for that here, and here.)

Fortunately, we’re seeing many new ways for founders to get into the clinic faster, and with less capital. Importantly, this puts power back into the hands of scientist-founders, and completely shifts the financing model for biotech companies.

Founder-friendly, West Coast-style seed and Series A rounds now make sense in biotech in ways they didn’t before. Funds no longer need to pre-fund the entire journey to the clinic just to get a meaningful outcome. The result: founders and employees keep their equity and vision in-tact, we get better quality data sooner, and the whole process of innovation speeds up.

Clinical Data Changes Everything For You

Getting into humans as fast as possible should be your North Star. Even at early stages you need to be thinking about this.

It’s amazing how quickly clinical data can change everything for your company. Just look at Capstan, recently acquired by Abbvie for $2.1B after dosing their first patients in China.

Capstan emerged from University of Pennsylvania research and built an in vivo CAR-T platform that uses targeted lipid nanoparticles to deliver mRNA and program a patient’s own T-cells inside the body. The company was able to raise and keep moving largely on the strength of their rigorous scientific work. But the real unlock was strategy – choosing an indication that got them closer to clinical data faster.

Early on, Capstan (then TeeFib) was focused on fibrosis, an unvalidated and hard-to-price indication space. They deliberately switched to oncology and anchored the platform on CD19, a target the market already understood clinically and commercially. That single decision made everything downstream easier: fundraising, trial design, etc.

Once they entered the clinic with a validated target and showed they could generate CAR-T cells in vivo, everything changed for them. They were acquired by AbbVie during their Phase I. Same science, different target, and an entirely different outcome. And while Capstan only had one asset, our company Mana Bio is getting to the clinic with many AI-designed LNPs for different cell types.

You can have lots of amazing pre-clinical data, but the clinic is the key valuation creation stage.

It really changes everything for your company.

How to Get to Clinic Faster and Cheaper

Over the last five to seven years, several independent forces have converged to reduce the cost and speed of getting to the clinic.

Here’s how we see early stage companies getting to clinic faster than ever:

- International Clinical Trials Are Much Cheaper

Running early clinical trials outside the United States can reduce costs by an order of magnitude. We see many companies doing this very successfully, generating high quality data along the way.

China is a hot location for this right now. First, Chinese hospitals are playing a more central role in high-impact scientific research. They account for over 25% of the world’s top 200 research hospitals by Nature Index Share (51 institutions), placing China second only to the U.S. in hospital research output. As a result, we’re seeing far more trials in China now than ever before. 2025 was the first year that China surpassed the US in the number of clinical trials conducted.

Second, trials tend to happen faster there. China has significantly streamlined their clinical trial approval processes compared to the U.S.

Finally, it’s just cheaper. The cost of conducting clinical trials in China is estimated to be at least 30-40% lower than conducting trials in the US – and it can be even cheaper.

For example, our portfolio company InGel Therapeutics (developing a regenerative cell therapy for degenerative retinal disease), recently dosed patients in China through an investigator-initiated trial (more on these later) during their seed stage, for less than $10M. This provided key data they can then use to move to Phase I trials, validate their approach and de-risk later stage fundraising.

While there is a lot of momentum heading towards doing clinical trials in China, it’s best to keep an eye on the macro environment. Some U.S. policymakers are increasingly framing clinical trial infrastructure as a national security asset in the competition with China, which raises the risk of future policies making trials there more difficult.

Should you avoid doing trials in China because of possible political tension? Ideally, this is a non-issue. “We share the same biology regardless of ideology,” after all. But sadly, it’s possible that political posturing will get in the way of a better, healthier world, so keep an eye on the news in this regard.

Anyway, it’s not all about China. There are many other countries with very favorable trial infrastructure. Australia is another standout. Australia offers an R&D tax rebate of 43.5% on clinical expenditures to companies making less than $20M per year, for example. And this program has existed since the 1980s, so US institutions are familiar with data generated in the Australian research environment.

Our company Centivax will be dosing their first patient in early 2026 in Australia.

Other examples of companies with favorable clinical trial infrastructure include:

- Puerto Rico: up to 50% rebates for qualifying research expenditures.

- UAE: Regulatory frameworks have been overhauled to maximize speed – they advertise less than 28 days between trial submission and approval decision.

- Georgia, Israel, Kazakhstan, and Eastern Europe have been modernizing trial infrastructure.

Of course, there are tradeoffs. For example, in some geographies, populations may be less diverse. Additionally, oversight is extremely important if you go this route. You need to have boots on the ground to ensure data quality, manufacturing control, and protocol adherence. But when done thoughtfully, this is a strong pathway for generating strong clinical data.

- Investigator-Initiated Trials Are Back

In the US, IITs fell out of favor years ago. They are now returning partially out of necessity. Academic investigators are more willing to run trials due to constrained public research funding. Pharma companies like Merck are aware of this dynamic, and have created dedicated IIT submission portals.

This is a generally useful trend for early stage startups – companies can generate valuable human data without bearing the full cost of a traditional Phase 1. They’re not substitutes for registrational trials, but these can help de-risk your platform far earlier.

This has compounding effects on your ability to fundraise, hire, or even move along that ladder of proof.

- AI and Automation Are Reducing the Translation Gap

The long-standing joke in biotech is that we’ve cured every disease multiple times…in mice.

The real challenge has always been translation: predicting what will work in humans. While no one has “solved” this yet, AI is making significant progress.

One day, maybe we will be able to fully predict trial outcomes in silico. But as a seed stage company today there are still many ways to use AI to speed up your process and focus your resources on the assets or programs most likely to move the needle for you. Our company Mana Bio is a great example here:

Mana Bio is a platform company using AI to generate novel, programmable lipid nanoparticles. Importantly, they have built their company like an AI engine. Their AI model is trained on huge amounts of chemistry papers and data, and they brought wet-lab scientists and AI engineers together in the same room. The result is they can generate novel LNP designs using AI, manufacture them, evaluate the results, and re-test, rapidly – collecting data the whole time.

This shortens their iteration cycles and is already leading to improvements in safety and efficacy of their LNPs. For example, Mana recently demonstrated that their machine learning model can generate formulations optimized for delivery to the lung. From there, the team was able to screen for the best candidates in vitro, and select the best candidates to move toward safety testing in mice and non-human primates.

The ability to predict and precisely tune assets before testing them in humans is a massive step forward in reducing the time and energy costs associated with many trials that produce sub-par results.

Mana is at the forefront of this wave, but it’s coming for all techbio platforms that are paying attention.

- Organoids and Disease Models Are Getting Much Better

One of the key ways companies are getting into the clinic faster is by gaining stronger pre-clinical data that tells you what’s even worth testing. AI, as we mentioned, is a major accelerant here. But we see other methods gaining traction.

Human-derived organoid models are becoming a great way to gain real insight into how assets behave in humans at low cost. There are many companies developing strong, organ and tissue-specific models today.

Our company Cyclana Bio, for example, is using menstrual fluid to develop a model of human endometrial tissue. Their platform captures the nuances of that dynamic environment, including signalling between immune cells, tissue-resident cells, and the extracellular matrix (ECM) – all of which shape disease progression.

Their first indication is endometriosis. But this platform will help them develop therapies much faster and cheaper over time. Read more about them here.

That’s just one example. This same principle applies for digital twin technologies, and iPSC-derived organoid models. There are more ways to get human-relevant data on the horizon.

The FDA is excited about these newer data sources, but they’re not quite ready for true substitution. Clinical data is still the gold standard, from that perspective. However, data derived from organoids and disease models is absolutely helpful when it comes to fundraising, attracting biz dev deals, and more.

- Pathways for Smaller Trials Are Developing

In niche areas – such as genetic diseases – the FDA has begun allowing patient-as-own-control, single arm trial designs.

This approach likely only works in very niche areas with small patient populations. (But demonstrating safety and efficacy, in humans, even in small populations, can still be a powerful way to prove out your platform at an early stage).

The FDA likely sees these trials as “most persuasive” when a disease is degenerative, and intervention is expected to lead to improvement – making it easier to demonstrate an effect of your intervention in a single patient. There are key confounding factors to consider with designs like this (do symptoms wax and wane? Is it possible symptoms have “peaked” and a patient may improve naturally?). The FDA outlines many of these in their draft guidance here.

But we bring this up to show that there are truly many ways to choose an indication and design a trial that helps prove out your asset or platform with lower-than-normal costs. It’s about seeing what’s possible, and being strategic with what might fit your platform’s goals.

More Shots on Goal Is Better for Humanity

This moment in tech bio feels very similar to the early days of the cloud. The cloud reduced up-front costs, made it faster to go-to-market, and made it possible to test and iterate in-real time for software companies. The result was a golden era of unicorns in the 2000s.

Biotech is finally entering a phase where the same dynamic is possible. When the costs and time associated with getting into the clinic goes down, the cost of not trying goes up. It makes sense to test more ideas, and generate more breakthroughs. Smaller indications become viable. Rare diseases get attention. Platform technologies get validated earlier, and more assets are created as a result.

Of course, bio will always require capital and regulation. The most important thing is to do solid science, and generate high quality data. But, the idea that you must raise $50–100M just to learn whether something works won’t be true for much longer. It is barely true today.

If we can get to the clinic faster, everything changes. Just like in software, that shift will enable the next generation of massive, life-changing companies.

If you’re one of those founders, and are excited to get into the clinic faster (and responsibly), come talk to us!

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.